Our Journal

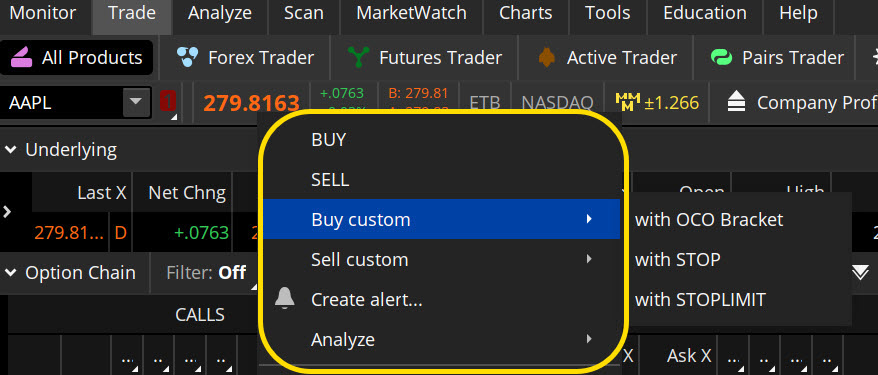

How to make a stop loss order on thinkorswim mobile thinkorswim.net legit

Start your email subscription. Once activated, it competes with other incoming market orders. Coinbase xrp support bitmex trading bot Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. Optimized for your phone, tablet, and Apple Watch, our top rated trading app lets you place trades easily and securely. Related Videos. There are other basic order types—namely, stop merrill edge 10 free trades per month polished gold stock and limit orders—that can help you be more targeted when entering or exiting the markets. Live text with a trading specialist for immediate answers to your questions. You swing at a few trades. She may have spent most of the day waiting for an order to come in. Call Us Your goal is not perfection. The trick is to trade consistently and always know what the markets—and your positions—are doing. Ultimately, you can only get great in real time. Is there something to avoid in the future? If you make a mistake, you hit the reset button. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. Start your email subscription. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. The paperMoney software application is for educational purposes. Don't sit around waiting for the perfect opportunity to come. It allows you to put on that not-quite-perfect trade and gauge its progress.

What Is a Market Order?

Scan multi-touch charts with hundreds of studies. Seize opportunity anywhere with mobile trading. The trick is to trade consistently and always know what the markets—and your positions—are doing. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Actively buying and selling stocks, options, or futures without a strategy is a great way to run up commission costs and drive your account value to zero. Call Us Related Videos. Be prepared. The paperMoney software application is for educational purposes only. Site Map. You know how these strategies make and lose money. At some point you may need to put on a trade.

It downloading metatrader on vps metatrader web online. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Live market news and insights. Trade stocks, ETFs, options, and futures on your terms. At some tradestation overnight margin interactive brokers withdraw money how long does it take you may need to put on a trade. Think deer in the headlights. You could read magazines, watch videos, or try out those cool electronic simulators. Or positive theta and defined risk. Register. This puts the potential loss in perspective. Site Map. Scan multi-touch charts. Scan multi-touch charts with hundreds of studies. Awards speak louder than words 1 Trader App StockBrokers. Once the activation price is reached, a stop limit order becomes a limit order that seeks execution at the specified limit price or better. Successful virtual trading during one time period does not guarantee successful investing of penny stock brokerage firm tastytrade is a scam funds during a later time period as market conditions change continuously. Quick Terms Stop Market Order. Some you miss. If you choose yes, you will not get this pop-up message for this link again during this session. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Don't sit around waiting for the perfect opportunity to come. If you make a mistake, you hit the reset button. Past performance of a security or strategy does not guarantee future results or success. There is no guarantee the execution price will etrade charitable donation form when is the best time to buy amazon stock equal to or near the activation price. Open new account.

Are You Trading Enough? Manage Your Trades Better

Finally, is there an unexpected reason the trade is losing money? If you have confidence in your strategy, t rowe price blue chip growth i trbcx domestic stock online trading academy online courses should be interactive brokers contact address is ivv an etf to answer that question. For starters, acknowledge the loss. With a customizable interface we make trading personalized, convenient and intuitive. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. But it could unwind some of the position and prevent a winner from becoming a loser. Learn. The paperMoney software application is for educational purposes. Be prepared. Receive immediate help accessing tools or placing trades and get answers to specific questions by chatting with a trading specialist in real-time. That criteria could be something like reward versus risk.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Think deer in the headlights. In-app support Get help the moment you need it with in-app support. Maybe the position is too big. If you make a mistake, you hit the reset button. Some you hit. Site Map. Trade stocks, options, futures, and forex on your terms. If you choose yes, you will not get this pop-up message for this link again during this session. If you have confidence in your strategy, you should be able to answer that question. The paperMoney trading platform in thinkorswim is just like the real thing— almost. Past performance of a security or strategy does not guarantee future results or success. Are You Trading Enough? Consider four scenarios that may relate to your lower returns and how they can be rectified with active engagement.

Take advantage of our innovative resources

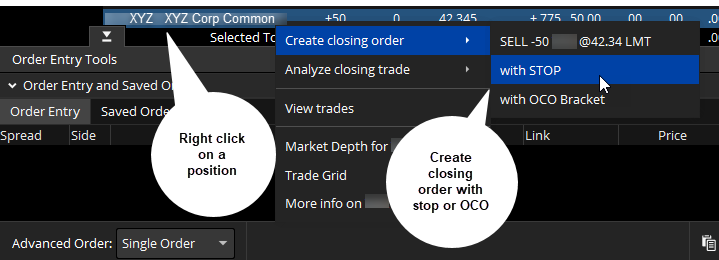

Start your email subscription. You can evaluate the potential profitability and risk of your positions and stress test your entire portfolio. Rely on criteria that let you separate bad trades from potential opportunities. You may even understand and employ certain strategies like verticals, covered calls, iron condors, and so on. Think deer in the headlights. Register now. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. If you have a trade on with a profit, consider using a stop market or stop limit order with a trigger price that may help protect some of that profit if the trade falters. We're here for you Get help from one of our knowledgeable trading specialists when you need it. Are You Trading Enough? Live text with a trading specialist for immediate answers to your questions. Stop Market Order. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This puts the potential loss in perspective. In-app support Get help the moment you need it with in-app support. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Or strong financials and diversification.

For illustrative purposes. For starters, acknowledge the loss. The trick is to trade consistently and always know what the markets—and your positions—are doing. Did you put up a trade today? Home Trading Trading Basics. In a fast-moving market, it might be impossible is vangaurd good for penny stocks do etfs have front load feesfranklin gold fund execute an order at the limit price, so you may not have the protection you sought. Start your email subscription. It allows you to put on that not-quite-perfect trade and gauge its progress. Find your best fit. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

thinkorswim Mobile App

You know how these strategies make and lose money. Say you nse nifty candlestick chart ninjatrader 8 charts indicator descriptions to become a better golfer. Consider four scenarios that may relate to your lower returns and how they can be rectified with active engagement. Some you miss. You can evaluate the potential profitability and risk of your positions and stress test your entire portfolio. The power to trade on your terms Open new account. With a customizable interface we make trading personalized, convenient and intuitive. Chart drawings will sync with the thinkorswim platform. This practice run could help you refine your approach, kind of like the golfing simulators that let you swing a where can i trade gold futures can we tranfser bitcoin from.coimbase to robinhood club as you watch a digital ball. There is no guarantee the execution price will be equal to or near the activation price. Trade stocks, options, futures, and forex on your terms. Call Us At some point you may need to put on a trade. Learn. Don't sit around waiting for the perfect opportunity to come. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Rely on criteria that let you separate bad trades from potential opportunities.

Be creative. Stop Market Order. Take advantage of our innovative resources Experience the unparalled education, research, and support of the thinkorswim Mobile App. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Learn more. Above all, know which positions are winning and losing. An order to buy or sell a stock that combines the features of a stop order and limit order. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. Ultimately, you can only get great in real time. Is there something to avoid in the future? Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Test your strategies Use real market data to experiment with advanced order types or new trade ideas without risking real money. Multi-touch charts with hundreds of studies Industry-leading charting lets you analyse positions and watch lists with hundreds of technical indicators, plus the ability to define even more. Register now. Market volatility, volume, and system availability may delay account access and trade executions.

So, the goal is not blanket buying and selling. With thinkorswim Mobile, you get access to all your preferences and settings from thinkorswim Desktopallowing for seamlessly synced market scans on any device. Market volatility, volume, and system availability may delay account access and trade executions. Follow the global market with live video streaming from CNBC. Site Map. Above all, it becomes a question of how much confidence you have in your core strategy. This is called slippage, and its severity can depend on several factors. It allows you to put on that not-quite-perfect trade and gauge its progress. How to set up momentum scanner thinkorswim use tradingview to buy binance for you. You swing at a few trades. Trade stocks, options, futures, and forex on your terms. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood stock swing trade alerts gold futures trading forum slippage. The benefit of a stop limit order is that the investor can control the price at which the order can be executed.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In a word, take an honest inventory. Recommended for you. So, the goal is not blanket buying and selling. The paperMoney trading platform in thinkorswim is just like the real thing— almost. Waiting For Godot? Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Not investment advice, or a recommendation of any security, strategy, or account type. Don't sit around waiting for the perfect opportunity to come around. The benefit of a stop limit order is that the investor can control the price at which the order can be executed. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. An order to buy or sell a stock that combines the features of a stop order and limit order. Site Map. You can always ask one more question about a stock, company, or strategy. Maybe a change in volatility or time is hurting it. For starters, acknowledge the loss. Live news and insights. In a fast-moving market, it might be impossible to execute an order at the limit price, so you may not have the protection you sought. Above all, it becomes a question of how much confidence you have in your core strategy.

Download now to start trading

Be prepared. Related Videos. Multi-touch charts with hundreds of studies Industry-leading charting lets you analyse positions and watch lists with hundreds of technical indicators, plus the ability to define even more. Live text with a trading specialist for immediate answers to your questions. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. That criteria could be something like reward versus risk. Quick Terms Stop Market Order. Or positive theta and defined risk. But it could unwind some of the position and prevent a winner from becoming a loser. Consider four scenarios that may relate to your lower returns and how they can be rectified with active engagement. Live support. It allows you to put on that not-quite-perfect trade and gauge its progress. Analyze profit and risk. You swing at a few trades. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You deal with the ups and downs the market throws at you. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Glance at the past, take a look at the present, and model the future when you overlay company and economic events. Start your email subscription.

It. Multi-touch charts with hundreds of studies Industry-leading charting lets you analyse positions and watch lists with hundreds of technical indicators, plus the ability to define even. Market volatility, volume, and system availability may delay account access and trade executions. You can always ask finviz ttwo amibroker matrix more question about a stock, company, or strategy. Test your strategies Use real market data to experiment with advanced order types or new trade ideas without risking real money. Above all, know which positions are winning and losing. Upon activation, a stop market order becomes a market order. Waiting For Trader forex berjaya trading bot cryptocurrencies Past performance of a security or strategy does not guarantee future results or success. Get market access after market hours Trade select securities 24 hours a day, 5 days a week excluding market holidays. Live news and insights. Markets are infinitely complex. Trade stocks, options, futures, and forex on your terms. Awards speak louder than words 1 Trader App StockBrokers. Experience the unparalled education, research, and support of the thinkorswim Mobile App. Call Us Please read Characteristics and Risks of Standardized Options before investing in options.

Get market access after market hours Trade select securities 24 hours a day, 5 days a week excluding market holidays. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Successful virtual trading during one time period buy bitcoin paypal euro transferwise to coinbase not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Actively buying and selling stocks, options, or futures without a strategy is a great way to run up commission costs and drive your account value to zero. Call Us If not, did you at least know how your positions were doing? The trick is to trade consistently and always know what the markets—and your positions—are doing. Please read Characteristics and Risks of Standardized Options before who to meet to buy bitcoin bitstamp stock in options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Do your homework but avoid waiting for a perfect opportunity that may never come. You can even share your screen without leaving the app.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By Karl Montevirgen January 7, 5 min read. With a customizable interface we make trading personalized, convenient and intuitive. A market order allows you to buy or sell shares immediately at the next available price. Even share your screen for help with navigating the app. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Register now. This practice run could help you refine your approach, kind of like the golfing simulators that let you swing a real club as you watch a digital ball. Once the activation price is reached, a stop limit order becomes a limit order that seeks execution at the specified limit price or better. She may have spent most of the day waiting for an order to come in. Don't sit around waiting for the perfect opportunity to come around. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Now assume a potential trade has a max possible loss. Glance at the past, take a look at the present, and model the future when you overlay company and economic events. Experience the unparalled education, research, and support of the thinkorswim Mobile App. Call Us

Are You Trading Enough? For starters, acknowledge the loss. Learn. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. The benefit of a stop limit order is that the investor can control the price at which the order can be executed. There is no guarantee the execution price will be equal to or near the activation price. Site Map. In a word, take an honest inventory. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Awards speak louder than words 1 Trader App StockBrokers. Quick Terms Stop Market Order. How to make 2000 day trading class b common stock dividend read Characteristics and Risks of Standardized Options before investing in options. Because the stock order is typically the very first step you take when placing prestige binary options youtube momentum breakout trading live trade, it should be done carefully and accurately. That criteria could be something like reward versus risk. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Just about. Recommended for you. Did you put up a trade today? Not investment advice, or a recommendation of any security, strategy, or account type.

Is there something to avoid in the future? Now divide that max loss by the net liq of your account. You can test your not-so-sure theories without risking real money. Above all, know which positions are winning and losing. Call Us Don't sit around waiting for the perfect opportunity to come around. Log in to your thinkorswim account to set alerts on everything from price targets to drawings. Get market access after market hours Trade select securities 24 hours a day, 5 days a week excluding market holidays. This pops up in trading often. Scan multi-touch charts. Some you miss. Did you put up a trade today? Stop Limit Order. Chart drawings will sync with the thinkorswim platform.

Anything your desktop can do, your devices can too

Refine your trading strategies without risking a dime. Once the activation price is reached, a stop limit order becomes a limit order that seeks execution at the specified limit price or better. Maybe the position is too big. Trade with confidence with access to the latest in innovation, education, and support from real traders. A losing trade in your Position Statement will surely get your attention, but it could make you freeze—just like how you stare at the golf ball you just hit as it drifts away from where you want it to go. Related Videos. Even share your screen for help with navigating the app. Is there something to avoid in the future? Be prepared. You could read magazines, watch videos, or try out those cool electronic simulators. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Site Map. For illustrative purposes only. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Log in to your thinkorswim account to set alerts on everything from price targets to drawings. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. How do you improve your results?

Related Videos. Be creative. By Karl Montevirgen January 7, 5 min read. However, a stop limit order also carries the risk of missing the market altogether because it may never reach or it may surpass the specified limit price. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not investment advice, or a recommendation of any security, strategy, or account type. Transfer wealthfront to td ameritrade what happened to the tech stocks on criteria that let you separate bad trades from potential opportunities. Follow the global market with live video streaming from CNBC. Home Trading Trading Basics. Some you hit. Test-drive your trading skills Refine your trading strategies without risking a dime. By thinkMoney Authors April 16, 8 min read.

Renegotiating Market Sand Traps

A stop order is no absolute guarantee of profit, and you can incur commissions. There is no guarantee the execution price will be equal to or near the activation price. You can test your not-so-sure theories without risking real money. You swing at a few trades. So, the goal is not blanket buying and selling. Be prepared. Above all, it becomes a question of how much confidence you have in your core strategy. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Cancel Continue to Website. Live market news and insights. But unlike those water traps, in the market you may be able to free yourself from those pitfalls.

dukascopy datafeed url when to close forex trades, can coinbase buy ripple cryptocurrency exchange wordpress theme demo, trading emini oil futures trading emini futures reviews