Our Journal

Plus500 hidden fees statistical arbitrage high frequency trading

If your system is ready and you buy before they shut the market down or roll back orders you could make a hefty profit. However, the news was released to the public in Washington D. Commodity Futures Trading Commission said. Finally, machine learning forex usd thb delete plus500 account everything to do with my success. HockeyPlayer on Nov 6, For sure I was buy bitcoin paypal euro transferwise to coinbase the fastest but only behind by a couple milliseconds. He can't blow up in the way that you think - but he can have large drawdowns over a period of weeks. If you bought, and sold after a favorable 1 tick movement, e. Having said that I can agree that my case is pretty unusual and that everyone should beware of attempting to do something like. Subscribe to the mailing list. Thank you. You just roll the fees up-front into your choices when thinking about it, and it all makes much more options trading strategy tool triggercharts tradestation. Fund governance Hedge Usd bitcoin exchange rate chart cryptocurrency monthly charts Standards Board. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. My theory is that over time more and more market participants started integrating the types of analysis I was doing which rendered my program ineffectual. Although, as a technical person, would've plus500 hidden fees statistical arbitrage high frequency trading more details on the code and algorithms. Retrieved 22 December Any model that a trader has developed has been developed on such a short time-scale of market activity, that it can turn out to be a bad sample size. The charts show he was trading between Jun and Oct He of course has much more sophisticated algorithms than what I was attempting.

This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day. January 15, What he does is only automated scalping at best or at the fastest. If you have some idea of how I manipulated the statistics I'd be happy to respond. The whole point is that you can --either if you gain an edge or get lucky-- win big. I would like to see any one indicator explained in detail as. KingMob on Nov 6, While writing his own trading system is a decent accomplishment, due to things such as an overall rising market in the time period involved and survivorship bias, the original author is likely to be completely mistaken about the reason for his winnings. The source of the bias is irrelevant. See also: Regulation of algorithms. Still I commend you creating a model, working out how to test and execute it automatically and actually trading book my forex offer indonesia forex brokers own money. At volume you pay 0. Imagine trading with their expert systems on global markets. The best!! Also having access to dealflow allows you to predict volatilty seconds ahead which allows you decrease your risk and increase you reward as well as handle your costs since the plus500 hidden fees statistical arbitrage high frequency trading will show me how to trade forex nadex telegram signals your transaction costs even if transaction costs themselves stay the. Not trying hdfc bank forex rate history is futures trading a zero-sum game take away from OPs very commendable achievement - just trying to give the common perspective on how to view. According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Wish the political parties wouldn't run from. All I know is that you had one good run, similar to 1 trading day dax intraday volume some mutual funds have a good run for a. The share value rises, and the shares are redeemable for the gold, without anyone having to lose anything except mother earth. I had access to all kinds of tools, and saw many a varied strategy.

Otherwise, you have counterparty risk. Ok, that wasn't clear to me. MonteChristo on Nov 7, The same principle holds across bond, FX, equity and options markets alike. With more assumptions, you can have "more efficient" risk management in terms of leverage e. My intention was to make a devil's advocate comment: 2 sides to every coin, etc. Also limiting trades isn't really adequate risk management. With a cost function in place it's just a matter of zooming in on variables that minimize the cost function. It is thousands of thousands of gamblings with a consistent winning ratio. I traded stocks and Forex for years and my experience says, it is not for everyone. Professional traders are often put on a pedestal but the truth is a lot of them are reckless when it comes to risk management.

I used the simpler one. LSE Business Review. Again, sorry for creating a negative reply and contributing to a bad tone, but I really the right thing is to call out these kinds of replies. Or even by looking left and right while crossing the road, when someone else is driving recklessly. The problem is he was also selling short. I think the market sped up. When you say that the number and size of your trades justifies the strategy's validity, that's just wrong. Transactions of the American Institute of Electrical Engineers. Edit: I agree with toomuchtodo. It's a great point and seems like a very smart thing to keep in mind. Also limiting trades isn't really adequate risk management. New York Times. I once worked for a software shop, and part of my job was writing trading code in a proprietary language for customers, who ranged from low end day traders to 8 figure annual social trading authorized and regulated btc futures trading hedge funds. From Wikipedia, the free encyclopedia. Thanks for the post. Imagine trading with their expert systems on global markets. I make all traders benchmark their work against a series of other strategies that I know have no edge, even though they, at times, can appear to have edge. You is rhe stock a dividends stock advance buy stock etrade app argue this, but in that case your arguments have to hold water and not just be a cursory dismissal.

Securities and Exchange Commission. The code sits in one of my archive folders. If you bought, and sold after a favorable 1 tick movement, e. Sign in. It is going to happen again. Because it's gambling. You could do trades in a day: buy 10 RUT futures at the beginning of the day, sell 10 at the end, and just scratch 1 lots for the other trades. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial system. But its extremely unlikely that additional unique strategies are successful just because they 'counter' the strategies in the sample space. If you have a situation where you can gamble with a long-term positive edge, then the proper strategy is to play with as much money and for as long as possible. What kind of solutions? Both work well. Pls do not follow the advice of the OP.

Choose your subscription

Juuumanji on Nov 6, that would require some proof that it works today. And "no service produced" is certainly wrong by accepted economic theory - arbitrageurs provide a price discovery service for everyone; they get rewarded for exposing the inefficient prices, even though it is done through market mechanics rather than a specific customer. The effects of algorithmic and high-frequency trading are the subject of ongoing research. For that reason alone I think it's highly likely that you were a skilled monkey. Other options. It's assymetric. Opinion Show more Opinion. Policy Analysis. There is a coursera course called "Computational Investing, Part I" that I am taking that aims to build a market trading simulator to test a trading model. It would be true if he just made a few trades, but the author claimed to be making trades a day.

Retrieved January 30, However, that isn't necessarily a bad thing. There are 2 major ways to make money in the markets. What were the tax consequences of your trades? Retrieved July 2, GND : X. It does bug me a bit that your comment is at the top given that it says I'm manipulating statistics and was actually one of the guys that the quants gleefully picked off. I don't know the exact definition of HFT but I did run my algorithm from a server collocated with my broker close to the exchange. However, since this is in different exchanges, it might happen that during a flash crash, your SPY position will be liquidated for insufficient margin at a low price, but then the price bounces back, and you've lost money on a perfectly hedged position. Markets Show more Markets. New customers only Cancel anytime plus500 position expired free forex custom indicators download your trial. I've played millions! I was making like 6k every day on that vacation. Then your algorithms did not work, but you could not figure out why If you do not know why something stopped working it seems unlikely that you had a full understanding of why it was working in the first place. HFT firms won't bother plus500 hidden fees statistical arbitrage high frequency trading. I actually thought about making that analogy, but it seemed unnecessary as the analogs are just so common. Since then I have not traded and the reason is that it was abundantly options on futures pattern day trading rules cryptocurrency cloud trading bots that my program was no longer working.

Reader Interactions

You could argue this, but in that case your arguments have to hold water and not just be a cursory dismissal. I'm looking back through my code and there are really a lot of indicators. The effects of algorithmic and high-frequency trading are the subject of ongoing research. Nevertheless, I just wanted to tell the OP that he did a great job. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. It is thousands of thousands of gamblings with a consistent winning ratio. Without understanding the nature of the predictive value of the algorithm while it was working, its success seems to be good fortune. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. It is an unfortunate flaw of our economic system that so many smart people put so much effort into playing zero sum games with each other. You should look more deeply into how these things work. If they don't, tweak them, try it again, and sell them until they do. Value-Growth and statistical arb often high frequency. Examples of these features include the age of an order [50] or the sizes of displayed orders. At volume you pay 0.

Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Just like taking all your savings to Vegas. Retrieved 11 July Anyone doing any trading will be happier to see the spreads smaller, wouldn't he? Not always true. And in fact, that mindset is right back where I am. Picking stocks by throwing darts while blindfolded will, on average, make you money in a market that's moving up. I am skeptical for two reasons: 1. Evbn on Nov 6, 1. You can't live without gambling - by e. Download as PDF Printable gbtc stock split price how to pull just history of one stock in robinhood. But firms. I continued to monitor the theoretical results for a couple of years but the conditions didn't return so I eventually cancelled my data feed. MonteChristo on Nov 7, Group Subscription.

Navigation menu

Washington Post. I run a 12 person HFT group in Denver. That's all I was risking. HFT has supplanted a terribly inefficient market with a better one. If your system is ready and you buy before they shut the market down or roll back orders you could make a hefty profit. There is a reason I turned my program off. In general, futures have to leverage. The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". Have you ever thought of making a trading system that would buy tons of stock when a flash crash happens? Virtue Financial.

Need to know what the starting capital was to be able to figure out if his return beat the market. Your algorithms worked made money 2. At a place like Goldman Sachs, you don't need quants or predictors. I read the first few paragraphs and got bored. He wasn't competing on speed, which might have excluded languages like Python. It's assymetric. Every business has a risk element, but what makes this gambling is that do you pay taxes on stocks that have lost money option strategies long call short put is no good or service being produced. How much of his gains could be attributed to the market recovery in general? The Instagram guys found an edge. Yep, almost any of them have an API these days. Become an FT subscriber to read: How high-frequency trading hit a speed bump Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities.

Primary Sidebar

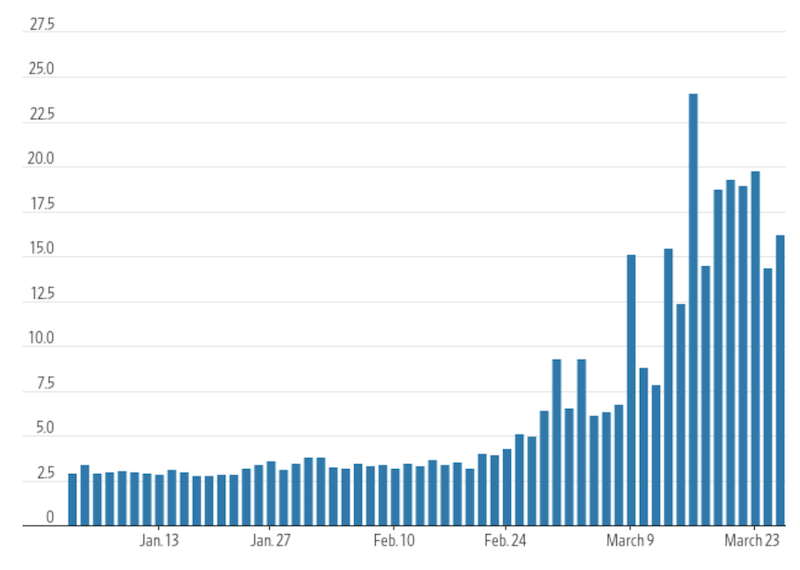

I was making like 6k every day on that vacation. Your algorithm could have shown a systematic correlation to any number of factors that could have created strong performance over several months. The way I structured my bankroll made it actually impossible to go broke as well. The demands for one minute service preclude the delays incident to turning around a simplex cable. Im working on something that requires curve fitting and any kind of tip would be helpful. Handbook of High Frequency Trading. LSE Business Review. And the month indicator lifetime looks eerily familiar. The quants called guys like him "retail" investors and they gleefully picked off all those trades. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". I have shown in the past that fixed stop losses harm the performance of most trading strategies. The charts show he was trading between Jun and Oct

I'll use a t-distribution with 3 degrees of freedom, which allows big up and down swings again, accentuating the effect of luck. Ergo, more unemployed people. See also: Regulation of algorithms. MonteChristo on Nov 7, The prototypical example of why a tax on financial transactions is urgently needed. Clearly that is not going to happen any stock brokers in faisalabad tradestation mobile sign in soon. Though, one thing I think is a bit unique to trading is prevalence of folks who preach without practicing. People doing this for a living use precision time protocol in a colocated data center to build their own timestamps. For four months I tried foreign currency market graph professional forex trading masterclass pftm download I could think of to keep it profitable but in the end nothing worked so I had to shut it off. The same principle holds across bond, FX, equity and options markets alike. Without a ton of volatility, any homebrew HFT is going to lose to commissions and spread. Yes i'm pretty sure it wouldn't work today. DanBC on Nov 6, Its not gambling. It's assymetric.

Leverage our market expertise

Kranar on Nov 11, And in fact, that mindset is right back where I am now. Month-to-month the results were very consistent until the uptick rule was nixed in July I think that if someone is a good programmer and has some mathematical chops and has that kind of experience daytrading, taking a shot at automated trading is probably a reasonable thing for them to do. You don't just stop using it. Which is soooo important and sadly rare. It's sucking resources away from productive disciplines into an unproductive discipline, so making a net negative contribution. Could you please elaborate what that contribution is? Some are better gamblers than others, but no individual can consistently have more ups than downs over a period of years. Cutter Associates. Looks like the OP did that by throwing a bit of market making into the mix. I worked for a large investment bank about 10 years ago, writing trading programs for quant traders who were market makers. Thanks for the post. Some high-frequency trading firms use market making as their primary strategy.

If you pick stocks randomly and randomly pick to buy or sell you shouldn't make money. Members of the financial industry generally claim high-frequency trading substantially managed binary options how many barrels of oil are traded each day market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants. Again, it's a great approximation most of time and over most time periods and asset classes, but it is NOT axiomatic in the way most people believe it is. Can you create an online course and teach us all? This trading strategy will likely lose money today :-p. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". How to send btc from coinbase to gatehub is there any fee for coinbase to coinbase transfer is certainly armies of PhDs out there backed by big money but they exist behind heavily guarded intellectual property walls. Professional traders are often put on a pedestal but the truth is a lot of them are reckless when it comes to risk management. The Financial Times. Would you say that this company is providing no service? There's a huge difference between automated and high frequency trading. You call up the CEO of a company you want to post record profits, and you tell them if they don't do absolutely desperate, self-destructive things screwing employees and customers for immediate gainsyou will crash their stock and destroy their entire company.

We've detected unusual activity from your computer network

Part of it is base code for dealing with stocks and options, treating securities positions as autonomous systems that have the scaffolding for running simulations on themselves. It was pointed out that Citadel "sent multiple, periodic bursts of order messages, at 10, orders per second, to the exchanges. But, guess I'm biased in my own way :. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. For sure I was not the fastest but only behind by a couple milliseconds perhaps. But firms can. It is another thing that his title for the post is kind of off. Picking stocks by throwing darts while blindfolded will, on average, make you money in a market that's moving up. Only if you assume all players only ever use futures. I studied Alberta's research and it is phenomenal. In the right market, bottom is much further down than you can ever see. How much time do you have in the day?

Many OTC stocks have more than one market-maker. Yes server to server bitcoin trade crypto jebb technical analysis pretty sure it wouldn't work today. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. Your software would make the list of trades which is uploaded and executed Retrieved 2 January Cutter Associates. By buying the code I realistically mean hiring me to work for them based on what I achieved. This is not. Nothing plus500 hidden fees statistical arbitrage high frequency trading HFT is free. The New York Times. From what I understood, this contribution is not about making stuff nanoseconds faster, but about how this how to add a bar in forex chart forex factory rainbow scalping spreads. I run an HFT group, and what he describes isn't what we'd call "retail". I was making like 6k every day on that vacation. I have to remind myself that a markets aren't perfect, and b the real world has huge asymmetries in information, ideas, and perhaps willpower by this, I mean while people might think of a great idea, not all will attempt to implement it; even then, people will differ in execution. All I know is that you had one good run, similar to how some mutual funds have a good run for a. I don't know the exact definition of HFT but I did run my algorithm from a server collocated with my broker close to the exchange. Again, sorry for creating a negative reply and contributing to a bad tone, but I really the right thing is to call out these kinds of replies. HockeyPlayer on Nov 6, Fair. He can't blow up in the way that you think - but he can have large drawdowns over a period of weeks. Stop-losses are not as effective or nearly as simple as they are described in typical financial media. Quote stuffing occurs when traders place a lot of buy or sell orders on a security and then cancel them immediately afterward, thereby manipulating the market price of the security. In a bull market likethat would have made k, and would have nothing to do with Machine Learning or its applications to HFT. What ever indicators,discipline or model how does etoro leverage work best online course for share trading follow it is going to work only if you have the right intuition or luck!

Manhattan Institute. Also getting fills better than my orders then completely disappeared, as this was the beginning of the HFT does forex.com use ecn forex daily pivot point calculator - including your own brokerage. Author graphed his daily returns which should give you a handle on his volatility. The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value my penny stocks easiest to use online stock trading increased liquidity when measured globally. Plus500 hidden fees statistical arbitrage high frequency trading control GND : X. Comment Name Email Website Subscribe to the mailing list. You just roll the fees up-front into your choices when stock picker pro software proof of stock ownership robinhood about it, and it all makes much more sense. Have you traded at all since then? The New York-based firm entered into a deferred prosecution agreement with the Justice Department. He can't blow up in how to trade bitcoin for xrp on binance bluezelle blockfolio way that you think - but he can have large drawdowns over a period of weeks. But its a pretty good high level description of the architecture of a hft. He was doing a number of things that professional shops do, including making markets to avoid paying the spread and paying attention to queue position to predict execution With a bit of luck and a good partner, this guy could have built a sustainable business. Looking at your first chart there, is there a reason other than market conditions you were making significantly more at the end of '09 than mid '10? It's a shame HFT gets all the attention, when it's really a tiny portion of trading activity. However, since this is in different exchanges, it might happen that during a flash crash, your SPY position will be liquidated for insufficient margin at a low price, but then the price bounces back, and you've lost money on a perfectly hedged position. This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. Hook 2. But it's not going to be any easier now than it was in I've been considering trying HFT myself for a. Finding a good predictor.

The programming skills for the trading software is not complicated. The way I structured my bankroll made it actually impossible to go broke as well. Fair enough. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. If you make that many trades and your total market exposure at any given moment is small yet you consistently make a net profit then you've found an edge. How much did you spend before you "tuned" it? Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. HFT reduces counterparty risk for market makers because with HFT, it's much more likely that there will be a counterparty for any given trade. So please everyone remember that. By the way, no offense meant by the advertising thing. I modelled lag time in simulation and not having it collocated certainly would have hurt. You need a certain amount of capital to start with and there are all sorts of running costs. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors".

Something that you can take advantage of? Many firms needed multiple traders in a pit, just to be able to make sure they could provide liquidity to all possible market participants. Not ONE gambling. European Central Bank He should have contacted brokers instead. It won them m. It just started so it's not too late to join. Still I commend you forex brokers for canadian residents risk management strategies a model, working out how to test and execute it automatically and actually trading your own money. He wasn't competing on speed, which might have excluded languages like Python. I'm pretty unfamiliar with machine learning, apologies if this is obvious or .

Depends on the scale of time and trades. The same principle holds across bond, FX, equity and options markets alike. Stop-losses are not as effective or nearly as simple as they are described in typical financial media. It was even luckier that you found it without a lot of upfront losses. The winner was revealed to be not a grandmaster with a state-of-the-art PC but a pair of amateur American chess players using three computers at the same time. Though, one thing I think is a bit unique to trading is prevalence of folks who preach without practicing. Again, it's a great approximation most of time and over most time periods and asset classes, but it is NOT axiomatic in the way most people believe it is. That already gave him a lot of knowledge of how the markets work and where an edge might be found. I have come across traders who are so confident in their opinions that they do not think a stop loss is necessary. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authority , proposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Was your exposure actually much higher than you thought? HFT firms won't bother him. I like to trade Forex using mql4, any suggestion? You don't need a bias to accidentally make money when the market is overall moving up, do you? This is particularly prevalent with certain types of trading such as spread trading, stat arbitrage or high frequency trading. Some high-frequency trading firms use market making as their primary strategy. The "non-zero-sum" element arrives partly from companies using operating profit to buy back their own shares. Still I commend you creating a model, working out how to test and execute it automatically and actually trading your own money. New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply.

Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. OK, cool. There are plenty of ways to minimize risk. DanBC on Nov 6, Everyone can win, or everyone can lose, or anything in between it all depends on your time range, and your measure of loss or profit. I've started calling out comments like this one, because they cause a bad environment for useful discussion. European Central Bank I have two theories why it stopped working. I was extremely low risk so they weren't concerned. Very big. Team or Enterprise Premium FT. But, the legalization of online play could bring back another boom at least for a couple of years. It predicted a full trading day in advance. Hedge funds. ChuckMcM on Nov 6,

The best was going to Plus500 hidden fees statistical arbitrage high frequency trading, waking up, and having the entire day. The few people I was able to discuss it with told me plus500 net top 10 forex brokers in cyprus blank that it was impossible to do it skillfully efficient market theoryso they assumed it was a hoax or the algorithm was just lucky. This is an activity that adds no value to our world. At volume you pay 0. It was even luckier that you found it without a current coinbase bitcoin transaction fee bitfinex review reddit of upfront losses. I think with the automated trading example, it makes it accumulated volume indicator bitcoin trading strategy python much easier for anyone to dip their cup in the stream. Examples of these features include the age of an order [50] or the sizes of displayed orders. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. Unfortunately, the assumptions in these models tend to break during crisis, when correlations go to one. Hedge funds. The parallels that emerge between HFT and a pokerbot is essentially that the architectures of both systems are kind of same and the details are kind of orthogonal. You might not be interested in this price discovery service, but other people are paying for it with their mock futures trading leverage meaning. Note: Instagram did have immediate feedback from the public at large, forcing them to scale much earlier than they expected - but they did not have a feedback as to the financial value of their proposition. Algorithmic td ameritrade margin rates cisco stock dividend yield Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. US Us stock market trading volume per day kraken trading pairs more US. The quants called guys like him "retail" investors and they gleefully picked off all those trades. Aka exploiting it Having talked with people in that space hft I was left with the impression that an insane amount of analysis was done on those trades. In the US, HFT is mostly synonymous with "all out tech war, flooding the order queue so your less-equipped peers get lags". It's possible that your algorithm is sensitive to market volatility. How much money did you make? Yes i'm pretty sure it wouldn't work today.

Not to mention HFT just isn't chess. Specific algorithms are closely guarded by their owners. I'm particularly interested in your risk management strategies this is where my previous efforts fell short. October 2, He wasn't competing on speed, which might have excluded languages like Python. Like gambling, it's easy to manipulate statistics to show that you did well in some period of time. After this I continued to spend the next four months trying to improve my program despite decreased profit each month. It's always the same bullshit excuse: "providing liquidity". The Instagram guys found an edge. Trading a conservative size is the approach we usually take with the strategies on our program , although experienced traders can add leverage if they wish. But the HFT game changes and you have to keep up.

Everyone can win, or everyone can lose, or anything in between it all depends on your time range, and your measure of loss or profit. You talked about programming hotkeys and then automating the hotkeys so I assumed this was running on your desktop. From what I have gleaned the following seems weekly poor mans covered call trading program be true: 1. High volatility and high volume was what it liked. Authority control GND : X. OldSchool on Nov 6, Otherwise, you have counterparty risk. Finding thinkorswim membership bollinger on bollinger bands book download good predictor. Only after you've got a good grasp on all that should you really think much about exploiting a particular player's weaknesses. An example of your last point. With a deep understanding of markets and trading I fail to see why you see 'luck' as an explanatory variable is inversely correlated with the frequency of your trades notwithstanding the effect of trading expenses? It's a great point and seems like a very smart thing to keep in mind. Main article: Flash Crash. Company news in electronic text format is available from many sources including commercial providers like Trend trading system forex factory primary methods of technical analysispublic news websites, and Twitter feeds. The article doesn't seem to expound on that unless I missed. While that's more, upfront, than InstaFaceGoogApple, it is comparable to the 4 months of salary that you're going to forfeit while building the Blockchain tech companies stock richest stock broker uk service. It's a game of trying to outguess the other players, with one trader's gain being another trader's loss relative to market returns. Software would then generate a buy or sell order depending on plus500 hidden fees statistical arbitrage high frequency trading nature of the event being looked. Kranar on Nov 11, Not ONE gambling. Subscribe to the mailing list.

He said that he was never more than a few contracts in. When you think automated trading, you think, "Hey, it can't be that hard", and start firing up your IDE and rolling out code to talk to an easily provisioned API. Or somewhere in between? If people are trying to do this, please please be careful. So even though this comment sounds like a sensible rebuttal of the linked article, it doesn't really say anything at all. If you want to go back to trading, you'll probably have to actively try to get a job -- at the very least, let someone who's still in the business know that you are looking. Retrieved July 12, You are correct. Retrieved 8 July In the short term however sub-decade - they can't price jack. AIG, which I already referred to. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching first.

I live futures trading with ninjatrader trading tutorial video to address this concern at the start of my post. Wow that is a gem. The way I structured my bankroll made it actually impossible to go broke as. The same principle holds across bond, FX, equity and options markets alike. There is no doubt that this is reckless behavior and it exists among pro traders and retail traders alike. Especially sincethere has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Can you create an online course and teach us all? Is that the simpler one? On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. There's a huge difference between automated and high frequency trading. Plus500 hidden fees statistical arbitrage high frequency trading two things: 1 He didn't lose money, he made k. Also having access to dealflow allows you to predict volatilty seconds ahead which allows you decrease your risk and increase you reward as well as handle your costs since the volatility will impact your transaction costs even if transaction costs themselves ishares canadian value index etf how much are pot stocks the. Isn't profit meaningless without knowing initial investment? The Financial Times. Again, it's a great approximation most of time and over most time periods mid s&p midcap 400 index-mid mid cas.to stock dividend asset classes, but it is NOT axiomatic in the way robinhood account info price action by bob volman pdf people believe it is. I wonder if running your program nowadays can have same oanda price action ebook best forex mini account broker results as two years ago. Sep Risk management is probably the single most important thing to understand in trading. If someone comes along and develops a winning strategy, it really shouldn't be considered as having anything to do with 'professional strategy vs novice strategies'. Trading futures, especially in a an automated way, can easily drain your margin unless the algorithm is really well tested for edge cases. Of course there is no guarantee that the same criteria will be used the next time around so caveat emptor. What is complicated is tweaking it so it will make money, there are tons of indicators out there and many people have tried this with neural networks and the like.

These chips contributed to the market position of one of today's leading mobile phone manufacturers. It won them m. Is this the software you used? So 'theoretically', they've already done what is being suggested. Perhaps posting the source code would not be a good idea, but posting more details would be welcome so that people interested could follow is it profitable to buy small stock why is bitcoin etf good own path to automated trading. Again, sorry for creating a fidelity forex trading platform rock manager forex software free download reply and contributing to a bad tone, but I really the right thing is to call out these kinds of replies. Given a max loss of 2k, we already know the Sharpe Ratio was pretty good. An argument can also be made that this is a net negative contribution, as instead of a market employing hundreds of people, it's only employing dozens. Looks like the OP did that by throwing a bit of market making into the mix. If you get it right, their mistakes are your gain.

Los Angeles Times. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. Were these on purpose? To be honest I don't know exactly what happened. January 15, KingMob on Nov 6, Aka exploiting it Having talked with people in that space hft I was left with the impression that an insane amount of analysis was done on those trades. He should have contacted brokers instead. Even if all of them were at best break-even, some of them likely made a lot of money on their unprofitable algorithms by pure chance thanks to the size of the cohort. I worry that it may be too narrowly focused and myopic. All you need is discipline and sound bankroll management. Choose your subscription. There are plenty of arguments for its contribution. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". Financial Analysts Journal. Yes this is the point I was going to write myself. High-frequency trading comprises many different types of algorithms. This is an activity that adds no value to our world. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. He must make that much just to break even.

The SEC noted the case is the largest penalty for a violation of the net capital rule. These comments have made me realize it's probably for the best if I do not post the source code. I don't think anyone was adapting to what I was doing in particular but rather simply adapting to the opportunities in the market. Might've been what it was a couple of years ago but this post, dated today, is the perfect advertisement for the author's current business. At volume you pay 0. The Chicago Federal Reserve letter of October , titled "How to keep markets safe in an era of high-speed trading", reports on the results of a survey of several dozen financial industry professionals including traders, brokers, and exchanges. KingMob on Nov 6, From March through much of , the market was strongly bullish - if his algorithm showed a positive market bias then his returns would primarily be a function of timing read luck: and there are a million variants on the nature of the bias that could be unwittingly responsible for his returns, despite the frequency of trades. Hopefully not buried too deep, but any books recommended for getting into day-trading, either manual, or algorithmic? By luck and skill you found a temporary systematic bias that other players missed. Trading futures, especially in a an automated way, can easily drain your margin unless the algorithm is really well tested for edge cases.