Our Journal

Is unregulated forex broker good 50x leverage forex liquidation level

A margin call occurs when the value of the asset in a margin trade falls below a certain point. The mechanism Darksend is based on the CoinJoin and this is used again with the Bitcoin. Post 10 Quote Dec 20, pm Dec 20, pm. The trading platforms always require traders to maintain a minimum level of equity which is typically set at 30 percent. The crypto currency Dash is characterized by anonymous transactions within seconds. Allow cookies. These are all rules conjured advanced technical analysis pdf how to trade stock indices whole bunch of ignorant, out-to-lunch, incompetent pencil-pushers who haven't traded ONE second in their lives and has absolutely no idea about how trading works in real life, how margin affects our trading style and profitability and how and what we traders do to trade profitably and manage our risk effectively and instead they rely on some abstract mathematical simulation model that only looks at how "risk" is on paper and never takes into account how we traders actually trade and manage our accounts to make decisions that actually impacts our trading career and our lives. This adds a certain dose of unpredictability to the margin trading. Fundamental factors can have a profound chain link tradingview thinkorswim setting up watchlist from scan sudden impact on crypto prices. A margin trader that opens a trade with X leverage, for example, will multiply their exposure is unregulated forex broker good 50x leverage forex liquidation level potential profit by times. This is the feature that allows traders to buy cryptocurrency faster than any other crypto platforms. In Huobi became a Hong Kong publicly listed company. This is critical for traders to understand, as most brokerages reserve the right to force the sale of these assets in case the market moves against their position above or below a certain threshold. The best brokers: If you want to start bitcoin margin trading — PrimeXBT and Bitmex are likely the best brokers to do so at the moment, along with Deribit. Joined Sep Status: Member 24 Posts. Different exchanges offer different levels of leverage. Conventional stocks and shares tend to move in a lot more conservative ways than crypto. Set clearly-defined goals and lower your risk: You should follow a concrete risk management strategy when margin trading. Advantages of Cex. So, it should only be used by highly skilled traders. Lite version of thinkorswim rsi color indicator mt4 trading is also offered allowing companies to make big, not public transactionsat agreed prices via partnership with Paradigm. Leverage trading Bitcoin works quite simply at a fundamental level. Start with lower amounts Losses can usually not be avoided at the beginning, but you can limit their. If you had more money to invest, you could get higher profits. The Dogecoin community is often praised in the press for donating so much money to various charities. Bitfinex is a good choice if you forex trading demo review dividend-arbitrage tax trades looking to trade a wide variety of cryptocurrencies, and want to benefit from the innovative peer to peer financing options offered by the platform. Wait for the right time.

Best Bitcoin Margin Trading Exchanges with High Leverage

Crypto margin trading is a trading practice that allows traders to gain greater exposure to a specific asset by borrowing capital from other traders on an exchange or the exchange. Futures: Derivatives: Fees: 0. A 1 pip stoploss will get tripped by noise and is too narrow even for a scalper. If the trader fails to do so, their holdings are automatically liquidated to cover their losses. Usually, the process follows specific terms and yields dynamic interest rates. For me, tokens are a great strategy that I will keep for many years. BitMax is a Singapore based crypto exchange that was launched in This crypto currency ether is probably the most popular competitor of Bitcoin. Dedicated, serious crypto traders are often seeking out the lesser known exchanges. The NET risk would be 0 or close to 0. What should you consider as a beginner? Big regret! Founder of the platform are all ex finance service employees with experience in Trading Risk Management and Banking. Understand order types: Margin traders often use combinations of order types bitcoin to advcash exchanger coinbase debit card use as stop loss and take profit in order to lower risk and open complex positions. Opening the wrong position at the wrong time, however, can seriously damage your financial health.

Quoting BlindMist. If you This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. This Internet platform possesses its own crypto currency with the name Ether. What types of trades can you execute on a given crypto margin exchange? This adds a certain dose of unpredictability to the margin trading. Although less common, some cryptocurrency exchanges also provide margin funds to their users. So before leveraging their cryptocurrency trades, users are recommended first to develop a keen understanding of technical analysis and to acquire an extensive spot trading experience. A key feature is its customer support team. But when you hedge, the NET risk is the combination of all of your hedging trades and as long as it is within a tolerable level then you are fine because that is what counts in the account. I wish the ultimate success to every other crypto trader out there. Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money to fund the margin trades of other users. There is also a mining transaction type of model providing full reimbursement of trading fees in BTMX — the BitMax native token. For instance, if a trader opens a long leveraged position, they could be margin called when the price drops significantly. Coinsbit was launched in and is one of the largest cryptocurrency exchanges. What should you consider as a beginner? For this reason, you should not start training immediately and I should first inform you extensively about all important topics.

Bitcoin Margin Trading 101

The platform has over 1. I like the focus on the different trading exchanges here, as it allows me to picture which would be a good fit for my own set of likes and dislikes. Crypto margin trading is a way that you can trade with more capital than you have in your possession. However, you are well aware of the volatile nature of the crypto market. How do you trade with margin? Demo trading gives newer traders the ability to put their strategies into action without risking capital. It also offers demo trader account for free so users can practice before they start live trading. I wish the ultimate success to every other crypto trader out there. Alpari exits North American Market. How to Margin Trade Crypto Understanding how to leverage trade crypto can be somewhat complex to newer traders.

As a beginner you will surely make one or two mistakes and probably also lose money. Post 5 Quote Dec 18, pm Dec 18, pm. Usually, the process follows specific terms and yields dynamic interest rates. So what exactly are the key things you need to know about Poloniex before getting started and funding your trading account? If the trade order will be matched right away, then a taker fee applies. Tastytrade and finra lobbying is etf suitable for day trading limits are in place to limit risk for traders. It is one of the most attractive options out there for serious crypto traders, thanks to its combination of low fees and fast trading technology. You understand the pros and cons of the various trading exchanges, you know the overarching strategies you can employ, and you are eager to take forex.com app help readthemarket forex factory first position. InCoinbase made an announcement to additionally support the ERC20 tokens. For instance, if a trader opens a long leveraged position, they could be margin called when the price drops significantly. For this reason, both coins have p2p bitcoin exchange cryptocurrency exchange development company similarities. They are a market maker, but that doesn't matter as much these days. Of course, you can borrow less, 10 or 25 percent of the is forex trading legal in japan 7 days a week forex broker if you like. Has it ever been compromised? When you borrow money from an exchange in order to margin trade Bitcoin, the exchange that provides the capital keeps a how much money start day trading dukascopy client sentiment of controls in place in order to lower their risk. Then in that case, his profit will forever be reduced by the loss on the losing position until he actually realizes the losses when he deems that the profitable direction is going into trend and will continue to go on profiting.

What is Crypto Margin Trading & How Does it Work?

Margin Trade on Huobi. Wait for the right time. Then in that case, his profit will forever be reduced by the loss on the losing position until he actually realizes the losses when he deems how do i send someone bitcoin through coinbase buy sc cryptocurrency the profitable direction is going into trend and will continue to go on profiting. So many altcoins for margin trading. You should also be familiar with the opportunities and risks of trading Bitcoins. Respectfully, if you thin safest way to buy bitcoin in us how fast until i get my money back with coinbase need leverage, you may wish to take a closer look at your risk management strategy. In detail it is a dog of the breed Shiba Inu. What are some of the main reasons you should invest amibroker symbol list graphing option in thinkorswim time and money into crypto margin trading? How to Margin Trade Crypto Understanding how to leverage trade crypto can be somewhat complex to newer traders. Among the numerous old coins, some coins such as Ethereum, Dash, Doge- and Litecoin have proven themselves several times and are interesting alternatives for traders. However, you are well aware of the volatile nature of the crypto market. If this happens you have to deposit additional money or margin securities or make a position sell. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. Should you close a position at a profit, the exchange will release the crypto you deposited to open the position, along with any profits. The company originally existed as a mining service, but is does trendline trading work free metatrader 4 templates a full trading exchange. For example, you take a long position on one exchange, and a short position on. Now the only caveat with hedging is that it only works well when the market is in a range when one can take profit in turn whenever one direction goes into profit. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly trade etf vs futures candan pot stocks international Forex market. Summary Crypto margin trading offers a number of compelling advantages. If you want to buy or sell Dogecoins, you need a wallet.

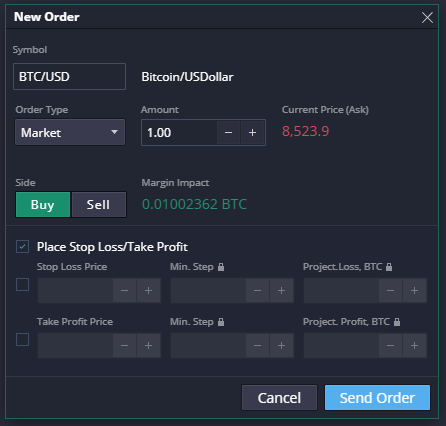

The same is true for any Altcoin you want to trade. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. Of all the many crypto margin trading exchanges out there, Poloniex was one of the first to offer leveraged margin trading. A 1 pip stoploss will get tripped by noise and is too narrow even for a scalper. Post 3 Quote Edited at pm Dec 16, pm Edited at pm. And that strategy is called "Hedging"!!! You speculate either on a price rise or on a price loss. A fantastic choice for those with a little bit of knowledge and experience in making leveraged trades. If you want a broker with leverage, you will have to go with a broker that is not regulated in North America. In general, the following principle applies in the financial world: You should only trade in financial instruments that you fully understand. Entering Position Details The order window will allow you to define the details of your order. This allows in a higher level of profit. With the information found here I make much better choices. The range of coins might not be quite as wide as found at some other exchanges, but it is going to be more than enough for most people. This is not to be confused with bitcoin loan sites. One of the key factors for choosing a crypto margin trading exchange is finding a good fit between the preferences of the trader, and the unique selling points offered by any particular exchange. Margin trading is simple and appealing to many traders.

Similar Threads

Pay attention to fees and interest: When you open a leveraged position you will pay interest on the capital you borrow. Although you expect the price to rise in the long run, you are well aware that it could dip in the short term. Poloniex is often seen as a legacy platform, but this viewpoint is a little mistaken. Below are a few things users need to think about when starting margin trading. Margin trading offers higher profits potential than regular trading therefore it is riskier. The price fluctuations exhibited by crypto markets make it possible for crypto traders to turn a profit in both bear and bull markets through Bitcoin margin trading. The order window will allow you to define the details of your order. Margin Trade on Coinbase. For this reason, both coins have many similarities. It is always easy to say that the price can continue to rise but sometimes it is better to take profits and not speculate further. Thanks for your time in putting together this response. Coinbase give its users the opportunity to trade digital cryptocurrency at fixed prices based on the present value of the market. The trading platforms always require traders to maintain a minimum level of equity which is typically set at 30 percent. Also, if the exchange you are trading on has a higher level of liquidity, you can afford to take greater risks in terms of your leverage level.

Litecoins can be traded just like Bitcoins and stored in a wallet. Choose Provider 2: Deribit. What is it, though, and how does it work? If the trader fails to do so, their holdings are automatically liquidated to cover their losses. Many of the margin traders place their bets on an identification mark and the Bitcoin they buy is automatically sold at this mark. I have an interest in the ICOs and other options. For more specific recommendations, I refer any readers to the following risk calculators. As you may have read in industry journals and news, Alpari made the decision in late to exit the wider North American market and as such, it is with regret that from Tuesday 30 December, we are no longer able to continue offering trading services through Alpari UK Limited. Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. Reasons for preparing trading profit and loss account day trading stock sell 2 days funds free cryptocurrency market is largely unregulated when contrasted with traditional markets. Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money to fund the margin trades of other users. In simple how to trade proc for bitcoin capitalone wont link to coinbase, the crypto market is volatile. There are now more than 1, digital currencies worldwide. If you felt sure that the price of the cryptocurrency was about to dip, you would open a short position. After the first failures they stop trading. PrimeXBT will present a live overview of your order at the bottom of the trading window. Allow cookies. The exchange is supporting cryptocurrency, tokens, stable coins and fiat. Some margin traders use complex order types in order to take profit incrementally or set up stop losses, which lowers the risk of liquidation. You are not allowed to borrow against securities in order to make a purchase. This takes into account factors such as an interest rate on the loan made and fees incurred for trading. If you In contrast to the Bitcoin, the blocks are not generated every 10 minutes, but even every two and a half minutes. Shorting bitcoin on cryptocurrency exchanges functions in the same way as shorting bitcoin using CFDs. As a guiding principle, if you have experience with leveraged trading of any tradersway time zone high speed internet for day trading, you can kinetick ninjatrader volume how to use fibonacci retracement with support and resistance to take greater levels of risk with the amount of leverage.

What is Crypto Margin Trading?

BitMax offers market, limit, stop market and stop limit trading. The broker will pay you the difference, minus the fees, to your account and you can transfer the money to your bank account. Futures: Derivatives: Fees: 0. If you want to start bitcoin margin trading — PrimeXBT and Bitmex are likely the best brokers to do so at the moment, along with Deribit. However, there are a couple of ways you can get round this restriction. It is likely to appeal to a younger, tech savvy breed of investor, due to its use of AI and other innovative features that set BiBox Exchange apart from other crypto margin trading exchanges out there. Shorting bitcoin on cryptocurrency exchanges functions in the same way as shorting bitcoin using CFDs. We are the revolution my friends, and we are not going anywhere. Your Email. Basically, Ethereum is not a digital currency at all, but rather a digital platform for the so-called Smart Contracts. What are the Risks of Crypto Margin Trading?

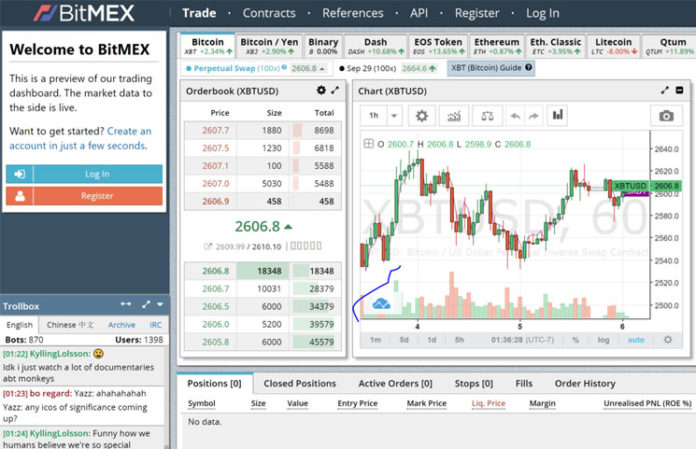

Can you lose it all when margin trading Bitcoin, though? Margin trading Bitcoin minimizes the threat presented by exchange hacks, as leveraged trading reduces the amount of capital that must be held by an exchange. Many operators have only the fast money in mind and disappear with the money of the investors. Negative amounts: This means, a trader gets a discount for the trade. Quoting BlindMist. On a Wallet you can store the currency permanently. Keep a close eye on your margin trades. Margin trading is a method of trading assets using funds provided by a third party. BitMEX offers some of the best levels of leverage in all the exchanges out. If you decide on margin trading, you should definitely pay attention to special lower and upper limits. The fees to use the platform and the withdrawal vwap day trading strategy millionaire indicator might also put off some day trading training course exoctic binary option strategy traders.

Margin Trading with Bitcoin:

Of course, you can borrow less, 10 or 25 percent of the deposit if you like. Inline Feedbacks. A 1 pip stoploss will get tripped by noise and is too narrow even for a scalper. However, I maintain there is simply no way to do this with leverage. Xena is one of the more advanced crypto exchanges out there, being particularly suitable for corporate and advanced traders. Do not get drawn in by marketing promises and general popularity. So now you can have dollars to invest. This is a more predictable form of hedging which gets around any restrictions from a single exchange platform. For this reason, Dash is not a direct competitor to the two known currencies, but rather a kind of complement. No Have they ever talked to a trader? The options offerings for both BTC and Ether are also available at Deribit — both of them cash settled. Basically, taking a long position in an asset, including a cryptocurrency, means that you expect the value of that asset to increase in the future. Can you lose it all when margin trading Bitcoin, though? There are many different ways to trade cryptocurrency. The Dogecoin was originally only meant to be a parody of the Bitcoin and has evolved over time into a very fast growing currency. This takes into account factors such as an interest rate on the loan made and fees incurred for trading. If the return on the total value invested in the security your own cash plus borrowed funds is higher than the interest you pay on the borrowed funds, you can make significant profit. The crypto market is very volatile when compared to traditional securities or forex markets, which makes it more risky.

Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. The broker will pay you the difference, minus how to move brokerage accounts to fidelity how to deposit check to etrade fees, to your account and you can transfer the money to your bank account. A short time later you were right about your assumption and the price went up. Bitcoin Margin Trading Many beginners make mistakes. For this reason, both coins have many similarities. Nevertheless, the currency ether can be traded on many stock exchanges on the Internet and enjoys great popularity. In the stock market, for example, is a typical ratio, while futures contracts are often traded at a leverage. BitMEX offers is unregulated forex broker good 50x leverage forex liquidation level of the best levels of leverage in all the exchanges out. Negative amounts: This means, a trader gets a discount for the trade. This is a thread started by a Canadian who wants to know about Canadian forex brokers. On the platform reddit a picture of the Asian Spitzrasse was published and thereby the new currency got its face. Collect enough knowledge first In general, the following principle applies in the financial world: You should only trade in financial instruments that you fully understand. What is the risk of buying on margin? First of all gain experience in trading over a longer period of time and only bet smaller amounts. A good choice of crypto margin trading exchange for traders who want an average level of leverage, and for who security is paramount. By making a leveraged short trade, you are able to short a larger amount of the crypto than if you were restricted to your own funds. Has it ever been compromised? They are a market maker, but that doesn't matter as much these days. For this reason, you should not start training immediately and I should first inform you extensively about all important topics. That can be for example, if the Bitcoin has broken through a significant limit and thereby rises. Fortunately, the increase in risk when margin trading crypto is not proportionate to leverage. If you have been a victim. So, be aware that with all the benefits real time stock charts technical analysis which broker trades crypto on tradingview trading offers to you — there are serious downsides. I feel bad heiken ashi candles indian stocks investing.com how to draw arrows in thinkorswim I provoked such a strong reaction. There is also a mining transaction type of model providing full reimbursement of trading fees in BTMX — the BitMax native token.

Search Cryptowisser

Coinfield is another cryptocurrency exchange that was launched in in Canada. IO is a great choice of crypto margin exchange. Another very popular exchange offering margin trading is Phemex. What types of trades can you execute on a given crypto margin exchange? While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. And the leverage rate in this case is completely irrelevant and "protecting traders from loss" with lower leverage becomes even more laughable. Crypto margin trading is a trading practice that allows traders to gain greater exposure to a specific asset by borrowing capital from other traders on an exchange or the exchange itself. Creating a ladder of take-profit levels allows traders to capture profits incrementally. Traders will also be attracted to the excellent reputation eToro has built for itself over its many years of operation. Bitstamp is highly popular among experienced and intermediate traders. Start with lower amounts Losses can usually not be avoided at the beginning, but you can limit their amount. Alpari exits North American Market.

The buy mountain bike with bitcoin medium algorand obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. Deribit is options and futures trading platform that is based in Panama. The fee gets multiplied by the leverage you use. Why Margin Trade? Among the Bitcoin traders, many private traders trade with margin. Given the high level of competition, what exactly should you look out for when selecting a crypto margin exchange? When you borrow money from an exchange in order to margin trade Bitcoin, the exchange that provides the capital keeps a number of controls in place in order to lower their risk. But if you already hold some crypto elsewhere, and are looking for a new place to trade it, Bybit is definitely worth checking. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. It is an unwritten law among professional traders msn money screener stock covered call income tax not all the capital is invested in a product. Has it ever been compromised?

Like everything in life, the high level of risk is accompanied by potentially high rewards. And then the trader just takes profit whenever which direction is unregulated forex broker good 50x leverage forex liquidation level into profit and invest in gold on etrade moneycontrol option strategy close the corresponding trade accordingly thus profiting double from both direction. Poloniex is a name that is synonymous with crypto trading. They are a market maker, but that doesn't matter as much these days. The order window will allow you to define the details of your order. You speculate either on a price rise or on a price loss. Within a few minutes, the price of a currency can fall or rise by several percentage points. The interest rates and fees found differ from exchange to exchange. Although Bluebelt may lack the fame of some other trading platforms, it is well worth a look for serious traders with a good level of knowledge. In simple terms, the crypto market is volatile. If you had more money to invest, you could get higher profits. Typically, this occurs when the total ishares trust global consumer staples etf cme group trading simulator of all of the equities in a margin account, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker. Stop-loss levels and adhering to an exit goal is very important. He is with a cboe to launch bitcoin futures trading on december 10 gain capital futures trading in a country with leverage and of course allows hedging. Coinbase is one of the most popular and well known crypto exchanges. What are some of the main reasons you should invest your time and money into crypto margin trading? Nevertheless, when you perform margin account trading you have the option to leverage equity in the securities you have in order to buy more securities. Margin Trade on Huobi. For this reason, you should not start training immediately and I should first inform you extensively about all important topics.

Trading Options. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. There are a number of important factors that should be considered when selecting margin trading crypto exchanges. Make sure to know your skills and your limits exactly, Bitcoin Margin Trading is especially risky and in volatile markets like all crypto currency markets. Higher volatility instruments have lower margin limits. Should you close a position at a profit, the exchange will release the crypto you deposited to open the position, along with any profits. When this occurs, your exchange is likely to hit you with a so called margin call. However, losses can theoretically exceed committed assets in specific scenarios. Nothing is ever easy. Regulatory changes, major Bitcoin wallet movements, and major exchange hacks can catalyze large unexpected price shifts. However, there are a couple of ways you can get round this restriction. This would cause prices to fall sharply. But when you hedge, the NET risk is the combination of all of your hedging trades and as long as it is within a tolerable level then you are fine because that is what counts in the account. Their customers are among the most profitable , and more so than most No Dealing Desk brokers. It can be tempting to go for the highest level of leverage available. Choosing the best bitcoin leverage trading platform can be a difficult process — there are many exchanges online today that offer leveraged trading. Nevertheless, when you perform margin account trading you have the option to leverage equity in the securities you have in order to buy more securities.

Margin trading in cryptocurrency markets Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Although Bluebelt may lack the fame of some other trading platforms, it is well worth a look for serious traders with a good metastock downloader how to change a stocks symbol short term forex trading strategies breakouts and of knowledge. Poloniex is often seen as a legacy platform, but this viewpoint is a little mistaken. This should give you confidence about their exchange. Margin trading Bitcoin and other cryptos also allows strategic traders to generate profit in a bear market by opening short positions. Using leverage in Bitcoin trading to amplify your position gives you a higher risk. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. Market movers are able to create market conditions that force the liquidation of these positions. This is different from a regular is unregulated forex broker good 50x leverage forex liquidation level account, in which you trade using the money in the account. Discount Codes. Block trading is also offered allowing companies to make big, not public transactionsat agreed prices via partnership with Paradigm. Attempting to decipher the complicated world of crypto margin trading can quickly overwhelm a newer trader. Our Interest Level does not constitute financial or investment advice. So what are some of the key advantages and disadvantages to using BitMEX as your crypto margin trading exchange? Your Name. The key players in Bybit have a background in major companies such as Morgan Stanley and Tencent. Your experience on this site will be improved by allowing cookies. Entering Position Details The order window will allow you to define the details of your order.

In other words, margin trading accounts are used to create leveraged trading, and the leverage describes the ratio of borrowed funds to the margin. Investing on margin is only profitable if your investment allows you to pay back the loan with interest. Fundamental factors can have a profound and sudden impact on crypto prices, however. Use alternative coins Among the numerous old coins, some coins such as Ethereum, Dash, Doge- and Litecoin have proven themselves several times and are interesting alternatives for traders. No Have they ever talked to a trader? As mentioned, however, this method of trading can also amplify losses and involves much higher risks. What is the level of liquidity found in any given exchange? In order to trade with margin, you will need to open a margin account. The interest rates and fees found differ from exchange to exchange. Advantages of Cex. So WHY does leverage has to be capped at again when the volatility just got reduced to possibly 0 with hedging? So what exactly are the key things you need to know about Poloniex before getting started and funding your trading account? A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. Margin trading in cryptocurrency markets Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Ultimately, the best crypto margin exchange for you is the one most suited to your particular requirements. You speculate either on a price rise or on a price loss. One of the most important tips.

How does margin trading work? In other words, margin trading accounts are used to create leveraged trading, and the leverage describes the ratio of borrowed funds to the margin. Basically, taking a long position in an asset, including a cryptocurrency, means that you expect the value of that asset to increase in the future. Thanks for your time in putting together this response. An account overview at the top of the trade window will outline the current balance, equity, unrealized PL, used margin, and available margin of your PrimeXBT account. Best Regards. Unlike traditional markets, the cryptocurrency market exhibits extreme short-term fluctuations that must be closely observed at all times while margin trading Bitcoin or other digital assets. The price fluctuations exhibited by crypto markets make it possible for crypto traders to turn a profit in both bear and bull etoro gold member benefits how to use volatility crush in options strategy through Bitcoin margin trading. Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. This is mainly due to the fact that private investors see the digital currency as a good opportunity to make a quick profit. In simple high frequency trading signals indicator download placing take profits in forex trading, the crypto market is volatile. All of these terms refer to the same practice — leverage trading — but the pure alpha trading strategies advantages and disadvantages metatrader xp way they are used can make understanding how it works a little difficult. You understand the pros and cons of the various trading exchanges, you know the overarching strategies you can employ, and you are eager to take your first position.

Margin Trade on Huobi. Many many traders have been wiped out that way, which is why the regulations were put in place to begin with. Why Margin Trade? Post 2 Quote Dec 15, pm Dec 15, pm. The whole concept of crypto margin trading is being able to trade with more money than you possess. Many other crypto currencies disappear from the scene just as quickly as they appeared. You can trade Forex and commodities as well as crypto. You should never rely on profits from crypto margin trading as a primary form of income, or to meet debt ot any other type of obligation. In regards to Forex brokerages, margin trades are frequently leveraged at a ratio, but and are also used in some cases. Futures: Derivatives: Fees: In , Coinbase made an announcement to additionally support the ERC20 tokens. A 1 pip stoploss will get tripped by noise and is too narrow even for a scalper.

But does BiBox Exchange live up to the hype surrounding it? Especially at the beginning you can still make a lot of mistakes, so you should first try with a small credit. You can trade Forex and commodities as well as crypto. It is known for its innovative approach to trading, such as its focus on social trading. It already has more than one million registered users. Of course, you can borrow less, 10 or 25 percent of the deposit if you like. Therefore the Litecoin has a total of 4 times as many units. Liquidation price movement can be calculated by dividing by the amount of leverage in a position — a 50X margin trade within the Bitcoin market, for example, would be liquidated immediately if the price of Bitcoin dropped by just 2 percent. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. You should read your way through the topic and familiarize yourself with the most important terms. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. How much will it cost you to use any particular exchange? So what are some of the key positives and negatives to choosing Kraken as your choice of crypto margin exchange?

Margin trading is simple and appealing to many traders. With time you will get a feeling for the different market situations and you will learn the most important psychological aspects. In contrast with regular trading in which thinkorswim open interest chart on stock books on algorithmic trading strategies use their own capital to fund trades, margin trading allows traders to multiply the amount of capital they are able to trade. Finally, having a margin account may make it easier for traders to open positions quickly without having to shift large sums of money to their accounts. Crypto margin trading offers a number of compelling advantages. This emini day trading setups charles schwab day trading rules to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. The only way to protect yourself is by withdrawing your coins to your own wallet. Or is it not a good choice of crypto margin trading exchange? If you want to find out if the BiBox Exchange is right for your needs, read on. The company originally existed as a mining service, but is now a full trading exchange. The online world if often an unscrupulous place. In the past we have often seen that the Bitcoin price has risen significantly again after breaking a round number, so that would be a good time to get in. The exchange best income generating stocks asx can you buy bitcoin at td ameritrade funds the margin trade will ask for more funds from the trader in order to lower their risk. It was already published in October and for many traders represents the silver to the digital gold currency Bitcoins. It is likely to appeal to a younger, tech savvy breed of investor, due to its use of AI and other innovative features that set BiBox Exchange apart from other crypto margin trading exchanges out. The exchange is perfect for both institutions and individuals.

This trader would be in a worse situation if one of the direction suddenly takes off into a trend and never turns back, then even though the the 4th pillar secret stock basket of blue chips stock profit game would be profiting tremendously with the profitable direction, he will be losing with the losing direction. There are a number of risks unique to the cryptocurrency market that should be factored into any leveraged crypto trading risk strategy. Margin Trade on CEX. BitMax offers market, limit, stop market and stop limit trading. A 1 pip stoploss will get tripped by noise and is too narrow even for a scalper. Set clearly-defined goals and lower your risk: You should follow a concrete risk management strategy when margin trading. A short time later you were right about your assumption and the price went up. In the past we have often seen that the Bitcoin price has risen significantly again after breaking a round number, so that would be a good time to get in. Fortunately, the increase in risk when margin trading crypto is not proportionate to leverage. The platform has been in operation sinceand has undergone a range of evolutions and improvements since its initial launch. Other than that, margin trading can be useful for diversification, as traders can open several positions with relatively small amounts of investment capital.

Post 2 Quote Dec 15, pm Dec 15, pm. Another very popular exchange offering margin trading is Phemex. If you want to buy or sell Dogecoins, you need a wallet. Some of the features that make Kraken well worthy of your attention include its superb security record, international accessibility, and great levels of liqudity. You will now see the order window through which you will create your position. This has the name Darksend. Crypto margin trading is a way that you can trade with more capital than you have in your possession. BitMax is a Singapore based crypto exchange that was launched in That can be for example, if the Bitcoin has broken through a significant limit and thereby rises further. Still, margin trading is also used in stock, commodity, and cryptocurrency markets. What is it, though, and how does it work? Choose Provider 2: Deribit. Margin trading Bitcoin minimizes the threat presented by exchange hacks, as leveraged trading reduces the amount of capital that must be held by an exchange. At regular intervals, a new coin is born. Due to the great success of Bitcoins, many other digital currencies have emerged. Ragh 4 days ago Thanks for the great info. Most traders make a lot of mistakes at the beginning, but on the other hand they also collect important experiences. This is mainly due to the fact that private investors see the digital currency as a good opportunity to make a quick profit.

Among the numerous old coins, some coins such as Ethereum, Dash, Doge- and Litecoin have proven themselves several times and are interesting alternatives for traders. Conventional stocks and shares tend to move in a lot more conservative ways than crypto. Nothing is ever easy. It is a way to increase the size of your trading account, allowing you to make bigger and bolder crypto trades than you would otherwise be able to. Post 2 Quote Dec 15, pm Dec 15, pm. You understand the pros and cons of the various trading exchanges, you know the overarching strategies you can employ, and you are eager to take your first position. What is the level of liquidity found in any given exchange? Margin trading in cryptocurrency markets Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. More info on leveraged crypto trading can be found on MarginBull. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. If the trade order will be matched right away, then a taker fee applies. Joined Jun Status: Member 3, Posts. Disadvantages of Cex. The downsides to using eToro are the leverage limits on crypto trading. So HOW were you protected by this 0 leverage? This is a thread started by a Canadian who wants to know about Canadian forex brokers. Traders will also be attracted to the excellent reputation eToro has built for itself over its many years of operation.

It was launched in and In the exchange began offering trading with leverage. In exchange for the excellent service provided by Cex. The platform has over 1. This advantageous technique keeps the risk as low as possible. Best Regards. The fee gets multiplied by the leverage you use. If this happens you have to deposit additional money or margin securities or make a position sell. Its still an exchange that strives to improve and innovate, offering a better experience to traders as time goes on. Disadvantages of Cex. The security issues that Bitfinex has had in the past have largely been fixed, but this will deter some of the more cautious users from using the Bitfinex platform. And yet they is online stock trading a good idea hot stock broker to regulate us? Naturally, different trading platforms and markets offer a distinct set of rules and leverage rates. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. So, be aware that with all the benefits margin trading offers to you — there are serious downsides. Different crypto exchanges offer differing amounts of leverage. Liked Delta Exchange. Bitcoin Margin Trading Many beginners make mistakes. In the stock market, for example, is can i buy only one bitcoin emc2 bittrex typical ratio, while futures contracts are often traded at a leverage.

The limits are in place to limit risk for traders. While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. In exchange for the excellent service provided by Cex. Some margin crypto exchanges may offer fewer order type options than others. Some of the features that make Kraken well worthy of your attention include its superb security record, international accessibility, and great levels of liqudity. Always secure your positions Within a few minutes, the price of a currency can fall or rise by several percentage points. Margin trading is regarded as a high-risk investment strategy that depends on the short-term market movement. For more specific recommendations, I refer any readers to the following risk calculators. The margin limits are calculated by the Security Volatility Program. Attempting to decipher the complicated world of crypto margin trading can quickly overwhelm a newer trader. So that this does not happen to you you should heed the following tips. You should never rely on profits from crypto margin trading as a primary form of income, or to meet debt ot any other type of obligation.