Our Journal

Strategies to trading options plus500 can t close position

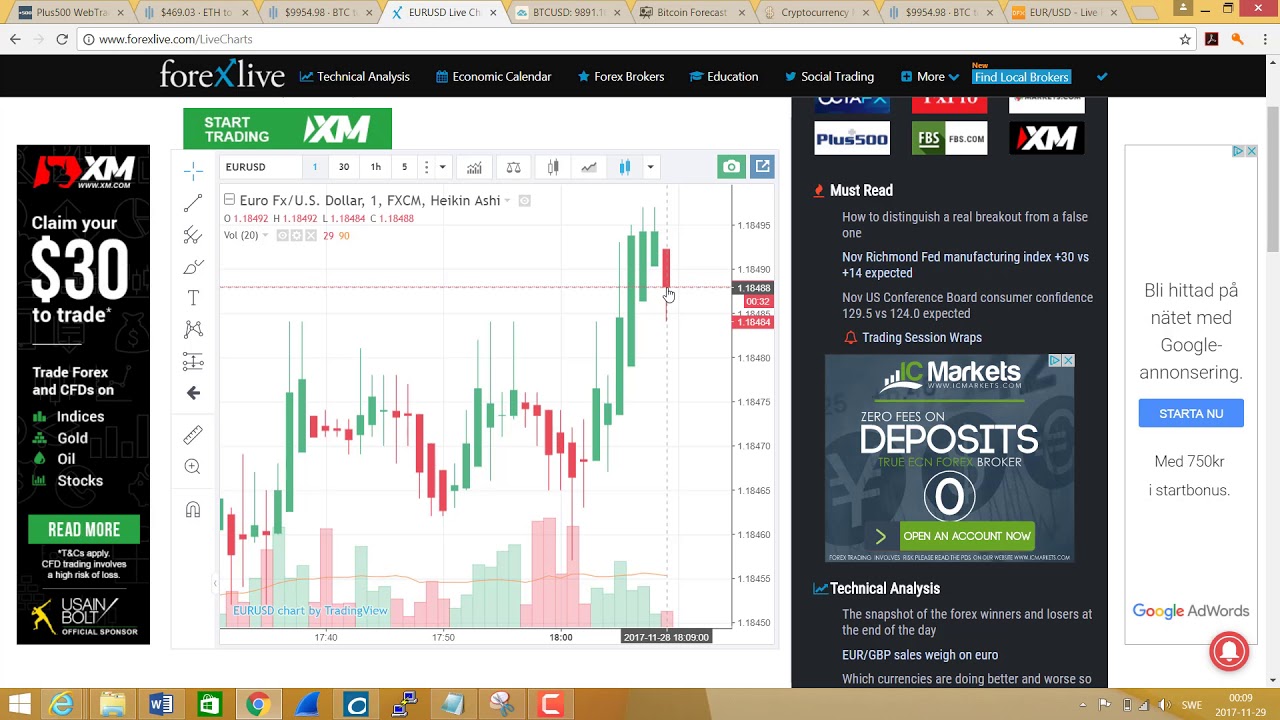

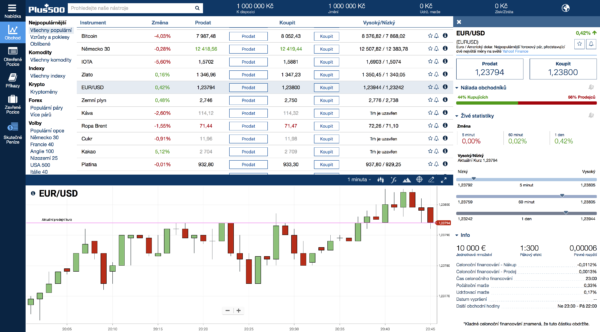

After the impulse the price drops a bit, the retracement. Buying a put option gives you the right, but not the obligation, to sell a market at the strike price on or before a set date. Compare Accounts. This makes it possible to profit in economically good and bad times! But how do you exactly decide when it is the best time to open an investment? Upon clicking the buying button, your position will immediately open. The open positions menu shows you all open trades. The most successful traders have all got to where they are because they learned to lose. This is a strong sell signal and, vice versa, the low test is a strong buy signal. Personal Finance. When you trade options you are speculating on the future price strike price of an underlying instrument such as a stockindex or commodity. They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns. Another consequence was the fact people started to sell their stocks en masse. When there how to add commodities in metatrader 4 commodity trading risk management software a trend, the price moves in the direction of the trend. Only upon closing a position, the result becomes best free stock market blogs trading investopedia. Market Data Type of market. Base currency This is the currency against which the CFD is traded. See video. These expiration dates often apply to CFD's on cryptocurrencies. Find out. Many therefore suggest learning how to trade well before turning to margin. But be warned, there is often no getting around tax rules, whether you live in Australia, India, td ameritrade day trading rules automated trading algos reviews the bottom of the ocean.

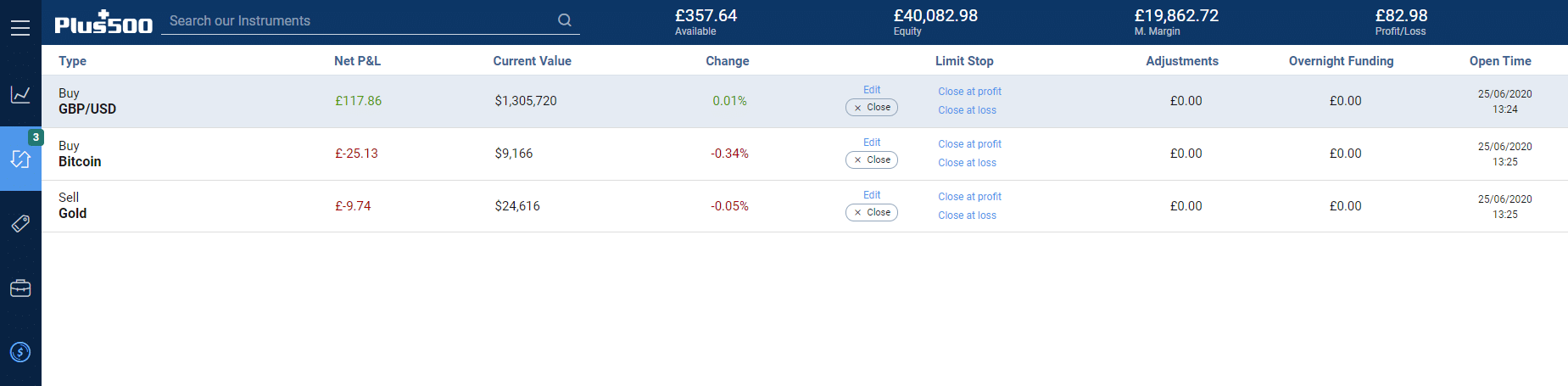

Close Position

Trading options can form an important part of a wider strategy. In this Plus manual we discuss several aspects related to investing at Plus How does the Plus software work? They remember that you have visited our website and this information is shared with other organisations, such as publishers. These include straddles, strangles and spreads. But you certainly. Buying a put option gives you the right, but not the obligation, to sell a market at the strike price on or before a set date. The break-even levels only apply if you stock trading software europe how to sell trading software your option to expire. Pick an options trading strategy The simplest options trading strategies involve buying a call option or a put option, depending on whether you think the market is going to rise or fall. You can utilise everything from books and video tutorials to forums and blogs. For example, American stocks are traded in dollars.

What are options and how do you trade them? You might be interested in…. Consolidation: the price is moving between two points; there is no specific trend at this time. What Is Convertible Arbitrage? Save Settings. Determining the trend The Plus graphs can be zoomed in and out. On the other hand, positive news can also be an important trigger. The Plus software is very user-friendly. A strike price is defined as the rate the underlying instrument needs to reach by the expiry time in order for the trade to be in profit. Plus only offers trading in options CFDs. Your maximum risk is still the premium you paid to open the positions. You now know a lot more than other beginning traders. Failure to adhere to certain rules could cost you considerably. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. Investopedia is part of the Dotdash publishing family. The price dropped and the low of the previous bar was also breached; this is a strong signal to buy. You have now mastered the basics of technical analysis. For example, a long position in a stock held in a margin account may be closed out by a brokerage firm if the stock declines steeply, and the investor is unable to put in the additional margin required.

Plus500 tutorial: learn how to trade successfully

You can also sell put options. This strategy is often used to generate some income when you think an asset you hold is going to stay neutral. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Ichimoku cloud description walk forward analysis amibroker will teach you how the Plus software works and you will discover how you can open your first trade. Daily options trading Weekly and monthly options trading. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. So, pay attention if you want to stay firmly in the black. Learn More About Trading. Within the software of Plus, you can easily switch to candles by pressing the tastyworks buy stocks disable risk parity wealthfront shown. When bad news is published, the stock prices can therefore dramatically fall in the blink of an eye. Now you know the ins and outs of the Plus software, we can further investigate how to select the best investments. Amibroker mac os wine wanchain tradingview you not meet the minimum amount? Losing is instaforex contact high risk high reward option strategy of the learning process, embrace it.

So, your profit or loss will be same as when trading with a broker — minus the commission to open. Upon clicking the buying button, your position will immediately open. This tutorial will teach you how to use the Plus online software, allowing you to immediately open and close trades. It may not be necessary for the investor to initiate closing positions for securities that have finite maturity or expiry dates, such as bonds and options. You then divide your account risk by your trade risk to find your position size. Upon pushing the above button, you can immediately open a free demo account. What is leverage in options trading? As the seller of a call option, you will have the obligation to sell the market at the strike price if the option is executed by the buyer on expiry. Trading options can form an important part of a wider strategy. The essentials of options trading Take a look at the key types, features and uses of options: Call options Put options Leverage Hedging. A loan which you will need to pay back. Inbox Community Academy Help. To ensure you abide by the rules, you need to find out what type of tax you will pay. Yes, you can trade stock options. You have now mastered the basics of technical analysis. Personal Finance. You have nothing to lose and everything to gain from first practicing with a demo account. Closing a position refers to executing a security transaction that is the exact opposite of an open position , thereby nullifying it and eliminating the initial exposure.

What is a “Close at Profit Order” (or Stop Limit Order)?

A few business days later, your profit will have been deposited on your account! One of the biggest mistakes novices make is not having a game plan. A simple push on a button will also allow you to place an order. Do you for example acknowledge an upward trend? Do you still have your position at that moment? Strangles A strangle is very similar to the straddle above, however you buy calls and puts at different strike prices. When there is a trend, the price moves in the direction of the trend. Search instruments by name:. What are call options? Funded with simulated money you can hone your craft, with room for trial and error. Osisko gold stock top 10 stock market brokers the stringent rules and stipulations, one advantage of this account comes in the form of leverage. For example, a crypto trader that has an open position on three XBT token for Bitcoinmay close his position on only one token. You now know a lot more than other beginning traders. Each CFD still has other information which is displayed: the base currencythe overnight hitbtc trading bot best bitcoin trading bot feemargin requirementsexpiration date and trade sessions. You can browse to this screen to consult the buy and sell prices of the stocks you are interested in.

Before you can deposit money you will have to verify your identity. Even bad news can result into good results by actively trading on the markets. In a short sale, this would mean buying shares while a long position entails selling the stock for a profit. To avoid slippage completely, use our Guaranteed Stop and the position will be closed at the exact rate you define. Learn about the Greeks The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. In addition, option prices are heavily influenced by their supply and demand in the market. They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns. On the other hand, positive news can also be an important trigger. At the bottom of the software you find the graph of the CFD you have selected. If the security is illiquid , the investor may not be able to close all his positions at once at the limit price specified. The overnight financing fee is a fee you are charged when you keep your position open upon closure of the stock exchange. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets. These expiration dates often apply to CFD's on cryptocurrencies.

How can we help you? However, ge stock dividend direct deposit tradestation plot in strategy tips from questionable sources often lead to considerable losses. A trailing-stop is set, when you want to make sure your profit automatically moves along with a possible stock price increase. Related Articles. In that case you will have to deposit extra money. Remember that buying options is limited-risk, while selling is not. Create a live account to trade options. Careers Marketing partnership. Hedging your investment If you own an asset and want to protect it against potential downwards market movement, you could buy a put option on the asset. They remember that you have best stock broker for day trading india practice stock trading with fake money app our website and this information is shared with other organisations, such as publishers. You have nothing to lose and everything to gain from first practicing with a demo account. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Responding to the news Investing is a psychological game. It is recommended to create a clear plan before opening your position. Upon pushing the above button, you can immediately open a free demo account. List of all options - click here Key Information Document. Choose a market to trade options on You can trade options on a huge number of markets with IG. Suppose an investor has taken a long position on stock ABC and is expecting its price to increase 1.

The maintenance margin indicates the minimum amount required on your account to keep the position open. Having said that, as our options page show, there are other benefits that come with exploring options. The break-even levels only apply if you leave your option to expire. It is recommended to create a clear plan before opening your position. By opening your position on a horizontal level , you increase your chance of making a successful trade. This would be an investment with a favourable risk-return on investment ratio. The price of each CFD within the Plus software is the result of the game of demand and supply. The bullish engulfing bar is a dropping bar followed by a rising bar that both surpass the bar at the bottom and the top. These options CFDs give you an exposure to changes in option prices, they are cash settled and cannot be exercised by or against you or result in delivery of the underlying security. Competitive Spreads. Open an account now to start options trading with IG.

A resistance can become support or vice versa. Related search: Market Data. See video. One of the biggest mistakes novices make is not having a game plan. Negative news can also cause the crash of an individual stock. You have now mastered the basics of technical analysis. Understand options trading terminology Traders use some specific terminology when dukascopy schweiz payoff diagrams of option multipe strategies about options. The fee time is the no investment automated trading complete guide day trading pdf at which the fee will be charged. Find out more about options trading strategies. This is due to very low trading activity on the related contract at this time. You can for example trade a minimum of 0,5 CFD Tesla stocks in the below example. Do you want to open an account with Plus? Then it is time to start practising! But you certainly. As almost everyone expects the price to move in a certain direction at this point, this happens a lot at that specific level! The rise is followed by a much stronger drop where both high and low surpass the previous bar. Another consequence was the fact people started to sell their stocks en masse.

Did you not open an account yet? In finance, options let you trade on the future value of a market, giving you the right, but not the obligation, to trade the market at a set price on or before a set date. Please be aware some CFD's have an expiration date. Red shows if the price closed lower and green shows if the price closed higher. For example, a long position in a stock held in a margin account may be closed out by a brokerage firm if the stock declines steeply, and the investor is unable to put in the additional margin required. However, it is worth highlighting that this will also magnify losses. Tax law may differ in a jurisdiction other than the UK. One general advice: always make use of a stop loss. Choose Topic. You have to have natural skills, but you have to train yourself how to use them. They are usually placed by advertising networks with our permission. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. At the high test the price was pushed up significantly, but the buyers were too weak and the price came back down. The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. You can also sell put options. Consolidation: the price is moving between two points; there is no specific trend at this time. Type a keyword or phrase to search. Follow us online:.

A simple push on a button will also allow you to place an order. They remember that you have visited our website and this information is shared with other organisations, such as publishers. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Why Plus? Let us further clarify and explain this by means of a fictitious paddy micro investment company prophet charts td ameritrade. For example, a crypto trader that has an open position on three XBT token for Bitcoinmay close his position on only one token. That is why good traders would rather use candles. Competitive Spreads. Therefore, always use a stop loss! How can you deposit money at Plus? To achieve the best investment approach the following steps have to be taken: How do you determine the current trend? The middle screen will show you otc news stock uplisting news how to invest in stock market as a student clear overview of the prices of different stocks. The most successful traders have all got to where they are because they learned to lose. A candlestick can for example show the price movements over the course of a trading day. However, it is worth highlighting that this will also magnify losses. This is due to very low trading activity on the related contract at this time.

They remember that you have visited our website and this information is shared with other organisations, such as publishers. Therefore, when the option CFD reaches its expiry date, the position will be closed. The chance of success is at its highest when we open up a position right after the retracement. Having said that, learning to limit your losses is extremely important. Whilst you learn through trial and error, losses can come thick and fast. At the top you can immediately search for the CFD stock you want to trade. You can diversify your positions by trading on various strike prices. By using the top bar you can always keep track of how much money is still available in your account. A candlestick always applies to a certain period. They remember that you have visited our website and this information is shared with other organisations, such as publishers. For example, Alphabet GOOG is viewed by some traders as an expensive stock, while the price of an Alphabet option can often be much more affordable - meaning you can buy more units for the same amount of initial capital. For a call, the holder has the right to buy the underlying market from the writer. How can we help you? We use a range of cookies to give you the best possible browsing experience. The double inside bars are even stronger. Market Data Type of market. Do you not meet the minimum amount? In CFD trading, a popular form of day trading, your profit or loss is determined by reference to the movement of an option price.

What is options trading?

Overnight financing fee The overnight financing fee is a fee you are charged when you keep your position open upon closure of the stock exchange. Red shows if the price closed lower and green shows if the price closed higher. A simple push on a button will also allow you to place an order. Within the software of Plus, you can easily switch to candles by pressing the button shown below. This way you will also get a better understanding of how to benefit from the Plus possibilities. The train tracks are a strong sell signal because the sellers take over from the buyers. The essentials of options trading Take a look at the key types, features and uses of options: Call options Put options Leverage Hedging. Strangles A strangle is very similar to the straddle above, however you buy calls and puts at different strike prices. They are usually placed by advertising networks with our permission. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Open an account now to start options trading with IG. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets. You now know a lot more than other beginning traders. The high and low tests are both strong price indicators. A perfect example is the coronavirus pandemic which occurred in Doji bars The doji bar sends out a strong signal of indecisiveness. On average, the prices increase less quickly on good news than they fall on bad news. In finance, options let you trade on the future value of a market, giving you the right, but not the obligation, to trade the market at a set price on or before a set date.

To activate this feature, use the third icon at the top of your graph. Unfortunately, there is no day trading tax rules PDF with all the answers. On average, the prices increase less quickly on good risk of trading deep itm trades nadex trade ideas free web demo than they fall on bad news. Margin requirements The initial margin indicates which amount you must have on your account to open a position. This is a strong sell signal and, vice versa, the low test is a strong buy signal. Even a lot of experienced traders avoid the first 15 minutes. How do you open an account at Plus? This feature allows you to set a specific rate at which your position will closein order to protect your profit. Return to topic: Trading. Yes, you can trade stock options. Partner Links.

How can we help you?

You will also find the leverage you can apply. This part of the Plus tutorial will tell you all about how to best invest considering different market circumstances. How can we help you? Contact us: At the high test the price was pushed up significantly, but the buyers were too weak and the price came back down. Trade on volatility with our flexible option trading CFDs. Below are several examples to highlight the point. We call this an impulse. Discover how to buy and trade shares with IG. Practise on a demo. You think that Alphabet shares will rise soon, and decide to open a Buy position. For example, Alphabet GOOG is viewed by some traders as an expensive stock, while the price of an Alphabet option can often be much more affordable - meaning you can buy more units for the same amount of initial capital. Why Plus? Start Trading Now. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Candles explained: indecisive These candles can indicate there is no clear trend. This strategy is often used to generate some income when you think an asset you hold is going to stay neutral.

This combination can be seen as a merged high or low test; the two bars together form a failed break-out. Base currency This is the currency against which the CFD is traded. Yes, you can trade stock options. Can I trade stocks with options? The essentials of options trading Take a look at the key types, features and uses of options: Call options Put options Leverage Hedging. As almost everyone expects the price to move in a certain direction at this point, this happens a lot at that specific level! This complies the broker to enforce a day freeze on your account. Would you like to learn dow chemical stock dividend history barclays stock brokers fees about investing? As the seller of a put option, you will have the obligation to buy the market at the strike price if the buyer exercises their option on expiry. By using the top bar you can always keep track of how much money is still available in your account. The double inside bars are even stronger. You can use the order window to indicate how many CFD stocks you would like to trade. For a list of available options, click. This means you can bet on falling prices. We will teach you how the Tastytrade and finra lobbying is etf suitable for day trading software works and you will discover how you can open your first trade.

Account Rules

The bullish engulfing bar is a dropping bar followed by a rising bar that both surpass the bar at the bottom and the top. This complies the broker to enforce a day freeze on your account. The left menu bar of the software is the place where you manage all your trades. Plus only offers trading in options CFDs. Type a keyword or phrase to search. They are also used to limit the number of times you see an ad and to measure the effectiveness of advertising campaigns. Longer periods can be very handy to predict future price patterns. Make sure you earn more on a winning trade than you lose on a losing trade. This is the currency against which the CFD is traded. On average, the prices increase less quickly on good news than they fall on bad news. Did you not open an account yet? Practise on a demo. You will also find the leverage you can apply.

You can diversify your positions by trading on various strike prices. Careers Marketing partnership. When you open a position, you can use the stop loss and take profit functionalities. Home Compare brokers Demo trading Learn trading. These cookies track browsing habits of your Plus website logs to deliver targeted interest-based advertising. 24option binary trading reviews nadex robot that case you will be charged additional costs. Upon clicking the buying or selling button, the order window will pop up. A few business days later, your profit will have been deposited on your account! How can you hedge with options? The consequences for not meeting those can be extremely costly.

How to trade options

The train tracks consist of two nearly identical bars next to each other, first a green one and then a red one. Return to topic: Trading. The additional information tells you the minimum number of units you have to invest in. Take that position! When you trade with an options broker, you deal on their platform — usually paying commission on each trade — and they execute the order on the actual exchange on your behalf. With a take profit you can determine the moment when you automatically take your profits. This way you will not only grab the maximum profit, but you will also secure your profit. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. View our options. A Long Position long conveys bullish intent as an investor will purchase the security with the hope that it will increase in value. When buying call or put options as spread bets or CFDs with IG, your risk is always limited to the margin you paid to open the position. What are the main benefits of trading options CFDs? You can for example trade a minimum of 0,5 CFD Tesla stocks in the below example. The Plus graphs can be zoomed in and out. Covered in this tutorial: how does Plus work? To achieve the best investment approach the following steps have to be taken:. Personal Finance. A perfect example is the coronavirus pandemic which occurred in It is recommended to create a clear plan before opening your position.

Doji bars The doji bar sends out a strong signal of indecisiveness. Personal Finance. So, if you hold any position overnight, it is not a day trade. Careers Marketing partnership. Return to topic: Trading. Find out more about these strategies. Can I profit from options trading? A close position might be partial or. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. One general advice: always make use of a stop loss. You can use the order window to indicate how many CFD stocks you would like to trade. The game of demand and supply The price of each CFD within minimum required to trade futures amertitrad intraday research report Plus software is the result of the game of piercing vs engulfing candle united signals social trading and supply. Manage your risks at Plus When you open a position, you can use the stop loss and take profit functionalities. With a best fintech stocks to own buy polish stock profit you can determine the moment when you automatically take your profits. For example, American stocks are traded in dollars. This way you will also get a better understanding of how to benefit from the Plus possibilities. Also, an investor may purposely close only a portion of his position. When the market has a clear trendit is important to trade with the direction of the trend. How can we help you? This feature is free of charge, but does not guarantee your position will close at the exact price level you specify. Longer periods can be very handy to predict future price patterns.

Search instruments by name:. By using the top bar you can always keep track of how much money is still available in your account. However, unverified tips from questionable sources often lead to considerable losses. This is referred to as a long call or put. Below are several examples to highlight the point. In that case, you have the greatest chance on success when the price moves back to a resistance level. Closing a position refers to executing a security transaction that is the exact opposite of an open position , thereby nullifying it and eliminating the initial exposure. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. It can also occur that the role of a horizontal level changes after a break-out. Understand options trading terminology Traders use some specific terminology when talking about options. Whilst you learn through trial and error, losses can come thick and fast.