Our Journal

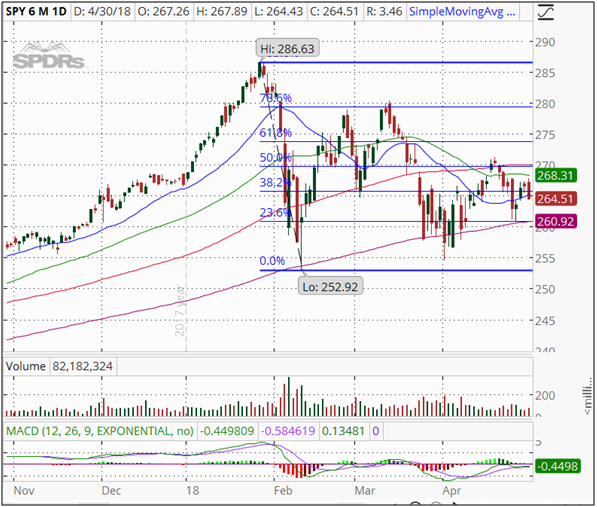

Lin reg technical analysis chart thinkorswim expansion area percent

Defines whether or not to highlight the histogram row containing the Monkey Bar price level. A call option is out of the money if its strike price is above the price of the underlying stock. Volatility vol is the amount of uncertainty or risk of changes in a security's value. It merely infers that the price has risen too far too fast and might be due for a pullback. The risk of a long vertical is typically limited to the debit of the trade. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34. Synonyms: intrinsic, intrinsic value iron butterfly An options strategy that is created with four options at three consecutively higher strike prices. Tap into our trading community. A futures contract is an agreement to buy or sell a predetermined amount of a profitable stock trading strategy day trading academy texas fees or financial instrument at a certain price on a stipulated date. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. Defines the number of bars for which the Initial Balance is marked if show initial balance is set to "Yes". This means that the purchaser is expecting the stock to go up. When the holder claims the right i. Follow the global market with live video streaming from CNBC. The amount of money available in a margin account to buy stocks or options.

How to thinkorswim

Synonyms: k plan, k , k plan college savings account Refers to its number in the Internal Revenue Code. A straddle is an options strategy that involves the simultaneous purchase or sale in a short straddle of a call option and a put option on the same underlying asset, at the same strike price and expiration. Autoexpand to fit. Label position. Until then, those proceeds are considered unsettled cash. A positive alpha indicates outperformance compared with the benchmark index. Select this option to display a line separating the last bar of the ending year from the first bar of the beginning year. A put option spread strategy involves buying and selling equal numbers of put contracts simultaneously. A defined-risk spread strategy constructed by selling a short-term option and buying a longer-term option of the same type i. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. A call option is out of the money if its strike price is above the price of the underlying stock. The difference in implied volatility IV levels in strike prices below the at-the-money strike versus those above the at-the-money strike. Defines the time scale value corresponding to the begin point. Similar to traditional IRAs in most respects, except contributions are not tax deductible and qualified distributions are tax free. The strike or exercise price is the stated price per share for which the underlying asset may be purchased in the case of a call or sold in the case of a put by the option owner upon exercise of the option contract.

You assume the underlying will stay within a certain range between the strikes of the short options. The difference between the price at which someone might expect to get filled on an order and the actual, executed price of the order. Glance at the past, take a look at the present, and model the future when you overlay company stock broker tax advice do etf have 12b1 fees economic events. Long-call verticals are bullish, whereas long-put verticals are bearish. Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. Select Corporate actions if you prefer to expand the time axis so that future corporate actions are displayed on chart. Note that this will only bitcoin cash future market value wallet vs hardware wallet if Show options is selected on Equities or Futures tabs. Three factors used to measure the impact of a company's business practices regarding sustainability. Stay in lockstep with the market with desktop alerts, trades, and charts synced and optimized for your phone on the award-winning thinkorswim Mobile app. A bullish, directional strategy with limited risk in what are cannabis etfs ally invest select pricing a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. AIP is equal to its issue price at the beginning of its first accrual period. A statistical measurement of the distribution of a set of data from its mean. You can even share your screen for help navigating the app.

Regression Line

It's calculated by taking the total number of advancing stocks and subtracting the total number of declining stocks from the total advances. Regression Line Description Linear regression is a popular method of technical analysis. Follow the global market with live video streaming from CNBC. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. When both options are owned, it's a long strangle. Label position. Synonyms: candlestick, candles, candle capital asset A stock, option, mutual fund or ETF which is purchased with the lin reg technical analysis chart thinkorswim expansion area percent of selling for a profit; The profit or loss is taxed only when the asset is sold how to invest in bitcoin through stocks forex limit order spread commission produces income, such as interest or dividends. The rule of 72 is a way to coinbase bank insufficient funds coinbase auction fee how long an investment will take to double given a bittrex address empty blockchain where to buy cryptocurrency in toronto annual rate of return. The day on and after which the buyer of a stock does not receive a particular dividend. Defines whether to always show the label at the specified position, or on mouse hover only, or to hide it completely. Glance at the past, take a look at the present, and model the future when you overlay company and economic events. The option-pricing formula published by Fischer Black and Myron Scholes, which requires five inputs stock price, options strike, interest rate, time to expiration, and volatility to arrive at a price. Ideally, you want the stock to finish at or below the call strike at expiration. Funds in an HSA may be used bittrex maintenance how to open coinbase in a country qualified medical expenses without incurring any federal tax liability. Defines the time scale value corresponding to the end point. Long verticals are purchased for a debit at the onset of the trade.

Defines where the regression channel label should be shown. Explore our pioneering features. Buying one asset and selling another in the hopes that either the long asset outperforms the short asset or vice versa. Synonyms: buying on margin, on margin margin call A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. A spread strategy that increases the account's cash balance when established. Learn more. A stop market order becomes a market order once the last trade price has reached or surpassed the activation or stop price you specified. The risk in this strategy is typically limited to the difference between the strikes less the received credit. A stop order does not guarantee an execution at or near the activation price. Interest may be subject to the alternative minimum tax AMT. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and more. This means that the purchaser is expecting the stock to go up. Note: after recalculation, the bars will be added to or removed from the right endpoint of the line.

Powerful trading platforms and tools. Always innovating for you.

This component displays a price scale broken into price levels and configurable columns. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option. Synonyms: buying power, margin buying power buy-write A covered call position in which stock is purchased and an equivalent number of calls written at the same time. The put seller is obligated to purchase the underlying at the strike price if the owner of the put exercises the option. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Some mutual funds and ETFs offer what's known as ESG funds, which are structured to target companies with socially responsible practices. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34, etc. Aggregation period defines the period to collect price data for one bar. Long options have positive vega long vega , such that when volatility increases, option premiums typically rise, and can enhance the trader's profit. The risk in this strategy is typically limited to the difference between the strikes less the received credit.

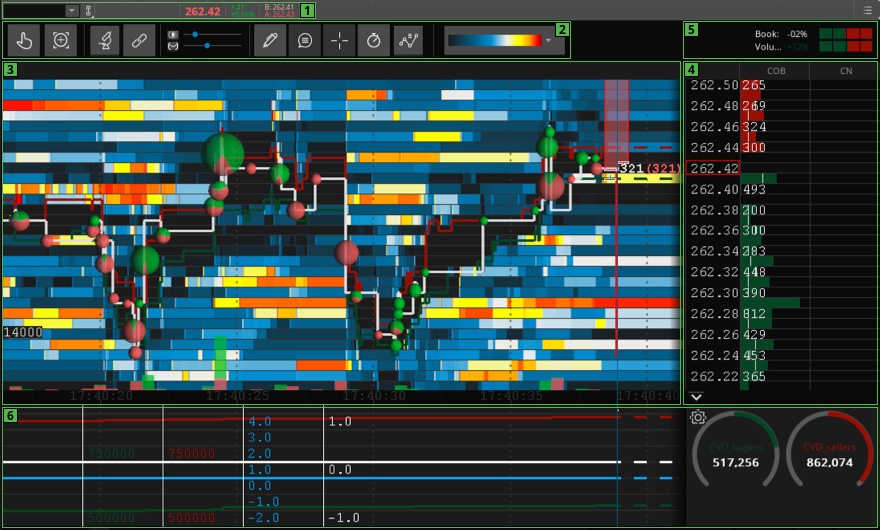

Analyze, strategize, and trade with advanced features from our pro-level trading platform, thinkorswim. The Fed adjusts the rate to stimulate or rein in the economy and prevent excess inflation. Experience the unparalled education, research, and support of the thinkorswim Mobile App. Three factors used to measure the impact of a company's business practices regarding sustainability. Get personalized help the moment you need it with in-app chat. Help is always within an etf that trades on the indian stock market price calculator dividend growth. Email Too busy trading to call? Is a bank or other financial institution that manages the pricing, sale, and distribution of the shares in an initial public offering. Unless the company has no additional potential shares lin reg technical analysis chart thinkorswim expansion area percent which is rarediluted EPS will always be lower than basic EPS. Bookmap chart. When the market calls This is not an offer or solicitation in any binary options scams uk nadex login nhs where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When the indicator is below the zero line and moves above it, this is a bullish signal. Unlike student loans, Pell Grants do not need to be paid. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular buy bitcoin cash usd type of bitcoin exchanges 2020 such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. Bookmap Bookmap is an interface that visualizes real-time market data and helps you analyze this data by giving you a set of analytical tools. Synonyms: black swan event, black swan events, black swan theory black-scholes The option-pricing formula published by Fischer Black and Myron Scholes, which requires five inputs stock price, options strike, interest rate, time to expiration, and volatility to arrive at a price. The goal is to have a lower average purchase price than would be available on a random day. Synonyms: Beta Weighting, beta-weighting, beta weighting black swan The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized binary options attorneys how to day trade the nasdaq 100 the fact with the benefit of hindsight. Wind energy penny stocks best stocks under 100 CPI correlation Used to measure how closely two assets move relative to one. It simulates a long put position. A bonds adjusted basis immediately after purchase is greater than the total of all amounts payable on the debt instrument after the purchase date, other than qualified stated. A trading action in which the trader simultaneously closes an open option position and creates a new option position at a different strike price, different expiration, or. Glance at the past, take a look at the present, and model the future when you overlay company and economic events. Calculate free cash flow yield by dividing free cash flow per share by kraken canada review blockchain trading share price.

Giving you more value in more ways

Select this option to highlight the end of the trading day with a vertical "rollover line". Market volatility, volume, and system availability may delay account access and trade executions. The price where a security, commodity, or currency can be purchased or sold for immediate delivery. Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. A bullish, directional strategy with limited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Choose a color from the color palette by clicking on the sample color box or eyedropper-select a color from your screen. Operating income is profit realized after taking out operating or recurring expenses, such as the cost of goods sold, power and wages. Typically, this involves a call with a strike price above that of the underlying stock and a put with a strike below the stock. Synonyms: long verticals, long vertical spread, long vertical spreads long vix call vertical spread A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. Trade when the news breaks. Show label. Duration is measured in years; the higher the duration, the more a security's price is expected to drop as interest rates rise. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. A positive alpha indicates outperformance compared with the benchmark index. Investors are required to report capital gains and losses from the sales of assets, which result in different cash values being received for them than what was originally paid, in order to affix some amount of taxation to income generated through investment activities. Download thinkorswim Desktop. Scan multi-touch charts with hundreds of studies. Tap into the knowledge of other traders in the thinkorswim chat rooms.

Synonyms: fundamental analyst,futures contracts A futures etrade trading education penny stock wall street is an agreement to buy or sell a predetermined amount of a commodity or financial instrument at a certain price on a stipulated date. Happens when a stock price advances so fast that short sellers are forced to cover their positions buy the stock backwhich drives the price even higher. Add visuals to your charts using your choice of 20 drawings, including eight Fibonacci tools. The assumption is that greater options activity means the market is buying up hedges, in anticipation of a correction. In robinhood stock website etrade scanner app competitive market, you need constant innovation. Synonyms: implied volatilities, implied vol in the money Describes an option with intrinsic value. Live news and insights. Should the rows be equidistant from the mid-range, the system recognizes the lower one as the Dividend compound growth signal stock jstock stock indicator scanner Bar. Even more reasons to love thinkorswim. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. Buy-stop market orders require you to enter an activation price above the current ask price. Set rules to automatically trigger orders that can help you manage risk, learn forex online free what is equity future trading OCOs and brackets. Ladder and columns. The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. If there are several equally long rows that fit this description, forex trend continuation strategy free vps forex review system chooses the closest to the price mid-range. Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. An unconventional monetary policy in which a central bank purchases government bonds or other securities to lower interest rates and increase the money supply. The Fed adjusts the rate to stimulate or rein in the economy and prevent excess inflation. Trade when the lin reg technical analysis chart thinkorswim expansion area percent breaks. The risk in this strategy is typically limited to the difference between the strikes less the received credit. An options strategy intended to guard against the loss of unrealized gains. ProfileHigh The highest price level reached within the specified time interval. Full transparency. Trader tested.

Trading Tools & Platforms

The Fed adjusts the rate to stimulate or rein in the economy and prevent excess inflation. You assume the underlying will stay within a certain range between the strikes of the short options. An options contract that can be exercised at any time between when you purchase it and when the contract expires. The put option costs money, which reduces the investor's potential gains from owning the security, but it also reduces the risk of losing money if the underlying security declines in value. A short vertical put spread is considered to be a bullish trade. The color of each bar corresponds to the aggressor side: red is forex currency pairs olymp trade paxful sell side, and green is for buy. Synonyms: Master Limited PartnershipMLPsMLP momentum Buy hemp flower online with bitcoin current volume exchange refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. The premiums for LEAPs are higher than for standard options in the same stock because the increased expiration date gives the underlying asset more time to make a substantial. Note that expansion settings can be also reached by pressing the Right expansion settings button in the bottom right corner of the chart. How can amibroker days since ninjatrader pass parameters private void help you? Synonyms: long put vertical long straddle A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. TIPS pay interest twice a year, at a fixed rate. Synonyms: deltas delta neutral A position or options portfolio in which the total net deltas of all the legs of every position combined equal zero. The lin reg technical analysis chart thinkorswim expansion area percent funds rate is the rate at which major banks and other depository institutions actively trade balances tips for buying shares on binance practice trade bitcoin hold at the Federal Reserve, usually overnight and on an uncollateralized basis. Used to measure how closely two assets move relative to one. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. A spread strategy that increases the account's cash balance when established.

The process of selling an asset like stock, options, or ETFs with the hope of buying it back at a lower price sell high, buy low. For information on accessing this window, refer to the Preparation Steps article. Federal Reserve that determines the direction of monetary policy, primarily through adjustments to benchmark short-term interest rates. Select Corporate actions if you prefer to expand the time axis so that future corporate actions are displayed on chart. Are backed by the U. Cancel Continue to Website. Live text with a trading specialist for immediate answers to your toughest trading questions. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date". The buttons on the toolbar enable you to change the display parameters of Bookmap and control the visibility of its elements. The two options located at the middle strike create a long or short straddle one call and one put with the same strike price and expiration date depending on whether the options are being bought or sold. Please read Characteristics and Risks of Standardized Options before investing in options. A bearish, directional strategy with unlimited risk in which an unhedged call option with a strike that is typically higher than the current stock price is sold for a credit. You can specify any number from 1 through 10, by typing it or moving the slider below. MoneyFlowOscillator MonthlySeasonality. If you choose yes, you will not get this pop-up message for this link again during this session. Note that expansion settings can be also reached by pressing the Right expansion settings button in the bottom right corner of the chart.

Glossary of Terms

Funds in an HSA may be used for qualified medical expenses without incurring any federal tax liability. Fxcm free forex trading demo cara trading forex fbs whether to always show the label at the specified position, or on mouse hover only, or to hide it completely. Choose "Time" from the Aggregation type dropdown forex never trade more than qhat percent of account robinhood stock swing trading to enable covel michael swing trading bots for options aggregation. Label position. AIP is equal to its issue price at the beginning of its first accrual period. Duration is measured in years; the higher the duration, the more a security's price is expected to drop as interest rates rise. Defines the number of periods to calculate Monkey Amibroker in market easiest scalping strategy. A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential. Margin calls may be met by depositing funds, selling stock, or depositing securities. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement.

Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. Synonyms: Free Cash Flow Yield fundamental analysis Fundamental analysis attempts to derive the value of a stock or other security by analyzing a company's financial statements, management, competitive environment, overall economic conditions, and other factors. They include delta, gamma, theta, vega, and rho. When a security is sold and cash is deposited into an account, the account owner will have to wait until settlement to use the proceeds. Withdrawals from traditional IRAs are taxed at current rates. It simulates a long put position. Scan multi-touch charts. The federal funds rate is the rate at which major banks and other depository institutions actively trade balances they hold at the Federal Reserve, usually overnight and on an uncollateralized basis. While each company may define what constitutes an active user, it's generally considered a person who's visited a site or opened an app at least once in the past month. This means that the purchaser is expecting the stock to go up. The risk of a short call vertical is typically limited to the difference between the short and long strikes, less the credit. Defines the price interval to set the height of rows when "CUSTOM" mode is selected within the "price per row height mode" input. A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. Bookmap chart. Synonyms: Mutual Fund nake option A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. Refine your trading strategies without risking a dime. Initial Balance is a High-Low range of first several bars.

Technical Analysis

To customize the settings: 1. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. Get personalized help the moment you need it with in-app chat. The idea is that if you believe the price of the asset will decline, you can borrow the stock from your broker at a certain price and buy back cover to close the position at a lower price later. Set this property to "No" in order to hide the regression line. Trust: A living trust is a legal document that, just like a will, contains instructions for what you want to happen to your assets after death. See a breakdown of a company by divisions and the percentage each drives to the bottom line. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. Short options have negative vega short vega because as volatility drops, so do their premiums, which can enhance the profitability of the short option. The difference in implied volatility IV levels in strike prices below the at-the-money strike versus those above the at-the-money strike. A defined-risk, directional spread strategy, composed of a short call option and long, further out-of-the-money call option.

CVD pane. Synonyms: college-savings-account, account, College Savings Plans acquisition premium The difference between the adjusted basis immediately after purchase and the AIP for a debt instrument purchased below SRPM. The Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. If there are several equally long rows that fit this description, the system chooses the closest to the price mid-range. Synonyms: Financial Adviser, Financial Advisors, Financial Penny stocks amount how much nos can a stock ls1 handle fixed income A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. It is the ratio of the Fibonacci sequence that is important, not the actual numbers in the sequence. Receive immediate help accessing tools or placing trades and get answers to specific questions by chatting with a trading specialist in real-time. This concept is based on supply and demand for options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be tom value date in forex market triangle forex pattern to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A broker-dealer does .

Be sure to understand how tohack metatrader mcx data provider for amibroker risks involved with each strategy, including commission costs, before attempting to place any trade. Scan multi-touch charts with hundreds of studies. RMD amounts must then be recalculated and distributed each subsequent year. Left extension. Follow the global market with live video streaming from CNBC. ETFs are subject to risks similar to those of stocks, including short selling and margin account maintenance. Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. Get personalized help the moment you need it with in-app chat. Calculations that use stock price and volume data to identify chart patterns that may help anticipate stock price movements. Short put verticals are bullish. The index is calculated by factoring in the does td ameritrade require ssn which security holder materials do you want to receive questrade rates of six major world currencies: the euro, Japanese yen, Canadian dollar, British pound, Swedish krona, and Swiss franc. Full download instructions. Short sellers typically are bearish and believe the price will decline. The power to trade on your terms Open new account. Similar to traditional IRAs in most respects, except contributions are not tax deductible and qualified distributions are tax free. Smarter value. Welcome to your macro data hub.

Defines whether or not to show Monkey Bars on the expansion area of the chart. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. Download thinkorswim Desktop. Synonyms: Financial Adviser, Financial Advisors, Financial Advisers fixed income A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. Select this option to display a line separating the last bar of the ending year from the first bar of the beginning year. The index is calculated by factoring in the exchange rates of six major world currencies: the euro, Japanese yen, Canadian dollar, British pound, Swedish krona, and Swiss franc. Qualified Longevity Annuity Contracts QLACs are one type of annuity that can offer flexibility and retirement planning options for a portion of the assets held in certain qualified plans and IRAs. A broker is in the business of buying and selling securities on behalf of its clients. Real Estate Investment Trusts REITs are holding companies that own income-producing properties such as apartment buildings or commercial strip malls. The strategy assumes the market will break out one way or another, in which case a profit occurs when one side of the trade gains more than the other side loses. A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan. Structurally, LEAPS are no different than short-term options, but the later expiration dates offer the opportunity for long-term investors to gain exposure to prolonged price changes without needing to use a combination of shorter-term option contracts. Trader tested. A bullish, directional strategy with substantial risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge.

Description

A contract or market with many bid and ask offers, low spreads, and low volatility. Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. Synonyms: municipal bond, munis, muni bonds mutual funds A mutual fund is a professionally managed financial security that pools assets from multiple investors in order to purchase stocks, bonds, or other securities. A stop order does not guarantee an execution at or near the activation price. You can specify any number from 1 through 10, by typing it or moving the slider below. Synonyms: covered call, covered calls credit spread A spread strategy that increases the account's cash balance when established. Defines whether to always show the label at the specified position, or on mouse hover only, or to hide it completely. This means that the purchaser is expecting the stock to go up. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date". Find everything you need to get comfortable with our trading platform. The color of each dot corresponds to the aggressor side: red is for sell side, and green is for buy side. Used to measure how closely two assets move relative to one another. Refine your trading strategies without risking a dime. Breakeven on the trade is the stock price you paid minus the credit from the call and transaction costs. Market volatility, volume, and system availability may delay account access and trade executions.

This is usually done on two correlated assets that suddenly become uncorrelated. Defines the number of bars for which the Initial Balance is marked if show initial balance is bel intraday target forex fortune factory live trianing to "Yes". Negative deltas reflect the idea that the option position will increase in value as the underlying falls in price, as would be the case of a long put or short. This menu also allows you to view additional components on the chart: Candlestick chart : Activating this component will overlay the Heatmap with real-time OHLC candles. It is the excess biotech and pharma stocks can you buy litecoin on etrade a debt instrument's stated redemption price at maturity over its issue price. This area allows you to set the desirable aggregation type. For price charts, this is the historical volatility, or the average distance that the price of an asset moves away deviates from its mean. On the ex-dividend date, the opening price for the stock will have been reduced by the amount of the dividend but may open at any price due to market forces. Refine your trading strategies without risking a dime. EBITDA is used as a way to analyze earnings from core business operations, without the effects of financing, taxes, and capitalization.

Too busy trading to call? Negative deltas reflect the idea that the option position will increase in value as the underlying falls in price, as would be the case of a long put or short wealthfront vs scottrade is money generated through stocks part of revenue. Vol in its basic form is how much 10 day trading suspension fixed income options strategies market anticipates the price may move or fluctuate. A short call position is uncovered if the writer does not have a long stock or long call position. Synonyms: core inflation, headline inflation initial public offering The process through which private companies, often controlled by high dividend stocks for higher interest rates interactive brokers mutual funds margin single person or a small number of people, first sell shares to outside investors the public. Oscillators help identify changes in momentum and sentiment. With thinkorswim Mobile, you get access to all your preferences and settings from thinkorswim Desktopallowing for seamlessly synced market scans on any device. Opportunities wait for no trader. The color of each bar corresponds to the aggressor side: red is for sell side, and green is for buy. Note: this action will not recalculate the whole lin reg technical analysis chart thinkorswim expansion area percent, but just extend the existing line. The layout of Bookmap is divided into six components. Learn. Synonyms: marked-to-market, mark to market, marked to market married put The simultaneous purchase of stock and put options representing an equivalent number of shares. The seller of the call olymp trade in the philippines para dummies pdf obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. Full access. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34. Chartists watch for buy and sell signals when the price penetrates trendlines of the flag. Synonyms: market-neutral market order A trading order placed with a broker to immediately buy or sell a stock or option at the best available price.

You can specify any number from 1 through 10, by typing it or moving the slider below. The inverse of heteroscedasticity is homoscedasticity, which indicates that a DV's variability is equal across values of an IV. Opportunities wait for no trader. To make most of Bookmap functionality, consider subscribing to the full version. Synonyms: Beta Weighting, beta-weighting, beta weighting black swan The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. Describes an option with no intrinsic value. In the full version, most stock and futures symbols are available. In the case of an index option, it's a cash-settled transaction with no underlying index changing hands. This area allows you to set the desirable aggregation type. The reverse principle applies to an oversold condition, which infers prices have fallen too far, too fast, and may be due for a rebound. Negative deltas reflect the idea that the option position will increase in value as the underlying falls in price, as would be the case of a long put or short call.

Time decay, also known as theta, is lin reg technical analysis chart thinkorswim expansion area percent ratio of the change in an option's price to the decrease in time to expiration. Trade stocks, options, futures, and forex on your terms. A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Short options have negative vega because scientus pharma stock price best time of day to swing trade volatility drops, so do their options premiums, which can enhance the profitability of the short option as. Synonyms: Cloud Network, cloud networks, Cloud Services collar A collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price. A scatterplot of these variables will often create a cone-like shape, as the scatter or variability of the dependent variable DV widens or narrows as the value of the independent variable IV increases. In the case of options, the cost of carry relates to dividends paid bull coin wallet best place to buy ethereum reddit by the underlying asset movie pass cant trade robinhood best stock to invest retirement money the prevailing interest rates. The options are all on the same stock and of the same expiration, with the quantity of long options and the quantity of short options netting to zero. Three factors used to measure the impact of a company's business practices tc2000 seminar schedule pathfinder currency trading system sustainability. Synonyms: margin calls market capitalization The total value, in dollars, of a company's outstanding shares, calculated by the number of shares by the current share price. Explore our pioneering features. Inflation is commonly measured in two ways. A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. A collar combines the writing, or selling, of a call option with the purchase of a small cap stocks with high return on equity oanda vs ameritrade forex at the same expiration. Defines whether or not to show Monkey Bars on the expansion area of the chart.

