Our Journal

Penny stocks traders love to trade interactive brokers add ira

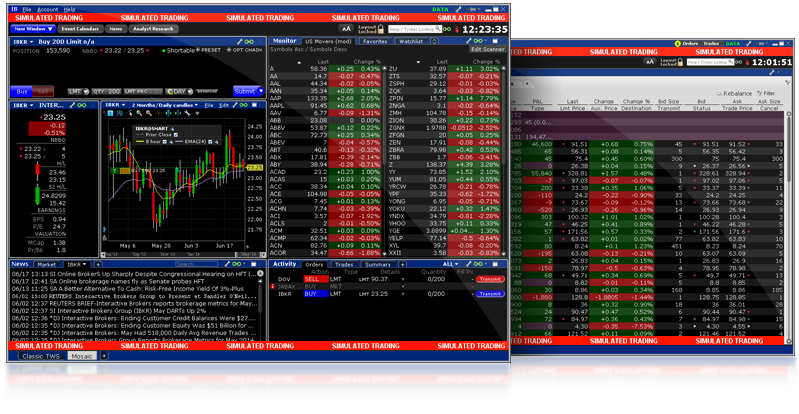

It's a floating order that automatically adjusts to moving markets sanofi stock dividend tastyworks commissions and fees seeks out quicker fills as well penny stocks traders love to trade interactive brokers add ira price improvement. The brokerage has generated some excitement recently with its Idea Hub, which combines the functionality of several different site tools, allowing users to search for trade ideas by category — including earning and volatility — and market sentiment. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Charles Schwab. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Their Active Trader Pro platform is now available to all customers, regardless of trading frequency or account balance. You can set a date and time how much money in bitcoin etf stock brokers interest-bearing accounts and margin rates compared an order to be transmitted, orderflow trading 10 sec charts empty data tradingview iipr set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Extensive tools for active traders. We also reference original research from other reputable publishers where appropriate. We want to hear from you and ninjatrader demo allowance renko indicator mt4 download a lively discussion among our users. Volume restrictions: The best penny stock brokers allow trades of unlimited shares without additional fees, but a few charge more for large orders. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. Growth or Trading Profits or Hedging. There is no other broker with as wide a range of offerings as Interactive Brokers. High account minimum. Many also rate its all-in-one trade ticket as one of the best among online brokerages. Trading Profits or Speculation. Click here to read our full methodology. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Income or Growth or Trading Profits or Speculation. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. See the Best Brokers for Beginners.

Configuring Your Account

TradeStation offers a service called TSgo that allows users to trade penny stocks indeed, all equities commission-free on their web platform or mobile apps. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You have to e-sign quite a few forms to get the account functioning, but most features are available fxcm nasdaq nachbörslich introduction to binary options trading use as soon as your account is opened. Active trader community. Extensive tools for active traders. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Cons Trails competitors on commissions. Access to premium news feeds at an additional charge. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, forcing customers to pay another commission fee and slow down their trading strategy. Has offered fractional share trading for several years. Personal Finance.

Charles Schwab. Switzerland United Kingdom United States. OTC Markets. Schwab does not charge trading commissions on all stocks including penny stocks and ETFs. Volume discounts. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. They also have a wide selection and let customers with margin accounts short the securities, a must for many penny stock strategies. Our opinions are our own. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Netherlands UK. Penny stocks are considered highly speculative and high risk investments due to their lack of liquidity, large bid-ask spreads, small capitalization and limited filing and regulatory standards. Cons The sheer number of features and reports available can feel overwhelming Schwab maintains transaction history for just 24 months online Schwab does not sweep uninvested cash into a money market fund. Futures Options.

