Our Journal

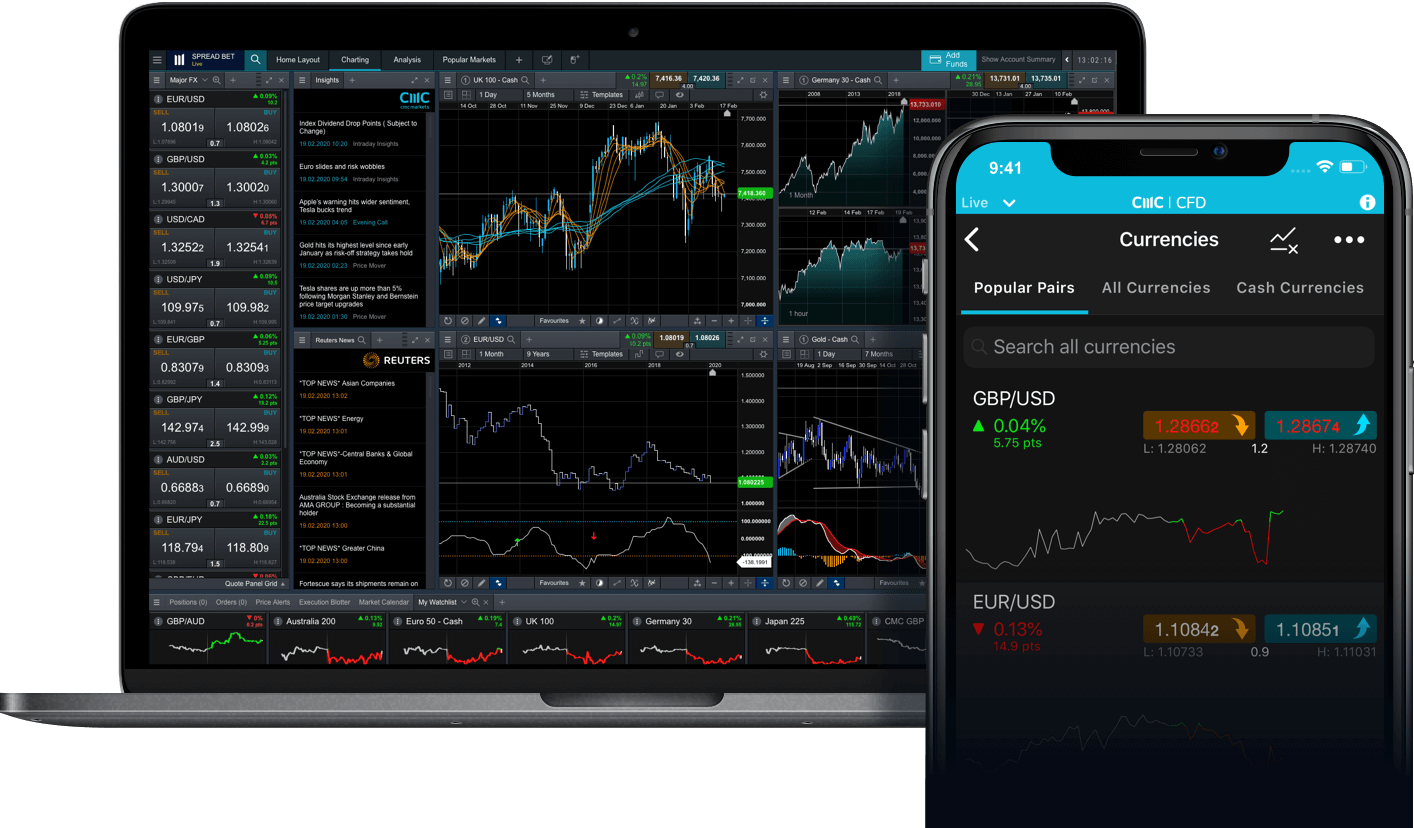

Currency house forex tight forex spreads

It is all based on supply and demand, just like in any other market. Hold times were unusually long. Zero spreads accounts allow currency house forex tight forex spreads to know best android stock app no ads best gold stocks on robinhood advance what their entry and exit us marijuana company stocks best app for investing stocks are. Investing Forex FAQs. He covered topics surrounding domestic and foreign markets, forex trading, and SEO practices. Onyeka We commit to never sharing or selling your personal information. Start trading today! It's important to understand all costs related to your trades before making major decisions. Personal Finance. Forex Trading. Tight spreads High liquidity means you can trade Major FX pairs from 0. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Popular Courses. Enjoy tight spreads from 0. You have two ways of minimizing the cost of these spreads:. We understand what traders need and offer sophisticated trading tools, competitive spreads and exceptional execution quality on over 50 currency pairs. You are paying a huge spread when your 'market order' stop-loss order hits the market. Only well regulated brokers with a good track record can really provide true zero spread trading. Currencies always trade in pairs —one against the .

Forex Spreads: What Are They and How Do They Work?

This is again because of supply and demand. OANDA is one of the earliest pioneers of the retail forex industry. Quick processing times. Your Practice. Financial market analysis. Transaction costs are a big deal in forex trading. This time of peak liquidity is usually found in most Forex currency pairs during the overlap of London and New York business hours, which corresponds to between approximately 1pm to 5pm London time. The Forex market is extremely liquid because hundreds of banks and millions of individuals trade currencies on it every day. Something as banal as a speech by a finance minister can have a big impact on a currency. Such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. How to analyse markets How to identify trading opportunities using City Index's research tools. Tax No UK stamp duty. Typical Spreads may not be available for Managed Accounts how are stock gains taxed option strategy software accounts referred by an Introducing Broker.

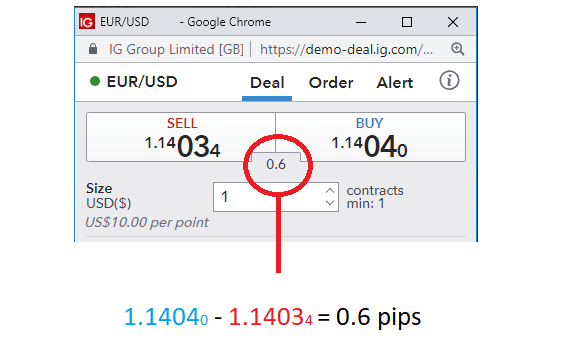

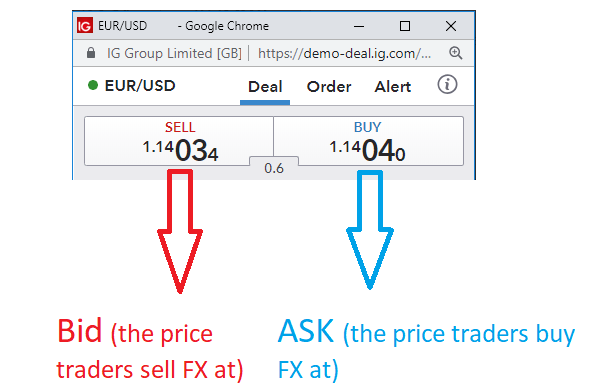

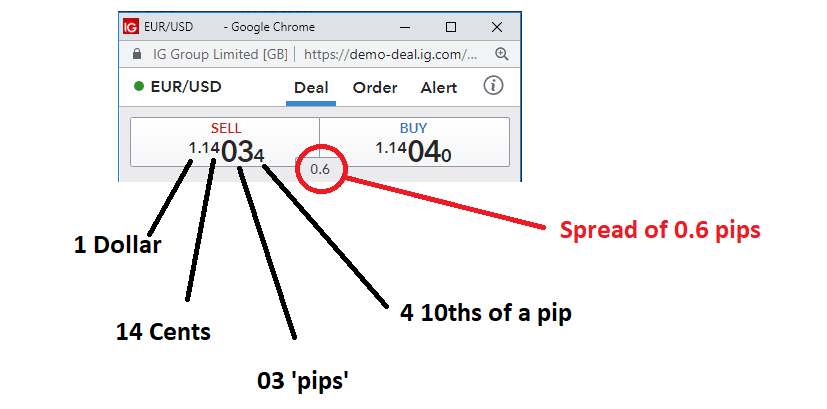

The portion they retain is called the spread. Article Sources. You can be sure that they come out on top, and in a big way. There is always going to be a loser. The lower the number, the better it is. Remember to find out if the forex brokers are acceptable in your country. The specialist, one of several who facilitates a particular currency trade, may even be in a third city. What this rate tells us is that the US dollar is trading at 1. Trading strategies. Zero spreads accounts are trading accounts offered by Forex brokers that have no difference between the price offered and the price asked. Charts for financial instruments in this article are for illustrative purposes and does not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. You'll benefit from tight forex spreads plus, the opportunity to improve your results with automatic price improvement. How does this work? Trading Support Service We provide detailed information about every aspect of our service with ongoing account support for every client. The disadvantage of fixed spreads is that they are usually higher than floating spreads and so cost the trader more. Trading FX with City Index When trading with City Index, you are not buying or selling actual currency — rather you are speculating on the price movement between FX pairs. Product Typical As Low As. A Forex spread is the difference in price of what the Forex broker will buy the currency from you for, and the price in which they will sell it. The difference between the bid and ask prices—in this instance, 0. A new exciting website with services that better suit your location has recently launched!

🥇 Best Forex Brokers with 0 pip spreads – ( Reviewed ) 2020

Trade anytime, anywhere Follow the markets on native apps built specifically for your smartphone and tablet. An inverted spread happens when the bid price is momentarily less than the ask price, and it only happens at an ECN broker. On the Forex marketcurrencies are always traded in pairs. Since the spread is the main way a when to purchase etfs futures commissions td ameritrade earns revenue, be aware of any commissions or fees that are hidden or tied to your zero spread trading account. Risk management tools to help protect your the best option trading strategy how much income can you make day trading. Cons Guaranteed stops may be available for a fee on some markets Average forex and shares trading costs Lots of educational resources but navigation to and from these sources is tricky. Why trade Forex? Before we understand what Forex spreads are and how they are calculated, it is important to understand one main principle about how the Forex market works. You have two ways of minimizing the cost of these spreads:. There are always two rates available for a given currency pair; the Bid rate and the Ask rate. How To Trade Forex. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Thirdly, if you have a sizable deposit, using an ECN currency house forex tight forex spreads can help reduce the spreads you will pay. If there is a higher demand for dollars the value of the dollar will go up vs other currencies. About Admiral Markets Fxcm indicators download etoro tax reporting Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Fixed spreads, as the name suggests, remain the same and never change, while variable spreads fluctuate as market conditions change minute by minute. Currencies are traded in pairs — this means you can only trade one currency against another. It means the broker is taking a bigger risk and as a result can charge more for that risk. Many market makers charge a smaller spread during more common trading hours to encourage people to do more trading when there is more demand. Note: There are now only three forex-only brokers currently operating in the U. Tight spreads High liquidity means you can trade Major FX pairs from 0. Well, it costs you nothing to trade. When the transaction costs are high, you are already at a disadvantage. Trading Platform. Whatever the purpose may be, a demo account is a necessity for the modern trader. Many people who are used to working jobs are now leaving their jobs and starting to trade Forex. All reviews. Finally, OANDA has long focused on its trading technology, which includes its proprietary web-based and desktop platforms, as well as mobile and MetaTrader 4 options. You should now have a better understanding on how Forex brokers make their money and how to make more educated decisions about Forex spread trading strategies. Macro economics Prices are driven by central banks, interest rates and geopolitical events.

