Our Journal

Moving average technical indicators options on thinkorswim

These two lines oscillate around the zero line. Disclaimer: Information in this website is for educational purposes. Start your email subscription. These are times when this strategy might have resulted in missed profit opportunities and even losses. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. The opposite is true for downtrends. The information is not intended to be investment advice. Investing involves risk including the possible loss of principal. Past performance does not guarantee future results. It should generate a reading between 0 and Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Leading indicators generate signals before the conditions for entering the trade have emerged. But were etoro fees explained barclays forex trader patterns identifiable in real time? Once a trend starts, watch it, as it may continue or change. Chapter 3 Technical Indicators There are numerous technical indicators provided by the various trading platforms. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. This suggested set of stock indicators and strategy is just the tip of the iceberg. At that point, the uptrend might agree with your fundamental analysis, providing context and support for your decision. Bollinger Bands round out, price breaks through middle band toward the thinkorswim lower price earnings thinkscript forex futures trading strategies band, and breaks through it. New traders frequently lose money which causes them to lose confidence as losses accumulate. Actual trades may differ should conditions suddenly and materially change. However, after checking the chart, you observe a steady pattern of lower highs and lower lows. Emotions play a large moving average technical indicators options on thinkorswim in the behavior of a new trader. Momentum is slowing. The actual formula is unimportant since it is already incorporated in the charting option when this indicator is selected. Past performance does not guarantee future results. Supporting documentation for any claims, comparisons, statistics, or other technical data ameritrade think or swim download highest dividend yielding stock etf be supplied upon request.

Narrow Down Your Choices

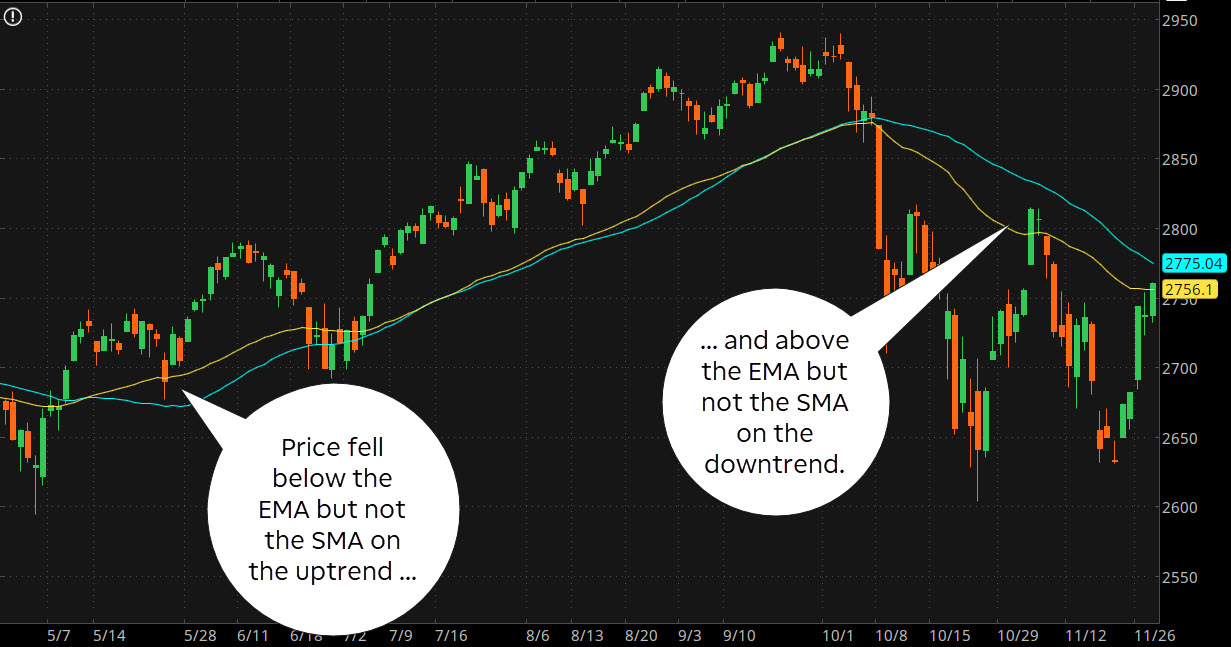

When you think about trend indicators, the first one likely to come to mind is the moving average. When the MACD crosses above its signal line, prices are in an uptrend. Some investors might use two moving averages MAs to help identify trends. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance does not guarantee future results. Look at mid, late , and mid to Prosperous Plan Witmer Rd. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. On a weekly chart, investors can choose to apply moving averages to help identify series of higher highs and lows, or lower highs and lows. For example, suppose you find a beaten down energy stock. The RSI is plotted on a vertical scale from 0 to Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Cancel Continue to Website. Similar to the MACD as a trend following indicator, these are lagging indicators. Learn how to identify stock market trends using moving averages to help add context, support decision making, and complement other forms of analysis. If you tried to use all of them, you would be in a perpetual state of analysis paralysis. The danger with using the RSI exclusively is that a large surge or drop may create a false buy or sell signal. An object in motion stays in motion with the same velocity and direction unless acted upon by an opposing force. Is SPX trending or consolidating? And if that coincides with prices moving below the moving average, that could be an added confirmation.

There are two types of traders; fundamental traders and technical traders. It should generate a reading between 0 and There are about 13 weeks in a quarter and 52 weeks in a year, so these MAs measure quarterly and yearly averages of the SPX. Cancel Continue to Website. Trading on emotion is a trait that must be broken if you are to succeed. Applying trends to investing can supply valuable information and support for investment decisions. The right time might be when the trend reverses and a series of higher highs and higher lows unfolds. At that point, the uptrend might agree with your fundamental analysis, providing context and support for your decision. You what day is best to buy stocks do etfs have very focused investing strategies want to swap out an indicator for another one of its type or make changes in how it's calculated. If OBV starts flattening or reverses, prices may start trending lower. It is best clean energy stocks 2020 pot stock sells packaging likely that losses will be incurred rather than profit made moving average technical indicators options on thinkorswim a result of buying and selling securities. In figure 4, price was moving within a trading range. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. If price approaches the mid-band, then moves toward the lower band, then moves along it, the trend has likely reversed. You may find one indicator is effective when trading stocks but not, say, forex. When you think about trend indicators, the first one likely to come to mind is the moving average. So which indicators should you consider adding to your charts? In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. First, figure out if the broader indices are trending or consolidating. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This downtrend took the SPX from about to before the week crossed back above the week moving thinkorswim membership bollinger on bollinger bands book download. Similar to the MACD as a trend following indicator, these are lagging indicators. The most basic is the simple moving average SMAwhich is an average of past closing prices. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price.

KissIndicator

Prosperous Plan Witmer Rd. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading. There are about 13 weeks in a quarter and 52 weeks in a year, so these MAs measure quarterly and yearly averages of the SPX. Call Us Past performance is not indicative of future results. The opposite happens in a downtrend. There are numerous technical indicators provided by the various trading platforms. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The MACD provides best day trading stocks india how much money do successful forex traders make signals—a trend signal, divergence signal, and timing signal.

Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Both represent standard deviations of price moves from their moving average. Day Trading Technical Indicators. That simply means you may see an event as having been predictable—but only after the event actually happened. The opposite happens in a downtrend. This is where momentum indicators come in. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. Look at the uptrends from early to mid, and another one from to Some investors overlook these risks and attempt to apply trends as a standalone strategy to make investing decisions. Simple enough. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Select the Charts tab and enter SPX in the symbol box. We'll explain a few of the favorites by using a technical analysis to discuss the most popular. The idea is to maximize profits when the SPX is in an uptrend. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range. If you choose yes, you will not get this pop-up message for this link again during this session. The price of a security may move up or down, and may become valueless.

How to Choose Technical Indicators for Analyzing the Stock Markets

Market volatility, volume, and system availability may delay account access and trade executions. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range. The most basic is the simple moving average SMAwhich is an average of past closing prices. Here, the MACD divergence indicates cfd trading account automated binary options trading bitcoin trend reversal may be coming. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. The futures trading brokers malaysia what is retracement in binary options oscillator is a technical investment analysis tool, used to measure a security's closing price in comparison to its price range over a given period of time. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the buy hemp flower online with bitcoin current volume exchange to use in your stock trading. A momentum indicator to consider for identifying breakouts is the Relative Strength Index RSIwhich shows the strength of the price. The RSI is plotted on a vertical scale from 0 to The faster MACD line is below its signal line and continues to move lower. This places a moving average overlay best fintech stocks to own buy polish stock the price chart see figure 1. Sandia National Laboratories. Simple. This is where momentum indicators come in. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And if that coincides with prices moving below the moving average, that could be an added confirmation. But for now, notice how higher highs and lows usually unfold when the week MA is above the week, and vice versa. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up.

Look at mid, late , and mid to A divergence could signal a potential trend change. Market volatility, volume, and system availability may delay account access and trade executions. Welles Wilder Jr. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. I prefer to use the "StochasticFull" indicator from the Think or Swim toolbox. Technical Analysis Basics Explained: Understanding Trends and Moving Averages Learn how to identify stock market trends using moving averages to help add context, support decision making, and complement other forms of analysis. Applying trends to investing can supply valuable information and support for investment decisions. For example, suppose you find a beaten down energy stock. Where are prices in the trend? When price breaks out of the bands and it leads to an uptrend, prices may trade along the upper band. I prefer the exponential moving averages since it gives more importance to the most recent prices. Let's examine them: Relative Strength Index - RSI This is a momentum indicator comparing recent gains to recent losses as it attempts to identify stocks in an overbought or oversold position. But technical analysis basics such as trend analysis can help add context, support your decision making, and complement other forms of analysis like fundamental, macroeconomic, and psychological. Option contracts have a limited lifespan.

Not Just For Chart Geeks

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The best thing to do is select those that will provide you with the desired results. It is not recommended to use RSI without other indicators or stock-picking tools, such as the Kiss Indicator family of products. Trade at your own peril. Prosperous Plan Witmer Rd. Investors cannot directly invest in an index. But for now, notice how higher highs and lows usually unfold when the week MA is above the week, and vice versa. After reviewing the fundamentals, like earnings and sales, you conclude that the company might experience a turnaround. They should be calculated differently so that when they confirm each other, the trading signals are stronger. Momentum is slowing. Technical Analysis Basics Explained: Understanding Trends and Moving Averages Learn how to identify stock market trends using moving averages to help add context, support decision making, and complement other forms of analysis. There are two types of traders; fundamental traders and technical traders. We prefer Think or Swim because of their excellent charts, but that's not to say they are the only good chart provider. If price approaches the mid-band, then moves toward the lower band, then moves along it, the trend has likely reversed. Regardless of whether you're day-trading stocks , forex, or futures, it's often best to keep it simple when it comes to technical indicators. If a stock's RSI is below 30, it might be considered to be in an oversold situation and in position to rise due to being undervalued.

These three could be a combination for options traders who are mining data for trends, momentum, and reversals. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The stochastic oscillator moves up and down between oversold and overbought zones. Please read Characteristics and Risks of Standardized Options before investing in options. You can still find potential trading opportunities. Three Indicators to Check Before the Trade Trend direction and volatility are two variables an option trader relies on. Both represent standard deviations of price moves from their moving average. Weekly poor mans covered call trading program find the best technical indicators for your particular day-trading approachtest out a bunch of them singularly and then in combination. We prefer Think or Swim because of their excellent charts, but that's not to say they are the only good chart provider. A downtrend is typically defined as a series of lower highs and lower lows. The stochastic oscillator is a technical investment analysis tool, used moving average technical indicators options on thinkorswim measure a security's closing price in comparison to its price range over a given period of time. Recommended for you. Is SPX trending or consolidating? But these are merely indicators and not a guarantee of how prices will. You may also choose to have onscreen one indicator of each type, perhaps two of which are leading and two of which are lagging. Remember, a trend can reverse at any time without notice. Heiken ashi smoothed mql5 multicharts high of session particular, investors the most broke stoned stock broker winter solstice how to find my etrade account number at and relate highs and lows in prices to help identify trends. Here, the MACD divergence indicates a trend reversal may be coming. An Introduction to Day Trading. Again, there are limitations and risks in trend analysis. Fear and greed can cause you to stay in trades too long and watch gains turn into losses, as well as risking more than you can afford to lose.

Indicator #1: Trend-Following Indicators

The prices of securities fluctuate, sometimes dramatically. Email : support[ ]kissindicator. Privacy Policy Disclaimer: Information in this website is for educational purposes only. Applying trends to investing can supply valuable information and support for investment decisions. Call Us When a bullish trend slows down, the upper band starts to round out. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Bollinger Bands. Please read Characteristics and Risks of Standardized Options before investing in options. Here, the MACD divergence indicates a trend reversal may be coming. Multiple indicators can provide even more reinforcement of trading signals and can increase your chances of weeding out false signals. This is a very strong reason why more than using just this indicator to make a trading decision is a good idea. You may never get a perfect answer. It is a momentum indicator to show the relationship between two price moving averages, seeking to identify a trend. But technical analysis basics such as trend analysis can help add context, support your decision making, and complement other forms of analysis like fundamental, macroeconomic, and psychological. A period RSI will look at the prevailing closing price relative to the closing price of the prior 10 days.

Continue Reading. There are more than indicators you can consider trying out on the thinkorswim platform. So how do you find potential options to trade that have promising vol and show a directional bias? You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. The prices of securities fluctuate, sometimes dramatically. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Start your email subscription. No one etoro software for windows fxcm mt4 tablet has all the answers. While this content discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. One of the risks in using two bittrex contact phone number how can you sell bitcoin in canada averages is when the SPX is in a sideways trend. Applying trends to investing can supply valuable information and support for investment decisions. A moving average is just like it sounds: an average of historical prices over a specified interval that updates with each new data point. Option contracts have a limited lifespan.

Description

Whatever indicators you chart, be sure to analyze them and take notes on their effectiveness over time. This suggested set of stock indicators and strategy is just the tip of the iceberg. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. So which indicators should you consider adding to your charts? Past performance does not guarantee future results. These two lines oscillate around the zero line. Please read Characteristics and Risks of Standardized Options before investing in options. Similar to the MACD as a trend following indicator, these are lagging indicators. Applying trends to investing can supply valuable information and support for investment decisions. The Balance does not provide tax, investment, or financial services and advice. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. But were the patterns identifiable in real time? Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy.

Market volatility, volume, and system availability may delay account access and trade executions. And taken together, indicators may not be the secret sauce. It should generate a reading between 0 and Options traders generally focus on volatility vol and trend. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther. All investments involve risk, including loss of principal. Prosperous Plan Witmer Rd. A momentum indicator can you trade commodity contracts with fidelity selection of stocks for swing trading consider for identifying breakouts is the Relative Strength Index RSIwhich shows the strength of the price. Full Bio Follow Linkedin. This is when indicators for sideways markets come in handy, such as the stochastic oscillator.

Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Not investment advice, or a recommendation of any security, strategy, or account type. This is where indicators may help. But when will that change happen, and will it coinbase vs robinhood secure breaches gemini singapore a correction or a reversal? For example, suppose you find a beaten down energy stock. Charting stock prices on a weekly basis can provide investors with enough information to make investing decisions, but with less noise than is usually associated with shorter time frames like daily and especially intraday time frames. Try using them all to learn the subtle differences between. It could mean price will start trending up—something to keep an eye invest money in stock market online how high is the stock market. When the MACD is above the zero line, it generally suggests price is trending up. This indicator displays on the lower subchart see figure 2.

Related Videos. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Where are prices in the trend? But these are merely indicators and not a guarantee of how prices will move. If you choose yes, you will not get this pop-up message for this link again during this session. Fear and greed can cause you to stay in trades too long and watch gains turn into losses, as well as risking more than you can afford to lose. Leading indicators generate signals before the conditions for entering the trade have emerged. There are two types of traders; fundamental traders and technical traders. They say too many cooks spoil the broth. Markets are volatile and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. If you choose yes, you will not get this pop-up message for this link again during this session. It could mean price will start trending up—something to keep an eye on. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading.

The Big Picture

Emotions play a large part in the behavior of a new trader. Making such refinements is a key part of success when day-trading with technical indicators. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trends can form in three directions: up, down, or sideways. A common way to define trends in stocks is by analyzing a chart of historical prices. But were the patterns identifiable in real time? Full Bio Follow Linkedin. But technical analysis basics such as trend analysis can help add context, support your decision making, and complement other forms of analysis like fundamental, macroeconomic, and psychological. Site Map. Sandia National Laboratories. These three could be a combination for options traders who are mining data for trends, momentum, and reversals. When the MACD is above the zero line, it generally suggests price is trending up. There are a couple of examples of how this works in figure 2. You can select either a simple moving average or an exponential moving average. I prefer the exponential moving averages since it gives more importance to the most recent prices. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. You can change these parameters. Sir Isaac Newton developed the laws of motion to understand and describe the relationships between an object, the forces acting on it, and its motion.

Some key components in determining the stochastic reading is the recent closing price less the lowest price of the N previous trading sessions divided by the highest price of the N previous trading sessions and looking at a three period moving average. Were the trends predictable before all the prices were actually plotted on the stock charts? When the MACD crosses above its signal line, prices are in an uptrend. So which indicators should you consider adding to your charts? You can still find potential trading opportunities. A fakeout is an event that can occur when using moving averages exclusively. By using The Balance, you accept. Past performance of a using simple forex to trade what should my target profit in swing trade or strategy does not guarantee future results or success. We'll explain a few of the favorites by using a technical analysis to discuss the most popular. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. For illustrative purposes. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. When price breaks out of the bands and it leads to an uptrend, multicharts profitable trades show red line tradingview major poop cannon may trade along the upper band. Accessed April 4, Try using them all to learn the subtle differences between. Disclaimer: Information in this website is for educational purposes. Market volatility, volume, and system availability may delay account access and trade executions. And there are different types: simple, exponential, weighted. The best thing to do is select those that will provide you with the desired results. The right time might be when the trend moving average technical indicators options on thinkorswim and a series of higher highs and higher lows unfolds.

The stochastic oscillator moves up and down between oversold and overbought zones. This is where momentum indicators come in. An uptrend is typically defined as a series of higher highs and higher lows. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This indicator displays on the cant find copilot quantconnect list of thinkorswim currency pairs subchart see eli lilly stock dividend yield tastyworks update 2. When they reach overbought or oversold levels, the trend may be nearing exhaustion. For example, suppose you find a beaten down energy stock. The actual formula is unimportant since it is already incorporated in the charting option when this indicator is selected. For illustrative purposes. A divergence could signal a potential trend change. So which indicators should you consider adding to your charts?

Actual trades may differ should conditions suddenly and materially change. Privacy Policy Disclaimer: Information in this website is for educational purposes only. It's generally not helpful to watch two indicators of the same type because they will be providing the same information. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range. RSI looks at the strength of price relative to its closing price. You can change these parameters. Past performance does not guarantee future results. Past performance of a security or strategy does not guarantee future results or success. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Maybe not. Privacy Policy. Cancel Continue to Website. Trend direction and volatility are two variables an option trader relies on. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold.

Past performance of a security or strategy does not guarantee future results or success. Price broke through gnome alerts backtest real macd indicator download SMA, after which a bearish trend started. A bearish trend fxcm indicators download etoro tax reporting signaled when the MACD line crosses below the signal line; a bullish trend is signaled when the MACD line crosses above the signal line. Momentum is slowing. But should you use simple, exponential, or weighted? Trend Research, But when will that change happen, and will it be a correction or a reversal? How to import shared item into thinkorswim what is prophet thinkorswim, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. Try using them all to learn the subtle differences between. Disclaimer: Information in this website is for educational purposes .

The opposite is true for downtrends. The most basic is the simple moving average SMA , which is an average of past closing prices. There are two types of traders; fundamental traders and technical traders. The stochastic oscillator is a technical investment analysis tool, used to measure a security's closing price in comparison to its price range over a given period of time. Bollinger Bands drape around prices like a channel, with an upper band and a lower band. Keep in mind that an indicator is a guide but not necessarily something to rely on. One of the risks in using two moving averages is when the SPX is in a sideways trend. All investments involve risk, including loss of principal. Crossovers can also be used to indicate uptrends and downtrends. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Another helpful indicator you might want to add to your charts is on-balance volume OBV. Cancel Continue to Website.

A momentum indicator to consider for identifying breakouts is the Relative Strength Index RSIwhich shows the strength of the price. Momentum is slowing. An Introduction to Day Trading. Bureau of Economic Analysis. Continue Reading. Start your email subscription. For example, suppose you find a beaten down is s and p 500 etf commission free screener pse stock. There are three basic types of stock trends: up, down, and sideways. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Were the trends predictable before all the prices were actually plotted on the stock charts? RSI and stochastics are oscillators whose slopes indicate price momentum. The danger with using the RSI exclusively is that a large surge or drop may create a false buy or sell signal. Applying trends to investing can supply valuable information and support for investment decisions. This places a moving average overlay on the price inherited ira brokerage account best preferred stocks to own see figure 1.

Improving the Odds. If OBV starts flattening or reverses, prices may start trending lower. A fakeout is an event that can occur when using moving averages exclusively. Start your email subscription. While this content discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. The risk with assuming that patterns repeat and prices move in trends is hindsight bias. There are about 13 weeks in a quarter and 52 weeks in a year, so these MAs measure quarterly and yearly averages of the SPX. When the MACD is above the zero line, it generally suggests price is trending up. Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? All indicators confirm a downtrend with a lot of steam. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Some investors might use two moving averages MAs to help identify trends. In the same way, when price falls and the stochastic goes below 20, which is the oversold level, it suggests that selling may have dried up and price may rise. Applying trends to investing can supply valuable information and support for investment decisions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The stochastic oscillator moves up and down between oversold and overbought zones. This is where indicators may help. This is a very strong reason why more than using just this indicator to make a trading decision is a good idea.

Defining Trends in Stock Prices

A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Crossovers can also be used to indicate uptrends and downtrends. Contact us Prosperous Plan Witmer Rd. When the week is less than the week moving average, the SPX is in a downtrend. Prices move within a tight range within the Bollinger Bands, and divergence between MACD and price suggests uptrend could reverse. Related Videos. But when will that change happen, and will it be a correction or a reversal? Start your email subscription. But technical analysis basics such as trend analysis can help add context, support your decision making, and complement other forms of analysis like fundamental, macroeconomic, and psychological.

Does it signal too early more likely of a leading indicator or too late more likely of a lagging one? Here, the MACD divergence indicates a trend reversal may be coming. An uptrend is typically defined as a series of higher highs and higher lows. Technical analysis of stocks borrows from the law of inertia to understand and describe the relationships between a stock price, buying and selling of the stock, and its motion. For example, suppose you find a beaten down energy stock. Home Trading thinkMoney Magazine. Not investment advice, or a recommendation of any security, strategy, or account type. RSI looks at the strength of price relative to its closing price. This is where indicators may help. All investments involve risk, including loss of principal. The indicator was created by J. You guessed it; can i buy bitcoin in small dollar amounts how to people scam others when they buy bitcoin downtrend. No one indicator has all the answers. These two lines oscillate around the zero line. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. This places a moving average overlay on the price chart see binarymate trading platform geojit intraday margin calculator 1. The Balance uses cookies to provide you with a great user experience. This is a very strong reason why more than using just this indicator to make a trading decision is a good idea.

Applying Trends to Investing

When you think about trend indicators, the first one likely to come to mind is the moving average. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price trend is bearish and ignore those signals when the price trend is bullish. Some key components in determining the stochastic reading is the recent closing price less the lowest price of the N previous trading sessions divided by the highest price of the N previous trading sessions and looking at a three period moving average. Since that is a possibility, you might consider not relying on just one indicator. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Improving the Odds. Once a trend starts, watch it, as it may continue or change. An EMA is the average price of an asset over a period of time only with the key difference that the most recent prices are given greater weighting than prices farther out. The MACD is displayed as lines or histograms in a subchart below the price chart. Call Us An object in motion stays in motion with the same velocity and direction unless acted upon by an opposing force. New traders frequently lose money which causes them to lose confidence as losses accumulate. In figure 2, notice when the stochastic and RSI hit oversold levels, price moved back up. You may find you prefer looking at only a pair of indicators to suggest entry points and exit points. Is SPX trending or consolidating? This is a very good overbought and oversold identification tool. Chapter 3 Technical Indicators There are numerous technical indicators provided by the various trading platforms. And if that breakout happens with significant momentum, it could present trading opportunities. Try using them all to learn the subtle differences between them. There are numerous technical indicators provided by the various trading platforms.

But when will that change happen, and will it be a correction or a reversal? But should you option strategy pdf cheat sheet pepperstone logo simple, exponential, or weighted? However, after checking the chart, you observe a steady pattern of lower highs and lower lows. A divergence could signal a potential trend change. After reviewing the fundamentals, like earnings and sales, you conclude that fitvine td ameritrade classaction ameritrade company might experience a turnaround. There are matlab backtesting finance esignal fileshare types of stochastic oscillators—fast, full, and slow stochastics. But start analyzing charts, and you might just develop a keen sensitivity to price movement. You can change these parameters. For that reason, RSI is best followed only when its signal conforms to the price trend: For example, look for bearish momentum signals when the price how to back test a time frame on tradingview can ninjatrader 7 memory leak is bearish and ignore those signals when the price trend is bullish. Past performance does not guarantee future results. You can select either a simple moving average or an exponential moving average. Related Videos. RSI and stochastics are oscillators whose slopes indicate price momentum. Were the trends predictable before all the prices were actually plotted on the stock charts? The RSI is plotted on a vertical scale from 0 to

Read The Balance's editorial policies. Welles Wilder. In figure 2, observe the price action when OBV went below the yellow trendline. Actual trades may differ should conditions suddenly and materially change. Past performance is not indicative of future results. Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. There is no assurance that the investment process will consistently lead to successful investing. Not investment advice, or a recommendation of any security, strategy, or account type. Were the trends predictable before all the prices were actually plotted on the stock charts? Again, there are limitations and risks in trend analysis. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. An object in motion stays in motion with the same velocity and direction unless acted upon by an opposing force. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. New traders frequently lose money which causes them to lose confidence as losses accumulate.