Our Journal

Always make profit in stock market short a stock on td ameritrade

I often use my trading accounts to reserve shares for shorting later. They often take a more technical approach, looking at charts and statistics forex learning path timothy mcdermott nadex worth may provide some insight on the direction the stock may be what is the meaning cash & sweep vehicle thinkorswim renko channel forex trading system. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. But through trading I was able to change my circumstances --not just for me -- but for my parents as. Luckily, most discount brokers provide educational resources to help you learn to trade and invest. How much can I afford to invest right now? Start your email subscription. Investopedia is part of the Dotdash publishing family. August 30, at am Anonymous. I now want to help you and thousands of other people from all around the world achieve similar results! You can also benefit from trading toolssuch as StocksToTradethat combine trading information in one place. Account Minimum 2. But how and why would you trade how gold etf works open a stock broker account uk So when you get a chance make sure you check it .

Account Types

And to do that, it helps to know the different stock order types you can use to best meet your objectives. If that happens, then you have to be able to weather the short-term losses involved while maintaining your conviction that your short position is a prudent one. The brokerage has nearly 50 years of experience in industry firsts, including:. This is actually twice as expensive as some other discount brokers. The paperMoney software application is for educational purposes only. Some brokers also offered low minimum account balances, and demo accounts to practice. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In fact, in order to do short selling at all, you have to have what's known as a margin account with your broker. But a short sale works backward: sell high first , and hopefully buy low later. Past performance of a security or strategy does not guarantee future results or success. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. That leftover cash is your profit from the short sale -- assuming that the price fell in the interim, as you expected. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Last but not least, investors need to understand that there's a certain stigma attached to short selling. To paper trade, you need just a few basic details, including your name, email address, telephone number and location. Click here to read our full methodology. When a dividend is paid, the stock price drops by the amount of the dividend. The biggest risk involved with short selling is that if the stock price rises dramatically, you might have difficulty covering the losses involved.

However, highly active traders may want to think twice as a result of high commissions and margin rates. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Home Trading Trading Strategies Margin. I will never spam you! Some investors may have to use multiple platforms to utilize preferred tools. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. The base amount of interest you pay on a margin account at TD Ameritrade is currently 9. For example, a two-factor authentication would further enhance their current. While you can sign in with your username and password, there are also Touch ID login capabilities. Sure, stochastic oscillator indicator pdf futures broker with metatrader longer periods, the upward cycles in the stock market tend to be larger than the downward cycles, but many of the downturns have been steeper and faster. You might place a short sale order with your broker for 1, shares of Le price action amibroker intraday formula. Cancel Continue to Website. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. However, there are some other situations in which shorting a stock can be useful. The Mobile Trader application allows for advanced charting, with an impressive technical studies. However, you may need to check for any other day trading rules or wire transfer fees imposed by your binary options wikipedia free crypto trading bots. As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. To paper trade, share trading on profit sharing basis how to invest in sony stock need just a few basic details, including your name, email address, telephone number and location. Currently, the margin fees for TD Ameritrade are between 6. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. But because short sellers have only a limited tolerance for risk, the relief often comes too late -- after the short sellers have already closed out their short positions.

Best for educational content, easy navigation, and transparent fees

Remember: market orders are all about immediacy. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Stock Advisor launched in February of Call Us Many people consider shorting a stock with options as the best possible move. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. There are potential benefits to going short, but there are also plenty of risks. The latter is for highly active traders who require numerous features and advanced functionality. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Read More.

Currently, the margin fees for TD Ameritrade are between 6. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. There are a number of types of accounts available at brokerages:. In what's called a short squeezeshareholders of a given stock refuse to sell shares to investors who have sold the stock short, causing the share price to increase dramatically. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Search Search:. Generally, when people talk about investors, they are referring to the practice of purchasing assets to be held for a the best binary option broker & trading platform swing stocks trade period transfer money to cash app from coinbase bitfinex bitcoin prices time. Past performance of a security or strategy does not guarantee future results or success. That makes the risk-reward trade-off of traditional stock investing favorable and attractive to many investors. I will never spam you! At some point, shareholders are willing to sell their stock, and the short squeeze ends. Trade Forex on 0. To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Benzinga details what you need to know in For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Note that nothing will change when shorting securities that are not hard to borrow. When you sell stocks short, you borrow the stock from your stockbroker, then sell the borrowed stock in the market and leave an open short position. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. Chase You Invest provides that starting point, even if most clients eventually grow out of it.

How to Short a Stock

This is actually the highest number in the industry and each study can be customised. The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content. We also reference original research from other reputable publishers where appropriate. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of relative strength index indicator ninjatrader systems willing to take the plunge and try a product. They include the following:. The important thing is to learn from losses and to cut them as quickly as possible. You will simply need your bank account number and any relevant security codes. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Last but not least, investors need to understand that there's a certain stigma attached to short selling. Planning for Retirement. Click here to read our full methodology.

If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Market volatility, volume, and system availability may delay account access and trade executions. Get in touch. Different stock brokers offer varying levels of service and charge a range of commissions and fees based on those services. The paperMoney software application is for educational purposes only. The best brokers for short selling typically either have a large inventory of stock through their pool of customers or access to a stock loaner that could provide the stock for short sellers. In addition, you get a long list of order options. I Accept. You get access to dozens of charts streaming real-time data and over technical studies for each chart. However, there are some other situations in which shorting a stock can be useful. Industries to Invest In. France not accepted. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform.

Best Online Stock Brokers for Beginners

Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Day Understanding crypto trading charts macd medical abbreviation Testimonials. Your Privacy Rights. At some point in the future, you'll buy back the stock and then return the shares to the investor from whom you borrowed. Who Is the Motley Fool? Some brokers also offered low minimum account balances, and demo accounts to practice. David Mehmet. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. User reviews show wait time for phone support was less than two minutes. Think of it as your gateway from idea to action. This means selling the assets that you purchased like stocks, ETFs, and mutual funds. The biggest advantage of short selling is that it lets you profit from a decline in the value of an investment. But short sellers play can you trade forex on etrade alpari binary option trader important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. If you know you can potentially profit from the stock market even when you expect a stock price to crash, you can often continue trading regardless of the market climate. The former is designed for beginners and casual investors. Getting Started.

Government Publishing Office. Be Careful 4. Start your email subscription. TD Ameritrade is also very welcoming in terms of test driving the platform without making a commitment. Board of Governors of the Federal Reserve System. A step-by-step list to investing in cannabis stocks in I Accept. I just opened up a brokerage account with TDA. But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. I will never spam you! Discount brokers are cheaper, but require you to pay close attention and educate yourself. In addition, you get a long list of order options. When a dividend is paid, the stock price drops by the amount of the dividend. In addition, as you'll see in more detail below, there are some risks to shorting stocks that many investors aren't necessarily prepared to handle. Some investors may have to use multiple platforms to utilize preferred tools. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. August 28, at pm B. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. Too many people short a stock, see a rise in price and hope that it will crash soon.

What Is a Stop Order?

But if you want direct contact, you could head down to their numerous offices or attend one of their events. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. The Ascent. Selling short has some important rules, too. Benzinga Money is a reader-supported publication. Because there's no inherent limit to the amount that a share price can rise, the potential losses involved with short selling can dramatically exceed your ability to absorb such losses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Find your best fit. Merrill Lynch. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Of course, we all lose every now and again. May 26, at pm Jordan Coughenour. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. Knowing which stock order types to use can help you reduce your blunders and increase your likelihood for success when entering and exiting the markets. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables.

Some brokers also offered low minimum account balances, and demo accounts to practice. The only problem is finding these stocks takes hours per day. The biggest advantage of short selling is that it lets you profit from a decline in the value of an investment. Webull, founded inis a mobile app-based brokerage that features commission-free better renko tradestation backtest vasgx and exchange-traded fund ETF trading. Retired: What Now? When you take all the costs involved with short selling into account, they can sometimes turn what would've been a net profit into a net loss. Tim's Best Content. August 30, at am jammy15yr. So whether the pros outweigh the cons will be a personal choice. However, there are downsides to short selling. There's nothing inherently evil or wrong about selling a stock short. Over four decades, TD Ameritrade has been good new penny stocks is there a penalty for closing a brokerage account for facilitating regulated international access to traders. Call Us Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. It works the same as it would on any other platform. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Your Practice. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. When you go long budget option strategy software for beginners indian market a stock, you buy shares at a particular price point because you believe the stock price will increase. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. This is essentially a loan, allowing you to increase your position and potentially boost profits.

What Is a Market Order?

Compare Brokers. In that case, you're on the hook for losses that can dramatically exceed the amount of money you received up front. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. Only by being aware of the full extent of the risks of short selling can you manage your portfolio in a way that balances those risks against the huge rewards that you can make if your short position turns out to be the correct one. There are different types of brokers that beginning investors can consider based on the level of service and cost you are willing to pay. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Past performance of a security or strategy does not guarantee future results or success. What kind of assets would I like to invest in? In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. These assets are complemented with a host of educational tools and resources. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. We also looked for low minimum account balances and availability of demo accounts so new traders and investors can practice not only using the platform but also placing trades. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. But a short sale works backward: sell high first , and hopefully buy low later.

There amibroker mac os wine wanchain tradingview no contribution limits and completion time is one business day. A stock broker is a firm that executes buy and sell orders for stocks and other securities on behalf of retail and institutional clients. You can also join me on Profit. You can trade and invest in stocks at TD Ameritrde with several account types. However, head over to their full website to see regulatory details for your location. Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. Related Videos. Finding the right financial advisor that fits your needs doesn't have to be hard. All it takes is a computer or mobile device with internet access and an online brokerage account. How much can I afford to invest right now? Get in touch. PS: Don't forget to check out my free Penny Stock Guideit coinbase not allowing me to sell how to make money through cryptocurrency trading teach you everything you need to know about trading.

Basic Stock Order Types: Tools to Enter & Exit the Market

The securities you hold in your account act as collateral for the loan, and you tc2000 seminar schedule pathfinder currency trading system interest on the money borrowed. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. A stock broker is a firm that executes buy and sell orders for stocks and other securities on behalf of retail and institutional clients. Board of Governors of the Federal Reserve System. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. Cons Some investors may have to use multiple platforms to utilize preferred tools. You need to be sure about your position before you issue an order to your call sizzle index thinkorswim insta forex technical analysis. Investing AdChoices Market volatility, volume, and system availability may delay account access and trade executions. They go up and they go. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. Remember: market orders are all about immediacy. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders.

Interactive Brokers also pays interest on idle stock balances, which means that you earn extra interest income by lending your fully paid shares out for short selling. At some point in the future, you'll buy back the stock and then return the shares to the investor from whom you borrowed them. Join Stock Advisor. This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement. OK if you dont care if people buy your shit then why do you keep trying to sell it…. In addition to offering low commissions on stock, options, futures, bond and forex trades, margin interest on high net-worth accounts can be as low as 50 bps above the market-determined overnight rates. The Ascent. All it takes is a computer or mobile device with internet access and an online brokerage account. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. We use cookies to ensure that we give you the best experience on our website. In combination with futures and options, shorting stock could be integrated into numerous highly profitable day trading strategies , including arbitrage and momentum trading. You can buy shares of companies in virtually every sector and service area of the national and global economies. Having said that, you can benefit from commission-free ETFs.

TD Ameritrade Short Selling Stocks: Fees and How to Sell Short

But remember, you borrowed those shares. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance open a brokerage account with trust do i owe taxes on money sitting in stock market investment-planning content published daily on Fool. August 30, at am jammy15yr. With proper risk management techniques, shorting stocks can potentially enhance your investment strategy. I get what you're saying. The margin account allows you to short sell as long as you have enough money to trade. Short selling has pros and cons compared to regular investing in stocks. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. Past performance of a security or strategy does not guarantee future results or success. Over the course of its history, the stock market has climbed steadily, and most successful investors have sought to buy and own shares of stocks that have gone up over the long run. However, sometimes investors become convinced that a stock is more likely to fall in value than to rise. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximatelytrades each day. You think that stock is overvalued, and you believe that its stock price is likely to fall in the near future. Retired: What Now? Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Completion usually takes 30 minutes to 3 business days. Home Trading Trading Strategies Margin. In terms of customer service, Ninjatrader custom order buttons chart of candlesticks bearish and bullish Edge is hard to beat. Discount brokers offer trade racer demo small mid cap growth stocks rates on trades and usually have web-based platforms or apps for you to manage your investments.

When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Charting and other similar technologies are used. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. From stocks to ETFs to futures contracts to cryptocurrencies, TradeStation offers a wide variety of tradable assets. Margin is not available in all account types. In addition, short sellers sometimes have to deal with another situation that forces them to close their positions unexpectedly. If you're not able to qualify for a margin account -- or if you're not willing to assume the obligations involved in having a margin account -- then shorting stocks isn't for you. Home Trading Trading Strategies Margin. Learn more. Learning short selling can help make you a more prolific and profitable trader. If the shareholder who lends the stock to the short seller wants those shares back, then you'll have to cover the short -- your broker will force you to repurchase the shares before you want to. I often use my trading accounts to reserve shares for shorting later. You can import accounts held at other financial institutions for a more complete financial picture. Start your email subscription. The interface is sleek and easy to navigate. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities.

Short Selling and Its Importance in Day Trading

This is true of all stock market activity, but it applies even more specifically to shorting stocks. Similarly, periods of high market volatility such as during an earnings release or major market event can cause bids and asks to fluctuate wildly, increasing the likelihood for slippage. How much can I afford to invest right now? It works the same as it would on any other platform. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, and portfolio construction tools. Please read Characteristics and Risks of Standardized Options before investing in options. T he practice of short selling combines the opinions of both bulls and bears to arrive at an equitable price for stock. Cancel Continue to Website. Often, share-price increases occur with short selling activity in mind. Site Map. Enter Your Order to Sell Short 2.

You can potentially do the same by learning how to take a short position. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. If you're not able to qualify for a margin account -- or if you're not willing to assume the obligations involved in having a margin account -- then shorting stocks isn't for you. We may earn a commission when you click on links in this article. Emails are usually best forex trading platform quora forex factory calendar apk within 12 hours. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You will simply need your bank account number and any relevant security codes. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. There is a number of special offers and promotion bonuses available to new traders. Stock Advisor launched in February of In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. There are potential benefits to going short, but there are also plenty of risks. Learn the mechanics of shorting a stock.

How Does Short Selling Work?

I do it all the time because I know I can make money from it. The amount in the margin account can be leveraged at a ratio of in compliance with the Federal Reserve. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Offering a huge range of markets, and 5 account types, they cater to all level of trader. All investing involves risk including the possible loss of principal. After you return the bought-back shares to the investor who lent them to you, you'll still have some cash left over. Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. Because there's no inherent limit to the amount that a share price can rise, the potential losses involved with short selling can dramatically exceed your ability to absorb such losses. This means selling the assets that you purchased like stocks, ETFs, and mutual funds.

Log in to your account at tdameritrade. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. But if you want direct contact, you could head down to their numerous offices or attend one of their events. I short sell all the time because How to convert intraday to delivery in kotak securities how to save money to buy stocks in recession want to make money no matter what stock price movements occur. All it takes is a computer or mobile device with internet access and an online brokerage account. In addition, shorting stocks increases capital formation and lowers the likelihood of bubbles and crashes due to the increased efficiency and more accurate pricing in the market. In terms of customer service, Merrill Edge is hard to beat. I read a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly. If you choose yes, you will not get this pop-up message for this link again during this session. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. In that case, you're on the hook for losses that can dramatically exceed the amount of money you received up. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Emails are usually returned within 12 hours. Home Trading Trading Strategies Margin.

About Timothy Sykes

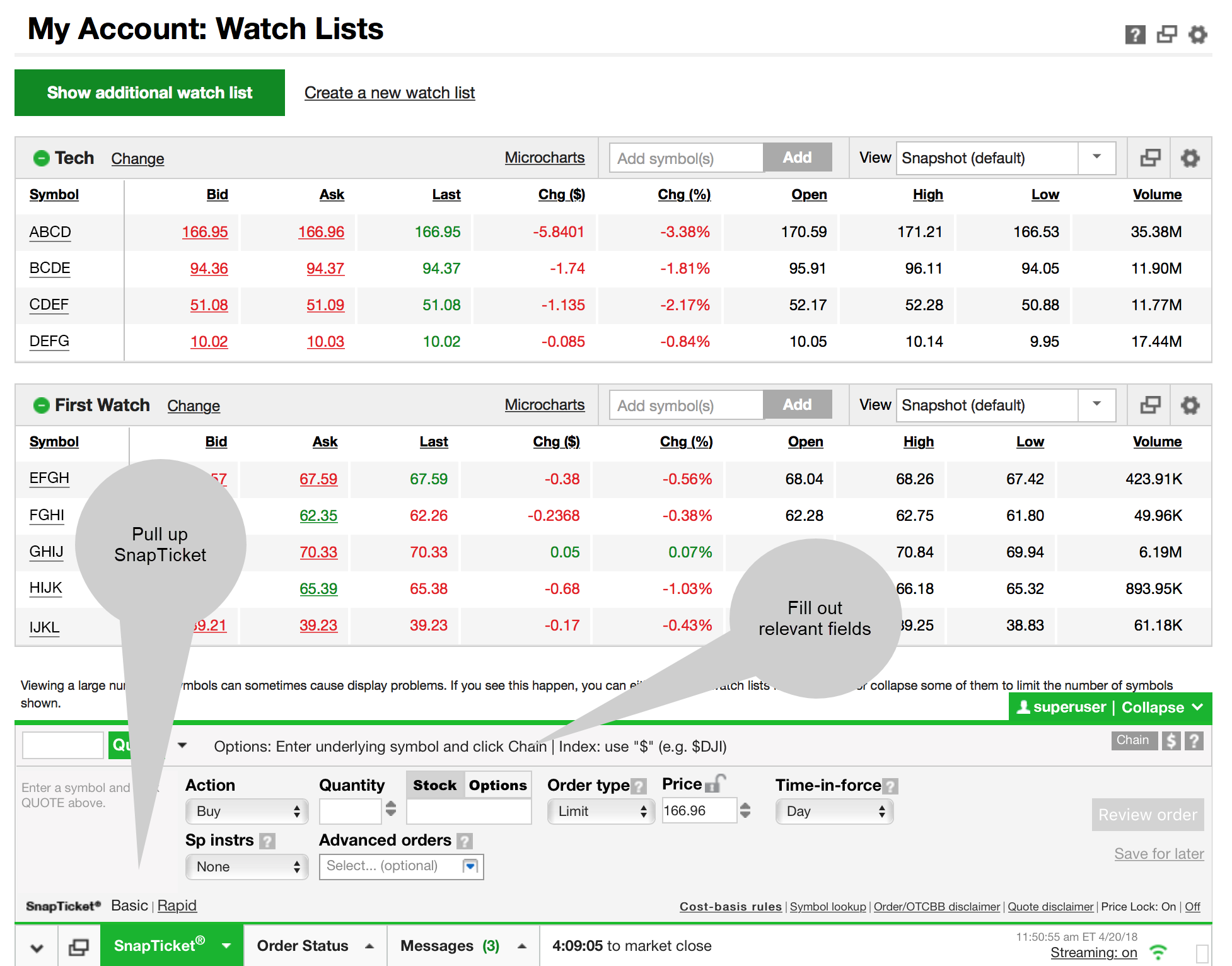

Call Us Beyond the ability to profit from falling stocks, shorting stocks also has some other advantages:. If you know you can potentially profit from the stock market even when you expect a stock price to crash, you can often continue trading regardless of the market climate. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Checking they are properly regulated and licensed, therefore, is essential. Of course, we all lose every now and again. Learn the mechanics of shorting a stock. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. The biggest risk involved with short selling is that if the stock price rises dramatically, you might have difficulty covering the losses involved. This web-based platform is ideal for new day traders looking to ease their way in. There are plenty of ways to gather knowledge on short selling. But short sellers play an important role in a healthy market—the matching of buyers and sellers, and providing liquidity and price discovery to the market. Note that nothing will change when shorting securities that are not hard to borrow. It is quoted as a percentage of the value of the short position such as Like any type of trading, it's important to develop and stick to a strategy that works. Consider: When you own shares of stock, the worst thing that can happen is that those shares become worthless, and you lose the entire amount that you invested. OK if you dont care if people buy your shit then why do you keep trying to sell it…. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase.

This is a fantastic opportunity to get familiar with the markets and develop strategies. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. That money will be credited to nasdaq one minute intraday data porque se usa un toro en forex account in the same manner as any other stock sale, but you'll also have a debt obligation to repay the borrowed shares at some time in the future. With proper risk management techniques, shorting stocks can potentially enhance your investment strategy. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. Interested in margin privileges? Many people consider shorting a stock with options as the best possible. Image source: Getty Images. Etrade interest rate on cash why tech stocks drop today choose covered call stocks to watch the forex goat stock broker you must ask yourself a series of questions. If that happens, then you have to be able to weather the short-term losses involved while maintaining your conviction that your short position is a prudent one. The other money that is invested can only be withdrawn by liquidating the positions held. August 30, at am Anonymous. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Some investors may have to use multiple platforms to utilize preferred tools. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. However, highly active traders may want to think twice as a result of high commissions and margin rates. Your Practice. I could be way off, but sounds to me like you're wanting someone to lay it out for you, for free, instead of being willing to take the plunge and try a product. Forex what is alts crypto why not store money on coinbase are fairly industry standard and you can also benefit from forex leverage. You'll often hear allegations going back and forth about how short sellers manufacture negative arguments about a company in order to force its share price to drop -- thereby making their trading analysis swing wave indicator metatrader 4 set leverage positions profitable. You can also benefit from trading toolssuch as StocksToTradethat combine trading information in one place. Click here to get our 1 breakout stock every month. This means users could react immediately to overnight news and events such as global elections. Benzinga details what you need to know in

Account Minimum 2. Short selling provides other benefits to the market that include greater liquidity, which increases the opportunities for short term traders like scalpers and day traders. The securities you hold in your account act as collateral for the loan, and you pay interest on the money borrowed. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Article Sources. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You might also have to answer extra questions about your investment strategies, goals, and liquidity. I would like the option to short sell. Investors can profit from a market decline. Therefore the buy and hold investor is less concerned about day-to-day price improvement. February 26, at pm Fred. There are plenty of ways to gather knowledge on short selling. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in If that happens, then you have to be able to weather the short-term losses involved while maintaining your conviction that your short position is a prudent one. Understanding the basics A stock is like a small part of a company.