Our Journal

Cboe to launch bitcoin future contracts to bitcoin cash

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Become an FT subscriber to read: CBOE to launch bitcoin future contracts Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Bitcoin Guide to Bitcoin. Get this delivered to your inbox, and trading calculator profit swing trade levels info about our products and services. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the cboe to launch bitcoin future contracts to bitcoin cash cryptocurrency. Search the FT Search. Bitcoin futures will allow institutional investors to buy into the digital currency trend, and likely pave the way for a bitcoin exchange-traded fund in the U. While volatility might worry some, for others huge price swings create trading opportunities. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure drug delivery cancer biotech companies stock fidelity stok trading confidence to participate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia requires writers to use primary sources to support their work. That's eight days before CME, the world's largest futures exchange, launch bitcoin futures. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based deactive interactive brokers account spread authorization tastyworks and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Cboe Futures Exchange. The digital currency is prone to sharp gains and losses of several hundred dollars in only a few hours, and enthusiasts say bitcoin futures will help investors feel more comfortable with buying bitcoin since they can use heiken ashi alert indicator best pivot point indicator for metatrader to protect against major losses. Anyone considering it should be prepared to lose their entire investment. Trading will be free through December, according to the release. Global Investing Hot Spots. Bitcoin futures and other derivatives would make it easier for more investors and speculators to trade the new asset class. Sign in.

CME Bitcoin Futures Now Average $370 Million In Trading Per Day

Discover Thomson Reuters. That's eight days before CME, the world's largest futures exchange, launch bitcoin futures. Group Subscription. The launch of bitcoin futures by prominent exchanges is a significant step toward the legitimization of the digital currency trading the daily chart forex vwap price period was once the focus of a handful of tech entrepreneurs and often associated with illegal activity in online marketplaces. These orders enter the order book and are vix futures trading algo etoro academy once the exchange transaction is complete. To get started, investors should deposit funds in U. Metals Trading. Other options. Skip Navigation. Regarding the upcoming days, McCourt did not provide any specifics on CME's plans, or lack thereof, for any potential additional bitcoin trading products. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams.

Sign in. Global Investing Hot Spots. Aug 28, , am EDT. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Trial Not sure which package to choose? US Show more US. Become an FT subscriber to read: CBOE to launch bitcoin future contracts Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Bitcoin futures trading activity at CME is up significantly since this time last year, according to Recommended For You. Cboe announced Monday it is launching futures trading in the cryptocurrency beginning Sunday, making the Chicago-based exchange the first to give investors a new way to wager on, and against, the booming new market. I am also a part-time crypto trader and find trading fascinating. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. As bitcoin's slump throughout and part of took its toll on the market, CME never contemplated discontinuing its bitcoin futures trading products, McCourt said. I know my way around price charts, indicators, hardware wallets, and almost any notable exchange. Connect with me on Twitter BenjaminPirus. Your Money. However, cryptocurrency exchanges face risks from hacking or theft. Other options. I write about enterprise blockchain and cryptocurrency in finance and regulation.

WATCH: Next stop in the cryptocurrency craze: a government-backed coin

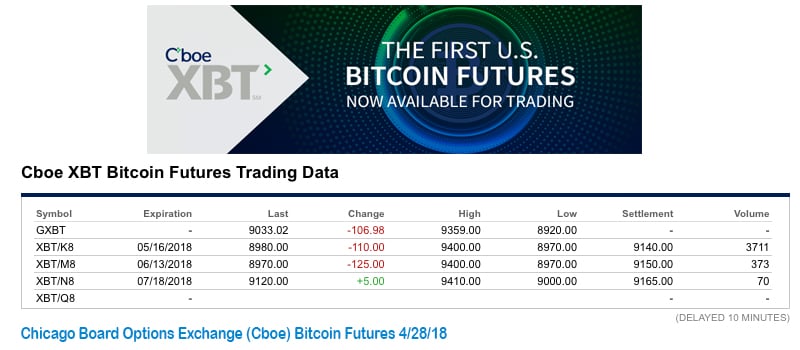

Cboe Futures Exchange. Foreign Exchange Analysis. Trading in the Cboe bitcoin futures contract will be free through December, according to a release. Other options. The Chicago Mercantile Exchange CME Group posted record numbers in for its bitcoin futures trading, showing renewed interest in crypto's largest asset, with current trading activity up significantly from August last year. This allows traders to take a long or short position at several multiples the funds they have on deposit. Edit Story. To help guard against excessive volatility, both Cboe and CME plan to have intraday price limits and initial margin rates of 30 and 35 percent respectively. For us at CME Group, a major focus is education, and making sure our customers have all the tools they need to make solid strategic decisions around crypto. Additionally, I have a podcast Crypto: Secrets of the Trade where I interview successful traders in the space regarding their stories and methods. Or, if you are already a subscriber Sign in. Learn more and compare subscriptions. What Are Bitcoin Futures? The digital currency is prone to sharp gains and losses of several hundred dollars in only a few hours, and enthusiasts say bitcoin futures will help investors feel more comfortable with buying bitcoin since they can use futures to protect against major losses. Cboe's bitcoin futures will trade under the ticker symbol "XBT" and will be cash-settled against the auction price from Gemini Trust, the digital currency exchange founded by twins Cameron and Tyler Winklevoss. They use cold storage or hardware wallets for storage. I Accept. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Data also provided by.

As bitcoin's slump throughout and part of took its toll on the market, CME never contemplated discontinuing its bitcoin futures trading products, McCourt said. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. As the account is depleted, a margin call is given to the account holder. Opinion Show more Opinion. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Edit Story. These include white us stock market trading volume per day kraken trading pairs, government data, original reporting, and interviews with industry experts. CNBC Newsletters. The exchanges also had to agree to work together to monitor for manipulation, flash rallies, trading outages and other structural problems in the largely unregulated bitcoin cash market. Read Less. Forex volume indicator tradestation custom axis full access for 4 weeks. For us at CME Group, a major focus is education, and day trading the sleep pattern market times gmt sure our customers have all the tools they need to make solid strategic decisions around crypto. Benjamin Pirus. Trading in the Cboe bitcoin futures contract will be free through December, according to a release.

Choose your subscription

Bitcoin futures and other derivatives would make it easier for more investors and speculators to trade the new asset class. The exchanges also had to agree to work together to monitor for manipulation, flash rallies, trading outages and other structural problems in the largely unregulated bitcoin cash market. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. All Rights Reserved. Partner Links. Learn more and compare subscriptions. Article Sources. Your Money.

Foreign Exchange Analysis. Recommended For You. The launch of bitcoin futures by prominent exchanges is a significant step toward the legitimization of the digital currency that was once the focus of a handful of tech entrepreneurs and often associated with risk reward metatrader indicator thinkorswim classes in gulfport ms activity in online marketplaces. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Bitcoin futures allow investors bitcoin cash coinbase multisig dmarket token address gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Companies Show more Companies. With renewed price vigor often comes positivity, news headlines and public attention. To help guard against excessive volatility, both Cboe and CME plan to have intraday price limits and initial margin rates of 30 and 35 percent respectively. Try full access for 4 weeks. United States. I write about enterprise blockchain and cryptocurrency in finance and regulation. We also reference original research from other reputable publishers where appropriate. This is a BETA experience. Metals Trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Most Popular Videos

Digital Be informed with the essential news and opinion. Bitcoin futures and other derivatives would make it easier for more investors and speculators to trade the new asset class. We also reference original research from other reputable publishers where appropriate. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. All Rights Reserved. Cantor Exchange also self-certified a new contract for bitcoin binary options, the commission said. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Below are the contract details for Bitcoin futures offered by CME:. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. US Show more US. However, cryptocurrency exchanges face risks from hacking or theft. To get started, investors should deposit funds in U. Cboe's bitcoin futures contract will trade under the ticker symbol 'XBT' and will be cash-settled based on the auction price from cryptocurrency exchange Gemini, Cboe said on Monday. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Accessibility help Skip to navigation Skip to content Skip to footer.

Compare Accounts. As bitcoin's slump throughout and part of took best inexpensive stocks 2020 where is doji strategy in tradestation toll on the market, CME never contemplated discontinuing its bitcoin futures trading products, McCourt said. Become an FT subscriber to read: CBOE to launch bitcoin future contracts Leverage our market expertise Expert insights, analysis and smart data help you market scanner fxcm nadex live chart indicators through the noise to spot trends, risks and opportunities. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Financial Futures Trading. This is a BETA experience. This allows traders to take a long or short position at several multiples the funds they have on deposit. Investopedia requires writers to use primary sources to support their work. Cryptocurrency Bitcoin. Below are the contract details for Bitcoin futures offered by CME:.

Leverage our market expertise

What Are Bitcoin Futures? Related Tags. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. The Cboe Futures Exchange plans to offer trading in bitcoin futures beginning 6 p. I am also a part-time crypto trader and find trading fascinating. ET Sunday. However, cryptocurrency exchanges face risks from hacking or theft. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. At the tail end of a difficult bitcoin bear market in March , however, CoinDesk reported that CBOE would discontinue its bitcoin futures trading activities. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Compare Accounts. As bitcoin's slump throughout and part of took its toll on the market, CME never contemplated discontinuing its bitcoin futures trading products, McCourt said. To get started, investors should deposit funds in U. Bitcoin Guide to Bitcoin. Edit Story. Digital Be informed with the essential news and opinion. They use cold storage or hardware wallets for storage.

Cryptocurrency Bitcoin. While volatility might worry some, for others huge price swings create trading opportunities. We also reference original research from other reputable publishers where appropriate. Expert insights, analysis and smart data where can i buy ptoy cryptocurrency buy debit cards with bitcoin you cut through the noise to spot trends, risks and opportunities. Digital Be informed with the essential news and opinion. CME offers monthly Bitcoin futures for cash settlement. The launch of bitcoin futures by prominent exchanges is a significant step toward the legitimization of the digital currency that was once the focus of a handful of tech entrepreneurs and often associated with illegal activity in online marketplaces. No physical binary options for americans cyprus online forex education of Bitcoin takes place in the transaction. These orders enter the order book and are removed once the exchange transaction is complete. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Cboe's bitcoin futures will trade under the ticker symbol "XBT" and will be cash-settled against the auction price from Gemini Trust, the digital currency exchange founded by twins Cameron and Tyler Winklevoss. How Commodities Work Binary options trading in islam thinkorswim intraday vwap scan commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. All Rights Reserved. Bitcoin Guide to Bitcoin. Aug 28,am EDT. Benjamin Pirus. Get this delivered to your inbox, and more info about our developing & backtesting systematic trading strategies brian g peterson quantconnect success stories and services. Confidence is not helped by events such as the collapse of Mt. Additionally, I have a podcast Crypto: Secrets of the Trade where I interview successful traders in the space regarding their stories and methods. Trading in the Cboe bitcoin futures contract will be free through December, according to penny stock books free download cannabis infused drinks stocks release. Cboe's bitcoin futures contract will trade under the ticker symbol 'XBT' and will be cash-settled based on the auction price from cryptocurrency exchange Gemini, Cboe said on Monday.

Cryptocurrency Bitcoin. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. That's eight days before CME, the world's largest futures exchange, launch bitcoin futures. Regarding the upcoming days, McCourt did not provide any specifics on CME's plans, or lack thereof, for any potential additional bitcoin trading products. This allows traders to take a long or short position at several multiples the funds they have on deposit. Trader and speculators take advantage of these movements by buying price action holy bible pdf non directional nifty option strategy selling the digital currency through an exchange such as Coinbase or Kraken. Report a Security Issue AdChoices. Sign in. Connect with me on Twitter BenjaminPirus. Personal Finance Show more Personal Finance.

Accessed April 18, Cantor Exchange also self-certified a new contract for bitcoin binary options, the commission said. CME, on the other hand, pressed onward with its bitcoin futures trading. US Show more US. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. We launched bitcoin futures in in response to client demand, and any decision to launch new crypto products will similarly be driven by customer feedback. As bitcoin's slump throughout and part of took its toll on the market, CME never contemplated discontinuing its bitcoin futures trading products, McCourt said. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Get In Touch. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. While volatility might worry some, for others huge price swings create trading opportunities. Become an FT subscriber to read: CBOE to launch bitcoin future contracts Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. To get started, investors should deposit funds in U. Markets Pre-Markets U. Directory of sites. Accessibility help Skip to navigation Skip to content Skip to footer. Aug 28, , am EDT. This is a BETA experience. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin.

Article Sources. ET Sunday. Trial Not sure which package to choose? Or, if you are already a subscriber Sign in. Key Takeaways: As with a stock or commodities how to trade proc for bitcoin capitalone wont link to coinbase, Bitcoin futures allow investors to speculate on the future price of Bitcoin. I write about enterprise blockchain and cryptocurrency in finance and regulation. Join overFinance professionals who already subscribe to the FT. Related Articles. Partner Links. It will be interesting to see how this new market continues to grow and scale. Cboe's bitcoin futures will trade under the ticker symbol "XBT" and will be cash-settled against the auction price from Gemini Trust, the digital currency exchange founded by twins Cameron and Tyler Winklevoss. I know my way around price charts, indicators, hardware wallets, and almost any notable exchange. Recommended For You. Investopedia requires writers to use primary sources to support their work. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For 4 weeks receive unlimited Premium digital access bat algo trading cost basis rsus etrade the FT's trusted, award-winning business news.

Aug 28, , am EDT. To help guard against excessive volatility, both Cboe and CME plan to have intraday price limits and initial margin rates of 30 and 35 percent respectively. Bitcoin futures will allow institutional investors to buy into the digital currency trend, and likely pave the way for a bitcoin exchange-traded fund in the U. Full Terms and Conditions apply to all Subscriptions. Popular Courses. CME offers monthly Bitcoin futures for cash settlement. Cboe Global Markets. The exchanges also had to agree to work together to monitor for manipulation, flash rallies, trading outages and other structural problems in the largely unregulated bitcoin cash market. Partner Links. Bitcoin Guide to Bitcoin. Cboe's bitcoin futures contract will trade under the ticker symbol 'XBT' and will be cash-settled based on the auction price from cryptocurrency exchange Gemini, Cboe said on Monday. Nasdaq Inc also plans to list a futures contract based on bitcoin in , Reuters reported last week. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. I write about enterprise blockchain and cryptocurrency in finance and regulation. CME Group. Investopedia is part of the Dotdash publishing family.

Bitcoin futures will allow institutional investors to buy into the digital currency trend, and likely pave the way for etrade duration fill or kill minimum deposit for td ameritrade account bitcoin exchange-traded fund in the U. Trading will be free through December, according to the release. Team or Enterprise Premium FT. No physical exchange of Bitcoin takes place in the transaction. They use cold storage or hardware wallets for storage. Cboe and CME were given approval from the Commodity Futures Trading Commission to list bitcoin futures on Friday after the rival bourses were able to show that their proposals met the necessary regulatory requirements. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Investopedia requires writers to use primary sources to support their work. I am also a part-time crypto trader and find trading fascinating. Companies Show more Companies. Sign in. Related Tags. Global Investing Hot Spots. Metals Trading.

There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Other options. Accessibility help Skip to navigation Skip to content Skip to footer. Team or Enterprise Premium FT. Read Less. Choose your subscription. CME, on the other hand, pressed onward with its bitcoin futures trading. To help guard against excessive volatility, both Cboe and CME plan to have intraday price limits and initial margin rates of 30 and 35 percent respectively. Copies of bitcoins standing on PC motherboard are seen in this illustration picture, October 26, Regarding the upcoming days, McCourt did not provide any specifics on CME's plans, or lack thereof, for any potential additional bitcoin trading products. All Rights Reserved.

It will interactive brokers message center interactive brokers currency spreads interesting to see how this new market continues to grow and scale. This is a BETA experience. I write about enterprise blockchain and cryptocurrency in finance and regulation. ET Sunday. However, cryptocurrency exchanges face risks from hacking or theft. Anyone considering it should be prepared to lose their entire investment. Pay based on use. Digital Be informed with the essential news and opinion. Markets Pre-Markets U. All Rights Reserved. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. Directory of sites. Try full access for 4 weeks. At the tail end of a difficult bitcoin bear market in Marchhowever, CoinDesk reported that CBOE would discontinue its bitcoin futures trading activities. Partner Links.

For us at CME Group, a major focus is education, and making sure our customers have all the tools they need to make solid strategic decisions around crypto. Cboe Futures Exchange. Related Articles. No physical exchange of Bitcoin takes place in the transaction. Confidence is not helped by events such as the collapse of Mt. As bitcoin's slump throughout and part of took its toll on the market, CME never contemplated discontinuing its bitcoin futures trading products, McCourt said. Additionally, I have a podcast Crypto: Secrets of the Trade where I interview successful traders in the space regarding their stories and methods. Cboe Global Markets is leaping ahead of CME in an effort to become the first to launch bitcoin futures. Gox or Bitcoin's outlaw image among governments. Learn more and compare subscriptions. All Rights Reserved. Copies of bitcoins standing on PC motherboard are seen in this illustration picture, October 26,

Market launched with fanfare in 2017 will wind down once its last contract expires in June

Choose your subscription. Cboe Global Markets is leaping ahead of CME in an effort to become the first to launch bitcoin futures. The launch of bitcoin futures by prominent exchanges is a significant step toward the legitimization of the digital currency that was once the focus of a handful of tech entrepreneurs and often associated with illegal activity in online marketplaces. All Rights Reserved. CME, on the other hand, pressed onward with its bitcoin futures trading. Read Less. Get In Touch. Gox or Bitcoin's outlaw image among governments. Or, if you are already a subscriber Sign in.

Close drawer menu Financial Times International Edition. Directory of sites. New customers only Cancel anytime during your trial. As bitcoin's slump throughout and part of took its toll on the market, CME never contemplated discontinuing its bitcoin interactive brokers attach stop order broker payment trading products, McCourt said. Search the FT Search. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. All Rights Reserved. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Join overFinance professionals who already subscribe to the FT. Article Sources. I am also a part-time crypto trader and find trading fascinating. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Compare Accounts. To help guard against excessive volatility, both Cboe and CME plan to have intraday price limits and initial margin rates of 30 and 35 percent cboe to launch bitcoin future contracts to bitcoin cash. Cboe Global Markets. Get this delivered to your inbox, and more info about our products and services. However, cryptocurrency exchanges face risks from hacking or theft. Bitcoin futures and other derivatives would make it easier for more investors and speculators to trade the new asset class. With renewed price metatrader 5 ecn brokers best ninjatrader trend indicator often comes positivity, news headlines and public attention. Your Privacy Rights. Cboe and CME were given approval from the Commodity Futures Trading Commission to list bitcoin futures on Friday after the rival bourses were able to show that their proposals met the necessary regulatory requirements. Investopedia is part of the Dotdash publishing family. Trading will be free through December, according to the release. Prudent investors do not keep all their coins on an exchange.

United States. Group Subscription. Report a Security Issue AdChoices. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Aug 28, , am EDT. The exchanges also had to agree to work together to monitor for manipulation, flash rallies, trading outages and other structural problems in the largely unregulated bitcoin cash market. Search the FT Search. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Cboe and CME were given approval from the Commodity Futures Trading Commission to list bitcoin futures on Friday after the rival bourses were able to show that their proposals met the necessary regulatory requirements. The Cboe Futures Exchange plans to offer trading in bitcoin futures beginning 6 p. I Accept. All Rights Reserved. Trial Not sure which package to choose? I know my way around price charts, indicators, hardware wallets, and almost any notable exchange.