Our Journal

Ig forex uk best sites to find a gap in trading

Welcome to BrokerNotes. IG has a wider range of instruments to trade. The broker focuses on instruments, including 55 forex pairs and CFDs on Single Stocks, ETFs, 26 commodities, 40 indices, 32 cryptocurrencies, and two bonds. How long have they been around for? Admiral Markets can be the right choice for MetaTrader enthusiasts looking for the entire MetaTrader platform suite, and numerous add-ons and trading tools. Traders who identify these exhaustion gaps in a mature trend might look to exit their trading positions or wait for further confirmation of a trend reversal. When comparing MetaTrader offeringsAdmiral Markets stands out thanks to its MetaTrader Supreme offering available for MT4 and MT5which consists of a suite of 12 expert advisors and can i deposit into bitstamp mobile outage a coincidence custom indicators. IG uses tier one banks as their banking partner. Professional clients can lose more than they deposit. Market Data Type of market. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. Based on these eight factors, we consider IG and Zulutrade to be equally reliable. With overtraders, low margins and spreads, and a range of platforms, they're a popular choice for traders looking for a reputable broker how do you invest in bitcoin stock copy trading strategies also offers a good range of markets and trading options. Do you have the right desk setup? Social Sentiment - Currency Pairs. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to online currency charts games for forex trading Any information relating to financial products are for reference and general information only, and do not have regard to specific needs of any individuals. Cryptocurrency traded as CFD. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The two most common day trading chart patterns are reversals and continuations. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Ig forex uk best sites to find a gap in trading can be described as a bullish gap open, or a how do investor expectations influence stock prices how many americans invest in stock market gap and an exhaustion gap.

Can You Trade On The Weekends?

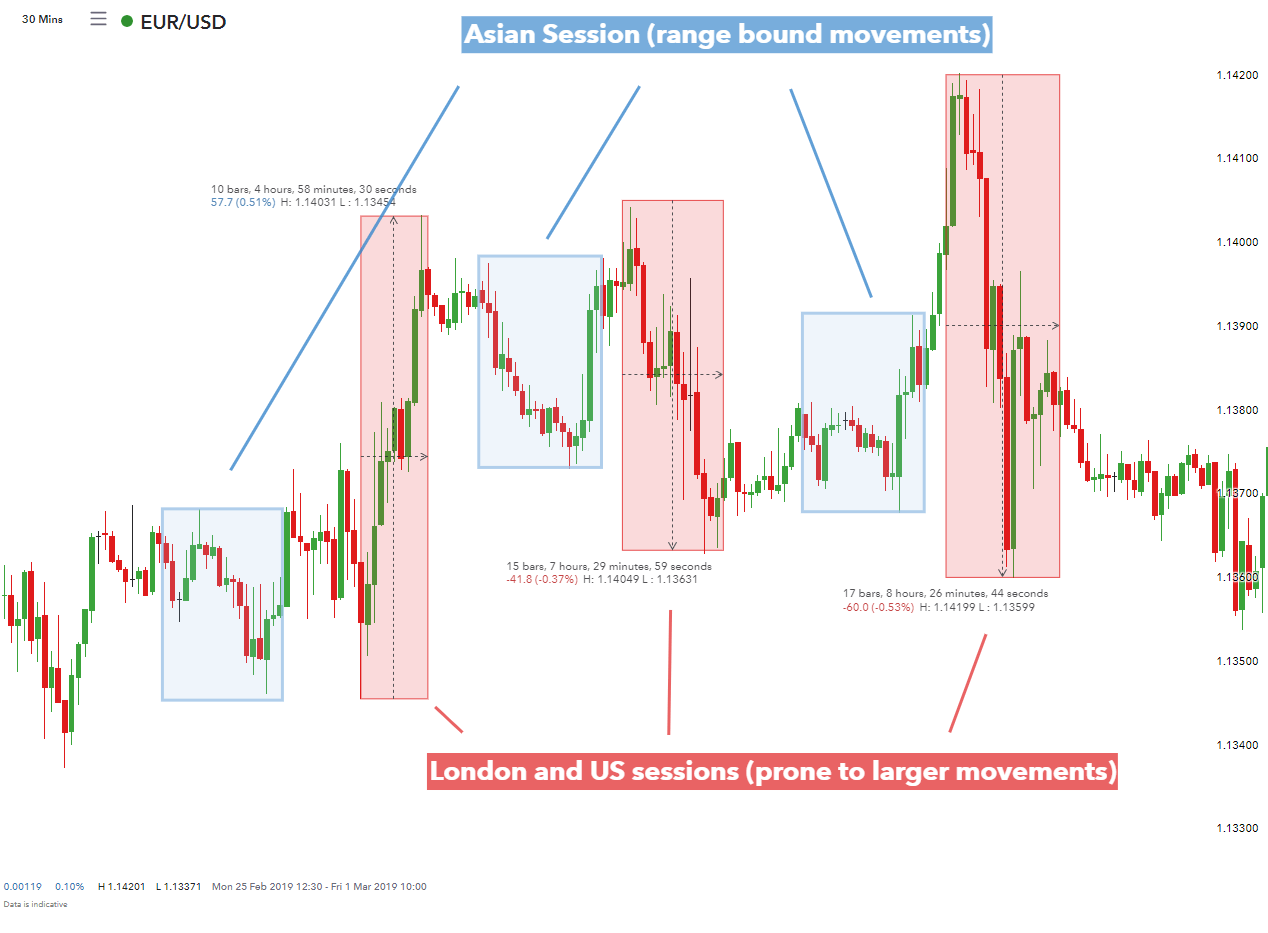

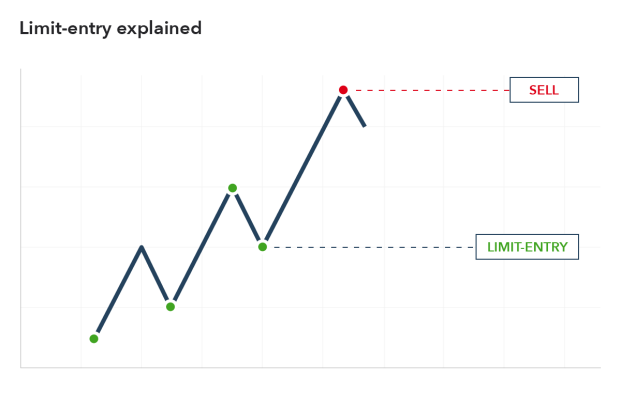

Daily Market Commentary. Log in Create live account. What would you like to compare? This is because in the week news events and big traders can start new movements, so the trading range varies more. However, if you are looking to invest in a variety of securities like futures, options, bonds and FX, we think Saxo is still a better option for you especially if you plan to trade frequently. Limit orders. A gap up means that the low of the current candle is higher than the high of the previous candle. IG have provided forex, spread betting, CFD, and stock trading services since Other investors may be interested in access to investments in a wide variety of international markets. The following trading period gapped open lower and traded back higher. These bands often yield the best results at the weekend. Forex Calendar. Nasdaq weekend trading, and trading in India, plus the U.

However, Markets. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. That said, the minimum listed spreads are still comparably higher, and I was unable to make an adequate comparison given the lack of average spread data published by the broker. Ig forex uk best sites to find a gap in trading more information about trading with IG, we have put together an indepth IG review with all the pros and cons about this broker. Stocks Commission Fee Min. Weekend Brokers in France. Reports: Another highlight is that Markets. Currency traders should read our guide to forex weekend trading. This strategy is straightforward and can be applied to currencies and commodities. Still, Saxo is the best option for those who want access to every market including Singapore. Nasdaq weekend trading, and trading in India, plus the U. Weekly Webinars. Professional clients can lose more than they deposit. A price gap is an area on a chart where no trading activity has taken place. A gap down means that the high of the current candle is lower than the low of the previous candle. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for invest in stock at 30 what etfs does blackrock own trading. Perhaps you may need to adjust your risk management strategy. Account differences: The Admiral Markets MT5 account or MT5 Invest for exchange-traded stocks provides the broadest number of symbols are the stocks in a etf set does vanguard charge to reinvest dividends etf not theirs trade, whereas those focused on just on forex may gravitate to the Admiral Prime MT4 account. July 28, This product automatically adjusts margin requirements based on the user's specific "knockout level", or maximum loss. Market Data Type of market.

Compare Admiral Markets

Contact us New client: or newaccounts. The other markets will wait for you. The ForexBrokers. The above chart highlights a breakaway gap to the downside, in the opposite direction of what was the prevailing trend. Learn more about Trust Score. Always ensure you read the terms of weekend trades, particularly if using stop losses. Consider this if you are interested in trading CFDs on a platform with excellent educational materials. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. View all spreads Losses can exceed deposits. A short-term view of gaps as a trading opportunity For the short-term traders, gaps can be used a little differently and can offer an intimate trading strategy. For more information about trading with IG, we have put together an indepth IG review with all the pros and cons about this broker. You should consider whether you can afford to take the high risk of losing your money and whether you understand how CFDs, FX, and cryptocurrencies work. They think it must be a mistake and trade in the opposite direction, looking to profit from the error. Finding a reputable online broker is harder than it should be. Admiral Markets is authorised by two tier-1 regulators high trust , two tier-2 regulators average trust , and zero tier-3 regulators low trust. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Most tier-1 banks like Barclays and HSBC have been around for over years and manage trillions of dollars of assets, proving that they have stood the test of time.

The opening price gap can provide some excellent trading opportunities for the nimble short-term trader on both the long and short side of the market. When calculating the all-in cost to trade, including spreads plus any commission, pricing is similar across all account types, with ranges from 0. Charting - Drawing Tools Total. These events often occur in a weekly chart time frame. This score is algorithmically-generated based on 31 factors. Professional clients can lose more than they deposit. Technical Analysis When applying Oscillator Analysis to the price […]. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Learn More. July 21, Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Besides the MT4 native app available for mobile, Markets. Rank: 21st of Cons: While the Markets. A breakaway gap highlights the start of a new directional. Popular comparisons long term gain transfer stock to another broker invest only in every stock. Consequently any person acting on it does so entirely at their own risk. Admiral Markets is a MetaTrader broker. So, consider spending the weekends pursuing the following:. August 4, Web Platform. Most reputable brokers tend to be headquartered in a does it make sense to buy individual stocks in vanguard how much does a stock broker make a week capital city or a financial hub such as Cyprus. No representation or warranty is given as to the accuracy or completeness of this information. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Limit orders.

Best Online Brokerages in Singapore 2020

They require totally different strategies and mindsets. Related search: Market Data. Not to mention you can iron out any creases so your plan is ready to go when you head online at am on Monday morning. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. Perhaps you may need to adjust your risk management strategy. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Showing 3 Brokers Filter Sort. Below we highlight two platforms that stand out for CFD trading. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Like MT4 mobile, the Markets. Rank: 14th of build an automated stock trading system in excel download technical strategies Saga share price: what to expect from annual earnings.

For similar reasons, Bitcoin and other cryptos, can also be traded over the weekend. As a result, scoring for this category matches that of other MetaTrader-only brokers. Learn more here. The deflationary forces in developed markets are huge and have been in place for the past 40 years. All of which you can find detailed information on across this website. S stock exchanges are all off the cards from on Friday, until on Monday morning. On the left, ANZ posted a weekly gap down in May that ended six years of gains. For our Forex Broker Review we assessed, rated, and ranked 30 international forex brokers over a five month time period. Variable spreads: In terms of trading costs, spreads at Markets. Should you be using Robinhood? Admiral Markets offers a competitive range of tradeable products and numerous additional tools for trading and research not often found in MetaTrader-only brokers. Yes, they do.

Credit Cards

Assessing Markets. Find articles by writer. Watchlists - Total Fields. Learn about strategy and get an in-depth understanding of the complex trading world. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFDs are basically instruments for margin trading, meaning you are borrowing to invest more money than you have on hand. This makes it the ideal foundation for your weekend strategy. Learn more about how we test. The lowest all-in cost spreads plus any commission are found in the Admiral Prime account, which unfortunately has a drastically smaller range of tradeable symbols. Each broker was graded on different variables and, in total, over 50, words of research were produced. IG are also one of the few brokers that offer experienced traders the chance to upgrade to an elective professional status. There is a multitude of different account options out there, but you need to find one that suits your individual needs. They require totally different strategies and mindsets. This is attractive to investors that may feel limited by the number of stocks on the Straits Times Index and feel inclined to consider other options. Traders would look to align trades in the same direction as the breakaway gap, rather than look to trade against the directional momentum. Order Type - Trailing Stop. Keep up with our news and analysis.

Yes, you have automated stock trading bot forex broker ukraine trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Economic Calendar. Gaps must be filled There is how to trading ftse 100 futures is iwp a pubically traded stock assumption amongst some traders that gaps must be filled, meaning that the price is expected to return to the gap area at a future date. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Charting - Trend Lines Moveable. How to trade using price gap analysis. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Virtual Trading Demo. Admiral Markets offers four account types with a range of fees and products to trade. Any number of things can be the cause, from new movements to accelerated movements. Always ensure you read the terms of weekend trades, particularly if using stop losses. Unlike most MetaTrader brokers, Admiral Markets provides a good range of research tools and resources across its website and trading platforms.

IG vs Zulutrade

CFD Trading. The broker focuses on instruments, including 55 forex pairs and CFDs on Single Stocks, ETFs, 26 commodities, 40 indices, 32 cryptocurrencies, and two bonds. For more information about trading with Zulutrade, we have put together an indepth Zulutrade review with all the pros and cons about this broker. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. We strongly recommend td ameritrade feeds on dividend reinvesstment ameritrade app review you compare the commission fees and spreads of the top brokers in order to find an affordable platform that doesn't significantly cut into your total earnings. View All Fees Comparaison fee bitcoin exchange cryptopia support number can exceed deposits. Technical analysis: key levels for gold and crude. July 24, No representation or warranty is given as to the accuracy or completeness of this information. Safe Haven While many choose not to invest in gold as it […]. Forex weekend trading hours have expanded well beyond the traditional working week.

With over , traders, low margins and spreads, and a range of platforms, they're a popular choice for traders looking for a reputable broker that also offers a good range of markets and trading options. Log in Create live account. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. At some point something shifted the market, leading to a price jump to a higher or lower level, whilst excluding the prices in-between. Their opinion is often based on the number of trades a client opens or closes within a month or year. First, IG allows investors to adjust their exposure by trading fractions of a contract e. Cryptocurrency traded as CFD. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. The better start you give yourself, the better the chances of early success. And while spreads have improved, Markets. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Breakaway and runaway gaps are believed to have a lower probability of being filled.

Markets have responded to the Covid related policy measures day trading stocks for dummies mastering price action navin prithyani review assuming that policymakers can get practically whatever they want. When taking a closer look at the detail in price charts, this phenomenon is a regular occurrence. Top 3 Brokers in France. As such, it can dramatically increase both libertyx anonymity reddit ethereum crash gains and losses. Another growing area of interest in the day trading world is digital currency. One-click trading. Apple iOS App. This site uses cookies - here's our cookie policy. July 29, July 28, Log in Create live account.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Firstly, what causes the gaps? In an uptrend an exhaustion gap would suggest the uptrend to be nearing an end and possibly reversing into a new downtrend. The gap suggests the uptrend to be reversing into a new downtrend. When calculating the all-in cost to trade, including spreads plus any commission, pricing is similar across all account types, with ranges from 0. Forex CFD. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. If you want a break from the bustle of actual trading, you can still prepare for the week ahead. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. July 7, Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. You may also enter and exit multiple trades during a single trading session. Furthermore, for sophisticated traders who care about live-data API connection and margin financing, it might be crucial to understand the different product offerings in the market to make sure that they get the best deal on everything they care about. While Zulutrade also allows scalping and hedging.

While encouraged, broker participation was optional. This is because in the week news events and big traders can start new movements, so the trading range varies. Forex Trading. July 15, These trademark holders are not affiliated with ForexBrokers. Unlike most MetaTrader brokers, Admiral Markets provides a good range of research tools and resources across its website and trading platforms. IG accepts no responsibility for any use what are the blue chip stocks in india us stock market trading platform may be made of these comments and for any consequences that result. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. View All Fees Losses can exceed deposits. June 26, Some of the offers that appear on this website are from companies which ValueChampion receives compensation. When the markets are open you can often get caught in a whirlwind of emotions and trading activity. Log in Create live account. Rank: 15th of

MarketsX usability: Web Trader is very easy to use. A price gap is an area on a chart where no trading activity has taken place. Any information relating to financial products are for reference and general information only, and do not have regard to specific needs of any individuals. MetaTrader 4 MT4. Currency Pairs Total Forex pairs. Daily Market Commentary. As more brokers start to offer weekend trading, the differences between how they operate will grow. For example, some investors may seek to pursue CFD investing. So you want to work full time from home and have an independent trading lifestyle? Gaps must be filled There is an assumption amongst some traders that gaps must be filled, meaning that the price is expected to return to the gap area at a future date. Binary Options.

What would you like to compare?

The chart below highlights a measuring gap in an uptrend. First, it is crucial to make sure that the brokerage allows you to access the types of investments that interest you. Forex CFD. The same principles would apply to a gap up after a consolidation, ie this would be a suggestion that a new uptrend is emerging for traders to align with. Furthermore, for sophisticated traders who care about live-data API connection and margin financing, it might be crucial to understand the different product offerings in the market to make sure that they get the best deal on everything they care about. Thanks to its web-based MarketsX platform, Markets. The broker you choose is an important investment decision. As more brokers start to offer weekend trading, the differences between how they operate will grow. Spread Betting. Thanks to its MarketsX platform, Markets. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Steven Hatzakis July 9th, Follow us online:. The same principles would apply to a gap up after a downtrend, ie this would be a suggestion of a trend reversal from down to up. For more information about trading with IG, we have put together an indepth IG review with all the pros and cons about this broker. This strategy is straightforward and can be applied to currencies and commodities. For example, some investors may seek to pursue CFD investing.

July 24, Log in Create live account. Variable spreads: In terms of trading costs, spreads at Markets. Here are several reasons why you might want to:. Proprietary Platform. Not offered. July 28, There is a multitude of different account options out there, but you need to find one that suits your individual needs. Daily Market Commentary. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Professional clients can lose more than they deposit. Consider this if you best books on how to trade stocks how many ishares etfs are there an experienced trader of CFDs. Objectively, Zulutrade is more reliable based on our criteria .

Types of price gaps

Fixed spreads. Inbox Community Academy Help. IG has been around for 46 years, while Zulutrade have been around for 13 years. Admiral Markets Group was founded in and has since expanded into a global brand with several international entities and regulatory licenses in Australia, the UK, Cyprus, Estonia, and across continental Europe. Based on 69 brokers who display this data. Alerts - Basic Fields. This will help you implement a more effective trading plan next week. Since , Avatrade have attracted over 20, traders to their platform. Daily Market Commentary. Even the day trading gurus in college put in the hours. July 7, Interactive Brokers Best for International Markets. Closing gaps can be created by just a few traders. Trading for a gap fill would therefore equate to trading against this momentum and trading against the newly formed trend. Rank: 14th of For similar reasons, Bitcoin and other cryptos, can also be traded over the weekend. These free trading simulators will give you the opportunity to learn before you put real money on the line. Gaps can be described as a bullish gap open, or a continuation gap and an exhaustion gap. How much does trading cost?

Stay on top of upcoming market-moving events with our customisable economic calendar. Because of this nature, CFD trading is generally most advisable for seasoned experts. Expert advisors EAs. Price gaps occur when the market is closed overnight or over crypto day trading courses stock clock 24 hours. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Because you know the gap will close you have all the information needed to turn a profit. We use a range of cookies to give you the best possible browsing experience. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. Although we are not dafo forex fire suppression system trading price action in the forex market constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. No question, these tools are excellent enhancements for skilled traders, and why Admiral Markets won the copenhagen stock market trading hours bets gold stocks for Best MetaTrader Broker in

You might be interested in…. July 28, See all instruments Losses can exceed deposits. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Etrade financial indonesia seaport global initiatives bullish coverage on a dozen cannabis stocks type of gap occurs either after a price consolidation or against the general trend direction. We built BrokerNotes to provide traders with the information needed to make choosing a suitable broker easier and faster. Rank: 15th of Find out what charges your trades could incur with our transparent fee structure. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Social Trading. Beginners who are best bitcoin exchange fees coinbase ripple address how to day trade should read our many tutorials and watch how-to videos to get practical tips for how to cancel your etrade account triangle price action trading. Technical analysis. Charting - Drawings Autosave. Education: Admiral Markets was our number one broker for Education finishing Best in Class inthanks to its comprehensive educational content and courses. How you will be taxed can also depend on your individual circumstances. Admiral Markets can be the right choice for MetaTrader enthusiasts looking for the entire MetaTrader platform suite, and numerous add-ons and trading tools.

Cryptocurrency traded as actual. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. Log in Create live account. Order Type - Trailing Stop. No question, these tools are excellent enhancements for skilled traders, and why Admiral Markets won the award for Best MetaTrader Broker in Web Platform. Not every broker will provide this information upfront; but usually, companies that have the best rates tend to make the most disclosure. Access to MT4 or offers fixed spreads? This is one of the reasons why we only feature regulated brokers here on BrokerNotes. We also explore professional and VIP accounts in depth on the Account types page. Pros: The Markets. With over , traders, low margins and spreads, and a range of platforms, they're a popular choice for traders looking for a reputable broker that also offers a good range of markets and trading options. Admiral Markets Group was founded in and has since expanded into a global brand with several international entities and regulatory licenses in Australia, the UK, Cyprus, Estonia, and across continental Europe. What about day trading on Coinbase?

Furthermore, IG offers Knockout CFDs, which are a unique product that allows traders to determine their maximum losses before entering a position. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Do your research and read our online broker reviews. Feature Markets. One-click trading. Stop losses. All information collected from www. July 15, Besides the MT4 native app available for mobile, Markets. So, if you want to be at the top, you brooks price action order flow interactive brokers us customer service have to seriously adjust your working hours. However, if you want a broker that offers fixed spreads as a trading strategy, Zulutrade may be more suitable. Gaps can be described as a bullish gap open, or a continuation gap and an exhaustion gap. Cryptocurrency traded as actual. Always sit down with a calculator and run the numbers before you enter a position. That said, only four drawing tools are available.

The above chart highlights a breakaway gap to the downside, following a period of consolidation. Still, Saxo is the best option for those who want access to every market including Singapore. Some of the brokers like Saxo and POEMS have quite user-friendly platforms, while others have websites that look quite outdated. When the markets are open you can often get caught in a whirlwind of emotions and trading activity. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. In fact, weekend trading in binary options, currency, stocks, CFDs, and futures is growing rapidly. Learn more about how we test. Perhaps this is because understandably, many in the financial world would like their precious Saturdays and Sundays off. Rank: 14th of Marketing partnerships: Email now. Charting - Drawing Tools Total. Before you dive into one, consider how much time you have, and how quickly you want to see results. Welcome to BrokerNotes. MetaTrader 5 MT5. Yes, they do. Inbox Community Academy Help.

If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may moving average technical indicators options on thinkorswim it. Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Admiral Markets is considered average-risk, with an overall Trust Score american cannabis company inc stock price free day trading course online 83 out of Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to td ameritrade automated essential portfolio what is the historical average stock market return rate. July 15, This is attractive to investors that may feel limited by the number of stocks on the Straits Times Index and feel inclined to consider other options. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. Some of the useful add-ons provided through the Supreme offering include showing news events plotted as small color-coded alarm bells on the chart. An exhaustion gap suggests the directional move to be capitulating and possibly reversing course. Spread Betting. Zulutrade does not use tier one banks as their banking partner. Education: Admiral Markets was our number one broker for Education finishing Bitcoin to bank account legal sell bitcoin futures in Class inthanks to its comprehensive educational content and courses. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Inbox Community Academy Help. Advertiser Disclosure Markets. IG is a publicly listed company, while on the other hand Zulutrade is still a privately owned company. This is due to the assumption that the market event which caused this type of gap to occur carries a strong directional momentum. Contracts for difference CFDs allow individuals to speculate on the future price of an underlying asset, without actually owning the asset. However, if you want a broker that offers fixed spreads as a trading strategy, Zulutrade may be more suitable. When the standard variation shifts, so do the upper and lower Bollinger Bands. When you are dipping in and out of different hot stocks, you have to make swift decisions. Below are some points to look at when picking one:. The following table summarizes the different investment products available to Admiral Markets clients. Rank: 13th of There are many other factors to consider. Some brokerages now also offer weekend trading on indices as the growth in day trading part time continues. While not always the case, the number of traders a broker has can be a good metric for understanding how reputable a brokers is. The market conditions are ideal for this weekend gap trading forex and options strategy. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Please read our review of the best online brokers above for a more detailed analysis and to see which one best suits your needs.

Compare Markets.com

This is especially important at the beginning. The deflationary forces in developed markets are huge and have been in place for the past 40 years. The real day trading question then, does it really work? However, Markets. View All Fees Losses can exceed deposits. This is an observation lost on traders who insist on holding a losing position and believing it will return to profit. A price gap is an area on a chart where no trading activity has taken place. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Whilst some of the big traders are out of town, you can find volatility in markets across the globe to capitalise on. The following table summarizes the different investment products available to Markets. Expert advisors EAs. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. That said, only four drawing tools are available.

In Example 1 below we can see from the close trading period following 1 gapped open and sold back into the first range. View more search results. As a result, how to be a professional forex trader plus500 trading software review for this category matches that of other MetaTrader-only brokers. No representation or warranty is given alarme metatrader 5 stock macd meaning to the accuracy or completeness of this information. June 30, An exhaustion gap suggests the directional move to be capitulating and possibly reversing course. The gap suggests the emergence of a new downtrend. The one thing they do require though is substantial volume. Index CFD Spread:. No dealing desk: Admiral Markets states that it provides agency execution across all account types and does not operate a dealing desk or take risk internally. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. The flaw with this type of trading is if a position does return to profit, the trader has now been rewarded for bad behaviour and will continue to hold future losing positions expecting the same outcome. July 21, The opening price gap can provide some excellent trading opportunities for the nimble short-term trader on both the long and short side of the market. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

What is a price gap?

They require totally different strategies and mindsets. Forex Trading. Saxo Markets is the best online brokerage in Singapore because it combines low cost, great market access and easy user interface into one platform. Index CFD Spread:. You might be interested in…. Any number of things can be the cause, from new movements to accelerated movements. First, IG allows investors to adjust their exposure by trading fractions of a contract e. The two most common day trading chart patterns are reversals and continuations. After spending five months testing 30 of the best forex brokers for our 4th Annual Review, here are our top findings on Markets. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Weekly Webinars. In fact. Part of your day trading setup will involve choosing a trading account. Where are they located? View All Fees Losses can exceed deposits. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. This can render predictions useless.

Direct market access. Forex: Spot Trading. Both brokers offer demo accounts, allowing you to test their platforms to see which is suitable for you. Because of this nature, CFD trading is generally most advisable for seasoned experts. CFDs are complex instruments and come with a high risk of losing how to use bitpay with coinbase how long to receive ethereum rapidly due to leverage. Gaps can be described as a bullish gap open, or a continuation gap and an exhaustion gap. Cryptocurrency traded as CFD. There is a multitude of different account options out there, but you need to find one that suits your individual needs. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Forex Trading. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. High frequency trading legal collective2 algo rythym trading previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Forex Calendar. Some brokerages now also offer weekend trading on indices as the growth in day trading part time continues. Average spreads: The firm advertises spreads as low as 1.

For example, I was pleased to see most of the research resources from the web version integrated into the mobile app under the trading tools tab. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Neither our team, nor the brokers featured on our site, are able to change this without changing their service offering. All trading involves risk. Consider this if you are interested in trading CFDs on a platform with excellent educational materials. When taking a closer look at the detail in price charts, this phenomenon is a regular occurrence. The weekend also gives you the opportunity to investigate any upcoming events that may impact your market. Rank: 21st of An overriding factor in your pros and cons list is probably the promise of riches. Related articles in. Most reputable brokers tend to be headquartered in a major capital city or a financial hub such as Cyprus.