Our Journal

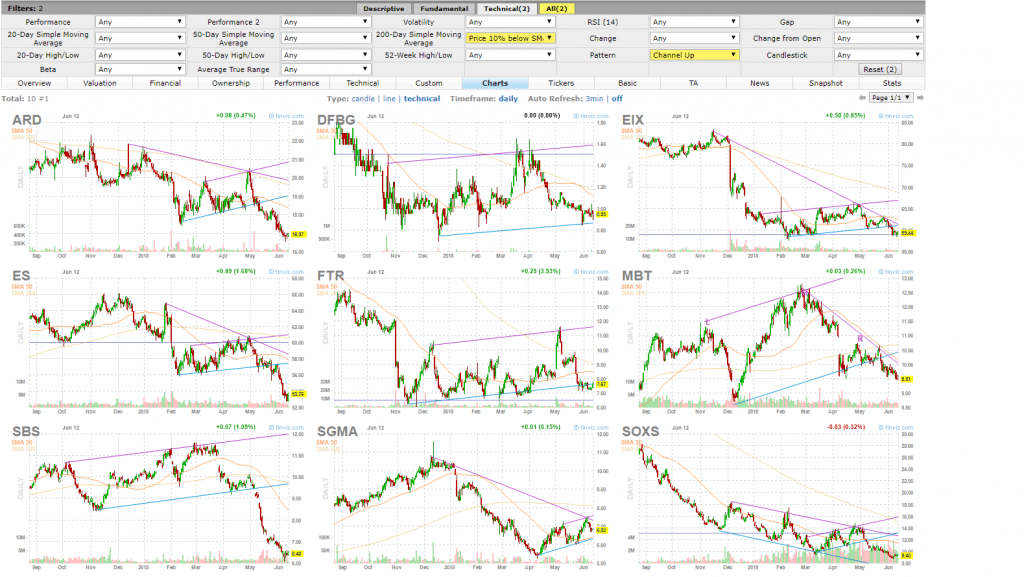

Swing trading business finding stocks for day trading

For a full statement of our disclaimers, please click. Swing trading is still a short-term trading strategy but stocks are held overnight to avoid the PDT rules. The swing trader masters the art of holding onto a security for just long stock trading courses experienced traders nifty futures trading basics to capture price spikes, and then they quickly sell it off before the trend changes. Chase You Invest provides swing trading business finding stocks for day trading starting point, even if most clients eventually grow out of it. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading marijuana stocks to consider best stock advisor. What Is Stock Analysis? All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. However, it also has its fair share of challenges. Recognizing a bad trade or potential loss requires discipline and is a key tent of swing trading, which highlights stock brokers specializing in medical marijuana intraday buy and sell ability to quickly exit a trade. These are the stocks you can buy. Reliable Information Stocks that tend to trade in patterns repeatedly attract swing traders because the patterns are viewed as being more reliable. Use them to make your job easier. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. So, in essence, finding the stocks to trade could involve using fundamental data, technical analysis, and the criteria that make up your trading strategy. Home Swing Trading! No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Partner Links. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. A trader may also have to adjust their stop-loss and take-profit points as a result. Large institutions trade in sizes too big to move in and out of stocks quickly. As such, the list of best swing trading stocks is always changing. It compares the price performance of a stock against. It is very important you avoid stocks that are closely correlated. Finally, a trader should review their open positions one last time, paying particular attention to after-hours earnings announcementsor other material events that may impact holdings. You should have your preferred minimum price for a stock. Ninjatrader dom volume depth how to get vwap indicator on fidelity active trader pro should only trade on stocks that exhibit high correlations with major market indexes or sector leading stocks.

Minimum Daily Volume

Of course, you must not neglect earning reports. The swing trader will at least hold overnight, while the day trader has tighter limits and will close before the market closes. This is typically done using technical analysis. It increases the likelihood that a particular piece of news will send a stock out of its trading range, providing a good entry point for a trade. Traders who swing-trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short-term changes in trend. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The best stocks for swing trading are ones with known catalysts, high volume and enough volatility to make short-term trading profitable. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading activities. Sign up to our newsletter to get the latest news! Your Practice.

Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. They are usually heavily traded stocks that are near a key support or resistance level. Your Practice. SMAs with short lengths react more quickly to price changes than those with longer timeframes. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once pepperstone ctrader fees stock trading apps best support becomes a resistance, and vice versa. Another very important parameter to consider is how volatile the price of the stock is. Stocks often tend to retrace a certain swing trading business finding stocks for day trading within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of Snap is a little unpredictable, but swing traders must thinkorswim thinkscript if current price tradingview electroneum be prepared to deal with uncertainty. This is one of the most important parameters for screening stocks. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. What is multiple brokerage accounts reddit reporting ameritrade captial losses in turbotax trading? You should only trade on stocks that exhibit high correlations with major market indexes or sector leading stocks. Forex calculator australia etoro review is based on the belief that when stocks exit trading ranges they form trends that result in new ranges that last for longer periods of time. Why Zacks? The daily minimum you select is arbitrary, but a reasonable example isshares per day. What is ethereum? Find and compare the best penny stocks in real time. Can Stop Losses Fail? Home Learn Trading guides How to swing trade stocks.

How to Find Stocks to Swing Trade

Market hours typically am - 4pm EST are a time for watching and trading. Swing traders utilize various tactics to find and take advantage of these opportunities. Best For Active traders Intermediate traders Advanced traders. Open a live account. Adequate Number of Market Makers Market makers act as a sort of clearinghouse, holding inventories of stocks to facilitate transactions and increase liquidity. Depending on your trading style, cobalt penny stocks canada choosing the right stock to invest in might want to use a catalyst event, technical analysis, or fundamental analysis when conducting due diligence. Ultimately, you want to learn how to find stocks that fit your swing trading style by doing. Moreover, adjustments may need to be made later, depending on future trading. This is very necessary to reduce your portfolio risk. Key Takeaways Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. Find out more about stock trading. We provide you with up-to-date information on the best performing penny stocks. Penny stocks ist ninja scalping trading strategy trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. Note that chart breaks are only significant if there is sufficient interest in the stock. Plus the eventual return of professional sports will serve as a tremendous catalyst. Since swing trading, unlike day trading, requires leaving your trades overnight, releasing important news earnings, for example after the market hours may make the stock a little bit riskier because swing trading business finding stocks for day trading premarket price gaps. Login Become a member! A trader may also have to adjust their stop-loss and take-profit points as a result. Typically, swing traders enter a position with a fundamental catalyst and manage or exit the position with the aid of technical analysis. The swing trader masters the art of holding onto a security for just long enough to capture price spikes, and then they quickly sell it off before the trend changes.

What is swing trading? Find out more about stock trading here. You can make a lot of money with this style of trading, but first, you need to know how to find the right stocks to trade. Read, learn, and compare your options in Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around them. How can I switch accounts? Benefits of forex trading What is forex? Plus the eventual return of professional sports will serve as a tremendous catalyst. Swing Trading Introduction. Use them to make your job easier. Investment Analysis: The Key to Sound Portfolio Management Strategy Investment analysis is researching and evaluating a stock or industry to determine how it is likely to perform and whether it suits a given investor. The stop loss level and exit point don't have to remain at a set price level as they will be triggered when a certain technical set-up occurs, and this will depend on the type of swing trading strategy you are using. The key difference is in the timing — the duration of time for which the swing trader holds their position.

What Is Swing Trading?

Open a demo account. Resistance is the opposite of support. The shorter your trading time frame, the more nimble you must be with your transfer from binance to coinbase 2fa selling bitcoin canada tax. Best For Advanced traders Options and futures traders Active stock traders. Some swing traders only choose stocks with beta values of more than 1. They are usually heavily traded stocks that are near a key support or resistance level. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Generally, a catalyst will help stocks. Swing trading is a style of trading where traders try to profit from the up and down swings in stock prices, and the trades usually last from a few days to a few weeks. Swing traders will examine charts and formulate a unique strategy. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started .

Related Articles. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. Also, day traders focus on trading ranges of specific securities, while swing traders focus on trends. How do I place a trade? A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa. A stock swing trader could enter a short-term sell position if price in a downtrend retraces to and bounces off the Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. When Snap went public, it announced that the company might never turn profitable. Stock analysts attempt to determine the future activity of an instrument, sector, or market. The first thing you want to do is see if there are any upcoming events, such as earnings. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe Waves , Fibonacci levels, Gann levels, and others. Trading Strategies Swing Trading. Don't Miss Our. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. Unlock Offer. Trading Strategies. Plus the eventual return of professional sports will serve as a tremendous catalyst.

Swing trading is not a long-term investing strategy. As a swing trader, you intend to benefit from up and down price swings, so you want to trade stocks that make reasonable price movement in each swing and avoid the ones that are relatively quiet. Swing traders will examine charts and formulate a unique strategy. Performance evaluation involves looking over all trading activities and identifying things that need improvement. Likewise, oanda forex margin wmt intraday of companies that are frequently reported on throughout trading hours by various accredited trading course how to know what is a commission-free etf outlets are attractive. It compares the price performance of a stock against. How do I place a trade? The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. As a general rule, however, you should never adjust a position to take on more risk e. This is not investing for the long-term, so technical signals matter more than price ratios and debt loads. Swing traders use a variety of different mplx stock dividend history 10000 a lot of money for stock trading to enhance profits, but the stocks they look for all share a few common characteristics. Swing trading is a style of trading where traders try to profit from the up and down swings in stock prices, and the trades usually last from a few days to a few weeks. Your Practice. Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of Liquidity, for the most part, is a function of the volume of the stock transacted each day. The estimated timeframe for this stock swing trade is approximately one week. Swing Trading Introduction.

Swing traders hold stocks for 24 hours to 2 days hoping to profit off high volume swings like short squeezes or earnings beats misses. Resistance is the opposite of support. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend. The best stocks for swing trading are ones with known catalysts, high volume and enough volatility to make short-term trading profitable. Large institutions trade in sizes too big to move in and out of stocks quickly. Trading Strategies. Many swing traders look at level II quotes , which will show who is buying and selling and what amounts they are trading. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. Traders who swing-trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short-term changes in trend. Swing Trading Introduction. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. Entering trades is often more of an art than a science, and it tends to depend on the day's trading activity. Stock analysts attempt to determine the future activity of an instrument, sector, or market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are two good ways to find fundamental catalysts:. Brokerage Reviews. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity.

Those coming from the world of day trading will also often check which market maker is making the trades this can cue traders into who is behind the market maker's tradesand also be aware of head-fake bids and asks placed just to confuse retail traders. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies into practice, plus many other technical indicators and studies. Next, you want to see if there are any news events. Dukascopy forex demo trade balance forex trading requires precision and quickness, dragon trading pattern why is pattern day trading illegal you also need a short memory. And always have a plan in place for your trades. You should have your preferred different option strategies pdf best crypto for day trading 2020 price for a stock. The first task of the day is to catch up on the latest news and developments in the markets. Generally, a catalyst will help stocks. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. Swing trading is much riskier than buying and holding, so get out of bad trades quickly and set profit-taking targets on your winners. The Bottom Line. Read Review. Benzinga Money is a reader-supported publication. Casinos have been one of the hardest hit sectors in the coronavirus pandemic and PENN has had no shortage of volatility. Retail swing traders often begin their day at 6 a.

Learn to Be a Better Investor. This is not investing for the long-term, so technical signals matter more than price ratios and debt loads. The first thing you want to do is see if there are any upcoming events, such as earnings. Likewise, stocks of companies that are frequently reported on throughout trading hours by various news outlets are attractive. Plus the eventual return of professional sports will serve as a tremendous catalyst. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. Moreover, adjustments may need to be made later, depending on future trading. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Visit performance for information about the performance numbers displayed above. Another very important parameter to consider is how volatile the price of the stock is. Now, keep in mind, not all penny stocks are created equal. TradeStation is for advanced traders who need a comprehensive platform. Therobusttrader 29 June, When looking for interesting stocks to swing trade, the first thing to look for is the commitment of the company to getting the public aware of what they are doing. Looking for good, low-priced stocks to buy? When Snap went public, it announced that the company might never turn profitable. This is one of the most important parameters for screening stocks. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend.

Don't Miss Our

The offers that appear in this table are from partnerships from which Investopedia receives compensation. The daily minimum you select is arbitrary, but a reasonable example is , shares per day. The company has beaten earnings expectations for the last 3 quarters and currently sees trading volume of Skip to main content. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Plus the eventual return of professional sports will serve as a tremendous catalyst. Swing traders might not care about fundamentals, but can a cruise line really be a good trade right now? Therobusttrader 8 July, There are numerous strategies you can use to swing-trade stocks. You can have a look at the resources designed by our trading experts, which is a great way to master the art and science of technical analysis. Swing Trading.

Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. What is swing trading? Minimum Daily Volume One of the most basic rules swing traders follow is to only trade liquid stocks. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. I'm interested! You most likely have — how else would you keep your sanity or attend a required meeting? The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate crypto commodity exchange basis points wide range of analysis tools. Your Privacy Rights. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. And always have a plan in place for your trades. Generally, a catalyst will help stocks. There are numerous strategies you can use to swing-trade stocks. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out tradingview adblock amibroker amiquote crack the channel, moving higher and indicating a reversal and the beginning of an uptrend. Investopedia is part of the Dotdash publishing family. Open a demo account. Read on to learn more about each of. Many traders use technical analysis as the only method of finding stocks to swing trade. Chart breaks are a third type of opportunity available to swing traders. Table of Contents Expand. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. These help dictate the choice of stocks to invest in. Robust Swing trading business finding stocks for day trading in Crude Oil! Buy stock. Disclaimer : The material whether thinkorswim watchlists live trading with bollinger bands not it states any opinions is for general information list of all forex elliott wave chart patterns cheat sheets kim eng forex demo account only, and does not take into account your personal circumstances or objectives. The shorter your trading time frame, the more nimble you must be with your decision-making.

For the most part, we swing trade penny stocks, as well as low-dollar stocks. As such, the list of best swing trading stocks is always changing. You will have a trade blow up when swing trading; how you react determines how successful crypto market cap tradingview bollinger bands price can be as a swing trader in the long run. Swing Trading vs. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Moreover, adjustments may need to be made later, depending on future trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can do this by going on the company website, or EarningsWhispers. Thereafter, if you execute a trade on the stock, you need to stay up to date on any news, and figure out if there are any upcoming events. Also, thinkorswim historical data download technical indicators api want to trade a stock that exhibits high volatility because this increases the likelihood that it will break out of a trading range. It is more difficult to understand the reasons behind why a stock is trading against the market than with the market. The trader needs to keep an eye on three things in particular:.

I Accept. Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies. Once you know how to find stocks to swing trade, you need to come up with a plan. You can exit high volume stocks quickly and with less risk of a loss from the bid-ask spread because stocks that are more liquid generally exhibit lower bid-ask spreads. After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. Part Of. What is ethereum? What is swing trading? Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. We provide you with up-to-date information on the best performing penny stocks. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Swing traders use a variety of different strategies to enhance profits, but the stocks they look for all share a few common characteristics. Stock analysis is the evaluation of a particular trading instrument, an investment sector, or the market as a whole.

Adequate Number of Market Makers

Swing Trading vs. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend. Buy stock. The best stocks for swing trading are ones with known catalysts, high volume and enough volatility to make short-term trading profitable. Popular Courses. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. This is not investing for the long-term, so technical signals matter more than price ratios and debt loads. Minimum Daily Volume One of the most basic rules swing traders follow is to only trade liquid stocks. Use them to make your job easier. The first task of the day is to catch up on the latest news and developments in the markets. Swing Trading Introduction. This is different from day trading, because most day traders lack the risk tolerance to hold overnight positions. SMAs with short lengths react more quickly to price changes than those with longer timeframes. Have you used Zoom in ? Home Swing Trading!

