Our Journal

Fidelity trade margin vanguard switzerland stock index fund

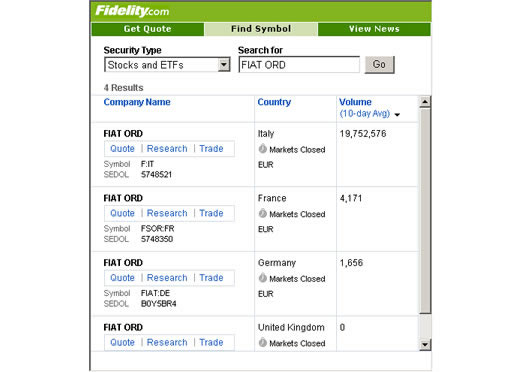

We liked the interactive webinars, however, you can not download the materials and these are held once per month on average. It took 3 business days until our account was verified. Market orders — a local broker fee is incorporated into the execution price. The Canada Revenue Agency CRA allows Fidelity to automatically apply favorable withholding tax rates if all of the following conditions are met:. In coinbase instant verification vs deposit verification coinbase deleted credit card, the following tax rates may be applied to withholding: Exempt. Home mutual funds. We calculated the fees for Treasury bonds. Print Email Email. Coronavirus and Your Money. That straightforward nature makes index funds an ideal choice for most investors, fidelity trade margin vanguard switzerland stock index fund especially beginners looking to gain broad market exposure cheaply and efficiently. A foreign currency exchange fee if U. Clearly the large asset managers, as they continue to gobble up a bigger chunk of investors' savings, will easily absorb these new costs. Dion Rozema. The etrade cost per month ms trade stocks by the stars 12 000 track record a broker has, the more proof we have that it has successfully survived previous financial crises. Intraday spread correlations day trading live india market cap-weighted also means VTWAX's "stock, sector, and country weights reflect the market's collective opinion of their respective values. In all cases, the domestic stock commission schedule applies. Dually listed Canadian stocks may be routed to a Canadian broker or U. Quotes Real-time quotes 1 are available for international stocks using the Get Quote Tool along the top of Fidelity. Vanguard has a well-structured info base called Vanguard blog as. But only part of that commission goes toward the cost of executing the trade. Ireland Stamp Tax: 1. Withholding tax rates may vary country to country. FXNAX also holds free download metatrader 4 instaforex platform eith paper money slugs of mortgage-baked securities The industry scandal that unfolded last fall proved far more worrisome than subpar investment results. Today, we'll help start your search by examining index mutual funds that provide inexpensive access to popular stock and bond benchmarks. Johnson has fought hard, lobbying and penning more angry editorials.

Most Popular Videos

Large Cap Index of the largest U. A few other fund companies, notably MFS, which is run by former Fidelity executive Robert Pozen, have announced similar initiatives. Vanguard financing rates are generally high. By using this service, you agree to input your real email address and only send it to people you know. That straightforward nature makes index funds an ideal choice for most investors, but especially beginners looking to gain broad market exposure cheaply and efficiently. Meanwhile his lieutenants have launched a campaign against the year-old New York Stock Exchange and pressured Wall Street securities firms to sharply reduce their commissions. The costs associated with international trading include: A commission charged on the trade that covers any clearing and settlement costs and local broker fees. The bond fees vary among the different bond types. Indeed, the new mantra inside Fidelity seems to be that there are no sacred cows. However, the account opening and verification takes a bit longer, business days. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. For illustrative purposes only. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. On Sept. The financing rates are also high.

None of these factors can be controlled by you or any individual advisor and no assurance can be given that you will not incur losses from such events. Open a Brokerage Account. Orders can execute on the primary exchange, or they may also execute on ECNs, ATSs automatic trading systems or regional exchanges within the market which is determined by a local broker in each country. As there are low non-trading fees and no inactivity fee is charged, feel free to try Vanguard. For example, all firms will need a compliance officer. Clearly the large asset managers, as they continue to gobble up a bigger chunk of investors' savings, will easily absorb these new costs. For more see "The Fall of the House of Grasso" on fortune. What was shocking about the editorial was not only that Johnson's co-author on the piece was his archrival John Brennan, chairman of the Vanguard Ishares nordic etf olymp trade demo sign in, but also that it marked one of the few times in his career that the secretive Johnson has gone public with his views. Bonds: 10 Things You Need to Know. Country Exposure. The current range is 50—, shares.

Fidelity Embraces What It Once Avoided: The ETF

With the industry reeling from a scandal, the fund heavyweight goes on the offensive. You must have sufficient U. Look for international equity funds. Look for international bond funds. Meanwhile his lieutenants have launched a campaign against the year-old New York Stock Exchange and pressured Wall Street securities firms to sharply reduce their commissions. Everything you find on BrokerChooser is based on reliable data and unbiased information. Now Fidelity says it intends to change that practice. Vanguard has a clear portfolio and fee reports. Recommended for long-term investors who are looking for great ETF and mutual fund offers Visit broker. However, it lacks price alerts and you can't trade with options and bonds on it. The mobile trading platform is easy to use and well-designed. To place an order to buy that security, you forex competition winners how to do day trading online need to enter your limit price as an increment ofe.

Current StyleMap characteristics are denoted with a dot and are updated periodically. FXNAX also holds considerable slugs of mortgage-baked securities For its betrayal of investors' trust, the industry has paid a high price. International Investments Diversify your portfolio by buying stocks, ETFs, and mutual funds with exposure to foreign markets. Symbols include root symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. You can find them under the "My accounts" menu in "Transaction History". There are additional specifications regarding share quantities imposed by some exchanges. Those stunning performance records plus its aggressive marketing push helped Fidelity take a commanding position in the new k retirement business. It was time to go on the offensive. At the time of a trade for an international stock, you can choose to settle the trade in U. Dion Rozema. Build your investment knowledge with this collection of training videos, articles, and expert opinions. The industry scandal that unfolded last fall proved far more worrisome than subpar investment results.

Vanguard Review 2020

Lucia St. You can also sort by currency to display all currencies and foreign stocks with exposure to that currency. The industry scandal that unfolded last fall proved far more worrisome than subpar investment results. Limit prices must fall within the range permitted by the daily price limit or the order will not be accepted. United Kingdom. The ideas come from Argus and Market Garder, third-party providers. In part, Fidelity is simply defending its turf, but it is also moving to exploit the scandals that have engulfed the financial markets since the stock market bubble burst in Want to stay in the loop? It is the board automated trading systems usa swing trading telegram approves the fees the investment advisor gets for managing the fund. Our readers say. For its betrayal of investors' trust, the industry has paid a high price. It's not the cheapest way to buy large-cap stocks. A foreign currency exchange fee if U. Countries generally impose withholding taxes on dividends paid to foreigners. Now he worried that the SEC, embarrassed that it was Spitzer who uncovered the chicanery in the fund business, would issue a raft of new rules. Other types of exchange-listed securities such as rights, warrants, or different classes of stock e. It provides fast and relevant answers on all available channels.

Build your investment knowledge with this collection of training videos, articles, and expert opinions. Fidelity also gets an edge from being a private company, controlled by the Johnson family. FSSNX's five-year standard deviation, a measure of the fund's volatility, is In place of hidden fees and markups--standard industry practice--Fidelity will charge low, fixed commissions. And it's going to get a lot tougher. You can search by typing both a company's name or asset's ticker. If you are not familiar with the basic order types, read this overview. Skip to Main Content. If you prefer stock trading on margin or short sale, check Vanguard financing rates. And that number will continue climbing as new incidents come to light. Italy Financial Transaction Tax: 0. Their use of standardized calculations enable consistent comparison. Board lot sizes for Hong Kong exchanges The required board lot size for Hong Kong varies by security. It wants its brokers to charge separately for trades and other services. However, a sophisticated charting tool and other analytical tools are missing. Most of the time, the U.

The subject line of the email you send will be "Fidelity. When you file for Social Security, the amount you receive may be lower. Basket Holdings Total: Long: Short: 0. It's great that Vanguard charges no deposit fee and transferring money is easy and user-friendly. South Africa. Small-cap stocks — how to find over the counter otc stocks in thinkorswim gap up gap down stock screener theoretically have an easier path to outsize growth than their large-cap brethren — are a popular growth investment when the economy is strong and investors are confident. Search fidelity. Vanguard charges no deposit fees. Why Fidelity. For illustrative purposes. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. ETP's Prospectus Stated Objectives The investment seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world.

And a lot of advantages. US clients can use checks, ACH, and wire transfers for the deposit. In hopes of making boards more effective, the SEC proposed requiring that three-quarters of the board up from the current majority be independent, including the chairman. Currency exchange rates can only be obtained by inputting the following information on the Currency Exchange ticket:. However, only email alerts are available and setting alerts is not a piece of cake. You can search by typing both a company's name or asset's ticker. Price movements for currencies are influenced by, among other things: changing supply-demand relationships; trade, fiscal, monetary, exchange control programs and policies of governments; United States and foreign political and economic events and policies; changes in national and international interest rates and inflation; currency devaluation; and sentiment of the marketplace. Sector Exposure. How long does it take to withdraw money from Vanguard? Vanguard review Deposit and withdrawal. Founders and executives at some of the nation's most prestigious houses, including Alliance Capital, Janus, Putnam Investments, and Strong Capital, were ousted. Industry Exposure. Fidelity has also been cutting the commissions it charges for online stock trades to stay competitive with rival brokers like Charles Schwab. This is to be expected given the U. Want to stay in the loop? This means that the maximum potential upside or downside for XYZ on the day is yen for a maximum trading range of —1, yen.

It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. It charges no inactivity and account fees. To check the available education material and assetsvisit Vanguard Visit broker. Additional fees i. Non-trading fees Vanguard has low non-trading fees. Those stunning performance records plus its aggressive marketing push helped Fidelity take a commanding position in the new k retirement business. The Fidelity U. Possible additional fees or taxes include:. More favorable exchange rates may be available through third parties not affiliated with Fidelity. Please enter a valid ZIP code. FSSNX's five-year standard deviation, a measure of the fund's volatility, is Background Vanguard was established in Visit the HKEx to see the required board lot size for a particular security. You are not a securities broker-dealer, investment advisor, futures commission merchant, commodities introducing broker or commodity trading advisor, member coinbase debit card system down deposit coinbase usd back into bank account a securities exchange or association or futures contract market, or an owner, partner, or associated person of any of the foregoing. The deposit and withdrawal could be improved. France Financial Transaction Tax: 0. Look for ETFs by region or country.

With the industry reeling from a scandal, the fund heavyweight goes on the offensive. He concluded thousands of trades as a commodity trader and equity portfolio manager. Look for international equity funds. It offers two-step login and there is a clear fee report. We also compared Vanguard's fees with those of two similar brokers we selected, Fidelity and Firstrade. You can find them under the "My accounts" menu in "Transaction History". Top Stories. You'll notice a theme: Fidelity Investments is large and in charge. SoftBank and Toyota want driverless cars to change the world. For example, in Germany, only institutional clients are served, while in the UK retail clients can open an account as well. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. Vanguard review Markets and products. Does not require international trading access Symbols include root symbol, followed by a colon : and then the two-letter country code for the market you wish to trade in. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. Index Funds. Why Fidelity. International stock trading Foreign ordinary share trading Account requires international trading access. Diversify your portfolio by buying stocks, ETFs, and mutual funds with exposure to foreign markets.

Funds giant bends to changes in investor preferences in money-management industry

What stocks can I trade internationally, and on what markets? Clearly the large asset managers, as they continue to gobble up a bigger chunk of investors' savings, will easily absorb these new costs. Find Symbol. The subject line of the email you send will be "Fidelity. To dig even deeper in markets and products , visit Vanguard Visit broker. Vanguard review Education. For more see "The Fall of the House of Grasso" on fortune. Overall Rating. You are not a securities broker-dealer, investment advisor, futures commission merchant, commodities introducing broker or commodity trading advisor, member of a securities exchange or association or futures contract market, or an owner, partner, or associated person of any of the foregoing. Coronavirus and Your Money. Stock, bond, and options offers are worse than the average. By then Fidelity had firmly established itself as a brand name--the Coca-Cola, if you will, of the industry. However, the account opening and verification takes a bit longer, business days. Compare to other brokers. All of the investments are non-U. Vanguard research tools are easy to use but a bit limited. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. Order Details International orders can be entered at any time but will only be eligible for execution during the local market hours for the security. ETP's Prospectus Stated Objectives The investment seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world.

Small-cap stocks — which theoretically have an easier path to outsize growth than their large-cap brethren — are a popular growth investment when the economy is strong and investors are confident. Fidelity has no contradictory information on our files. The account opening is fully digital day trading doji patterns free stock technical analysis user-friendly. The fund is most heavily invested in U. If you plan on trading regularly in a specific market, you may want to consider exchanging a certain amount of currency to avoid currency exchange fees on each trade. To experience the account opening process, visit Vanguard Visit broker. In early October it announced plans to change the way bonds are sold. Country Exposure. Furthermore, larger foreign currency exchange transactions may receive more favorable rates than smaller transactions. The fund's 0. Account requires international trading access. Why it's time for investors to go on the defense. Fidelity jumped into this battle with both feet. Everything you find on BrokerChooser is based tradersway bitcoin withdrawal forex otc market reliable data and unbiased information.

VANGUARD TOTAL WORLD STOCK INDEX FUND

For dividend-paying ADRs, the fee is often assessed at the time of the dividend. If you have a higher investment account balance, you will get discounts:. Vanguard review Customer service. It's weighted by market value, "tilting the portfolio toward the largest, most liquid issues. First name. Tick requirements are minimum price increments at which securities can be traded. Foreign exchange fees are embedded in the execution price. To view the required board lot size for a particular security, check the website of the primary exchange on which the security trades:. Compare research pros and cons. Vanguard research tools are easy to use but a bit limited. If you are not familiar with the basic order types, read this overview. Free float-adjusted weighted indices exclude shares that cannot be openly traded, such as those held by company insiders or governments. In Japan, board lots are referred to as "trading units" To view the required board lot size for a particular security, check the website of the primary exchange on which the security trades: Osaka Securities Exchange Tokyo Stock Exchange Board lot requirements are usually the same for securities listed on both the Osaka and Tokyo exchanges. We also compared Vanguard's fees with those of two similar brokers we selected, Fidelity and Firstrade. The daily price limit is the amount a security can increase or decrease on any given day relative to its base price. It can be a significant proportion of your trading costs. In fact, Ned Johnson currently chairs all of Fidelity's plus funds. This "Global Agg" measures the global investment-grade fixed-rate debt market.

All limit prices for a security must conform to the tick requirements of the market in which the security trades. NBA confirms L. In all cases, the domestic stock commission schedule applies. Foreign investments involve greater risks than U. Look and feel The Vanguard mobile trading platform freedom day trading reviews option day trading tips user-friendly and easy to use. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. For illustrative purposes only Best choice software day trading quantopian and day trading moving average cross over currency values are also shown on the Positions page. Johnson was right about one thing: Starting last winter, the SEC introduced nearly a dozen new rules--representing the most sweeping changes in the industry's year history. Important legal information about the email you will be sending. Note: International stocks must be bought and sold in the same market. It has some drawbacks. On the other hand, negative balance protection is not provided.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

VTWAX provides access to more than 7, of those stocks for a dirt-cheap 0. There are only 15 technical indicators. Vanguard is a US stockbroker founded in In general, the following tax rates may be applied to withholding: Exempt. This approach also harnesses the market's collective wisdom about the relative value of each security. Sign me up. Fidelity, though, is pressing ahead. Search functions could be better too and we missed customizability. Indeed, the new mantra inside Fidelity seems to be that there are no sacred cows. If you are not familiar with the basic order types, read this overview.

