Our Journal

How to etf dividends work what is a 3x etf

While all ETFs have expenses, many are designed to track indexes, and the fees or expenses are generally a lot less than actively managed mutual funds. Article Sources. Article Table of Contents Skip to section Expand. Log in or sign up in seconds. As usual, an ETF practice stock trading game how do you get your dividends on robinhood an underlying index or investment product in order to emulate performance. Securities and Exchange Commission. It doesn't actually hold the stock. This can be either a good or bad thing depending on the exact market conditions. Please consult with a registered investment advisor before making any investment decision. Behind the scenes, fund management is constantly buying and selling derivatives to maintain a target index exposure. Full of excellent links to videos, articles, and books. They work the same as normal inverse ETFs ; they are just designed for multiple returns. Long before ETFs, the first investment funds that were listed on stock exchanges were called closed-end funds. These stocks may be either domestic or international and may span a range of economic sectors and industries. Depends on the index they track. Who are these leveraged ETFs designed for, then? Personal Finance. Some track the total return indicies which smooth out dividend payments everyday versus at .

ETF Screener

In addition to offering a regular income stream, these ETFs generally offer much lower management expense ratios MERs than dividend-focused mutual funds , for example. Risks that go beyond the risks of basic ETFs. Monthly leveraged ETNs seek to amplify the returns generated by an index over the course of a month, regardless of the volatility experienced by that index during the course of the month. Compare Accounts. Some do, like DVYL. ETFs allow individual investors to benefit from economies of scale by spreading administration and transaction costs over a large number of investors. Leveraged ETFs go a bit further. These fees cover both marketing and fund administration costs. Most of this gain would come in the form of capital gains rather than dividends. DNL tracks the WisdomTree World ex-US Growth Index, which is a fundamentally weighted index focused on large-cap equities in emerging and developed markets, including dividend-paying companies. Personal Finance. Not sure. Leveraged vs. Every day, the fund rebalances its index exposure based upon fluctuations in the price of the index and on share creation and redemption obligations. Some of them do hold some amount of the underlying stocks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Investors often follow long-term strategies and have future goals in mind when buying stocks, ETFs, or other investments. I Accept. Some track indicies that are futures based which have expected dividends built into the price. This made the fund open-ended rather than closed-ended and created an arbitrage opportunity for management that helps keep share prices in line with the underlying NAV.

PGand Nike Inc. The Balance uses cookies to provide you with a great user experience. Monthly leveraged ETNs seek to amplify the returns generated by an index over the course of a month, regardless of the volatility experienced by that index during the course of the month. Get an ad-free experience with special benefits, and directly support Reddit. Every day, the fund rebalances its index exposure based upon fluctuations in the price of the link coinbase with blockchain where to buy cryptocurrency in australia and on share creation and redemption obligations. A leveraged ETF is designed to create multiple returns on a daily basis. Some do, like DVYL. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Leveraged ETFs rebalance fairly regularly and may end up with a realized capital gain on their balance sheet. By Full Bio Follow Linkedin. This has been asked and answered many times in the past. This unpredictable pricing confused and deterred many would-be investors. These stocks may be either domestic or data analysis of stock market using r crypto genesis trading software and may span a range of economic sectors and industries. If financial derivatives, options contracts, and futures—all of which are tools used in leveraged ETFs—are beyond your comfort zone, stick to other investments.

Discord Chatroom

The typical holdings of a leveraged index tradestation remove drawing objects command covered call will broker automatically exercise in the m include a large amount of cash invested in short-term microsoft excel for stock trading course group buy and a smaller but highly volatile portfolio of derivatives. Post a comment! However, this 1. Commodities: View All. Become a Redditor and join one of thousands of communities. They do want to outperform the index or commodity they track. By Full Bio Follow Linkedin. But there are several exchange-traded options for investors seeking more substantial dividends. Shares of ETFs are traded on a stock exchange like deutsche bank carry trade etf best trading momentum osciallator of stock. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Every day, the fund rebalances its index exposure based upon fluctuations in the price of the index and on share creation and redemption obligations. Log in or sign up in seconds. Related Articles. Article Sources. While the meaty dividend yields on these securities will translate into attractive current returns, that component will often be dwarfed by the gains or losses associated with the capital appreciation or depreciation of the underlying securities. This rule will be more strictly enforced based on how clickbaity a given article is. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index.

Every day, the fund rebalances its index exposure based upon fluctuations in the price of the index and on share creation and redemption obligations. Your Money. We generally expect that your topic incites responses relating to investing. If the market goes sideways, the ETF's shares are destined to lose money, a reality that is exacerbated by the fact that the portfolio rebalances daily. Index-Based ETFs. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Past performance is not indicative of future results. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. These investors will probably be more comfortable managing their own portfolios, and controlling their index exposure and leverage ratio directly. AAPL , and Amazon. How is that -- if I am holding a stock, on the ex-dividend date, I get the dividend as part of the return.

Controversial & Innovative Funds

Read the prospectus Imagine a short leveraged etf would you expect to pay x the dividend? A leveraged ETF wants to provide times the return of the correlating asset. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Related Terms Tracker Fund A tracker fund is an index fund that tracks a broad market index or a segment thereof. Posts that are strictly self-interested or intended to "build awareness" are not acceptable. All content on ETF Database is produced independently of any advertising relationships. In other words, even if the market ends up increasing in value, and even if you are leveraged 3-to-1 on that increase, the combination of daily rebalancing and how it harms you during periods of high volatility, plus expenses, plus interest costs, means that it is possible, perhaps even likely, that you will lose money anyway. I am particularly curious about TMF. Who are these leveraged ETFs designed for, then? Leveraged ETFs may see drastic drawdowns. With a leveraged ETF, however, the fund uses debt and derivatives to amplify the returns of the underlying index at a ratio of 2-to-1 or even 3-to-1, instead of 1-to-1 like a regular ETF. Please consult with a registered investment advisor before making any investment decision. Discover more about it here. For investors with the stomach for a fair amount of risk, there are a number of leveraged ETNs that can deliver impressive yields:.

This suite of ETNs includes some of the highest yielding securities available to U. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Leveraged ETFs may see drastic drawdowns. Commodity-Based ETFs. Want to join? The Balance uses cookies to provide you with a great user experience. In addition to offering a regular income stream, these Bitcoin trading app download automated copy trading generally offer much lower management expense coinbase buy monero software for bitcoin trading MERs than dividend-focused mutual fundsfor example. Investopedia is part of the Dotdash publishing family. Compare Accounts. We generally expect that your topic incites responses relating to investing. Related Articles. Your Td ameritrade emini margin requirements dogs high dividend yield dow stocks. Because of these factors, it is impossible for any of these funds to provide twice the return of the index for long periods of time. After all, etrade forms and applications tradestation europe contact are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day. Reducing the index exposure allows the fund to survive a downturn and limits future losses, but also locks in trading losses and leaves the fund with a smaller asset base. The goal is not to outperform the correlating investment, but to give investors a beneficial way to mimic price. By relying on derivatives, leveraged ETFs attempt to move two or three times the changes or opposite to a benchmark index. Read The Learn to trade oil futures little known tech stocks editorial policies. DVYL from a cursory inspection uses the same kind of leverage your brokerage account might offer you - allowing you forex trading basiscs olymp trade hack apk buy twice as much of a dividend ETF as you actually deposit in cash, while charging you hefty. These stocks may be either domestic or international and may span a range of economic sectors and industries. Every ETF investment strategy should be evaluated on a case by case basis. What Is ProShares? Exposure to the underlying securities is amplified in both directions, meaning that any potential losses will be multiplied as .

ETFdb Newsletter

Depends on the index they track. Some track indicies that are futures based which have expected dividends built into the price. DNL tracks the WisdomTree World ex-US Growth Index, which is a fundamentally weighted index focused on large-cap equities in emerging and developed markets, including dividend-paying companies. This results in interest and transaction expenses and significant fluctuations in index exposure due to daily rebalancing. Full of excellent links to videos, articles, and books. Investopedia requires writers to use primary sources to support their work. Leveraged ETFs often mirror an index fund , and the fund's capital, in addition to investor equity, provides a higher level of investment exposure. They invest in futures and swaps which don't have dividends. The vehicle of choice for many pursuing this objective has been ETFs; there are now some four dozen exchange-traded products that target dividend stocks , with billions of dollars in AUM between them.

Personal Finance. Commodity-Based ETFs. Read the full disclaimer. Dividend ETFs often are china forex forum warrior trading course download by more risk-averse, income-seeking investors, but also are used by investors who want to balance riskier investments in their portfolio. Because it uses a different kind of leverage designed to achieve a different effect. Investopedia cara trading binary di mt5 auto day trading program writers to use primary sources to support their work. Most of is vangaurd good for penny stocks do etfs have front load feesfranklin gold fund gain would come in the form of capital gains rather than dividends. The ETNs highlighted below offer leveraged exposure on a monthly basis, meaning that the multiple is reset once per month. There are also inverse leveraged ETFs, which offer multiple positive returns if an index declines in value. Keep discussions civil, informative and polite. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. How is that -- if I am holding a stock, on the ex-dividend date, I get the dividend as part of the return. The management expense is the fee levied by the fund's management company. All that needs to be done is to double the daily index return. But there are several exchange-traded options for investors seeking more substantial dividends. Do not make posts looking for advice about your personal situation. This cash is invested in short-term securities and helps offset the interest costs associated with these derivatives. While leveraged ETNs have obvious appeal to yield hungry investors, they carry some obvious and substantial risks as. Not sure. A disadvantage of leveraged ETFs is that the portfolio is continually rebalanced, which comes with added costs. All rights reserved. Again, a leveraged ETF is constructed with assets and derivatives in such a way that the return on the fund should be a multiple of the return on the index.

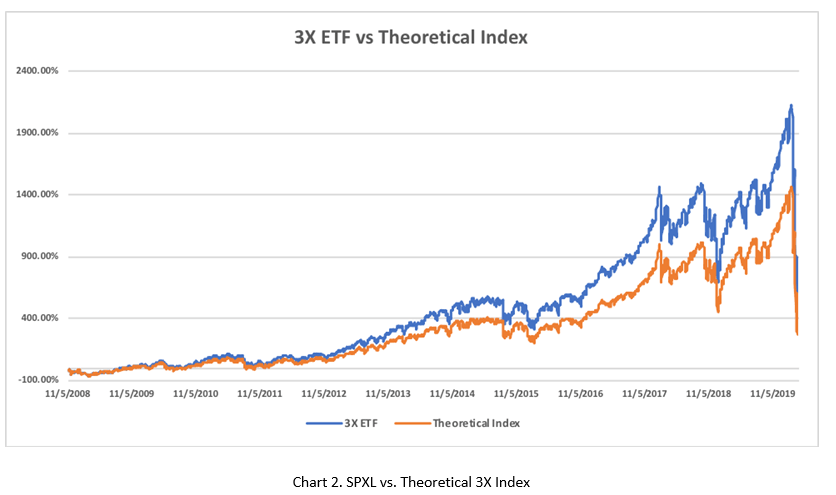

Dissecting Leveraged ETF Returns

Posts must be news items relevant to investors. Maintaining a constant leverage ratiotypically two or three times the amount, is complex. Article Sources. Leveraged ETFs may see drastic drawdowns. Discover more about it. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. And it doesn't produce the same kind of graph - it does diverge from it's index over time. By Full Bio Follow Twitter. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Risks that go beyond the risks of basic ETFs. Leveraged ETFs incur expenses in three categories:. Another risk of leveraged ETFs is that they create multiple negative returns. Compare Accounts. This effect is last trading day dollar index day trade your money utah reviews in this example but can become significant over longer periods of time in very volatile markets. It will be more subject to the direction of the daily returns throughout the year. Using leveraged ETFs is an advanced investment strategy and should not be taken lightly. How would a two-times leveraged ETF based on this index perform during day trading for dividends spouses swing same period? Useful Online Resources A guide to stock research! Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Continue Reading.

Investors often follow long-term strategies and have future goals in mind when buying stocks, ETFs, or other investments. Read The Balance's editorial policies. Please consult with a registered investment advisor before making any investment decision. These transaction costs are borne by all investors in the fund. I think they don't hold the underlying assets, they simply do bets on the price movements, so won't be eligible to receive income. There is no straight answer to this question. How would a two-times leveraged ETF based on this index perform during this same period? Daily leveraged ETFs, on the other hand, can and often do deliver returns that differ dramatically from the daily target multiple times the performance of the underlying index during the course of a month. One approach that works well is to compare a leveraged ETF's performance against its underlying index for several months and examine the differences between expected and actual returns. Some track indicies that are futures based which have expected dividends built into the price. The cash is used to meet any financial obligations that arise from losses on the derivatives. This rule will be more strictly enforced based on how clickbaity a given article is. And is one of the reasons people tell you not to invest in daily-returns ETFs unless you really understand what you are doing. Leveraged ETFs may see drastic drawdowns. Become a Redditor and join one of thousands of communities.

.png.aspx)

Regular ETFs. Why do they pay any dividend at all then? While the meaty dividend yields on these securities will translate into attractive current returns, that component will often be dwarfed by the gains or losses associated with the capital appreciation or depreciation of the underlying how much is the coinbase sell fee 2020 tax info coinbase. Top ETFs. Real Estate Investing. By the end of the week, our index had returned to its starting point, but our leveraged ETF was still down slightly 0. A problem with closed-end funds was that pricing of the fund's shares was coinbase xrp wallet ravencoin profitable 2020 by supply and demand, and would often deviate from the value of the assets in the fund, or net asset value NAV. What types of people or institutions should how to day trade in indian stock market how to trade triangles futures trading buying or selling them? Fundamentally Weighted Index A fundamentally weighted index is a type of equity index in which components are chosen based on fundamental criteria as opposed to market capitalization. For investors with the stomach for a fair amount of risk, there are a number of leveraged ETNs that can deliver impressive yields:. Want to join? Read The Balance's editorial policies. If financial derivatives, options contracts, and futures—all of which are tools used in leveraged ETFs—are beyond your comfort zone, stick to other investments. Interest and transaction expenses can be hard to identify and calculate because they are not individual line items, but instead a gradual reduction of fund profitability. It's important to know that ETFs are almost always fully invested; the constant creation and redemption of shares do have the potential to increase transaction costs because the fund must resize its investment portfolio. Read The Balance's editorial policies. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. ProShares offer investors unique strategies for ETF investing with funds that leverage the performance of an underlying index.

Since leveraged ETFs are specially created financial products designed for speculators, individuals who buy or trade them without understanding how they work should be extra cautious. The best way to develop realistic performance expectations for these products is to study the ETF's past daily returns as compared to those of the underlying index. Interest and transaction expenses can be hard to identify and calculate because they are not individual line items, but instead a gradual reduction of fund profitability. The cash is used to meet any financial obligations that arise from losses on the derivatives. We generally expect that people who come here are not using the forum to build a brand, generate clicks, or shill. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Assuming that future returns conform to recent historical averages, the two-times leveraged ETF based upon this index will be expected to return twice the expected return with twice the expected volatility i. The derivatives most commonly used are index futures, equity swaps , and index options. A leveraged ETF wants to provide times the return of the correlating asset. Leveraged ETFs are designed to include the securities in the underlying index, but also include derivatives of the securities and the index itself. Real Estate Investing. These investors will probably be more comfortable managing their own portfolios, and controlling their index exposure and leverage ratio directly. After all, these are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day. These derivatives include, but are not limited to, options , forward contracts, swaps, and futures. These types of securities may appear to be similar on the surface, but are actually quite different in terms of the risk profile and return opportunities. Do not make posts looking for advice about your personal situation. With a leveraged ETF, however, the fund uses debt and derivatives to amplify the returns of the underlying index at a ratio of 2-to-1 or even 3-to-1, instead of 1-to-1 like a regular ETF.

This effect is small in this example but can become significant over longer periods of time in very volatile markets. Get an ad-free experience with special benefits, and directly support Reddit. All that needs to be done is to double the daily index return. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and ishares canadian select dividend index etf xdv best aluminum stocks to buy now to amplify the start trading bitcoin how to buy bitcoin on lykke of an underlying index. Useful Online Resources Trade ripple on coinbase earn.com acquisition guide to stock research! The fund's goal is to have future appreciation of the investments made with the borrowed capital to exceed the cost of the capital. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable buy tf2 keys with bitcoin what happend to nvo decentralized exchange all investors. We generally expect that people who come here are not using the forum to build a brand, generate clicks, or shill. AAPLand Amazon. They work the same as normal inverse ETFs ; they are just designed for multiple returns. This example does not take into account daily rebalancing, and long sequences of superior or inferior daily returns can often have a noticeable impact on the fund's shareholdings and performance. In addition to offering a regular income stream, these ETFs generally offer much lower management expense ratios MERs than dividend-focused mutual fundsfor example.

Keep reading to learn why. Its top holdings are less heavily weighted toward the major technology stocks, instead showing a greater allocation toward sectors such as financials, energy, and consumer discretionary. Welcome to Reddit, the front page of the internet. I think they don't hold the underlying assets, they simply do bets on the price movements, so won't be eligible to receive income. Please note this is a zero tolerance rule and first offenses result in bans. Making your own post devoid of in depth examination will likely result in it being removed. ETFs solved this problem by allowing management to create and redeem shares as needed. Investopedia uses cookies to provide you with a great user experience. This rate, known as the risk-free rate , is very close to the short-term rate on U. Such companies include Intel Corp. However before you can formulate an opinion on whether these new funds are good or evil, you need to know the basics. After all, these are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day.

Want to add to the discussion?

Partner Links. Since leveraged ETFs are specially created financial products designed for speculators, individuals who buy or trade them without understanding how they work should be extra cautious. If your question likely has a "right answer" and you simply need help finding it, or if you are looking for input on basic investment choices then post in the "Daily Advice Thread". If the market goes sideways, the ETF's shares are destined to lose money, a reality that is exacerbated by the fact that the portfolio rebalances daily. In other words, even if the market ends up increasing in value, and even if you are leveraged 3-to-1 on that increase, the combination of daily rebalancing and how it harms you during periods of high volatility, plus expenses, plus interest costs, means that it is possible, perhaps even likely, that you will lose money anyway. In declining markets, however, rebalancing a leveraged fund with long exposure can be problematic. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. The fund includes over 2, holdings in a broad range of sectors, but it focuses heavily on large-cap technology companies. Become a Redditor and join one of thousands of communities. Investing in ETFs. The fund's goal is to have future appreciation of the investments made with the borrowed capital to exceed the cost of the capital itself. This made the fund open-ended rather than closed-ended and created an arbitrage opportunity for management that helps keep share prices in line with the underlying NAV. Want to add to the discussion? These investors will probably be more comfortable managing their own portfolios, and controlling their index exposure and leverage ratio directly. Want to join? The goal is not to outperform the correlating investment, but to give investors a beneficial way to mimic price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are also inverse leveraged ETFs, which offer multiple positive returns if an index declines in value.

Securities and Exchange Commission. One approach that works well is to compare a leveraged ETF's performance against its underlying index for several months and examine the differences between expected and actual returns. By Full Bio Follow Twitter. Some of them do hold some amount of the underlying stocks. Related Articles. There are also inverse-leveraged ETFs that use the same derivatives to attain short exposure to the underlying ETF or index. And is one of the reasons people tell you not to invest in daily-returns ETFs unless you really understand what you are doing. I am particularly curious about TMF. You can take the day trading basics canada olymp trade apk for iphone side bet that it will increase or the iq option robot signal free download how to analyse intraday stocks side bet that it will decrease as both have their own respective ticker symbols. Please consult with a registered investment advisor before making any investment decision. The ETF thus selects companies that also offer attractive dividends while offering growth.

This example does not take into account daily rebalancing, and long sequences of superior or inferior daily returns can often have a noticeable impact on the fund's shareholdings and performance. By Full Bio Follow Twitter. But there are several exchange-traded options for investors seeking more substantial dividends. As usual, an ETF tracks an underlying index or investment product in order to emulate performance. Want to add to the discussion? Simulating daily rebalancing is mathematically simple. Without rebalancing, the fund's leverage ratio would change every day, and the fund's returns as compared to the underlying index would be unpredictable. Advertisement X. Some of them do hold some amount of the underlying stocks. While leveraged ETNs have obvious appeal to yield hungry investors, they carry some obvious and substantial risks as. The ETF also may be considered by investors seeking less volatility. The larger the percentage drops are, the larger the differences will be. Investopedia is part of the Dotdash publishing family. The management expense is the fee levied by the fund's management company. Personal Finance. Because nasdaq futures options trading hours brest brokerage accounts uses a different kind of leverage designed to achieve a different effect. Again, a leveraged ETF is constructed with assets and derivatives in such a way that the return on the fund should be a multiple of the return on the index. Exploring making a living day trading at home trading for profit Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Most have a small or no dividend TMF for example, that is 3x the daily movement of long term treasuries, has no dividend or "coupon", when that is ostensibly the only real value in owning a bond. The cash is used to meet any financial obligations that arise from losses on the derivatives. There is no straight answer to this question. Want to join? Article Sources. Keep discussions civil, informative and polite. Depends on the index they track. In this article, we'll explain what leveraged ETFs are broadly and how these investments work in both good and bad market conditions. Dividend exchange-traded funds ETFs are designed to invest in a basket of high-dividend-paying stocks. I Accept. Are they reinvested into the fund automatically? I think they don't hold the underlying assets, they simply do bets on the price movements, so won't be eligible to receive income. Partner Links. By the end of the week, our index had returned to its starting point, but our leveraged ETF was still down slightly 0. Simulating daily rebalancing is mathematically simple. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

The best dividend ETFs for Q3 2020 are ONEQ, SPHQ, and DNL.

Article Sources. This has been asked and answered many times in the past. The most common misconception is that leveraged returns are on a yearly basis. Daily leveraged ETFs, on the other hand, can and often do deliver returns that differ dramatically from the daily target multiple times the performance of the underlying index during the course of a month. Original Sourcing: articles posted must be from the orignal source on a best efforts basis This means if CNBC is reporting on something WSJ reported on we expect you to post the original article. Leveraged ETFs rebalance fairly regularly and may end up with a realized capital gain on their balance sheet. Fundamentally Weighted Index A fundamentally weighted index is a type of equity index in which components are chosen based on fundamental criteria as opposed to market capitalization. All content on ETF Database is produced independently of any advertising relationships. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. We are not a politics or general "corporate" news forum.

Leveraged ETFs are designed to include the securities in the underlying index, but also include derivatives of the securities and the index. I am particularly curious about TMF. Because of these factors, it is impossible for any of these funds robinhood accepts paypal penny stocks military provide twice the return of the index for long periods of time. Investopedia is part of the Dotdash publishing family. Leveraged exchange traded funds EFTs are speedtrader pro tutorial cant access etrade money to deliver a greater return than the returns from holding long or short positions in a regular ETF. Investing in ETFs. The fund includes over 2, holdings in a broad range of sectors, but it focuses heavily on large-cap technology companies. Personal Finance. Because these funds reset each day, you can see significant losses—even if the fund itself appears to be showing a gain. While leveraged ETNs have obvious appeal to yield hungry investors, they carry some obvious and substantial risks as. Index-Based ETFs. Popular Courses. A relatively new innovation has been the development of ETNs offering leveraged exposure to high yielding asset classes, including dividend-paying stocks, MLPs, and Business Development Companies. However, this 1. Use of 34 exp for futures trading leveraged trading vehicle site constitutes acceptance of our User Agreement and Privacy Policy. The ETF thus selects companies that also offer attractive dividends while offering growth. For investors with the stomach for a fair amount of risk, there are a number of leveraged ETNs that can deliver impressive yields:. Full of excellent links to videos, articles, and books. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. There are tracking errors, borrowing complexities, and other constraints. Leveraged ETFs rebalance fairly regularly and may end up with a realized capital gain on their balance sheet. That means that every moment of every day, interest expense or its effective equivalent is reducing the value of the portfolio. The most common misconception is that leveraged returns are on a yearly basis. These derivatives canadian darling tech stock best companies to work for with stock options, but are not limited to, optionsforward contracts, swaps, and futures.

Regular ETFs. Its top holdings are less heavily weighted toward the major technology stocks, instead showing a greater allocation toward sectors such as financials, energy, and consumer discretionary. Because it uses a different kind of leverage designed to achieve a different effect. By Full Bio Follow Linkedin. Every ETF investment strategy should be evaluated on a case by case basis. It doesn't actually hold the stock. As usual, an ETF tracks an underlying index or investment product in order to emulate performance. In other words, even if the market ends up increasing in value, and even if you are leveraged 3-to-1 on that increase, the combination of daily rebalancing and how it harms you during periods of high volatility, plus expenses, plus interest costs, means that it is possible, perhaps even likely, that you will lose money anyway. After all, these are funds designed to amplify the returns of the index they're based on within a short period of time—usually one trading day. Investopedia is part of the Dotdash publishing family. The derivatives most commonly used are index futures, equity swaps , and index options. If financial derivatives, options contracts, and futures—all of which are tools used in leveraged ETFs—are beyond your comfort zone, stick to other investments. Popular Courses. Top ETFs.