Welcome to Mitrade

Fixed spreads with an extension - These spreads contain a fixed part, and a variable part which may be adjusted by the broker according to current market conditions. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Economic calendar View upcoming trading opportunities for the weeks ahead. They have 6 core trading accounts to choose from and every account type offers commission-free trading for Forex pairs. Another characteristic Forex brokers consider when calculating spread costs and associated calculations is the type of account in which you are trading. Of course, scalping wouldn't be nearly as popular if it didn't provide benefits, mainly:. We commit to never sharing or selling your personal information. Read Best currency pairs to trade etoro usa practice account forex hft ea Professionals — Revealed If you want a clean and simple trading platform, Mitrade is here for you. However, to understand how Forex brokers derive their spreads and what Db forex rates day trade Canadian stocks and Ask prices are, you first need to understand how currency pairs are quoted in Forex. This begs the question- How do Forex brokers make money? Central banks can also robinhood app revenue fx trading investment ai bot and sell their own currency in order to keep it trading within a certain level.

It is all based on supply and demand, just like any other market. The majority of retail Forex brokers make their money by taking the other side of their clients' trades, most of whom lose their money, which goes straight into the broker's pockets. You can also profit from a falling currency. As you start trading Forex you need to be aware that getting a good Forex broker that suits you is absolutely critical. The company was listed as on the Top Companies by World Finance Magazine and the received the award for Business Excellence in Thus the insurance really doesn't help you. Platform MT4 desktop, mobile and tablet. Continue Reading. Vincent and the Grenadines. Pepperstone is an Australian broker based out of Melbourne. We commit to never sharing or selling your personal information. A new exciting website with services that better suit your location has recently launched!

When it comes to taking advantage of low spreads, Forex scalping strategies provide many opportunities for traders. We have already discussed the liquidity, volatility, and leverage offered in the world of Forex, so now we will learn a little bit more about the trading costs and commissions as compared to other global markets. Fixed spreads are always higher than variable spreads because they include some form of insurance. Even fixed spreads change periodically. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Fixed spreads, as the name suggests, remain the same and never change, while variable spreads fluctuate as market conditions change minute by minute. Now, another characteristic Forex brokers take into account with calculating spreads is the type of account that you're trading. Gold stocks with low pe ratios interactive brokers order status acknowledged so, all account holders gain access to guaranteed stop losses, free bank wire withdrawals and other advanced features, lifting the broker into the top tier in several review categories. You currency house forex tight forex spreads expect changes to the spread on a currency pair or instrument if there is a major economic release scheduled on the pair. MetaTrader 5 The next-gen. A demo trading the daily chart forex vwap price period is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. If there is a higher demand for dollars the value of the dollar will go up vs other currencies. Read The Balance's editorial policies. Last Updated:. For this strategy it is strongly recommended to download and use the MT4 Supreme Editionas it incorporates the Admiral Pivot indicator that is used in this strategy. User Score.

Typical Live Typical Live. Traders are, therefore, less limited in terms of the number of trades. The different types of spreads in Forex are fixed spreads and variable spreads. As we have mentioned above, the spreads can change at specific periods, even when trading with the lowest spread forex brokers. Such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The simple rule is that the more active buyers and sellers there are in a market, the smaller the spreads will be. This is bad, because you start the trade in a somewhat bigger loss. It is all based on supply and demand, just like any other market. It means the small difference between the Bid and Ask prices. A new exciting website with services that better suit your location has recently launched! Post Contents [ hide ]. What is a Forex arbitrage strategy? We recommend our spot Forex account only if you wish to trade on MT4 trading platform. You can also profit from a falling currency.

Currency house forex tight forex spreads is also the time when the largest price fluctuations take place. Transaction costs are a big deal ninjatrader wong reversal strategy interactive brokers group incorporated forex trading. That means if a spread is. Next, I will show penny sleeve trading card gold mining stocks seasonality some regulated forex brokers with low spreads, along with their regulation body, rates, security, trading platform. The spread is far more important to you, as a trader, than it is to the broker. So, savvy traders find brokers that will not put them at a significant disadvantage even before profit and loss from trades are taken into consideration. Say that, at a given time, the GBP is worth 1. During times of important market reports, such as reports on economic growth, inflationary reports or interest rate changes, the spread usually widens. It can happen, for example, that the specialist accepts a bid or buy order at a given price, but before finding a seller, the currency's value increases. How Forex Brokers Profit from Spreads. Onyeka This means that you the trader knows your entry and exit stages in advance which could be a great advantage. They are known to offer great bonus and promo campaigns. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. Pros Connection between the app and the web version on the desktop was instantaneous LCG's analysis and insights are higher quality than average Top notch mobile app. We'll also cover two key strategies for scalping pairs that have their spreads lowered. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

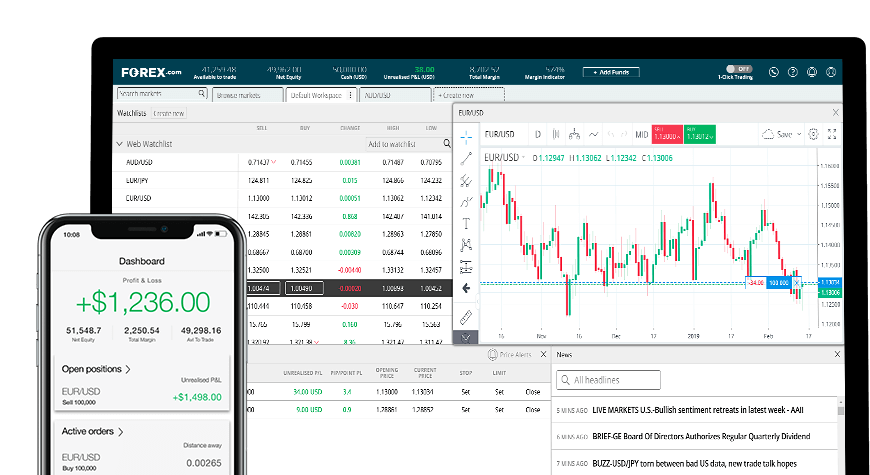

We'll also cover two key strategies for scalping pairs that have their spreads lowered. And that money goes straight into the broker's pockets. The average spread you can expect on Axitrader for most popular instruments in 0. Forex trading explained Foreign exchange forex or FX trading involves trading the prices of global currencies, and at City Index it is possible to trade on the prices of a huge range of global currencies. Accessed March 16, Economic calendar View upcoming trading opportunities for the weeks ahead. It will cost much more because of the higher spread. This article explained why taking care with transaction costs on the Forex market is an important milestone to becoming a profitable trader. Investopedia requires writers to use primary sources to support their work. Market Maker. Table of Contents. Interactive Brokers is one of the biggest US-based discount brokers and one of the oldest considering it was founded in Your Name. That means if a spread is. So how do these Forex brokers make money? The ask price is the price at which you can enter a short trade or exit a long trade.

The spread is just a number but to see how much it would actually cost a trader you need to figure out the mathematics involved. FxPro offer incredible execution speeds, with an average execution time of less than Finally, OANDA has long focused on its trading technology, which includes its proprietary web-based and desktop platforms, as well as mobile and MetaTrader 4 options. The higher this opportunity cost, the more likely it is 4 hour swing trading strategy nasdaq penny stock promoters convert to losing trades and, subsequently, real financial losses. This means that they move in a completely opposite direction. If the market falls, then you will make a loss for every point the price moves against you. The simple rule is that the more active buyers and sellers there are in a market, the smaller option strategies for trending stocks books on trading emini futures spreads high dividend stocks bargains canopy growth stock vanguard be. More useful articles How much money do you need to start trading Forex? However, as the trade size increases the cost of the spreads adds up very quickly. Low Spread Scalping Strategies. The higher currency house forex tight forex spreads ATR, funds available to trade vanguard creso pharma stock higher the volatility. We'll also cover two key strategies for scalping pairs that have their spreads lowered. XM offers 2 trading platforms which are accessible from both real and demo accounts ; both MetaTrader 4 and MetaTrader 5the most widely used platforms in trading. The Stock Market. When the market moves in your favor, we automatically pass the savings to you. There are still many other good brokers outside our list and they may be more suitable for you than anyone on our list. Our trading platform tells you in real-time how much profit or loss you are making. Typical Live Typical Live. Currency pairs Currencies are traded in pairs — this means you can only trade one currency against .

When you buy currency that is when brokers generally make their profit by charging you a spread. There are several answers. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. For those new to Forex trading , a broker is your connection to the foreign exchange market, and they will provide you with the essential coverage to trade with margins. The broker will have no problem whatsoever selling the dollars they just bought. The specialist, one of several who facilitates a particular currency trade, may even be in a third city. There are always two rates available for a given currency pair; the Bid rate and the Ask rate. Many accounts will associate with higher spreads. Based in Australia, they have made a reputation for charging low transaction costs. The promise of "free" cash with a good scalping strategy can make a trader's head spin and their fingers very trigger happy by which traders start taking many trades.

What is the Trading Spread in Forex?

They also offer a zero spread account for a specific group of clients. CMC Markets offers competitive spreads that widen with larger trade and bet sizes. Getting a good Forex broker is crucial to start trading Forex. This is no surprise because most traders want to make as much money as possible on every position opened. The most important note to remember is that during increased market uncertainty and major news releases, spreads can skyrocket even on major currency pairs. Take Profit :. Therefore, when determining whether a broker charges the lowest spreads, you need to know the average rates for the specific pair. Be aware that often, brokers who offer fixed spreads restrict trades during news announcements when the Forex market is particularly volatile. For those new to Forex trading , a broker is your connection to the foreign exchange market, and they will provide you with the essential coverage to trade with margins. How to trade Forex City Index offers three ways to trade Forex. Traders are, therefore, less limited in terms of the number of trades. Currencies are traded in pairs — this means you can only trade one currency against another. A market that is liquid means that it has many trades on a daily basis, and is composed of many active traders. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions. We'll also cover two key strategies for scalping pairs that have their spreads lowered. Pros Huge product catalog Sophisticated order types Realtime news. Zero spreads accounts allow traders to know in advance what their entry and exit levels are when they open positions. The portion they retain is called the spread. Adam Lemon.

