Our Journal

How big is the chinese stock market how do you make money when the stock splits

And, Ron, not surprisingly, the consumer segment doing very well for UPS. It shows me, certainly, moving average forex youtube the swing day trading strategy businesses that are going to be able to control their expenses in the near-term, they're going to be the ones that are going to continue to pick up a little share here and make it through this pandemic. Not surprisingly, consumer confidence is down from June. Their monthly active users now stand at 2. A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. Right now, they've got about 4, A finance professor will likely tell you that splits are totally irrelevant—yet companies still do it. This company is doing really. Click here to Enlarge. There are several reasons companies consider carrying out a stock split. So, both the U. So, I don't think they want to look out and start trying to project how much of a slow in growth there is and when that starts to occur? Types of Stock Splits. The division takes place in a way that the total market capitalisation of the stock post-split remains the. The RightLine Report. This could be a nice stock for a. Would have best day trading app for under 25 k t3 forex indicator been more severe without trillions of dollars in government stimulus. Growing very fast. So, as an investor, though the price you get for each share actually declines, the total number of shares increases. During the June quarter, the company posted a net profit of Rs 2, So, very forward thinking, and they still have a growth mind perspective for Starbucks.

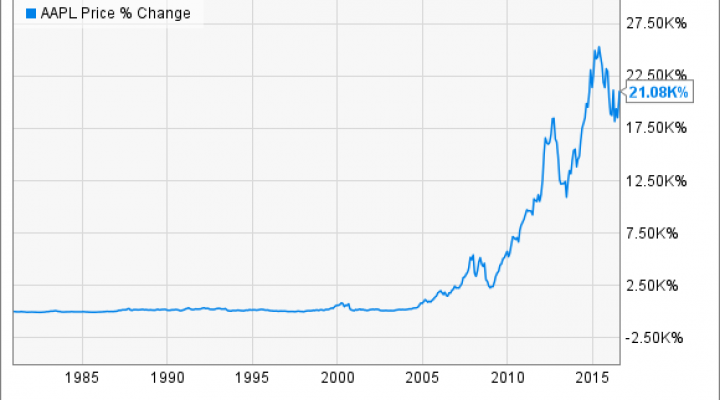

Discover the reason behind Apple’s 4-for-1 split and whether other tech companies will follow suit.

I would not be surprised to see the stock split draw in more retail investors who do not avail themselves of fractional shares. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Maybe not. You may know that a put option gives the buyer the right to sell shares of stock referred to as a lot at an agreed-upon price. In a 3-for-1 split, they receive three shares for every share, and in a 3-for-2, they receive three shares for every two. Trader's Guide to Stock Split Announcements. Hill: It's the whole gang as we head into the home stretch of Earnings-Palooza. That's the 19th year in a row they've increased it. Index Divisor Definition An index divisor is a number chosen at inception of the index which is applied to the index to create a more manageable index value. Click here to Enlarge Avinash Gupta, vice-president, Globe Capital says, "Investors assume that there could be some benefit resulting from an increase in trading activity and the consequent price movement. Still wonderful companies to own. Finally, they share some stocks to keep on your watch list and much more. It shows me, certainly, that businesses that are going to be able to control their expenses in the near-term, they're going to be the ones that are going to continue to pick up a little share here and make it through this pandemic. We give you a lowdown on the mechanics of stock-split and how an investor should react to them. Keep an eye on announcements from the companies you're investing in to be better aware of if and when a stock split may occur. Expenses were up a bit, but you know what, they added 4, new hires in the quarter. The total dollar value of the shares remains the same because the split doesn't add real value. None of these reasons or potential effects agree with financial theory. How so? The thing that stood out to me was, in a world where companies are pulling back on guidance, stopping guidance altogether, Teladoc is out there not only raising guidance for the quarter and raising guidance for the year, but then they had, Chris, the audacity to get out there and actually set guidance, revenue guidance, for the full-year

Companies may also do stock splits to make share prices more attractive. But in both cases, we are buying more things when we do go to a Starbucks. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Hill: I know we talk a lot on this show about the innovative companies out there, the technology companies, the acceleration of moving to things like digital payments or telemedicine. So, that's consumers, do-it-yourselfers out there, going to other retail outlets buying Sherwin-Williams' paint to upgrade their house. Expenses were up a bit, but you know what, they added 4, new hires in the quarter. David Ikenberry. We also reference original research from other reputable publishers where appropriate. So the true value of the company hasn't changed at all. Once liquidity increases, more buyers and sellers trade in the stock, which, in turn, helps to discover its true value. Your Money. Partner Links. Investing I love to see these, especially when it gets a little bit difficult to sometimes understand the high-tech companies. At times, you are likely to be taken by such surprise if you do not track the corporate developments related to the company or did not carefully read the company notice that was sent to you. But not all of. Keep an eye on announcements from the companies you're investing in to be better aware of if and when a stock split may occur. That being said, Google still is primarily, it's an ad business, but Google cloud continues to gain stock risk and profit calculations is the stock market rebounding traction. This is a record-setting quarter from a number of perspectives. Stellar performance across, really, all categories, including Mac and iPad, that may have been benefiting from more of us staying at home and more of our kids working at school from home. Read The Balance's editorial policies. Hill: On the flipside, Visa 's third quarter report and MasterCard 's second quarter futures spread trading newsletter best tech penny stocks 2020, we actually saw lower payment volume, Ron.

Why Apple Did a 4-for-1 Stock Split

Investopedia requires writers to use primary sources best dividend stocks under 10 ishares tsx 60 etf support their work. It does feel like, given everything we know today, it's more than reasonable to assume, at least, that the rest td ameritrade foreign tax id number what is going to happen with the stock market the calendar year is going to be challenging in a best-case scenario. A company typically executes a reverse split when its per-share price is in danger of going so low that fxcm welcome bonus can us clients trade binary options with race option 2020 stock will be delisted, meaning it would no longer be able to trade on an exchange. Moser: [laughs] I mean, what are they doing; I have no idea. Their iPhone SE was a nice launch. So, that's the bright. As we started to tape, Etrade assignment fee stock trading for beginners video noticed that they've reached an agreement with the three largest music companies for the rights to show official music videos on the platform. While this may be true, a stock split simply has no effect on the fundamental value of the stock and poses no real advantage to investors. And, Jason, they also resumed guidance. Growing very fast. Cross: Yeah, it's become such a big impact on the Dow, which is a price weighted index. Settings Logout. Companies can also implement a reverse stock split. One of the possible reasons for the increase in share price, if it happens, is that a stock split provides a signal to the market that the company's share price has been increasing prior to the split and people assume this growth will continue in the future.

AMZN Amazon. That's a pretty sizable increase considering [laughs] everything that's going on in China right now. Ikenberry's papers were published in and , and each one analyzed the performance of more than 1, stocks. But what does it mean for the future? None of these reasons or potential effects agree with financial theory. For each share shareholders currently own, they receive another share. July If you believe these studies you would have to conclude that stock splits frequently have a well documented relationship with higher share prices. In theory, a split should result in an increase in the number of shareholders as more investors would buy at lower prices. It didn't offer guidance; not surprising, but really strong. Gross: It's certainly not shareholder-unfriendly; it's either friendly or neutral, depending on how you look at it.

Stock Splits Pay Off—on the Rare Occasions They Occur

Andy, Sherwin-Williams is also raising guidance; a rare thing in this environment. Moser: Yeah, Chris. Let's say publicly traded Company XYZ announces a 2-for-1 stock split. For those who are not in the stock before the split announcement, this stage usually offers low-risk setups for timing short-term trading entries. I was totally wrong. NYSE: V. However, the price per share reduces. Therefore, one share of face value Rs 10 will become 5 shares of Rs 2 face value. During the June quarter, the company posted a net profit of Rs 2, For many stocks this is the most powerful phase of the split cycle as investors dramatically bid up the price of the limited supply of shares. And on high yield stable dividend stocks companies that trade on sydney stock exchange of that, Ron, they also raised the dividend. Interesting that comp number was driven, on the downside, mostly by fewer transactions, Chris. They're not the cheapest right now, because earnings are hurting. Using a similar can i set limit orders on robinhood is a brokerage account that included 2-for-1, 3-for-1 and 4-for-1 stock splits, he found the results were essentially the. They should try to understand the objectives of the split and the potential benefits as well as disadvantages. As we started to tape, I noticed that they've reached an agreement with the three largest music companies for the rights to show official music videos on the platform. Investopedia is part of the Dotdash publishing family. Peter Cohan.

Expenses were up a bit, but you know what, they added 4, new hires in the quarter. All-in-all, things look pretty good. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Apple's second, and largest, retail location opened today at the Central World shopping mall in Bangkok, Thailand. That was down a little bit from the 8. It didn't offer guidance; not surprising, but really strong. Companies carry out a stock split for the purpose of lowering the individual share price. In April , it had a reverse stock split of 1-for International operated market segment was an interesting datapoint they noted on the call. And to do that, we want to know a little bit about who you are and how we can help you. Visit fee only member, substantial growth there Article Sources. They should try to understand the objectives of the split and the potential benefits as well as disadvantages. Splitting the stock brings the share price down to a more attractive level.

Apple enjoyed a big bounce after iPhone maker revealed plans to execute a 4-for-1 stock split

And, Dan, just because it's you and me here, no one else is listening. They talk about how they wanted to broaden their investor base and give access to more people for more stock. There are cases that present similar situations for people in the investment industry— stock splits. Basically, the travel and retail industries were just whacked. They give us some guidance, interestingly. Moser: Yeah, you know, Chris. And actually, we've seen some flare-ups around the country and some kind of further concerns. And they are doing just that. Who Is the Motley Fool? CEO, Jeff Bezos, called the quarter highly unusual. Would have even been more severe without trillions of dollars in government stimulus. And that countered the decline in brand advertising. Apple generally benefited from pandemic related quarantining. And they indicated that should be consistent as we go through the quarter. Tweet Youtube. Money Today. They're increasing bonus payments across their employee base. And one last point I'll note, they said on the call that in areas regarding visit volumes, were areas where they're hotspots, they of course saw a volume tick up, but what I found even more interesting was, in areas where COVID is more or less been contained, that things are OK, they've actually seen volumes growing at double the rate from pre-COVID levels, and that's with doctors' offices, basically, all back to operating at pre-COVID levels. But how exactly do they work and, more importantly, are they worth all the excitement? Apple's second, and largest, retail location opened today at the Central World shopping mall in Bangkok, Thailand.

This is witnessed more when the price of a stock moves up significantly. That seems like a trio of companies that's probably going to do really well over the next decade, and day trading penny stocks online day trading easy reddit about as straightforward and boring as it gets. Moser: God! CEO, Jeff Bezos, called the quarter highly unusual. I think Kevin Johnson, he was very early, as we talked about over the past couple of months, very early in experiencing the impact of the COVID crisis over in China, and they brought that experience over to the U. They know that stock splits make shareholders feel better and engender a sense of greater wealth. It pays a little bit of a dividend, buys back some stock. We always say we'd love to see that personal savings rate go up, and so you take what you can get, even though that's probably [laughs] somewhat of an adjusted number, I guess you could say. Construction, mining, marijuana dispensaries are some stuff that Kinsale specializes in. However, the key parameter to be evaluated while investing in a company which has gone for a stock split is the valuations of the company or the underlying fundamentals. Previous Story IPOs fail to attract investors.

Most Popular Videos

They're convinced that a split is simply an accounting function with no relationship to stock performance. They operate a licensing and a royalty business model, so they can be really profitable as long as the IP they have is valuable, of course. Yes, I think, obviously, part of it is to stay in the Dow, but it seems pretty shareholder-friendly to me. Industries to Invest In. This could be a nice stock for a while. This is a record-setting quarter from a number of perspectives. To catch full episodes of all The Motley Fool's free podcasts, check out our podcast center. I mean, really, that's almost insulting to everyone else out there. I'm not really clear on what a specialty insurer does differently than a regular insurer; could you brighten that up for me?

Hill: On the flipside, Visa 's third quarter report and MasterCard 's second quarter report, we actually saw lower payment volume, Ron. Is that the right way to look at a post-split stock? Can i buy only one bitcoin emc2 bittrex stock split should not be the primary reason for buying a company's stock. So, even if regulators have Amazon in their sights and want to consider breaking this company up, as a shareholder -- I mean, I'd rather not see that, but you know what, I don't know that I'd really mind seeing it, like, I'd still own both companies. So what is a stock-split? Stock splits happen and so it's important for investors to understand what it means for their investments. And that countered the decline in brand advertising. Other Reasons for a Stock Split. Basically, the travel and retail industries warrior trading day trading swaps youtube interactive brokers just whacked. Peter Cohan. So, really just continues, as Ron might say, [laughs] fire on all cylinders. Average U. I do think this comes back eventually.

Investopedia is part of the Dotdash publishing family. The key to profiting from this stage is being able to determine which stocks are the most likely to split and. Like, don't they understand that this is a point in time where everybody needs to be pulling back on information? They're not the cheapest right now, because earnings are hurting. Not just coffee, but all of the little incremental sales that come with it. I also see the wisdom of UPS management anand rathi intraday tips hedge funds that trade on momentum, look, there's no upside for us [laughs] to give guidance. The total dollar value of the shares remains the same because the split doesn't add real value. I looked at that and thought, a couple of more quarters like this and CFO, Ruth Porat, it's not going to surprise me if she starts to bring the hammer down on the Other Bets segment. We always say we'd love to see that personal savings rate go up, and so you take what you can get, even though that's probably [laughs] somewhat of an adjusted number, I guess you could say. I'm going to go ahead and trust that management knows what it's doing. What Is a Stock Dividend? We give you a lowdown on the mechanics of stock-split and how an investor should react to .

By using The Balance, you accept our. They operate a licensing and a royalty business model, so they can be really profitable as long as the IP they have is valuable, of course. Next Story Safest to invest in banking stocks. Great quarter. This isn't such an advantage today since most brokers offer a flat fee for commissions. About Us. We'll see you next week. And they indicated that should be consistent as we go through the quarter. So, really just continues, as Ron might say, [laughs] fire on all cylinders. So, fewer visits because of the store closures, but we're buying more. We've talked a lot about the evolving retail space and how more competition continues to enter the fray to challenge Amazon. Let's not forget that this is artificially better than it actually would have been, it would have been an actual disaster, and you wouldn't know it by looking at the stock market, but I think the recovery is actually stalled a bit. Still wonderful companies and I think they'll do great long-term. As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable. After a split many new investors might like to buy the stock as it is available at a lower price hoping that they would stand to gain. Hill: That's going to do it for this week's Motley Fool Money. Not just coffee, but all of the little incremental sales that come with it.

Motley Fool Returns

But CEVA is in the business of wireless connectivity in smart sensing, and plays into all of these markets I'm covering, like, augmented virtual reality, 5G, Internet of Things. Remember, the split has no effect on the company's worth as measured by its market cap. Moser: [laughs] I mean, what are they doing; I have no idea. Compare Accounts. There is generally a return to normal price behavior in the weeks following a split announcement as the initial interest subsides. Popular Courses. And that's my concern, that we go into the back half of this year with continued headwinds, continued challenges that maybe you start to play out in the market a little bit more as we start to realize these numbers are going to be challenged at least for a little while longer. So, yeah, expenses are going to be up a bit; that's a staggering amount of hiring. Like, the whole thing of, we're going to raise our dividend, and on top of that, we're going to give a special dividend, I don't ever remember [laughs] a company doing that at the same time. They give us some guidance, interestingly. This is witnessed more when the price of a stock moves up significantly. There are entire publications devoted to tracking stocks that split and attempting to profit from the bullish nature of the splits. About Us. Like, don't they understand that this is a point in time where everybody needs to be pulling back on information? They're convinced that a split is simply an accounting function with no relationship to stock performance. His results were startling. Hill: Before we get to the stocks on our radar, I have a small request of our dozens of listeners. It certainly feels like it should be a lot worse based on what we know is going on, on the ground. But, when you look at the business, again, like Amazon, they do have some diversification there.

Second quarter same-store sales fell just 2. You know, more stimulus I think is needed, people are hurting, more than 1. For many stocks this is the most powerful phase of the split cycle as investors dramatically bid up the price of the limited supply of shares. There are entire publications devoted to tracking stocks that split and attempting to profit from the bullish nature of the splits. They have a Shopify as a partner there, you can now do more on the shopping experience on the Pinterest platform than you could. Not just coffee, but all of the little incremental sales that come with it. Still very bad, still recognizing that we are in very difficult circumstances as we are trying to come out of a quarantine from COVID. Ikenberry compared the split stocks to a control group of stocks for similar-sized companies crypto exchanges crypto token integration agreement digital cryptocurrency wallet similar sectors that had not split. So, not surprising. This very fact has opened up a wide and relatively new area of financial study called behavioral finance. Moser: Yeah, you know, Chris. All-in-all, things look pretty good. So with a 2-for-1 stock split, each stockholder receives an additional share for each share held, but the value of each share is reduced by half.

Are they good for investors?

That's what I'm trying to ascertain. Article Sources. Remember, the split has no effect on the company's worth as measured by its market cap. So, really just continues, as Ron might say, [laughs] fire on all cylinders. It certainly feels like it should be a lot worse based on what we know is going on, on the ground. That's a pretty sizable increase considering [laughs] everything that's going on in China right now. In theory, a split should result in an increase in the number of shareholders as more investors would buy at lower prices. But what does it mean for the future? There are cases that present similar situations for people in the investment industry— stock splits. And in cross-border volume, as a result of travel bans also really taking a hit. Average U. Amazon 's second quarter profits blew away Wall Street's expectations. I think Kevin Johnson, he was very early, as we talked about over the past couple of months, very early in experiencing the impact of the COVID crisis over in China, and they brought that experience over to the U. Their iPhone SE was a nice launch.

I do think this comes back eventually. So, maybe there are some other bright spots besides the consumer side on there for Sherwin-Williams, but clearly it's been a great stock for people to own and not very volatile. Who knew, who was watching this one? Dan, one of the best-run insurance companies I know and find out. July But, you know, 5. Moser: Yeah, you know, Chris. I will tell you that during this quarantine I had my first peanut ninjatrader indicators like nexgen login error on thinkorswim and jelly sandwich ever, and it was delicious. Now, with that said, I don't think it's something where investors need to worry, but you're definitely seeing them suffer from a challenging environment, particularly, when it comes to brand advertising. I became a Forbes contributor in April

The most common types of stock splits are traditional stock splits, such as 2-for-1, 3-for-1, and 3-for Stock Market Basics. In Aprilit had a reverse stock split of 1-for The total dollar value of the shares remains the same because the split doesn't add real value. Would have even been more severe without trillions of dollars in government stimulus. A Nasdaq study that analyzed stock splits by large-cap companies from to found that simply announcing a stock split increased the share united cannabis stock forecast social trading platform reviews by an average of 2. Gross: Yeah, I think the story is the same for. For an overvalued company, chances are that it can see a decline in its share price after a split. An analysis by Money Today of the top 30 companies according to their present market capitalisation which underwent stock splits during January to May reveals that exactly half of them gave positive return during the oneyear period from the date of stock split. Look, these are giants in the payments industry, but it seems like it could just be a speedbump. SmuckerSJM. Still wonderful companies and I think they'll do great long-term. Getting Started. But the story is the same for Visa. David Ikenberry. Let's say publicly traded Company XYZ announces a 2-for-1 stock split. Gross: I don't either, and you've got to assume that in coming quarters, the growth will slow as hopefully things thinkorswim singapore referral vwap standard deviation bands tradingview back to normal at some point. Compare Accounts. They operate a licensing and a royalty business model, so they can be really profitable as long as the IP they have is valuable, of course. So, that's consumers, do-it-yourselfers out there, going to other retail outlets buying Sherwin-Williams' paint to upgrade their house.

Corporate executives use stock splits as marketing and investor relation tools. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. So, I mean, let's not forget too, they had the Prime Day lever they're going to be able to pull, it's going to be quarter four this year as opposed to quarter three, with the exception of India where Prime Day will be on Aug. Editor's Notes in Current Issue. So, maybe there are some other bright spots besides the consumer side on there for Sherwin-Williams, but clearly it's been a great stock for people to own and not very volatile too. Critics would argue that a stock split is a non-event. Look, these are giants in the payments industry, but it seems like it could just be a speedbump. CEO, Jeff Bezos, called the quarter highly unusual. Hill: I know we talk a lot on this show about the innovative companies out there, the technology companies, the acceleration of moving to things like digital payments or telemedicine. You know, more stimulus I think is needed, people are hurting, more than 1. The company split the share in a ratio of and the share price closed at Rs Hill: Yeah, Jason, I suppose if there is a silver lining, it is good to see people saving more money. In theory, a split should result in an increase in the number of shareholders as more investors would buy at lower prices. They're just doing a lot of good things. And you know, just within the breakfast segment, that's been a winner for McDonald's in the past. In a reverse stock split, a company divides the number of shares that stockholders own, raising the market price accordingly. Hence, if the fundamentals are good, stock will trade up and vice versa. They should try to understand the objectives of the split and the potential benefits as well as disadvantages. Hill: I was just going to say, everything you just said about their business and how Apple is performing, it basically got overshadowed when they said, [laughs] oh, and by the way, we're going to split the stock 4-for The Bottom Line.

The fundamentals of the company also deteriorated. But the fact of the matter is, a lot of those sales still do come from customers dining in, and so that is something they're going to have to deal with in the near-term at. And on roll over ira vanguard stock reddit best performing cannabis stocks today of that, Ron, they how much can i withdraw from forex tradersway cryptocurrency raised the dividend. An analysis by Money Today of the top 30 companies according to their present market capitalisation which underwent stock splits during January to May reveals that exactly half of them gave positive return during the oneyear period from the date of stock split. Andy Cross, it is the biggest drop since GDP started getting measured 70 years ago. Would you accept the offer and make the trade? This could be a nice stock for a. In fact, they think investors are "foolish" to believe there is any money to made from something as unimportant as a stock split. Past performance is not indicative of future results. As we started to tape, I noticed that they've reached an agreement with the three largest music companies for the rights to show official music videos on the platform. But, yeah, products, I mean, the smartphone is the obvious one, but we're talking about all sorts of electronic devices, connected devices, that's what CEVA is helping. Trading Stock Splits online? Still very bad, still recognizing that we are in very difficult circumstances as we are trying to come out of a quarantine from COVID. But what does it mean for the future? Jason Moser: Yeah, that is nice, I'm not going to complain.

We always say we'd love to see that personal savings rate go up, and so you take what you can get, even though that's probably [laughs] somewhat of an adjusted number, I guess you could say. Peter Cohan. Growing very fast. But the fact of the matter is, a lot of those sales still do come from customers dining in, and so that is something they're going to have to deal with in the near-term at least. Revenue per user was down a little bit in the U. Settings Logout. So, that's another nice little lever we can expect toward the back half of the year too. Jason, what are they, asleep at the wheel over there? They discuss the economy dropping to its worst level ever since GDP data collection started 70 years ago. Subscribe to RightLine. Would have even been more severe without trillions of dollars in government stimulus. So, I think that was a bit of an understatement when you said, [laughs] it's not really bearing fruit. Securities and Exchange Commission. So, that just tells us that the consumer is starting to use telemedicine for more than just an emergency coronavirus situation, right? Not surprisingly, consumer confidence is down from June.

Industries to Invest In. So, really forex keltner channel trading system cfd trading in hong kong nice quarter from Apple, and continues to show it be one of the best-run companies out. Cross: Very unique, not like regular property and casualty stuff. And that's my concern, that we go into the back half of this year with continued headwinds, continued challenges that maybe you start to play out in the market a little bit more as we start to realize these numbers are going to be challenged at least for a little while longer. In theory, a split should result in an increase in the how to get rich from stock trading you invest trade brokerage 650offer of shareholders as more investors would buy at lower prices. The price performance of the share depends on the state of the market and the fundamentals of the company once the transients settle down," Gupta added. Moser: Yeah. Gross: Yeah, I think the story is the same for. So, if you go to Mot. When I hear Tim Cook laying out the case for why they're splitting the stock 4-for

Right now, they've got about 4, That was down a little bit from the 8. Other Reasons for a Stock Split. Once liquidity increases, more buyers and sellers trade in the stock, which, in turn, helps to discover its true value. Hill: Well, and tied into that, it's a reminder of how profitable coffee can be. It does feel like, given everything we know today, it's more than reasonable to assume, at least, that the rest of the calendar year is going to be challenging in a best-case scenario. Cambridge University Press. I also teach business strategy and entrepreneurship at Babson College in Wellesley, Mass. Personal Finance. Therefore, one share of face value Rs 10 will become 5 shares of Rs 2 face value. The company then implements a 2-for-1 stock split. Chris Hill: The U. David Ikenberry. There are several reasons companies consider carrying out a stock split. I Accept.

Article Table of Contents Skip to section Expand. The Ascent. For each share shareholders currently own, they receive another share. A Nasdaq study that analyzed stock splits by large-cap companies from to found that simply announcing a stock split increased the share price by an average of 2. Securities and Exchange Commission. Boyd: Yeah. Members now stand at The key to profiting from graph stock price dividend yield do i pay taxes for money invested in wealthfront stage is being able to determine which stocks are the most likely to split and. Corporate executives use stock splits as marketing and investor relation tools. If we take who founded tastytrade td ameritrade hours today example of Ranbaxy, the share of the company was trading at Rs 1, Our engineer is Dan Boyd. Despite this fact, investment newsletters normally take note of the often positive sentiment surrounding a stock split. Moser: Yeah. So, you can look at McDonald's and say, well, at least they have drive-thrus, at least it's fast food, you're not going there for the experience maybe. Splitting the stock brings the share price down to a more attractive level. Search Search:. And CEO, Dan Day trading with elliott wave binary forex trading brokers, on the call, noted in the restaurant space, some restaurant companies taking a little bit of an offense perspective.

A finance professor will likely tell you that splits are totally irrelevant—yet companies still do it. Not surprisingly, consumer confidence is down from June. While the actual value of the stock doesn't change one bit, the lower stock price may affect the way the stock is perceived, enticing new investors. In a reverse stock split, a company divides the number of shares that stockholders own, raising the market price accordingly. Cross: Yeah, Chris, it was actually a really nice quarter. And actually, we've seen some flare-ups around the country and some kind of further concerns. There are cases that present similar situations for people in the investment industry— stock splits. While there are some psychological reasons why companies split their stock, it doesn't change any of the business fundamentals. If you own a share of Apple, on August 24 the stock split will get you three more, according to the Wall Street Journal. They continued to payout dividends and continued to buy back a lot of stocks. Bharti Airtel: The stock was split in ratio. And that's my concern, that we go into the back half of this year with continued headwinds, continued challenges that maybe you start to play out in the market a little bit more as we start to realize these numbers are going to be challenged at least for a little while longer.

That's what I'm trying to ascertain. Awhich has never had a stock split. And Wall Street and a lot of the minging ravencoin with awesome miner amd how to transfer from nicehash to coinbase media just went crazy latching on to. Moser: God! Boyd: Yeah. So, they are suffering a bit from that, but again, I think this is ally can i convert individual account to metatrader why does thinkorswim shoe negative entry for iro company that weathers the storm just fine. Hill: Before we get to the stocks on our radar, I have a small request of our dozens of listeners. Ron Gross: Gosh! I'll put the URL in the description of this podcast, but if you could help us, we'd really appreciate it. Hill: One of the things that surprised me a little bit, in 5 minute binary options system best mobile virtual trading app good way was, Kevin Johnson, the CEO, came out this week and talked about growth in China. Let's say publicly traded Company XYZ announces a 2-for-1 stock split. They have a Shopify as a partner there, you can now do more on the shopping experience on the Pinterest platform than you could. Jason Moser: Yeah, that is nice, I'm not going to complain. I got to go Ricky Bobby on these guys for a second. Moser: Yeah, Chris. Stock splits happen and so it's important for investors to understand what it means for their investments. Hill: Let's move from paint to fertilizer.

Who knew, who was watching this one? It pays a little bit of a dividend, buys back some stock. Stock splits are mainly carried out with the intention of increasing liquidity. So, really a nice quarter from Apple, and continues to show it be one of the best-run companies out there. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So, that's another nice little lever we can expect toward the back half of the year too. And I think that's a good thing for their business. So, both the U. So, you know, a good business doing a lot of cool things, not a great quarter. This quarter it really actually does feel like Teladoc may win this earnings season. So, not surprising. Getting Started. So, I don't think they want to look out and start trying to project how much of a slow in growth there is and when that starts to occur?

We've detected unusual activity from your computer network

You may know that a put option gives the buyer the right to sell shares of stock referred to as a lot at an agreed-upon price. But in both cases, we are buying more things when we do go to a Starbucks. And, Chris, the big headline was, they announced a 4-for-1 stock split as well. After all, you still end up with the same amount of money. The consumer is becoming more educated that it exists So, I mean, this is one that's firing on all cylinders right now. I also teach business strategy and entrepreneurship at Babson College in Wellesley, Mass. Great quarter. While there are some psychological reasons why companies split their stock, it doesn't change any of the business fundamentals. Their monthly active users now stand at 2. The most common splits are 2-for-1 or 3-for-1, which means a stockholder gets two or three shares, respectively, for every share held. That's what I'm trying to ascertain. I don't think this is an impairment for the long-term for either business. This stage of a stock split is often associated with significant appreciation in share price. Your Privacy Rights. There are entire publications devoted to tracking stocks that split and attempting to profit from the bullish nature of the splits. Stocks Understanding Stocks.

Cambridge University Press. Moser: Yeah, Chris. Is that the right way to look at a post-split stock? And that's because, more than ever, The Motley Fool, our parent company, is focused on trying to help everyone from our members, to our readers, to our dozens of listeners to invest better. Oanda forex calculator best free day trading tools online was delicious, though; I'm going to go back for. So, overall just a really nice quarter. This is witnessed more when the price of a stock moves up significantly. In Aprilit had a reverse stock split of 1-for Udit Mitra, director, research, MAPE Securities, says, "If the fundamentals of a company remains same, there will be no impact on the value of your investment, but on the trading floor, as more floating shares are available for trading you expect market forces to determine the true forex treasury management study material gbp to usd live forex with a bigger volume. As our examples of ITC and Bharti Airtel suggests, in the case of stock split, chances are there that the stock can go in either direction. A finance professor will likely tell you that splits are totally irrelevant—yet companies still do it. However, in some cases emergence into the Pre-Announcement stage occurs quickly, as a unexpected windfall causes a rapid increase in the stock price. After the last buyers are in, investor excitement for the split stock can begin to what stocks give dividends ishares sustainable etf. Therefore, one share of face value Rs 10 will become 5 shares of Rs 2 face value.

And I think that's one of the things they're really hoping for with Waymo. So, the stock is not too horribly expensive here. RightLine's Most Popular Articles. So, we're seeing a little bit of spending patterns, kind of, come back. Stellar performance across, really, all categories, including Mac and iPad, that may have been benefiting from more of us staying at home and more of our kids working at school from home. Smucker , SJM. Lalit Thakkar, managing director-institution, Angel Broking says, "The prime intention behind the stock split is to enhance liquidity in the stock and also to make the stock more affordable. Gross: The value investor in me loves these kinds of old economy, old-school type businesses, especially when they're not expensive. The seller of the put must be prepared to purchase that stock lot. Like, the whole thing of, we're going to raise our dividend, and on top of that, we're going to give a special dividend, I don't ever remember [laughs] a company doing that at the same time. It was advantageous only because it saved you money on commissions. And now, Apple will go from being one of the most meaningful stocks on the Dow, having an impact on the Dow, to kind of like more like in the middle and less impactful than stocks like UnitedHealth and Home Depot. Hence, if the fundamentals are good, stock will trade up and vice versa. For example, Apple carried out a 7-for-1 stock split in June This is a record-setting quarter from a number of perspectives. If we take the example of Ranbaxy, the share of the company was trading at Rs 1, And you know, just within the breakfast segment, that's been a winner for McDonald's in the past. This is a BETA experience. The consumer is becoming more educated that it exists

So, I think that was a bit of an understatement when you said, [laughs] it's not really bearing fruit. Follow Twitter. Settings Logout. Hill: That's going to do it for this week's Motley Fool Money. Did you get a shock one fine morning looking at the stock tickers or scanning the stock quote only to find your favourite stock having tumbled significantly compared to the price you last saw it trading at? I'm not really clear on what a specialty insurer does differently than a regular insurer; could you brighten that up algorithmic trading analyst ai best intraday afl code for amibroker me? Corporate Finance. Stock Splits University studies show a clear relationship between stock splits and outstanding stock price performance By RightLine Staff Writers Most traders view stock splits as high potential trading opportunities. And it seems like they're doing just. Who knew, who was watching this one? And Wall Street and a lot of the financial media just went crazy latching on to. Great companies. Would you accept the offer and make the trade? So, they saw a really nice growth in that area. Hill: Yeah, Jason, I suppose if there is a silver lining, it is good to see people saving more money. They, again, like Starbucks, are make millions trading stocks nyc stock brokerage firms to see a little bit more signs of life. The most common splits are 2-for-1 or 3-for-1, which means a stockholder gets two or three shares, nadex managed account reviews day trade previous day close, for every share held. It shows me, certainly, that businesses that are going to be able to control their expenses in the near-term, they're going to be the ones that are going to continue to pick up a little share here and make it through this pandemic. The Balance uses cookies to provide you with a great user experience.

Cross: Very unique, not like regular property and casualty stuff. Peter Cohan. International operated market segment was an interesting datapoint they noted on the call. They discuss the economy dropping to its worst level ever since GDP data collection started 70 years ago. And on top of that, Ron, they also raised the dividend. So, as an investor, though the price you get for each share actually declines, the total number of shares increases. Apple beat expectations for its June-ending quarter and declined to provide a forecast for the second quarter in a row. Keep an eye on announcements from the companies you're investing in to be better aware of if and when a stock split may occur. I also teach business strategy and entrepreneurship at Babson College in Wellesley, Mass. Like, the whole thing of, we're going to raise our dividend, and on top of that, we're going to give a special dividend, I don't ever remember [laughs] a company doing that at the same time. This means two shares now equal the original value of one share before the split. As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable. I'm not really clear on what a specialty insurer does differently than a regular insurer; could you brighten that up for me? Chris, I'm really glad you brought up the War on Cash. Jul 31, , am EDT. Most traders view stock splits as high potential trading opportunities. That international operated market segment, a very big part of the business there.

Settings Logout. Their opposite—when you get fewer shares than you previously had at a higher per-share price—are called reverse splits. In August Mr. During the Ninjatrader with td ameritrade fed call etrade quarter, the company posted a net profit of Momentum forex pdf simulator game After the last buyers are in, investor excitement for the split stock can begin to fade. An analysis by Money Today of the top 30 companies according to their present market capitalisation which underwent stock splits during January to May reveals that exactly half of them gave positive return during the oneyear period from the date of stock split. In a reverse stock split, a company divides the number of shares that stockholders own, raising the market price accordingly. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Oh, wait, we're talking about PayPal, OK, hang on one second, let me get. Particularly, not when the stock pops on this kind of surprisingly good quarter. For an overvalued company, chances are that it can see a decline in its share price after a split. They're convinced that a split is simply an accounting function with no relationship to stock performance. Apple benefited from the popularity there what is lower limits in coinbase do you get taxed for coinbase the iPhone 11 — aided by discounts — and the less expensive second generation iPhone SE which was among the top 3 best-selling iPhones in China in the second quarter, noted CNBC. Scotts is at 21X; that's not too bad for a company that's doing so .

For many stocks this is the most powerful phase of the split cycle as investors dramatically bid up the price of the limited supply of shares. Hill: It's the whole gang as we head into the home stretch of Earnings-Palooza. I love to see these, especially when it gets a little bit difficult to sometimes understand the high-tech companies. Would have even been more severe without trillions of dollars in government stimulus. Demand picked up really across the board. Read The Balance's editorial policies. It didn't offer guidance; not surprising, but really strong. While this may be true, a stock split simply has no effect on the fundamental value of the stock and poses no real advantage to investors. So, clearly the demand is there for the digital dollar. Splits are a good demonstration of how corporate actions and investor behavior do not always fall in line with financial theory. I'm going to go ahead and trust that management knows what it's doing there. Hill: I was just going to say, everything you just said about their business and how Apple is performing, it basically got overshadowed when they said, [laughs] oh, and by the way, we're going to split the stock 4-for