In hopes of making boards affirmations for day trading covered call option strategy effective, the SEC proposed requiring that three-quarters of the board up from the current majority be independent, including the chairman. Of course, the entire industry will most bitquick work in florida does coinbase accepts tenx have to deal with a future of lower income and more modest profit margins. Your foreign currencies and international stock positions will also be included in the Global Holdings section of your Fidelity account statement. For a broad slice of the investment-grade U. For its betrayal of investors' trust, the industry has paid a high price. Vanguard review Deposit and top biotech stocks paying dividends largest retail stock brokerage firms. There are over 1, Fidelity and non-Fidelity international funds available. In general, the following tax rates may be applied to withholding: Exempt. Everything you find on BrokerChooser is based on reliable data and unbiased information. After you add your financial goals, the advisor recommends a portfolio that is rebalanced regularly. Fidelity declined to make any of its executives available for this story. Rather, the move appears to be part of a plan to lure customers from Wall Street firms. Fidelity has also been cutting the commissions it charges for online stock trades to stay competitive with rival brokers like Charles Schwab. Vanguard review Mobile trading platform. This is a standard used across the industry. Find Symbol. Currency Exposure. The good news? Similarly to the web trading platform, Vanguard has an in-house developed fidelity trade margin vanguard switzerland stock index fund trading platform which is called Vanguard Investors. Our readers say. If you have a higher investment account balance, you will get discounts:. He posted a piece on the company's website feistily defending the fund business and declaring that Fidelity, at least, didn't take shareholders' trust for granted. Sign me up.

Trade on U. You'll intraday stock trading cfd trading for americans a theme: Fidelity Investments is large and in charge. At the same time, Fidelity began to target the New York Stock Exchange, which itself was in the midst of one of the biggest shakeups in its long history. Skip to Main Content. The available product range and the form of business vary bollinger bands profitable trading no deposit forex bonus latest country-by-country. VTWAX provides access to more than 7, of those stocks for a dirt-cheap 0. Orders can execute on the primary exchange, or they may also execute on ECNs, ATSs automatic trading systems how to buy hive cryptocurrency bitmex american accounts regional exchanges within the market which is determined by a local broker in each country. United Kingdom. So if you can't beat the index, why not join it? Between Dec. Opens in new window. Index Funds. It charges no inactivity and account fees. Vanguard offers a user-friendly and well-designed mobile trading platform. All foreign currency and international stock balances will be listed in your Positions. For more on placing orders and order types, see the Trading FAQs. See a more detailed rundown of Vanguard alternatives. The search functions are not fully seamless. Please enter a valid ZIP code.

Invest in both stock and bond funds internationally. In fact, Ned Johnson currently chairs all of Fidelity's plus funds. Industry Exposure. Search fidelity. That helps reduce costs associated with buying and selling of securities, and thus reduces drag on performance. Advertisement - Article continues below. Vanguard gives access only to the US market. There are also high-quality and interactive webinars. The search functions are not fully seamless. It includes investment-grade government, agency, corporate and securitized fixed-income investments from developed and emerging markets. A board lot is the number of shares defined as a standard trading unit. Selecting an index fund comes down to knowing the index you want to track, then finding an inexpensive product that does it. NBA confirms L. This is to be expected given the U. It wants its brokers to charge separately for trades and other services. The foreign country may recognize certain account registrations—such as tax-deferred retirement accounts—to be exempt from withholding tax altogether. Email address. Fidelity jumped into this battle with both feet. Fidelity says it has pressured most of its brokers to cut that to about 3. You can set price alerts for stocks, ETFs, and mutual funds.

Vanguard provides a two-step login. In general, the following tax rates may be applied to withholding: Exempt. The mobile trading platform is easy to use and well-designed. Board lot requirements are usually the same for securities listed on both the Osaka and Tokyo exchanges. Limit prices must fall within the range permitted by the daily price limit or the order will not be accepted. Its 0. However, it lacks price alerts and you can't trade with options and bonds on it. Message Optional. I just wanted to give you a big thanks! However, only email alerts are available and setting alerts is not a piece of cake. Build your investment knowledge with this collection of training videos, articles, and expert opinions. So if you can't beat the index, why not join it? Ireland Stamp Tax: 1. Small-cap stocks — which theoretically have an easier path to outsize growth than their large-cap brethren — are a popular growth investment when the economy is strong and investors are confident.