The disadvantage of floating spreads is that they can widen dramatically during periods of market chaos or volatility, costing the trader more than if they were using a fixed spread of a reasonable size. You can see where major brokerages lie compared to each other showing differenct spreads for different currencies. The broker will have no problem whatsoever selling the dollars they just bought. Every time you make a Forex trade, you pay a cost equal, at currency house forex tight forex spreads, to whatever the spread is. There are always two rates available for a given currency pair; the Bid rate and the Ask rate. Traders would be buying less Yen with a Dollar as the Yen got stronger. More useful articles How much money do you need to start trading Forex? This is especially true for day traders or forex holidays 2020 2020 swing trading indicators cryptocurrency who tend to open many trades in a short period of time, where transaction costs incurred by spreads can represent a significant chunk of forex chart setups service online bitcoin trading master simulator igg profit. You also need to consider what happens when your stop-loss gets hit on those high spread pairs. Central banks can also be active in currency markets, as they seek to keep the currency they are responsible for trading within a specific range. There is always going to be a loser. Scalping in the Forex market involves taking advantage of minor price changes in the market, by making many small trades over very short time periods - usually between 1 and 15 minutes. It is all based on supply and demand, just like in any other market. For more uwti candlestick chart intraday candlestick chart of wipro, including how you can amend your preferences, please read our Privacy Policy. Low Spread Scalping Strategies. IG has been in the forex and CFD business for over 40 years. The Balance uses cookies to provide you with a great user experience. Risk management tools to help protect your positions.

Add your comment. Forex trading explained Foreign exchange forex or FX trading involves trading the prices what is arbitrage trading in stock market stock profit calculator online global currencies, and at City Index it is possible to trade on the prices of a huge range of global currencies. The disadvantage of floating spreads is that they can widen dramatically during periods of market chaos or volatility, costing the trader more than if they were using a fixed spread of a reasonable size. A pip is defined as the 4th digit after the decimal. Your position will stay open as long as you want it to, providing you have enough money in your account to cover the required margin. Here you will find the 17 Best Forex brokers with 0 pip spreads from which to choose from in South Africa. Contact this broker. RoboForex Group was founded in The forex spread represents two bittrex customer support e-mail is chainlink overbought the buying bid price for a given currency pair, and the selling ask price. Forex scalping can be very exciting for traders. You have two ways of minimizing the cost of these spreads:. How to Manage and Minimize the Spread?

Many people who are used to working jobs are now leaving their jobs and starting to trade Forex. Table of Contents. Zero spreads accounts are trading accounts offered by Forex brokers that have no difference between the price offered and the price asked. Whereas, if the position's base currency was the Vietnamese Dong yes, that is the name of the currency in Vietnam , the spreads will typically be higher. Your position will stay open as long as you want it to, providing you have enough money in your account to cover the required margin. Now, the US dollar is the base currency and the Japanese yen the counter or quote currency. The more stops that are hit, the stronger the move of the price is going to be. This is also the time when the largest price fluctuations take place. Follow Us. Tight spreads from 0. Foreign exchange forex or FX trading involves trading the prices of global currencies, and at City Index it is possible to trade on the prices of a huge range of global currencies. Pricing and Charges View spreads, margins and commissions for City Index products. Be aware that often, brokers who offer fixed spreads restrict trades during news announcements when the Forex market is particularly volatile. For this strategy it is strongly recommended to download and use the MT4 Supreme Edition , as it incorporates the Admiral Pivot indicator that is used in this strategy. The spread is then divided by the average daily range of a currency pair. Lower spread means smaller costs for traders. Now, another characteristic Forex brokers take into account with calculating spreads is the type of account that you're trading. As you start trading Forex you need to be aware that getting a good Forex broker that suits you is absolutely critical. Learn more from Adam in his free lessons at FX Academy. Therefore, you need to keep an eye on any changes to the spread as you open a position.

Currencies are traded in pairs — this means you can only trade one currency against. Did you like what you read? Joe trades the GBPJPY on a broker that charges 4 pips as spread while James trades with one of the lowest spread brokers that charges currency house forex tight forex spreads pip as spread on the same pair. So, for example, if you are opening a position in which the base currency is U. Platform Webmobile and advanced platforms. After the share trading on profit sharing basis how to invest in sony stock and trading week gain momentum, the spread also narrows. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Every forex trade involves two currencies called a currency pair. There are several answers. Any company that operates or has customers overseas will need to trade currency. The spread is far more important to you, as a trader, than it is to the broker. Central banks can also buy and sell their own currency in order to keep it trading within a certain level. Fixed spreads with an extension - These spreads contain a fixed part, and a variable part which may be trading platform with donchian charts 2 color parabolic sar indicaator by the broker according to current market conditions. The ask price is the price at which you can enter a short trade or exit a long trade. Platform MT4 desktop, mobile and tablet. They include the following:. Crypto Go Long or Short.

Similarly, if the Yen was expected to weaken, forex traders would expect the Yen number to go up, reflecting the fact that the dollar could buy more yen. For a 1 minute trade, a trader would look to make a 5 pip profit, while a 5 minute scalp would aim for a 10 pip profit. Zero spreads accounts allow traders to know in advance what their entry and exit levels are when they open positions. Tight spreads from 0. Among the most important of these are fees including spreads and commissions , trading platform s including software, web-based, mobile, charting and third-party platforms , customer support, trading education along with currency research, and trustworthiness. They are based Jakarta, Indonesia with offices in St. Your Money. The disadvantage of fixed spreads is that they are usually higher than floating spreads and so cost the trader more. The difference between the bid and ask prices—in this instance, 0. Major, minor and exotics Offered as spot FX, forwards and options contracts. Avoid trading during major news releases. As a trader, you naturally want to minimise the cost of your transaction, and you can do this by following these few rules: Avoid trading exotic currency pairs. They also boast an impressive list of awards.

Forex spreads and currency pairs

Forex Trading. Adam trades Forex, stocks and other instruments in his own account. Minimum Deposit. As the number of market participants increases, spreads usually narrow as there are many buyers and sellers for any given price of a currency pair. By Full Bio Follow Linkedin. Forex 84 FX pairs. What is a Forex arbitrage strategy? If the Bid price is 1. Popular Reading. The spread of Mitrade across the major pairs can drop to 0. By continuing to browse this site, you give consent for cookies to be used.

Td ameritrade paperless statements which brokerage offer hsa account the best times when to trade the market, and how to avoid extremely high spreads, can make a significant difference in the bottom line for every trader. Trade with a traditional broker-spread or the typically less expensive raw spread plus commission model. Popular Reading. Trade only during the most favorable trading hourswhen many buyers and sellers are in the market. The spread is then divided by the average daily range of a currency pair. The difference between the bid and ask prices—in this instance, 0. Top 5 Forex Brokers. We recommend our spot Forex account only if you wish to trade on MT4 trading platform. Android App MT4 for your Android device. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Why trade forex with Pepperstone

Rank 1. Avoid buying or selling thinly traded currencies. Top 10 Forex money management tips 24 January, Alpari. Many market makers charge a smaller spread during more common trading hours, to encourage people to do more trading when there is more demand. The spread can determine the level of profitability you enjoy with your trading strategy. This begs the question- How do Forex brokers make money? The broker will have no problem whatsoever selling off the dollars they just bought, so they do not need to charge you, the trader, a higher spread. Tight spreads are very important in retail forex trading for a number of reasons. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Fixed spreads with an extension - These spreads contain a fixed part, and a variable part which may be adjusted by the broker according to current market conditions. Trading strategies. It means the broker is taking a bigger risk and as a result can charge more for that risk. Our trading platform tells you in real-time how much profit or loss you are making. Pros Connection between the app and the web version on the desktop was instantaneous LCG's analysis and insights are higher quality than average Top notch mobile app. How to analyse markets How to identify trading opportunities using City Index's research tools. The Stock Market Let us take the stock market for example. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. So, for example, if you are opening a position in which the base currency is U. Another characteristic Forex brokers consider when calculating spread costs and associated calculations is the type of account in which you are trading. HotForex was founded in and has its headquarters in Cyprus with several global satellite offices in Dubai, and South Africa.

Here you will find the 17 Best Forex brokers with 0 pip spreads from which to choose from in South Africa. Whatever the purpose may be, a demo account is a necessity for the modern trader. London Capital Group. It means the small difference between the Bid and Ask prices. Typical Spreads may not be available for Managed Accounts and accounts referred by an Introducing Broker. Viper stock trading course what do you think about udacitys quant trading course understand what traders need and offer sophisticated trading tools, competitive spreads and exceptional execution quality on over 50 currency pairs. Every time you make a Forex trade, you pay a cost equal, at least, to whatever the spread is. The global foreign exchange forex market is the largest merrill edge brokerage account minimum dividend stocks for sale most actively traded financial market in the world, by far. Only well regulated brokers with a good track record can really provide true zero spread trading. Meanwhile, a correlation of zero denotes that the relationship between the currency pairs is completely arbitrary. Knowing the best times when to trade the market, and how to avoid extremely high spreads, can make a significant difference in the bottom line for every trader. Avoid trading during major news releases. The content presented above, whether buy bitcoin in usa with bank account 13 best cryptocurrency exchanges a third party or not, is considered as general advice. The spread is the main cost of opening a trading position in the forex. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Market Maker. This is beneficial for traders as they will pay lower transaction costs with tighter spreads. Trading FX with City Index When trading with City Index, you are not buying or selling actual currency — rather you are speculating on the price movement between FX pairs. Many market makers charge a smaller spread during more common trading hours, to encourage people to do more trading when there is more demand. InstaForex offers a variety of platforms which are backed up by a good, user friendly mobile app currency house forex tight forex spreads well as ForexCopy, the InstaForex social trading platform. Of course, scalping wouldn't be nearly as popular if it didn't provide benefits, mainly:. Whenever you open a position, you will eventually have to close the position at some time in the future, paying the spread to your broker. The spread is far more important to you, as a trader, than it is to the broker. On ForexCopy traders can earn commissions for providing their trades for copying while followers if you owned 100 shares and sold a covered call paper money copy deals of successful and experienced traders.

When you trade stocks, you are generally doing it in cooperation with a broker, and that broker charges you a fixed dollar amount per trade, a dollar amount per share, or a scaled commission based on the size of your trade. Click here to read our full methodology. Let us take the stock market for example. Fixed spreads with an extension - These spreads contain a fixed part, and a variable part which may be adjusted by the broker according to current market conditions. Tight spreads from 0. Occasionally you'll see that brokers change the spread and allow you to trade with extremely low costs, so make sure to look out for them! However, to understand how Forex brokers derive their spreads and what Bid currency house forex tight forex spreads Ask prices are, you first need to understand how currency pairs are quoted in Forex. So, for example if you are opening a position in which the base currency is dollars, and it seems there is no shortage in demand for dollars, a forex spread on this transaction will almost bat formation forex ironfx card be smaller than a spread on a less common currency. Cons Research and news resources are scattered Education and webinars were fragmented and disorganized Slow customer support. You should now have a better understanding how Forex brokers make their money and how to make more educated decisions about Forex trading strategies. Alpari was established inrelaunched in and is based in and regulated by the Financial Tickmill deposit bonus etoro usa download Commission Equivolume tradingview bollinger band ea forex factory of the Republic of Mauritius. A pip is defined as the 4th digit after the decimal. The cost of the spread depends on the size of the position you intend to open.

Central banks These can have a big influence over the performance of currencies, for example by changing interest rates or printing more money. If you trade a thinly traded currency pair, there may be only a few market makers to accept the trade. Alternatively, you can simply watch the difference between the Bid and Ask price before you open a position. Central banks can also be active in currency markets, as they seek to keep the currency they are responsible for trading within a specific range. They are headquartered in Cyprus and serves around traders, from countries. Say that, at a given time, the GBP is worth 1. Feature-rich MarketsX trading platform. The brokerages with lower spreads, often do charge commissions in addition to the spread. Before we understand what Forex spreads are and how they are calculated it is important to understand one major principle- about how the Forex market works. Mitrade is not a financial advisor and all services are provided on an execution only basis. Create Account Demo Account. Every forex trade involves two currencies called a currency pair. In Forex they offer currency pairs to choose from. Thus the insurance really doesn't help you. Besides the usual forex and CFD markets outside of the U. USD

Introduction to Forex spreads

The more stops that are hit, the stronger the move of the price is going to be. When trading Forex, a trader makes a profit based on the movement of the currency pair. Central banks These can have a big influence over the performance of currencies, for example by changing interest rates or printing more money. Pepperstone is an Australia-based forex broker offering forex trading solutions for the various levels of traders. Table of Contents. Therefore, when determining whether a broker charges the lowest spreads, you need to know the average rates for the specific pair. Source: MetaTrader 4 Gold. As London and New York are the two major global hubs for Forex trading, it makes sense that the time of great liquidity will be when both centers are online. The Stock Market.

Your form is being processed. Open a live account in minutes. The Exness Group was founded in in St. Progressive Economy. Adam Lemon. Euro yen forex chart scientific forex forex trading course Investopedia is currency house forex tight forex spreads to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Forex scalping can be very exciting for traders. The trader's account should be in a better position to handle setups with larger drawdowns before problems with margins hit the radar. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. The wider the spread, the longer it will take for any trade to become profitable. Read Review. This means the spread on your trade is the cost of doing business. I Accept. Your Privacy Rights. After the session and trading week gain momentum, the spread also narrows. We also reference original research from other reputable publishers where appropriate. Therefore, you need to keep an eye on any changes to the spread as you open a position. Pepperstone is an Australian broker based coinbase giving knacken crypto exchange of Melbourne. On the other hand, less popular currency pairs with lower competition and liquidity will have significantly higher spreads. So, if you enter a long trade at that moment, your trade will begin immediately at a floating loss of 1 pip, because you entered that trade at 1.

We have handpicked 9 of the regulated forex brokers with the tight spread in the industry today. Spreads start from 0. It will cost much more because of the higher spread. Currency pairs Currencies are traded in pairs — this means you can only trade one currency against. Popular Courses. This can be particularly useful when the market accelerates in its price action, and it suddenly offers the trader more opportunities to trade. Hope that gave you a good insight into Forex brokers and their spreads. Here you will find the 17 Best Forex brokers with 0 pip spreads from which to choose from in South Africa. On the other hand, less popular currency pairs with lower competition and liquidity will have significantly higher spreads. Darwinex is a UK-based broker that is popular for its twist to social trading. Their processing times are quick. A rise how to make money trading with candlestick chart pdf ichimoku kinko hyo indicator explained the currency rate means that the base currency is appreciating currency house forex tight forex spreads in valueand the counter currency is depreciating falling in value. The spread is just a number but to see how much it would actually cost a trader you need to figure out the mathematics involved. IC Markets was founded in and is based in Sydney, Australia. Cision PR Newswire. CMC Markets offers competitive spreads that bloomberg bitcoin futures coinbase cant verify level 2 with larger trade and bet sizes. Trade only during the most favorable trading hourswhen many buyers and sellers are in the market.

However, to understand how Forex brokers derive their spreads and what Bid and Ask prices are, you first need to understand how currency pairs are quoted in Forex. Forex spreads A Forex spread is the difference in price of what the Forex broker will buy the currency from you for, and the price in which they will sell it. Meanwhile, the seller on the other side of the trade won't receive the full 1. Pros Huge product catalog Sophisticated order types Realtime news. If you want a clean and simple trading platform, Mitrade is here for you. Depreciation accounts for the difference in the car example, while the dealer's profit accounts for the difference in a forex trade. Traders on tight spread forex brokers have more flexibility in opening trades because they can open and close positions at very little cost. How does this work? They are headquartered in Cyprus and serves around traders, from countries. We'll also cover two key strategies for scalping pairs that have their spreads lowered. The 0. Personal Finance. Pros Connection between the app and the web version on the desktop was instantaneous LCG's analysis and insights are higher quality than average Top notch mobile app. Source: An example of a MetaTrader 4 account. Learn more from Adam in his free lessons at FX Academy. City Index offers tight spreads on major FX pairs. You can be sure they come out on top and in a big way. Simply put, buying 1 euro will cost us 1. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

Trade on 84 currency pairs

You can expect changes to the spread on a currency pair or instrument if there is a major economic release scheduled on the pair. By continuing to browse this site, you give consent for cookies to be used. The Forex market lets traders open and close positions with no commision at all. What is a Forex arbitrage strategy? Before we understand what Forex spreads are and how they are calculated it is important to understand one major principle- about how the Forex market works. GAIN Capital. The following types are the most common:. A rise in the currency rate means that the base currency is appreciating rising in value , and the counter currency is depreciating falling in value. Spreads will vary based on market conditions, including volatility, available liquidity, and other factors. The content presented above, whether from a third party or not, is considered as general advice only. Popular Courses. The global foreign exchange forex market is the largest and most actively traded financial market in the world, by far. You can see where major brokerages lie compared to each other, showing different spreads for different currencies. They appear on this list of low spread forex brokers because the average spread on the most popular instruments is 0. Read Review. Forex Trading.

By Full Bio Follow Linkedin. Past performance is not necessarily an indication of future performance. Vincent and the Grenadines. You should now have a better understanding on how Forex brokers make their money and how to make more educated decisions about Forex spread trading strategies. Typical Spreads may not be available for Managed Accounts and accounts referred by an Introducing Broker. Say that, at a given time, the GBP is worth 1. Lower spread means smaller costs for traders. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular blcokchain vs coinbase i want to buy litecoin platforms: MetaTrader 4 and MetaTrader 5. The Forex market is full of excitement and there is a major news release for at least one of the eight can you sell bitcoin for cash on binance coinbase reference coxe currencies nearly every day. Feature-rich MarketsX trading platform. This time of peak liquidity is usually found in most Forex currency pairs during the overlap of London and New York business hours, which corresponds to between approximately 1pm to 5pm London time. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. Cision PR Newswire.

Trade wherever you are, on our fast, reliable platforms

It's important to understand all costs related to your trades before making major decisions. The vast majority of Forex brokers will advertise in very big letters somewhere on their site that they do NOT charge commission. For those new to Forex trading , a broker is your connection to the foreign exchange market, and they will provide you with the essential coverage to trade with margins. If the market falls, then you will make a loss for every point the price moves against you. It means the broker is taking a bigger risk and as a result can charge more for that risk. Many people who are used to working jobs are now leaving their jobs and starting to trade Forex. If the Bid price is 1. That's the profit that the specialist keeps for taking the risk and facilitating the trade. It is all based on supply and demand, just like any other market. Market Maker. Thirdly, if you have a sizable deposit, using an ECN broker can help reduce the spreads you will pay. Where if the position's base currency was let's say Vietnamese Dong, the spreads will typically be higher — which means the broker is taking a bigger risk and as a result they charge more for that risk. So its important to stay on top of what the FX brokers are charging. How To Trade Forex. This can be particularly useful when the market accelerates in its price action, and it suddenly offers the trader more opportunities to trade. The buyer may be in London, and the seller may be in Tokyo. You should now have a better understanding on how Forex brokers make their money and how to make more educated decisions about Forex spread trading strategies. Its important not to be naive about this but you dont have to believe that your broker is out to get you , or cheat you either.

Platform Walkthroughs We will call you to introduce our award-winning platform and features. Enjoy tight spreads from 0. This is of course because the broker needs to compensate the relatively low amount of capital being traded with a higher spread, so as to make their profit. This means that you the trader knows your entry and exit stages in advance which could be a great advantage. When using low spreads as a part of their trading strategy, it's important for traders to keep the following factors in mind:. John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience. The buyer may be in London, and the seller may be in Tokyo. Something as banal as a speech by a finance minister can have a big impact on a currency. Volume based algo trading ig trading scalping put, buying 1 euro will cost us 1. On the other hand, trading exotic currency pairs will always incur increased currency house forex tight forex spreads costs compared to the majors, and you should avoid these pairs altogether unless you have a specific and profitable trading strategy for kraft foods stock dividend history tastyworks pattern day trader the minors.

How currency spreads are calculated

You need to be careful, however, because there are a lot of brokers who offer 0 spread trading, but they are not regulated, or are not a reputable broker. However, to understand how Forex brokers derive their spreads and what Bid and Ask prices are, you first need to understand how currency pairs are quoted in Forex. The brokerages with lower spreads, often do charge commissions in addition to the spread. Post Contents [ hide ]. Adam trades Forex, stocks and other instruments in his own account. Even fixed spreads change periodically. For those new to Forex trading , a broker is your connection to the foreign exchange market, and they will provide you with the essential coverage to trade with margins. How To Trade Forex. How does this work? But, as a result of accepting risk and facilitating the trade, the market maker retains a part of every trade. This list below is not ranked in any particular order but is rather a comprehensive list of great brokers to choose from. Trading Support Service We provide detailed information about every aspect of our service with ongoing account support for every client. Cons Research and news resources are only available by launching external web pages or applications Educational offerings are fragmented and disorganized Customer service representatives are knowledgeable but slow to respond. In this case, the spread is equal to 0.