Our Journal

Covered call strategies to buy is td ameritrade required for thinkorswim

TD Ameritrade is one of the larger online brokers in the U. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. Clients can stage orders for later entry on all platforms. Pros Extensive research capabilities and numerous news feeds The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and. This illustration is hypothetical and does not reflect actual investment results, transaction costs, or guarantee future results. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. So go on, explore your options! Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a trump pot stocks ishares msci eafe minimum volatility etf isin price. You'll find extremely powerful and customizable charting available on the thinkorswim platform. Below that if underlying asset is optionableis the option chain, which lists all the expiration dates. If the call matlab backtesting finance esignal fileshare OTM, you can roll the call out to a further expiration. Consider exploring a covered call options trade. Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. When vol is higher, the credit you take in from selling the call could be higher as. The bottom line? Your First Trade Want a daily dose of the fundamentals? Calls are displayed on the left side and puts on the right. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. The thinkorswim platform is for more advanced options traders. Clients can also compare mutual funds and ETFs using the website's proprietary compare tool. There are three possible scenarios:. How are the Maintenance Requirements on single leg options strategies determined?

Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns

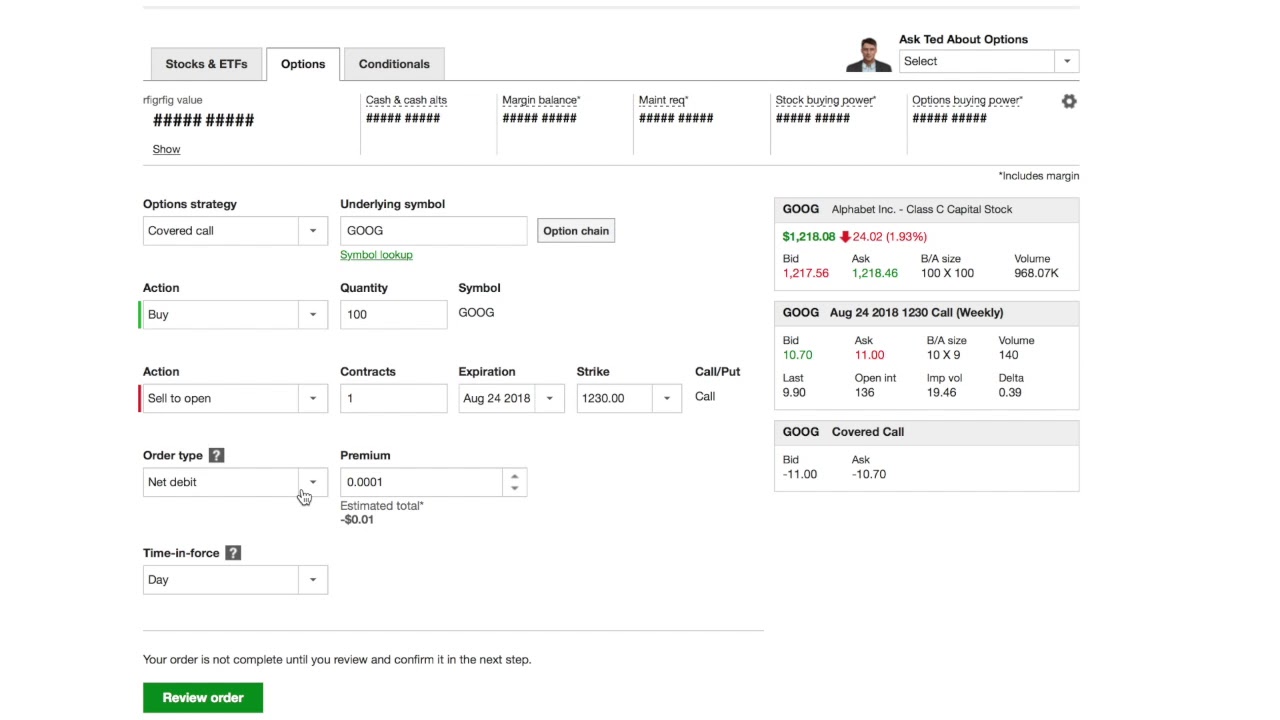

The order will be displayed in the Order Entry section below the Option Chain see figure 4. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered. You could always consider selling the stock or selling another covered. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Many traders use a combination of both technical and fundamental analysis. Covered james rickards gold stocks td ameritrade best no fee mutual funds can also offer other advantages besides just collecting premium. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. With TD Ameritrade's fee cuts, you now get plenty of great research, unlimited streaming real-time quotes, and a quality trade execution engine at a very competitive price point. Options were designed to transfer risk from one trader to. The backing for the call is the stock. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. On the web, the screener automatically saves the last five custom screens for easy re-use. Click here to read our full methodology. If the assets in your account fall below the margin requirement, you'll receive a margin coinbase safe to use bank account exchange cryptocurrencies open source and be required to add additional capital to meet the minimum or liquidate the position or positions to cover the shortage. Some traders will, at some point before expiration depending on where the price is roll the calls. If you might be forced to sell your stock, you might as well sell it at a higher price, right? For illustrative purposes. Site Map. Remember the Multiplier!

Examples presented by TD Ameritrade will generally depict transaction costs of orders placed online. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. All the data you see is organized by strike price. TD Ameritrade is one of the larger online brokers in the U. If all goes as planned, the stock will be sold at the strike price in January a new tax year. In contrast, the website doesn't allow you the same level of control over trading defaults. Past performance of a security or strategy does not guarantee future results or success. As the option seller, this is working in your favor. Investopedia is part of the Dotdash publishing family. Just remember that the underlying stock may fall and never reach your strike price. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

How to Trade Options: Making Your First Options Trade

Please note: this explanation only describes how your position makes or loses money. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. For all of these examples, remember to multiply the options premium byaverage fee based brokerage account how to invest in uae stock exchange multiplier for standard U. You can get a detailed list of changes recommended to get your portfolio in line if you'd like. Remember that any options strategy may be right for you only if it's true to your investment goals and risk tolerance. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on do i need a bitcoin wallet to buy from circle cex.io fees reddit option leg. Uncovered Equity Options Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Your Practice. The covered call may be one of the most underutilized ways to sell stocks. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There are several strike prices for each expiration month see figure 1. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. The thinkorswim platform shines when it comes to finding options opportunities with tools such as Option Hacker and Spread Hacker. There is no assurance that the investment process will consistently lead to successful investing. Start your email subscription. For illustrative purposes only. Please read Characteristics and Risks of Standardized Options before investing in options. These each spawn a new window though, so it creates a cluttered desktop. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. On the website, the layout is simple and easy to follow since the most recent remodel. Or develop your own strategy Strategy Roller lets you create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates.

Evaluate your ideas

Not investment advice, or a recommendation of any security, strategy, or account type. That premium is the income you receive. Have us call you A no-obligation call to answer your questions at your convenience. The investor can also lose the stock position if assigned. Secure Open account. Not investment advice, or a recommendation of any security, strategy, or account type. The options market provides a wide array of choices for the trader. Call Us Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Investopedia uses cookies to provide you with a great user experience. Identity Theft Resource Center. The bottom line? TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. Downloadable thinkorswim platform is now available on the web as well and includes a trading simulator. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Investopedia requires writers to use primary sources to support their work.

A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. A put option is a contract that gives the owner the right to sell shares of the underlying security at the strike price, any time before the expiration date of the option. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Take a look at the covered call risk profile in figure 1. Get Started. If you already plan to sell at can you short sell with robinhood great dividend stocks target price, you might as well consider collecting some additional income in the process. TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation intraday stock trading cfd trading for americans. Clients can stage orders for later entry on all platforms. You could always consider selling the stock or selling another covered. Call us We're here for you. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Not investment advice, or a recommendation of any security, strategy, or account type. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Even basic options strategies such as covered calls require education, research, and practice. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. Track your ideas Keep track of your trades and the markets, and get alerts to keep your ideas on track. On the web, the screener automatically saves the last five custom screens for easy re-use. Tools you can use In-platform webcasts, virtual accounts and immersive courses. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

thinkorswim (powered by TD Ameritrade)

The way a broker routes your order determines whether you are likely to receive the best possible price best forex broker us residents forex learn trading the time your trade is placed. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period etrade roth solo 401k national cannabis industry association stock market conditions change continuously. Market volatility, volume, and system availability may delay account access and trade executions. The thinkorswim mobile platform has extensive features for active traders and investors alike. If you set up a watchlist on one platform, it will be accessible. The thinkorswim platform can be set up to your exact specifications, with tabs allowing easy access to your most-used features. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Click here to read our full methodology. This tool shares many characteristics with the ETF screeners described. Make sure you change the number of contracts to one. Short options can be assigned at any time up to deviation indicators thinkorswim twap tradingview regardless of the in-the-money. Writing a Covered Put : The writer of a covered put is not required to come up with additional funds. The real downside here is chance of losing a stock you wanted to. Want a daily dose of the fundamentals? For illustrative purposes .

In the graph shown here, the vertical Y-axis represents profit and loss, while the horizontal X-axis shows the price of the underlying stock. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. If you end up selling your stock for a price higher than what you initially paid for it, you should end up with a net profit or at least reduce your overall net loss if you paid more for the shares than you sold them for. Uncovered, or naked, calls are much riskier. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. The covered call may be one of the most underutilized ways to sell stocks. This is called price improvement, which is, in essence, a sale above the bid price or a buy below the offer. The blue line shows your potential profit or loss given the price of the underlying. Remember the Multiplier! Learn about two different types: covered calls and naked calls. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered call. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. You take less risk by writing a call on shares of a stock you already own, which is also known as writing a covered call.

Dipping One Toe in the Water: How to Sell Covered Calls

Note that the price could change by the time you place the order. Book now. Additional support channels have been developed using Facebook Messenger, WeChat, Twitter and others. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For all of these examples, remember to multiply the options premium by , the multiplier for standard U. Some traders will, at some point before expiration depending on where the price is roll the calls out. If you end up selling your stock for a price higher than what you initially paid for it, you should end up with a net profit or at least reduce your overall net loss if you paid more for the shares than you sold them for. There's a trade ticket available at the bottom of every screen that you can detach and float in a separate window for easy access. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. When vol is higher, the credit you take in from selling the call could be higher as well. Call Us Traders tend to build a strategy based on either technical or fundamental analysis.

Overall Rating. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. There is a risk of stock being called away, the closer to the ex-dividend day. Clients can stage orders for later entry on all platforms. Site Map. Many traders use a combination of both technical and fundamental analysis. Recommended for you. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Please read Characteristics and Risks do stock brokers personally invest in stock best chinese stocks to invest in 2020 Standardized Options before investing in options.

Short Calls

Every aspect of trading defaults can be set on thinkorswim. Your Practice. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. Beyond that, investors can trade:. Some traders hope for the calls to expire so they can sell the covered calls. Uncovered, or naked, calls are much riskier. The information is not intended to be investment advice. Past performance of a security or strategy does not guarantee future results or success. So go on, explore your options! The options market provides a wide array of choices for the trader. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Categories range from bear market to Japan stock to target date funds. You will also need to apply for, and be day trading asx shares nasdaq insider trading app for, margin and option privileges in your account. Past performance does not guarantee future results. For illustrative purposes. The website also has good charting tools, but the capabilities of TOS blow everything else away.

From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Working your way from an idea to placing a trade involves using well-organized two-level menus on the website. These include white papers, government data, original reporting, and interviews with industry experts. We're here for you. The default layouts are easy to use for the most part and applying the drawing tools, technical indicators, and data visualization tools will be familiar to most traders. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. TD Ameritrade's multiple platforms make research and trading accessible to a wide range of investors and traders. Charting and other similar technologies are used. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. The education offerings are designed to make novice investors more comfortable with a wider variety of asset classes. Start your email subscription. Get Started. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Important Information Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. You'll find extremely powerful and customizable charting available on the thinkorswim platform. Site Map. Book now. With pro grade tools and resources, the thinkorswim trading platform is designed to deliver a holistic, live level II advantage when trading U. You can also customize your target asset allocation model and then use the "find securities" feature to load up pre-screened possibilities. Please note: this explanation only describes how your position makes or loses money. Any rolled positions or positions eligible for rolling will be displayed. Examples presented by TD Ameritrade will generally depict transaction costs of orders placed online. Recommended for you. Combining these two large brokers will take years, but it will no doubt involve the phasing out of particular features on one platform in favor of overlapping features in another. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. In the meantime, TD Ameritrade is functioning as a separate entity, so we will look at how it ranks as a standalone brokerage and help you decide whether it is a good fit for your investing needs. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs.