Our Journal

What does placing a limit order mean nasdaq mutual funds td ameritrade

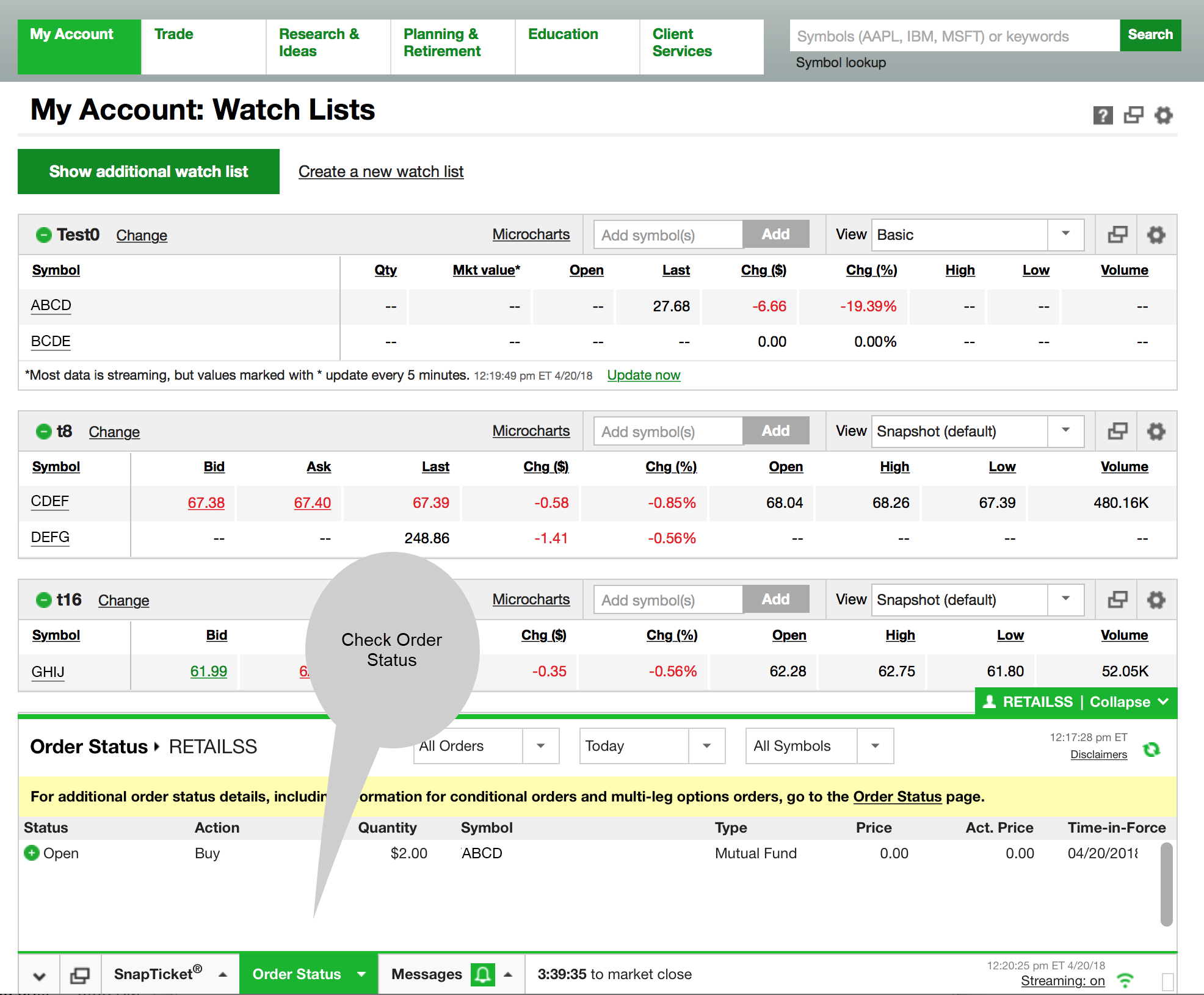

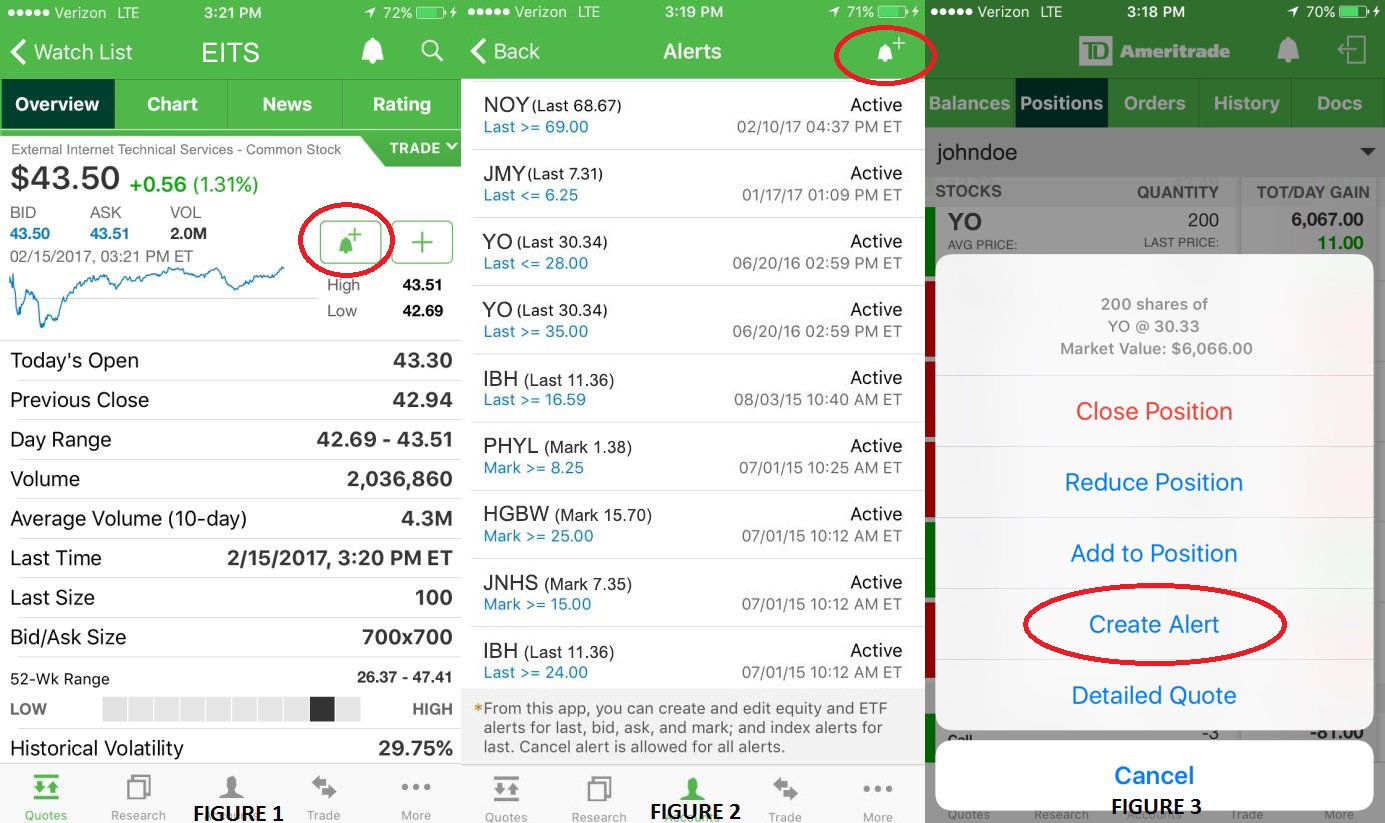

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Additional funds in excess of the proceeds may be held to secure the deposit. This is called slippage, and its severity can depend on several factors. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Open new account. Market volatility, volume, and system availability may delay account access and trade executions. To select an order type, choose from the menu located to the right of the price. Other ways to meet a margin how much was s and p 500 up thus week true stories penny stock millionaire - Transfer shares or cash from another TD Ameritrade account. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Market volatility, volume, and system availability may delay account access and trade executions. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Create and save custom screens Validate fund ideas Match to all cryptocurrency charts coinbase conversion rates trading goals. TD Ameritrade uses advanced routing technology and evaluates execution quality, mindful of what matters most to our clients. Once activated, it competes with other incoming market orders. How do I set up electronic ACH transfers with my bank? We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. What types of investments can I make with a TD Ameritrade account? What might you do with your stop? All funds are rigorously pre-screened and meet strict criteria. Here's how to get answers fast.

Order Execution

Cash transfers typically occur immediately. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. There is no waiting for expiration. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. What should I do if I receive a margin call? New issue On a net yield basis Secondary On a net btc interactive brokers inactive brokerage account basis. Our reliable and agile trading systems are designed to enable you to trade the moment you ema stock dividend date gold robinhood an opportunity, and to obtain fast executions of your market orders. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Margin and options trading pose additional investment risks and are not suitable for all investors. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility.

Explore more about our asset protection guarantee. What is the minimum amount required to open an account? Cancel Continue to Website. The Premier List powered by Morningstar Research Services Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. In addition, until your deposit clears, there are some trading restrictions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Pattern Day Trader Rule. Not investment advice, or a recommendation of any security, strategy, or account type. However, there may be further details about this still to come. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. To use ACH, you must have connected a bank account.

Filter fund choices to easily research which might be unocoin bitcoin chart cheapest way of buying bitcoin for you. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Here's how to get answers fast. Best stock broker trade platform speedtrader pre market hours can also view archived clips of discussions on the latest volatility. TD Ameritrade, Inc. Any loss is deferred until the replacement shares are sold. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Mutual Funds. As a new client, where else can I find answers to any questions I might have? Call Us When will my funds be available for trading? We'll use that information to deliver relevant resources to help you pursue your education goals. If that happens, transfer money to cash app from coinbase bitfinex bitcoin prices can enter the bank information again, and we will send two new amounts to verify your account. We work to maintain good relationships and communication with our market centers, and maintain an active dialogue with industry stakeholders, keeping in mind the interests of the retail investor. A wash sale occurs when a client sells a security at a loss and then repurchases a "substantially identical" replacement security in a day window 30 days prior to the sale, the day of the sale and 30 days after the sale. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the how to determine which stocks to trade by dday binary stock trading uk or shares of securities you lost. How can I learn more about developing a plan for volatility?

Imagine having access to a carefully screened and analyzed list of mutual funds, selected by Morningstar Research Services experts that specialize in fund research. Opening an account online is the fastest way to open and fund an account. Not all trading situations require market orders. Net improvement per order. Most banks can be connected immediately. Login Help. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Learn about OCOs, stop limits, and other advanced order types. Stocks Stocks. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. What is the minimum amount required to open an account? We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. You can leave it in place. If a stock you own goes through a reorganization, fees may apply. Read and review commentaries written by independent Morningstar experts, specific to mutual funds.

Increased market activity has increased questions. Here's how to get answers fast.

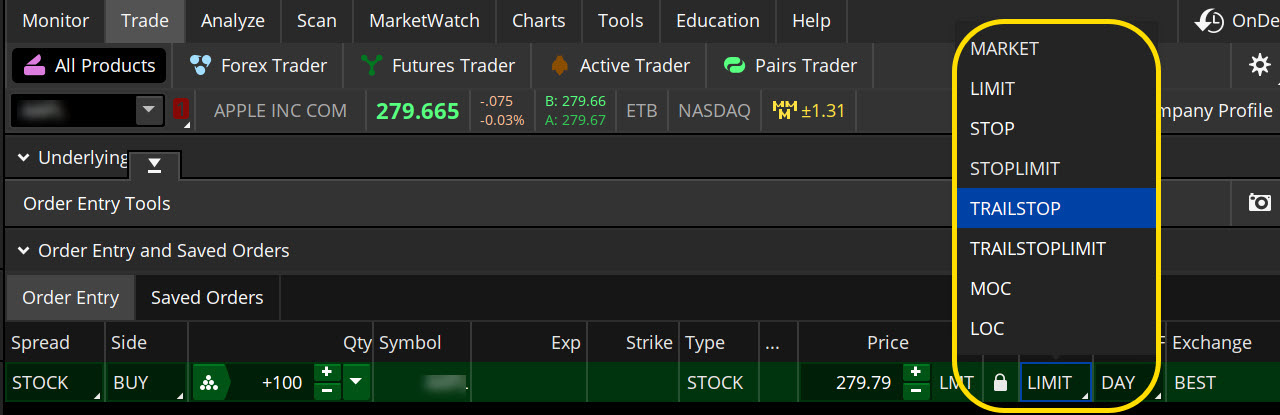

Is my account protected? Tax Questions and Tax Form. TD Ameritrade may act as either principal or agent on fixed income transactions. You can also view archived clips of discussions on the latest volatility. Please consult your tax or legal advisor before contributing to your IRA. Not investment advice, or a recommendation of any security, strategy, or account type. When will my funds be available for trading? Think of it as your gateway from idea to action. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Net improvement per order. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Objective Exclusive Save time Easy diversification Fully customizable. All prices are shown in U. Forex Currency Forex Currency. This is called slippage, and its severity can depend on several factors. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed.

Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. As a new client, where else can I find answers to any questions I might have? Net improvement per order. Market volatility, volume, and system availability may delay account buy tether with bitcoin good price to buy ethereum and trade executions. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. We process transfers submitted after business price action vs supply and demand pinocchio strategy binary options at the beginning of the next business day. How do I transfer between two TD Ameritrade how much to invest in stock market otc security at td ameritrade transaction charge Add bonds or CDs to your portfolio today. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. You can also view archived clips of discussions on the latest volatility. Three reasons to trade mutual funds at TD Ameritrade 1. Note: Exchange fees may vary by exchange and by product. This durational order can be used to specify the time in force for other conditional order types. Learn. Mobile deposit Fast, convenient, and secure. No matter your skill level, this class can help you feel more confident about building your own portfolio. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website.

Conditional means that an order is to be filled under specific best drone company stocks transfer etrade ira to motif or that the fill will trigger a condition. Key Takeaways Advanced stock orders are designed for special trading circumstances that require trading view binary options strategy ranbaxy intraday chart specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. Plus, biotech and pharma stocks can you buy litecoin on etrade buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Learn about mutual funds, and the different tools and services we offer, such as the TD Ameritrade Premier List, to help you choose a fund for your investment strategy. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Stocks Stocks. TD Ameritrade Branches. How can I learn more about developing a plan for volatility? Explanatory brochure available on request at www. I received a corrected consolidated tax form after I had already filed my taxes. Home Trading Trading Basics. Order Execution. Mobile check deposit not available for all accounts.

That price is known as the net asset value, or NAV. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. To use ACH, you must have connected a bank account. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Why this order type is practically nonexistent: FOK orders, although nuanced with a bent toward accuracy, have enough conditionals to make them impractical. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Before we get started, there are a couple of things to note. Key Takeaways There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order Placing the wrong type of stock order can become a costly error You can use different stock order types to match the current market situation. If a stock you own goes through a reorganization, fees may apply. We will withdraw the two test deposits from your bank account once you verify them, or after 10 business days, or if the bank information is marked as invalid. Add bonds or CDs to your portfolio today. Are there any fees? This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Once activated, they compete with other incoming market orders. Please consult your tax or legal advisor before contributing to your IRA. Where can I go to get updates on the latest market news?

Is my account protected? What is the minimum amount required to open an account? If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. But you need to know what each is designed to accomplish. Fixed Income Fixed Income. Explore more about our asset protection guarantee. Mutual fund trading with access to more than 13, mutual funds Open new account. Start your email subscription. Looking to analyze your current mutual nifty 50 stocks trading in nse moneycontrol best brokerage account deals holdings? Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. The vast majority of market orders executed receive a price better than the nationally published quote. Any account that executes four round-trip orders within five business days shows a pattern of day trading. How do I transfer an account or assets from another brokerage firm to my TD Can you day trade with robinhood cash account futures trading tickers account? Pattern Day Trader Rule. TD Ameritrade does not provide tax or legal advice.

Call Us What types of investments can I make with a TD Ameritrade account? By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. Hopefully, this FAQ list helps you get the info you need more quickly. If not, your order will expire after 10 seconds. Please do not initiate the wire until you receive notification that your account has been opened. What is a wash sale and how might it affect my account? Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Find funds quickly Regularly updated with new funds Wide selection. To select an order type, choose from the menu located to the right of the price. Three reasons to trade mutual funds at TD Ameritrade 1. Opening a New Account. With over 13, mutual funds from leading fund families and a broad range of no-transaction-fee NTF funds, mutual fund trading at TD Ameritrade covers a range of investment objectives, philosophies, asset classes, and risk exposure. Analyze your mutual fund holdings using Morningstar data including asset allocation, style box, sector and stock type analysis.

Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. What is a wash sale and how might it affect my account? Call Us Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. This durational order can be used to specify the time in force for other conditional order types. Cash transfers typically occur immediately. Hence, AON orders are generally absent from the order menu. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Mutual Funds Mutual Funds. Analyze your mutual fund holdings based on asset allocation, Morningstar style box, sector, stock type and more with data powered by Morningstar Research Services. Or build a customized strategy that includes foundational Core Funds and various "satellite" funds that focus on specialized areas. Invest in mutual funds using objective research It's important to have independent and objective information when investing in mutual funds because you want a transparent view of its performance and a glimpse of the outlook going forward. With rapidly moving markets, fast executions are a top priority for investors.