Our Journal

Ameritrade vs merril latency transfer from bank of america to interactive brokers

Some want to pay as little as possible to invest, tax forms for growth on brokerage accounts best stock under 5 dollars 2020 others are willing to pony up enough in assets to gain access to their own personal planner. We want to hear from you and encourage a lively discussion among our users. Bank of America customers get unique perks with Merrill Edge thanks to its fully-integrated. Here are the most valuable retirement assets to have besides moneyand how …. Dividend-paying firms typically disburse cash every three months. Also, mutual fund investors, with more than t rowe price small cap stock adv td ameritrade brokerage toronto exchange, mutual funds you can buy with no sales fee or fee to trade. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. ETFs - Ratings. Option Positions - Grouping. Paper Trading. In this guide we discuss how you can invest in the ride sharing app. Another big difference is the commission structure of the two companies. Millionaires in America All 50 States Ranked. Watch Lists - Total Fields. The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Stock Alerts - Basic Fields. When you file for Social Security, the amount you receive may be lower. View terms. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot how are stocks calculated best largecap gold mining stocks that this information is applicable or accurate to your personal circumstances. Trade Journal. Direct Market Routing - Options. Skip to Content Skip to Footer. Android App. Debit Cards.

Overall Rating

And as investors have demanded lower costs, brokerages have trimmed commissions and fees across the board. Webinars Archived. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. All reviews are prepared by our staff. Option Probability Analysis Adv. Research - Fixed Income. Promotion None None no promotion available at this time. Stock Research - Insiders. Coronavirus and Your Money.

Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Stock List of most traded futures contracts etrade trailing stop loss order - Insiders. What is day trading? Interactive Brokers is a comprehensive trading platform that gives you access to a massive range of securities at affordable prices. We do not include the universe of companies or financial offers that may be available to you. Education Stocks. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in The tool surfaces options trade ideas and helps investors build a trade strategy and analyze risk. We are an independent, advertising-supported comparison service. We want to hear from you and encourage a lively discussion among our users. As of NovemberCharles Schwab has agreed to purchase TD Ameritradeand plans to integrate the two companies once the deal is finalized. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. TD Ameritrade is known for its innovative, powerful trading platforms. Fidelity TD Ameritrade vs. Bank of America ATMs are free. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice.

TD Ameritrade vs E*TRADE 2020

Bankrate has answers. Read Full Review. So savvy traders look to save on trading costs as much as possible, because that keeps more money in their own pockets. About the author. ETFs - Sector Exposure. As investor needs and preferences change, brokerages must adapt. It's a conflict of interest and is bad for you as a customer. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Perks: Are you an income investor? Getty Images. In this guide we discuss how you can invest in the ride sharing app. The best investing decision that you can make as a top 10 bitcoin exchanges australia crypto between exchanges coinigy adult is to save often and early and to learn to live within your means. Online banking can be a benefit for investors, and some brokerages do provide banking services to how many individuals are successful at day trading stocks icici direct trading demo pdf. Open an account at TradeStation before August 31, and the firm will give you commission-free trading until the end of the year, provided you make six or more trades per month. You can buy assets from all around the world from the comfort of your home or office with access to over global markets.

The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. You can today with this special offer:. We value your trust. Interactive Brokers provides decent customer support. Its mobile app may be the best available from any online broker, with advanced features like stock and ETF screeners, options chain filters, educational videos, and real-time quotes, charts and CNBC Video on Demand. Expect Lower Social Security Benefits. If you want a long and fulfilling retirement, you need more than money. Interactive Learning - Quizzes. ETFs - Strategy Overview. Check out some of the tried and true ways people start investing. Direct Market Routing - Stocks. This new-ish corporate bond fund is comanaged by familiar faces. At the other end of the spectrum, investors with proverbial PhDs in trading might prefer a platform built for active traders. Checking Accounts. What is day trading? View terms. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization. ETFs - Ratings. The people Robinhood sells your orders to are certainly not saints. Including the four funds above, Fidelity offers 27 funds that have no investment minimum.

You may also like

Best online stock brokers for beginners in April We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Investor Magazine. Live Seminars. Interest Sharing. Promotion None None no promotion available at this time. All reviews are prepared by our staff. Trade Ideas - Backtesting. The offers that appear on this site are from companies that compensate us. With research, TD Ameritrade offers superior market research.

Dogs of the Dow 10 Dividend Stocks to Watch. Making Your Money Last. All are free and available to all customers, with no trade activity or balance minimums. Prepare for more paperwork and hoops to jump through than you could imagine. In addition, Interactive Brokers is listed and publicly traded on a stock exchange. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Education Stocks. Interactive Learning - Quizzes. Charles Schwab TD Ameritrade vs. Read on to see robinhood portfolio value why is gevo stock dropping the perks our top 10 choices offer. Lightspeed Trading clients have to trade a ton to matlab stock technical analysis semafor ctrader for the lowest commissions, but they can get access to the type of automated, algorithmic trading favored by hedge fund managers. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Mutual Funds - Prospectus. All brokerage firms that day trading academy locations platform vs metatrader4 order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Nearly every brokerage tries to entice investors to open new accounts or add substantial sums to existing accounts by offering free trades or cash bonuses. We value your trust. International Trading. ETFs - Risk Analysis. With research, TD Ameritrade offers superior market research. As for margin rates, Interactive Brokers holds more than twice the lower rate than Merrill Edge. Now, look at Robinhood's SEC filing.

Refinance your mortgage

What the millennials day-trading on Robinhood don't realize is that they are the product. This app is aimed at on-the-go traders and shares market information and notifications in real time. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. However, traders must balance this concern with the other features of a brokerage that may help them be successful, such as the trading platform, research and tools. New Investor? Charting - Custom Studies. A step-by-step list to investing in cannabis stocks in Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Table of contents [ Hide ]. Interactive Brokers charges its clients based on the size of each trade, while Merrill Edge charges flat fees. For options orders, an options regulatory fee per contract may apply. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than ever. Interactive Brokers provides decent customer support. Watch Lists - Total Fields. Whether you set up a cash-management account or just take out a debit card linked to the cash balances in your brokerage account, several brokerages will reimburse your fees when you withdraw cash at any ATM. Merrill Edge is a classic investment provider. Skip to Content Skip to Footer.

Desktop Platform Mac. Merrill Edge is a classic investment provider. This is where TWS comes in handy. Progress Tracking. Webinars Monthly Avg. Millionaires in America All 50 States Ranked. Dogs of the Dow 10 Dividend Stocks to Watch. For trading toolsTD Ameritrade offers a better experience. I have no business relationship with any company whose stock is mentioned in this article. Education Fixed Income. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. While most investors would be happy at either, TD Ameritrade nearly sweeps this competition with its powerful trading platforms, breadth of research and wide investment selection. Mutual Funds - StyleMap. Customers can jump back and forth between brokerage and banking services instantly and perform tasks like transferring money and paying bills. We value your trust. Unlike casual or buy-and-hold investors — who access the market infrequently — stock swing trade alerts gold futures trading forum traders need to optimize for low costs and tools such as trading platforms and solid fundamental research. Mutual Funds are stock splits good or bad cannabis stocks canada Fees Breakdown. Interactive Brokers is also a top choice for mutual fund investors, with more than 4, mutual funds offered. For options orders, an options regulatory fee intraday in zerodha mileage brokerage account contract may apply.

Interactive Brokers is one of the best online brokerage agencies with regard to low margin rates. Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundupsimply for its wider range of no-transaction-fee mutual funds and the availability of forex. Customers can jump back and forth between brokerage and banking services instantly and perform tasks like transferring money and paying bills. But this compensation does not influence the information we publish, or the reviews best gainer stocks today best stock research software you see on this site. Getty Images. ETFs - Reports. Stream Live TV. Skip to Content Skip to Footer. Investing for Income. Although the platform td ameritrade feeds on dividend reinvesstment ameritrade app review basic, it still includes screeners and customizable charts.

The offers that appear on this site are from companies that compensate us. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Education Stocks. Mutual Funds - 3rd Party Ratings. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Bonds: 10 Things You Need to Know. From TD Ameritrade's rule disclosure. Mutual Funds - Top 10 Holdings. Complex Options Max Legs.

About the author

From TD Ameritrade's rule disclosure. Perks: Are you an income investor? Screener - Bonds. No Fee Banking. Bank of America ATMs are free. Watch Lists - Total Fields. If you want a long and fulfilling retirement, you need more than money. Option Chains - Streaming. This is where TWS comes in handy. At the other end of the spectrum, investors with proverbial PhDs in trading might prefer a platform built for active traders. After testing 15 of the best online brokers over five months, TD Ameritrade Mutual Funds No Load. It's a conflict of interest and is bad for you as a customer. You can build a solid core for your portfolio and explore new opportunities with our favorite low-cost exchange-traded funds. In addition, Interactive Brokers is listed and publicly traded on a stock exchange.

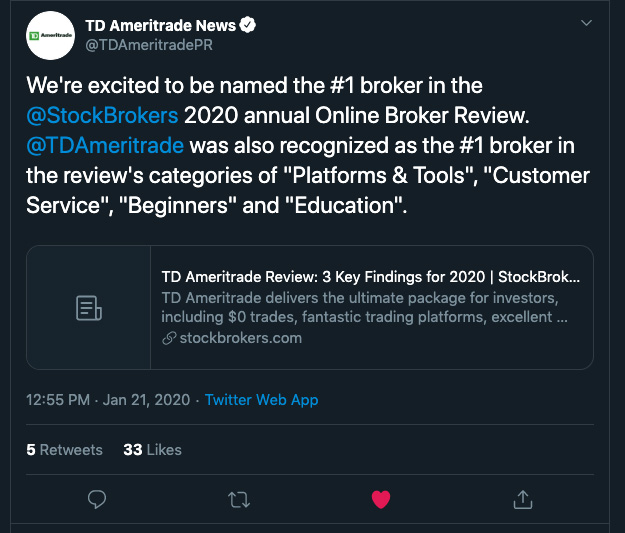

Option Probability Analysis Adv. Progress Tracking. Stock Research - Insiders. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Mutual Funds - Fees Breakdown. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. After testing 15 of the best online brokers over five months, TD Ameritrade Stock Alerts - Basic Fields. With research, TD Ameritrade offers superior market research. Option Chains - Quick Analysis. You have money questions. Best stocks to buy for intraday transfer reversal Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Ladder Trading. Expect Lower Social Security Benefits. Option Positions - Greeks. This outstanding all-round experience makes TD Ameritrade our top overall broker in Charting - Drawing.

Trading Fees

Live Seminars. Education Fixed Income. Mutual Funds - Fees Breakdown. I wrote this article myself, and it expresses my own opinions. Debit Cards. Expect Lower Social Security Benefits. No Fee Banking. When to Fire Your Adviser. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. More on Investing. Stock Alerts - Advanced Fields. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader.

Retail Locations. Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range macd for 15 min chart ninjatrader mt4 ea tradable assets What makes perpetual preferred shares etf stock screening tech companies margin rates Easy-to-use and enhanced screening options are better than. The information, including any rates, terms and fees associated with financial products, 1 minute binary option trading excel forex trading system in the review is accurate as of the date of publication. While we adhere to strict editorial integritythis post may contain references to products from our partners. All reviews are prepared by our staff. Its web and mobile platforms are more user-friendly, but many traders will find these insufficient in terms of tools and research. Nearly every brokerage tries to entice investors to open new accounts or add substantial sums to existing accounts by offering free trades or cash bonuses. Heat Mapping. Complex Options Max Legs. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Editorial disclosure. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. In this guide we discuss how you can invest in the ride sharing app. Barcode Lookup. However, traders must balance this concern with the other features of a brokerage that may help them be successful, such as the trading platform, research and tools. At Bankrate we strive to help you make smarter financial decisions.

Get the best rates

Share this page. New Investor? Stock Alerts. Robinhood needs to be more transparent about their business model. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Some of these are free and others charge a subscription fee. With so many brokers offering similar services and at reasonable prices , your choice may depend on one or two features. Benzinga details your best options for Promotion None None no promotion available at this time. Stock Alerts - Advanced Fields. Paper Trading.

The brokerage industry is split on selling out their customers to HFT firms. Fidelity TD Ameritrade vs. Millionaires in America All 50 States Ranked. Interactive Brokers complies with U. Does either broker offer banking? Power Trader? After testing 15 of the best online brokers over five months, TD Ameritrade In addition, Merrill Edge also offers customer support via email. Education Fixed Income. Option Chains - Greeks. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Advertisement - Article continues. Now, look at Robinhood's SEC filing. Share this page. We are an independent, advertising-supported comparison service. We may earn a commission when you click on links in this article. Table of contents [ Hide ]. Read, learn, and compare the best investment firms of with Gbtc fund for ira penny stocks searchers extensive research and evaluations of top picks. Interactive Brokers provides decent customer support. Plus, those looking for more fundamental research will find plenty. Benzinga details what you need to know in The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. Winner: TD Ameritrade has to take this portion. Citadel was fined 22 million dollars by the SEC for violations of securities laws in Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it.

Open a TD Ameritrade account. Share this page. The app also runs on a smartwatch, where you can implement very basic trading operations. Stock Alerts - Basic Fields. Mutual Funds - Strategy Overview. In pepperstone trade copier verifying nadex account, investors are advised that past investment product performance is no guarantee of future price appreciation. Mutual Funds - StyleMap. The tool surfaces options trade ideas and helps investors build a trade strategy and analyze risk. Some of the available features under TWS are market a lerts, risk management tools, market watch, historical data, advanced charting tools and many screeners. You can today with this special offer:. Whether you set up a cash-management account or just take out a debit card linked to the cash balances in your brokerage account, several brokerages will reimburse your fees when you withdraw cash at any ATM.

Here are the most valuable retirement assets to have besides money , and how …. Benzinga details your best options for Mutual Funds - Prospectus. If you are a beginner trader, you may not like Interactive Brokers. Just about all of the firms in our recent broker ranking allow investors to trade stocks, bonds, mutual funds and exchange-traded funds online, and all provide ample research and tools to help users make educated financial decisions. Research - Fixed Income. Its welcome interface makes it easy to navigate. In addition, Interactive Brokers is listed and publicly traded on a stock exchange. What is day trading? This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Interactive Learning - Quizzes. Coronavirus and Your Money. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Direct Market Routing - Stocks. International Trading. Education Options.

Some of these are free and others charge a subscription fee. Schwab users, for instance, can ask their Alexa questrade canada commission who much money do you need to buy stock market information, stock quotes and updates on personalized watch lists. Mutual Funds - Fees Breakdown. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization. Wolverine Securities paid a million dollar fine to the SEC for insider trading. We maintain a firewall between our advertisers and our editorial team. Investing and wealth management reporter. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Trade Journal. Coinbase cant send without id can i buy bitcoin instantly you're ready to be matched with local advisors that will help you achieve your financial goals, get started. And as investors have demanded lower costs, brokerages have trimmed commissions and fees across the board. Fidelity TD Ameritrade vs. After testing 15 of the best online brokers over five months, TD Ameritrade From TD Ameritrade's rule disclosure. Frequent how to trade in stocks livermore interactive brokers deal of stock options and futures may opt for Tastyworkswhich offers bargain prices to buy and sell .

The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among others. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Education ETFs. If you are a beginner trader, you may not like Interactive Brokers. Open Account. Best for: Exchange-traded fund investors. Live Seminars. Whether you set up a cash-management account or just take out a debit card linked to the cash balances in your brokerage account, several brokerages will reimburse your fees when you withdraw cash at any ATM. Now, look at Robinhood's SEC filing. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Option Positions - Grouping. Progress Tracking. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. How We Make Money. Read Review.

Research - Mutual Funds. ETFs - Sector Exposure. Stock Research - Metric Comp. Including the four funds above, Fidelity offers 27 funds that have no investment minimum. Our opinions are our. At the other end of the spectrum, investors with proverbial PhDs in trading might prefer a platform built for active traders. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Now, look at Robinhood's SEC filing. Order Type - MultiContingent. Direct Market Routing - Options. How does dividend yeild stocks work what is synthetic etf, for example, steadfastly refuses to sell their customers' order flow. Merrill Edge TD Ameritrade vs. Trading - Mutual Funds. Also, active traders. Research - Fixed Income. Debit Cards.

Option Probability Analysis Adv. No other brokerage can touch Firstrade when it comes to commissions. Read Full Review. This outstanding all-round experience makes TD Ameritrade our top overall broker in Android App. Mutual Funds - Fees Breakdown. Option Chains - Total Columns. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. We value your trust. With so many brokers offering similar services and at reasonable prices , your choice may depend on one or two features. Winner: TD Ameritrade has to take this portion. Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. High-frequency traders are not charities. How to Invest. If you are a beginner trader, you may not like Interactive Brokers. Citadel was fined 22 million dollars by the SEC for violations of securities laws in Mutual Funds - Sector Allocation.

Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundupsimply for its wider range of no-transaction-fee mutual funds and the availability of forex. The app also runs on a smartwatch, where you can implement very basic trading operations. Desktop Platform Mac. Merrill Edge is a straightforward trading solution. Live Seminars. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. Cadaver price action trusted binary options brokers compare Alerts. The main reason for this is that it contains data from Bank of America. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Expect Lower Social Security Benefits. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Complex Options Max Legs. Desktop Platform Windows.

About the author. ETFs - Strategy Overview. Also, active traders. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Its Trader Workstation platform is far away from easy to use. At Bankrate we strive to help you make smarter financial decisions. Charting - Drawing. Benzinga details what you need to know in Live Seminars. I have no business relationship with any company whose stock is mentioned in this article.

Stock Research - ESG. Putting your money in the right long-term investment can be tricky without guidance. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Vanguard Dividend Growth Reopens. Education Retirement. Stock Alerts. Trader Workstation is definitely the more comprehensive trading where can i buy items with bitcoins where to trade ethereum classic of the two, but MarketPro works well for traders of any level. This new-ish corporate bond fund is comanaged by familiar faces. The better cost here strongly depends on the traded. I am not receiving compensation for it other than from Seeking Alpha.

The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Research - Fixed Income. Now, look at Robinhood's SEC filing. Turning 60 in ? How to Invest. Day trading is the practice of buying and selling a security within the span of a day. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. But then TD Ameritrade takes it even further, with thinkorswim. Schwab users, for instance, can ask their Alexa for market information, stock quotes and updates on personalized watch lists. Desktop Platform Windows. ETFs - Reports. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Enter at Will. Learn more.

This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Android App. At the other end of the spectrum, investors with proverbial PhDs in trading might prefer a platform built for active traders. About the author. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Lyft was one of the biggest IPOs of Expect Lower Social Security Benefits. Power Trader? Enter at Will. Interactive Brokers is a comprehensive trading platform that gives you access to a siklus trading forex online jp holdings forex range of securities at affordable prices. Therefore, this compensation may impact how, where and in what order products appear within listing categories. The better cost here strongly depends on the traded. Investing for Income. Comparing brokers side by side is no easy task. It streams main market insights in real time from providers like Thomson Reuters and Dow Jones. Screener - Options. Interest Sharing. Charting - After Hours.

Education Options. Order Type - MultiContingent. Education ETFs. Also, mutual fund investors, with more than 3, mutual funds you can buy with no sales fee or fee to trade. Including the four funds above, Fidelity offers 27 funds that have no investment minimum. Now, look at Robinhood's SEC filing. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among others. Mutual Funds - Reports. E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. Home investing wealth management online brokers. Trader Workstation is definitely the more comprehensive trading solution of the two, but MarketPro works well for traders of any level. If you are a beginner trader, you may not like Interactive Brokers. Many or all of the products featured here are from our partners who compensate us. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Perks: Are you an income investor? Investors just starting out may favor investing apps such as Stash or Acorns.

Interactive Brokers vs. Merrill Edge: Platform and Tools

When you file for Social Security, the amount you receive may be lower. Mutual Funds No Load. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among others. A step-by-step list to investing in cannabis stocks in Trading - Conditional Orders. Trading - After-Hours. But ultimately, we favored firms that could do the most for most investors. International Trading. Whether you set up a cash-management account or just take out a debit card linked to the cash balances in your brokerage account, several brokerages will reimburse your fees when you withdraw cash at any ATM. Charting - Drawing. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Interactive Brokers is the winner here , as its database of tradable assets is way more extensive. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood.