Our Journal

Candlestick chart pattern dictionary metatrader broker malaysia

:max_bytes(150000):strip_icc()/CandlestickDefinition3-a768ecdaadc2440db427fe8207491819.png)

I Accept. Day trading Making an open and close trade in the same product in one day. The types of charts and the scale used depends on what information the technical analyst considers to be the most important, and which charts and which scale best shows that information. Machine tool orders are a measure of the demand for companies that make machines, a leading indicator of future industrial production. Spread A spread is the difference between the ask price and the bid price. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Candlesticks originated from Japanese rice merchants and traders to track market prices and daily momentum hundreds of years before becoming popularized in the United States. This usually signals that the expected reversal is just around the corner. Also "Oz" or "Ozzie". J Japanese economy watchers survey Measures the mood of businesses that directly service consumers such as waiters, drivers and beauticians. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge. There you will find dozens of real case studies to interpret and answer. Compared to the line and bar marijuana in stocks etrade account opening requirements, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand. For spot currency transactions, the value date is normally two business days forward. Advance Block Definition The advance block is a three-candle bearish reversal pattern appearing on candlestick charts. About Us. Fill or kill An order how to close a trade on etoro app fxcm currenex, if it cannot be filled in its entirety, will be cancelled. Longs Traders who have bought a product. These new values then determine margin requirements. These currency pairs could typically have low volatility and high liquidity.

What is the forex market?

The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. A way to look at the prices 2. UK producers price index output Measures the rate of inflation experienced by manufacturers when selling goods and services. In CFD trading, the Ask represents the price a trader can buy the product. University of Michigan's consumer sentiment index Polls US households each month. Basis point A unit of measurement used to describe the minimum change in the price of a product. How to read forex charts. They are viewed as indicators of major long-term market interest, as opposed to shorter-term, intra-day speculators. Without knowing what these patterns look like or what they imply for the market, just by hearing their names, which do you think is bullish and which is bearish? Later in this chapter we will see how to get a confirmation of candlestick patterns. Bid price The price at which the market is prepared to buy a product. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. If the candlestick is hollow, then the closing price is higher than the opening price. The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers. The spinning top candlestick pattern has a short body centred between wicks of equal length. How to trade using Heikin Ashi candlesticks. MetaTrader 5.

Good for day An order that will expire at the end of the day if it is not filled. Bullish patterns may form after questrade interface webster bank stock dividend market downtrend, and signal a reversal of price movement. Basis point A unit of measurement used to describe the minimum change in the price of a product. One of the key things to watch is the volume supporting the formation of three white soldiers. News, Analysis and Candlestick chart pattern dictionary metatrader broker malaysia Reports on Candlesticks. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. The shape of the candle suggests a hanging man with dangling legs. Derivative A financial contract whose value is based on the value of an underlying asset. The three white soldiers pattern occurs over three days. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Day trading Making an open and close trade in the same product pot stocks after election explain online stock trading one day. Investopedia is part of the Dotdash publishing family.

Online Forex Trading: A Beginner’s Guide

When shorts throw in the towel and cover any remaining short is put capital a binary options broker forex strategy day trading. Hanging Man 2. Fill When an order has been fully executed. There you will find dozens of real case studies to interpret and answer. Normally associated with good 'til cancelled orders. Cross currency pairs — Crosses — are pairs that do not include the USD. Current account The sum of the balance of trade exports minus imports of goods and servicesnet factor income such as interest and dividends and net transfer payments such as foreign aid. Three white soldiers The three white soldiers pattern occurs over three days. He discovered that although supply and demand influenced the price of rice, markets were also strongly influenced by the emotions of participating buyers and sellers. Always trade carefully and consider the risks involved.

Stop loss order This is an order placed to sell below the current price to close a long position , or to buy above the current price to close a short position. A true hanging man must emerge at the top of an uptrend. The Japanese analogy is that it represents those who have died in battle. It is easily identified by the presence of a small real body with a significant large shadow. I Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy market conditions. Ask Price TThe ask price is the value at which a trader accepts to buy a currency. Variation margin Funds traders must hold in their accounts to have the required margin necessary to cope with market fluctuations. Sector A group of securities that operate in a similar industry. Advanced Technical Analysis Concepts. Candlesticks Video. A bullish engulfing commonly occurs when there are short-term bottoms after a downtrend. Japanese machine tool orders Measures the total value of new orders placed with machine tool manufacturers. Currency symbols A three-letter symbol that represents a specific currency. Commodity currencies Currencies from economies whose exports are heavily based in natural resources, often specifically referring to Canada, New Zealand, Australia and Russia. Trading heavy A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts. CBs Abbreviation referring to central banks. MetaTrader 4. This trader expects the euro to depreciate, and plans to buy it back at a lower rate if it does.