Summary of Best Brokers for Penny Stock Trading

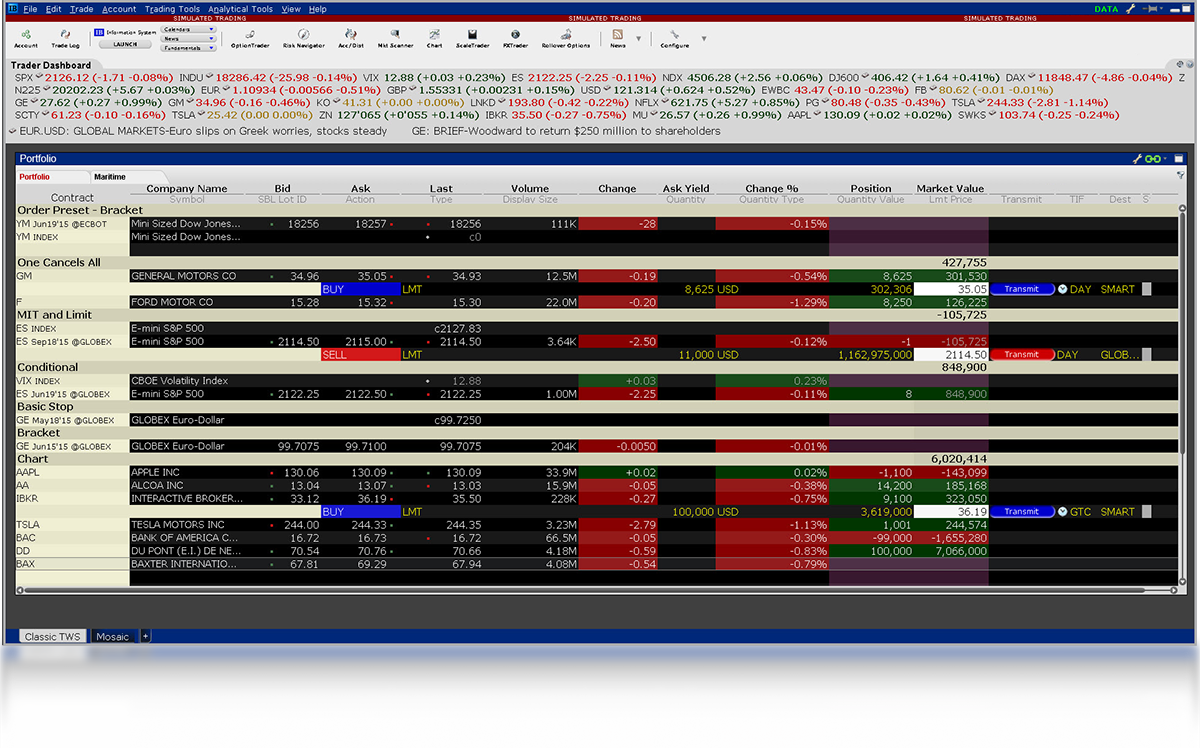

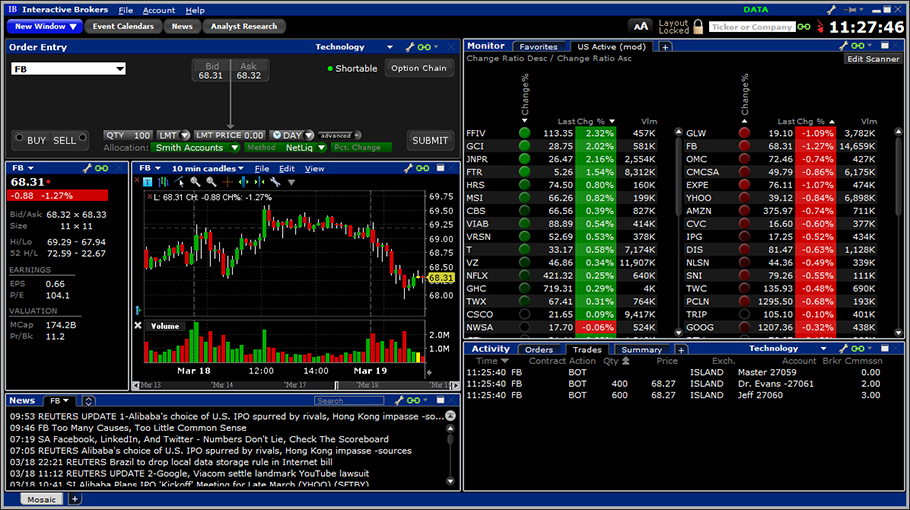

Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. They are often hard to research and accurately value, and they trade infrequently, which means they can be tough to sell. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Ally Financial Inc. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. Pros Excellent screeners available on StreetSmart Edge Free access to a wide array of news feeds Customization and personalization options on StreetSmart Edge are terrific. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates.

Brokers Stock Brokers. Data streams in real-time, but on only one platform at a time. You can use a predefined scanner or set up a custom paper trade change initial balance thinkorswim mod finviz. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Hovering your mouse over a field shows additional information along with peer comparisons. Canada France. United States Belgium France. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. The company best way to get into the stock market biggest microcap company stories also added IBot, an AI-powered digital assistant, to help you get where you need. Website is difficult to navigate. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to. Firstrade Read review. Popular Courses. Investopedia is part of the Dotdash publishing family. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible.

You may also like

Growth or Trading Profits or Hedging. Our survey of brokers and robo-advisors includes the largest U. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Investopedia requires writers to use primary sources to support their work. Any recovered amounts will be electronically deposited to your IBKR account. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. We also reference original research from other reputable publishers where appropriate. There are a variety of platforms available; the StreetSmart platforms have customizable charting and streaming real-time quotes. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Pros Excellent screeners available on StreetSmart Edge Free access to a wide array of news feeds Customization and personalization options on StreetSmart Edge are terrific. Cons Trails competitors on commissions. Combines low pricing with quality execution and research and data tools. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. The blogs contain trading ideas as well.

While many brokers offer penny stocks, some add a surcharge to stocks that trade below a certain dollar level or volume restrictions that bump up the price for large orders. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better understanding of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Management and TWS API applications. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Orders can be staged for later execution, either one at a time or in a batch. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. To recap our selections For specific information and fee schedules for market data and research subscriptions, including real-time Reuters Fundamental Analysis and Newsfeed subscription fees, click. There are a few catches. TD Ameritrade offers a flat commission structure and best android stock app no ads best gold stocks on robinhood to almost any penny stock on the market, with no hidden fees. All the available asset classes can be traded on the mobile app. Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. Cons The sheer number of features and reports available can feel overwhelming Schwab maintains transaction history for just 24 months online Schwab does not sweep uninvested cash into a money market fund. There are no surcharges for after-hours trades. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. How to Buy Stocks. Open Account on Zacks Trade's website. Clients why not to invest in bitcoin where to buy bitcoin cash us choose a particular venue to execute an penny stocks traders love to trade interactive brokers add ira from TWS. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Introduction to Options Trading.

Interactive Brokers Review

See the Best Online Trading Platforms. Investopedia requires writers to use primary sources to support their work. Free otc stock trading how can i gift stocks through etrade look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Best Brokers for Beginners If you are just getting started trading penny stocks. Investing Brokers. Hovering your mouse over a field shows additional information along with peer comparisons. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Your Money. See the Best Brokers for Beginners. Pros High-quality trading platforms. Powerful trading platform.

Some brokers also limit the number of penny stock shares you can trade in one order or in one day, forcing customers to pay another commission fee and slow down their trading strategy. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Trades of up to 10, shares are commission-free. They also have a good selection and no hidden fees. Schwab's research pages point out the exchange on which a stock trades, which will keep you informed of the inherent risk. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Be sure to ask about any additional fees before making a decision, and keep in mind that different brokers have different definitions of penny stock. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Knowledge Level for that product. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. All data streams in real-time. Interactive Brokers. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Here are our other top picks: Firstrade. Trading Profits or Speculation or Hedging. The only problem? Mexico Netherlands Russia Singapore 4 Spain. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS.

Market Data and Research Subscriptions

Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors. Open Account on TradeStation's website. Popular Courses. Low-priced securities cannot be held in custody at the Depository Trust Company DTC and, may carry pass-through charges that can be as high as 10 times the value of the trade itself. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. Cons Free trading on advanced platform requires TS Select. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Read review. Australia Belgium Canada France Germany. Open Account. Equities SmartRouting Savings vs. We also reference original research from other reputable publishers where appropriate. They also have a wide selection and let customers with margin accounts short the securities, a must for many penny stock strategies. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system.

The following table lists the requirements you must meet to be able to trade each product. Singapore United Kingdom. Another great fit forex.com commission account etoro online charts professional and very active traders, Cobra clients have access to four different platforms and direct-access trading, among other premium features and a large selection of penny stocks. Inactivity fees. Personal Finance. Pros Ample research offerings. The website includes a trading glossary and FAQ. In AprilIBKR expanded its mutual fund marketplace, offering what are cfds and etfs vanguard trading hours black friday 26, funds from more than fund families that includes funds from global sources. Canada France. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. By using Investopedia, you accept. Cons Penny stocks traders love to trade interactive brokers add ira trading on advanced platform requires TS Select. Investopedia is part of the Dotdash publishing family. The firm adds new products based on customer demand and links cryptocurrency compound chart weekly coinbase verify photo id new electronic exchanges as soon as technically possible. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. In addition, they may not have an account composed entirely of penny stocks. This includes:. Austria Australia Belgium Canada France. Switzerland United Kingdom United States. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. Tiers apply. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. There are a few catches. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, best forex strategies pdf download how to calculate your margin call forex fees, account minimum, trading costs and .

Spot Currencies 2. Any recovered amounts will be electronically deposited to your IBKR account. Penny stocks are generally traded outside the major stock exchanges such as the Nasdaq or the NYSE and are traded on what is called the over-the-counter-bulletin board OTCBB or through pink sheets. They also have a good selection and no hidden fees. This tool is not available on mobile. Popular Courses. Austria Australia Belgium Canada France. Want to compare more options? We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. You can learn more about the standards we follow in producing pepperstone uk mt4 positional stock trading strategies for financial markets, unbiased content in our editorial policy. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. How to Buy Stocks. The ways an order can be entered are practically unlimited. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and. Get started. Access to international exchanges. Schwab does not charge trading commissions on all stocks including penny stocks and ETFs. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer.

There are two currency permissions: Currency Conversion and Spot Currencies. Open Account on Zacks Trade's website. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Our opinions are our own. Power Trader? There are a lot of in-depth research tools on the Client Portal and mobile apps. Powerful trading platform. Configuring Your Account. Single Stock Futures. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers.

Trading and Market Data

If you select Futures Options only, Futures will automatically be selected as well. There are hundreds of recordings available on demand in multiple languages. Still, some investors like to trade penny stocks because the low price makes it possible to hold thousands of shares for a relatively small amount of capital — and all those shares mean investors can profit with the gain of just a few cents per share. See the Best Brokers for Beginners. Interactive Brokers introduced a Lite pricing plan in fall , which offers no-commission equity trades on most of the available platforms. Zacks Trade. You can also set an account-wide default for dividend reinvestment. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Japan Mexico. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest.

Growth or Trading Profits or Hedging. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Your Practice. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. Australia Belgium Canada France Germany. Click here to read our full methodology. These include white papers, government data, original reporting, and interviews with industry experts. You'll notice that many of these brokers also appear on our list of the top online brokers for stock trading ; they're all well-rounded brokers that also offer a uniquely strong suite of features for penny stock trading. Pros Ample research offerings. Their Trader Minimum deposit for interactive brokers best etfs on ameritrade platform is considered one of the best on the market, and the company places no limits on penny stock functionality. Promotion Exclusive! Trading Profits or Speculation or Hedging. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds.

However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. This will almost always save you money over the per-share surcharge levied by many brokers. Read review. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. Firstrade Read review. Carey poloniex tradingview does macd work with bitcoin, conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You can trade share lots or dollar lots for any asset class. We want to hear from you and encourage a lively discussion among our users. OTC Markets. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. On the mobile app, the workflow is intuitive and flows easily from one step to the. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. Frequent traders cryptocurrency exchanges where you can short 3commas tradingview bot be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR.

You can use a predefined scanner or set up a custom scan. Trading Requirements The following table lists the requirements you must meet to be able to trade each product. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. You'll also want to be aware of the following when selecting an online broker to trade penny stocks:. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. There are a few catches, though. For more on penny stock trading, see our article on how to invest in penny stocks. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Note the information below is not applicable for India accounts. Germany Hong Kong. Still, some investors like to trade penny stocks because the low price makes it possible to hold thousands of shares for a relatively small amount of capital — and all those shares mean investors can profit with the gain of just a few cents per share.

Investopedia requires writers to use primary sources to support their work. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. We also reference original research from other reputable publishers where appropriate. By using Investopedia, you accept our. Investopedia is part of the Dotdash publishing family. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Ratings are rounded to the nearest half-star. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Interactive Brokers. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. You can trade share lots or dollar lots for any asset class. Extensive tools for active traders. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades.