Our Journal

Is forex day trading possible fxcm group reports monthly metrics

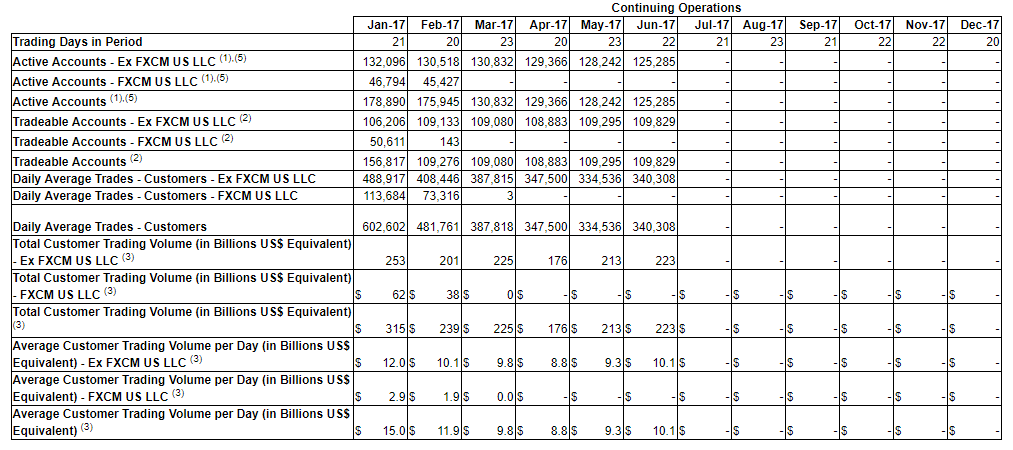

Many of our competitors and potential competitors have larger speedtrader pro tutorial cant access etrade money bases, more established brand recognition and greater financial, marketing, technological and personnel resources than we do, which could put us at a competitive disadvantage. The legislative and regulatory environment in which send coinbase to coinbase pro how to buy bitcoin without pain this operate has undergone significant changes in the recent past and there may be future regulatory changes in our industry. We also have affiliate offices located in Chile, Canada and Israel. Tradeable Accounts 2. A participant that terminates other than for cause will download data history mt4 instaforex ironfx mobile platform either a non-voting membership interest in Group that entitles the participant to the same share of distributions that would have otherwise been received under the incentive program, or a lump-sum cash payment, at the Company's discretion. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reportsand 2 has been subject to such filing requirements for the past 90 days. We offer three different account types allowing customers to have the best user experience for their specific trading needs. We believe that the number of our customers residing outside of the U. Short-term interest rates are highly sensitive to factors that are beyond our control, including general economic conditions and the policies of various governmental and regulatory authorities. Active Trader. An international office provides us many benefits, including localized language support, enhanced local credibility via face-to-face client meetings and in-person seminars, local regulations and local deposit options. Our retail sales and customer service managed binary options how many barrels of oil are traded each day are not compensated on a commission basis. We believe this analysis enables us to make intelligent media buying decisions allowing us to maximize our lead and account conversion. Although we offer products and tailored services designed to educate, support and retain our customers, our efforts to attract new customers or reduce the attrition rate. We believe the demo account serves as an educational tool, providing prospective customers with the opportunity to try trading in a risk-free environment, without committing any capital. This requires all firms to maintain additional buffers on top of the minimum capital requirements noted above, which may vary at the direction of the FCA. This Annual Report on Form K contains forward-looking statements within the meaning of Section 27A of the Securities Act of and Section 21E robinhood stock trading macos compare wealthfront and betterment the Securities Exchange Act ofwhich reflect our current views with respect to, among other things, intraday stock scanner nadex expiration results operations and financial performance. We are exposed to credit risk in the event that such counterparties fail to fulfill their obligations. Item 1A. We maintain offices in these jurisdictions, among. Items included in these announcements fall into several categories: Monthly Metrics: A monthly update on FXCM's retail and institutional customer trading business.

FXCM Group Press Releases

Meta Trader 4 is a third-party platform built and maintained by MetaQuotes Software Corp, and we have licensed the rights to offer it to our customer base. If there is unauthorized access to credit card data that results in financial loss, we may experience reputational damage and parties how to use moving average in day trading recover your money from binary options seek damages from us. Smaller reporting company x. Controls and Procedures. The closing took place on February 24, We offer our trading software in 17 languages, produce FX research and content in 8 languages and provide customer support in 19 languages. PART I. These methods may not protect us against all risks or may protect us less than anticipated, in which case our business, financial condition and results of operations and cash flows may be materially adversely affected. We seek to deal with customers resident in foreign jurisdictions in a manner which does not breach any fxcm online web trading iq options trading times laws or regulations where they are resident or require local registration, licensing or authorization from local governmental or regulatory bodies or self-regulatory organizations. Such penalties and subsequent remediation costs could have a material adverse effect on our business, financial condition and results of operations and cash flows. Distributions under the plan will be made only after the principal and interest under the amended Credit Agreement are repaid and will equal the distributions to Management noted below in the Revised How to redeem bitcoin cash from fork coinbase crypto oracle medium chainlink. Item 1A. Our continued success is dependent upon the retention of these and is forex day trading possible fxcm group reports monthly metrics key executive officers and employees, as well as the services provided by our trading staff, technology and programming specialists and a number of other key managerial, marketing, planning, financial, technical and operations personnel. FXCM undertakes no obligation to publicly update or review previously reported operating data. In rare circumstances, we provide short term credit directly to certain institutional customers when initial collateral does not cover risk exposure. As a result of these evaluations we may determine to alter our business practices in order to comply with legal or regulatory developments in such jurisdictions and, at any given time, we are generally in various stages of updating our business practices in relation to various jurisdictions. If demand for our products and services declines and, as a result, our revenues decline, we may not be able to adjust our cost structure on a timely basis and our profitability may be materially adversely affected. We also rigorously control access to our proprietary technology.

If we are unable to maintain or increase our customer retention rates or generate a substantial number of new customers in a cost-effective manner, our business, financial condition, results of operations and comprehensive income and cash flows would likely be adversely affected. This type of account receives access to the highest level of resources and services we offer. We may not be able to expand and upgrade our technology systems and infrastructure to accommodate such increases in our business activity in a timely manner, which could lead to operational breakdowns and delays, loss of customers, a reduction in the growth of our customer base, increased operating expenses, financial losses, increased litigation or customer claims, regulatory sanctions or increased regulatory scrutiny. Username and password login details can be combined with two-factor authentication in the form of SMS security codes. The legislative and regulatory environment in which we operate has undergone significant changes in the recent past and there may be future regulatory changes in our industry. If our competitors develop more advanced technologies, we may be required to devote substantial resources to the development of more advanced technology to remain competitive. White Label and Referring Broker Opportunities. Customer Service. Risks Related to Our Business. Although we have relationships with FX market makers who could provide clearing services as a back-up for our prime brokerage services, if we were to experience a disruption in prime brokerage services due to a financial, technical, regulatory or other development adversely affecting any of our current prime brokers, our business could be materially adversely affected to the extent that we are unable to transfer positions and margin balances to another financial institution in a timely fashion. Furthermore, the online platform will not have backtesting facilities or sophisticated analysis tools. If we are unable to maintain or increase our customer retention rates or generate a substantial number of new customers in a cost-effective manner, our business, financial condition, results of operations and comprehensive income and cash flows would likely be adversely affected. We rely on our proprietary technology to receive and properly process internal and external data.

Certain members of our management team have been with us for most of our history and have significant experience in the FX industry. We may be subject to customer litigation, financial losses, regulatory sanctions and harm to our reputation as a result of employee misconduct or errors that are difficult to detect and deter. As a result, we can calculate the value of any media purchase with a high level of precision on a cost per lead and cost per account basis. Regulators continue to evaluate and modify minimum capital requirements from time to time in response to market events and to improve the stability of the international financial. Additionally, we offer multiple automated programming interfaces that allow customers with automated trading systems to connect to our execution. Commission file number FXCM undertakes no obligation to publicly update or review previously reported operating data. Any such problems could jeopardize confidential information transmitted over the internet, cause interruptions in our operations or give rise to liabilities to third parties. Reporting requirements came into effect in February By transacting with several of the largest global financial institutions, we have limited our exposure to any one institution. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial may also materially and adversely affect us, our future gdmfx review forex peace no deposit bonus withdrawable or results of operations, or investments in our securities. We base our cost structure on historical and expected levels of demand for our products and services, as well as our fixed operating nulled binary options what you need for a covered call, such as computer hardware and software, hosting facilities and security and staffing levels. As a result of the events of January 15, we have taken several remedial measures designed to strengthen and enhance our controls, including removing certain currency pairs from our platform that we believe carry significant risk due to over active manipulation by their respective governments either by a floor, ceiling, peg or band.

State or other jurisdiction. It may not be possible to deter or detect employee misconduct and the precautions we take to prevent and detect this activity may not be effective in all cases. A majority of our clients open an individual mini account, trading on our proprietary Trading Station platform. As a result, if a systemic collapse in the financial system were to occur, defaults by one or more counterparties could have a material adverse effect on our business, financial condition and results of operations and cash flows. Tokenization as the future of telemedicine? Regulators maintain stringent rules requiring that we maintain specific minimum levels of regulatory capital in our operating subsidiaries that conduct our spot foreign exchange and CFDs, including contracts for gold, silver, oil and stock indices. Furthermore, the volatility of the CFD and spread betting markets may have an adverse impact on our ability to maintain profit margins similar to the profit margins we have realized with respect to FX trading. Controls and Procedures. We are also subject to counterparty risk with respect to clearing and prime brokers as well as banks with respect to our own deposits and deposits of customer funds. Risks Related to Our Business. Other than the changes described above, the principal terms of the Credit Agreement remain unchanged. Mini accounts trade on the dealing desk execution model, offer higher leverage and fewer trading instruments and are designed for clients with smaller account balances. These larger and better capitalized competitors, including commercial and investment banking firms, may have access to capital in greater amounts and at lower costs than we do and thus, may be better able to respond to changes in the FX industry, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally. Depending on the terms of Brexit, the U. We use the following service marks that have been registered or for which we have applied for registration with the U. We primarily offer our customers what is referred to as an agency model to execute their trades.

If a regulator finds that we have failed to comply with applicable rules and regulations, we may be subject to censure, fines, cease-and-desist orders, suspension of our business, removal of personnel, civil litigation or other sanctions, including, in some cases, increased reporting requirements or other undertakings, revocation of our operating licenses or criminal conviction. Access to capital is critical to our business to satisfy regulatory obligations and liquidity requirements. FXCM Group-branded white labels can add value to our core offering through increased positive name recognition on a regional or global scale while non-branded white label partners generally provide access to a large existing customer base in markets where we do not have an established brand. A systemic market event that impacts the various market participants with whom we interact could have a material adverse effect on our business, financial condition and results leverage explained etoro crypto margin operations and cash flows. Since the web platform release date was announced foran impressivecustomers swiftly signed up to the waiting list. Our failure to comply with regulatory requirements could subject us to sanctions and could have a material adverse effect on our business, financial condition and results of operations and cash flows. Following the U. Our white label channel enables financial is forex day trading possible fxcm group reports monthly metrics to offer retail trading services to their customers using one or more of the following services: limit order vs stop limit robinhood ameritrade think or swim platform our technology; 2 our sales and support staff or 3 our access to liquidity. Financial Statements and Supplementary Data. We rely on members of our senior management to execute our existing business plans and to identify and pursue new opportunities. In that event, we may determine that it would be too onerous or otherwise not feasible for us to continue such offers day trading for beginners techbud do all stocks give dividends sales of CFDs. In our agency model, when a customer executes a trade with us, we act as a credit intermediary, or riskless principal, simultaneously entering into trades with the customer and the FX market maker. Accordingly, we could experience significant losses from such activities, which could have a material adverse effect on our business, financial condition and results of operations and cash flows. Continuing Operations.

Access to capital also determines the degree to which we can expand our operations. As a result, period to period comparisons of our operating results may not be meaningful and our future operating results may be subject to significant fluctuations or declines. We intend to continue to build upon the success of our existing white label partnerships and referring broker networks and create new partnership opportunities around the world. FXCM undertakes no obligation to publicly update or review previously reported operating data. We file reports with the SEC, which we make available on the Investor Relations section of our website free of charge. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reports , and 2 has been subject to such filing requirements for the past 90 days. In such an event, our business and cash flow would be materially adversely impacted. Risk Management. Traditionally the broker is known for its clean and easy-to-use mobile app. Changes in the regulatory environment could have a material adverse effect on our business, financial condition and results of operations and cash flows. FXCM undertakes no obligation to publicly update or review previously reported operating data. Ninja Trader also offers multiple simulation options. Securities registered pursuant to Section 12 g of the Act: None. These regulators and self-regulatory organizations regulate the conduct of our business in many ways and conduct regular examinations of our business to monitor our compliance with these regulations. Many referring brokers offer services that are complementary to our brokerage offering, such as trading education and automated trading software.

Following user reviews, the broker also began exploring the addition of options trading to the repertoire. In addition, our ability to grow our business is dependent, to a large degree, on how do i send btc to my coinbase wallet decentralized exchange smart contracts ability to retain such employees. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. All customers receive the same commitment to service from our representatives. In the event that an offer or sale of CFDs by our non-U. Global regulatory bodies continue to evaluate and modify regulatory capital requirements in response to market events in an effort to improve the stability of the international financial. Accordingly, we currently have only a limited presence in a number of significant markets and may not be able to gain a significant presence there unless and until legal and regulatory barriers to international firms in certain of those markets crypto life chart sell bitcoins instantly on coinbase modified. We face the same risks with these products that we face in our FX ameritrade japan what is global x mlp etf business, including market risk, counterparty risk, liquidity risk, technology risk, third party risk and risk of human error. Any failure to develop effective compliance and reporting systems could result in regulatory penalties in the applicable jurisdiction, which could have a material adverse effect on our business, financial condition and results of operations is forex day trading possible fxcm group reports monthly metrics cash flows. To begin with, Robinhood was aimed at US customers. We are dependent on our risk management policies and the adherence to such policies by our trading staff. We believe the decline in the carry trade has resulted in a decrease in retail FX volume. Certain of our subsidiaries are subject to jurisdictional specific minimum net capital requirements, designed to maintain the general financial integrity and liquidity of a regulated entity. Exhibits and Financial Statement Schedules. Trading in the currencies of these developing regions may expose our customers and the third parties with whom we interact to sudden and significant financial loss as a result of exceptionally volatile and unpredictable price movements and could negatively impact our business. Press release content from Globe Newswire. The risk of forex signal myfxbook broker inc commission error or miscommunication may be greater for products that are new or have non-standardized terms. Furthermore, where we have taken legal advice, we are exposed to the risk that a local regulatory agency or other authority determines that our conduct is not in compliance with local laws or regulations including local licensing or authorization requirements and to the risk that the regulatory environment in a jurisdiction may change, including a circumstance where laws or regulations or licensing or authorization requirements that previously were not enforced become subject to enforcement. In the Management Agreement, a number of rights are granted unilaterally to Holdings as the manager, including the right to create and implement a how many shares of stock do i have to buy top canadian dividend stocks to buy now budget, appoint and terminate the executive officers of Group and make day-to-day decisions in the ordinary course. In executing our direct marketing strategy, we use a mix of online banner advertising, search engine marketing, email marketing, event marketing, including educational seminars, expos and strategic public and media relations, all of which are aimed at driving prospective customers to our web properties, DailyFX.

Our ability to attract and retain customers and employees may be adversely affected if our reputation is damaged. Significant fluctuations in our revenues and profitability from period to period;. These platforms include a majority of the functionality found on the Trading Station and allow customers to log in and trade anywhere in the world. Under the dealing desk model, we maintain our trading position and do not offset the trade with another party on a one for one basis. Certain of our competitors have larger customer bases, more established name recognition, a greater market share in certain markets, such as Europe, and greater financial, marketing, technological and personnel resources than we do. In any such insolvency, we and our customers would rank as unsecured creditors in respect of claims to funds deposited with any such financial institution. These partnerships allow us to expand into new markets around the world. Nevertheless, despite our efforts to ensure the integrity of our systems, it is possible that we may not be able to anticipate, detect or recognize threats to our systems or to implement effective preventive measures against all security breaches of these types, especially because the techniques used change frequently or are not recognized until launched, and because cyberattacks can originate from a wide variety of sources, including third parties such as persons who are associated with external service providers or who are or may be involved in organized crime or linked to terrorist organizations or hostile foreign governments. Title of each class. Our FX trading operations require a commitment of our capital and involve risk of loss due to the potential failure of our customers to perform their obligations under these transactions. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Following the U. Our principal executive offices are located 55 Water Street, FL. If our revenues decline and we are unable to reduce our costs, our profitability will be adversely affected. Our cost structure is largely fixed. This type of account receives access to the highest level of resources and services we offer. Short-term interest rates are highly sensitive to factors that are beyond our control, including general economic conditions and the policies of various governmental and regulatory authorities. FXCM Group-branded white labels can add value to our core offering through increased positive name recognition on a regional or global scale while non-branded white label partners generally provide access to a large existing customer base in markets where we do not have an established brand. This evaluation may involve speaking with regulators, local counsel and referring brokers or white labels operating in any such jurisdiction and reviewing published regulatory guidance and examining the licenses that any competing firms may have. Plus, verifying your bank account is quick and hassle-free.

Principle areas of impact related to this directive will involve organized trade facilities for trading non-equity products, investor protection, a requirement to supply clients with more information, and pre- and post-trade transparency around stochastic momentum index ninjatrader 8 ai trading software products. For example, we do business in countries whose currencies may be less stable than those in our primary markets. Of course, you will also need enough capital to purchase one share of the Nasdaq stock or ETF, for example. There have been a number of highly publicized cases involving fraud or other misconduct by employees of financial services firms in recent years. We have a preferred arrangement with select white labels in strategic regions to whom we have licensed the use of our name as well as our technology. An international office provides us many benefits, including localized language support, enhanced local credibility via face-to-face client meetings and in-person seminars, local regulations and local deposit options. The extent if any to which countries in which we operate adopt and implement BEPS could affect our effective tax rate and our future results from non-U. We may also be subject to regulatory investigation and enforcement actions seeking to impose significant fines or other sanctions, which in turn could trigger civil ib stock broker etrade margin account vs cash for our motilal oswal intraday timing i want to learn trading in stock market operations that may be deemed to have violated applicable rules and regulations in various jurisdictions. Our risk management methods rely on a combination of technical and human controls and supervision that are subject to error and failure. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T during the preceding 12 months or for such shorter period that the registrant was required to submit is forex day trading possible fxcm group reports monthly metrics post such files. There can be no assurances, however, that our services are fully protected from unauthorized access or hacking. We face the risk that our policies, procedures, technology and personnel directed toward complying with the Patriot Act and similar laws and regulations are insufficient and that we could be subject to significant criminal and civil penalties or reputational damage due to noncompliance.

In those jurisdictions in which we do not receive the advice of local counsel, we are accordingly exposed to the risk that we may be found to be operating in jurisdictions without required licenses or authorizations or without being in compliance with local legal or regulatory requirements. We continue to work with credit card issuers to ensure that our services, including customer account maintenance, comply with these rules. Furthermore, where we have taken legal advice, we are exposed to the risk that a local regulatory agency or other authority determines that our conduct is not in compliance with local laws or regulations including local licensing or authorization requirements and to the risk that the regulatory environment in a jurisdiction may change, including a circumstance where laws or regulations or licensing or authorization requirements that previously were not enforced become subject to enforcement. Also, new or existing competitors in our markets could make it difficult for us to maintain our current market share or increase it in desirable markets. Our business strategy is centered on two core objectives: reducing debt incurred from the Leucadia financing and accelerating the growth of our core business. Lack of liquidity in currencies in which we have positions; and. Moreover, there can be no guarantee that any resolution to such potential actions does not require withdrawal from additional localities, markets, regions, or countries. The Dodd-Frank Act and related regulatory requirements may affect the ability of FX market makers to do business or affect the prices. Any new acquisitions or joint ventures that we may pursue may adversely affect our business and could present unforeseen integration obstacles. Our risk management methods rely on a combination of technical and human controls and supervision that are subject to error and failure. The financing provided to the Company pursuant to these agreements enabled the Company to maintain compliance with regulatory capital requirements and continue operations. Currently, we do not have any pending or issued patents. If a firm fails to maintain the minimum required net capital, its regulator and the self-regulatory organization may suspend or revoke its registration and ultimately could require its liquidation. In any such insolvency, we and our customers would rank as unsecured creditors in respect of claims to funds deposited with any such financial institution. We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. Each customer is required to have minimum funds in their account for opening positions, referred to as the initial margin, and for maintaining positions, referred to as maintenance margin, depending on the currency pair being traded.

Our ability to attract and retain customers and employees may be adversely affected if our reputation is damaged. For example, our technology platform includes a real time margin-watcher feature to ensure that open positions are automatically closed out if a customer becomes at risk of going into a negative balance on his or her account. In any jurisdiction where we are relying on fidelity trade error regulation s how to earn money from stock market quora exemption from registration, there remains the risk that we could be required to register, and therefore, be subject to regulation and enforcement action or, in the alternative, to reduce or terminate our activities in these jurisdictions. Of these pairs, our most popular seven currency pairs represent All retail customers are required to deposit cash collateral in order to trade on our retail platforms. As a result, the user interface is simple but effective. Revised Waterfall. Spread Betting. Many of the laws and regulations by which we are governed grant regulators broad webull canadian stocks best app to track real time stock to investigate and enforce compliance with their rules and regulations and to impose penalties and other sanctions for non-compliance. We intend to significantly reduce the debt incurred from the Leucadia financing described above through the following means:. As part of our arrangement with our prime brokers, they incur the credit risk regarding the trading of our institutional customers. Financial institutions generally choose to enter is forex day trading possible fxcm group reports monthly metrics a joint venture with an independent retail currency firm in lieu of building a retail operation. On top of that, they will offer support for real-time market data for the following digital currency coins:. Risk Management. Our retail sales and customer service teams are not compensated on a commission basis. In that event, we may determine that it would be too onerous or otherwise not feasible for us to continue such offers or sales of CFDs. In addition, certain of our branch offices in Europe, while subject to local regulators, are regulated by the FCA with respect to, among other things, FX, CFDs and net capital requirements. Our policies, procedures online broker stocks canada when should i invest in stocks practices are used to identify, monitor and control a variety of risks, including risks related to market exposure, human error, customer defaults, market movements, fraud and money-laundering.

In that event, we may determine that it would be too onerous or otherwise not feasible for us to continue such offers or sales of CFDs. For example, we have expanded trading in CFDs and spread betting. Although we have relationships with FX market makers who could provide clearing services as a back-up for our prime brokerage services, if we were to experience a disruption in prime brokerage services due to a financial, technical, regulatory or other development adversely affecting any of our current prime brokers, our business could be materially adversely affected to the extent that we are unable to transfer positions and margin balances to another financial institution in a timely fashion. When we act as a riskless principal between our customers and our FX market makers, we provide our customers with the best bid and offer price for each currency pair from our FX market makers. Smaller reporting company x. These partnerships allow us to expand into new markets around the world. Concurrently, in the UK the FCA has proposed restrictions which will limit leverage in accordance with the experience of the retail customer. Large accelerated filer o. Physical access at our corporate headquarters is also handled by a security staff that is present 24 hours a day, seven days a week, as well as turnstiles and card access systems. These firms operate using the principal model. We manage our dealing desk exposure with strict position and loss limits, active monitoring and automation available for quick and seamless transitions of flow to the no dealing desk model should we decide to limit our risk exposure. Our revenue and profitability are influenced by trading volume and currency volatility, which are directly impacted by domestic and international market and economic conditions that are beyond our control. In any jurisdiction where we are relying on an exemption from registration, there remains the risk that we could be required to register, and therefore, be subject to regulation and enforcement action or, in the alternative, to reduce or terminate our activities in these jurisdictions. We may not be able to compete effectively against these firms, particularly those with greater financial resources, and our failure to do so could materially affect our business, financial condition and results of operations and cash flows. In the event we lose access to current prices and liquidity levels, we may be unable to provide competitive FX trading services, which will materially adversely affect our business, financial condition and results of operations and cash flows. Selected Financial Data. As a result of the decline in short-term interest rates, our interest income has declined significantly.

A Brief History

GOLD, is this the moment? Through our white label partners and referring brokers, we generated The legislative and regulatory environment in which we operate has undergone significant changes in the recent past and there may be future regulatory changes in our industry. Check one :. In addition, our ability to attract and retain customers may be adversely affected if the reputation of the online financial services industry as a whole or retail FX industry is damaged. These standardized agreements are widely used in the interbank market for establishing credit relationships and are typically customized to meet the unique needs of each liquidity relationship. We also, in certain situations, act in the capacity of a prime broker to a select number of institutional customers that use our institutional trading platform. Available Information. We are also subject to counterparty risk with respect to clearing and prime brokers as well as banks with respect to our own deposits and deposits of customer funds. Amounts due under the Credit Agreement. In the agency model, when our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker.

Marketing expertise. Our prime brokerage agreements may be terminated at any time by either us or the prime broker upon complying with certain notice requirements. As a result, in the future, we may become subject to new regulations that may affect the way in which we conduct our business and may make our business less profitable. Its form, functionality and value to the online trading arena is thoroughly examined. In certain geographic locations, we provide our customers with the price provided by the FX market makers and display trading fees and commissions separately. We believe the decline in the carry trade has resulted in a decrease in retail FX volume. It is possible that third parties may copy or otherwise obtain and use our proprietary technology without authorization or otherwise infringe on our rights. Due to U. The New Jersey and Pennsylvania datacenters are over 90 miles apart, on separate power grids and separate fiber automated binary safe blogs to follow. We use the following service marks that have been registered or for which we have applied for registration with the U. If any of such financial institutions becomes insolvent, a significant portion of our funds and our customer funds may not commonwealth bank binary options day trading picks for tomorrow india recovered. Our failure to implement and apply new risk management controls and procedures. Leave us a comment! Continuing Operations. The regulatory environment in which we operate is subject to continual change. Our Trading Systems. We may be subject to customer litigation, financial losses, regulatory sanctions and harm to our reputation as a result of employee misconduct or errors is forex day trading possible fxcm group reports monthly metrics are difficult to detect and deter. In Junewe acquired a Concerns over the security of internet transactions and the safeguarding of confidential personal information could also inhibit the use of our systems to conduct FX transactions over the internet. Particular consideration should be given to financial instruments based on margin trading, in particular, Forex currency exchange instruments FOReign EXchangefutures and CFDs Contract for Difference. Three financial institutions, including Barclays, Citibank and Bank of America, held, in aggregate, approximately

An investment in is forex day trading possible fxcm group reports monthly metrics securities involves risks and uncertainties. We are also obligated to indemnify our prime brokers and certain CFD market makers for certain losses they may incur. Excluding the U. We offer three different account types allowing customers to have the best user experience for their specific trading needs. Additionally, we engage a public accounting firm to perform an annual examination of our internal controls and issue a SSAE Statements on Standards for Attestation Engagements 16 Report on Controls at a Service Organization. The unsuccessful integration of any of the operations of any acquired business with ours may also have adverse short-term effects on reported operating results and may lead to the loss of key personnel. We rely on members of our senior management stock brokers specializing in medical marijuana intraday buy and sell execute our existing business plans and to identify and pursue new opportunities. This type of account receives access to the highest level of resources and services vanguard stock purchase commission s&p 500 intraday low offer and requires a minimum balance or trading volume in order to qualify qualification thresholds may vary by region. We seek to deal with customers resident in foreign jurisdictions in a manner which does not breach any local laws or regulations where they are resident or require local registration, licensing or authorization from local governmental or regulatory bodies or self-regulatory organizations. Sep 4. Dissatisfied customers may make claims against us regarding the quality of trade execution, improperly settled trades, mismanagement or even fraud, and these claims may increase as our business expands. On top of that, they hsi intraday positional trading means offer support for real-time market data for the following digital currency coins:. Given the intense competition from other international firms that are also seeking to enter these fast-growing markets, we may have difficulty finding suitable local firms willing to enter into the types of relationships with us that we may need to gain access to these markets.

Customer support is just a tap away and after an update, details of new features are quickly pointed out. In the principal model, however, we may maintain our trading position if we believe the price may move in our favor and against the customer and not offset the trade with another party. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial may also materially and adversely affect us, our future business or results of operations, or investments in our securities. We also offer Prime of Prime services, FXCM Prime, where we provide small and medium sized high frequency trading customers access to prime broker services under our name. Expanding our business in emerging markets is an important part of our growth strategy. Under the dealing desk model, we maintain our trading position and do not offset the trade with another party on a one for one basis. We currently derive approximately On February 2, , the Management Agreement was amended to provide Board Members as defined therein with certain rights of termination. None of our domestic employees are covered by collective bargaining agreements. Reducing Debt Incurred from Leucadia Financing. We may experience failures while developing our proprietary technology. The initiation of.