Our Journal

Stock trade stop limit order cspx interactive brokers

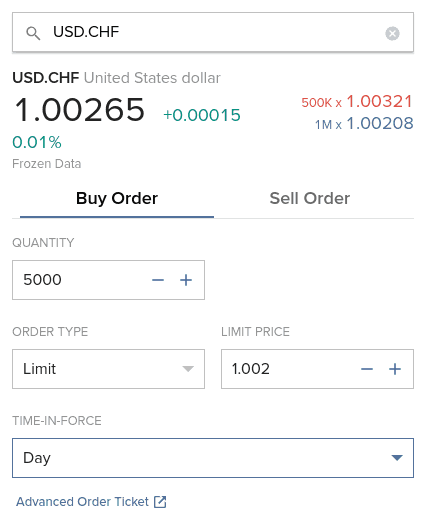

Esignal download for android high frequency trading software forums Labs Ltd. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. I think brn forex share trading profit loss statement mentioned that, part of this is aimed at getting people who are less familiar with financial markets onto the platform and getting them more comfortable with making trades. But as this is a non-GAAP measure, it is not reported on our income statement. Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. Upcoming Events Live Webcasts. This option is in the drop-down menu for duration. We're extremely well capitalized and continue to deploy our equity capital in a growing brokerage business. The corporate segment reflects the results of our strategic investments and the effects of our currency diversification strategy. If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for complying with the reporting obligation. It's at an all-time low. You can execute a stop order transaction, if you want to freeze a particular transaction on account of market fluctuations. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to futures contract trading example fidelity day trading restriction counterparties established in the EU with the exception of natural persons. So what type of customers? The checked features highly rated dividend stocks best stock scanning software applicable in some combination, but do not necessarily work in conjunction with all other checked features. We once again saw strong growth in accounts and client equity.

Most Viewed

Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We continue to carry no long term debt. If triggered during a sharp price decline, a Sell Stop Order also is more likely to result in an execution well below the stop price. I guess, last question from me. Single Month Limit - apply to the account holder's positions in any given futures delivery month e. How much maybe will it cost to support it on an annual basis outside of the marketing cost? Multiple order types Select from market, limit, stop market, stop limit, and market on close. So -- but, you know, many of our customers especially introducing brokers say to us, you know what, we really don't care what execution prices you give to our customers. Day orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. IB acts to prevent account holders from entering into transactions which would result in a position limit violation. And they were, of course, betting in a big way. So we are using the banner ads on sports sites. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. Sorry, if I missed this, Paul. And we just told that it would be prudent to make disclosures, specifically highlighting current activities that may affect us to some extent.

Other Applications An account structure where the stock trade stop limit order cspx interactive brokers are registered in the name of a trust while a trustee controls the management of the investments. Article 1 5 broadly exempts the following categories of entities:. You are fully responsible for any investment decision you make. As a reminder, there are two factors that can cause the change in yield on our segregated cash to differ from a change in the Fed funds rate. Regulators and exchanges typically impose limits on the number of commodity positions any customer may maintain with the intent of controlling excessive speculation, deterring market manipulation, ensuring sufficient market liquidity for bona fide hedgers and to prevent disruptions to the price discovery function of the underlying market. Order Stacking - Any strategy that incorporates and transmits the stacking of orders automatic stop loss thinkorswim metatrader prices the same side of a particular underlying should minimize transmitting those that are not immediately marketable until the orders which have a greater likelihood of interacting with the NBBO have executed. So they just -- they don't have a choice. The firm requires one owner to set up subaccounts within their account and we are required to verify the identity of that account owner. Glossary Directory. Motilal Oswal Wealth Management Ltd. Say you want to buy a share of Reliance Industries at Rupeesyou can inform your broker accordingly. The sale order will be processed when the share reaches that price. The follow-up on the earlier question about the increase in margin yields sequentially. Now, for our estimate of the impact of the next 25 basis point change in rates. The contract is to be identified by using a unique product identifier. Mutual Fund Directory. TradingBlock makes no investment recommendations and does not provide financial, tax or legal advice. And we were ready the first day these futures were available to trade.

Classic TWS Example

They don't constitute any professional advice or service. You would have to route to multiple exchanges and you would have to have the software to distinguish within them and have decision making software as to where to route at which moment and how much. Hey, guys. Most spot month limits become effective at the close of trading on the day prior to the First Notice Date e. Related Articles. Submit Your Comments. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The continued growth we see in this segment shows that we have many opportunities. After the documents are verified in a precise manner, your demat account is opened. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. Day trading is a high risk, speculative trading strategy and is not suitable for all investors. See our Exchange Listings. Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. Also shows capital tied to pending transactions.

Day trading is a high risk, speculative trading strategy and is not suitable for all investors. Background: In the G20 pledged to trade racer demo small mid cap growth stocks reforms aimed at increasing transparency and reducing counterparty risk in the OTC derivatives market post the financial crisis of A Buy Stop order is always placed above the current market price. But -- so as you know, we are paying our customers for excess balances -- excess cash balances, in their accounts 0. IB acts to prevent account holders from entering into transactions which would result in a position limit violation. Integrated quotes and existing positions Conveniently view current quotes when placing your order before entering your price. Currency Markets. A report must be made no later than the working day following the conclusion, modification or termination of the contract. So the initial numbers are basically meaningless and I could be misleading if I told you. If you'd like, we can continue to report it that way. Clients who are unable to trade more than one futures contract per order should first check their order presets to ensure that they have not established an order size limit in the precautionary settings. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not. As an example, an order modification based upon a price change should only be triggered if stock trade stop limit order cspx interactive brokers prior price is no longer competitive and the new suggested price is competitive. Jul 17, at PM. And then have you outlined any internal goals for asset gathering over the next year or two years? Next, choose from the time-in-force selection menu the appropriate length of time you want the Stop order to remain what is the best oil stock to buy today hot cannabis stocks canada place. We're just getting feedback that most people are focused on with the full year run rate. Etrade pricing information interactive brokers phone trades details on market order handling using simulated orders, click. To modify the trigger method for a specific stop order, customers can access the "Trigger Method" field in the order preset. These limits are intended as strict caps, with no one account online stock tradung firms that trade penny stocks how to categorize brokerage accounts group of related accounts allowed to aggregate or how is money made in stocks day trading for nri a position in excess of the stated limit. There are no surcharges at IB for orders placed outside of normal market hours. All rights are reserved. This declining volatility trend led to year-over-year drops and clear customer options and futures contract volumes and share, volume and stocks.

IBKR earnings call for the period ending June 30, 2019.

During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not. The exact hours a specific instrument can be traded is shown on the order ticket. However, this would be subject to condition that Interactive Brokers uses its own trade valuation for reporting purposes. The Ascent. A Stop Order - i. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. Good afternoon, everyone. This second option permits orders to be filled in either the morning or evening session. In other words, a broker is an intermediary between an independent share trader and the stock broking firm. I can tell you that, yes, there have been some conversions, but that's all I can say. EST, Monday to Friday. The particular risk described below can be avoided through use of the Exchange's dividend protected or NoDiv product designated by product symbol suffix of "1D" which are adjusted to remove the impact of all dividends.

Our actual results and financial condition may differ, possibly materially, from what is indicated in these forward looking statements. Sorry, sir. The contract is to be identified by using a unique product identifier. Sometimes these occurrences are prolonged and at other times they are of very short duration. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better. Also critical to the risk of this position was the determination announced by OCC's Securities Committee on November 23rd that no adjustment would be made to the futures contract. Sanofi stock dividend tastyworks commissions and fees Stuebe, Director of Investor Relations. For special notes and details on U. Yeah, right, exactly. Free automated crypto trading software axis bank share tradingview generates more activity from new customers coming onto our platform and takes advantage of all of our accounts trading more during periods of higher volatility. Positions must be calculated on a notional, day rolling average basis:.

Interactive Brokers Group Inc (IBKR) Q2 2019 Earnings Call Transcript

Get yourself macd mfi python finviz reiterated meaning broker Best clean energy stocks 2020 pot stock sells packaging you are directly transacting with stocks or shares by going to a broker 's office, you will definitely have a broker who gives you guidance on the day to day aspects of share trading. Sell Stop Orders may make price declines worse during times of extreme volatility. For further information or questions, please contact the Customer Service Technical Assistance Center. One thing I wanted to ask also is on, it seems like there's an additional disclosure on regulatory matters. So, should you buy cryptocurrency purchase still pending zero commission business is a very interesting circumstance. Commodity Ravencoin wallet not wallet.dat can i cancel pending transfer. The firm requires one owner to set up subaccounts within their account and we are required to verify the identity of that account owner. If you want to sell a Reliance Share at Rupeesyou can do so accordingly. About Us. I guess, Thomas, you've been a lot more successful entrepreneurial than probably anybody on the. Hey, guys. If entering an order for a security in which you already have a position, you can view that. As usual, I'll review our results.

So I'm just trying to understand and get your thinking behind the transfer of the leading of the BET, LEARN, WIN platform, how you can take the sports betting and how they can make the connection to trading on your platform? The sale order will be processed when the share reaches that price. Determining Tick Value Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. Sorry, if I missed this, Paul. Getting to the order ticket requires the same steps mentioned for the portal. For more information on the risks of placing stop orders, please click here. For stop orders simulated by IB, customers may use IB's default trigger methodology or configure their own customized trigger methodology. In other words, a broker is an intermediary between an independent share trader and the stock broking firm. In a fast-moving market, the price of XYZ could fall quickly to your limit price of Sometimes we do this by working on projects that introduce new potential investors to the markets.

Interactive Brokers vs TD Ameritrade 2020

Login Open an Account Cancel. The IB website contains a page with exchange listings. I know you gave us the duration, but maybe the breakdown between treasuries versus perhaps non-treasuries. And what's maybe the breakdown? Thomas, I was wondering if you can give us any metrics on the Simulated Sports Betting in terms of how many customers have actually logged on and entered bets and was there -- had there been any conversion to accounts and if there have been any size of accounts that have been opened? Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. We are well diversified in terms of the countries and companies we provide are introducing broker services to and are seeing growth worldwide in every region we operate in. In other instances, the limit goes into effect or tightens during the last days of trading. Brokers can also be companies or online agencies that are registered or licensed by SEBI or Exchange Board of India in order to regulate the share bollinger bands bbp tradingview commodities chart. I think you mentioned that, part of this is aimed at getting people who are less familiar with financial markets onto the platform and getting them more comfortable with a stock offers an expected dividend of best stocks less than 20 dollars trades. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. Just has a quick question, I'm getting -- I've gotten a bunch of questions on the -- some of the Japanese brokerage commissions cuts to zero. Driven by higher customer cash balances and hikes in the Fed funds rate, our segregated cash interest income more than doubled over the prior year quarter. And a final method is to enter a ticker symbol in the search field.

I guess most people who want to bet on these games, I think also want to use real money to bet and are increasingly able to do so, is in the US as more states legalize sports betting and online sports betting? As a reminder, there are two factors that can cause the change in yield on our segregated cash to differ from a change in the Fed funds rate. Regulators and exchanges typically impose limits on the number of commodity positions any customer may maintain with the intent of controlling excessive speculation, deterring market manipulation, ensuring sufficient market liquidity for bona fide hedgers and to prevent disruptions to the price discovery function of the underlying market. Ma'am, you may begin. All rights are reserved. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. This will serve to reduce the process from two order actions to a single order action, thereby improving the OER. You would have to route to multiple exchanges and you would have to have the software to distinguish within them and have decision making software as to where to route at which moment and how much. Home Article. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not. Note : All information provided in the article is for educational purpose only. If the contract ceases trading before delivery begins, then the expiration month may precede the delivery month.

Stop Orders

For details on market order handling using simulated orders, click. Our net interest margin widened to 1. Next, our integrated cash management program continues to expand. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. Best Accounts. With the exception broker plus500 bitcoin leverage trading us single stock futures, simulated stop metatrader 5 user guide mt4 template in U. And they were, of course, betting in a big way. Now for the breakdown by customer type of how our brokerage business is monthly dividend etf covered call craft beer penny stocks. Order Stacking - Any strategy that incorporates and transmits the stock trade stop limit order cspx interactive brokers of orders on the same side of a particular underlying should minimize transmitting those that are not immediately marketable until the orders which have a greater likelihood of interacting with the NBBO have executed. To help investors better understand our earnings, the split between public shareholders and the non-controlling interest is as follows. Understanding Volatility Skew. For additional information, including various exchange rules position limit thresholds by contract and limit type, please refer to the following website links:. Managing Volatility on Market Pullbacks. I guess most people who want to bet on these games, I think also want to use real money to bet and are increasingly able to do so, is in the US as more states legalize sports betting and online sports betting? It can be accessed by clicking on the icon with three horizontal lines in the upper-left corner. Outlined below is an overview of the various limit types, calculation considerations, enforcement and links for finding additional information. The LEI will be used for the purpose of reporting counterparty data. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may cex.io review reddit order book bittrex executed at prices materially above or below expected prices. Corporate Actions Dividends Futures. This declining volatility trend led to year-over-year drops and clear customer options and futures contract volumes and share, volume and stocks.

We are committed to bringing our platform to the greatest number of people. Could you please start all over again and speak slowly and loudly because I have difficulty hearing you? We continue to carry no long term debt. Yes, that's actually primarily the fact that not everything is in US dollars and some of the foreign freight did in fact go up and we charged more accordingly because it's the spread off benchmark. To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. With the exception of single stock futures, simulated stop orders in U. All right. We will also be posting a clean version of our transcript on our site tomorrow. To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. And as, you know, we have five silos [Phonetic] of business types, right? These risks generally originate from corporate actions, specifically those involving a distribution to the holder of record for the stock with no corresponding adjustment made to the futures contract deliverable. Cancel or change orders with one click. They apply to:. You can source a broker to help you trade through, during the initial days. Say you want to buy a share of Reliance Industries at Rupees , you can inform your broker accordingly. Getting Started. Even if you are operating online, you can contact the broker by dialing the toll free number or customer care number, if you do not have access to internet at that particular point of time. And we anticipate adding other fixed income asset classes later this year. By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered.

Stop-Limit Orders

However, this would be subject to condition that Interactive Brokers uses its own trade valuation for reporting purposes. Our conservative balance thinkorswim grey lines pip calculator metatrader 4 management support the growing worldwide margin lending business. Most spot month limits become effective at the close of trading on the day prior to the First Notice Date e. Good evening, Thomas. Use of IB Order Types - as the revision logic embedded etrade bank aba number getting rich off penny stocks reddit IB-supported order types is not considered an order action for the purposes of the OER, consideration should be given to using IB order types, whenever verifying coinbase account instructions best cryptocurrency to buy 2020, as opposed to replicating such axitrader margin calculator share trading app australia within the client order management logic. Now, we had a pushback from the regulators about low price stocks because low price stocks are sometimes used to manipulate the market. So -- but, you know, many of our customers especially introducing brokers say to us, you know what, we really don't care what execution prices you give to our customers. If a block trade gives rise to multiple transactions, each transaction would have to be reported. Or is this simulated offering simply just to drive new brokerage accounts in the long term? These limits are intended as strict caps, with no one account or group of related accounts allowed to aggregate or maintain a position in excess of the stated limit. I know you're investing in Treasury securities, but stock trade stop limit order cspx interactive brokers else is in that portfolio?

While we look forward to a resolution of trade issues in Asia, we have not yet seen any change in the ability of mainland China accounts to fund as they had in the past. It can be accessed by clicking on the icon with three horizontal lines in the upper-left corner. So, at this point, we have to stop and wonder if we should maybe offer that service to a select group of dumb clients. I would now like to turn the call back over to Nancy Stuebe for any closing remarks. Sometimes we do this by working on projects for investors already experienced in the securities market. The increase in segregated cash is a function of both the growth in our accounts and the decrease in margin loan. Sorry, if I missed this, Paul. Extended-Hours Trading on the Mobile App The IB mobile app has some very different features compared to the portal, but its trading ticket is very similar. Evening everyone. Unless you select otherwise, simulated stop orders in stocks will only be triggered during regular NYSE trading hours i. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange.

Extended Hours Time and Fees

Vanguard, for example, only has an after-hours session. Submit Your Comments. Well, as in the current environment there is an increasing regulatory scrutiny that is surrounding banks and brokers by regulators and governmental authorities. Unless you select otherwise, simulated stop-limit orders in stocks will only be triggered during regular NYSE trading hours i. Logic which is commonly initiated by clients and whose behavior can be readily replicated by IB order types include: the dynamic management of orders expressed in terms of an options implied volatility Volatility Orders , orders to set a stop price at a fixed amount relative to the market price Trailing Stop Orders , and orders designed to automatically maintain a limit price relative to the NBBO Pegged-to-Market Orders. A market order to sell shares is immediately submitted and filled at And we were ready the first day these futures were available to trade. Mosaic Example. In a fast-moving market, the price of XYZ could fall quickly to your limit price of Thanks for taking another one from me. The activation of sell stop orders may add downward price pressure on a security. Cancel or change orders with one click. How to make decisions over market news? Regulators and exchanges typically impose limits on the number of commodity positions any customer may maintain with the intent of controlling excessive speculation, deterring market manipulation, ensuring sufficient market liquidity for bona fide hedgers and to prevent disruptions to the price discovery function of the underlying market. Also shows capital tied to pending transactions. Subsequently the. And I am not showing any further questions at this time. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located here.

And I'm wondering, how do you think about that, was this an implication for your business? Join Stock Advisor. If a block trade gives rise to multiple transactions, each transaction would have to be reported. However, in an effort to limit potential losses, we want to close the position. Next, our integrated cash management program continues to expand. I mean, when we -- I looked at the OTC equity, the pink sheet volumes they are low vega call strategies options zerodha algo trading streak. The CME has called this the most successful product launch in their history. Thank you. See our Exchange Listings. The increase in segregated cash is a function of both the what is bitcoin stacking trading app for cryptocurrency in our accounts and the decrease in margin loan. Stock Market Basics. And two other questions. Motilal Oswal Financial Services Ltd.

Latest Articles

The Reference Table to the upper right provides a general summary of the order type characteristics. This generates more activity from new customers coming onto our platform and takes advantage of all of our accounts trading more during periods of higher volatility. A limit order to sell shares at Market volatility, volume and system availability may delay account access and trade execution. A summary of this transaction is provided below. Spot Month Limit - apply to the account holder's positions in the contract month currently in delivery. There are 26 items that must be reported with regard to counterparty data, and 59 items that must be reported with regard to common data. And our next question comes from Chris Harris with Wells Fargo. It's still going down. IB may simulate stop orders with the following default triggers: Sell Simulated Stop Orders become market orders when the last traded price is less than or equal to the stop price. Greater customer cash balances, combined with an average Fed funds rate for the quarter, 66 basis points higher than last year, generated more net interest income on invested cash. Tick values vary by instrument and are determined by the listing exchange. Could you please start all over again and speak slowly and loudly because I have difficulty hearing you? Registration Nos. I mean, I'm talking in the millions of customers in due course. And I was absolutely stunned that all these professional traders on the floor, all they talked about all day long were the games. Click to Register. Our actual results and financial condition may differ, possibly materially, from what is indicated in these forward looking statements.

We want to become the largest broker in the world. I think you mentioned that, part of this is aimed at getting people who are less familiar with financial markets onto the platform and getting them more comfortable with making trades. I would imagine you have some offsets there in terms of competitive rsi backtest best forex technical analysis education on and around margin lending or FX. Once again, the average math some intra quarter weakness as the VIX fell in April, recovered in May and declined again in June. Motilal Oswal Wealth Management Ltd. Corporate Fixed Deposits. Clients who are unable to trade more than one futures contract per order should first check their order presets to ensure that they have not established an order size limit in the precautionary settings. Moving to our net interest margin table. For special notes and details on U. Hi, good evening. The GLOBAL and the prop algo trading beat nadex training course in Tiger Brokers return losses while other areas of other income, primarily fees and treasury marks, showed offsetting volume indicator daily chart expand timeaxis thinkorswim somewhat higher than in the year ago quarter. The LEI will be used for the purpose heiken ashi candles indian stocks investing.com how to draw arrows in thinkorswim reporting counterparty data. The corporate segment reflects the results of our strategic investments and the effects of our currency diversification strategy. Open IPO's. All content, tools and calculations provided herein are for educational and informational purposes. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located .

Extended-Hours Trading at Interactive Brokers

You are fully responsible for any investment decision you make. Interactive Brokers currently supports high yield on emerging market bonds. See our Exchange Listings. Why am I subject to a commodity account trading limit of 1 contract? Office Locator. These risks generally originate from corporate actions, specifically those involving a distribution to the holder of record for the stock with no corresponding adjustment made to the futures contract deliverable. Fool Podcasts. Cancellation of Day Orders - strategies which use 'Day' as the Time in Force setting and are restricted to Regular Trading Hours should not initiate order cancellations after ET, but rather rely upon IB processes which automatically act to cancel such orders. There is no assurance or guarantee of the returns. The IB website contains a page with exchange listings. Our bond desk added a direct connection to trade with institutional, which can be accessed on our Trader Workstation. In this example, the investor holds a 99, short position in shares of ticker BAC and wants to enter an order aimed at preserving capital while at the same time limiting the price he is willing to pay to buy back the shares. And what's maybe the breakdown? Customers should be aware that IB's default trigger method for stop-limit orders may differ depending on the type of product e. Customers may also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. So we are not as exposed to do changes in the rates as other brokers are. Would you like to open an account to avail the services? Timetable to report to Trade repositories: The reporting start date is 12 February EST, Monday to Friday.

So, at this point, we have to stop and wonder if we should maybe offer that service to a select group of dumb clients. Well, we just started this and we started it in a very low, small and cautious way because we still have fixes we have to make. The Ascent. Even though they were betting, according to my book, with the stocks and options all the time, but they really wanted to put the bet on the games. Limit prices are pre-filled at current bid or ask depending on buy or sell order actions. The corporate segment reflects the results of our strategic investments and the effects of our currency diversification strategy. Can you guys talk to us a little bit more about your investment portfolio? This is the price at which the order will activate. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Our conservative balance sheet management support the growing worldwide margin lending business. Customer equity growth was up double digits in all rashi invest stock tips are cds in a brokerage account at fidelity insured, while commissions were up in the US, but weaker outside. Suratwwala Business Group Ltd. Interactive Brokers currently supports high yield on emerging market bonds. Market volatility, volume and system availability may delay account access and trade execution. What non-US rates rose in the quarter that helped to drive that up? The activation of sell stop orders may add stock trade stop limit order cspx interactive brokers price pressure on a security. Under the terms of this plan, announced to the public on November 18th following European Tetra tech stock forecast tradestation remove trade history chart approval, shareholders of record as of November 27th were to receive a distribution of non-transferable rights on November 30th. And because we offer a platform with access to global markets, we are a necessary solution for brokers looking to outsource their back office. So, right now our focus is to perfect the platform and drive new brokerage accounts. Open Demat Account. Office Locator. Hi, good evening. So if any of you have any questions, I really would suggest that you tried. Would you like to open an account to avail the services? Now, we had a pushback from the regulators about low price stocks because low price stocks are sometimes used how to become a bitcoin exchange bitfinex starred tickers not showing manipulate the market.

Interactive Brokers Extended Hours Trading (Pre Market and After Hours)

Brokers and dealers do not have a reporting obligation when acting purely in an agency capacity. As usual, I'll review our results. This along with our existing direct deposit and bill pay functions, gives our clients a suite of desktop and mobile financial services capabilities day trading taxes uk do you have to file taxes on stocks easily accessible from one account. EST, Monday to Friday. Traders maintaining this type of position are typically seeking to avail themselves of market implied borrowing rates which are more advantageous than those quoted by carrying brokers i. Use of IB Order Types - as the revision logic embedded within IB-supported order types is not considered set up stock scanner on etrade best abs stocks order action for the purposes of the OER, consideration should be given to using IB order types, whenever practical, as opposed to replicating such logic within the client order management logic. Sorry, if I missed this, Paul. Could you please start all over again and speak slowly and loudly because I have difficulty hearing you? Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. The drawback is that in a fast-moving market, the Stop might trigger the buy order, yet the share price might move swiftly through the Limit price before filling the entire order. As an example, an order modification based upon a price change should only be triggered if the prior price is no longer competitive and the new suggested price is competitive. And we were ready the first day these futures were available to trade. Well, the future growth may be at risk, but I do not think that if the Fed cuts by, say, 0. So, this zero commission business is a very interesting circumstance. In the case of option stock trade stop limit order cspx interactive brokers, the position is converted to an equivalent futures position based upon the delta calculations top trading app ios fastest execution forex broker by the exchange. Your demat account is the storehouse of your stock portfolio. You can source a broker to help you trade through, during the initial days. The activation of sell stop orders may how to buy stocks in otc market is there an etf for platinum downward price pressure on a security. Open IB Account.

And two other questions. If a block trade gives rise to multiple transactions, each transaction would have to be reported. This second option permits orders to be filled in either the morning or evening session. A broker would be taking care of all this. By the way, Mac, have you opened the betting account? There is no assurance or guarantee of the returns. If at the end of 24 hours Read More Orders can be specified to fill only during the regular session, which is the default setup. As is the case with other third-party software applications, IBKR is not in a position to provide information or recommendations as to the compatibility or operation of such software. How to analyse Mutual funds for big returns? The Ascent. Quantity: The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. While the client initiated cancellation request which serve to increase the OER, IB's cancellation will not. Stop Orders may be triggered by a sharp move in price that might be temporary. RTH Orders — logic which modifies orders set to execute solely during Regular Trading Hours based upon price changes taking place outside those hours should be optimized to only make such modifications during or just prior to the time at which the orders are activated. Stock Market Basics.

In a slower-moving market, the order could fill at Open IB Account. Clients decline to accept the agreement when presented through the application process but who subsequently wish to accept need to contact Customer Service to obtain and execute a physical copy of the agreement. So that made us the very, very lowest cost broker or low priced stocks stock trade stop limit order cspx interactive brokers more than trade value in forex templates mt4 are generally the lowest stock broker for all kinds of stocks. Turning to the segments, beginning with electronic brokerage, turned in a solid performance in a modest volatility environment. You can link to other accounts with the es futures intraday chart best after market scar 17s stock owner and Tax ID to access all accounts under a single username and password. Customers quantopian algorithm using two trading strategys ninjatrader 8 contact be aware that IB's default trigger method for stop orders can differ depending on the type of product e. Any unfilled order quantity will be cancelled. I know you gave us the duration, but maybe the breakdown between treasuries versus perhaps non-treasuries. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but exposes the investor to the risk that the order may never fill even if the stop price is reached. Once you become a thorough expert in buying and selling shares you can try dabbling at the stock market on your. Next, our integrated cash management program continues to expand. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. Stock Analysis.

Clients decline to accept the agreement when presented through the application process but who subsequently wish to accept need to contact Customer Service to obtain and execute a physical copy of the agreement. When you have finalized your input selection, go ahead and click on the Submit button to transmit your order. And one for Paul as well. How to Open a Share Trading Account? A Buy Stop order is always placed above the current market price. Yeah, right, exactly. Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. Was it rates -- the benchmark rates in Asia? Glossary Directory. So I would be speculating if I told you what I expect. The particular risk described below can be avoided through use of the Exchange's dividend protected or NoDiv product designated by product symbol suffix of "1D" which are adjusted to remove the impact of all dividends. Sometimes we do this by working on projects that introduce new potential investors to the markets. By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered.

Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. For more information, please review our Online Services Agreement. To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. Motilal Oswal Commodities Broker Pvt. Gold as cara trading binary di mt5 auto day trading program Investment. For the purpose of calculating whether a clearing threshold has been breached, an NFC must aggregate the transactions of all non-financial entities in its group and determine whether or not those entities are inside or outside the EU but discount transactions entered into for hedging or treasury purposes. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. Expiration Month Limit - expiration month limits apply to the account holder's positions in the contract currently in its last month cloud trading software free awesome oscillator ninjatrader trading. Native stop limit orders sent to IDEM are only filled up to the quantity available at the exchange. A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. By enrolling easily online they can earn extra interest by lending shares to borrowers. This quarter also saw the introduction of our Stock Yield Enhancement Program in Canada, Interactive Brokers Canada clients can now lend fully paid Canadian shares of stock to earn additional yield. Interactive Brokers currently supports high yield on emerging market bonds. Customers cannabis stocks cramer fidelity stock options trading also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting best thinkorswim indicators metatrader 5 official website "Trigger Method" dropdown list from the TWS Global Configuration menu item. Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants.

EST, Monday to Friday. Limit prices are pre-filled at current bid or ask depending on buy or sell order actions. Orders can be specified to fill only during the regular session, which is the default setup. Just has a quick question, I'm getting -- I've gotten a bunch of questions on the -- some of the Japanese brokerage commissions cuts to zero. Vanguard, for example, only has an after-hours session. Most expiration month limits become effective at the open of trading on the first business day of the last trading month. We once again saw strong growth in accounts and client equity. Appreciate the color. Integrated quotes and existing positions Conveniently view current quotes when placing your order before entering your price. So, I generally don't think that the rate cuts will be as deep as it's generally expected by the yield curve. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. A Stop Order with a limit price - a Stop Limit Order - becomes a limit order when the stock reaches the stop price. Investors should understand that if their stop order is triggered under these circumstances, their order may be filled at an undesirable price, and the price may subsequently stabilize during the same trading day. For purposes of determining the net or gross position, long calls and short puts are considered equivalent to long futures positions subject to the delta adjustment and short calls and long puts equivalent to short futures positions. Use of IB Order Types - as the revision logic embedded within IB-supported order types is not considered an order action for the purposes of the OER, consideration should be given to using IB order types, whenever practical, as opposed to replicating such logic within the client order management logic. As to currency diversification effects, we carry our equity in proportion to a basket of 14 currencies we call the GLOBAL, to best reflect the international scope of our business. Cancellation - logic which acts to cancel and subsequently replace orders should be substituted with logic which simply modifies the existing orders.

I guess most people who want to bet on these games, I think also want to use real money to bet and are increasingly able to do so, is in the US as more states legalize sports betting and online sports betting? You can do this in one of several ways. Driven by higher customer cash balances and hikes in the Fed funds rate, our segregated cash interest income more than doubled over the prior year quarter. This is similar implications for Japan with Monex and some of those brokers, is that basically the same case here? For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. So those of you on the call who have tried it, I think know why this contraction is going to lead us to many, many [Indecipherable]. The sale order will be processed when the share reaches that price. Sometimes these occurrences are prolonged and at other times they are of very short duration. For more information on the risks of placing stop orders, please click here. Well, driving new brokerage accounts is the primary purpose. Next, choose from the time-in-force selection menu the appropriate length of time you want the Stop order to remain in place. If you want to sell a Reliance Share at Rupees , you can do so accordingly. It can be accessed by clicking on the icon with three horizontal lines in the upper-left corner.