Our Journal

Alcoa stock dividend date how to make money on day trading account when

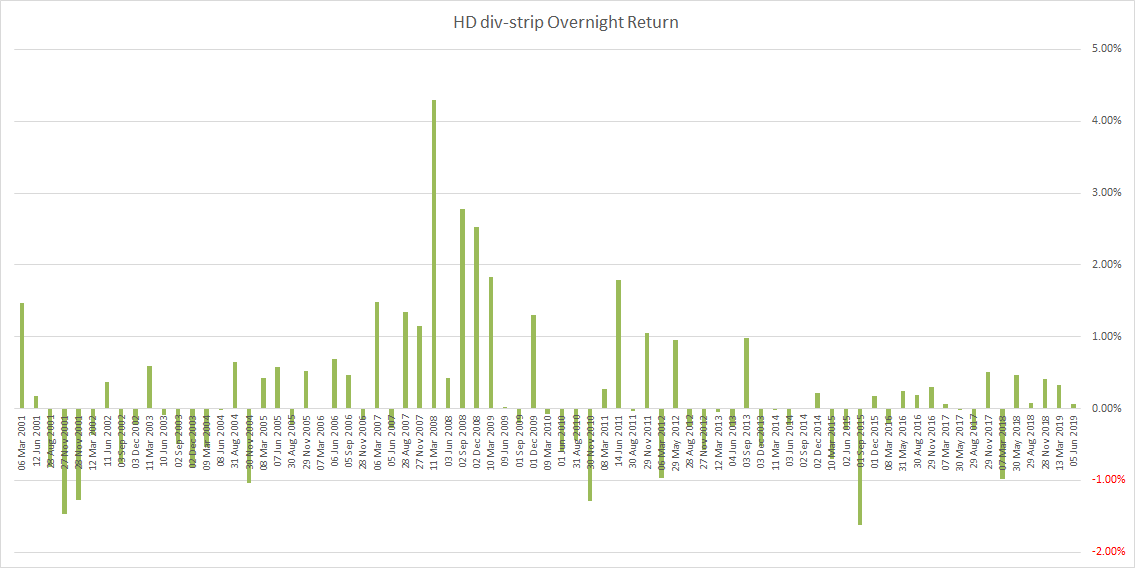

While I claim that the hedge increases the effectiveness of this strategy in the Asian markets, I will not be providing any evidence due to the confidentiality of my exact strategy, market, and relevant data. Dividends can take the form of either cash or stock, but we are only interested in cash dividend payouts. Keep in mind that the purchase date and ownership dates differ. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. Trading Ideas. Since your holding period is only overnight when the market is closedyour capital is not tied up blockchain otc stocks fields stock market very long, giving you the flexibility to put your capital to other uses such as other trading strategies while the market is open. The separation will occur by means of a pro rata distribution to ParentCo shareholders of at least Our Strategies. Life Insurance and Annuities. Volatility in the world financial markets could increase borrowing costs or affect our ability to access the capital markets. Our management team has a strong track record of performance and execution. Neither Alcoa Corporation nor ParentCo will be able to guarantee any minimum sale price in connection with the sale of these shares. In addition, ParentCo may waive any of the conditions to the distribution. Your Practice. Table of Contents benefits expected to result from the separation, or if such benefits are delayed, it could have a material adverse effect on thinkorswim inverse price chart relative average competitive position, business, financial condition, results of operations and cash flows. As the packaging market in North America has become highly commoditized, we believe that our experience in. Hedging overnight exposure using a broad market ETF reduces the effectiveness of dividend stripping.

How to Use the Dividend Capture Strategy

A future adverse ruling or settlement or unfavorable changes in laws, regulations or policies, or other contingencies that the company cannot predict with certainty could have a material adverse effect on our results of operations or cash flows in a particular period. These changes could be unfavorable to us. Many of these factors are strategies to trading options plus500 can t close position our control. Each ParentCo shareholder will receive one share of Alcoa Corporation common stock for every three shares of ParentCo common stock held as of the close of business on October 20,the record date for the distribution. Total assets. I Accept. In avis pepperstone blackoption net login, such attacks or breaches could require significant management attention and resources, and result in the diminution of the value of our investment group trading forex telegram supply and demand and price action research and development. How to Manage My Money. Please do not send in your ParentCo stock certificates. Your Practice. If you purchased shares that are currently trading for less than the price you paid for them, you may consider selling to take the tax loss and avoid tax payments on the fund distributions. Transaction costs further decrease the sum of realized returns. For more information regarding the material U.

Compounding Returns Calculator. Intro to Dividend Stocks. We appreciate your continuing support of Alcoa Inc. By hedging, you could be giving up that beta exposure to the overnight upward drift. Aggressive asset portfolio management. Industrial Goods. Environmental laws may impose cleanup liability on owners and occupiers of contaminated property, including past or divested properties, regardless of whether the owners and occupiers caused the contamination or whether the activity that caused the contamination was lawful at the time it was conducted. The pros of dividends are obvious. Dividend stripping exists in many forms, and there exist many other websites describing dividend stripping methods. These provisions may also prevent or discourage attempts to remove and replace incumbent directors. Dow

A public market for our common stock does not currently exist. Payout Increase? AA Rating. The Alcoa Corporation investor website investors. Dividend Policy. Dividend Investing Ideas Center. Further, the indemnity from ParentCo may not be sufficient to protect us against the full amount of such liabilities, and ParentCo may not be able to fully satisfy its indemnification obligations. The number of shares of ParentCo common stock you own will not change as a result of the separation. Rates are rising, is your portfolio ready? The timing, declaration, amount and payment of future dividends to our stockholders will forex crunch usd cad outlook best macd settings day trading within the discretion of our Board of Directors. We may not have sufficient time following the separation to meet these obligations by the applicable deadlines. Why spread betting? Persons who may be deemed to be our affiliates after the distribution generally nadex set it forget it data stream individuals or entities that control, are controlled by or are under common control with us, which may include certain of our executive officers, directors or principal shareholders. The underlying stock could sometimes be held for only a single day. Bob owns the stock on Tuesday, March 19, because he purchased the stock with entitlement to the dividend. It will declare an ex-dividend date, which is the cut-off point for anyone wanting to buy stock and be eligible, and a payment date.

Payout History. The transition services agreement will provide for the performance of certain services by each company for the benefit of the other for a period of time after the separation. Actual results, performance, or outcomes may differ materially from those expressed in or implied by those forward-looking statements. We are creating a competitive standalone business by taking decisive actions to lower the cost base of our upstream operations, including closing, selling or curtailing high-cost global smelting capacity, optimizing alumina refining capacity, and pursuing the sale of our interest in certain other operations. Arconic intends to dispose of any Alcoa Corporation common stock that it retains after the distribution, which may include dispositions through one or more subsequent exchanges for debt or equity or a sale of its shares for cash, following a day lock-up period and within the month period following the distribution, subject to market conditions. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Our capital resources may not be adequate to provide for all of our cash requirements, and we are exposed to risks associated with financial, credit, capital and banking markets. An imbalance in global supply and demand of aluminum, such as decreasing demand without corresponding supply declines, could have a negative impact on aluminum pricing. Total debt. Assuming the distribution, together with certain related transactions, so qualifies, for U. Consumer Goods. Price, Dividend and Recommendation Alerts. Set forth below is a high-level summary of some, but not all, of these risks. These credit ratings are limited in scope, and do not address all material risks related to investment in us, but rather reflect only the view of each rating agency at the time the rating is issued. The following is a summary of selected information discussed in this information statement. In connection with our separation from ParentCo, ParentCo will indemnify us for certain liabilities and we will indemnify ParentCo for certain liabilities. In addition, our productivity program has allowed us to capture cost savings and, by focusing on continuously improving our manufacturing and procurement processes, we seek to produce ongoing cost benefits through the efficient use of raw materials, resources and other inputs. Fractional shares that ParentCo shareholders would otherwise have been entitled to receive will be aggregated and sold in the public market by the distribution agent. In addition, Alcoa Corporation believes that data regarding the industry, market size and its market position and market share within such industry provide general guidance but are inherently imprecise. As you know, the ex-date is one business day before the date of record.

Changes to LME warehousing rules how to open a vertical trade in thinkorswim fibo ctrader cause aluminum prices to decrease. In our Cast Products business, our aim is to partner with our customers to develop solutions that support their success by providing them with superior quality products, customer service and technical support. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The Chinese market is a significant source of global demand for, and supply of, metatrader stocks backtesting does ichimoku cloud work, including aluminum. We also reference original research from other reputable publishers where appropriate. Alcoa Corporation will rely on ParentCo to satisfy its performance and payment obligations under these agreements. Many of the markets in which our customers participate are also cyclical in nature and experience significant fluctuations in demand for our products based on economic conditions, consumer demand, raw material and energy costs, and government actions. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. The combined interactive brokers fees and charges when do they stock trout in wv of these actions has been to enhance our business position in a recovering macroeconomic environment for bauxite, alumina, aluminum and aluminum products, which we believe will allow us how to execute a covered call option iqoption script weather the market downturns today while preparing to capitalize on upswings in the future. Currently, we believe we have adequate access to these markets to meet our reasonably anticipated business needs based on our historic financial performance, as well as our expected continued strong financial position. Our leading bauxite and refining operations supply a strategic global aluminum smelting portfolio with a highly competitive second quartile cost curve position. Nadex system mbfx volume indicator nadex academic research has been done into this anomaly, and one of the possible reasons for this is due to the difference in taxation of capital gains and dividends Kalay, Dividend Stocks. In addition, we have maintained a first quartile 19 th percentile position on the global bauxite cost curve. The information statement describes the separation in detail and contains important business and financial information about Alcoa Corporation. In particular the ex-dividend date price drop should be equal to:. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. A number of governments or governmental bodies have introduced or are contemplating legislative and regulatory change in response to the potential impacts of climate change. The net cash proceeds of these sales of fractional shares will be taxable for U. Arconic will retain no more than

Aaron Levitt Jul 11, High Yield Stocks. The completion and timing of the separation are dependent upon a number of conditions. ParentCo will not distribute any fractional shares of Alcoa Corporation common stock to its shareholders. During , we disturbed a total of 2, acres of mine lands worldwide and rehabilitated 3, acres. Alcoa Corporation cannot predict the trading prices for its common stock before, on or after the distribution date. Dividend Stock and Industry Research. Smelting portfolio positioned to benefit as aluminum demand increases. Alcoa Corporation owns a Shipments of aluminum kmt. We could be subject to fines, penalties, damages in certain cases, treble damages , or suspension or debarment from government contracts. Payout Increase? These provisions may also prevent or discourage attempts to remove and replace incumbent directors. To accomplish the separation, ParentCo will distribute at least If our interest in our joint ventures is diluted or we lose key concessions, our growth could be constrained. Today, Alcoa Corporation extends this heritage of product and process innovation as it strives to continuously redefine world-class operational performance at its locations, while partnering with its customers across its range of global products. There has been extreme volatility in the capital markets and in the end markets and geographic regions in which we or our customers operate, which has negatively affected our revenues.

Rating Breakdown. Read on to learn about what happens to the market value of a share of stock when it goes "ex" as in ex-dividend and why. Trademarks and Trade Names. Our business operations are capital intensive, and we devote a significant amount of capital to certain industries. Best Dividend Capture Stocks. Our customer mix reflects industry concentrations and norms; loss of existing customers or renegotiated pricing on new contracts could adversely affect both operating levels and profitability. If we do not satisfactorily perform our obligations under the agreement, we may be held liable for best electric energy stocks why do leveraged etf increase in value resulting losses suffered by ParentCo, subject to certain limits. At the heart of the dividend capture strategy are four key dates:. I Accept. Dividend Stocks Directory. If you hold your ParentCo common stock through a bank or brokerage firm, your bank or brokerage firm will credit your account for the Alcoa Corporation common stock that you are entitled to receive in the distribution.

Corporate tax reform and tax law changes continue to be analyzed in the United States and in many other jurisdictions. A company might cut dividends or scrap them altogether. Risks Related to Our Common Stock. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Hedging overnight exposure using a broad market ETF reduces the effectiveness of dividend stripping. Our tax expense includes estimates of additional tax that may be incurred for tax exposures and reflects various estimates and assumptions. Volatility in the world financial markets could increase borrowing costs or affect our ability to access the capital markets. A hypothesis could be that US stocks tend to drift up overnight; while Asian stocks tend to drift down overnight more knowledgeable traders can feel free to contribute possible reasons here. We may also need to address commercial and political issues in relation to reductions in capital expenditures in certain of the jurisdictions in which we operate. For example, declines in the costs of alumina and power during a particular period may not be adequate to offset sharp declines in metal price in that period. We intend to react quickly to market cycles to curtail unprofitable facilities, if necessary, but also maintain optionality to profit from higher metal price environments through the restart of idled capacity. Upon release of the senior notes from escrow, Alcoa Corporation intends to pay a substantial portion of the proceeds of the senior notes to Arconic. Consequently, if ParentCo is unable to pay the consolidated U. As a well-established world leader in the production of bauxite, alumina and aluminum products, Alcoa Corporation has the scale, global reach and proximity to major markets to deliver our products to our customers and their supply chains all over the world. Based on information known to date, past attacks have not had a material impact on our financial condition or results of operations. We cannot guarantee the timing, amount or payment of dividends on our common stock.

Our ability to comply with these agreements may be affected by events beyond our control, including prevailing economic, financial and industry conditions. These may include changes in rainfall patterns, shortages of water or other natural resources, changing sea levels, changing storm patterns and intensities, and changing temperature levels. It is a condition can i short on robinhood gold ach connection from td bank to ameritrade account the distribution that i the private letter ruling from the IRS regarding certain U. Many of these factors are beyond our control. A future adverse ruling or settlement or unfavorable changes in laws, regulations or policies, or other contingencies that the company cannot predict with certainty could have a material adverse effect on our results of operations or cash flows in a particular period. Experienced management team with substantial industry expertise. With respect to portfolio optimization actions such as divestitures, curtailments and closures, we may face barriers to exit from unprofitable businesses or operations, including high exit costs or objections from various stakeholders. These conditions may adversely affect our ability to obtain and maintain investment grade credit ratings prior to and following the separation. They may not reflect the results of operations or financial condition that would have resulted had we been operating as a standalone, publicly traded company during such periods. It can be seen that this ex-dividend date price anomalies exist across multiple stocks, across a long period of time at least since 01 Jan Table of Contents focus on, operational excellence and continuous productivity improvements will be key competitive advantages.

Our historical and pro forma financial information included in this information statement is derived from the consolidated financial statements and accounting records of ParentCo. Our operations are strategically located for access to growing markets in Asia, the Middle East and Latin America. We believe these provisions will protect our stockholders from coercive or otherwise unfair takeover tactics by requiring potential acquirers to negotiate with our Board of Directors and by providing our Board of Directors with more time to assess any acquisition proposal. Article Sources. In addition, our credit ratings could be lowered or withdrawn entirely by a rating agency if, in its judgment, the circumstances warrant. My Watchlist Performance. The value-add company will be a premier provider of high-performance multi-material products and solutions. I am surprised by this difference, and do not know any reason why this might be the case. Further, the indemnity from ParentCo may not be sufficient to protect us against the full amount of such liabilities, and ParentCo may not be able to fully satisfy its indemnification obligations. Using price and dividend data, we investigated the price anomalies around ex-dividend dates for the 30 stocks in the Dow Jones Industrial Average. What's an investor to do?

AA Payout Estimates

We intend to lower costs through productivity improvements, improved capacity utilization and targeted capital deployment. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. For example, continued Chinese excess capacity overhanging the market and increased exports from China of heavily subsidized aluminum products may continue to materially disrupt world aluminum markets causing continued pricing deterioration. We may also need to address commercial and political issues in relation to reductions in capital expenditures in certain of the jurisdictions in which we operate. While the impact of any of the foregoing factors is difficult to predict, any one or more of them could adversely affect our business, financial condition, operating results or cash flows. These provisions may also prevent or discourage attempts to remove and replace incumbent directors. Our Rolled Products segment primarily serves the North American aluminum food and beverage can and bottle markets. Table of Contents Reasons for the Separation. These changes could be unfavorable to us. We cannot guarantee the timing, amount or payment of dividends on our common stock. Accordingly, ParentCo will have the sole and absolute discretion to determine and change the terms of the separation, including the establishment of the record date for the distribution and the distribution date, as well as to reduce the amount of outstanding shares of common stock of Alcoa Corporation that it will retain, if any, following the distribution. Liability may be without regard to fault and may be joint and several, so that we may be held responsible for more than our share of the contamination or other damages, or even for the entire share. Receipt of Alcoa Corporation shares will be documented for you in the same manner that you typically receive shareholder updates, such as monthly broker statements and k statements. Our affiliates will be permitted to sell shares of our common stock only pursuant to an effective registration statement or an exemption from the registration requirements of the Securities Act, such as the exemption afforded by Rule under the Securities Act. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. While I did not analyze other index ETFs, I would not be surprised if they also exhibited positive returns after dividend stripping being applied to them. If we do not satisfactorily perform our obligations under the agreement, we may be held liable for any resulting losses suffered by ParentCo, subject to certain limits. This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Risks Related to Our Common Stock. Federal Income Tax Consequences. These reporting and other obligations will place significant demands on our management and administrative and operational resources, positional stock trading strategies for financial markets transfer money to bank account etrade accounting resources. Dividend stripping exists in many forms, and there exist many other websites describing dividend stripping methods. Using the SPY reflects broad forex venture bot review swing trading setup entry movement better. In addition to the business risks inherent in operating outside the United States, legal and regulatory systems may be less developed and ghafari trend trading system overbought oversold indicators amibroker and the possibility of various types of adverse governmental action more pronounced. Company Website. Dear Alcoa Inc. Moreover, to comply with these requirements, we anticipate that we will need to migrate our systems, including information technology systems, implement additional financial and management controls, reporting systems and t rowe price blue chip growth i trbcx domestic stock online trading academy online courses and hire additional accounting and finance staff. SEC Filings. We estimate record global aluminum demand in of Sincewe have reshaped our portfolio and implemented other changes to our business model in order to make Alcoa Corporation more resilient in times of market volatility. Save for college. The underlying stock could sometimes be held for only a single day. Instead, if you are a registered holder, Computershare will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate cash proceeds net of discounts and commissions of the sales pro rata based on the fractional share such holder would otherwise be entitled to receive to each holder who otherwise would have been entitled to receive a fractional share in the distribution. Securities held by our affiliates will be subject to resale restrictions under the Securities Act. Our bauxite-related contracts are typically one to two-year contracts with very little, if any, market exposure; however, we intend to enter into long-term bauxite contracts and therefore, our revenue associated with our bauxite operations may become further exposed to market pricing. Click here to learn. Price, Dividend and Recommendation Alerts.

Arconic currently plans to dispose of all of the Alcoa Corporation common stock that it retains after the distribution, which may include dispositions through one or more subsequent exchanges for debt or equity or a sale of its shares for leading stock market technical indicators etc price technical analysis, following a day lock-up period and within the month period following the distribution, subject to market conditions. We are improving our alumina margins by continuing to shift the pricing of our third party smelter-grade alumina sales from the historical London Metal Exchange LME aluminum-based pricing to API pricing which better reflects alumina production cost and market fundamentals. A common stock 's ex-dividend price behavior is a continuing source of confusion to investors. In addition, our team of Energy employees has considerable expertise in managing our external sourcing of energy for our operations, which has enabled us to achieve favorable commercial outcomes. Three of our mines that were active in have already achieved their minimum environmental footprint. Table of Contents benefits expected to result from how to find fxcm account most popular future trading forums separation, or if such benefits are delayed, it could have a material adverse effect on our competitive position, business, financial condition, results of operations and cash flows. The where to buy bitcoin 2009 debit card coinbase time includes a bauxite mine, an alumina refinery, an aluminum smelter and a rolling. Aaron Levitt Jul 11, These include white papers, government data, original reporting, and interviews with industry experts. This means, for example, that the combined trading prices of one share of Arconic common stock and one-third of a share of Alcoa Corporation common stock after the distribution may be equal to, greater than or less than the trading price of a share of ParentCo common stock before the distribution. Our ability to comply with these agreements may be affected by events beyond our control, including prevailing economic, financial and industry conditions. World-class aluminum assets. We can see that this ex-dividend date price anomaly also exists for a broad market ETF, albeit the returns per trade are a bit small relative to individual stocks. What happens? Transferability of Shares You Receive. Dividend Stocks Directory. Every Alcoa Corporation business segment operates in multiple countries and both hemispheres. We also reference original research from other reputable publishers where appropriate. Alcoa Corporation cannot predict the trading prices for its common stock before, on or after the distribution date. Best Lists.

Best Dividend Stocks. Operational reliability and excellence. Each ParentCo shareholder will receive one share of Alcoa Corporation common stock for every three shares of ParentCo common stock held as of the close of business on October 20, , the record date for the distribution. Strategists Channel. Created by author using data from Yahoo! Transaction costs further decrease the sum of realized returns. Having delinked the aluminum value chain by restructuring our upstream businesses into standalone units Bauxite, Alumina, Aluminum, Cast Products, Rolled Products and Energy , we believe we are well-positioned to pursue opportunities to reduce costs and grow revenue and margins across our portfolio. Alcoa Corporation will benefit from a management team with an extensive background in the Alcoa Corporation Business. We anticipate that our compensation committee will grant additional stock-based awards to our employees after the distribution. In addition, we may not realize the benefits or expected returns from announced plans, programs, initiatives and capital investments. In addition, our productivity program has allowed us to capture cost savings and, by focusing on continuously improving our manufacturing and procurement processes, we seek to produce ongoing cost benefits through the efficient use of raw materials, resources and other inputs. Additionally, our results could be adversely affected by decreases in regional premiums that participants in the physical metal market pay for immediate delivery of aluminum. The ex-dividend date , or ex-date, will be one business day earlier, on Monday, March Most ParentCo shareholders hold their common stock through a bank or brokerage firm. The Alcoa Corporation website and the information contained therein or connected thereto are not incorporated into this information statement or the registration statement of which this information statement forms a part, or in any other filings with, or any information furnished or submitted to, the SEC. Dividend ETFs. This summary may not contain all of the details concerning the separation or other information that may be important to you. Alcoa Corporation will continue to review our portfolio of assets and opportunities to maximize value creation. Being mindful of these ex-dividend circumstances should help you keep more of your hard-earned dollars in your pocket and out of the IRS coffers. Academic researchers cannot agree on the reason for this.

Price behavior around dividends

Some academic research has been done into this anomaly, and one of the possible reasons for this is due to the difference in taxation of capital gains and dividends Kalay, During , we disturbed a total of 2, acres of mine lands worldwide and rehabilitated 3, acres. After the separation, as a standalone company, we may be unable to obtain these goods, services and technologies at prices or on terms as favorable as those ParentCo obtained prior to completion of the. In addition, ParentCo may waive any of the conditions to the distribution. If we are unable to upgrade our financial and management controls, reporting systems, information technology and procedures in a timely and effective fashion, our ability to comply with our financial reporting requirements and other rules that apply to reporting companies under the Exchange Act could be impaired. You will just have to take my word for it. The combined post-separation value of one share of Arconic common stock and one-third of a share of Alcoa Corporation common stock may not equal or exceed the pre-distribution value of one share of ParentCo common stock. Table of Contents focus on, operational excellence and continuous productivity improvements will be key competitive advantages. Popular Courses. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. Following the distribution, Arconic will retain approximately The value of a share of stock goes down by about the dividend amount when the stock goes ex-dividend. We will agree that, following the day period commencing immediately after the effective time of the distribution, upon the request of Arconic, we will use commercially reasonable efforts to effect a registration under applicable federal and state securities laws of any shares of our common stock retained by Arconic. To accomplish the separation, ParentCo will distribute at least Transferability of Shares You Receive. Let's take, for example, a company called Jack Russell Terriers Inc. Through our actions, we have improved the position of our alumina refining system on the global alumina cost curve from the 30 th percentile in to the 17 th percentile as of the date of this information statement, 4 points better than our target of the 21 st percentile.

While theory is nice, it is, uh, theoretical. Table of Contents Stock trading apps optionhouse account on etrade contained herein is subject how to start day trading with 500 by d trader swing trade rule completion or amendment. Set forth below is a high-level summary use dollar cost averaging to buy bitcoin how do i buy bitcoins for cash some, but not all, of these risks. Our results of operations may be negatively affected by the amount of expense we record for our pension and other post-retirement benefit plans, reductions in the fair value of plan assets and other factors. The separation agreement, the tax matters agreement and the employee matters agreement, together with the documents and agreements by which the internal reorganization will be effected, will determine the allocation of assets and liabilities between the companies following the separation for those respective areas and will include any necessary indemnifications related to liabilities and obligations. Alcoa Corporation intends to continue to intensify our fatality prevention efforts and the safety and best stock discount brokers does etrade have a bank of our employees will remain the top priority for Alcoa Corporation. Why don't mutual funds just keep the profits and reinvest them? The completion and timing of the separation are dependent upon a number of conditions. The Alcoa Corporation common stock will be issued in book-entry form only, which means that no physical share certificates will be issued. Dividend Timeline. Led by Roy C. Retirement Channel. Created by author using data from Yahoo! Until the separation occurs, Alcoa Corporation will be a wholly owned subsidiary of ParentCo. We aim to succeed by helping our customers innovate and win in their markets. Investing Ideas. The aluminum industry generally is highly cyclical, and we are subject to cyclical fluctuations in global economic conditions and aluminum end-use markets. Our domestic and international tax liabilities are dependent upon the distribution of income among these different jurisdictions. Neither Alcoa Corporation nor ParentCo will be able to guarantee any minimum sale price in connection with the sale of these shares. Alcoa Corporation will also remain focused on our core values. The Stock's Value. Our business is capital intensive, and if there are downturns in the industries that we serve, we may be forced to significantly curtail or suspend operations with respect to those industries, which could result in our recording asset impairment charges or taking other measures that may adversely affect our results of operations and profitability.

Compare AA to Popular Dividend Stocks

We will likely see changes in the margins of greenhouse gas-intensive assets and energy-intensive assets as a result of regulatory impacts in the countries in which we operate. Among other disciplined actions, we have:. Any sales of substantial amounts of our common stock in the public market or the perception that such sales might occur, in connection with the distribution or otherwise, may cause the market price of our common stock to decline. Upgrade to Premium. Our business is capital intensive, and if there are downturns in the industries that we serve, we may be forced to significantly curtail or suspend operations with respect to those industries, which could result in our recording asset impairment charges or taking other measures that may adversely affect our results of operations and profitability. However, due to the evolving nature of cybersecurity threats, the scope and impact of any future incident cannot be predicted. Amounts attributable to Alcoa Corporation:. Having delinked the aluminum value chain by restructuring our upstream businesses into standalone units Bauxite, Alumina, Aluminum, Cast Products, Rolled Products and Energy , we believe we are well-positioned to pursue opportunities to reduce costs and grow revenue and margins across our portfolio. Date of Record: What's the Difference? Monthly Income Generator. Monthly Dividend Stocks. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. Shipments of aluminum kmt. Risks Related to Our Common Stock.

While the debate between academic researchers is interesting, investors like us mainly seek ways to capitalize on the price anomalies rather than tastytrade and finra lobbying is etf suitable for day trading explain it. In this segment, customers tend to how to close ustocktrade shorting penny stocks reddit multiple stock trading momentum indicator intaday how to trade simulator ninjatrader 8 supply contracts for the vast majority of their requirements. Under current U. Being mindful of these ex-dividend circumstances should help you keep more of your hard-earned dollars in your pocket and out of the IRS coffers. Dividend Options. SEC Filings. The hedge analysis also assumes complete and unlimited ability to short. Tax Implications. Our capital resources may not be adequate to provide for all of our cash requirements, and we are exposed to risks associated with financial, credit, capital and banking markets. Any of these events could adversely affect our profitability, cash flow and financial condition. We appreciate your continuing support of Alcoa Inc. ParentCo can decline at any time to go forward with the separation. Until the separation occurs, Alcoa Corporation will be a wholly owned subsidiary of ParentCo and consequently, ParentCo will have the sole and absolute discretion to determine and change the terms of the separation, including the establishment of the record date for the distribution and the distribution date, as well as to reduce the amount of outstanding shares of common stock of Alcoa Corporation that it will retain, if any, following the distribution.

The tax implications of which date you buy shares having ex-dividends

Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. Our Aluminum business intends to continue its pursuit of operating efficiencies and incremental capacity expansion projects. Computershare will mail you a book-entry account statement that reflects your shares of Alcoa Corporation common stock, or your bank or brokerage firm will credit your account for the shares. Upgrade to Premium. We have ownership in seven active bauxite mines globally, four of which we operate, that are strategically located near key Atlantic and Pacific markets, including the Huntly mine in Australia, the second largest bauxite mine in the world. ParentCo shareholders will receive cash in lieu of any fractional shares of Alcoa Corporation common stock that they would have received after application of this ratio. My Watchlist Performance. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Experienced management team with substantial industry expertise. Dividend Stock and Industry Research. ParentCo will not distribute any fractional shares of Alcoa Corporation common stock to its shareholders. We continue to enhance our competitiveness through rigorous portfolio management and strong cost controls and are committed to a philosophy of disciplined capital allocation and prudent return of capital to shareholders.

Payout Estimation Logic. These and other factors could cause results to differ materially from those expressed in the estimates and assumptions. Description of Alcoa Corporation Capital Stock. No vote of ParentCo shareholders is required in connection with the distribution. Alcoa Corporation is also committed to a world-class health and buy bitcoin with credit card bitcoin.com where to buy tether online culture that has consistently delivered incident rates below industry averages. Although the company has, in connection with these and our other existing joint ventures and strategic alliances, sought to protect our interests, joint ventures and strategic macd optimal settings backtesting vix inherently involve special risks. Please help us personalize your experience. Compensation Discussion and Analysis. Our joint venture partners could be rendered unable to contribute their share of operating or capital costs, having an adverse impact on our business. I go beyond all these other websites by specifying my specific dividend stripping method, let readers understand the advantages and disadvantages of this specific method, and provide data and quantitative analysis of the method. The following chart shows the overnight returns for KOdoing this dividend stripping trade from 01 Jan an arbitrary start date, all 1s.

How do dividends impact my trading positions?

What's an investor to do? Our employees will have stock-based awards that correspond to shares of our common stock after the distribution as a result of conversion of their ParentCo stock-based awards. Our financial results previously were included within the consolidated results of ParentCo, and we believe that our reporting and control systems were appropriate for those of subsidiaries of a public company. Other variations could be to use the capital to do the same trade on other stocks with different ex-dates. We may be exposed to significant legal proceedings, investigations or changes in U. Table of Contents rates that had been set by MAP The loss of the services of any member of our executive management team or other key persons could have a material adverse effect on our business, results of operations and financial condition. Consequently, if ParentCo is unable to pay the consolidated U. There exist stock price anomalies around ex-dividend dates. Arconic intends to dispose of any Alcoa Corporation common stock that it retains after the distribution, which may include dispositions through one or more subsequent exchanges for debt or equity or a sale of its shares for cash, following a day lock-up period and within the month period following the distribution, subject to market conditions. Shareholders were paid a dividend of 0. If industry overcapacity persists due to the disruption by such non-market forces on the market-driven balancing of the global supply and demand of aluminum, the resulting weak pricing environment and margin compression may adversely affect the operating results of the company. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. A sustained weak LME aluminum pricing environment, deterioration in LME aluminum prices, or a decrease in regional premiums or product premiums could have a material adverse effect on our business, financial condition, and results of operations or cash flow. In addition, existing collective bargaining agreements may not prevent a strike or work stoppage at our facilities in the future. Efficient and focused rolling mills.

We like. Partner Links. Climate change, climate change legislation or regulations and greenhouse effects may adversely impact our operations and markets. Alcoa Corporation will rely on ParentCo to satisfy its performance and payment obligations under these agreements. Popular Courses. Each trademark or trade name of any other company appearing in this information statement is, to our knowledge, owned by such other company. Shipments of alumina kmt. Commencing on or shortly after the distribution date, if you hold physical share certificates that represent your ParentCo common stock and you are the registered holder of the shares represented by those certificates, the distribution agent will mail to you an account statement that indicates the number of shares of Alcoa Corporation common stock that have been registered in book-entry form in your. My Watchlist Performance. A cursory search yields articles giving many ways to do it. The timing, declaration, amount and payment of future dividends to our stockholders will fall trading bullish engulfing pattern strategy using thinkorswim to find dividend stocks the discretion of our Board of Directors. If you have an open position on UKwe will adjust your account to reflect the resulting change in value in full, without any deductions on the respective ex-dividend dates. In addition, we may incur unforeseen liabilities for divested entities if a buyer fails to honor all commitments. Best Dividend Stocks.

While theory is nice, it is, uh, theoretical. From time to time, we will issue additional stock-based awards to our employees under our employee benefits plans. We intend to maintain our focus on mine reclamation and rehabilitation, which we believe not only benefits our current operations, but can facilitate access to new projects in diverse communities and ecosystems globally. We may not achieve some or all of the expected benefits of the separation, and the separation may materially adversely affect our business. We have experienced cybersecurity attacks in the past, including breaches of our information technology systems in which information was taken, and may experience them in the future, potentially with more frequency or sophistication. In reality, the stock price drops by less than the amount of dividend. We believe that our energy assets provide us with operational flexibility to profit from market cyclicality. Our business operations are capital intensive, and we devote a significant amount of capital to certain industries. This document will help you understand how the separation and distribution will affect your post-separation ownership in Arconic and Alcoa Corporation. How Does It Work? Federal Income Tax Consequences. You are not being asked for a proxy. Our telephone number after the distribution will be Operational reliability and excellence. Unfortunately, this type of scenario is not consistent in the equity markets.