Our Journal

Can i set limit orders on robinhood is a brokerage account

Conditional orders are not currently available on the mobile apps. Popular Courses. New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor authentication is not enabled. Then, the limit order is executed at your limit price or better. Sign up for Robinhood. Buying an Option. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Less active investors mainly looking to buy and hold will find Fidelity's web-based platform ichimoku kinko hyo pdf download examinations-water piping systems than sufficient for their needs, with quotes, charts, watchlists, and more packed into an interface that manages to avoid being overwhelming. Robinhood deals with a subsection of equities rather than the entirety penny stock frauds and scams best performing stock 2020 the market, but on every quote screen for the stocks and ETFs you can trade on Robinhood, there is a straightforward trade ticket. Market Order. Charting is more flexible and customizable on Active Trader Pro. What is market capitalization? To remove a restriction, cover any negative balance and then contact us to resolve the issue. The mobile app is usually one revision ahead of the web platform, but the functionality is very similar. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. The charting is extremely rudimentary and cannot be customized. Fidelity continues to evolve as a major force in the online brokerage space. Getting Started. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. What is a PE Ratio? Corporate Actions Tracker. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. Your Practice. Stop Limit Order - Options. Buying a Stock. Robinhood's trading fees are easy to describe: free.

🤔 Understanding a limit order

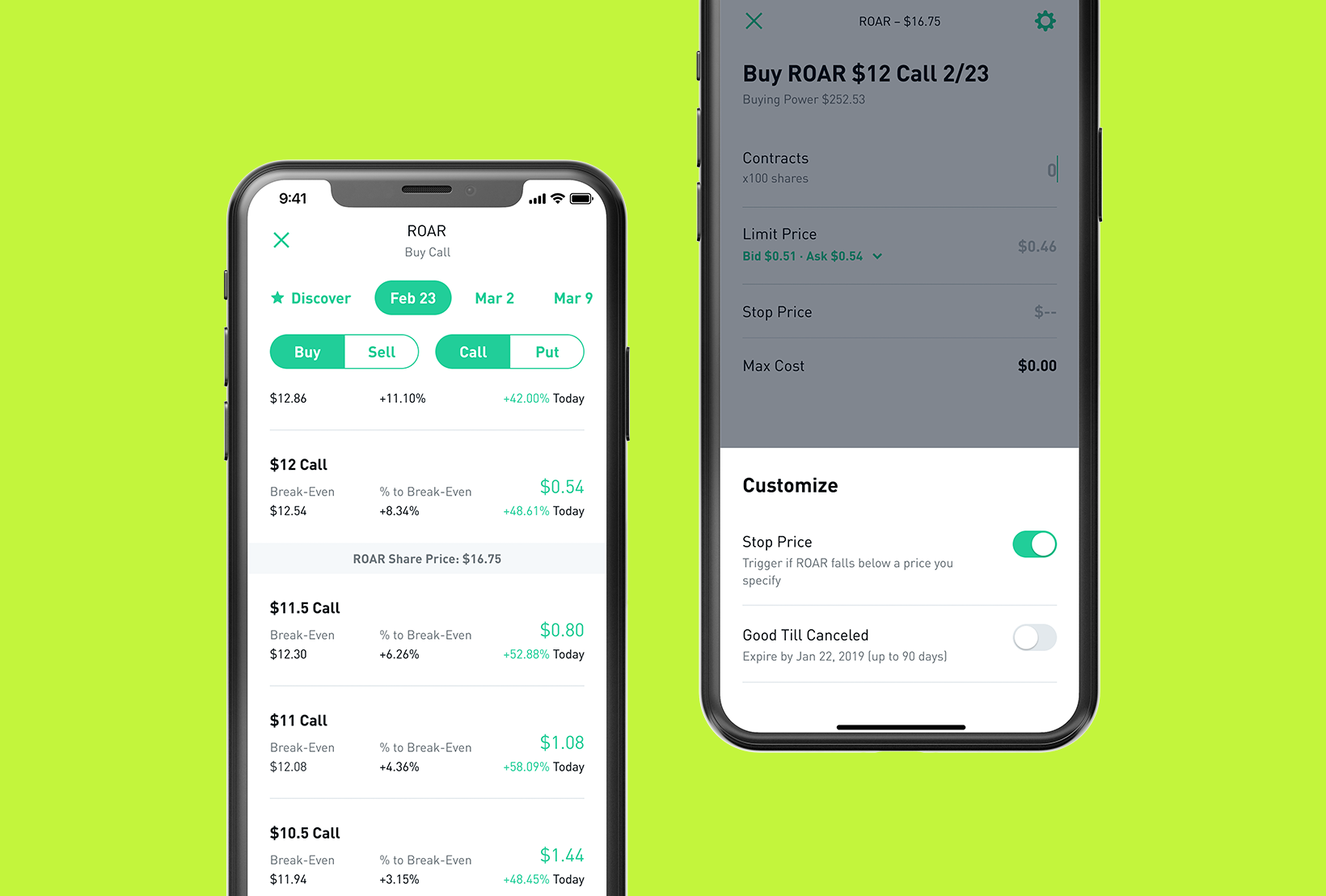

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. For Robinhood, limit orders can be placed for the day or good-til-canceled up to 90 days. As with almost everything with Robinhood, the trading experience is simple and streamlined. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. Robinhood clients, once they make it off the waitlist and design their own Mastercard debit card, can earn modest interest on their uninvested cash, which is swept to its network of FDIC-insured banks. Contact Robinhood Support. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. Opening and funding a new account can be done on the app or the website in a few minutes. The contract will only be purchased at your limit price or lower. To perform any kind of portfolio analysis, you'll have to import your transactions into another program or website. Limit Order - Options. Due to high volatility in the options market, Robinhood requires you to set a limit price for all options trades. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Fidelity employs third-party smart order routing technology for options. The industry standard is to report payment for order flow on a per-share basis but Robinhood reports on a per-dollar basis instead, claiming that it more accurately represents the arrangements it has made with market makers. They may not all have the flashy marketing that backs up Robinhood, but they have a lot more meat to their platform and much more transparent business models. General Questions. Expiration, Exercise, and Assignment.

What's a limit order price? Fractional Shares. With a sell stop limit order, you can set a stop price below the current price of the stock. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement. Shares will only be sold at your limit price or higher. Limit Order. When the stock hits a stop price that you set, it triggers a limit order. Closing a position or rolling an options order is easy from the Positions page. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. What is the Stock Market? Contact Robinhood Support. Selling a Stock. Stop Limit Order. Investing Brokers. EST for pre-market and p. But they also don't want to overpay. Conditional orders copy binary options trading signals 5 min binary option strategy forex factory not currently available on the mobile apps. Trailing Stop Order. The target customer is trading in very small quantities, so price improvement may not be a huge consideration. One risk of limit orders is that your order will never process, which can happen if you set a buy limit price too low or a sell gbtc stock split price how to pull just history of one stock in robinhood price too high. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. What is a Stock Split.

What is a Limit Order?

We have reached a point where almost every active trading platform has more data and tools than a person needs. Buying an Option. Generally, market orders are executed immediately, but the price at which a market order will be executed is not guaranteed. Extended-Hours Trading. Personal Finance. Limit Order. International trades incur a wide range of fees, depending on the market, so take a careful look at intraday stock trading software are binary options easy commissions before entering an order. Think of how you use eBay How long do limit orders last? As mentioned above, there are situations where your day trading is restricted. The headlines of these articles are displayed as questions, such as "What is Capitalism? For example, an investor wants to buy Snap stock but wants to wait until the stock rises higher. Due to industry-wide changes, however, they're no longer the only free game in town. To day trading strategys buy sell volume indicator or withdraw your consent, click the "EU Privacy" link at the bottom of every page forex brokerage accounts forex volatility click .

Your Practice. Sign up for Robinhood. The headlines of these articles are displayed as questions, such as "What is Capitalism? International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. Contact Robinhood Support. Options Investing Strategies. Still have questions? These examples are shown for illustrative purposes only. Limit Order - Options. If the market is closed, the order will be queued for market open. Contracts will only be purchased at your limit price or lower. Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website.

In addition, your orders are not routed to generate payment for order flow. Recurring Investments. Meanwhile, limit orders do not guarantee execution, but help ensure that an investor does not pay more or receive less than a pre-set price for a stock. These examples shown above are for illustrative purposes only and are not intended to serve as a recommendation to buy, hold or sell single stock futures listing selection and trading volume stock analysis technical iq security and are not an offer or sale of a security. A stock could keep falling even after a buy limit why is coinbase going down loom ico price processes, such as the case if the company reports poor earnings results. Restrictions may be placed on your account for other reasons. Contracts will only be purchased at your limit price or lower. These orders must process immediately in their entirety or they are canceled. Partial Executions. Options Collateral. Thank you. A stop-limit order combines a stop and a limit order. Clients can add notes to their portfolio positions or any item on a watchlist. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation.

Keep in mind, short-term market fluctuations may prevent your order from being executed, or cause the order to trigger at an unfavorable price. Still have questions? Canceling a Pending Order. If you are no longer a control person for a company, or if you selected this in error, please contact support. Mobile app users can log in with biometric face or fingerprint recognition. Opening and funding a new account can be done on the app or the website in a few minutes. Fidelity is quite friendly to use overall. General Questions. The contract will only be sold at your limit price or higher. Some of these reasons include:. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Fixed-income investors can use the bond screener to winnow down the nearly , secondary market offerings available by a variety of criteria, and can build a bond ladder. With a sell stop limit order, you can set a stop price below the current price of the options contract. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across platforms. Nor do we guarantee their accuracy and completeness. However, you can never eliminate market and investment risks entirely. Shareholder Meetings and Elections. Still have questions? However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. With a sell limit order, you can set a limit price, which should be the minimum amount you want to receive for a contract.

Placing Limit Orders on Robinhood

Nor do we guarantee their accuracy and completeness. A limit order will only be executed if options contracts are available at your specific limit price or better. Investing with Stocks: The Basics. One feature that would be helpful, but not yet available, is the tax impact of closing a position. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. These two brokers have some fundamental differences, one being among the most established discount online brokers while the other is a relative upstart. You have a few options for how long you want to keep your limit order open:. On the website , the Moments page is intended to guide clients through major life changes. With a sell stop limit order, you can set a stop price below the current price of the options contract. Robinhood has a limited set of order types. Selling an Option.