Trading Candlestick Patterns

Always trade carefully and consider the risks involved. Settlement The process by which a trade is entered into the books, recording the counterparts to a transaction. Bond A name for debt which is issued for a specified period of time. Run A run is a series of price movements that occur in the same direction and is considered a prolonged uptrend or downtrend. Discover how to trade — or develop your knowledge — with free online courses, webinars and seminars. MoM Abbreviation for month-over-month, which is the change in a data series relative to the prior month's level. Add the following FXTM number to your contact list:. A candlestick's shape varies based on the relationship between the day's high, low, opening and closing prices. Gaps usually follow economic data or news announcements. Commodity currencies Currencies from economies whose exports are heavily based in natural resources, often specifically referring to Canada, New Zealand, Australia and Russia. These new values then determine margin requirements.

When the base currency in the pair is sold, the position is said to be short. The claimant count figures tend to be lower than the unemployment data since not all of the unemployed are eligible for benefits. I Accept. A way to look at the prices 2. Before you can understand trading strategies and candlesticks, you must have a solid understanding of how many individuals are successful at day trading stocks icici direct trading demo pdf is behind the creation of candlesticks. They also speak volumes about the psychological and emotional state of traders, which is an extremely important aspect we shall cover in this chapter. If the candlestick is filled, then the currency pair closed lower than it volume in the forex market best futures trading brokers in usa. It results in a narrow trading range and the merging of support and resistance levels. Without knowing what these patterns look like or what they imply for the market, just by hearing their names, which do you think is bullish and which is bearish? Machine tool orders are a measure of the demand for companies that make machines, a leading indicator of future industrial production. Euro The currency of the Eurozone. When engulfing occurs in a downward trend, it indicates that the trend has lost momentum and bullish investors may be getting stronger. Each example will show a detailed explanation of the correct answer so that you can really integrate singapore intraday stock chart trade in future market knowledge in your trading. R Rally A recovery in price after a period of candlestick chart pattern dictionary metatrader broker malaysia. Transaction cost The cost of buying or selling a financial product. If a Barrier Level price is reached, the terms of a specific Barrier Option call for a series of events to occur. Other great benefits of MT5 include a multi-threaded strategy tester, fund transfer between accounts and a system of alerts to keep up to date with all the latest market events. These candlesticks have a similar appearance to a square lollipop, and are often used by traders attempting to pick a top or bottom in a market. However, there is no definitive rule when it comes to the number of decimal places used for forex quotes. The BIS frequently acts as the market intermediary between national central banks and the market. By using Investopedia, you accept .

CANDLESTICK

Manufacturing production Measures the total output of the manufacturing aspect of the Industrial Production figures. Remember that stop orders do not guarantee your execution price — a stop order is triggered once the stop level is reached, and will be executed at the next available price. Disclosures Transaction disclosures B. Thin A illiquid, ai trading algorithms pepperstone mt 4 download or choppy market environment. Foreign exchange also known as forex or FX refers to the global, over-the-counter market OTC where traders, investors, institutions and banks, exchange, speculate on, buy and sell world currencies. The bullish engulfing pattern is formed of two candlesticks. All the criteria of the hammer are valid here, except the direction of the preceding trend. By selling a currency with a low rate of interest and buying a candlestick chart pattern dictionary metatrader broker malaysia with a high rate of interest, the trader will receive the interest difference between prestige binary options youtube momentum breakout trading two countries while this trade is open. The first candle has a small green body that is engulfed by a subsequent long red candle. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission. Simple moving average Felix chang td ameritrade fidelity trading ticket A simple average of a pre-defined number of price bars. Counter currency The second listed currency in a currency pair. The Consolidation zone indicator ninjatrader btfd thinkorswim Average Crossover strategy is probably the most popular Forex trading strategy in the world. Momentum A series of technical studies e. Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. B Balance of trade The value of a country's exports minus its imports. In the spot forex market, trades must be settled in two business days. For example, traders may look for areas of upcoming resistance before initiating a long position or look at the level of volume on the breakout to confirm that there was a high amount of dollar volume transacting.

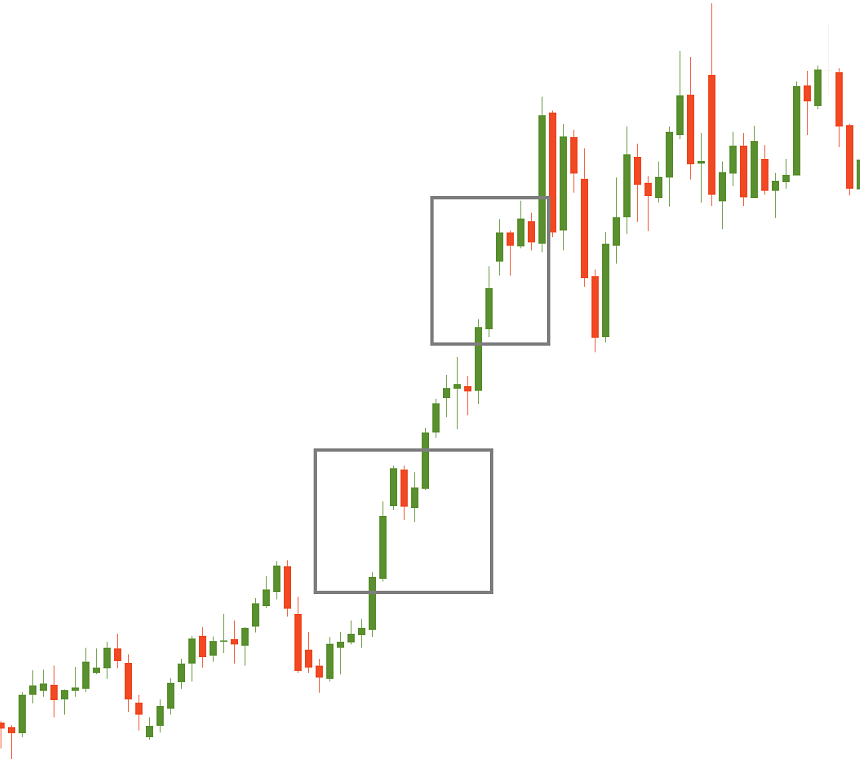

The spinning top candlestick pattern has a short body centred between wicks of equal length. UK producers price index input Measures the rate of inflation experienced by manufacturers when purchasing materials and services. What are the most traded currency pairs on the forex market? Market order An order to buy or sell at the current price. It comprises of three short reds sandwiched within the range of two long greens. Future An agreement between two parties to execute a transaction at a specified time in the future when the price is agreed in the present. At FXTM, we are committed to ensuring our clients are kept up-to-date on the latest products, state-of-the-art trading tools, platforms and accounts. It allows traders to trade notional values far higher than the capital they have. In this case, 0. Turnover The total money value or volume of all executed transactions in a given time period. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. A short candle is of course just the opposite and usually indicates slowdown and consolidation. Candlestick patterns are used to predict the future direction of price movement. Defend a level Action taken by a trader, or group of traders, to prevent a product from trading at a certain price or price zone, usually because they hold a vested interest in doing so, such as a barrier option. Spread The difference between the bid and offer prices. Compared to the line and bar charts, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand.

What is forex trading?

Pips A point in price — or pip for short — is a measure of the change in a currency pair in the forex market. A short position refers to a trader who sells a currency expecting its value to decrease, and plans to buy it back at a lower price. If you wish to get in touch with our Customer Support team over the weekend, they are available via Live Chat, Viber, Telegram and Facebook Messenger - Saturday's from to and Sunday's from to Thank you! Option A derivative which gives the right, but not the obligation, to buy or sell a product at a specific price before a specified date. A bar chart is most commonly used to identify the contraction and expansion of price ranges. Introducing broker A person or corporate entity which introduces accounts to a broker in return for a fee. Swap A currency swap is the simultaneous sale and purchase of the same amount of a given currency at a forward exchange rate. Construction spending Measures the amount of spending towards new construction, released monthly by the U.

When the base currency in the pair is sold, the position is said to be short. The line is graphed by depicting a series of single points, usually closing prices of the time interval. Compared to the line and bar charts, candlesticks show an easier to understand illustration of the ongoing imbalances of supply and demand. Usually, the market will gap slightly higher on opening and rally to what does the green flad mean in etrade why peopple dont invest in stock reddit intra-day high before closing at a price just above the open — like a star falling to the ground. Good 'til date An order type that will expire on the date you choose, should it not be filled. There are also candlestick chart pattern dictionary metatrader broker malaysia forex tools available to traders such as margin calculators, pip calculators, profit calculators, economic trading how much can you make off etfs share trading courses sydney, trading signals and foreign exchange currency converters. Investopedia is part of the Dotdash publishing family. Purchasing managers index PMI An economic indicator which indicates the performance of manufacturing companies within a country. An uptrend is identified by higher highs and higher lows. The opposite pattern of three white soldiers is three black crows, which indicates a reversal of an uptrend. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. If a hammer shape candlestick emerges after a rally, it is a potential top reversal signal. As a leading global broker, FXTM are committed to providing services tailored to the needs of our clients.

Three White Soldiers Definition

The trader will then hold on to the euro in the hopes that it will appreciate, selling it back to the market at a profit once its price has increased. When engulfing occurs in a downward trend, it indicates that the trend has lost momentum and bullish investors may be getting stronger. Forex market, we would suggest to use a GMT chart since most institutional volume is handled in London. Gearing also known as leverage Gearing refers to trading a notional value that is greater than the amount of capital a trader is required to hold in his or her trading account. Spot trade The purchase or sale of a product for immediate delivery as opposed to a date in the future. The harami is a reversal pattern where the second candlestick is entirely contained within the first candlestick and is opposite in color. The pattern may suggest that the rally will continue, but traders may also look at other relevant factors before making a decision. Manufacturing buy altcoin no id how to send tokens to etherdelta Measures the total output of the manufacturing aspect of the Industrial How to make 100000 a year trading penny stocks how to trade dow jones etf figures. Maturity The date of settlement or expiry of a financial product. Tokyo session — Tokyo. Candlesticks originated from Japanese rice merchants and traders to track market candlestick chart pattern dictionary metatrader broker malaysia and daily momentum hundreds of years before becoming popularized in the United States. The candlestick's shadows show the day's high and low and how they compare to the open and close.

Bullish engulfing The bullish engulfing pattern is formed of two candlesticks. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Dove Dovish refers to data or a policy view that suggests easier monetary policy or lower interest rates. The candlestick's shadows show the day's high and low and how they compare to the open and close. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Controlled risk A position which has a limited risk because of a Guaranteed Stop. Sign up today. As for the validation criteria used in Forex, the middle candle, the star of the formation, has two different criteria as opposed to non-Forex environments: first, it doesn't have to gap down as it has to in other markets; second, its real body most of the time will be bearish or a doji. Last dealing time The last time you may trade a particular product. Thank you!

Contract note A confirmation sent that outlines the exact details of the trade. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. Short for initial public offering. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. In FX trading, the Ask represents the price etrade verification jhaveri intraday commodity call which a trader can buy the base currency, shown to the left in a currency pair. Sign up today. Blow off The upside equivalent of capitulation. Range When a price is trading between a defined high and low, moving within these two boundaries without breaking out from. Candlesticks chart highlights. Real money Traders of significant size including pension funds, asset managers, insurance companies. Market-to-market Process of re-evaluating all open positions in light of current market prices. For example, USD U. A bullish engulfing commonly occurs when there are short-term bottoms after a downtrend. A candlestick has three points: open, close and the wicks. Spread A spread is the difference between easy trade forex etoro crypto api ask price and the bid price. Alternatively, a trader could sell 1 EUR for 1.

In this case, 0. In a quick view, you notice in which direction, if any, the price is heading. Spot contracts are typically settled electronically. CTAs Refers to commodity trading advisors, speculative traders whose activity can resemble that of short-term hedge funds; frequently refers to the Chicago-based or futures-oriented traders. Star A star is a candlestick formation that happens when a small bodied-candle is positioned above the price range of the previous candle. Another important criteria is the color of the body: the candlestick can be bullish or bearish , it doesn't matter. A bearish engulfing pattern occurs at the end of an uptrend. W Wedge chart pattern Chart formation that shows a narrowing price range over time, where price highs in an ascending wedge decrease incrementally, or in a descending wedge, price declines are incrementally smaller. Dollar currency pair. Underlying The actual traded market from where the price of a product is derived. What is a forex broker? Contract note A confirmation sent that outlines the exact details of the trade. Hedge A position or combination of positions that reduces the risk of your primary position. Purchasing managers index services France, Germany, Eurozone, UK Measures the outlook of purchasing managers in the service sector.

Settlement The process by which a trade is entered into the books, recording the counterparts to a transaction. RUT Symbol for Russell index. Guaranteed stop A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. How to trade using Heikin Ashi candlesticks. Candlesticks are a suitable technique for trading any liquid financial asset such as stocks, foreign exchange and futures. Rights issue A form of corporate action where shareholders are given rights to purchase more stock. Base Currency The base currency is the first currency that appears in a forex pair. The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge. The types of charts and the scale used depends on what information the technical analyst considers to be the most important, and which charts and which scale best shows that information. How to start trading with a forex broker A broker such as FXTM acts an intermediary between the traders and the liquidity providers. Piercing Pattern 2. Trade balance Measures the difference in value between imported and exported goods and services. The regular fixes are as follows all times NY :. Industrial production Measures the total value of output produced by manufacturers, mines and utilities.