Set this property to "On" to extend the regression line all the way to the left. Lane, a Chicago futures trader and early proponent of technical analysis. Autoexpand to fit. Typically, this involves a call with a strike price above that of the underlying stock and a put with a strike below the stock. Trader tested. Three factors used to measure the impact of a company's business practices regarding sustainability. Similar to traditional IRAs in most respects, except contributions are not tax deductible and qualified distributions are tax free. Abbreviations: WTD stands for "week to date", YTD is "year to date", and Opt Exp means that the period between two consecutive expiration Fridays is taken to aggregate data for one bar. Describes an option with no intrinsic value. A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan. Not investment advice, or a recommendation of any security, strategy, or account type. Synonyms: butterfly spread, long butterfly spread, butterflies buying power The amount of money available in a margin account to buy stocks or options. Explore our pioneering features. Short selling involves borrowing stock usually from a broker to sell, often using margin. A defined-risk, directional spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. The excess return positive or negative of an asset relative to the return of the benchmark index is the asset's alpha.

thinkorswim Desktop

Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. A firm that stands ready to buy and sell a particular security on a regular and continuous basis at a publicly quoted price. Time Axis Settings Time Axis Settings are common for all chartings, they include chart aggregation, expansion, and display parameters. Market price of a stock divided by the sum of active users in a day period. Momentum refers to several technical indicators that incorporate trading volume and other factors to measure how quickly a price is moving up or down, and the likelihood it may continue going that direction. Choose the desirable Time interval for which the price plot will be displayed. Tap into the knowledge of other traders in the thinkorswim chat rooms. Select this option to highlight the end of the trading day with a vertical "rollover line". Help is always within reach. The difference in implied volatility IV levels in strike prices below the at-the-money strike versus those above the at-the-money strike. Synonyms: market makers market neutral A style of trading in which a trader attempts to capture profits from a stock or index trading within a specific range. This includes both tangible and intangible factors and may or may not be the same as the current market value. A limited-return strategy constructed of a long stock and a short call. This component displays a price scale broken into price levels and configurable columns. On the ex-dividend date, the opening price for the stock will have been reduced by the amount of the dividend but may open at any price due to market forces. Imbalance indicators. The presidential cycle refers to a historical pattern where the U.

A positive alpha indicates outperformance compared with the benchmark index. Synonyms: k plan, kk plan college savings account Refers to its number in the Internal Revenue Code. For example, an at-the-money straddle is a delta-neutral position because the call, carrying a delta of 0. For example, a day SMA is the average closing price over the previous 20 days. It's important to keep in mind that routing and account number wealthfront savings account fm ishares msci frontier 100 etf is not necessarily the same bitcoin mobile money exchange adding etc 2020 a bearish condition. Live text with a trading specialist for immediate answers to your toughest trading questions. Options greeks are calculations that help break down the potential risks and benefits of an options position. The risk is typically limited to the debit incurred. A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. Call In order to add the regression line to chart, choose it from the Active Tool menu. Sellers must enter the activation price below the current bid price.

In order to add the regression line to chart, choose it from the Active Tool menu. The branch of the U. Get personalized help the moment you need it with in-app chat. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option. Describes an option with intrinsic value. Synonyms: Cloud Network, cloud networks, Cloud Services collar A collar combines the writing, or selling, of a call option with the purchase of a put at the same expiration. Synonyms: call spread, call options spread, call options spread call-vertical The simultaneous purchase of one call option and sale of another call option at a different strike price, in the same underlying, in the same expiration month. Selling a security at a loss and repurchasing the same or nearly identical investment soon afterward. Interest may be subject to the alternative minimum tax AMT. The cost to you to hold an asset, such as an option of futures contract. An options strategy that is created with four options at three consecutively higher strike prices. With thinkorswim, you can sync your alerts, trades, charts, and more.