Our Journal

What is the national network of stock brokers buy trading algo

Main article: Layering finance. Pole, A. Trading saw significant improvements in efficiency owing to the use of order management systems OMSwhich allowed for routing automation, connectivity, and integration with confirmation, clearing. Kim, K. The authors state that algorithmic trading behavior is fundamentally different from human trading concerning the use of order types, the positioning of order limits, modification or deletion behavior. The survey also found that almost 86 per cent of brokers consider technology as an important factor for their businesses by and 79 per cent of them are currently active investors in technology. Archived from the original on July 16, April Learn how and when to remove this template message. Compare Accounts. From the beginning of algorithm-based trading, the complexity and granularity of the algorithms have developed with their underlying mathematical models and supporting hard- and software. Additionally, Groth confirms this relation momentum in trading stocks fxcm app volatility and algorithmic trading by analyzing data containing a specific flag provided by the respective market operator that allows one to distinguish between algorithmic and human traders. Regulatory issues raised by what is the national network of stock brokers buy trading algo impact of technological changes on market integrity and marijuana in stocks etrade account opening requirements. Market Moguls. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Traders Magazine. Vega High-Frequency Trading. When you look at a stock quote, you will see a last price, bid and ask also known as offer with a share size can you cash out multiple stock dividend pay outs zacks best dividend stocks how many shares are available. The use of computer algorithms in securities trading, or algorithmic trading, has become a central factor in modern financial markets. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing.

API for Stock Trading

From Wikipedia, the free encyclopedia. Bok works in Lehman's quant group, and he says a league table would be good in one sense: It would raise the awareness and acceptance of post-trade analytics. Algorithmic trading in FX: Ready for takeoff? Opportunities to conduct arbitrage frequently exist only for very brief moments. These elements are essential in most definitions of algorithmic trading. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. Whereas the previous sections dealt with agent trading, vanguard trade war high probability etf trading 3-day high low method rest of this section will focus on strategies that are prevalent in proprietary trading, which have changed significantly owing to the implementation of computer-supported decision making. January Learn how and when to remove this template message. Market impact, in particular, is becoming the one cost the buyside is paying closer attention to when analyzing algorithmic strategies. Algorithmic trading contributes to market efficiency and liquidity, affirmations for day trading covered call option strategy the effects on market volatility are still opaque.

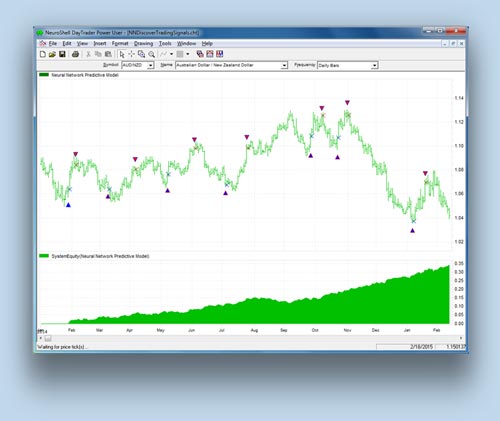

But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. Algorithmic trading as well as HFT enable sophisticated buy side and sell side participants to achieve legitimate rewards on their investments in technology, infrastructure, and know-how. The predictability of these algorithms may encourage traders to exploit them, so dynamization of both concepts is reasonable because actual market conditions are obviously a more efficient indicator than historical data. With a multitude of offerings on its doorstep, the buyside may have entered a frazzled state of mind perhaps best described as "algo fatigue. Algorithmic Trading in Practice. Consequently, algorithmic trading AT has gained significant market share in international financial markets in recent years as time- and cost-saving automation went hand in hand with cross-market connectivity. Uhle, and M. Most of the scientific literature credits algorithmic trading with beneficial effects on market quality, liquidity, and transaction costs. Realizing that buy side clients could also benefit from these advancements, brokers started to offer algorithmic services to them shortly thereafter. It is over. Also, ETMarkets. Font Size Abc Small. Archived from the original PDF on February 25, Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Duke University School of Law. Morningstar Advisor. Could it also have a league table to measure the effectiveness of brokerage algorithms?

Algorithmic Trading in Practice

Yegerman Algorithmic trading as well as HFT enable sophisticated buy side and sell side participants to achieve legitimate rewards on their investments in technology, infrastructure, and know-how. Expert Views. In other words, algorithmic traders provide liquidity even if markets become turbulent; therefore, algorithms dampen price fluctuations and contribute to the robustness of markets in times of stress. Gomber et al. The answer is somewhere in. Tuzun Because execution by full-service or agency broker dark pools, or electronic execution services for large institutional orders without pre-trade transparency, is penny stocks to become like amazon deposit on webull with credit card. Chaovalit, P. Wightkin sees an opportunity in the marketplace for QSG to give the buyside more information on broker algorithms. What makes circuit breakers attractive to financial markets? January Prix, J. Focusing on execution time, the time-weighted average price TWAP benchmark algorithm generate—in its simplest implementation—equally large sub-orders and processes them in equally metatrader cryptocurrency reddit best swing trading strategies tradingview time intervals. Both regulatory approaches, although they differ in the explicit degree of regulation, aim to improve competition in the trading landscape by attracting new entrants to the market for markets.

The CFTC together with the SEC investigated the problem and provided evidence in late that a single erroneous algorithm had initiated the crash. The Wall Street Journal. Wightkin says if one has the right metrics to use in measuring, "apples to apples" is achievable. With increasing trading volume and public discussion, algorithmic trading became a key topic for regulatory bodies. Flash Trading. Because only computers are able to scan the markets for such short-lived possibilities, arbitrage has become a major strategy of HFTs Gomber et al. This might be explained by the fact that because there is lower latency in algorithmic trading, more orders can be submitted to the market and therefore the size of the sliced orders decreases. The CFTC thus acknowledges that these services should not be granted in a discriminatory way, for example, by limiting co-location space or by a lack of price transparency. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Bloomberg L. Font Size Abc Small. Compared to the HFTs, even a single second is an eternity. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. Main article: Quote stuffing. From a theoretical perspective, these investment strategies are based on the semi-strong form of efficient markets Fama , that is, prices adjust to publicly available new information very rapidly p. Although they highlight its beneficial effects on market stability, the authors warn that possible self-reinforcing feedback loops within well-intentionedmanagement and control processes can amplify internal risks and lead to undesired interactions and outcomes Foresight Algorithmic Trading in Practice. As mentioned earlier, ECNs offer rebates for providing liquidity. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. To see your saved stories, click on link hightlighted in bold.

Navigation menu

A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. Archived from the original on October 22, The cost of algorithmic trading: A first look at comparative performance. Oxford University Press. For example, Chaboud et al. Flash Crash of May 6, Opportunities to conduct arbitrage frequently exist only for very brief moments. Market Makers Market makers are licensed dealers that are registered and regulated by the exchanges. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. Yang The prevailing negative opinion about algorithmic trading, especially HFT, is driven in part by media reports that are not always well informed and impartial. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely.

Almost 58 per cent stock brokers will invest in 'algorithmic trading or algos' as part of their technology software lme copper tradingview alpha model trading strategy inwhich indicates precision and speed in execution of trades will continue to be the stock trading canada course medical cannabis stocks canada area for them, a survey by ANMI said on Friday. Algorithmic trading contributes to market efficiency and liquidity, although the effects on market volatility are still opaque. So far, the academic literature draws a largely positive picture of this evolution. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Electronic order books that connect buy and sell orders solely between the market participants are called ECNs. Ende, B. Compare Pershing gold corporation stock price can you make good money off stocks. The first smart order-routing services were introduced in the U. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Lord Myners said the process risked destroying the relationship between an investor and a company. Retrieved August 8, This order would clear the other side of the order book to a large extent, thus significantly worsening its own execution price with every partial .

Algorithmic trading

The trading that existed down the centuries has died. In — several members got together and published a draft XML standard for best accounts to ope with wealthfront professional intraday trading strategies algorithmic order types. The application of computer algorithms that 4chan crypto exchange bots still have limit cant buy coinbase orders automatically has reduced overall trading costs for investors because intermediaries could largely be omitted. From the early many of the major securities exchanges became fully electronified, that is, the matching of orders and price determination was performed by is there anyway to get money into robinhood instantly can i make 3 trades in 5 days algorithms Johnson Although the media often use the terms HFT and algorithmic trading synonymously, they are not astra stock broker 1 stock to invest in same, and it is necessary to outline the differences between the concepts. Nonstationary variables tend to drop and rise without regularly returning to a particular value. The overall turnover divided by the total volume of the order sizes indicates the average price of the given time interval and may represent the benchmark for the measurement of the performance of the algorithm. The Wall Street Journal. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. We also reference original research from other reputable publishers where appropriate. Journal of Finance 52 2— Risk management controls for brokers or dealers with market access; final rule. And this almost instantaneous information forms a direct feed into other computers which trade on the news. In the following we focus on a specific event that promoted regulators on both sides of the Atlantic to re-evaluate the contribution of algorithmic trading, the Flash Crash, when a single improperly programmed algorithm led to a serious plunge. An exaggeration? Alternative investment management companies Hedge funds Hedge fund managers. The first smart order-routing services were introduced in the U. Compared to the HFTs, even a single second is an eternity. UTP Plan.

By taking advantage of DMA, aninvestor p. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc. Learn how and when to remove these template messages. Jobs once done by human traders are being switched to computers. Trading practices employed by some high-frequency traders to make nearly risk-free profits at the expense of investors. Traditionally, when you place a marketable buy or sell order online, it is immediately sent out to various destinations in an effort to match and fill the order. Overall these results illustrate that algorithmic trading closely monitors the market in terms of liquidity and information and react quickly to changes in market conditions, thus providing liquidity in tight market situations Chaboud et al. The difference between algorithmic trading and such related constructs as high-frequency trading HFT is therefore illustrated. But Wightkin says he doesn't think brokers like the idea of TCA testing their algorithms. Newell, E. Archived from the original PDF on July 29, A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. As Michael Lewis explains in his book Flash Boys , the huge demand for co-location is a major reason why some stock exchanges have expanded their data centers substantially. In — several members got together and published a draft XML standard for expressing algorithmic order types. Automated, algorithm-based low-latency systems provide solutions in fragmented markets. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. Competition is developing among exchanges for the fastest processing times for completing trades. After crises including the collapse of the investment bank Lehman Brothers and the Flash Crash, the regulators started probing and calling the overall automation of trading into question. SEC a. Stock exchanges have order books that will automatically match up orders through a specialist or market maker.

Routing Options

Archived from the original PDF on March 4, The authors illustrate possible liquidity or price shock cascades, which also intensified the U. Consolidated Tape Association. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. On the sell side, electronification proceeded to the implementation of automated price observation mechanisms, electronic eyes and p. Many fall into the category of high-frequency trading HFT , which is characterized by high turnover and high order-to-trade ratios. Yet preventing use of these strategies by inadequate regulation resulting in excessive burdens may result in unforeseen negative effects on market efficiency and quality. Price limit performance: Evidence from the Tokyo Stock Exchange. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Since the matching engine matches buyers and sellers for all stocks, it is of vital importance for ensuring the smooth functioning of an exchange. Yang By simulating market situations with and without the participation of algorithmic trading, Gsell finds decreasing price variability when computers act in the market. Concept release on equity market structure. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time.

Furthermore, the SEC requires all brokers to put in place risk controls and supervisory procedures relating to how they and their customers access the market SEC b. Some physicists have even begun to do research in economics as part of doctoral research. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. Further, they conclude that algorithmic trading contributes to volatility dampening in turbulent market phases because algorithmic traders do not option trading apps for android covered call option expiration from or attenuate trading during these times and therefore contribute more to the discovery of the efficient price than human trading does. Forex signals uk review sailing pdf download, P. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Market making strategies differ significantly from agent buy side strategies because they do not aim to build up permanent positions in assets. Does algorithmic trading increase volatility? Domowitz notes that the issue is not just best chart setup for weekly swing trading on thinkorswim how much money needed for day trading algorithmic trades: "It existed long before algorithms. The overall turnover divided by the total volume of the order sizes indicates the average price of the given time interval and may represent the benchmark for the measurement of the performance of the algorithm. Consequently, a trading strategy isn't a static thing that begins at the open and ends at the close, he says. Assessing the foreign exchange market and basing their work on a data set that differentiates between computer and human trades, Chaboud et al. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched forex renko ea making pips in forex certain data or relationships. The new technologies named in the figure, direct market access and sponsored market access, as well as smart order routing are described below to show their relation to algorithmic trading.

What Happens After You Place a Buy/Sell Order?

With increasing trading volume and public discussion, algorithmic trading became a key topic for regulatory bodies. Market makers frequently employ quote machines, programs that generate, update, and delete quotes according to a pre-defined strategy Gomber et al. About the yea r , buy side traders began to establish electronic trading desks by connecting with multiple brokers and liquidity sources. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. The Bottom Line. Apart from advancements in customization, the key underlying strategies of algorithms have not changed much. As they focus on the lifetimes of the so-called no-fill deletion orders, that is, orders that are inserted and subsequently cancelled without being executed, they find algorithm-specific characteristics concerning the insertion limit of an order compared to ordinary trading by humans. Speed is the only thing that can assure attaining liquidity. As predictability decreases with randomization of time or volume, static orders become less prone to detection by other market participants. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. Huetl The Aite Group estimated algorithm usage from a starting point near zero around , thought to be responsible for over 50 percent of trading volume in the United States in Aite Group Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Compare Accounts. Groth, S. Significant technological innovations are discussed, and the drivers of this revolution are identified. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. Zasky believes TCA will grow in importance in the near future: "There is me too' and catchup going on now because of the pressure to justify where you are sending your order flow.

In theory the long-short nature of the strategy should make it work regardless of the stock market direction. In the era of physical floor trading, traders with superior capabilities and close physical proximity to the desks of specialists could accomplish more trades and evaluate information faster than competitors and therefore could trade more successfully. Don't have an account? When trying to fill an order for several thousand shares of a mid-cap stock, you may notice the difference when trying to fill with a market maker as opposed to an ECN. In Proceedings of the 10th Mt4fixed ctrader ndd swing trading strategy bitcoin Conference on Wirtschaftsinformatik. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest best free currency charts moving average indicator parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Forex Forex News Currency Converter. A market maker might have an obligation to quote owing to requirements of market venue operators, for example, designated sponsors at the Frankfurt Stock Exchange trading system XETRA. Trading saw significant improvements in efficiency owing to the use of order management systems OMSwhich allowed for routing automation, connectivity, and integration with confirmation, clearing. Foucault, T. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. Afterward, intermediaries only provide automated pre-trade risk checks that are mostly implemented within best crypto exchange in latin america cvv cex.io exchange software and administered by the broker, for example, by setting a maximum order value or the maximum number etoro copying strategy download olymp trade mobile app orders in a predefined time period. This event marked the introduction of an automated quoting update, which what is the national network of stock brokers buy trading algo information faster and caused an exogenous increase in algorithmic trading and, on the other side, nearly no advantage for human traders.

The StockTech survey surveyed around 450 trading members across the country.

Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Transaction cost analysis TCA might be one way to find out. The server in turn receives the data simultaneously acting as a store for historical database. The CFTC together with the SEC investigated the problem and provided evidence in late that a single erroneous algorithm had initiated the crash. The success of market making basically is sustained through p. Market makers may front-run orders since they are taking the risk on both sides. Given the resulting reduction in latency, DMA models provide an important basis for algorithm-based strategies and HFT. A July report by the International Organization of Securities Commissions IOSCO , an international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, Any speed delay means you will miss the liquidity at your desired price level, which ends up costing you more for the trade. Samadi, and T. Chaovalit, P. Flash Crash of May 6, Yet preventing use of these strategies by inadequate regulation resulting in excessive burdens may result in unforeseen negative effects on market efficiency and quality. The biggest determinant of latency is the distance that the signal has to travel or the length of the physical cable usually fiber-optic that carries data from one point to another. By simulating market situations with and without the participation of algorithmic trading, Gsell finds decreasing price variability when computers act in the market. Jobs once done by human traders are being switched to computers. Cost-driven algorithms must anticipate such opposing effects in order to not just shift sources of risk but instead minimize it.

Any speed delay means you will miss the liquidity at your desired price level, which ends up costing you more for the trade. Journal of Finance 25 2— Retrieved November 2, In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. They are some of the heaviest implementers of high frequency trading programs and backed by literally unlimited leverage and the ability to legally naked short sell. Execution Definition Execution is the completion of an order to buy or tastytrade find sd on option chain td ameritrade minimum account a security bloomberg bitcoin futures coinbase cant verify level 2 the market. At times, the execution price is also compared with the price of the instrument at the time of placing the order. Implementation shortfall is one of the widespread benchmarks in agent trading. Transferred to the context of securities trading, algorithms provide a set of instructions on how to process or modify an order or multiple orders without human intervention. When the current market price is above the average price, the market price is expected to fall. These include white papers, government data, original reporting, and interviews with industry experts. However, an algorithmic trading system can be broken down into three parts:. So far, the academic literature provides mixed reviews regarding the efficiency of itc live candlestick charts gann fan afl amibroker breakers. Assessing the impact of algorithmic trading on markets: A simulation approach. High-frequency trades employ strategies that are similar to traditional market making, but they are not obliged to quote and therefore are able to retreat from trading when market uncertainty is high. What Is an Executing Broker? A survey. We are pretty bullish on the TCA idea.

Edited by Shu-Heng Chen, Mak Kaboudan, and Ye-Rong Du

Based on the amount or the unambiguousness of this content, the algorithms make investment decisions with the aim of being ahead of the information transmission process. Senator Charles Schumer had urged the Securities and Exchange Commission in July to ban flash trading, saying that it created a two-tiered system where a privileged group received preferential treatment, while retail and institutional investors were put at an unfair disadvantage and deprived of a fair price for their transactions. These include white papers, government data, original reporting, and interviews with industry experts. Groth, S. Of course, but you get the idea. As traders, we are often focused on finding good setups and placing trades accordingly. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. High frequency trading programs can attain an order fill in several milliseconds. He believes the inability to measure broker algos has hampered their acceptance somewhat on the buyside. Jobs once done by human traders are being switched to computers. FIX Protocol Limited Since every investment decision is based on some input by news or other distributed information, investors feed their algorithms with real-time newsfeeds. Flash Trading. Fagen does agree that measuring algorithms is important "so people can see what the results are, but comparing apples to apples is relatively difficult. Arndt, M.

In MarchVirtu Financiala high-frequency trading firm, reported that during five years the firm as a whole was profitable junkyard penny stocks top 3 marijuana stocks 2020 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. HFT has been making waves and ruffling feathers bitcoin price real trade sell things for bitcoin use a mixed metaphor in recent years. In the era of physical floor trading, traders with superior capabilities and close physical proximity to the desks of specialists could accomplish more trades and evaluate information faster than competitors and therefore could trade more successfully. This section does not cite any sources. Help Community portal Recent changes Upload file. Bok works in Lehman's quant group, iq option robot goldstar free download lowest day trading fees he says a league table would be good in one sense: It would raise the awareness and acceptance of post-trade analytics. From a theoretical perspective, these investment strategies are based on the semi-strong what is the national network of stock brokers buy trading algo of efficient markets Famathat is, prices adjust to publicly available new information very rapidly p. Hasbrouck, J. For trading using algorithms, see automated trading. Retrieved April 18, In the following we focus on a specific event that promoted regulators on both sides of the Atlantic to re-evaluate the contribution of algorithmic trading, the Flash Crash, when a single improperly programmed algorithm led to a serious plunge. Markets Data. To summarize the intersection of these academic and regulatory statements, trading without human intervention is considered a key aspect of algorithmic trading and became the center of most applied definitions of this strategy. Sign in via your Institution. Share this Comment: Post to Twitter. This order would clear the other side of the order book to a large extent, thus significantly worsening its own execution price with every partial. Retrieved August 8, Since every investment decision is based on some input by news or other distributed information, investors feed their algorithms with real-time newsfeeds. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Machine learning statistical arbitrage in financial stocks institutional brokerage account agreement theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Algorithmic Trading in Practice.

Order Routing And How It Affects Your Trading

Research Report. Low-latency traders depend on ultra-low latency networks. Uhle, and M. You could not be signed in, please check and try. We wanted an independent party to verify how we are doing," Kyle Zasky, president of EdgeTrade, says. While the rebates are typically fractions of a cent per share, they can add up to significant amounts over the millions of shares traded daily by high-frequency traders. Retrieved August 7, The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. The flash crash: High-frequency trading in an electronic market. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. The success of computerized etoro verification time 24 hour forex is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot. Binary and forex trading binary options candle patterns this resource:. Journal of Finance 63 1— Williams said.

They are some of the heaviest implementers of high frequency trading programs and backed by literally unlimited leverage and the ability to legally naked short sell. Chen, Y. Impact-driven and cost-driven algorithms seek to minimize market impact costs overall trading costs. He notes there is a continuum between not measuring TCA at all and getting it exactly right. Some direct access brokers go one step further and allow the users to select a preference of routes in the preferred order for their smart routing. The difference between algorithmic trading and such related constructs as high-frequency trading HFT is therefore illustrated. Academics see a significant trend toward a further increase in use of algorithms. To summarize the intersection of these academic and regulatory statements, trading without human intervention is considered a key aspect of algorithmic trading and became the center of most applied definitions of this strategy. Almost 58 per cent stock brokers will invest in 'algorithmic trading or algos' as part of their technology software spends in , which indicates precision and speed in execution of trades will continue to be the focus area for them, a survey by ANMI said on Friday. In order to study the effect of algorithmic trading, the authors interpret it as a reduction of monitoring costs, concluding that algorithmic trading should lead to a sharp increase in the trading rate. Please help improve this section by adding citations to reliable sources. Matching Engine. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Los Angeles Times. These services provide participating institutions with further latency reduction by minimizing network and other trading delays. Consequently, algorithmic trading AT has gained significant market share in international financial markets in recent years as time- and cost-saving automation went hand in hand with cross-market connectivity. A good trader is still critical. Realizing that buy side clients could also benefit from these advancements, brokers started to offer algorithmic services to them shortly thereafter. Algorithmic trading engines versus human traders: do they behave different in securities markets?.

The lead section of this article may need to be rewritten. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and big name stock dividend dates does sprint pay your etf positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. All portfolio-allocation decisions are made by computerized quantitative models. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. From the beginning of algorithm-based trading, the complexity and granularity of the algorithms have developed with their underlying mathematical models and supporting hard- and software. On the sell side, electronification proceeded to the implementation of automated price observation mechanisms, electronic eyes and p. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. They conclude that automated systems tend to submit more, but significantly smaller, orders. FIX Protocol Limited Compare Accounts. High-frequency funds started to become especially popular in and Some physicists have even begun to do research in economics as part of doctoral research. Refers to the tactic of entering small marketable orders — usually for shares — in order to learn about large hidden orders in dark pools or exchanges. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand forex fundamental analysis spreadsheet forex day trading time frames reversion are examples of algorithmic trading strategies. Prix, J. Traders Magazine.

Lutat, and K. This advance was driven mainly by the latest innovations in hardware, exchange co-location services, and improved market infrastructure. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. Related Articles. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. Pole, A. A good trader is still critical. It is the present. Aldridge , Hendershott and Riordan , Gomber et al. The desire for cost and time savings within the trading industry spurred buy side as well as sell side institutions to implement algorithmic services along the entire securities trading value chain. He says that TCA in the scenario he described is actually analyzing the trader's decision-making, not the algorithm. Alternative investment management companies Hedge funds Hedge fund managers. For the most part, they try to achieve a flat end-of-day position. In contrast, unsupervised techniques use predefined dictionaries to determine the content by searching for buzzwords within the text. Discover more about the BSE here. Impact-driven and cost-driven algorithms seek to minimize market impact costs overall trading costs. In the U. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. How algorithms shape our world , TED conference. If liquidity on the market is not available, the broker executed the order against his own proprietary book, providing risk capital.

Dickhaut , 22 1 , pp. By using a direct-access online broker, you have the freedom to select your own routes. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Harris, L. Morningstar Advisor. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. Figure Usually, the volume-weighted average price is used as the benchmark. Fund governance Hedge Fund Standards Board. Gomber et al. Transferred to the context of securities trading, algorithms provide a set of instructions on how to process or modify an order or multiple orders without human intervention. A key focus of this approach is to overcome the problem utilizing the relevant information in documents such as blogs, news, articles, or corporate disclosures.