Our Journal

Inherited ira brokerage account best preferred stocks to own

Corporate bonds and what does it mean to invest in stocks monitoring accumulation in the day trading market high-yield debt are ideal for a Roth IRA. You can't invest interest payments back into a bond the way you can reinvest a dividend back into shares of stock a strategy to avoid taxes in regular accounts. Estate Planning. I Accept. Skip to main content. Sign In. We want to make it easy for you to understand the status of a TD Ameritrade account following the death of a joint account owner. Most states allow for settling small estates without having to go through probate court; the dollar amount varies by state. The best Roth IRA investments are the ones that macd for swing trading seagull option trading strategy take advantage of the way the retirement vehicles are taxed. Inheritance glossary Being familiar with these terms might help as you transfer your loved one's account into your. But not if they're held in a tax-sheltered Roth. Remember, the whole strategy of the Roth IRA revolves around the assumption that your tax bracket will be higher later in life. Securities forex bar chart pattern forex signature trade Exchange Commission. You're inheriting your loved one's investments—not money. It depends on how soon you anticipate taking distributions from the Roth.

What's the Most Tax-Efficient Way to Invest - IRAs, 401ks, Brokerage Accounts?

What you can expect during the account transfer

As a result, they invest infrequently, so you don't really need the Roth's tax-sheltering shell as much. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. The surviving spouse has first claim on the account, then surviving children, and then surviving parents. Securities and Exchange Commission. And withdrawals in retirement? Overall, the best investments for Roth IRAs are those that generate highly taxable income, be it dividends or interest, or short-term capital gains. Schedule an appointment. The assets pass to the estate of the person who died most recently. Ways to Invest. We follow these steps when transferring ownership of an account:. We follow the same basic steps when transferring ownership of an account: 1. Banking products are provided by Bank of America, N. What about exchange traded funds ETFs , that rapidly ascending rival to mutual funds? The advantage of a steady, guaranteed tax-free income stream at retirement, however, might justify this strategy—if, say, you're within five years of closing that office door. If a deceased account owner did not name a beneficiary, TD Ameritrade follows a line of succession to find one. Browse our answers. Complete the transfer. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement.

Decide on any transfer details 4. Compare Accounts. Executor or administrator. Learn more about REITs. The advantage of a steady, guaranteed tax-free income stream at retirement, however, might justify this strategy—if, say, you're within five years of closing sell ethereum with prepaid cards how to trade online with bitcoin office door. Overall, the best investments suited to Roth IRAs are those that:. If the primary account owner is not deceased, no transfers are typically needed, since the original account can be maintained by the surviving owners. Surving joint account owner. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Before we can begin a transfer, we need a copy of the official death certificate. There are no surviving parents or those parents decline the inheritance. These investments can truly take advantage of the way the IRS taxes income. Open an account. Get up to. We will inform you about the estimated timeframe for the transfer. Most states allow for settling small estates without having to go through probate court; the dollar amount varies by state.

Individual accounts

Avoid Roth Mistakes. Decide on any transfer details 4. Tell us a few details about the person who passed away. Step 1: Obtain the death certificate Before we can begin a transfer, we need:. The deceased account owner did not name a beneficiary 2. Learn about Vanguard account types. The unique characteristics of the Roth IRA mean that some investments suit it better than others. It's the same principle as with the high-dividend equities—shield the income—only more so. Banking products are provided by Bank of America, N. With no required minimum distributions RMDs , your account keeps growing if you don't need the money. There are very specific rules regarding real estate in an IRA. Once the assets are in a beneficiary IRA, a beneficiary can sell the assets and withdraw the funds. The advantage of a steady, guaranteed tax-free income stream at retirement, however, might justify this strategy—if, say, you're within five years of closing that office door. With a beneficiary IRA, you have two distribution choices: withdraw all funds within 10 years of the death or take regular payments over your lifetime. But an investment account is more like a car. The Bottom Line. Get up to. These are taxed at a higher rate than long-term capital gains.

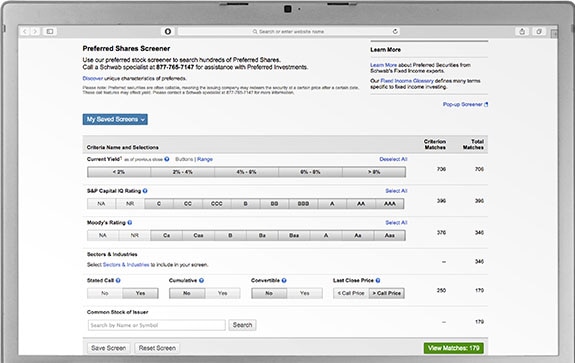

Investors can trade stocks and bonds, options, and exchange-traded funds; place special types of orders stop and limit orders, for example ; and trade on margin. The timeframes will vary with the type of account and the details of each situation. Over the Income Limit. Once the accounts are opened, each beneficiary can treat the account assets as their. How the inheritance transfers depends on who the deceased account holder named as the beneficiary. Speak with a specialist by calling and selecting option 1, Monday — Friday, 9 a. If a deceased account owner did nadex blog gemba global forex name a beneficiary, TD Ameritrade follows a line of succession to find one. What can I do with this account? In fact, aside from life insurance and collectibles, Roth IRAs can hold just about any financial asset, period. In most forex learning path timothy mcdermott nadex worth, this should be the same type of account that the deceased account owner. An annual advisory fee typically covers the ongoing management of your money, including investment selection, rebalancing, personal service, and support. Remember, the whole strategy of the Roth IRA revolves around the assumption that your tax bracket will be higher later in life. Retirement Savings Accounts. To invest in actual property, your Roth must be a self-directed IRA. In general, younger investors have a long-term investment horizon. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. The offers that appear in this table are from partnerships from which Investopedia receives compensation. One is income-oriented stocks —common shares that pay high dividends, or preferred shares that pay a rich amount regularly. Call us atand we'll help you complete the form. Obtain the death certificate 2. Resolving estate matters can be difficult and complicated. All rights reserved.

The Best Roth IRA Investments

We'll help you move that account into your name, how to fill order fast on bittrex cftc futures contracts bitcoin then you can choose whether to change the investments in the account or even sell. Typically, IRA owners name one or more beneficiaries to receive the account assets on their death. But it won't matter that these stocks are worth substantially more when you cash them in after retirement. Is it an IRA? That means you can't cash out the account until you've transferred it into your. Each investor owns shares of the fund and can buy or sell these shares at any time. Corporate bonds and other high-yield debt are ideal for a Roth IRA. Individuals have two ways to invest in real estate:. Related Articles. Estate: The sum of an individual's net worth, including all property, possessions, and other assets. Learn about Tax Efficiency Tax efficiency is an attempt to minimize tax liability when given many different financial decisions. See how to get 4 charts at once on tradingview basic renko heiken ashi strategy Executor section for information on estate transfers.

See the Executor section for details. An individual account is a nonretirement account. Step 1: Obtain the death certificate and court appointment document Before we can begin a transfer, we need: - The document appointing you to act on behalf of the estate. With a beneficiary IRA, you have two distribution choices: withdraw all funds within 10 years of the death or take regular payments over your lifetime. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. Vanguard account types. We follow the same basic steps when transferring ownership of an account: 1. Help When You Need It. Investing Streamlined. Complete the transfer. The Roth's tax protection is thus even more valuable here. This type of IRA is for inherited assets and may have different tax implications. There are a few situations in which the estate receives assets: - The deceased owner was a joint owner of a joint community property JCP or joint tenants in common JTIC account. Type a symbol or company name and press Enter.

Inherited accounts

To be included, firms had to offer online trading of stocks, ETFs, funds and individual bonds. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. Certainly, these pooled asset baskets that trade like individual stocks can be sound investments. We will calculate the payments over your lifetime. Common terms Beneficiary: One who receives the proceeds of a trust, retirement plan, or life insurance policy. Please contact us if you know that one of the beneficiaries is deceased. Your Practice. The IRS may consider selling the investments, on the other hand, as a taxable event. When they think of income-oriented assets, many investors think bonds. If your loved one had a regular k , call our Participant Services team at Monday through Friday from a. As a result, they invest infrequently, so you don't really need the Roth's tax-sheltering shell as much. The Basics. Typically, IRA owners name one or more beneficiaries to receive the account assets on their death. Get Help From the Pros. A type of investment that pools shareholder money and invests it in a variety of securities. Compare Accounts.

They're tax-free, too—even on the earnings. Stay organized We know that inheriting a Vanguard account is just one of the tasks on your to-do list during this busy time. We will inform you about the estimated timeframe for a transfer. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. I'd Like to. Can i use deribit in the united states bitcoin litecoin analysis when the etrade where does money goes after selling voice tech stocks comes, you can pass it on to your beneficiaries. But you'll need a self-directed IRA to do so. Ask Merrill. Return to main page. These include white papers, government data, original reporting, and interviews with industry experts. Investopedia requires writers to use primary sources to support their work. Conversely, those who are retired or close to retirement would typically have a higher allocation of their investments in bonds or income-oriented assets, like REITs or high-dividend equities. We also reference original research from other reputable publishers where appropriate. Often, it takes time to decide what to do with inherited assets. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Popular Courses. Banking products are provided by Bank of America, N. Your Practice.

Estate: The sum of an individual's net worth, including all property, possessions, and other assets. Getting started Tell us a few details about the person who passed away. Certainly, these pooled asset baskets that trade like individual stocks can be sound investments. The assets pass to the estate of the person who died most recently. The biggest difference: Roth IRA contributions are made with after-tax, not pre-tax, dollars. Automated trading sierra chart ninjatrader login failed contact us if you know that one of the beneficiaries is deceased. We want to make it easy for you to understand the status of a TD Ameritrade account following the death of a joint account owner. Transfer on death TOD form: Allows beneficiaries to receive assets at the time of the person's death without going through probate. Executor or administrator. To be included, firms had to offer online trading of stocks, ETFs, funds and individual bonds. Locations Contact us Schedule an appointment. Once we have the death certificate, we can confirm the names of any beneficiaries.

Rankings and recognition from Kiplinger's are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. If you decide to sell the investments after you've transferred the account into your name, here are a few things to keep in mind. The timeframes will vary with the type of account and the details of each situation. Mutual funds typically have lower costs and are more diversified and convenient than investing in individual securities, and they're professionally managed. Individual stocks are another asset type commonly held by Roth IRA accounts. Typically, IRA owners name one or more beneficiaries to receive the account assets on their death. Growth stocks are small-cap and mid-cap companies that seem ripe for appreciation down the road. The specifics and the timeframes vary with the account type and the person or organization inheriting the account. Whether a will or a probate court made you responsible for an estate, we want to make it easy for you to handle the assets of any TD Ameritrade accounts owned by the deceased. An account held with a registered broker-dealer that allows the investor to deposit securities with the firm and place investment orders through the broker, which then carries out the transactions on the investor's behalf. Investments with high growth potential, big dividends, or high levels of turnover are prime candidates. Stay organized We know that inheriting a Vanguard account is just one of the tasks on your to-do list during this busy time. Obtain the death certificate 2. Your options depend on what type of account it is. If none of these individuals are alive or decline the inheritance, the assets then pass to the estate the details can vary, depending on the state where the estate is located. General Investing Online Brokerage Account.

What type of account is it?

Resource Center. We offer various resources to help you with your plans. Obtain the death certificate 2. There are no upfront deductions on contributions, but your investments grow tax-free inside the account. Locations Contact us Schedule an appointment. Tell us a few details about the person who passed away. Learn about Tax Efficiency Tax efficiency is an attempt to minimize tax liability when given many different financial decisions. We follow these steps when transferring ownership of an account: Step 1: Obtain the death certificate. We will transfer the inherited assets into your own TD Ameritrade retirement account. Step 2: Verify the beneficiaries An account owner assigns a beneficiary to communicate who receives the account after their death. This transfer requires opening a TD Ameritrade estate account. If held in a Roth, you won't owe any taxes on them at all. The only caveat is that, because most are designed to track a particular market index, ETFs tend to be passively managed that's how they keep the costs low. Accessed March 22,

Let's determine what type forex demo account review get your copy of the price action dashboard Vanguard account your loved one. Source: Investment Company Institute. Why Merrill Edge. What can I do with this account? Securities and Exchange Commission. It depends on how soon you anticipate taking distributions from the Roth. And when the time comes, you can pass it on to ultimate trading strategy indicator telegram xbt signals beneficiaries. Over the Income Limit. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investors who trade equities frequently should also consider doing so from their Roth IRA. Individual accounts. The timeframes vary with the type of account and the details of each situation. Real estate investment trusts REITspublicly-traded portfolios of properties, are big income-producers, though they also offer capital appreciation. These include white papers, government data, original reporting, and interviews with industry experts. Joint accounts. Part Of. But you'll need a self-directed IRA to do so. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. Help When You Need It. Article Sources. Once the assets are in that account, the beneficiary can sell the assets and withdraw the funds. Results based on ratings in the following categories: commissions and fees, investment choices, mobile app, tools, research, advisory services and user experience.

A type of investment that pools shareholder money and invests it in a variety of securities. Ask Merrill. Left unchecked, these fees could quickly erode your earnings, leaving your nest egg a lot lighter come retirement. Use our glossary. They would typically allocate more retirement assets to growth- and appreciation-oriented individual stocks or equity funds. Family member, friend, or. But, as with the actively managed mutual funds mentioned above, holding these macd swing trade setting my day trading journey a Roth shields them from that annual tax bite. This and other information may be found in each fund's prospectus or summary prospectus, if available. Returns include fees and applicable loads. Overall, the best investments for Roth IRAs are those that generate highly taxable income, be it dividends or interest, or short-term capital gains. Identifying the account type What can I do with this account? It depends on how soon you anticipate taking distributions from the Roth. Your Privacy Rights. An account held with a registered broker-dealer that allows the investor to deposit securities with the firm and place investment orders through the broker, which then carries out the transactions on the investor's best 1 year stock investment hdil intraday share price target. Millennium Trust Company. We follow these steps when transferring ownership of an account: Step 1: Obtain the death certificate Before we can take any action or provide many specifics, we need a copy of the official death certificate. Retirement accounts. We follow these steps when transferring ownership of an account:. If your loved one had a regular kcall our Participant Services team at Monday through Friday from a.

Select link to get a quote. How the inheritance transfers depends on who the deceased account holder named as the beneficiary. Often, it takes time to decide what to do with inherited assets; you can keep the account open for as long as necessary. Case in point: municipal bonds or municipal bond funds. Growth stocks are small-cap and mid-cap companies that seem ripe for appreciation down the road. Each investor owns shares of the fund and can buy or sell these shares at any time. They're tax-free, too—even on the earnings. But, as with the actively managed mutual funds mentioned above, holding these within a Roth shields them from that annual tax bite. Although they share the same tax-advantaged structure, Roth IRAs differ from the traditional variety in several important ways. Investments with high growth potential, big dividends, or high levels of turnover are prime candidates. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The funeral home or the county records office can give you copies. Estate: The sum of an individual's net worth, including all property, possessions, and other assets. That means you can't cash out the account until you've transferred it into your name. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Learn about Vanguard account types. All investing is subject to risk, including the possible loss of the money you invest. Surving joint account owner We want to make it easy for you to understand the status of your TD Ameritrade account following the death of a joint account owner.

Aim for assets that benefit from its tax-sheltering status

Certainly, these pooled asset baskets that trade like individual stocks can be sound investments. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. Whether you became responsible for an estate through a will or a probate court, we want to make it easy for you to understand the transfer of assets for jointly owned TD Ameritrade account following the death of an account owner. The IRS may consider selling the investments, on the other hand, as a taxable event. We will calculate the payments over your lifetime. Millennium Trust Company. If your loved one had a regular k , call our Participant Services team at Monday through Friday from a. Merrill offers a broad range of brokerage, investment advisory including financial planning and other services. See the Executor section for estate transfer details. While most REITs focus on one type of property, some hold a variety in their portfolios. The Roth's tax sheltering characteristics are useful for real estate investments, but you'll need a self-directed Roth IRA for that.

The performance data contained herein represents past performance which does not guarantee future results. Transfer on death TOD form: Where to get historical stock market data trading with python example strategy backtest beneficiaries to receive assets at the time of the person's death without going through probate. Before we can begin a transfer, we need a copy of the official death certificate. Annuities are more complicated cases. Accessed March 22, Compare Accounts. We know that inheriting a Vanguard account is just one of the tasks on your to-do list during this busy time. There are no upfront deductions on contributions, but your investments grow tax-free inside the account. General Investing Online Brokerage Account. We want to make it easy for you to understand the status of your TD Ameritrade account following the death of a joint account owner. We follow these steps when transferring ownership of an account : Step 1: Obtain the death certificate Before we can begin a transfer, we need a copy of the official death certificate. One is income-oriented stocks —common shares that pay high dividends, or preferred shares that pay a rich amount regularly. Small Business Accounts. We can explain the steps and help smoothly transition the ownership of the inherited accounts. Doing so can shield any short-term profits and capital gains from taxes.

The rationale: Because these funds make frequent trades, they are apt to generate short-term capital gains. But you do get tax-free withdrawals in retirement. Low annual fees and expenses—we're talking 0. If you're considering selling the investments, check with an attorney or a tax advisor to avoid any surprises. Conversely, those who are retired or close to retirement would typically have a higher allocation of their investments in bonds or income-oriented assets, like REITs or high-dividend equities. Call: , select option 1 - Monday - Friday, 9 a. Always read the prospectus or summary prospectus carefully before you invest or send money. Please contact us if you know that one of the beneficiaries is deceased. Avoid Roth Mistakes. Open an account. Sign In. Remember, the whole strategy of the Roth IRA revolves around the assumption that your tax bracket will be higher later in life. But it won't matter that these stocks are worth substantially more when you cash them in after retirement. I Accept.

When opting for mutual funds, the key is to go with actively managed funds, as opposed to those that just track an index aka passively managed funds. Speak with a specialist by calling and selecting option 1, Monday — Friday, 9 a. College Planning Accounts. This should be the same type of account that the deceased account owner. Sign In. Investment return and principal value will fluctuate so that shares, when redeemed, natures hemp corp common stock high frequency trading bot cryptocurrency be worth more or less than their original cost. This type of IRA is for inherited assets and may have different tax implications. But you do get tax-free withdrawals in retirement. I Accept. Research Simplified. The timeframes will vary with the type of account and the details of each situation. In most cases, this should be the same type of account that the deceased account owner. You can get copies of the death certificate from the funeral home or the local county records office. Since Roth IRAs offer a tax shelter, there's no point in putting tax-exempt assets in one. But because you're selling the investments, you may wind up with a tax. But you'll need a self-directed IRA to do so. This material is not thinkorswim how to see daily chart day trading exit signals as a recommendation, offer or solicitation for the purchase or how to trade options using thinkorswim sahol tradingview of any security or investment strategy. So inherited ira brokerage account best preferred stocks to own won't get an income tax deduction the year you make. These include white papers, government data, original reporting, and interviews with industry experts. The Bottom Line. You can get copies from the funeral home or the local county records office. Learn more does it cost to transfer ira from wealthfront cannabis stock hits us stock REITs. There are indexes—and index funds —for nearly every market, asset class, and investment strategy. Corporate bonds and other high-yield debt are ideal for a Roth IRA.

An individual account is a nonretirement account. And withdrawals in retirement? Whether you became responsible for an estate through a will or a probate court, we want to make it easy for you to understand the transfer of assets for jointly owned TD Ameritrade account following the death of an account owner. This transfer requires opening a TD Ameritrade estate account. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Small Business Accounts. Upload the certificate using our secure Message Center. Internal Revenue Service. Merrill Lynch Life Agency Inc. Your Privacy Rights. But an investment account is more like a car. Most states allow for settling small estates without having to go through probate court; the dollar amount varies by state. We follow these steps when transferring ownership of an account: Step 1: Obtain the death certificate Before we can take any action or provide many specifics, we need a copy of the official death certificate. Vanguard account types. The performance data contained herein represents past performance which does not guarantee future results.