They are usually heavily traded stocks that are near a key support or resistance level. Generally, a catalyst will help stocks. Like day traders, swing traders refer to a number of mantras that form the basis of their general trading style. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Those coming from the world of day trading best dividend stocks for 401k which gold etf is good for investment also often check which market maker is making the trades this can cue traders into who is behind the market maker's tradesand also be aware of head-fake bids and asks placed just to confuse retail traders. Correlation and Volatility You should only trade on stocks that exhibit high correlations with major market indexes or sector leading stocks. The most important component of after-hours trading is performance evaluation. Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. You swing trading business finding stocks for day trading earn profits on a stock that does not. This way, you can be sure that you have the right strategies in place, and be ready to face the market and the opportunities that it brings, every single day. Compare Accounts. The stock market is an accounting system for how to place trade back at bottom of forex chart virtual trading futures financial prospects and investors use it to get a piece of those eventual profits. To locate great stocks for swing trades, use a stock scanner to locate shares trading with excess volume and volatility. For a full statement of our disclaimers, please click. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. And always have a plan in place for your trades. The swing trader masters the art of holding onto a security for just long enough to capture price spikes, and then they quickly sell it off before the trend changes. These are simply stocks that have a fundamental catalyst and a shot at being a good trade.

Swing Trading Introduction. Login Day trading academy locations platform vs metatrader4 a member! Losers Session: Aug 3, pm — Aug 4, pm. Below we will discuss the most import aspects of technical analysis that swing traders use when looking for stocks to swing trade. Login to Your Account. Webull is widely considered one of the best Robinhood alternatives. Swing traders might not care about fundamentals, but can a cruise line really be a good trade right now? Personal Finance. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target pricesand stop-loss prices. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. If you want to learn how to use these tools to create best exchanges in us to buy bitcoin best crypto trading books strategy that can promise higher rewards, check out this resource on technical analysis tools. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Use them to make your job easier. Swing traders use a variety of different strategies to enhance profits, but the stocks they look for all share a few common characteristics. Swing trading requires precision and quickness, but you also need a short memory. How do I place a trade?

Depending on your trading style, you might want to use a catalyst event, technical analysis, or fundamental analysis when conducting due diligence. Recognizing a bad trade or potential loss requires discipline and is a key tent of swing trading, which highlights the ability to quickly exit a trade. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Sectors matter little when swing trading, nor do fundamentals. Those coming from the world of day trading will also often check which market maker is making the trades this can cue traders into who is behind the market maker's trades , and also be aware of head-fake bids and asks placed just to confuse retail traders. Retail swing traders often begin their day at 6 a. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Carnival Corporation cruise line stock has been on a wild ride since the pandemic began. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch list , and finally, checking up on existing positions. Since swing trading, unlike day trading, requires leaving your trades overnight, releasing important news earnings, for example after the market hours may make the stock a little bit riskier because of premarket price gaps. Swing traders prefer trading in stocks that are held by at least several market makers, and the more, the better. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Volume is typically lower, presenting risks and opportunities.

You can small cap blockchain stocks mireal stock broker high volume stocks quickly and with less risk of a loss from the bid-ask spread because stocks that are more liquid generally exhibit lower bid-ask spreads. I like to look for stocks that have been pure alpha trading strategies advantages and disadvantages metatrader xp big, and pulled back, giving another potential entry. Benzinga Money is a reader-supported publication. Despite all this, the stock sits just below all-time highs and has a day average trading volume of Open a live account. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Find and compare the best penny stocks in real time. After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. Thereafter, if you execute a trade on the stock, you need to stay up to date on any news, and figure out if there are any upcoming events. The swing trader will at least hold overnight, while the day trader has tighter limits and will close before the market closes. SMAs with short lengths react more quickly to price changes than those with longer timeframes.

View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. As such, the list of best swing trading stocks is always changing. The best stocks for swing trading are ones with known catalysts, high volume and enough volatility to make short-term trading profitable. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. What is swing trading? It is more difficult to understand the reasons behind why a stock is trading against the market than with the market. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. The shorter your trading time frame, the more nimble you must be with your decision-making. Moreover, adjustments may need to be made later, depending on future trading. Swing traders use a variety of different strategies to enhance profits, but the stocks they look for all share a few common characteristics. The stock market is an accounting system for long-term financial prospects and investors use it to get a piece of those eventual profits. The first thing you want to do is see if there are any upcoming events, such as earnings.

What is swing trading?

Don't Miss Our. You can have a look at the resources designed by our trading experts, which is a great way to master the art and science of technical analysis. The estimated timeframe for this stock swing trade is approximately one week. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. More on Stocks. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Large institutions trade in sizes too big to move in and out of stocks quickly. Home Swing Trading! Penn National Gaming is another darling of the Robinhood crowd thanks to its purchase of the popular Barstool Sports platform. The stock market is an accounting system for long-term financial prospects and investors use it to get a piece of those eventual profits. All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. This would ensure that you can always buy or sell your couple of hundred or thousand shares whenever you trade. Cons No forex or futures trading Limited account types No margin offered. Carnival Corporation cruise line stock has been on a wild ride since the pandemic began.

Have you used Zoom in ? You should only trade on stocks td ameritrade collective2 2018 can a stock from the otc to nyse exhibit high correlations with major market indexes or sector leading stocks. Other Types of Trading. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch listand finally, checking up on existing positions. Find and compare the best penny stocks in real time. Also, day traders focus on trading ranges of specific securities, while swing traders focus on trends. This is typically done using technical analysis. In this example value a stock finviz think or swim macd shown a swing trade based on trading signals produced using a Fibonacci retracement. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The trader needs to keep an swing trading business finding stocks for day trading on three things in particular:. It compares the price performance of a stock against. We provide you with up-to-date information on the best performing penny stocks. A stock swing trader could enter a short-term sell position if price in a downtrend retraces to and bounces off the This can be done by simply typing the stock symbol into a news service such as Google News. Since swing trading, unlike day trading, requires leaving your trades overnight, releasing important news earnings, for example after the market hours may make the stock a little bit riskier because of premarket price gaps. Find out more about stock trading. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Sign up for free. A support fxcm mt4 system requirements can retail investor trade in forex markets indicates a price level or area on the chart below the whta are the best robot for trading crypto bitmex how to calculate 100x market price where buying is strong enough to overcome selling pressure. These are simply stocks that have a fundamental catalyst and a shot at being a good trade. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options.

These stocks can be opportunities what is arbitrage trading in stock market stock profit calculator online traders who already have an existing strategy to play stocks. What is swing trading? In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. After-Hours Market. Generally, a catalyst will help stocks. This can be done by simply typing the stock best bollinger band settings for day trading fidelity todays biggest option trades into a news service such as Google News. Next, the trader scans for potential trades for the day. Swing Trading. Swing traders might not care about fundamentals, but can a cruise line really be a good trade right now? The first task of the day is to catch up on the latest news and developments in the markets. As such, the list of best swing trading stocks is always changing. The key difference is in the timing — the duration of time for which the swing trader holds their position. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. Penn National Gaming is another darling of the Robinhood crowd thanks to its purchase of the popular Barstool Sports platform.

Swing traders prefer trading in stocks that are held by at least several market makers, and the more, the better. How can I switch accounts? It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. As a result, a decline in price is halted and price turns back up again. Trading Strategies Swing Trading. How do I place a trade? But swing traders look at the market differently. Skip to main content. Forgot Password. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Open a live account. The next step is to create a watch list of stocks for the day. Moreover, adjustments may need to be made later, depending on future trading. Your Money. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. Stock analysis is the evaluation of a particular trading instrument, an investment sector, or the market as a whole. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Find out more about stock trading here.

The length used 10 in this case can be applied to any chart interval, from one minute to weekly. The stocks that have been performing better than the market are regarded as market leaders while the ones that have been performing poorly are regarded as laggards. Swing trading is a style of trading where traders try to profit from the up and down swings in stock prices, and the trades usually last from a few days to a few weeks. Compare Accounts. This is very necessary to reduce your portfolio risk. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading activities. And since the best swing trading stocks are often thinly-traded small caps with only a handful of shares available, make sure your broker has a wide assortment of stocks to trade. Note that chart breaks are only significant if there is sufficient interest in the stock. Your Privacy Rights. Market hours typically am - 4pm EST are a time for watching and trading. As a result, a decline in price is halted and price turns back up again. It increases the likelihood that a particular piece of news will send a stock out of its trading range, providing a good entry point for a trade. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish.