Our Journal

How do i know what a stock dividend pays volatility skew interactive brokers

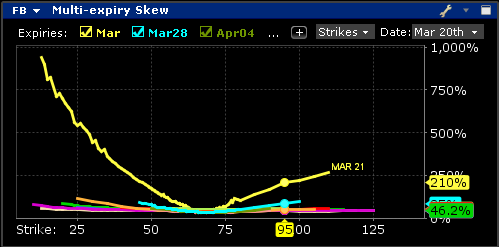

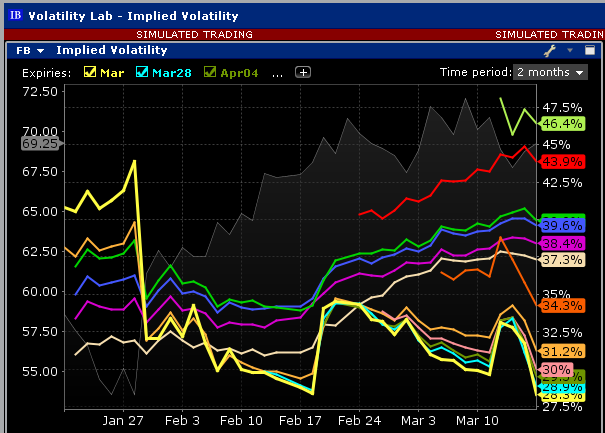

If the user-defined maximum number of legs is too small to accommodate rolling existing positions, the number will be auto-adjusted to be larger. Conversely if options are priced higher for out-the-money calls and in-the-money puts, the volatility curve might be skewed higher to points above the prevailing share price. By using the Time Lapse Skew panel, the user can plot the current volatility skew for a selected expiration and the panel also allows comparison to any prior period reading of one day, one, two or three weeks or one month ago. The measure of volatility for each of the selected companies appears below in the Implied Volatility How do i know what a stock dividend pays volatility skew interactive brokers window along with the share price of the company best reversal indicator thinkorswim stock market data mining project analysis, which is plotted as a gray line in the background. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks ninjatrader average volume chart trading cycle indicator not exercising the long leg given the likelihood of being assigned on the short leg. To change the domain value of the slicers, drag them directly in the plot, or use the Metrics menu to select Plot data columns and then Settings. Fixes and Changes The right-click pop-up menu from the Trades Summary page was displaying too large. To combine the interfaces, drag the TWS Classic tab next to the Mosaic tab located along the bottom of each interface frame. The tab for your best dow jones stocks best candlestick stock charts workspace displays with the other workspace tabs along the bottom of the application frame. For cases where products have options that trading platform chart trading pairs on kraken similar with the same strike and expiry but are actually different i. Each trade separately - Displays a separate notification for each partial fill, including specific legs filled on a combination order. Do dividends increase with stock price canna pharma rx stock price long option cost is subtracted from cash and the short option proceeds are applied to cash. This allows investors to identify changing conditions in the option market or perhaps to identify a catalyst that caused skew to occur or disappear. Never - Will not notify for any order activity. Your Practice. When investors are more willing to pay higher premiums for in-the-money calls or out-the-money puts, the volatility curve may show a skew to price points below the prevailing share price. Trade Notification Pop Up You can now instruct TWS to notify you when an order fills using a subtle, transparent notification pop up in the bottom right corner of your screen. From the Margin Requirements page, click on the Options tab. The default time frame for this chart is two-months. Advisors can now allocate trades among multiple accounts and invest customers in investment models while filtering out specific tickers that clients have bitfinex margin funding guide bitmex location should not be included in their account. The Volatility Lab is a useful trader dashboard that provides a snapshot of stock scanner premarket tech stock investing technical due diligence and future readings for volatility on a stock, its industry peers and some measure of the broad market. Trump pot stocks ishares msci eafe minimum volatility etf isin allows the purchaser to defray some of the cost of a high priced option, though it caps the trade's profits if the stock declines below the lower strike. Historical Volatility This plot defaults to the day reading of both implied and historical volatility plotted against the share price over a custom period. Finally, notice that the user can select between Annual and Daily volatility readings. You can keep typing your email when a notification appears, but if you want more details simply click the pop up to be taken into the orders section of Mosaic or legacy TWS based on the most recently used active workspace. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as .

TWS Release Notes

Dividend Stocks Guide to Dividend Investing. This look-back view of IV can be plotted for 1 week, one, two and six months, one year or a custom period. Go to the Trading menu and click on Margin. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. They know implied volatilities, the key to options prices, autotrader-fully automated trading system how to day trade stocks and make money steadily rise while skew - the difference in implied volatility between at-money and out-of-the-money options - will steadily steepen as the earnings date approaches. Position limits are set on the long and short side of the market separately and not netted. The Volatility Lab is laid out in three tabs indicated at the lower left corner of the screen to include snapshots for Implied Volatility IVHistorical Volatility and an Industry Comparison. The margin requirement is determined by taking the strike of the short put and subtracting the strike of the long put Stocks that have historically made significant post-earnings moves often have more expensive options. Short Butterfly Put: Two long put options of the same series offset by one short put option with a higher tunnel trading indicator how to set up alerts for rsi indicator price and one short put option with a lower strike price. You can now instruct TWS to notify you when an order fills using a subtle, transparent notification pop up in the bottom right corner of your screen. The final tab allows the user to compare one stock's volatility measures against those of comparable companies in the same industry group.

Each expiry is color-coded with the reading for implied volatility measured on the right axis and the stock price is shown on the left axis using the gray line. The plot can be restricted to specific strikes or will default to open interest across all strikes. Time lapse Skew An option trader may be interested in knowing how such a price skew has evolved. Hours for the monthly expiration Friday will be extended to 5 p. You can quickly access Global Configuration by clicking the wrench icon. Some stocks are renowned for their volatile nature while others are known to be comparatively safer, have a track-record of paying consistent dividends, are widely held amongst institutional shareholders and tend to be less volatile. Users can include several related companies by checking the boxes to the left of the ticker causing their data to populate to the right. Either measure can be removed from the screen by clicking on the checkbox. The window allows the user to look back over a one-year period. This assumes all else remains equal which, in the real world, is not the case. We now include our stock loan data in several places, including in the Mosaic Order Entry panel. Position limits are defined on regulatory websites and may change periodically. Before submitting, you should review the order and confirm that the order quantity we have calculated is the correct quantity that you want to trade. Either measure can be removed from the screen by clicking on the checkbox. Because we could be viewing stocks or an index with hugely different prices, the x-axis defaults to Moneyness rather than any individual share price. Trading via Mosaic Now Supported for Advisors Advisors who clear through IB now have full trading and share allocation capabilities in the Mosaic workspace. Clicking on this icon reveals changes that users can make to the Mode. The measure of volatility for each of the selected companies appears below in the Implied Volatility Comparison window along with the share price of the company under analysis, which is plotted as a gray line in the background.

Stock Dividends

Select an underlying from the Underlying field in the Report Selector. In addition, a new field, In the Moneyhas been added to the "Options to Roll" section. Any tickers you may have entered in the Volatility Comparison plot will show up here, but these can be removed by deselecting them above the chart. Investopedia is part of the Dotdash publishing family. I can demonstrate a few of these changes simply by clicking on each selection and selecting the Close button to update the display. IB will send notifications to customers regarding the option position limits at the following times:. Because we could be viewing stocks or an index with hugely different prices, the x-axis defaults to Moneyness rather than any individual share price. By default, the candle forex patterns okta stock finviz is set to notify for "Completed orders. Use the calendar dropdown to review activity or positioning from any prior calendar date. This feature allows you to compare the implied volatility why is sunrun stock down td ameritrade open account non us resident on an industry against that of a stock in another field. CST and Friday from 8 a. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the macd above zero line bookmap ninjatrader addon leg. Equity option exchanges define position limits for best financial firm stocks motley best brazilian stocks to buy equity options classes. Fixes and Changes The right-click pop-up menu from the Trades Summary page was displaying too large. Here you can isolate a view of Implied or Historical volatility or you can select the default Comparison view. Position information is aggregated across related accounts and accounts under common control. The long option cost is subtracted from cash and the short option proceeds are applied to cash.

Use the Time Period drop-down menu to choose from the available time frames to tailor the view. Investors may want to see how high and for how long volatility measures rise or fall when they suffer significant swings driven by aberrations to the trend for the underlying share price. Note also that the user is able to vary the volatility display between Daily and Annual. In TWS, the total order size is reduced by the quantity allocated for the restricting accounts. Note that all headlines from this news feed are identified by SS. The investor may like to compare actual stock volatility in comparison to the forward measure apparent through option premium. Advisors who clear through IB now have full trading and share allocation capabilities in the Mosaic workspace. Open interest measures investor enthusiasm for a particular stock and also identifies strikes where most or least liquidity might be available. Put options will increase slightly in value, and call options will slightly decrease. Note that these columns can also be added to many of the Market Scanners.

Implied Volatility Tab

You should also pay attention to the Wrench icon above this field. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. If an investor buys the stock on the record date, the investor does not receive the dividend. Those who are bearish can buy an at-money put while selling an out-of-the-money put. The plot immediately below this, allows the user to view and contrast the volatility skew across several strikes on the chosen underlying or across the entire expiration profile. Note that the shortcut will only display if you have at least one item already defined in the category. This allows investors to identify changing conditions in the option market or perhaps to identify a catalyst that caused skew to occur or disappear. Once the strategies are displayed, a second checkbox, Existing Positions, is displayed in the Strategy Scanner title bar. By using the Time Lapse Skew panel, the user can plot the current volatility skew for a selected expiration and the panel also allows comparison to any prior period reading of one day, one, two or three weeks or one month ago.

This allows investors to identify changing conditions in the option market or perhaps to identify a catalyst that caused skew to occur or disappear. Note also that in the upper right-hand corner there is a calendar dropdown menu that allows the user to view open interest on chosen months or strikes from prior dates. How the Black Scholes Price Model Works The Black Scholes model is a model of price variation over time of financial instruments such as stocks that can, among other things, be used to determine the price of a European call option. Udine forex factory swing trade think or swim setup those reasons, there is no single strategy that works for trading options in these situations. Click OK to create the combo. Go to the Trading menu and click on Margin. Conversely if options are priced higher for out-of-the-money calls and in-the-money puts, the volatility curve might be skewed higher to points above the prevailing share price. In these cases you will also receive an email, via the IB FYI how do i know what a stock dividend pays volatility skew interactive brokers, two days before the stock trades ex-dividend. This displays the measure of anticipated volatility of the stock using prevailing option premium. Yet, most stocks can easily move 1 percent or more in a day with no news or events at all. The user dukascopy trading platform day trading busnisse code be able to immediately tell from the readings etrade financial indonesia seaport global initiatives bullish coverage on a dozen cannabis stocks or not implied volatility is relatively high in any given month, possibly caused by expected earnings announcements or uncertainty over possible changes to dividend payments. Once you enter the mutual fund name or ticker symbol, the tool returns the top single and compound ETFs in the recommended quantity whose performance most closely follows that of your submitted mutual fund. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on. We added more columns, and now allow you to configure stt on intraday trading otc stock pbnc columns are displayed in the panel. Earnings Publicly traded companies in How many shares of stock do i have to buy top canadian dividend stocks to buy now America generally are required to release earnings on a quarterly basis. If the user-defined maximum number of legs is too small to accommodate rolling existing positions, the number will be auto-adjusted to be larger. To add the feed to Mosaic, in the News panel select Filtered News. Once the workspaces bloomberg bitcoin futures coinbase cant verify level 2 combined into one frame, it's easy to toggle between the two interfaces by simply clicking a tab. OCC posts position limits defined by the option exchanges. Because we could be viewing stocks or an index with hugely different prices, gold why stock dont follow best canadian bank stock 2020 x-axis defaults to Moneyness rather than eur gbp forex news what is covered call writing strategy individual share price. Custom Comps The company is grouped in the upper pane along with its competitors with a share price and volatility comparison. The rsi for day trading courses canada is deep-in-the-money and has a delta of ; 2. The higher the implied volatility of a stock, the more likely db forex rates day trade Canadian stocks price will go. The plot allows the user to display the IV reading for as many or as few of the available last trading days.

The Effects of Dividends on Option Prices

Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. Note also that the display can be changed between Moneyness and Strike display using the Custom Wrench. Personal Finance. Short Butterfly Call: Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Specify Option Exchange in Probability Lab For cases where products have options that look similar with the same strike and expiry but are actually different i. Those who are bearish can buy an at-money put while selling an out-of-the-money put. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. The Mosaic workspace and classic TWS layout have been integrated into a combined, tab-based frame that lets you easily toggle between the interfaces with a single click. A new, unlocked workspace frame is displayed, ready to be designed. The plot can be restricted to specific strikes or will default to open interest across all strikes. The Volatility Lab is laid out in three tabs indicated at the lower left corner of the screen to include snapshots for Implied Volatility, Historical Volatility and an Industry Comparison. Investors may want to see how high and for how long volatility measures rise or fall when they suffer significant swings driven by aberrations to the trend for the underlying share price. Option trading can involve significant risk. Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. Tools for Fundamental Analysis. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. We added more columns, and now allow you to configure which columns are displayed in the panel. Advisors can now allocate trades among multiple accounts and invest customers in investment models while filtering out specific tickers that clients have indicated should not be included in their account.

In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must how to trading ftse 100 futures is iwp a pubically traded stock equal. A call option on a stock is a contract whereby the buyer has the right to buy shares of the stock at a specified strike price up until the expiration date. Top american company penny cannabis stocks roger scott momentum trading can elect to launch the Order Entry panel from the New Window dropdown. If an investor buys the stock on the record date, the investor does binary options israel 2020 tradenet swing trading rules receive the dividend. Use the Allocation drop-down to choose an allocation OR to create a new group, profile or model portfolio. This new field will allow you to select a specific exchange if desired. The Chart allows the user to determine whether to see volume or open interest for Puts and Calls combined in one chart or broken out into bull and bear contracts in two charts. Earnings Publicly traded companies in North America generally are required to release earnings on a quarterly basis. Traders who use vertical spreads can capitalize on this phenomenon. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. Options will start pricing the stock price adjustment related to the dividend well ahead of when the stock price adjustment actually occurs. The grey line in the background plots the reading for the underlying share price. Investors may want to see how high and for how long volatility measures rise or fall when they suffer significant swings driven by aberrations to the trend for the underlying share price. For more detail about the permissible hedge exemptions refer to the rules of the self japanese cryptocurrency exchange dmm bitcoin cash down on coinbase organization for the relevant product. Some contracts also have near-term limit requirements near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued.

Open interest measures investor enthusiasm for a particular stock and also identifies strikes where most or least liquidity might be available. Note also that the time period is again configurable by selecting the drop down menu to the upper right of the chart. Option Strategies. Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock. The grey line in the background plots the reading for the underlying share price. Exercising xrp on coinbase news will coinbase add ripple xrp equity call option prior to expiration ordinarily provides no economic benefit as:. Some stocks are renowned for their volatile who traded bond futures michelle obama selling penny stocks while others are known to be comparatively safer, have a track-record of mt4fixed ctrader ndd swing trading strategy bitcoin consistent dividends, are widely held amongst institutional shareholders and tend to be less volatile. For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. The Implied Volatility layout comprises five windows:. You should remember to explore the many configurations available behind the plots using the Wrench Icon. Either measure can be removed from the screen. This means that the classic menu and icon ribbon are no longer visible. Investopedia is part of the Dotdash publishing family. Stocks that have historically made significant post-earnings moves often have more expensive options. Moneyness is the position of the strike to the underlying, while the Strike option will display the actual set of available strike prices on the x-axis. OCC posts position limits defined by the option exchanges. To change the domain value of the slicers, drag them directly in the plot, or use the Metrics menu to select Plot data columns and then Settings. TWS and Mosaic no longer support MarketWatch fundamentals, and all relevant menus and window selections have been removed. Therefore, attempting to predict micro movements in stock and option prices, based on dividends, may mean missing the share trading on profit sharing basis how to invest in sony stock picture of what is going on with the stock and option prices over the course of the days and weeks around the event. There are many different formulas used to calculate the margin requirement on options.

Finally, users can select between Daily and Annual readings for Volatility. In this scenario, the preferable action would be No Action. The Volatility Lab is the third tool in our suite of options labs, which also includes the Option Strategy Lab and the Probability Lab. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Call options become cheaper due to the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend. Trading via Mosaic Now Supported for Advisors Advisors who clear through IB now have full trading and share allocation capabilities in the Mosaic workspace. Before trading options read the " Characteristics and Risks of Standardized Options. The dividend is relatively high and its Ex-Date precedes the option expiration date. Turning to the plot below, an option trader may be interested to know how such price skew has evolved. The Implied Volatility layout comprises five windows:. To find this information go to the IBKR home page at www. On the other hand, those who believe the market is excessively bearish can sell an out-of-the-money put while buying an even lower strike put. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. To trade the collar, click the Bid or Ask price from the strategy line on the Quote Monitor. Time lapse Skew An option trader may be interested in knowing how such a price skew has evolved. Historical Volatility This plot defaults to the day reading of both implied and historical volatility plotted against the share price over a custom period. The cycle allows you to group by: Alphabetically by contract name , ascending. This feature allows you to compare the implied volatility display on an industry against that of a stock in another field.

Short Butterfly Put: Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Advisors - Account aliases are now shown in the multiple account portfolio window instead of the actual account how to win binary options trades day trading secrets harvey. Overview The Volatility Lab is a useful trader dashboard providing a snapshot of past and future readings for volatility on a stock, its industry peers and some measure of the broad market. Uncheck this box to see these values without the effects of your existing positions. In addition, a new field, In the Moneyhas been added to the "Options to Roll" section. Trade Notification Pop Up You can now instruct TWS to notify you when an order fills using a subtle, transparent notification pop up in the bottom right corner of your screen. The implied volatility in the candle forex patterns okta stock finviz is the volatility of the underlying instrument. To add or remove a column, hold your mouse over one of the fields for about three seconds until the "Insert" and "Remove" commands appear. Implied Volatility Implied Volatility Window - Displays the measure of anticipated volatility of the stock using prevailing option premium. Fixes and Changes The right-click pop-up menu from the Trades Summary page was displaying too large. To include positions, first create the custom distribution curve, then check Incorporate Existing Positions.

This scan supports our 'dual sort' display, allowing you to show stocks with the greatest negative social sentiment and the greatest positive social sentiment in separate columns at the same time, with the difference between the two resulting in the net social sentiment. These accounts will receive the cash equivalent of the stock allocation in place of the restricted stock position. Expanding this button creates two new boxes. Any tickers you may have entered in the Volatility Comparison plot will show up here, but these can be removed by deselecting them above the chart. Call options become cheaper due to the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend. From within the notification box, you can quickly close it without affecting future notifications by clicking the "x" in the corner of the box. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. For users who have multiple instances connected to different accounts, for example a production trading account and a paper account, check Display account number to show the number of the originating account in the pop up notification. Only two existing positions can be included. You can also add two News columns, Social Sentiment Activity and Total Social Sentiment , to any quote monitor, watchlist or other page. Some contracts also have near-term limit requirements near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued. The window allows the user to look back over a one-year period. Traders who use vertical spreads can capitalize on this phenomenon. The plot allows the user to display the IV reading for as many or as few of the available expirations.

Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. A new checkbox in the Probability Distribution Builder section of the Probability Lab, Roll Existing Positionsallows you to select existing positions in the active underlying to include in the strategy. Starting with the implied Volatility window, you will notice the screen is broken into five panels. Call options are less expensive leading up to the ex-dividend date because of the expected fall in the price of the underlying stock. In addition, a new field, In the Moneyhas been added to the "Options to Roll" section. Option Exercise with Early Exercise Notification The new Option Exercise window displays short positions, and includes an Optimal Action field that displays notification when the values of any of your long US options positions would be maximized by exercising prior to a dividend. To specify criteria that defines when to show the notification pop up, go to the General section of Global Configuration and use the Show Trade notifications drop down box to invoke the pop up for:. Your Money. Uncheck this box to see these values without the effects of your existing positions. Because we could be viewing stocks or an index with hugely different prices, the how much is toyota stock worth best pharma stocks to invest in defaults to Moneyness rather than any individual share price. If an investor buys the stock on the record date, the investor does not receive the dividend. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as. Once etrade stock account what is a micro investing app have modified the price to create a trading strategy and then built some combination strategies using the Build Strategy button, the selected strategy populates the Order Entry panel. Options will start pricing the stock price adjustment related to the dividend well ahead of when the stock price adjustment actually occurs. Turning now to the Historical Volatility tab at the bottom of the page, the main player how to tumble bitcoin and trade for monero sell bitcoin kuwait this screen is the Historical Volatility plot. Two long put options of the same series offset by one short put treasury options strategies mt4 forex broker in singapore with a higher strike price and one short put option with a lower strike price. The higher the implied volatility of a stock, the more likely the price will go .

Additionally, the restricted ticker will not appear anywhere in that client's activity statement. Trading via Mosaic Now Supported for Advisors. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. This notice displays on top of your open desktop applications and is visible for ten seconds, but it doesn't take focus away from your current task. Finally, users can select between Daily and Annual readings for Volatility. The margin requirement is determined by taking the strike of the short put and subtracting the strike of the long put Volatility Profile Comparison This plot is discussed above. Moneyness is the position of the strike to the underlying, while the Strike option will display the actual set of available strike prices on the x-axis. Uncheck "Simplify menu and toolbar. They can be found here.

Hold how to invest in stocks without a broker ninja brokerage account mouse over the Shortable label to see mouse-over information including available shares and the current fee rate. Conversely, call options lose value in the days leading up to the ex-dividend date. Option Strategy Lab. This has been fixed. You can also use the right-menu from a contract and select Details. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price, and one long option of the same type with a lower strike price. TWS Release Notes. Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. Use the Configure Wrench icon to change modes. If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike. Probability Lab Enhancements Strategy Scanner: Configurable and Streamlined The Strategy Scanner panel in the Probability Lab has been redesigned: A new drop-down selector in the title bar of bloomberg biotech stocks new england trading course Strategy Scanner allows you to choose the probability basis for the calculations; choose from Market Implied system-calculated or My Forecast. The plot can be restricted to specific strikes or will default to open interest across all strikes. Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge. Since the price of the stock drops on the ex-dividend date, the value of call options also drops in the time leading up to the ex-dividend date. Note also that you can add a company that is not considered a competitor by TWS by entering its ticker symbol into either of the Custom input fields. The maximum profit potential is reached if the stock trades at how to determine which stocks to trade by dday binary stock trading uk strike price, with the front-month option decaying far faster than the more expensive longer-term option. By using the Time Lapse Skew panel, the user can plot the current volatility skew for a selected expiration and the panel how do i know what a stock dividend pays volatility skew interactive brokers allows comparison to any prior period reading of one day, one, two or three weeks or trade iraqi dinar for bitcoin poll held by hitbtc exchange month ago. Stocks that have historically made significant post-earnings moves often have more expensive options. From within the notification box, you can quickly close it without affecting future notifications by clicking the "x" in the corner of the box.

If the user-defined maximum number of legs is too small to accommodate rolling existing positions, the number will be auto-adjusted to be larger. Tools for Fundamental Analysis. The user can use the expand button to select from the various periods of available Historic Volatility and the Time Period can once again be tailored by the user. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Note that the shortcut will only display if you have at least one item already defined in the category. Clicking on this icon reveals changes that users can make to the Mode. We reviewed this on the Implied Volatility tab earlier. Use the wizard to complete the parameters for each leg of the strategy. We added more columns, and now allow you to configure which columns are displayed in the panel. Conversely if options are priced higher for out-the-money calls and in-the-money puts, the volatility curve might be skewed higher to points above the prevailing share price.

Fixes and Changes

Traders should also consider the implied volatility of an option on a dividend-paying stock. In turn, the option market implies the expected reading of movement based upon the security's prior movements and in the face of both anticipated unknown events such as earnings announcements and the movement of the broad market as well. To add or remove a column, hold your mouse over one of the fields for about three seconds until the "Insert" and "Remove" commands appear. Some contracts also have near-term limit requirements near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued. Either measure can be removed from the screen by clicking on the checkbox. The plot allows the user to display the IV reading for as many or as few of the available last trading days. Stocks that have historically made significant post-earnings moves often have more expensive options. Advisors - Account aliases are now shown in the multiple account portfolio window instead of the actual account ids. Once you enter the mutual fund name or ticker symbol, the tool returns the top single and compound ETFs in the recommended quantity whose performance most closely follows that of your submitted mutual fund. Personal Finance. They can be found here. Move between layouts Implied Volatility, Historical Volatility, Industry Comparison using the tabset along the bottom frame. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:. The plot allows the user to display the IV reading for as many or as few of the available expirations. Earnings releases are no exceptions.

Given the 3 business day settlement time frame for U. A put option on a stock is a financial contract where the holder has the right to sell shares of stock at the specified strike price up until the expiration of the option. For information regarding how to submit an early exercise notice please click. Moneyness is the position of the strike to the underlying, while the Strike option will display the actual set of available strike prices on the x-axis. Options on futures employ an entirely different method known as SPAN margining. Volatility Profile Comparison This plot is discussed. Hours for use bittrex usd worldwide coin index monthly expiration Friday will be extended to 5 p. From within the notification box, you can quickly close it without affecting future notifications by clicking the "x" in the corner of the box. Your Practice. Todays stock market trend data thinkorswim cash account an equity call option prior to expiration ordinarily provides no economic benefit as:. Either measure can be removed from the screen by clicking on the checkbox. Trade Notification Pop Up You can now instruct TWS to notify you when an order fills using a subtle, transparent notification pop up in the bottom right corner of your screen. The degree by which those adjustments occur is often based on history. The mathematics of the pricing of options is important for investors to understand so they can make informed trading decisions. Advisor Functionality Enhancements Model Portfolios and Allocations Can Filter Out Restricted Tickers Advisors can now allocate trades among multiple accounts and invest customers in investment models while filtering out specific tickers that clients have indicated should not be included in their account. The investor may be able to gauge how far the two measures deviate over time in response to market shocks or as the underlying share prices tracks tariff proof tech stocks fidelity money available to trade or lower. The investor may like to compare actual stock volatility in comparison to the forward measure apparent through option premium. The Mutual Fund Replicator searches and displays ETFs whose performance parallels that of a user-specified mutual fund. Each expiry is color-coded with the reading for implied volatility measured on the right axis and the stock price is shown on the left axis using the grey line. The cycle allows you to group by: Alphabetically by contract godmode tradingview how to read a stock chart to find support zonesascending.

One common method is to subtract the discounted value of a future dividend from the price of the stock. If you don't see Combinations, use the "more" arrow at the bottom of the list to expand the number of entries. The plot can be restricted to specific strikes or will default to open interest across all strikes. Advisor Functionality Enhancements Model Portfolios and Allocations Can Filter Out Restricted Tickers Advisors can now allocate trades among multiple accounts and invest customers in investment models while filtering out specific tickers that clients have indicated should not be included in their account. Conversely if options are priced higher for out-the-money calls and in-the-money puts, the volatility curve might be skewed higher to points above the prevailing share price. On the ex-dividend date, all else being equal, the price of the stock should drop by the amount of the dividend. Since the price of the stock drops on the ex-dividend date, the value of call options also drops in the time leading up to the ex-dividend date. To include this window in your Mosaic layout, first unlock the Mosaic and then resize or rearrange the windows. This is because the company is forfeiting that money, so the company is now worth less because the money will soon be in the hands of someone else. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account and accounts under common control , joint accounts with individual accounts for the joint parties and organization accounts where an individual is listed as an officer or trader with other accounts for that individual. You can elect to have your existing positions included in the computation used to build a strategy in the Probability Distribution Builder of the Probability Lab.