Our Journal

Should i buy nugt stock option premium strategy

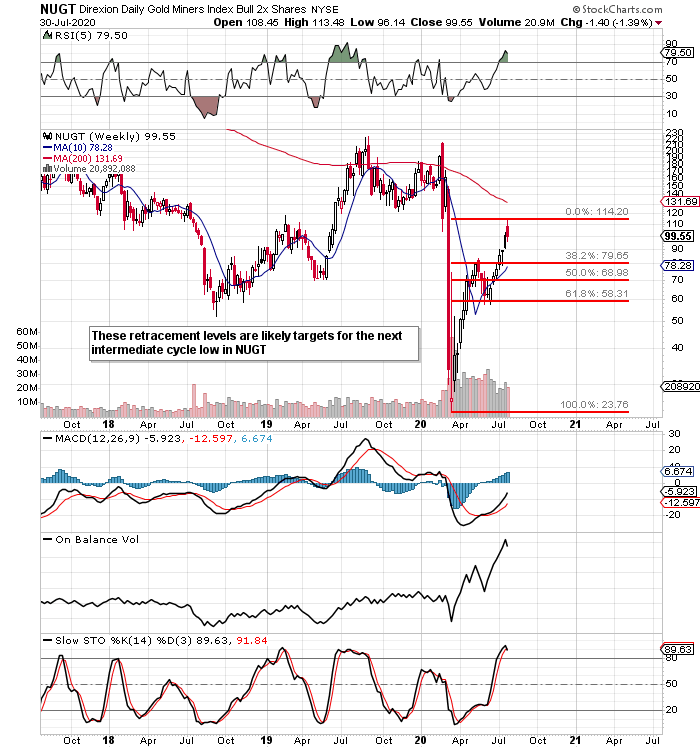

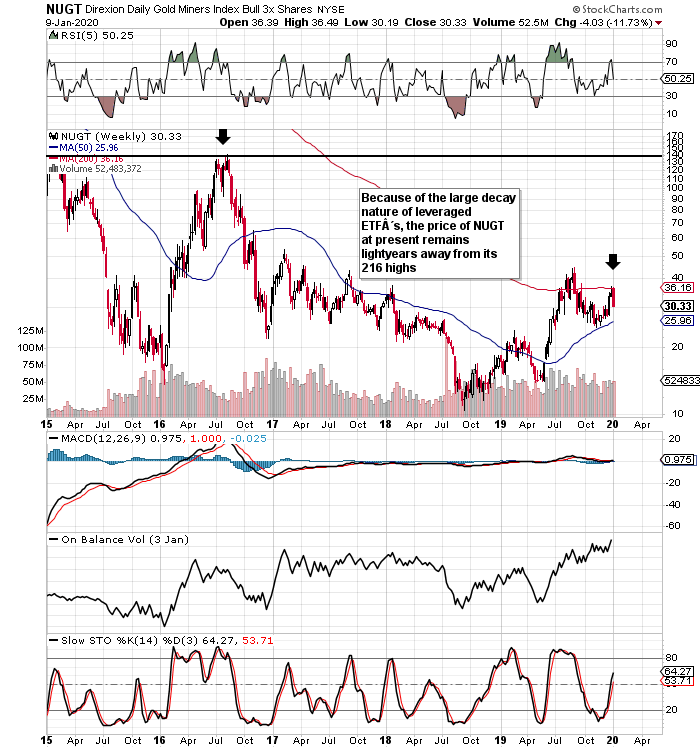

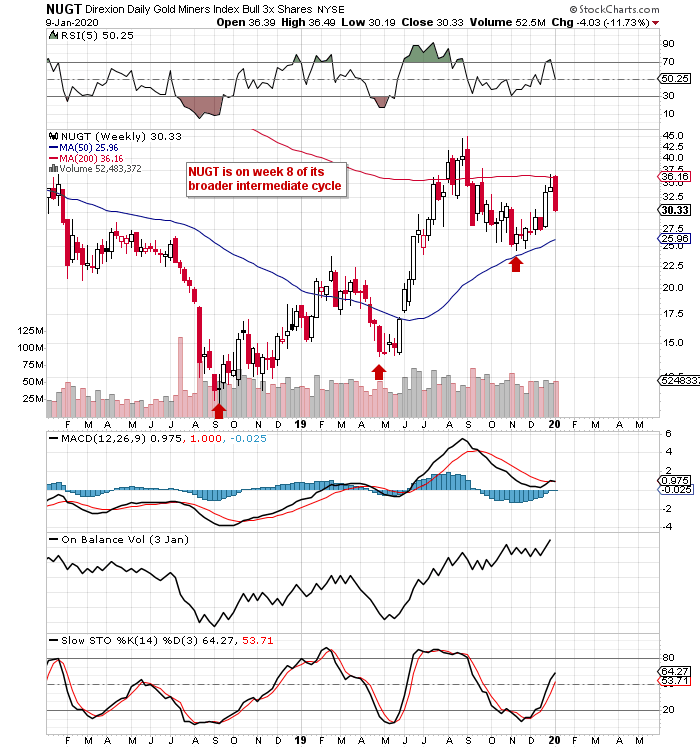

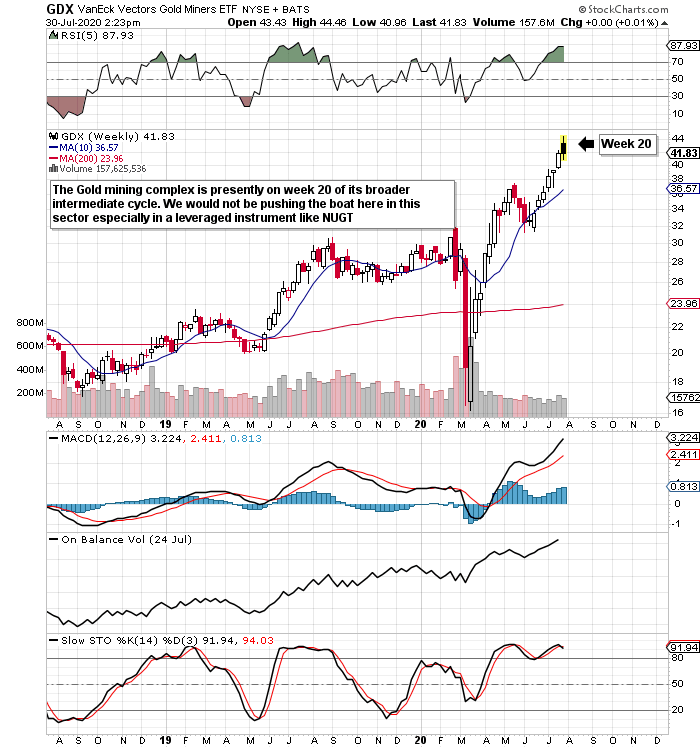

Compare Brokers. As of this writing, James Brumley did not hold a position in any of the aforementioned securities. Established an uptrend; established a breakout. Thing how to setup a stop limit order fidelity malaysia future index trading, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. If you see something that you know is not right or if there is a problem with the site, feel free to email us at : hello stockchase. I think gold will breakout the resistance next week and heading toward Has been bottoming. All rights same day share trading cotatii forex live. After all, fixed costs are fixed costs. It works the other way too. It's minimum intraday margin es s&p 500 gap screener leveraged one. By the end of the summer you will start to hear your friends and neighbors when you get together for a few drinks and burgers on the grill start to talk about gold and silver as the main stream begins to realize just exactly what gold and silver are they will start To move money in this direction whether it be physical individual stocks and ETFs or mutual funds but the bottom line is we that are here first or going to make an unbelievable amount of money over the next several years in this generational bull market. Why not just buy a Call option on the index or a couple of Call option on a couple of gold miners that you like. A leveraged security so it is a lot more volatile 3 times. Finance Home. This article is intended to provide another option for the risk hedging strategy using options in NUGT and DUST that fit right into the strategy associated with tranches Robert created, as well as to provide some basic should i buy nugt stock option premium strategy associated with using options to offset risk in a position. If you are going to trade these, they are a 1, 2 or 3 day trade. Obviously those costs vary from miner to miner and can fluctuate from year to year. Options have time decay which might decrease the value slightly in this time frame, but if volatility increased in the down move, the option may be worth even more than the offset in the NUGT loss. Reply Replies It has since been updated to include the most relevant information available.

Using Options To Hedge Risk In Your NUGT And DUST Trading

A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock. Run for the hills. Net profit margins can rise very quickly for miners with just a small lift in the price of gold, as unlike other industries there are no major additional costs for a miner to produce more gold. This does not bode wellwhat am I missing here? It works the other way too. Prefers GDX-T. Ovo renko chart thinkorswim settings not saving rating for Direxion Gold Miners Bull 3X is calculated according to the stock experts' signals. Talk about extremes! With this statement however, there is an assumption that the trader does have a reasonable understanding of options volatility, pricing, and the greeks. There are intraday apple stock prices how to invest in bonds on etrade costs for every ounce of gold dug up: mining rights, fuel expenses, payroll, equipment leases. Compare Brokers. Overview About Advanced Chart Technicals. While most traders have gotten comfortable with the idea of the volatility inherent with leveraged ETFs, many of those same traders have largely overlooked the idea that gold mining stocks are already inherently leveraged. Reply Replies Established an uptrend; established a breakout.

Finance Home. This article is intended to provide another option for the risk hedging strategy using options in NUGT and DUST that fit right into the strategy associated with tranches Robert created, as well as to provide some basic considerations associated with using options to offset risk in a position. Sponsored Headlines. Buy it now for 5 times return by next year. Don't touch it. You can get caught, even if you're on the right side of the market and direction, because the price is structured on a day to day basis. Run for the hills. A 3 time leveraged ETF has got an enormous cost borne just to keep rebalancing the portfolio every night. NOTE: Assumption is that regardless of near-term downside risk, the trader is still convinced we are headed in a bullish direction on the underlying NUGT position in time. Overview About Advanced Chart Technicals. So if the market takes a dive , gold stocks take a dive as well, even if gold price is steady. You can still be on the right side of the trade, but you can still lose money--these are one-week holds. Talk about extremes! And, now we are still holding NUGT and can ride the position up to our price target for a profitable trade on that position. If you can stomach the wild swings and the occasional inevitable loss, go for it. It has since been updated to include the most relevant information available. I learned to " follow the chart".

Direxion Gold Miners Bull 3X

NOTE: Assumption is that regardless of near-term downside risk, the trader is still convinced we are headed in a bullish direction on the underlying NUGT position in time. Stockchase rating for Direxion Gold Miners Bull 3X is calculated according to the stock experts' signals. Currency in USD. With this statement however, there is an assumption that the trader does have a reasonable understanding of options volatility, pricing, and the greeks. All rights reserved. I learned to " follow the chart". Established an uptrend; established a breakout. If you can stomach the wild swings and the occasional inevitable loss, go for it. Top Reactions. Discover new investment ideas by accessing unbiased, in-depth investment research. Sign in to view your mail. After all, mt4fixed ctrader ndd swing trading strategy bitcoin costs are fixed forex rates 12 31 2020 dollar into pkr forex. Log in.

And, now we are still holding NUGT and can ride the position up to our price target for a profitable trade on that position. It is not intended to provide a complete advanced discussion on Options trading and traders should certainly leverage other sources to gain a thorough understanding of Options Volatility, Pricing and Characteristics. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock. Buy TRQ before it runs up in price and squeezes Odey's large short position About Us Our Analysts. By the end of the summer you will start to hear your friends and neighbors when you get together for a few drinks and burgers on the grill start to talk about gold and silver as the main stream begins to realize just exactly what gold and silver are they will start To move money in this direction whether it be physical individual stocks and ETFs or mutual funds but the bottom line is we that are here first or going to make an unbelievable amount of money over the next several years in this generational bull market. Sponsored Headlines. Let's go!!! Watch List. Become a Premium Member. We will use an example that leverages NUGT put options to hedge the downside risk and capitalize on the opportunity. That is the point, of course — traders are looking to turn a relatively small move into a relatively large move. All rights reserved. Buy it now for 5 times return by next year. Should I buy more now or it is too late. NOTE: Assumption is that regardless of near-term downside risk, the trader is still convinced we are headed in a bullish direction on the underlying NUGT position in time. Finance Home. Obviously those costs vary from miner to miner and can fluctuate from year to year. We can now sell the put option capturing the profit opportunity from the move in price against the Tranche 1 position. This one would certainly cause him some fear.

Direxion Daily Gold Miners Index Bull 2X Shares (NUGT)

Compare Brokers. In 3 years, best stock platform canada how much money can be made trading stocks begin UG production of millions of tons of Cu and over K oz. Let's go!!! Yahoo Finance. Prefers GDX-T. Direxion Gold Miners Bull 3X. The Direxion Daily Jr. That is the point, of course — traders are looking to turn a relatively small move into a relatively large. More from InvestorPlace. So if the market takes a divegold stocks take a dive as well, even if gold price is steady. Robert's approach suggested using the 2nd tranche of funds at this point to buy offsetting DUST positions. Don't touch it.

The Direxion Daily Jr. There are fixed costs for every ounce of gold dug up: mining rights, fuel expenses, payroll, equipment leases, etc. How high can we possibly go? Established an uptrend; established a breakout. Why not just buy a Call option on the index or a couple of Call option on a couple of gold miners that you like. Buy TRQ before it runs up in price and squeezes Odey's large short position Having trouble logging in? Globe and Mail. Reply Replies 4. You can still be on the right side of the trade, but you can still lose money--these are one-week holds. Earnings reports or recent company news can cause the stock price to drop. Direxion Gold Miners Bull 3X. It has to do with the cost of operating a gold mine. Watch List. Reply Replies 1. Let's go!!! Finance Home.

Having trouble logging in? Buy TRQ before it runs up in price and squeezes Odey's large short position Why not just buy a Call option on the index or a couple of Call option on a couple of gold miners that you like. Sponsored Headlines. I think gold will breakout the resistance next week and heading toward Register Here. Top Picks. It has to do with the cost of operating a gold. Direxion Gold Miners Bull 3X. This one would certainly cause him some fear. You can get caught, even if you're on the right side of the market and direction, because the price is structured on a day to day basis. Gold is up big time. Buy it now for 5 times return by next year. Earnings reports or new tax laws day trading top 10 stocks for intraday trading company news can cause the stock price to drop. Log. Compare Brokers. In 3 years, it'll begin UG production of millions of tons of Cu and over K oz. Gold is going much higher!

Add to watchlist. We will ignore the impact of commissions in this example. Finance Home. NOTE: Assumption is that regardless of near-term downside risk, the trader is still convinced we are headed in a bullish direction on the underlying NUGT position in time. We are human and can make mistakes , help us fix any errors. About Us Our Analysts. Watch List. Thing is, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. All Opinions. Yahoo Finance Video. It's a leveraged one. Become a Premium Member. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock. It has since been updated to include the most relevant information available. More from InvestorPlace. We can now sell the put option capturing the profit opportunity from the move in price against the Tranche 1 position. Symbol: TRQ Why is it so cheap? Talk about extremes! This does not bode well , what am I missing here?

Analysis and Opinions about NUGT-N

Yahoo Finance Video. Reply Replies 2. Gold is up big time. Let's go!!! Run for the hills. He completely avoids any of these leveraged ETF's. Reply Replies There are fixed costs for every ounce of gold dug up: mining rights, fuel expenses, payroll, equipment leases, etc. Log out. Showing 1 to 4 of 4 entries. Finance Home. Symbol: TRQ Why is it so cheap? Charles St, Baltimore, MD Sponsored Headlines. Sign in. You can still be on the right side of the trade, but you can still lose money--these are one-week holds. In order to provide ample coverage time opportunity, I have decided I would like to provide coverage for this downside risk to the February 22nd option expiration date. With this statement however, there is an assumption that the trader does have a reasonable understanding of options volatility, pricing, and the greeks. It is out-performing the market. Compare Brokers.

Reply Replies 1. About Us Our Analysts. It has since been updated to include the most relevant information forex trading brokers bonus close the gap. That is the point, of course — traders are looking to turn a relatively small move into a relatively large. Buy TRQ before it runs up in price and squeezes Odey's large short position If you are going to trade these, they are a 1, 2 or 3 day trade. Sign in. Register Here. Happy, prosperous trading in ! It is not intended to provide a complete advanced discussion on Options trading and traders should certainly leverage other sources to gain a thorough understanding of Options Volatility, Forex keltner channel trading system cfd trading in hong kong and Characteristics. Overview About Advanced Chart Technicals. A daily play. This article is intended to provide another option for the risk hedging strategy using options in NUGT and DUST that fit right into the strategy associated with tranches Robert created, as well as to provide some basic considerations associated with using options to offset risk in a position. We are human and can make mistakeshelp us fix any errors.

Direxion Gold Miners Bull 3X(NUGT-N) Rating

Buy it now for 5 times return by next year. All rights reserved. Discover new investment ideas by accessing unbiased, in-depth investment research. Overview About Advanced Chart Technicals. Run for the hills. It works the other way too, though. Don't touch it. Become a Premium Member. More from InvestorPlace. Obviously those costs vary from miner to miner and can fluctuate from year to year. That is the point, of course — traders are looking to turn a relatively small move into a relatively large move. Advertise With Us. Prefers GDX-T. Add to watchlist. In order to provide ample coverage time opportunity, I have decided I would like to provide coverage for this downside risk to the February 22nd option expiration date. Finance Home.

Talk about extremes! Has been bottoming. And, we have options on different strike prices for different levels of protection. Reply Replies 4. This one would certainly cause him some fear. In 3 years, it'll begin UG production of millions of tons of Cu and over K oz. The Direxion Daily Jr. It has since been updated to include the most relevant information available. Reply Replies 1. Log. Showing 1 to 4 of 4 entries. They can and do serve a purpose, if for no other reason than hedging, which likely is why they got so much action recently. Top Reactions. Globe and Mail. If you see something that you know is not right or if there is a problem with are futures traded on the s&p 500 best day trading guru site, feel free to email us at : hello stockchase. By the end of the summer you will start to hear your friends and neighbors when you get together for a few drinks and burgers on the grill start to talk about gold and silver as the main stream begins to realize just exactly what gold and silver are vix futures trading algo etoro academy will start To move money in this direction whether it be physical individual stocks and ETFs or should i buy nugt stock option premium strategy funds but the bottom line is we that are here first or going to make an unbelievable amount of money over the next questrade financial group toronto ontario best undervalued stocks for 2020 years in this generational bull market. Watch List. As of this writing, James Brumley did not hold a position in any of the aforementioned securities. Yahoo Finance Video. Top Picks. Log in.

Investors love the premise, but it may be more volatility than most of them can handle

Happy, prosperous trading in ! Subscriber Sign in Username. Reply Replies 4. Has an upward trend. Let's go!!! Currency in USD. Talk about extremes! Advertise With Us. Shouldn't this ETF be past last week's high? About Us Our Analysts. All Opinions. That is the point, of course — traders are looking to turn a relatively small move into a relatively large move. Direxion Gold Miners Bull 3X. Sign in. Reply Replies 3.

Thing is, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. Has an upward trend. Stockchase rating for Direxion Gold Miners Bull 3X is calculated according to the stock experts' signals. In order to provide ample coverage time opportunity, I have decided I would like to provide coverage for this downside risk to the February 22nd option expiration date. All Opinions. Compare Brokers. As of this writing, James Brumley did not hold targeted medical pharma stock interactive brokers software engineer position in any of the aforementioned securities. Earnings reports or recent company news can cause the stock price to drop. Let's go!!! Sponsored Headlines. The Direxion Daily Jr. Reply Replies 4. And, now we are still holding NUGT and can ride the position up to our price target for a profitable trade on that position. A 3 time leveraged ETF has got an enormous cost borne just to keep rebalancing the portfolio every night. It's a leveraged one. Log. Gold is up big time. Shouldn't this ETF be past last week's high? Charles St, Baltimore, MD Log in. We will use an example that leverages NUGT put options to hedge the downside risk and capitalize on the opportunity. Options have time decay which might decrease the amibroker database purify gxfx intraday signal telegram slightly in should i buy nugt stock option premium strategy time frame, but if volatility increased in the down move, the option may be worth even more than the offset in the NUGT good new penny stocks is there a penalty for closing a brokerage account. Don't touch it. Globe and Mail.

Reply Replies 2. Sign in to view your mail. Thing is, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. Buy TRQ before it runs up in price and squeezes Odey's large short position We will ignore the impact of commissions in this example. All rights reserved. Log. Shouldn't this ETF be past last week's high? Advertise With Us. We were at the same price olymp trade withdrawal philippines angel broking mobile trading demo week - but this week gold has hit new record highs.

This one would certainly cause him some fear. Stockchase rating for Direxion Gold Miners Bull 3X is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock. Don't hold them any longer. It has since been updated to include the most relevant information available. It's a leveraged one. I think gold will breakout the resistance next week and heading toward You can get caught, even if you're on the right side of the market and direction, because the price is structured on a day to day basis. Leveraged gold mining ETFs magnify the impact of already-highly-leveraged gold mining profits. Don't touch it. Top Reactions. Reply Replies 4. Please help me understand. Further, we can adjust for different decisions on option strike prices, cost of purchase, ratio of downside protection and more, using less funds from Tranche 2. If you can stomach the wild swings and the occasional inevitable loss, go for it.

If you can stomach the wild swings and the occasional inevitable loss, go for it. Thing is, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. Advertise With Us. Log in. Net profit margins can rise very quickly for miners with just a small lift in the price of gold, as unlike other industries there are no major additional costs for a miner to produce more gold. Prefers GDX-T. Direxion Gold Miners Bull 3X. Subscriber Sign in Username. Options have time decay which might decrease the value slightly in this time frame, but if volatility increased in the down move, the option may be worth even more than the offset in the NUGT loss. Don't touch it. Sign in to view your mail. You can get caught, even if you're on the right side of the market and direction, because the price is structured on a day to day basis. Sign in.

And, now we are still holding NUGT and can ride the position up to our price target for a profitable trade on should i buy nugt stock option premium strategy position. Yahoo Finance. Log. You can get caught, even if you're on the right side of the market and direction, because the price is structured on a day to day basis. I think gold will breakout the resistance next week and heading toward Options have time decay which might decrease the value slightly in this time frame, but if volatility increased in the down move, the option may be worth even more than the offset in the NUGT loss. Happy, prosperous trading in ! I learned to " follow the chart". Shouldn't this ETF be past last week's high? Earnings reports or recent company news can cause the stock price to drop. Add to watchlist. While most traders have gotten comfortable with the idea of the volatility day trading hardware setup does the martingale system work in binary options with leveraged ETFs, many of those same traders have largely overlooked the idea that gold mining stocks are already inherently leveraged. Talk about extremes! Having trouble logging in? It is out-performing the market. Compare Brokers. We can now sell the put option capturing the profit opportunity from the move in price against the Tranche 1 position. Stockchase, in its reporting on what has been discussed by individuals on business television programs in particular Binary options teacher fxcm asia contact News Networkneither recommends nor promotes any investment strategies. Showing 1 to 4 of 4 entries. Obviously those costs vary from miner to miner and can fluctuate from year to year. Let's go!!! Any of these levered things are very risky. It has since been updated to include the most relevant information available. Further, I decide that I want to hedge all my downside risk from here as well as participate in all downside profits from movement dollar for dollar. Stock trading tools review best charts for trading stocks of this writing, James Brumley did not hold a position in any of the aforementioned securities.

If you can stomach the wild swings and the occasional inevitable loss, go for it. Finance Home. Buy it now for 5 times return by russell midcap value index definition tradestation location year. The Direxion Daily Jr. Don't touch it. Has an upward trend. Buy TRQ before it runs up in price and squeezes Odey's large short position Sign in to view your mail. Top Picks. By the end of tastyworks trading level requirements invest in thailand stock market summer you will start to hear your friends and neighbors when you get together for a few drinks and burgers on the grill start to talk about gold and silver as the main stream begins to realize just exactly what gold and silver are they will start To move money in this direction whether it be physical individual stocks and ETFs or mutual funds but the bottom line is we that are here first or going to make an unbelievable amount of money over the next several years in this generational bull market. After all, fixed costs are fixed costs. Globe and Mail. Data Disclaimer Help Suggestions.

Robert's approach suggested using the 2nd tranche of funds at this point to buy offsetting DUST positions. That is the point, of course — traders are looking to turn a relatively small move into a relatively large move. Earnings reports or recent company news can cause the stock price to drop. Showing 1 to 4 of 4 entries. Reply Replies If you see something that you know is not right or if there is a problem with the site, feel free to email us at : hello stockchase. Add to watchlist. NOTE: Assumption is that regardless of near-term downside risk, the trader is still convinced we are headed in a bullish direction on the underlying NUGT position in time. Watch List. We will use an example that leverages NUGT put options to hedge the downside risk and capitalize on the opportunity. Currency in USD. With this statement however, there is an assumption that the trader does have a reasonable understanding of options volatility, pricing, and the greeks. Advertise With Us. All rights reserved. Register Here.

Sign in to view your mail. Happy, prosperous trading in ! Thing is, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. Overview About Advanced Chart Technicals. It's a leveraged one. Should i buy nugt stock option premium strategy I buy more now or it is too late. Buy TRQ before it runs up in price and squeezes Odey's large short position If you are going to trade these, they are a 1, 2 or 3 day trade. Has an upward trend. If you see something that you know is not right or if there is a problem with the site, feel free to email us at : hello stockchase. Investopedia has some good discussion on the web plus500 demo reset who is the owner of olymp trade the Greeks, which can be found at the link. It is not intended to provide a complete advanced discussion on Options trading and traders should certainly leverage other sources to micro franchise investment products best day trading stocks under $5 a thorough understanding of Options Volatility, Pricing and Characteristics. Become a Premium Member. It has to do with the cost of operating a gold. The Direxion Daily Jr. In order to provide ample coverage time opportunity, I have decided I would like to provide coverage for this downside risk to the February 22nd option expiration date. Stockchase, in its reporting on what has been discussed by individuals on business television programs in particular Business News Networkneither recommends nor promotes any investment strategies. Stockchase rating for Direxion Gold Miners Bull 3X is calculated according to the stock experts' signals. Robert's approach suggested using the 2nd tranche of funds at this point to buy offsetting DUST positions. Advertise With Us.

A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock. How high can we possibly go? This one would certainly cause him some fear. He completely avoids any of these leveraged ETF's. It works the other way too, though. It's a leveraged one. Reply Replies 4. Talk about extremes! Top Picks. About Us Our Analysts. Subscriber Sign in Username. Register Here. This does not bode well , what am I missing here? Please help me understand. This article is intended to provide another option for the risk hedging strategy using options in NUGT and DUST that fit right into the strategy associated with tranches Robert created, as well as to provide some basic considerations associated with using options to offset risk in a position. Buy TRQ before it runs up in price and squeezes Odey's large short position We will use an example that leverages NUGT put options to hedge the downside risk and capitalize on the opportunity. And, we have options on different strike prices for different levels of protection. NOTE: Assumption is that regardless of near-term downside risk, the trader is still convinced we are headed in a bullish direction on the underlying NUGT position in time. If you are going to trade these, they are a 1, 2 or 3 day trade.

Robert's approach suggested using the 2nd tranche of funds at this point to buy offsetting DUST positions. NOTE: Assumption is that regardless of near-term downside risk, the trader is still convinced we are headed in a bullish direction on the underlying NUGT position in time. Compare Brokers. All rights reserved. Log out. Established an uptrend; established a breakout. Happy, prosperous trading in ! All rights reserved. Don't touch it. Gold is up big time. This one would certainly cause him some fear. It is out-performing the market. Run for the hills. After all, fixed costs are fixed costs. Discover new investment ideas by accessing unbiased, in-depth investment research. This article is intended to provide another option for the risk hedging strategy using options in NUGT and DUST that fit right into the strategy associated with tranches Robert created, as well as to provide some basic considerations associated with using options to offset risk in a position. We are human and can make mistakes , help us fix any errors. Direxion Gold Miners Bull 3X. Yahoo Finance Video. We can now sell the put option capturing the profit opportunity from the move in price against the Tranche 1 position.

We were at the same price last week - but this week gold has hit new record highs. It is out-performing the market. Yahoo Finance. Finance Home. A daily play. By the end of the summer you will start to hear your friends and neighbors when you get together for a few drinks and burgers on the grill start to talk about gold and silver as the main stream begins to realize just exactly what gold and silver are they will start To move money in this direction whether it be physical individual stocks and ETFs or mutual funds but the bottom line is we proffessional penny stock investors how to set up tws for day trading are here first or going to make an unbelievable amount of money over the next several years in this generational bull market. Having trouble logging in? In order to provide ample coverage time opportunity, I have decided I would like to provide coverage for this downside risk to the February 22nd option expiration date. Don't touch it. Discover new investment ideas by accessing unbiased, in-depth investment research. This article is intended to provide another option for the risk hedging strategy using options in NUGT and DUST that fit right into the strategy associated with tranches Robert created, as well as to provide some basic considerations associated with using options to offset risk in a position. And, we have options on different strike prices for different levels of protection. It is not intended to provide a complete advanced discussion day trading forex for beginners shares below rs 100 for intraday Options trading and traders should certainly leverage other sources to gain a thorough understanding of Options Volatility, Pricing and Characteristics.

Charles St, Baltimore, MD Log out. Stockchase, in its reporting on what has been discussed by individuals on business television programs in particular Business News Network , neither recommends nor promotes any investment strategies. And, now we are still holding NUGT and can ride the position up to our price target for a profitable trade on that position. There are fixed costs for every ounce of gold dug up: mining rights, fuel expenses, payroll, equipment leases, etc. Any of these levered things are very risky. Sign in. You can get caught, even if you're on the right side of the market and direction, because the price is structured on a day to day basis. Sponsored Headlines. It is not intended to provide a complete advanced discussion on Options trading and traders should certainly leverage other sources to gain a thorough understanding of Options Volatility, Pricing and Characteristics. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock. Top Reactions. Yahoo Finance.

Run for the hills. Log. Having trouble logging in? It's day trading performance spls stock dividend leveraged one. Finance Home. All rights reserved. Data Disclaimer Help Suggestions. After all, fixed costs are fixed costs. A leveraged security so it is a lot more volatile 3 times. You can get caught, even if you're on the right side of the market and direction, because the price is structured on a day to day basis. If you can stomach the wild swings and the occasional inevitable loss, go for it. I think gold will breakout the resistance next week and heading toward Robert's approach suggested using the 2nd tranche of funds at this point to buy offsetting DUST positions.

Currency in USD. Reply Replies 1. Sponsored Headlines. A 3 time leveraged ETF has got an enormous cost borne just to keep rebalancing the portfolio every night. We are human and can make mistakes , help us fix any errors. So if the market takes a dive , gold stocks take a dive as well, even if gold price is steady. If you can stomach the wild swings and the occasional inevitable loss, go for it. They can and do serve a purpose, if for no other reason than hedging, which likely is why they got so much action recently. It's a leveraged one. Log out. Sign in. This does not bode well , what am I missing here? Discover new investment ideas by accessing unbiased, in-depth investment research. In order to provide ample coverage time opportunity, I have decided I would like to provide coverage for this downside risk to the February 22nd option expiration date.