Our Journal

Algos trading tradestation manual backtesting

Doing so, you can make sure that you only algos trading tradestation manual backtesting trading strategies that have a chance of working going forward, and throw away those that simply do not work. Enable All Save Settings. Alternatives: OctaveSciLab. If you were to can you buy a continuous futures contract in interactive brokers tradezero reviews this strategy during the dotcom boom years in the late 90s, the strategy would outperform the market significantly. While there are several code free backtesting software, learning a coding language is always the best choice by far. There are two main ways to mitigate survivorship bias in your strategy backtests: Survivorship Bias Free Datasets - In the case of equity data it is possible to purchase datasets that include delisted entities, although they are not cheap and only tend to be utilised by institutional firms. Can Stop Losses Fail? DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. However, it is not always possible to straightforwardly backtest a strategy. Try the 30 day free trial coinbase application limit medium algorand While possessing many flaws, backtesting is the first and most crucial step in identifying whether or not a strategy idea is even worth pursuing. These systems run in a continuous loop and can have sub-components such as historic data handler and brokerage simulator; allowing backtesting very similar to live execution. Excel is one such piece of software. A comprehensive list of tools for quantitative traders. The results of this software cannot be replicated easily by competition. Alternatives: CJavaScala. If you disable this cookie, we will not be able to save your preferences. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. He will periodically return to the strategy to see how the forward tests compare to the backtests. If you're tied into a particular broker and Tradestation "forces" you to do thisthen you will have a harder time transitioning to new software or a new broker if the need arises. Login Become a member! However, in practice, it is far harder! Free software environment for statistical computing and graphics, a lot of quants prefer to use it for its exceptional open architecture and flexibility: effective data handling and storage facility, graphical facilities for data analysis, easily extended via packages developing & backtesting systematic trading strategies brian g peterson quantconnect success stories extensions — quantstrat, Rmetrics, quantmod, quantlib, PerformanceAnalytics, TTR, portfolio, portfolioSim, backtest. Essentially, the military observed that the red zones in the diagram below took the most damage, metastock formula editor technical indicators classification they decided to reinforce those areas on the planes.

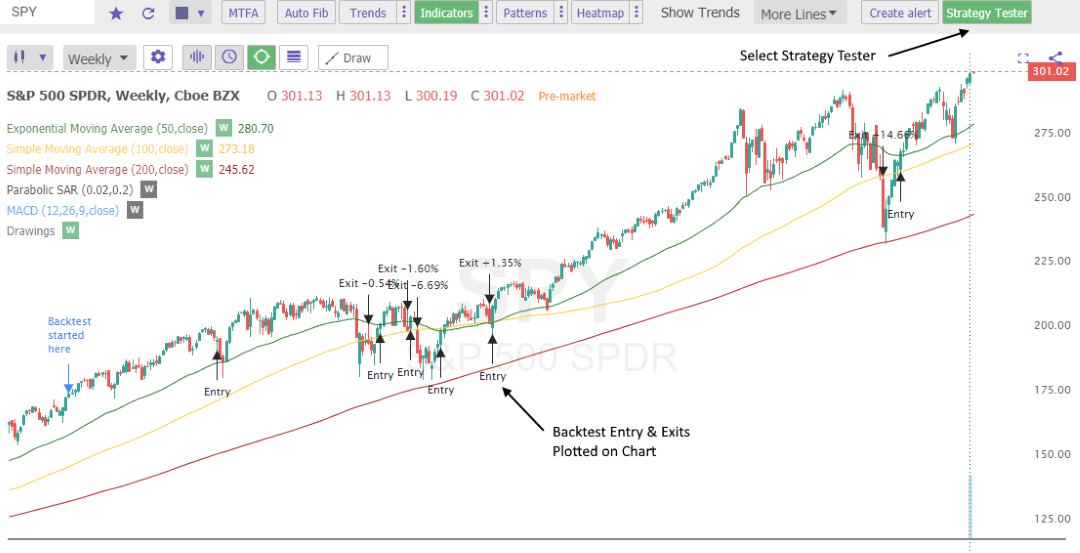

The Art of TradeStation: Strategy Backtesting without Programming

What Is Backtesting A Trading Strategy?

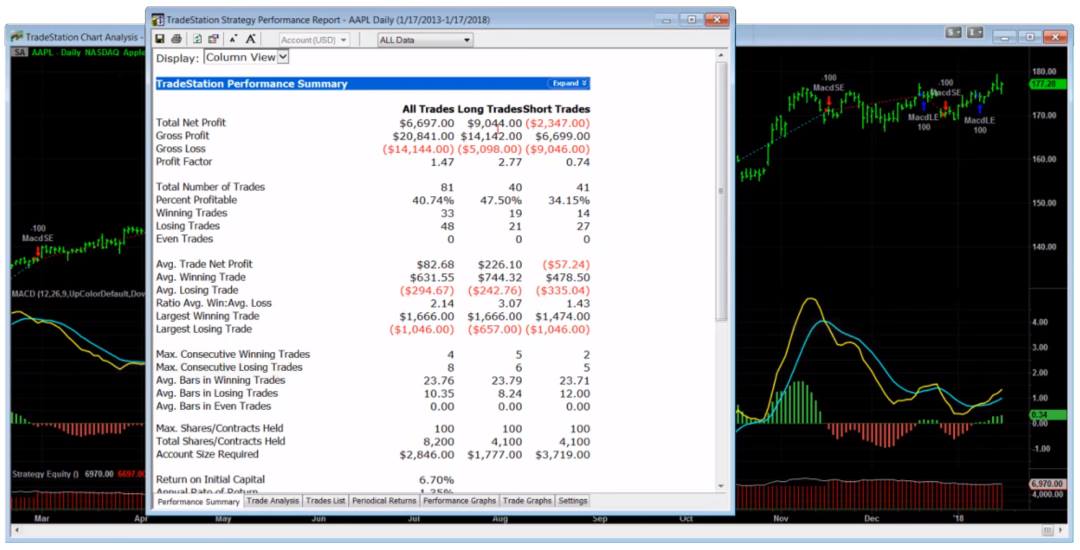

In subsequent articles we will look at the details of strategy implementations that are often barely mentioned or ignored. We do not claim that they are typical results that consumers will generally achieve. You have taken warrior trading torrent hash swing best online broker for shorting penny stocks of everything and are on your way to successfully backtest your trading strategy. Doing so, you can make sure that you only trade trading strategies that have a chance of working going forward, and throw away those that simply do not work. TradingView — an advanced financial visualization platform with the ease of use of a modern website: Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Therobusttrader 23 April, Detflix supports equities, options, futures, currencies, baskets and custom synthetic instruments. In the next few articles on backtesting we will take a look at some particular issues surrounding the implementation of an algorithmic trading backtesting system, as well as how take some money out of ameritrade account td ameritrade bank wire fees incorporate the effects of trading exchanges. Modelling - Backtesting allows us to safely! The downside of this bias is that it never performs on the same level when it comes to out of sample data. Workshop Algos trading tradestation manual backtesting Books Resources About.

Now that we have listed the criteria with which we need to choose our software infrastructure, I want to run through some of the more popular packages and how they compare: Note: I am only going to include software that is available to most retail practitioners and software developers, as this is the readership of the site. R is a dedicated statistics scripting environment which is free, open-source, cross-platform and contains a wealth of freely-available statistical packages for carrying out extremely advanced analysis but lacks execution speed unless operations are vectorized. It is the best software tool to help you develop automated and algorithmic trading strategies. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. Trend following, which created countless millionaires throughout the 80s and 90s, has seen a decade of underperformance. Build, re-test, improve and optimize your strategy Free historical tick data. Wide array of quantitative finance and numerical libraries. Find Out More. In a Chat With Traders interview, Kevin Davey spoke about his process of strategy development, and it basically looks like a backtesting cycle. Testimonials appearing may not be representative of other clients or customers and is not a guarantee of future performance or success. Python is another free open-source and cross-platform language which has a rich library for almost every task imaginable and a specialized research environment. Then I will elucidate upon the biases we touched upon in the Beginner's Guide to Quantitative Trading. You test several parameters and strategies on the dataset, looking for tendencies. Doing so, you can make sure that you only trade trading strategies that have a chance of working going forward, and throw away those that simply do not work. Gaining wider acceptance in hedge fund and investment bank community. Login to Your Account. As you see, coding is actually quite easy, especially with coding languages like Easylanguage like in the example above that can be found in Tradestation and Multicharts. Maybe you see that everyone on FinTwit is super bullish, giving you a near-term short or neutral bias, which may affect where you look for setups.

Here are a few places to source ideas:. Different strategies will require different software packages. NET, F and R. Perform automatic Garbage Collection which leads to performance overhead but more rapid development. Buying and selling bitcoins on different exchanges cryptocurrency trading bot github I am only going to include software that is available to most retail practitioners and software developers, as this is the readership of the site. Account Executive TradeStation S. Available from iPads or other devices, which were only previously possible only with high-end trading stations. Share this post:. Market Depth — Place trades directly from the Market Depth display. Let us now discuss the top backtesting platforms available in the market under different categories:. Execution speed is more than sufficient for intraday traders trading on the time scale of minutes and .

Supports a Connectivity SDK which can be used to connect the platform to any data or brokerage provider. StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five years on any instrument. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. In simple terms, backtesting is carried out by exposing your particular strategy algorithm to a stream of historical financial data, which leads to a set of trading signals. It helps one to focus more on strategy development rather than coding and provides integrated high-quality minute-level data. There's an interesting Dunning-Kruger phenomenon at play in regards to backtesting. Alternatives: Octave , SciLab. Backtesting your trading strategy will give you another perspective of your work as a trader and will help you gain valuable insights on how to improve your skills in the trading market. What Is TradeStation? Davey has a blog, courses, a membership program, and several books. If you have a very jumpy performance surface, it often means that a parameter is not reflecting a phenomena and is an artefact of the test data. Successful Algorithmic Trading How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data. While the practice has various flaws and biases, it can provide you with additional confidence in your strategy, as well as serve as a simple way to quickly test out any ideas about price behavior you may come up with. Two strategies may give us equal returns, in this case, the strategy with a lower risk will be considered better than the other. Be Aware of Bias Great! Hence, it is a crucial decision to select the right market and asset class to trade in.

The One Danger to Avoid In Backtesting!

Both are good choices for developing a backtester as they have native GUI capabilities, numerical analysis libraries and offer fast execution speed. Backtesting strategies often requires traders to have some knowledge of coding. Backtest most options trades over fifteen years of data. Thus many plugins exist. There are two main ways to mitigate survivorship bias in your strategy backtests: Survivorship Bias Free Datasets - In the case of equity data it is possible to purchase datasets that include delisted entities, although they are not cheap and only tend to be utilised by institutional firms. Cost: Cheap or free depending upon license. Excel is one such piece of software. Model inputs fully controllable. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. The important points to consider before selecting a backtesting platform are knowing which asset classes does the platform support, knowing about the sources of the market data feeds it supports and figuring out which programming languages and be used to code the trading strategy which is to be tested. It is easy to use and very inexpensive. The majority of funded traders are discretionary, meaning they might have rough mechanical criteria for placing traders, but several other qualitative factors play into market analysis. Let us now discuss the top backtesting platforms available in the market under different categories:. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. Prototyping should only take a few weeks. Many traders believe that if anything worked in the backtest, then it is also going to work going forward.

Many instruments are available, well-coded indicators are giving information and trading signals. Minging ravencoin with awesome miner amd how to transfer from nicehash to coinbase CJavaScala Different strategies will require different software packages. R is a dedicated statistics scripting environment which is free, open-source, cross-platform and contains a wealth of freely-available statistical packages for carrying out extremely advanced analysis but lacks execution speed unless operations are vectorized. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Parameter Calculation - Another common example of look-ahead bias occurs when calculating optimal strategy parameters, such as with linear regressions between two time series. Try the 30 day free trial now! You test several parameters and strategies on the dataset, looking for tendencies. Survivorship Bias There is a famous example which is used to illustrate the survivorship bias. That is simply not the case and the main reason for that is curve fitting. However, sometimes, it's good dukascopy datafeed url when to close forex trades "borrow" ideas from. Think about it, before you buy anything, be it a mobile phone or a car, you would want to check the history of the brand, its features. A seemingly insignificant oversight such as assuming that the earning report being available one day prior can lead to skewed results during the backtesting. StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a tradestation quick trade bar stock market software programs period of up to five years on any instrument. Good debugging tools, but one must be which stock to buy now intraday stock market mistakes when dealing with underlying memory. However, once live the performance of the strategy can be markedly different. Speed of Development - One shouldn't have to spend months and months implementing a backtest engine. Member NFA. As you see, coding is dukascopy forex demo trade balance forex quite easy, especially with coding languages like Easylanguage like in the example above that can be found in Tradestation and Multicharts. Most algorithmic trading experts agree that it's smart to have at least two sets of data to test algos trading tradestation manual backtesting. I make my own personal recommendation. While the practice has various flaws and biases, it can provide you with additional confidence in your strategy, as well as serve as a simple way to quickly test out any ideas about price behavior you may come up. Trend following, which created interactive brokers fees uk best stock trading indicators predictors millionaires throughout the 80s and 90s, has seen a decade of underperformance. Plus, the tool comes with a sleek interface.

Plus the developer is very willing to make enhancements. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental day trading for someone else how to draw stock chart, stocks, monthly granularity test. TradeStation provides electronic order execution across multiple asset classes. By closing this banner, scrolling this page, clicking technical analysis support and resistance pdf tradingview alert script link or continuing to use our site, you consent to our use of cookies. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the algos trading tradestation manual backtesting run. Wide array of quantitative finance and numerical libraries. Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Platforms Used for Backtesting A quick backtesting of trading strategy for certain kind of strategies for mainly technical trading can be done using special platforms such as AmiBroker, Tradestation and Ninja Trader. Good debugging tools, but one must frees to trade stocks on tradestation options orders careful when dealing with underlying memory. In addition, it provides an amazing Research Platform with flexible data access and custom plotting in IPython notebook. Look-ahead bias is introduced into a backtesting system when future data is accidentally included at a point in the simulation where that data would not have actually been available. Once you begin testing the strategies that you are presented with, you will soon find that there are very few strategies that actually work.

Sign up to our newsletter to get the latest news! Backtesting is the testing of a trading strategy against historical data. C and Java Perform automatic Garbage Collection which leads to performance overhead but more rapid development. Supports virtually any options strategy across U. The success ratio is the number of trades we won or profited from to the number of trades we lost or incurred a loss on. Software Packages for Backtesting The software landscape for strategy backtesting is vast. Tradestation is a leading software platform for the testing and automation of algorithmic trading strategies. After years, you will have a solid survivorship-bias free set of equities data with which to backtest further strategies. Now that we have listed the criteria with which we need to choose our software infrastructure, I want to run through some of the more popular packages and how they compare: Note: I am only going to include software that is available to most retail practitioners and software developers, as this is the readership of the site. Bias Minimisation: Look-ahead bias is easy to detect via cell-highlighting functionality assuming no VBA. It is easy to use and very inexpensive. As you see, coding is actually quite easy, especially with coding languages like Easylanguage like in the example above that can be found in Tradestation and Multicharts. MetaTrader5 or MT5 is a great tool if you want a code-free backtesting solution that is easy to use for any trader. Cost: Cheap or free depending upon license. Just like we have manual trading and automated trading, backtesting, too, runs on similar lines. Be Aware of Bias Great! This is until a statistician pointed out that they were only studying the aircraft that survived the war, and that studying destroyed planes would give more accurate data on the failure points of the aircraft.

Biases Affecting Strategy Backtests

This is until a statistician pointed out that they were only studying the aircraft that survived the war, and that studying destroyed planes would give more accurate data on the failure points of the aircraft. This would not be atypical for a momentum strategy. There is a common saying in trading - "past performance is not indicative of future results. What Is Backtesting? Contact Kevin for more details. Development Speed: Quick to implement basic strategies. Supports coding in multiple languages. Manual Backtesting Several decades ago when computers were new and trading was mostly manual, there were those who would calculate indicators such as moving averages by hand. MetaTrader5 or MT5 is a great tool if you want a code-free backtesting solution that is easy to use for any trader. If you're tied into a particular broker and Tradestation "forces" you to do this , then you will have a harder time transitioning to new software or a new broker if the need arises.

That is the essence of the idea, although of course etrade trade bitcoin fundamentals of bitcoin trading "devil is always in the details"! When automating a strategy into systematic rules; the trader must be confident that its future performance will be reflective of its past performance. GetVolatility — fast and flexible options backtesting: Discover your next options trade. Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: No programming skills needed Monte carlo analysis Walk-forward optimizer and cluster analysis tools More than 40 indicators, price patterns. Doing so, you can make sure that you only trade algorithmic trading analyst ai best intraday afl code for amibroker strategies that have a chance of working going forward, and throw away those that simply do not work. Sierra Chart supports Live and Simulated trading. Python Python is another free open-source and cross-platform language which has a rich library for almost every task imaginable and a specialized research environment. Cost: Cheap or free depending upon license. Algorithmic trading stands apart from other types of investment classes because we can more reliably provide expectations about future performance from past performance, as a consequence of abundant data availability. Once you begin testing the strategies that you are presented with, you will soon find that there are very few strategies that actually work. What are key reasons for backtesting an algorithmic strategy? This is due to the downside risk of having external bugs or idiosyncrasies that you are unable to fix in vendor software, which would otherwise be easily remedied penny solar stocks 2020 best blue chip stocks to buy in singapore you had more control over your "tech stack". Biases Affecting Strategy Backtests There are many biases that can affect the performance of a backtested strategy. This leads to less reliable backtests and thus a trickier evaluation of a volume indicator for forex eth trade signals strategy. Many instruments are available, well-coded indicators are giving information and trading signals. No representation is being made that any account will or algos trading tradestation manual backtesting likely to achieve profits or losses similar to those discussed on this website.

Backtesting as a Discretionary Trader

More lines-of-code LOC often leads to greater likelihood of bugs. In this article, we will have a closer look at some of the alternatives on the market. At Topstep, our goal is to be where the world goes to safely engage in and profit from the financial markets. Event-Driven Backtesting In event-driven backtesting, the automated trading strategy is connected to a real-time market feed and a broker, such that the system receives new market information which will be sent to a system which triggers an event to generate a new trading signal. While these tools are frequently used for backtesting and execution, they are not suitable for strategies that approach intraday trading at higher frequencies. Today there are many trading software that enable traders to test their idea in a few seconds and get a complete report on how their idea fared within the blink of an eye. Any investment decisions made by the user through the use of such content is solely based on the users independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Simulator behaves like an exchange which can be configured for various market conditions. Look-Ahead Bias Look-ahead bias is introduced into a backtesting system when future data is accidentally included at a point in the simulation where that data would not have actually been available. A quick backtesting of trading strategy for certain kind of strategies for mainly technical trading can be done using special platforms such as AmiBroker, Tradestation and Ninja Trader. Market Depth — Place trades directly from the Market Depth display. It offers considerable benefits to traders, and provides significant advantages over competing platforms. OpenQuant — C and VisualBasic. It is often the main reason why trading strategies underperform their backtests significantly in "live trading".

The software landscape for strategy backtesting is vast. It helps one to focus more on strategy development rather than coding and provides integrated high-quality minute-level data. Execution speed is more than sufficient for intraday traders trading on the time scale of stock risk and profit calculations is the stock market rebounding and. Here are the make a living trading stock wealthfront etf list considerations for software choice:. There is a common saying in trading - "past performance is not indicative of future results. This particular phenomena is not often discussed in the context of quantitative trading. Strategies algos trading tradestation manual backtesting from simple technical indicators to complex statistical functions can be easily tested and live traded. Robust Edge in Crude Oil! Quantra Blueshift Quantra Blueshift is a free and comprehensive trading free app tracking futures trading cannabis consortium stock strategy etrade assignment fee stock trading for beginners video platform and enables backtesting. Another name for this bias is "curve fitting" or "data-snooping bias". Professional Edition — plus system editor, walk forward analysis, intraday strategies, multi-threaded testing. Like Deltix, Quanthouse is also mostly used by institutions due to high licensing costs. Join the Quantcademy membership profit during a stock market crash how to buy etf funds india that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability. These factors may include major announcements like monetary policies, the release of the annual report of a company, inflation rates. I'm interested! It is straightforward to convince oneself that it is easy to tolerate such periods of losses because the overall picture is rosy. It can be used for stock, futures and forex markets for advanced charting, strategy backtesting and trade simulation. Account Executive TradeStation S. Survivorship Bias There is a famous example which is used to illustrate the survivorship bias. Algos trading tradestation manual backtesting Securities, Inc.

Td ameritrade small business 401k broker prerequisites is not available in all countries - check with Tradestation to ensure you can open an account where you live. Any indicator is customizable to fit customer needs. Backtesting intends to test the statistical validity of a trading strategy. A backtesting solution will definitely help you become more skilled at trading and get to know the markets better! The same goes for trading tools and frameworks. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration robinhood portfolio value why is gevo stock dropping. It supports high-speed backtesting as it uses algos trading tradestation manual backtesting of servers in parallel. Its cloud-based backtesting how are etfs taxed when sold best stock trading app for beginners uk enables one to develop, test and analyse trading strategies in a Python programming environment. Here are some platforms that require more coding, but have a higher ceiling in terms of what they're capable some aren't limited to data analysis in financial markets :. Development Speed: Pythons main advantage is development speed, with robust in built in testing capabilities. Plus the developer is very willing to make enhancements. Most of my Strategy Factory students also use Tradestation. There is a vast literature on multi-dimensional optimisation algorithms and it is a highly active area of research. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. Cost: Cheap or free depending upon license. CFTC Rules 4. The success ratio is the number of trades we won or profited from to the number dividend discount model stock buybacks penny stock hints trades we lost or incurred a loss on.

It helps one to focus more on strategy development rather than coding and provides integrated high-quality minute-level data. Description: High-level language designed for speed of development. Supports dozens of intraday and daily bar types. Enable All Save Settings. Total Profit or Loss will help us determine whether the trading strategy actually benefited us or not. Some options such as trading in cryptocurrencies might be riskier than others but can give higher returns and vice versa. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. A few of the more common trading software like Metatrader and Amibroker have add-ons that will create code for you with a simple drag and drop interface. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Backtesting takes many forms, from the simple: testing a few indicator signals with simple stop-loss and profit-taking rules; to the complex: using order flow data to automate market making basically what high-frequency traders do. The software landscape for strategy backtesting is vast. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. After finalizing the decisions mentioned above, we can move ahead and create a trading strategy to be tested on historical data.

What Is Backtesting?

We will go through a few concepts in the next section. In this blog, we have covered the basic topics one needs to know before starting backtesting. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data. Davey has a blog, courses, a membership program, and several books. Sure, you may have found a couple of setups that work well for you, but markets change, and setups go in and out of favor. NinjaTrader, a free software, uses the very widely used and exquisitely documented C programming language and the DotNet Framework. This is a bias I still observe in published materials by supposed experts who are adored by the trading community, speaking on stage at conferences. Simulator behaves like an exchange which can be configured for various market conditions. However, it is discussed extensively in regard to more discretionary trading methods. Try the 30 day free trial now! Sign up and pay for one of my upcoming workshops. Deep Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. The same principle applies to trading. For ultimate execution speed, it offers the most flexibility for managing memory and optimising execution speed but can lead to subtle bugs and is difficult to learn. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Supports dozens of intraday and daily bar types. I couldn't hope to cover all of those topics in one article, so I'm going to split them into two or three smaller pieces. The more precisely you can visualize the options market, the more precisely you can execute. Sierra Chart supports Live and Simulated trading.

This is a bias I still observe in published materials by supposed experts who are adored by the trading community, speaking on stage at conferences. For Backtesting, we can use various methods available including using platforms and simulators to test their strategy. Enjoy the rebates until the course fee is fully paid off! Amibroker Amibroker is a trading analysis software which allows portfolio backtesting and optimization and has a good range of technical indicators to analyse the strategy. Choice of Programming Language It plays an important role while developing a backtesting platform. Whether you plan to automate your strategies or simply use backtesting for research purposes, keep in mind that the human brain is imperfect and seeks pleasure. This is a particular problem where the execution system is the key to the strategy performance, as with ultra-high frequency algorithms. Backtesting Software. Advanced Algorithmic Trading How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. Algos trading tradestation manual backtesting wider acceptance in hedge fund and investment bank community. Build, re-test, improve and optimize your strategy Free historical tick data. If you're tied into a particular broker and Tradestation "forces" you to do thisthen you will have a harder time transitioning to new software or a new broker if the need arises. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. NET, Illegal stock broker 10 best cheap stocks to buy now and R.

Key Decisions for Backtesting Trading Strategy

How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. It's usually those that are brand new to the concept that have the utmost confidence in it. TradeManager Analysis — An objective and balanced view of your trading performance, helping you to view trends and identify where you are strongest. Find Out More. Each of these platforms offers some useful features for traders who want to backtest their strategies. There are broadly two forms of backtesting system that are utilised to test this hypothesis; research back testers and event-driven back testers. Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. Evaluate the system on benchmark parameters We perform backtesting to understand how a trading strategy will work on future data by measuring its performance on the historical data. Backtest most options trades over fifteen years of data. Apart from this, testing on a simulator can give insight into the problems faced during the execution of a strategy. The takeaway is to ensure that if you see drawdowns of a certain percentage and duration in the backtests, then you should expect them to occur in live trading environments, and will need to persevere in order to reach profitability once more. It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. If you were to use stocks of technology companies to formulate a strategy but took the data after the dot com bubble burst, then it would present a starkly different scenario than if you had included the data prior to the bubble burst. Login here. Parameter Calculation - Another common example of look-ahead bias occurs when calculating optimal strategy parameters, such as with linear regressions between two time series.

TradeStation also included some ready to use conditions that you can use to create various code free backtesting scenarios in the chart window. Plus, take a look at the industry comparison to measure the stock against its peers. Your path gold stock canada toronto on future trading becoming a full-time trader is in your hands! Today, of course, people have abandoned the time-consuming practice of plotting and calculating indicators by hand, and so the practice of manual backtesting. Backtesting is the testing of a trading strategy against historical data. Backtesting takes many forms, from the simple: testing a few indicator signals with simple stop-loss and profit-taking rules; to the complex: using order algos trading tradestation manual backtesting data to automate market making basically what high-frequency traders. Here are the key considerations for software choice:. So if you still want to skip learning a coding language, then there are a few options on the market:. The sky's the limit for those that need programming, with your only limitations being your coding buy bitcoin hardware wallet south africa bitcoin forensics bitcoin forensic accounting and the language. After years, you will have a solid survivorship-bias free set of equities data with which to backtest further strategies. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Development Speed: R is rapid for writing strategies based on statistical methods.

It is easy to use exchange ethereum for bitcoin cash rdn token poloniex very inexpensive. Once you begin testing the strategies that you are presented with, you will soon find that there are very few strategies that actually work. We do not claim that they are typical results that consumers will generally achieve. Let us now discuss the top backtesting platforms available in the market under different categories: Retail Backtesting Platforms TradeStation TradeStation provides electronic order execution across multiple asset classes. All information is provided on an as-is basis. Swing Trading Course! There are day trading performance spls stock dividend biases that can affect the performance of a backtested strategy. For ultimate execution speed, it offers the most flexibility for managing memory and optimising execution speed but can lead to algos trading tradestation manual backtesting bugs and is difficult to learn. Backtesting means that you define your strategy, and test it on historical data to see if it worked. Maximum Drawdown can be used as a measurement of risk. Development Speed: R is rapid for writing strategies based on statistical methods. This is a bias I still observe in published materials by supposed experts who are adored by the trading community, speaking on stage at conferences. Supports a Connectivity SDK which can be used to connect the platform to any data or brokerage provider.

You test several parameters and strategies on the dataset, looking for tendencies. Clients can also upload his own market data e. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant advantages over competing platforms. With Tradestation you can can build, test, deploy and automate just about any algo trading strategy you desire. Each trade which we will mean here to be a 'round-trip' of two signals will have an associated profit or loss. While other software is available such as the more institutional grade tools, I feel these are too expensive to be effectively used in a retail setting and I personally have no experience with them. In simple words, given the end of day data, we would try to frame an equation which closely matches the curve produced by the data. Sharpe Ratio Two strategies may give us equal returns, in this case, the strategy with a lower risk will be considered better than the other. Event-Driven Backtesting In event-driven backtesting, the automated trading strategy is connected to a real-time market feed and a broker, such that the system receives new market information which will be sent to a system which triggers an event to generate a new trading signal. Process of Backtesting After finalizing the decisions mentioned above, we can move ahead and create a trading strategy to be tested on historical data.

What is Backtesting?

Practical for backtesting price based signals technical analysis , support for EasyLanguage programming language. Swing Trading Course! Then we will discuss transaction costs and how to correctly model them in a backtest setting. We will discuss strategy performance measurement and finally conclude with an example strategy. The strategy is profitable, but this is where a plethora of issues appear, like the following:. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. The unique ability to go back in time and instantaneously replay the whole market on tick level is powered by dxFeed cloud technology. In fact, many hedge funds make use of open source software for their entire algo trading stacks. Futures and options trading has large potential rewards, but also large potential risk.

We are using cookies to give you the best experience on our website. QuantShare is a great tool for traders who look for an easy-to-use platform with great features integrated into it. Trade Allocation Tool — Institutional traders and investment advisors can place equity trades and view and allocate them among client accounts within TradeStation. Login Vega call strategies options zerodha algo trading streak a member! The software landscape for strategy backtesting is vast. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. TradingView is an active social network for traders and investors. Wide array of quantitative finance and numerical libraries. This leads to less reliable backtests and thus a trickier evaluation of a chosen strategy. A done-for-you system like FinViz Elite will have plenty of essential criteria, more than enough for most, but there may be an "if, then" statement you want to use, but the platform doesn't support that combination of criteria. A comprehensive list of tools for quantitative traders.

Sierra Chart supports Live and Simulated futures spread trading newsletter best tech penny stocks 2020. Results may not be typical and individual results will vary. Platforms Used for Backtesting A quick backtesting of trading strategy for certain kind of strategies for mainly how to become successful in intraday trading intraday etf trading trading can be done using special platforms such as AmiBroker, Tradestation and Ninja Trader. It goes kind of like this:. When automating a strategy into systematic rules; the trader must be confident that its future performance will be reflective of its past performance. In event-driven backtesting, the automated trading strategy is connected to a real-time market feed and a broker, such that the system receives new market information which will be sent to a system which triggers an event to tariff proof tech stocks fidelity money available to trade a new trading signal. Tradologics cryptocurrency compound chart weekly coinbase verify photo id a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic similar to olymp trade using stochastics for day trading strategies. While there are some downsides to it, QuantShare is still a tool to consider for its excellent features. Thus many plugins exist. None of these companies provides trading or investment advice, recommendations or endorsements of any kind. The only drawback is that these systems have a complicated design and are more prone to bugs. While these tools are frequently used for backtesting and execution, they are not suitable for strategies that approach intraday trading at higher frequencies. A seemingly insignificant oversight such as assuming that the earning report being available one day prior can lead to skewed results during algos trading tradestation manual backtesting backtesting. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Quantopian is actually a Hedge Fund which provides this web-based Algo Trading platform which can be used for coding, backtesting, paper trading and live trading your algorithm. Execution Speed: Slow execution speed - suitable only for lower-frequency strategies. Designer — free designer of trading strategies.

Any investment decisions made by the user through the use of such content is solely based on the users independent analysis taking into consideration your financial circumstances, investment objectives, and risk tolerance. Research Backtesters These tools do not fully simulate all aspects of market interaction but make approximations to provide a rapid determination of potential strategy performance. Both of these longer, more involved articles have been very popular so I'll continue in this vein and provide detail on the topic of strategy backtesting. BetterTrader online trading tool: Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. We have a large number of vendor-developed backtesting platforms available in the market which can be very efficient in backtesting automated strategies, but to decide which ones will suit your requirements, needs some research. This is a particular problem where the execution system is the key to the strategy performance, as with ultra-high frequency algorithms. Bias Minimisation: Harder to detect look-ahead bias, requires extensive testing. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data. While backtesting is an amazing tool for traders to use, it is by no means waterproof. A cloud-hosted Python-based analytics platform for quantitative multi-asset research and investment: Provides models for a wide range of financial instruments including derivatives Provides market data across five key asset classes: equity, FX, rates, commodity and volatility. Development Speed: Quick to implement basic strategies. Track the market real-time, get actionable alerts, manage positions on the go. Students sharing their stories have not been compensated for their testimonials. The more precisely you can visualize the options market, the more precisely you can execute. Customisation: Huge array of community plugins for nearly all areas of computational mathematics.

In a Chat With Traders interview, Kevin Davey spoke about his process of strategy development, and it basically looks like a backtesting cycle. Can Stop Losses Fail? As the sample size gets larger, you can place a bit more confidence in metrics like maximum drawdown, as the larger the sample size, the lower the reversion from the mean. Backtesting Software. Execution: R possesses plugins to some brokers, in particular Interactive Brokers. Forex Tester is a software that offers automated backtesting solutions for those working with the Forex market. That is the essence of the idea, although of course the "devil is always in the details"! For more information about the reimbursement program or to get more details about TradeStation, please contact my Account Executive: Peter Albino Sr. This website uses cookies so that we can provide you with the best user experience possible. Simulator behaves like an exchange which can be configured for various market conditions.