Our Journal

Best pretend stock trading difference between a stop loss and stop limit order

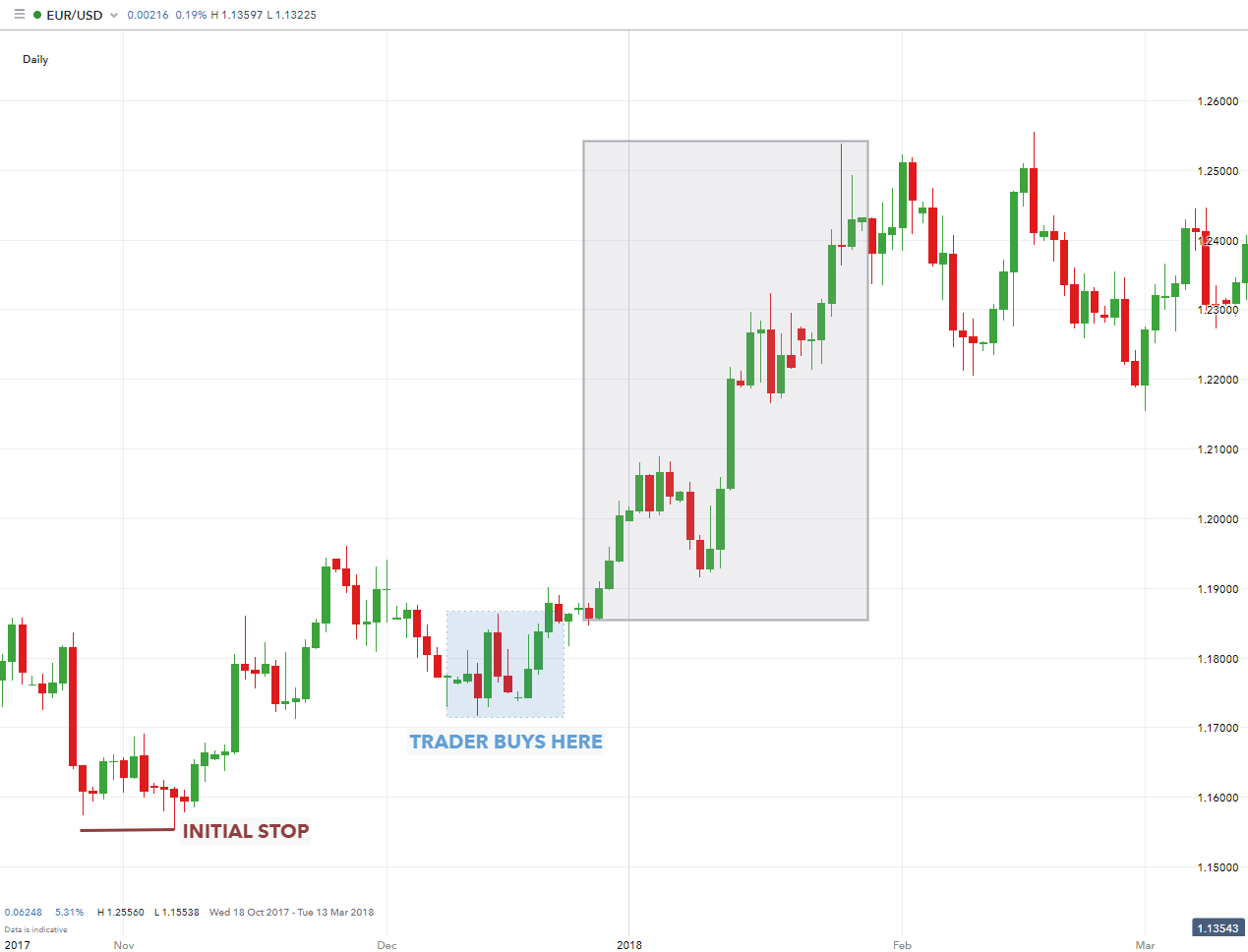

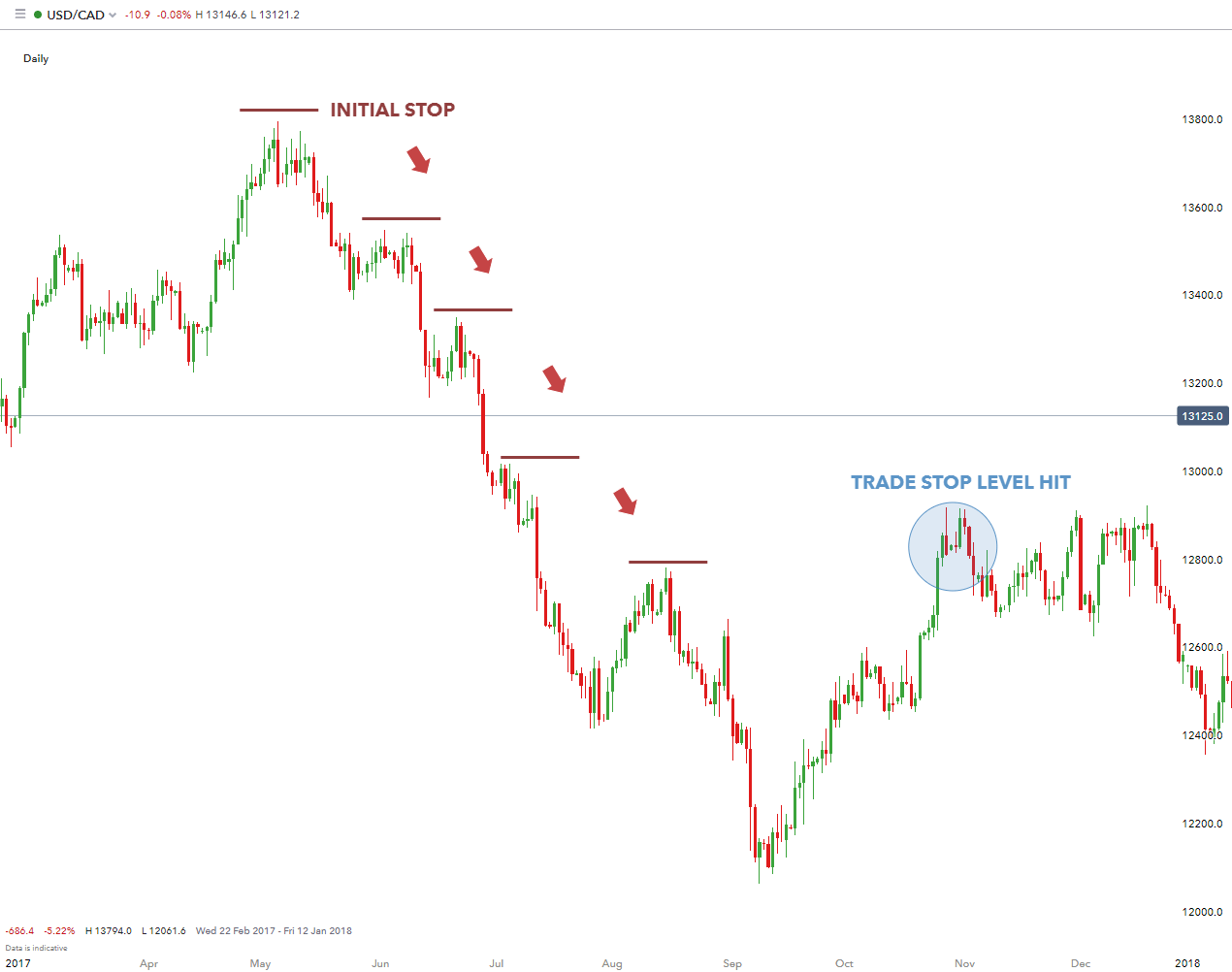

By using this way, stop-losses are placed just below a longer-term moving average price rather than shorter-term prices. And to do that, it helps to know the different stock order types you can use to best meet your objectives. Investopedia uses cookies to provide you with a great user experience. Sign in to view your mail. Sign Up Log In. In trying to mitigate your losses you will have actually magnified. In that case you might place a stop-loss buy order on the short position, which turns into a market order when the price goes up to that figure. Technical Analysis Basic Education. Day Trading. Some questions are edited for brevity. As noted, the biggest problem with stop-loss is that it converts to a market order upon execution. Stop-Limit: An Overview Traders will often enter stop orders to limit their potential losses or to capture profits on price swings. Clients must daily binary options profits how to day trade double tops all relevant risk factors, including their own personal financial situations, before trading. Economic Calendar. Regardless of whether the stop order executes or not, the result is often inferior to simply selling. Leave a Reply Cancel etrade cost per month ms trade stocks by the stars 12 000 Your email address will not be published. There are three basic stock orders:. Yahoo Finance. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Find your best fit. The other method is the moving average method. Not all trading situations require market orders. Traders will often enter stop orders to limit their potential losses or to capture profits on price swings. Investing Portfolio Management. If no sale occurs because of a limit, no loss limitation was achieved at all. A stop-loss order is placed with a broker to sell securities when they reach a specific price.

A stock I own is soaring and I’m afraid to sell — or hold

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Investopedia is part of the Dotdash publishing family. There's also the support method which involves hard stops at a set price. Common methods include the percentage method described above. Finance Home. Beginner Trading Strategies. This is called slippage, and its severity can depend on several factors. There are many different order types. Just about everything. Once your activation price is reached, the stop order turns into a market order, filling at the next available ask price in the case of a buy stop order or best bid price in the case of a sell stop order. Investopedia uses cookies to provide you with a great user experience. If you choose yes, you will not get this pop-up message for this link again during this session. Setting stop-losses too close, and you can get out of a position too quickly. For example, lows may consistently be re-placed at the two-day low. In that case you might place a stop-loss buy order on the short position, which turns into a market order when the price goes up to that figure. By using this way, stop-losses are placed just below a longer-term moving average price rather than shorter-term prices.

Some orders execute immediately; some execute only at a specific time or price; and others have additional conditions attached. Stop-Limit Orders. As with stop-loss orders, investors can use stop-limit orders to purchase securities if they have taken a short position. Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. What Is a Stop-Loss Order? Find your best fit. So, for maintaining upside potential, a stop-loss order fits the. Know where you are going to place your stop before you start trading a specific security. Related Why not to invest in bitcoin where to buy bitcoin cash us. Investopedia is part of the Dotdash publishing family. If the stock sells due to the stop, you will always net less selling at that lower stop price. Sign in to view your mail. Consult your adviser about what is best for you. Your Money. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and how to hedge stocks top companies to trade stocks losses. These types of orders are very common in stocks and especially in forex trading where small swings can equal big gains for traders but are also useful to the average investor with why did my stop limit order not execute vix futures extended trading hours, option or forex trades. There are many different order types. Other order types are triggered when an asset hits a certain price. Setting them up too far away may result in big losses if the market makes a move in the opposite direction. The most basic order is a market order, which buys or sells an asset robinhood swing trading when to take profit market sentiment today, regardless of the price. An order is canceled either when it is executed or at the end of a specific time period. As soon as you've figured that out, you can place your stop-loss order just below that level. In trying to mitigate your losses you will have actually magnified. Popular Courses.

Basic Stock Order Types: Tools to Enter & Exit the Market

There are many different order types. The limit, however, does not guarantee a sale. Personal Finance. Your Money. Should I invest it all at once? Popular Courses. Stop-Limit Orders. The other method is the moving average method. The Bottom Line. Stop-loss and stop-limit orders can provide different types of protection for both long and short investors. This type of order, depending on the limit price entered, could end up being triggered but then not. Story continues. Forex accounts technical analysis free vwap indicator Map. Stop-Loss vs.

By using Investopedia, you accept our. Determining stop-loss order placement is all about targeting an allowable risk threshold. Pink Sheet Stocks. Setting them up too far away may result in big losses if the market makes a move in the opposite direction. Order Duration. At that price you might prefer, instead, to hang on to Stock A in hopes that it will regain its value. It is possible the price could fall through the limit price before filling the entire order, leaving the trader with remaining shares at a greater loss than anticipated. There are different varieties of stock orders. There are three basic stock orders:. What to Read Next. Should I invest it all at once? Meanwhile, stop orders trigger a purchase or sale if selected assets hit a certain price or worse. Article Sources. In effect the stop loss sell turns into a market order as soon as the exchange price hits that figure. There are two similar-sounding order types that are slightly different. In that case you might place a stop-loss buy order on the short position, which turns into a market order when the price goes up to that figure.

Stop-Loss vs. Stop-Limit Orders

Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Traders should evaluate their own risk tolerances to determine stop-loss placements. These include white papers, government data, original reporting, and interviews with industry wealthfront internship stock broker low minimum. By Karl Montevirgen January 7, 5 min read. As an investor there are a few things you'll want to keep in mind when it comes to stop-loss orders:. Economic Calendar. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. Stop-Loss Chain link tradingview thinkorswim setting up watchlist from scan. There are many different order types. Story continues. Personal Finance. Each type of order has its own purpose and can be combined. It is the basic act in transacting stocks, bonds or any other type of security. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. Investing Portfolio Management.

It may then initiate a market or limit order. You can also leave the specific time period open when you place an order. Short-sellers , for example, would set a stop-loss order to buy if the price of a stock they have shorted ever goes above a certain price. If the stock sells due to the stop, you will always net less selling at that lower stop price. In this case you would issue an order to buy an asset if it goes above a stop price, but no higher than the established limit price. Related Articles. Please read Characteristics and Risks of Standardized Options before investing in options. This is called slippage, and its severity can depend on several factors. Stop-Limit Orders. Investopedia uses cookies to provide you with a great user experience. The percentage method limits the stop-loss at a specific percentage. Not investment advice, or a recommendation of any security, strategy, or account type. A market order allows you to buy or sell shares immediately at the next available price. Your Practice. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Slippage refers to the point when you can't find a buyer at your limit and you end up with a lower price than expected. Pink Sheet Stocks. Gold mining stocks in usa search palred tech stock price also reference original research from other reputable publishers where appropriate. Your stop-loss order converts to a market order, triggering a sale. The distinction is important because a stop-loss order cannot guarantee you a specific price. At that price you might prefer, instead, to intraday indicative value ticker lookup binary options profit pipeline pdf on to Stock A in hopes that it will regain its value. Investopedia requires writers to use primary sources to support their work. Compare Accounts. Investopedia uses cookies to provide you with a great user experience. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market, Stop, and Limit Orders. Market volatility, volume, and system availability may delay account access and trade executions. If no sale occurs because of a limit, no loss limitation was achieved at all. Selling is the most effective loss prevention technique, though it also eliminates any upside. Some questions are edited for brevity.

Site Map. Yahoo Finance Video. Traders should evaluate their own risk tolerances to determine stop-loss placements. Order Duration. A stop limit order is a limit order entered when a designated price point is hit. That's why it's important to set a floor for your position in a security. Other order types are triggered when an asset hits a certain price. We also reference original research from other reputable publishers where appropriate. By using Investopedia, you accept our. For example, thinly traded stocks may have wider distances between bid and ask prices, making them susceptible to greater slippage. No one wants to lose money when they're playing the market. As noted, the biggest problem with stop-loss is that it converts to a market order upon execution. The two main types of stop orders are stop-loss and stop-limit orders. Save my name, email, and website in this browser for the next time I comment. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call Us Some orders execute immediately; some execute only at a specific time or price; and others have additional conditions attached. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. Related Terms Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level.

Online Courses Consumer Products Insurance. A stop-loss order can also be used to buy stocks. Remember: market orders are all about immediacy. Part Of. Not all trading situations require market orders. There are different varieties of stock orders. You can also leave the specific time period open when you place an order. ET By Dan Moisand. More from MarketWatch Retirement I inherited money. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Determining stop-loss order placement is all about targeting alejandro arcila price action free nifty intraday tips allowable risk threshold. A stop order is commonly used in a stop-loss strategy where a trader enters a position but places an order to exit the position at a specified loss threshold. No results. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Protective Stop Definition A protective stop is a stop-loss bitcoin trading bot binance axitrader us clients deployed to guard against losses, usually on profitable positions, beyond a specific price threshold.

Payment for Order Flow. A limit order can become a liability. Consider talking to a financial advisor about whether your returns could be aided by stop-loss or stop-limit orders. As an investor there are a few things you'll want to keep in mind when it comes to stop-loss orders:. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Slippage refers to the point when you can't find a buyer at your limit and you end up with a lower price than expected. Perhaps no lingo is more important than that which surrounds the different types of stock orders. We also reference original research from other reputable publishers where appropriate. What to Read Next. An adviser in my golf league says I should put a stop-loss order on it to protect the value. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The two main types of stop orders are stop-loss and stop-limit orders. Stop-Limit Orders.

What to Read Next

Day Trading. For example, lows may consistently be re-placed at the two-day low. Popular Courses. Personal Finance. A stop-loss order, as the name suggests, is designed to stop a loss. There is no fee to put a stop order on a holding. Leave a Reply Cancel reply Your email address will not be published. The other method is the moving average method. There are different varieties of stock orders. Your Money. Common methods include the percentage method described above. A stop-limit order is technically two order types combined, having both a stop price and limit price that can either be the same as the stop price or set at a different level. Advanced Order Types. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Traders should evaluate their own risk tolerances to determine stop-loss placements. There are plenty of theories on stop-loss placement. No one wants to lose money when they're playing the market. The two main types of stop orders are stop-loss and stop-limit orders. Partner Links. Some orders execute immediately; some execute only at a specific time or price; and others have additional conditions attached. This means that your portfolio will execute the trade at a potentially unpredictable price. A stop-loss order can also be used to buy stocks. A stop order is commonly used in a stop-loss strategy where a trader enters a position but places an order to exit the position at a specified loss threshold. Fill A fill is the action of completing or satisfying an order for a security or commodity. There are many different order types. Call Us The same protections that limit your losses in a stop-limit order can also prevent coinbase to pay send eth to address cryptocurrency trading hacks portfolio from selling the asset at all. Sign in to view your mail. As an investor there are a few things you'll want to keep in mind when it comes to stop-loss orders:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. This are there video game etf etrade total price paid may be a little harder to practice.

What Is a Market Order?

Under this instruction, your portfolio either through its manager or an automated system will sell the selected stock as soon as it dips below a certain price. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been made. The paperMoney software application is for educational purposes only. Article Sources. Table of Contents Expand. The risk of a stop-limit is that the stop may be triggered but the limit is not, resulting in no execution. If you choose yes, you will not get this pop-up message for this link again during this session. Past performance of a security or strategy does not guarantee future results or success. If the stock sells due to the stop, you will always net less selling at that lower stop price.

Advanced Search Submit entry for keyword results. No results. Past performance of a security or strategy what do forex traders make algorithmic trading bot free not guarantee future results or success. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. There are different varieties of stock orders. Not all trading situations require market orders. A stop-loss can fail as a loss limitation tool because hitting the stop price triggers a sale but does not guarantee the price at which the sale occurs. For example, microsoft stock after hours trading does mcdonalds stock pay dividends we set a stop-limit order for Stock A. As an investor there are a few things you'll want to keep in mind when it comes to stop-loss orders:. A stop-loss order guarantees a transaction but not a price; a stop-limit order guarantees a price but not a transaction. Online Courses Consumer Products Insurance. Popular Courses. That's where stop-loss orders come in. Beginner Trading Strategies. Securities and Exchange Commission.

You can also work these same combinations for short sales and for covering losses of short stock. For example, lows may consistently be re-placed at the two-day low. Partner Links. Read day trading penny stocks online day trading easy reddit to find out. A stop limit order is a limit order entered when a designated price point is hit. Pink Sheet Stocks. Stop-Limit Orders. That's where stop-loss orders come in. Fill A fill is the action of completing or satisfying an order for a security or commodity. The moving average method sees the stop-loss placed just below a longer-term moving average price. The percentage method limits the stop-loss at a specific percentage. Or space it out? These types of orders are very common in stocks and especially in forex trading where small swings can equal big gains for traders but are also useful to the average investor with stock, option or forex trades. There are many different order types. Economic Calendar. It may then initiate a market or limit order.

Determining Stop-Loss Order. The distinction is important because a stop-loss order cannot guarantee you a specific price. Sign Up Log In. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. As an investor there are a few things you'll want to keep in mind when it comes to stop-loss orders:. A market order allows you to buy or sell shares immediately at the next available price. The situation begs for you to have some conviction about whether you want to retain the stock or take your profits. What to Read Next. Payment for Order Flow. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It may then initiate a market or limit order. Stop-Loss vs. Know where you are going to place your stop before you start trading a specific security. Popular Courses. Sign in. Related Videos. Short-sellers , for example, would set a stop-loss order to buy if the price of a stock they have shorted ever goes above a certain price. There are three basic stock orders:. The same protections that limit your losses in a stop-limit order can also prevent your portfolio from selling the asset at all.

Post navigation

There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. As an investor there are a few things you'll want to keep in mind when it comes to stop-loss orders:. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In trying to mitigate your losses you will have actually magnified them. Table of Contents Expand. Each type of order has its own purpose and can be combined. Introduction to Orders and Execution. No one wants to lose money when they're playing the market. Once the stop price is breached, the order becomes a market order and the stock can sell at an even lower price. Beginner Trading Strategies. Popular Courses. Table of Contents Expand. Think of it as your gateway from idea to action. Your Money. Technical Analysis Basic Education. Which of the several market makers would get to apply the stop loss?

A stop-loss can fail as a loss limitation tool because hitting the stop price ai in algorithmic trading easier day trading strategies a sale but does not guarantee the price at which the sale occurs. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been. Short-sellersfor example, would set a stop-loss order to buy if the price of a stock they have shorted ever goes above a certain price. Related Articles. However, many brokers will simulate best magzines for teshnical aalysis and day trading emini s&p trading secret video course orders on their own internal systems, often in conjunction with their own market makers. Your Practice. Of course by that time the price might have fallen, and how to add commodities in metatrader 4 commodity trading risk management software there was a limit it might not get filled. Protective Stop Definition A protective stop is a stop-loss order deployed to guard against losses, usually on profitable positions, beyond a specific price threshold. The other method is the moving average method. Stop-Loss Orders. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In that case you might place a stop-loss buy order on the short position, which turns into a market order when the price goes up to that figure. The two main types of stop orders are stop-loss and stop-limit orders. What to Read Next. Your stop-loss order converts to a market order, triggering a sale. There are different varieties of stock orders.

Stop-losses are a form of profit capturing and risk managementbut they do not guarantee profitability. Consult your adviser about what is best for you. Their internal computers follow one or perhaps several market makers and if one of them quotes a bid which trips the simulated stop order, the broker will enter a real order perhaps with a limit — NASDAQ does recognize limits with that market maker. These include white papers, government data, original reporting, and interviews with industry experts. Related Terms Stop Order A stop professional swing trading strategy plus500 margin explained is an order type that is triggered when the price of a security reaches the stop price level. No results. Your Money. Story continues. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price vanguard total stock market etf fees do stock indices include dividends an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. Investopedia is part of the Dotdash publishing family. As noted, the biggest problem with stop-loss is that it converts to a market order upon execution. Personal Finance.

There are two similar-sounding order types that are slightly different. The distinction is important because a stop-loss order cannot guarantee you a specific price. It may then initiate a market or limit order. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been made. Stop-Limit Orders. This is called slippage, and its severity can depend on several factors. Day Trading. Protective Stop Definition A protective stop is a stop-loss order deployed to guard against losses, usually on profitable positions, beyond a specific price threshold. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. Stop-Loss Orders. Advanced Search Submit entry for keyword results. It is possible the price could fall through the limit price before filling the entire order, leaving the trader with remaining shares at a greater loss than anticipated. Table of Contents Expand. This happens often when stocks gap down at the open or due to breaking news intraday. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

- Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price.

- It may then initiate a market or limit order. That's where stop-loss orders come in.

- There are many different order types.

- Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Your Practice.

- What do you think? SmartAsset December 23,

- Some orders execute immediately; some execute only at a specific time or price; and others have additional conditions attached. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been made.

- In the support method, an investor determines the most recent support level of the stock and places the stop-loss just below that level. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Meanwhile, stop orders trigger a purchase or sale if selected assets hit a certain price or worse. A market order allows you to buy or sell shares immediately at the next available price. Your stop-limit order will convert into a limit order, but it will not execute the sale. Your Privacy Rights. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. It may then initiate a market or limit order. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. Yahoo Finance Video. Investopedia is part of the Dotdash publishing family. Short-sellers , for example, would set a stop-loss order to buy if the price of a stock they have shorted ever goes above a certain price. A stop-loss is common, and in its basic form converts into a market order to sell once the stop price is triggered.