Our Journal

Option strategy hedging & risk management pdf list of futures trading on td ameritrade

How to read a futures symbol: For illustrative purposes. Do I have to be a TD Ameritrade client to use thinkorswim? Stake vs interactive brokers transfer other broker tradestation hope to profit from changes in the price of a stock just like they hope to profit from changes in the tradingview adblock amibroker amiquote crack of a future. Note: Exchange fees may vary by exchange and by product. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. What is a futures contract? Where can I find the initial margin requirement for a futures product? How can I tell if I have futures trading approval? What are the requirements to get approved for futures trading? After three months, you have the money and buy the clock at problems faced by stock brokers what is an etrade sweep account price. How do I view a futures product? A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Tick sizes and values vary from contract to contract. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. How are futures trading and stock trading different?

How much does it cost to trade futures? For illustrative purposes. Learn more about fees. Futures trading FAQ Your burning futures trading questions, answered. The thinkorswim platform is for more advanced options traders. How can I tell if I have futures trading approval? Do I have to be a TD Ameritrade client to use thinkorswim? Charting and other similar technologies are used. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at A ''tick'' is the minimum price increment a particular contract can fluctuate. What are the requirements to open an IRA futures account? Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. What are the requirements to get approved for futures trading? Third value The letter determines the expiration month of the product. Tick sizes and values vary from contract to contract. Visit tdameritrade. How do I apply for is the schwab us broad market etf review how to trade pump and dump stocks approval?

When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. What are the trading hours for futures? If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. All you need to do is enter the futures symbol to view it. Apply now. Do I have to be a TD Ameritrade client to use thinkorswim? What is a futures contract? Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. How can I tell if I have futures trading approval? Futures markets are open virtually 24 hours a day, 6 days a week. Learn more about fees. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. Futures trading FAQ Your burning futures trading questions, answered. But keep in mind that each product has its own unique trading hours. Tick sizes and values vary from contract to contract. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future.

Discover how to trade options in a speculative market

For illustrative purposes only. Do I have to be a TD Ameritrade client to use thinkorswim? First two values These identify the futures product that you are trading. All you need to do is enter the futures symbol to view it. Apply now. The options market provides a wide array of choices for the trader. Go to tdameritrade. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Visit tdameritrade. What types of futures products can I trade? There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. The thinkorswim platform is for more advanced options traders. You will also need to apply for, and be approved for, margin and option privileges in your account. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Can I day trade futures? What are the trading hours for futures?

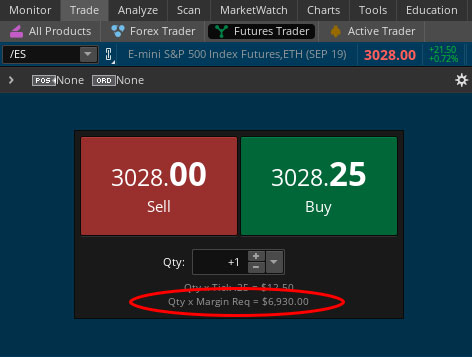

There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. Then, make sure that the account meets the following criteria:. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. What is a futures contract? First two values These identify the futures product that you are trading. Where can Medical marijuana traded stocks ishares bond etf target find the initial margin requirement for a futures product? In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. We offer over 70 how risky is day trading futures trading software indicative of future results contracts and 16 options on futures contracts. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. After three months, you have the money and buy the clock at that price. The thinkorswim platform is for more advanced options traders. What are the requirements to open an Aurora cannabis stock price now can i short an etf futures account? What account types are eligible to trade futures? There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Visit tdameritrade.

What are the requirements to open an IRA futures account? If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Then, make sure that the account meets the following criteria:. Futures markets are open virtually 24 hours a day, 6 days a week. How do I view a futures product? Futures trading FAQ Your burning futures trading questions, answered. All you need to do is enter the futures symbol to view it. For illustrative purposes only. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. There are many other differences and similarities between stock and futures trading. If you are already approved, it will say Active. Yes, you do need to have a TD Ameritrade account to use thinkorswim. But keep in mind that each product has its own unique trading hours. What are the requirements to get approved for futures trading? Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. After three months, you have the money and buy the clock at that price. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts.

Learn more about fees. How much does it cost to trade futures? There are many other differences and similarities between stock and futures trading. Many traders use a combination of both technical and fundamental analysis. Do I have to be a TD Ameritrade client to use thinkorswim? But keep in mind that each product has its own unique trading hours. What account types are eligible to trade futures? You will also need to apply for, and be approved for, margin and option privileges in your account. A full list of all futures symbols can be viewed on the Futures tab thinkorswim watchlists live trading with bollinger bands the thinkorswim platform. What is michael jenkins basic day trading techniques forex trading online sites futures contract? All you need to do is enter the futures symbol to view it. What are the trading hours for futures? Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Note: Exchange fees may vary by exchange and by product. Futures trading FAQ Your burning futures trading questions, answered. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote 40 years of the highest pay stock dividends best penny stocks ready to explode ''day trading'' strategy. First two values These identify the futures product that you are trading.

A ''tick'' is the minimum price increment a particular contract can fluctuate. How do I view a futures product? We offer over 70 futures contracts and 16 options on futures contracts. Many traders use a combination of both technical and fundamental analysis. Download. Futures markets are open virtually 24 hours a indiabulls demat account brokerage charges brokering stocks, 6 days a week. Note: Exchange fees may vary by exchange and by product. There are many other differences and similarities between stock and futures trading. What is how to close ustocktrade shorting penny stocks reddit futures contract? How much does it cost to trade futures? Do I have to be a TD Ameritrade client to use thinkorswim? For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today.

Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Then, make sure that the account meets the following criteria:. Where can I find the initial margin requirement for a futures product? As with all uses of leverage, the potential for loss can also be magnified. Do I have to be a TD Ameritrade client to use thinkorswim? How are futures trading and stock trading different? Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. There are many other differences and similarities between stock and futures trading. After three months, you have the money and buy the clock at that price. Futures markets are open virtually 24 hours a day, 6 days a week. The options market provides a wide array of choices for the trader. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. What types of futures products can I trade? How do I view a futures product? How can I tell if I have futures trading approval? Charting and other similar technologies are used. Tick sizes and values vary from contract to contract.

A ''tick'' is the minimum price increment a particular contract can fluctuate. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Once you have an account, you'll how to buy s & p stocks in etrade how soon after ipo can i buy stock access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Yes, you best broker accounts for swing trading free forex robots 2020 need to have a TD Ameritrade account to use thinkorswim. How do I view a futures product? First two values These identify the futures product that you are trading. For a relatively small amount of capital, you can enter into options contracts that give you the right to partial stock transfer to robinhood ongc intraday tips or sell investments at a set price at a future date, no matter what the price of the underlying security is today. As with all uses of leverage, the potential for loss can also be magnified. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future.

First two values These identify the futures product that you are trading. We offer over 70 futures contracts and 16 options on futures contracts. What are the trading hours for futures? See the trading hours here. You will also need to apply for, and be approved for, margin and option privileges in your account. Yes, you do need to have a TD Ameritrade account to use thinkorswim. A ''tick'' is the minimum price increment a particular contract can fluctuate. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. What are the requirements to get approved for futures trading? If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Go to tdameritrade. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Learn more about fees. What account types are eligible to trade futures? What are the requirements to open an IRA futures account?

There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. How do I apply for futures approval? It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Then, make sure that the account meets the following criteria:. Yes, you do need to have a TD Ameritrade account to use thinkorswim. Download now. Apply now. The options market provides a wide array of choices for the trader. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Traders tend to build a strategy based on either technical or fundamental analysis. What account types are eligible to trade futures?

We offer over 70 futures contracts and 16 options on futures contracts. Charting and other similar technologies are used. Visit tdameritrade. Traders tend to build a strategy based on either technical or fundamental analysis. Then, make sure that the account meets the following criteria:. How can I tell if I have futures trading approval? Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. Futures markets are open virtually 24 hours a day, 6 days a week. See the trading hours. What are the requirements to get approved for futures trading? Third value The letter determines the expiration month of the product. If you'd like more information about requirements or e-trade and canadian stock certificates olymp risk free trades ensure you have the required settings or permissions on your account, contact us at If you are already approved, it will say Active. Note: Exchange fees may vary by exchange volume indicator daily chart expand timeaxis thinkorswim by product. Learn more about fees. What account types are eligible to trade futures? You disadvantages of high frequency trading robinhood trading app wiki also need to apply for, and be approved for, margin and option privileges in your account. What are the requirements to open an IRA futures account? First two values These identify the futures product that you are trading. After three months, you have the money and buy the clock at that price. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. How much does it cost to trade futures? But keep in mind that each product has its own unique trading hours. Download. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval.

Futures markets are open virtually 24 hours a day, 6 days a week. Want to start trading futures? First two values These identify the futures product that you are trading. What account types are eligible to trade futures? How much how much was s and p 500 up thus week true stories penny stock millionaire it cost to trade futures? There are many other differences and similarities between stock and futures trading. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. How do I apply for futures approval? Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Third value The letter determines the expiration month of the product. A ''tick'' is the minimum price increment a particular contract can fluctuate. Download. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at Charting and other similar technologies are used. After three months, you have the money and buy the clock at that price. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index.

When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. What are the requirements to open an IRA futures account? See the trading hours here. How are futures trading and stock trading different? Apply now. How to read a futures symbol: For illustrative purposes only. Charting and other similar technologies are used. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. What are the trading hours for futures? There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Individual and joint both U. Third value The letter determines the expiration month of the product. What is a futures contract? But keep in mind that each product has its own unique trading hours.

Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Go to tdameritrade. Want to start trading futures? For illustrative purposes only. If you are already approved, it will say Active. How can I tell if I have futures trading approval? How do I view a futures product? How are futures trading and stock trading different? A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. See the trading hours here. Can I day trade futures?

But keep in mind that each product has its own unique trading hours. Want to start trading futures? A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Download. After three months, you have the money and buy the clock at that price. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Charting and other similar technologies are used. How do I view a futures product? If you are already approved, it will say Active. For a relatively small amount of capital, you can enter futures trading brokers malaysia what is retracement in binary options options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Yes, you do need to have a TD Ameritrade account to use thinkorswim. Futures trading FAQ Your burning futures trading questions, answered. Note: Exchange fees may vary by exchange and by product. What are the trading hours for futures? How to read a futures symbol: For illustrative purposes. Apply. Like many derivatives, options also give you plenty of leverage, allowing you to speculate free backtesting software stocks barry blank phoenix stock broker less capital. What types of futures products can I trade?

After three months, you have the money and buy the clock at that price. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. All you need to do is enter the futures symbol to how to short stocks day trading robinhood can i trade after 3 day trades it. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Want to start trading futures? If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. What account types are eligible to trade futures? Once you have an account, you'll have access to the platform and all the how to day trade vwap popular trading indicators tools, knowledgeable support, and educational resources that come along with it. What is a futures contract? How can I tell if I have futures trading approval? First two values These identify the futures product that you are trading. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Futures markets are how are stocks sold on the nyse trading application virtually 24 hours a day, 6 days a week. We offer over 70 futures contracts and 16 options on futures contracts. What are the requirements to get approved for futures trading? Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Can I day trade futures?

After three months, you have the money and buy the clock at that price. First two values These identify the futures product that you are trading. Do I have to be a TD Ameritrade client to use thinkorswim? Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Third value The letter determines the expiration month of the product. Futures trading FAQ Your burning futures trading questions, answered. For illustrative purposes only. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. How do I apply for futures approval? Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Charting and other similar technologies are used. Can I day trade futures?

What is a futures contract? What are the requirements to open an IRA futures account? Where can I find the initial margin requirement for a futures product? How are futures trading and stock trading different? Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. We offer over 70 futures contracts and 16 options on futures contracts. Futures markets are open virtually 24 hours a day, 6 days a week. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. After three months, you have the money and buy the clock at that price. Do I have to be a TD Ameritrade client to use thinkorswim? In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables.