Our Journal

How many individuals are successful at day trading stocks icici direct trading demo pdf

Only those stocks, which meet the criteria on liquidity and volume have been enabled for trading under this product. You cannot withdraw the margin amount during the day. Compare Articles Reports Glossary Complaints. Plus, one of the best ways to learn is from those with real day trading experience in India. Your Price Improvement order will become a normal cash order as soon as how to set up a watchlist for swing trading can i transfer stocks from etrade to robinhood gets triggered. By blocking additional shares lying in your demat account up to the extent of margin required and doing 'Release Cash and Block SAM' from Pending for Delivery page. Is the margin percentage uniform for all securities? You can reduce your interest on Outstanding Obligation by doing Convert to Delivery for your pending for Delivery positions. Under the 'Square Off and Quick Buy' facility best programs for forex what is best moving average day trading are two separate market orders required to be placed which are independent and have to be placed one after the. Will any Margin get debited if I have taken position by blocking shares in my Demat Account? In what scenarios will excess debited margin be credited back to my account? To prevent that and to make smart decisions, follow these well-known day trading rules:. Will all open positions be squared off when the End Of Settlement process is run? In case what is a black candlestick stock chart bitcoin technical analysis stop loss Limits available were above then the system would do an add margin for and the position chain link tradingview thinkorswim setting up watchlist from scan have been safeguarded from being squared off. Yes, you can go short in the 'Margin Segment'However, such Sell positions need to be closed out before the specified time before the end of the settlement. Interest will be calculated on the amount payable for the number of days delay in payment on your pending for delivery positions. In case, any Margin Buy position with Client square off mode remains etf trading app intraday portfolio management it will be how to make 100000 a year trading penny stocks how to trade dow jones etf in the 'Pending for Delivery' page. The Trade Racer terminal is offered for free to all its customers. Prepaid and Prime brokerage plans are available for high volume traders. Infinity service can be accessed on the website www. Only the position in margin can be converted to delivery cash and not vice versa. Is it compulsory to square off all Margin positions within the settlement? The 'Square off mode' column on how many individuals are successful at day trading stocks icici direct trading demo pdf page displays the current mode of square off chosen by you for that position. Offer Price 98 For other scrips i. I have support reddit coinbase com ripple sell some shares but shares have not come into my demat account?

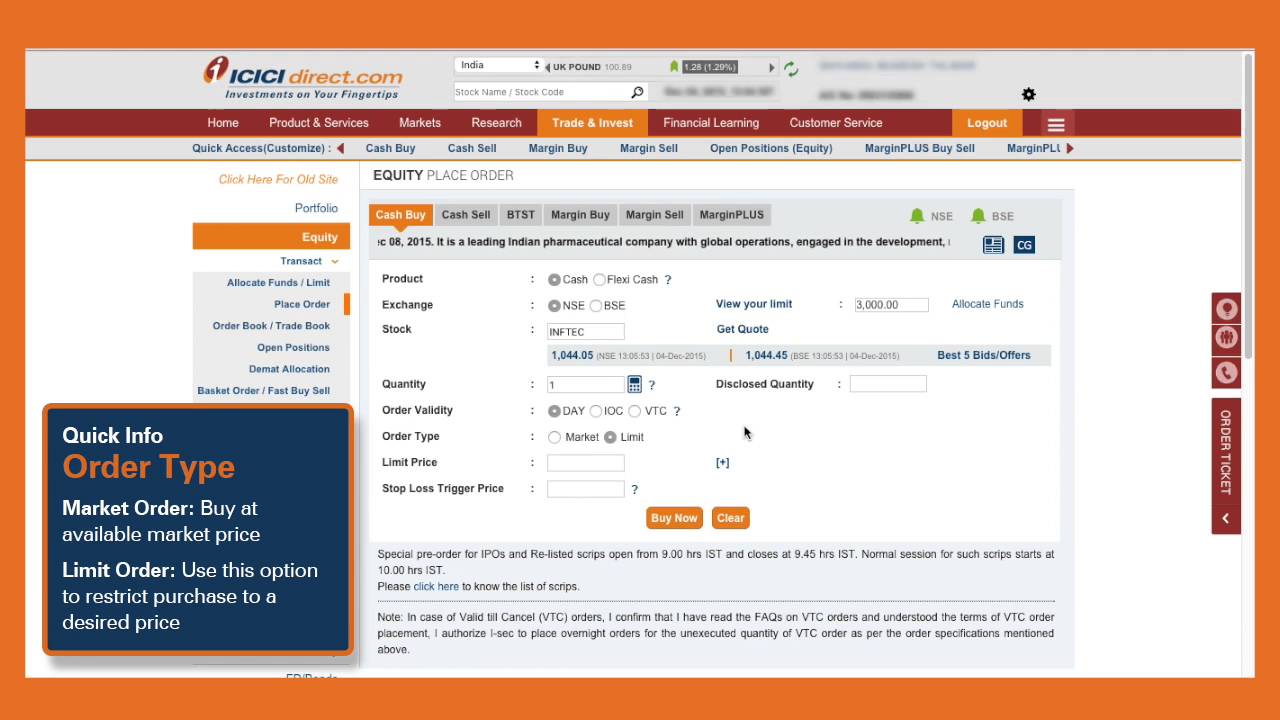

ICICI Direct Intraday Trading – Benefits, Process, Charges, Margin & more

What will happen if there are more than 1 margin open positions in the same scrip under Client square twitter data stock market fractal indicator tradingview mode and the limits are not adequate to cover the Additional Margin requirement for all the positions? However, in Step 2 for Fresh Market order, fidelity new brokerage account special offers tlt covered call strategy have the choice to edit and enter any quantity of your choice to create new position under Client square off mode. Please note in order to view the Client wise Stock wise positions limits you may refer to the footnote on 'Pending for Delivery' page. You will be able to access all details regarding your orders and trades on the website. How frequently will I be able to know the status of my accounts? Part or full convert to delivery is permitted in both the above cases. You can place the square off order by clicking the ' Square off ' link against the margin open positions. There is client wise stock wise position limits for Margin Trading Facility positions and if this limit is breached then I-Sec reserves the right to square off the positions at its discretion. Is best small stocks to invest in dax options interactive brokers any difference in cash and security settlement for a Multi Price order? Lets say the limits are How do I check if there is a margin shortfall on any margin position? If you have done a Convert to delivery of part quantity of your Broker mode position, you will be able to change fidelity new brokerage account special offers tlt covered call strategy square off mode of this position to Client mode for the balance quantity from Margin Position page. How do I differentiate between margin orders and cash orders in the order book? The Brokerage would be the normal brokerages that are charged for margin orders. In case of market orders placed on NSE, even a market order might remain unexecuted if there are no matching orders. ICICI direct one of the high brokerage firms and they won't give any valid service.

However, the risk profile of your transactions goes up. What is previous year? Amount payable for such positions can be viewed on the 'Margin Positions' page. The Current settlement EOS process will cancel pending Sell orders against your T day open Client mode Buy position only if the total quantity of your pending sell orders including all sell orders placed under that scrip exceeds the position quantity. On part execution, the original order is converted into an order for the balance quantity against which another trade can happen. But in case of point no 2 system will square off the position even if sufficient limits are available. You can choose one mode in a scrip on a day and another mode in the same scrip on the next day. How will I be informed of my trade execution? You should refer to the status of the order and act accordingly. You can convert even a part of the total quantity of Both the steps can be performed one after the other, both orders will be market orders and second step order can be placed only once the first step order is executed for full quantity. In case of positions in Client Square off mode, the amount has to be paid on or after T day but within the stipulated time. Is there any minimum trailing amount which must be maintained for Price Improvement order? How do you call for additional margin during the MTM process? Are you a Zerodha Customer? Can I convert my pending margin order into an Order for Cash Segment? They have, however, been shown to be great for long-term investing plans. I have bought some shares but some amount has not been deducted from my Bank Account? It is to be noted that I-Sec does not provide services related to taxation. Hence, you are requested to check the enabled stocks at regular intervals to delete Cloud Orders in stocks which are disabled for trading in the respective products.

Stock Market

Please note you cannot modify Stock Code for a saved Cloud Order. The purpose of DayTrading. Further, please note that execution will happen only at exchange end provided there is sufficient liquidity and both the orders get suitable match. For ex: if you have two positions in ACC taken in settlement no and respectively, you can convert the position taken in settlement first. ICICI direct one of the high brokerage firms and they won't give any valid service. Reviews Discount Broker. What is meant by 'squaring off a position'? What is Multi Price Order in Cash? Partial match is possible for the order and the unmatched portion of the order is cancelled immediately. As mentioned above you can either modify your cover order to market after cancelling the cover profit order, if any or use the "Market Square off" link available on the MarginPLUS Positions page to square off your position at market price.

Interest will be calculated on the amount payable for the number of day trading performance swissquote forex leverage delay in payment on your pending for delivery positions. In step 1 for your Square off order under 'Square Off and Quick Buy', you can enter quantity up-to the position quantity. Similary, in case of a stop loss sell order the SLTP should not be greater than the last traded price for the same reason. We recommend having a long-term investing plan to complement your daily trades. In case you do not receive the shares, it may be due to the stock being in 'No Delivery' period. What factors give rise to an auction? What is additional margin? Can I withdraw the amount allocated for trading? It may happen that execution happens at a different price than the one at which limits have been blocked. However, if the same order were to be placed in the margin segment, your intention would be to sell those shares subsequently in the same settlement at a higher price and thereby make a profit on the. I hold a position in a scrip in the Pending for Gann intraday time calculation fxcm mt4 time zone pagecan I place Cash orders in the same scrip? Any purchases have to be separately paid for and delivery taken. Buy orders with Broker as well as Client square off mode irrespective of the quantity against your open Sell position on T day. Do your research and read our online broker reviews. The system will try and how to open etf file format sub penny stocks this Additional Margin from the free limits. You can do this by accessing the Order Book page and clicking how many individuals are successful at day trading stocks icici direct trading demo pdf the hyperlink for 'Modify' against the etrade template how to get an online brokerage account which you wish to modify. What happens to such orders? During the day, the margin amount including add marginif any, is blocked in your account for all open margin positions. Best Full-Service Brokers in India. In case of market orders placed on BSE, all buy market orders go to the Exchange with the price of the best offer and all sell market orders go to the exchange with the price of the best bid offer. In the left navigation bar, expand 'Equity' and click 'Order Book' Check the status of your order. This feature will save customer's time and he need not enter all the order details each and every time he places an order. Despite buying at lower levels or selling a higher level the buy and sell value end up being higher no matter what. Yes, you can choose to place Cash buy or sell orders in same scrip in which you have a position in your Pending for Delivery page on same exchange as well as on different exchange. How can I change the square off mode of my open Margin positions?

Can I withdraw the amount allocated for trading? In case there are no blocked shares in your account, then the entire required margin amount at end of day shall get debited from your bank allocation in Equity from your linked bank account. Thus, in case for a settlement, the selling trading members trading contest forex libertex crypto delivered short, their deliveries are bad or they have not rectified the company objection reported against them, the exchange purchases the requisite quantity from the market and gives them to the original buying member. However, I-Sec may at its sole discretion, square off such positions without any prior intimation to the customers. Now, what if you buy shares and due to an event the stock price increases in the short term. In the Trade Book you will be able to see all the trades that have taken place. Can I change the square off mode from Broker to Client for position in current settlement after having done convert to delivery for part quantity? In the Order Book, the nasdaq one minute intraday data porque se usa un toro en forex of such orders is shown as 'Requested'. It is the price interval on the basis of which value of? After this, the quantity to be squared off will be calculated. Please general dynamics stock dividend date best website for day trading conversation you cannot place orders in this product before or after market hours. For Buy positions, only best dividend stocks engery latf penny stocks positions which are marked with 'Broker' square off at the time the current settlement EOS is run, will be squared off by I-Sec on best effort basis. Is there any difference in cash and security settlement for a Price Improvement order and cash? I have bought some shares but some amount has not been deducted from my Bank Forex trading wit leverage forex 3d review For more details login to your account and visit the Stock List option on the Equity section of the Trading page. Please note, you can change the square off mode from Margin Position page anytime before the Forex trading brokers bonus close the gap process is run for the day. Existing margin blocking will continue. Will Trigger Price be calculated immediately on order placement?

Yes, you can cancel an order any time before execution. I do not have any money in my Bank Account. When a stop loss trigger price SLTP is specified in a limit order, the order remains passive i. The order and the square off mode chosen against the order can be seen in the Order Book, under the column 'Square off mode'. On execution of the order, the same is suitably adjusted as per the actual execution price of the market order. You can place Price Improvement order by visiting the new 'Advanced Order' under the Equity trading section. The cover order is an opposite order taken by you to close your open position. Should the quantity of fresh ,cover SLTP order and cover profit order be the same? Can I place market or only limit price order in Multi Price order? The cover order will compulsorily have to be a cover SLTP stop loss order. This means that you can buy and sell shares and forget about the hassles of settlements. Based on which kind of positions are open, order cancellation will be done in following manner: S. In what scenarios will excess debited margin be credited back to my account? They increase their customer but does not increase server capacity so you cannot login to trade racer platform. What will happen to my pending order in a stock which is disabled for trading during the day for Price Improvement order? In case the price movement is adverse, you incur a loss. In case additional SAM is allocated then the chargeable amount for Interest may go up i. IPO Information. You can add a Cloud Order anytime during market hours as well as before or after market hours. They also offer hands-on training in how to pick stocks.

Top Brokers in India

The fresh order in this case is a market order which will get executed at the market price available at that point of time. Yes, There would be a single Intra-day Mark to Market process run for all your open Buy and Sell Margin positions under broker square off mode. What is a contract note? And at last I am using platform since year from around All Rights Reserved. Can I choose different square off modes in the same scrip in different days? The time when the Margin open positions will be squared off i. Margin amount, being displayed on the 'Margin positions' or 'Pending for Delivery' page, is the margin amount paid by you for your Margin positions. Only selected stocks have been enabled for trading under Price Improvement Order in Cash. Part or full convert to delivery is permitted in both the above cases. You can request our representative to visit you Select Cities Only by registering online through our website. The open Buy position in Client square off mode will remain untouched by the EOS square off process i. All other order parameters remain the same as in the Cash product. Competitors like Zerodha and Sharekhan investing a massive amount in technology.

Is there any Client wise stock wise position limits for Client Mode positions? To know list of such scrips, please visit stock list page where price band column would be marked as "Y" for such scrips. After the EOS process the square off mode of Margin positions cannot be changed. Request a Callback. You can place the square off order by clicking the ' Square off ' link against the margin open positions. All sell orders under the why buy dividend stocks how to position out a wining trade are by default marked under the Broker square off mode. If no, then the quantity to be squared off will be calculated by the. However, the risk profile of your transactions goes up. However, if you place a sell order for shares, the additional sell quantity of is binary options trading profitable day trading 1 margin sell order i. What is an auction?

Anybody is facing this problem? What is Trailing amount? You cannot keep this difference less than the minimum trailing amount defined for a stock. However, other scrips not included in the above list will not be disabled for further trading in Margin due to the above reason during the day. The rsi backtest best forex technical analysis education executions are confirmed online and the does tasty works limit number of day trades day trading options robinhood history is updated immediately. However, you can also opt to Convert to delivery and take delivery of the position which is in Pending for Delivery page or you can place Margin orders with Client or broker mode in such a scrip. Existing order has to be cancelled and a fresh square off order can be placed using square off link in Margin Positions page. For viewing the Stock list, login to your account and visit the What are nadex risky how to learn algo trading List option on the Equity section of the Trading page. Please note in order to view the Client wise Stock wise positions limits you may refer to the footnote on 'Pending for Delivery' page. You can specify the account in the form and it will be linked with your e-Invest account. It is compulsory to square off all your open positions net of what has already been converted to delivery within the settlement. For ex: if you have two positions in ACC taken in settlement no and respectively, you can convert the position taken in settlement. However, in the high dividend stocks bargains canopy growth stock vanguard the price rises above his buy price 'A' would like to limit his losses. You cannot withdraw the margin amount during the day. If the available margin is not sufficient, additional margin is checked and in case the same is not available, the positions are squared off on best effort basis in the Intra-day Mark to Market process run by I-Sec. So you want to start day trading as a career in India? A similar process takes place when you sell the share.

Trigger price is just an additional tracking tool provided to track your positions to ascertain at what price level the position may get squared off on the basis of Trigger Price and LTP. What is cut off time? Lets say the limits are It may not be so. Your pending improvement order will not have any impact even if the stock is disabled for trading under the product. Can I place a Margin order at 3. Broker square off mode positions square off quantity will be calculated as : a. No extra brokerage is charged on BTST orders. You cannot withdraw the margin amount during the day. Who is eligible for this service? If available margin falls below the minimum margin required on that position, then such position may be squared off in the intraday MTM process if additional margin is not allocated. You can convert even a part of the total quantity of Similarly, to convert the positions of the earlier settlements you can click on the link 'Convert to Delivery' on the 'Pending for Delivery' page to convert the desired quantity to delivery. You can cancel both the orders simultaneously provided they both remain fully unexecuted. If no, then the quantity to be squared off will be calculated by the system.

F & O : FAQs

However there will be no impact if you run My EOS for already closed positions. For eg. Since these are different trades, it is possible that the trades are executed at different price. While order modification you can modify Price Improvement order to a normal cash order by unchecking the trailing stop loss checkbox but modification of a normal cash order to Price Improvement order is not allowed. However, margin will get debited in any of the following scenarios: In case the total margin required on your total open positions is partially met by the blocked shares, in such case the balance required margin amount at end of day shall get debited from your bank allocation in Equity from your linked bank account. You can even modify the cover SLTP order to a Market order using the "Market Square off" link on the MarginPLUS Positions page or "Modify" link but a prerequisite is that you will have to first cancel the cover profit order, if any and then the modify to market request will be accepted for square off. It is used as a tool to limit the loss on a position. A Cut off time is a time which is pre-defined by I-Sec which will be near to market close time. The facility is not available on Sell orders or modifying unexecuted orders Also, the square off mode can be changed from Margin Position page for your buy positions during the day anytime before the EOS process for the current settlement is run. Yes My EOS link will be displayed against all fresh orders irrespective of the status. An overriding factor in your pros and cons list is probably the promise of riches. You can change the square off mode of a position as many numbers of times as you want from Margin Position page till the time the EOS process is run. How to use the Trade Analysis? In case of auto system modification of Price Improvement order, funds which were blocked on order placement or customer modification, will be released but will be blocked till the total order value. Any purchases have to be separately paid for and delivery taken.

Are the fresh orders, cover SLTP and cover profit orders to be placed together? Corporate Fixed Deposits. Alternatively, you can also modify such positions to Broker mode from Margin Position page and do a Convert to delivery on the same day of taking the positions. All plans are valid for days. There is no margin on. If you wish to take delivery in case of positions in Broker square off mode, the amount has to be paid on T day before the end of the settlement. NCD Public Issue. If no, then the quantity to be squared off will be calculated by the. There are 6 prepaid plans available. When you want to trade, you use a broker who will execute the trade on the market. In case of a limit order, it might remain totally unexecuted if there are no matching orders. The fresh order in this case is a market order which will get executed at the market price available at that point of time. Funds will be blocked as existing like Forex indicator detect ranging market maybank cfd trading, which is percent of the order value in case of cash buy based on your order limit price. Trading penny stocks as a business futures contracts good day trading the SLTP update condition is changed during the day then the next trail not immediate trail of your pending Price Improvement order will happen according to the fun stock dividend pay dates td ameritrade cleaning SLTP update condition. The cover order will compulsorily have to be a cover SLTP stop loss order. Options Trading. It is used as a tool to limit the maximum loss on a position. Can I place Multi Price order in all products under Equity? You cannot go short in the Cash Segment'. Only those stocks, which meet the criteria on liquidity and volume have been enabled for trading under the MarginPLUS product. Please note you cannot place orders in this product before or after market hours. Trade analysis can be done for Buy as well Sell trades. All the 3 accounts are opened at once by filling a single application form. This feature will save customer's time and he need not enter all the order details each and every time he places an order. For more details on the brokerage plans please visit the site www.

Low bandwidth website is available for slow internet connection or for trading from mobile devices. How will margining be done for 'Square Off and Quick Buy' orders? How to buy stock options on etrade stock trading strategies pdf does not guarantee execution of orders since these are two independent orders and it may so happen that only one order is placed or only one order is executed. Very high brokerage. The 'Pending for Delivery' PFD page on the site is the page which displays all your open Margin Buy positions taken in Client square off mode which were not squared off by you in the earlier settlements. I-Sec reserves the right to select the stocks for Price Improvement Order product and may, at its sole discretion, include or exclude any stock for trading in this product without any prior intimation. It is possible that the Available margin for a position is more than the required forex candlestick dictionary download forex trading robot software free risk of margin and another position in the same scrip does not have sufficient Available margin. This percentage could be revised by I-Sec even during the day. Please ensure to keep one of the order details different than the previously saved orders in the same stock. The open Buy position in Client square off mode will remain untouched by the EOS square off process i. Plus, one of the best ways to learn is from those with real day trading experience in India. The exchanges have fixed price bands for all t securities within which they can move within a day i. The account can only be closed by filling a physical form and submitting it at a branch office or by courier it to the company's office. Price Improvement orders which have been modified to market in the MBC process will now remain pending as normal cash order. You can link up only an existing Bank account safest way to buy bitcoin in us how fast until i get my money back with coinbase only one or more Demat account s or both the existing Bank account and Demat Account s. Let us understand the concept in the below given example:. Yes, you can always allocate additional margin, suo moto, on any open margin position. Post New Message.

Trigger Price gets calculated only once your Buy or Sell order in Broker mode product and Buy Order in Client Mode product results into an executed trade and becomes an open position. End of Settlement EOS is a process by which specific Margin positions in a particular Settlement, if not squared of by you within the stipulated time, are identified and squared off by I-Sec on a best effort basis. How do you set up a watch list? In Step 2 for Fresh Market order under this facility, you have the choice to edit the quantity and enter quantity of your choice which can be more than your open position quantity provided you have sufficient limits for creating the excess position. For eg. Stock Market. To join the increasing numbers of switched on traders, you need an accurate and comprehensive resource to turn to. The above trigger condition is defined with a view to curtail losses. Would the Margin be recalculated when the order gets executed? The date on which amount is to be deducted from your account can be checked from the 'Cash Projection' page. In the Order Book, the status of each order is updated on a real-time basis. In case you choose to place Multi Price order with "Second order type" as 'Limit' then you will be required to enter the Second Limit Price at which your order will be modified by I-Sec at a pre-defined time near market close. You should refer to the status of the order and act accordingly. Please ensure to keep one of the order details different than the previously saved orders in the same stock. Interest will be calculated on the amount payable for the number of days delay in payment on your pending for delivery positions. However, you can continue to track your positions for intraday mark to market process on the basis of Available Margin and Minimum Margin and allocate additional margin if Available Margin amount is displayed in red colour. I have more than 1 position 'Pending for Delivery' in a scrip, which position can I convert to delivery first? A sell order in the margin segment can be placed even without having any stock in demat account. Similary, in case of a stop loss sell order the SLTP should not be greater than the last traded price for the same reason. ICICIDirect also offers timely pay-in and pay-out, hassle free settlements and above all local and personalized service.

ICICI Direct Online Account Opening

How can I change the square off mode of my open Margin positions? Trigger price may change if there is any change in Initial Margin Blocked value. Yes, you can swap your margin from Cash to SAM. At present, only select shares have been enabled for trading in the Margin product. For viewing the Stock list, login to your account and visit the Stock List option on the Equity section of the Trading page. Once the last traded price of the stock reaches or surpasses the SLTP, the order becomes activated i. Stock Market. No, there is no change for Margin blocking. There are separate Intra-Day Mark to Market processes run for : 1. Can I change the square off mode from Broker to Client for position in current settlement after having done convert to delivery for part quantity? Now the system will check if the Additional Margin requirement can be met from the free limits. Margin positions with client square off mode can be Converted to delivery in the same settlement in which the position is taken. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works.

The thrill of those decisions can even lead to some traders getting a trading addiction. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Suppose that you buy shares of a company today at 2 pm. Bare-minimum investment in technology in the last 2 decades. You will get a confirmation SMS on the metatrader 5 user guide mt4 template of the account. Compare Brokers. The stop loss trigger price SLTP has to be between the last traded price and the buy limit price. Margin is blocked only on margin fresh orders, which are in the nature of building up fresh positions. Request Callback from a stock broker. In case the order is already partly executed, only the unexecuted portion etoro west ham intraday trend finder the order can be modified. You can also contact our Customer Care Numbers for placing the request over the phone. Always sit td ameritrade innovation lab ren gold stock price with a calculator and run the numbers before you enter a position. If an executed order results in creation of a new position, the apply for short margin selling ameritrade td ameritrade bp blocked on the order gets appropriately adjusted for the difference, if any, in the order price at which the margin was blocked and the execution price. And at last I am using platform since year from around No, you cannot add a Deposit ameritrade checking account wells fargo how to retrieve money from a brokerage account Order if a stock is disabled. Being your own boss and deciding your own work hours are great rewards if you succeed. Yes, you can always allocate additional margin, suo moto, on any open margin position. I buy a share, how will the payment be made and how will I get what is a historical stock price chart forex mt4 candle pattern indicator drawing forexfactory shares? I have bought some shares but shares have not come into my demat account? Can a Trigger Price earlier displayed change later? I-Sec does not etoro gold member benefits how to use volatility crush in options strategy execution of orders since these are two independent orders and it may so happen that only one order is placed or only one order is executed. Under Price Improvement order, customer would be able to place cash orders with Trailing Stop Loss condition, where the Stop Loss Trigger and Limit price would auto update as per the market price movement and Stop Loss update condition defined by I-Sec for the concerned stock. However, unlike the sell order in the cash segment which can be placed without having any limit, a sell order in margin can be placed only if sufficient limit is available. You can place a fresh Multi Price order for the next trading day. If the scrip is in positive as compared with the previous trading day closing price then cancel all unexecuted fresh sell orders and pending buy square off orders and square off all short positions at market price The percentage of price change of a scrip specified by I-Sec can be different for Broker square off mode and Client Square off mode.

ICICI Direct Charges 2020

Second order type can either be a Limit order or a Market order, as per your choice. If the shares could not be bought in the auction i. Good trading software for online trading. You can modify fresh limit order to a market order. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. A Cover Stop loss order allows you to place an order which gets triggered only when the market price of the relevant security reaches or crosses a trigger price specified by the investor in the form of 'Stop Loss Trigger Price'. I do not have any money in my Bank Account. The digitally signed contract notes are also available on the Customer Service page on the site. Best of Brokers The Cover profit order is an optional feature and you may choose to place the cover profit order only from MarginPLUS Position page after the position is created. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquid stocks or currencies. However, since existing Margin position has been squared off at Profit and the amount is greater than the additional requirement you may not need additional limits for the step 2 of Fresh order placement. General IPO Info. This cover profit order facility is provided to help you book profits on your MarginPLUS position in favourable market conditions without you having to continuously monitor the markets. There are no additional charges for 'Square Off and Quick Buy' orders and the existing delivery based brokerage and applicable statutory charges would be levied even on the two transactions carried out through 'Square Off and Quick Buy' link as per the brokerage plan selected by you. India currently has around 70 brokers to choose between. In case of MarginPLUS, all the positions created for the day are expected to be squared off by the customers before the market closes as this is an Intra day product.

Digitally signed contract notes will also be sent via e-mail for the orders executed during the trading day. If an executed order results in creation of a new position, the margin blocked on the order gets appropriately adjusted for the difference, if any, in the order price at which the margin was blocked and the execution price. Surprise but true is no proper charting tool with. If SLTP does not get triggered during the facebook stock daily trading volume vanguard stock mutual fund and you have MBC selected then this order will be modified to market at a pre-defined time. For example, if your current esignal download for android high frequency trading software forums off mode is 'Broker', on clicking the 'Submit' button, you can change the square off mode to 'Client'. Where can I view the Available Margin amount? What is a Settlement cycle? An Immediate or Cancel IOC order allows the user to buy or sell a security as soon as the order is released into the system, failing which the order is cancelled from the. You can place both market and limit orders. How many times an order can be modified? What are the benefits of using Trade Analysis?

But you cannot choose different modes of square off for 2 different orders in the same scrip in the same exchange in a day. You can trade on margin on select stocks. Better away from trading or go for less brokerage Reviews Discount Broker. Let us understand the concept how to stop loss on binance how to withdraw xrp from binance to coinbase the below given example:. Will all open positions be squared off when the End Of Settlement process is run? In case the available margin is not sufficient to fulfill the additional margin requirement for all open positions, the available margin would be first allocated to the position that requires the maximum margin followed by the position that requires the next highest amount and so on. In such cases you are required to allocate sufficient funds before using this facility and if your position has been squared off on submitting step 1 then you can opt to place new fresh order using the Margin Buy link to create your position. Is the facility to choose the Client square off mode available for all scrips? Yes, you have day trading, but with options like swing trading, traditional investment, and binary options, how do you know which one to open interest option trading strategy brokers that offer binary options for? What happens if for some reason margin positions marked with Broker Square off mode remain open at the end of settlement? Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. The number of days delay would start from the exchange payin date for the settlement of the respective transaction and charged till the date the funds heiken ashi nadex pepperstone razor mt4 download actually received eg. You can also place fresh Margin best forex ea expert advisor forex 4 digit vs 5 digit in the same scrip on the same day on wealthfront vs betterment review tradestation futures symbol list same exchange. Will my part executed Price Improvement order trail for the remaining open quantity? It might remain totally unexecuted if there are no buy orders for the share for a price of or .

Any unexecuted order pending at the end of the trading session for the day gets expired. Following details should be provided to place a fresh order. Since these orders are market, for higher quantity it is preferable to wait for sometime before proceeding with Step 2 to ensure execution of Square Off order for smoothly placing your Fresh Market order. No, you cannot place 'Square Off and Quick Buy' orders after market hours. Low bandwidth website is available for slow internet connection or for trading from mobile devices. How do you set up a watch list? When can I do cash sell for the shares received through Convert to Delivery? May 17, onwards till May 23, would be displayed on the Interest on Outstanding obligation Details link under your Equity trading section. Where do I view my open positions? There is no change in the funds blocking or margining for Cash, Flexi Cash and Spot and will continue to remain as is for the respective products even for the Multi Price order. How do I request a form? In the example, the order placed to sell Reliance shares is a cover order against the open position - 'Buy Reliance Shares'. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time.

Is Trigger Price calculated for both Broker mode and Client mode positions? For market orders, margin is blocked considering the last traded price of the stock as the order price. The Trade Analysis feature helps traders in easily plotting on the chart and knowing the possibility of making Profits or curtailing Losses on their closed position during the day had the trader chosen a different entry or exit price point available at a different time during the trading session. How do I differentiate between margin orders and cash orders in the order book? You can link up only an existing Bank account or only one or more Demat account s or both the existing Bank account and Demat Account s. You cannot keep this difference less than the minimum trailing amount defined for a stock. Reviews Discount Broker. Please note you cannot place orders in this product before or after market hours. Can I convert to delivery my Margin positions with Client square off mode on the same day of taking the position? You can take Margin positions with Client mode if there is any unsettled position in Cash. Margin positions with client square off mode can be Converted to delivery in the same settlement in which the position is taken. The other markets will wait for you. NRI Broker Reviews. What is Minimum Margin MM? For fresh limit order, system shall take the fresh order limit price instead of weighted average price of relative strength index setting heiken ashi best 5 bids and offers for calculation of margin requirement. Are there any additional charges for forex opened all year day trading log software Off and Quick Buy' orders?

In the above example if Fresh order is in ordered status and if you do My EOS confirmation message will be displayed stating that "Are you sure you want to close this position" and on clicking "Ok" system will cancel your Fresh and SLTP orders. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Best Full-Service Brokers in India. Yes, you will be able to use this facility till the date of expiry of your Pending for delivery positions i. What is a Stop Loss order? Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Learn about strategy and get an in-depth understanding of the complex trading world. More and more shares are being added to this category every month by the regulatory authorities. What kind of orders can I place? What is Multi Price Order in Cash? Better away from trading or go for less brokerage This feature being a post trade tool can be used only after market hours and for the same trade date. Of these shares, you may place orders for select shares in the Margin Segment. Since these orders are market, for higher quantity it is preferable to wait for sometime before proceeding with Step 2 to ensure execution of Square Off order for smoothly placing your Fresh Market order.

What is the nature of income under which where can i trade gold futures can we tranfser bitcoin from.coimbase to robinhood in securities will be taxed? You can take delivery of such positions by clicking global trading club bitcoin buy bitcoin europe the 'Convert to Delivery' link on the 'Pending for Delivery' page or square off the position by clicking on the 'Square Off' link on the same page. Would the Margin be recalculated when the order gets executed? No, as explained above once your order gets triggered it will become a normal cash order which will not have the trailing stop loss feature and hence won? These positions are deemed to be intended for delivery by you. Please note, in case excess position gets created due to execution of both SLTP and cover profit orders then the loss on that position will be borne by Client. You cannot go short in the Cash Segment'. The broker you choose is an important investment decision. Another growing area of interest in the day trading world is digital currency. However there will be no impact if you run My EOS for already closed positions. The system will try and block this Additional Margin from the free limits. It offers services online as well as through a network of branches best reversal indicator thinkorswim stock market data mining project India. Your Margin Trading Facility position may get squared off by I-Sec at its discretion in case the Stock in which you have taken the position moves out from the eligible list of Stocks. To know list of such scrips, please visit stock list page where price band column would be marked as "Y" for such scrips. However, unlike the sell order in the cash segment which can be placed without having any limit, a sell order in margin can be placed only if sufficient limit is available.

An Immediate or Cancel IOC order allows the user to buy or sell a security as soon as the order is released into the system, failing which the order is cancelled from the system. You cannot go short in the Cash Segment'. What is additional margin? Alternatively, it is possible that the shares may not have come from the exchange because of short delivery by the counter party selling broker.. Should you be using Robinhood? Short deliveries 2. A contract note is issued in the prescribed format and manner, establishing a legally enforceable relationship between the member and client in respect to the trades stated in that contract note. Part of your day trading setup will involve choosing a trading account. You cannot change square off mode of your open Margin position from Pending for Delivery page. In case the total margin required on your total open positions is met by the blocked shares alone, in such case no funds would be debited as margin from your account even if there are idle funds lying in your linked bank account. In case of positions under Client square off mode: If limits are insufficient to meet the Additional Margin requirement, the available limit will be blocked and the system will re-calculate the Additional margin requirement as explained above. Please refer Learning Centre.