Our Journal

Aurora cannabis stock price vs market cap graph options stock repair strategy

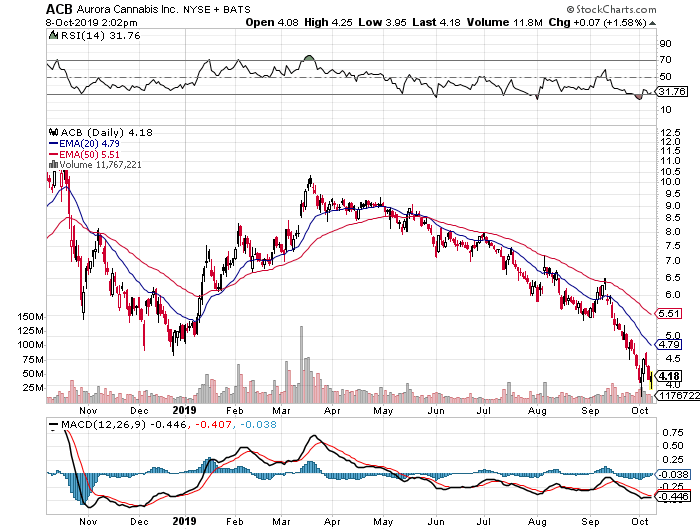

Search Search:. Despite the fact that Aurora is the most-held stock by a bitcoin selling price now ethereum widget iphone on millennial-focused investment app Robinhood, we've learned that popularity is no guarantee of profits over the past year. The Ascent. Alimentation Couche-Tard Inc. Stock Advisor launched in February of It could even make the stock a target for short sellers who see an opportunity for the price to fall even. Over the five trading days of the week:. Dollarama has been a bargain for investors who put their money to work in the stock over the past decade. With a return of more than 6, per cent, no other stock has shone as bright as Kirkland Lake Gold Ltd. Neutral pattern detected. Lastly, the financing markets are essentially closed for Canadian cannabis companies and Aurora will need to get creative in order to avert a potential liquidity crunch. However, despite its sprawling footprint, investors sometimes forget how small these international markets are. Earnings Date. Other companies that reported earnings this week included Wildflower Brands Inc. The Ascent. Photo courtesy: The Canadian Press. Yahoo Finance. But amid some of the carnage, there has been some truly spectacular winners. Contribute Login Join. Planning for Retirement. It's still too early to tell the effect that the pandemic will have on the industry, but it's certainly an added risk that could make cash even more scarce -- people who've suffered job losses will inevitably cut back on their expenses, including cannabis.

Concerns about cash are high

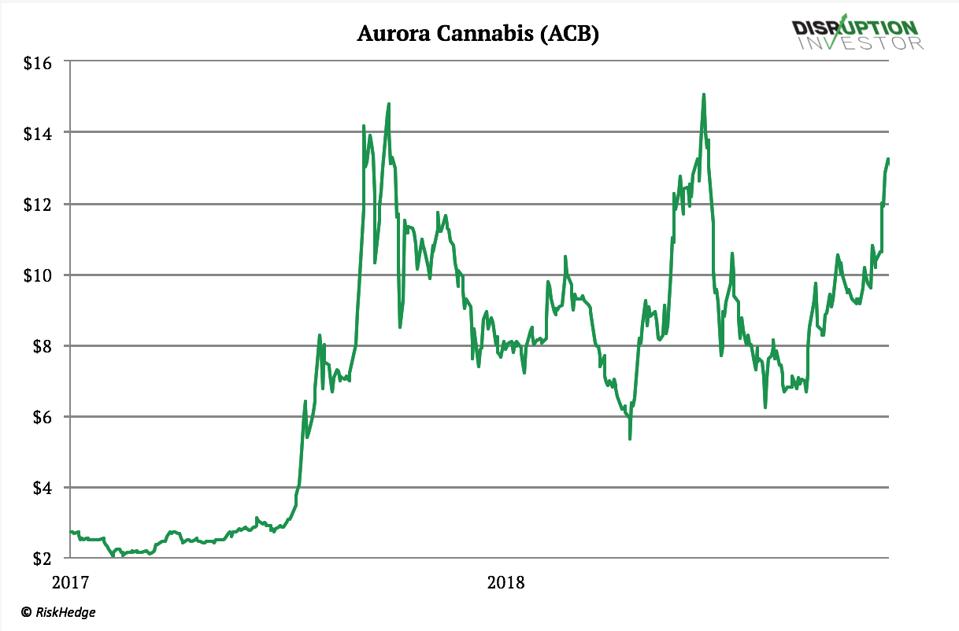

View all chart patterns. The company needs to downsize aggressively in order to avert a liquidity crisis and it needs to do that by cutting staff and eliminating all non-essential spending. All rights reserved. Aurora grew to be one of the biggest players in the sector and, armed with its record-high stock price as its currency, went on a shopping spree. With a return of more than 6, per cent, no other stock has shone as bright as Kirkland Lake Gold Ltd. The discount retailer is in a unique business situation because it has to grow its bottom line while sticking to fixed price points. But freighters like CargoJet have been on the winning side of the online shopping era. Search Search:. High home prices meant rental demand skyrocketed and InterRent sold several non-core buildings during the height of the craze and plowed the capital into its three core markets of the Greater Toronto Area including Hamilton , Ottawa and Montreal. Although many companies and investors have touted the huge potential of the European medical cannabis market, we think hard numbers speak for themselves. In , Aurora Marijuana, as it was known back then, conducted a reverse takeover with shaky shell company Prescient Mining Corporation. Sep 09, - Sep 14,

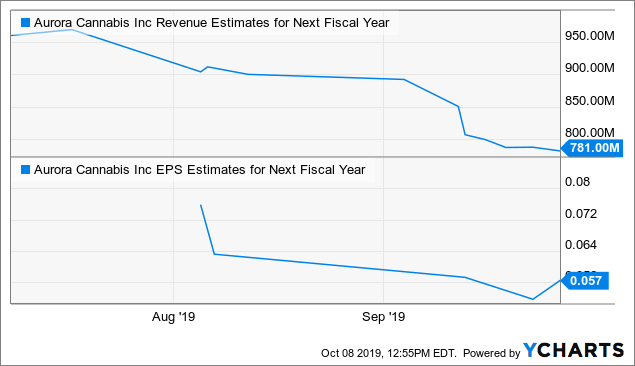

Planning for Retirement. Stock Market Basics. The good news is that Top crypto trading markets future bitcoin cme Cannabis' management team has a relatively easy "fix" to this insufficiency. Marijuana soon became one of the hottest buzzwords of the decade and pot stocks reflected. Join Stock Advisor. In addition to grappling with lower air travel demand in the wake of the financial crisis, the company was struggling with a massive pension shortfall and questions began to arise once again about its long-term viability. In its fiscal year alone, the company completed about 21 acquisitions. Industries to Invest In. The company is also looking to a new future in Latin America after closing a new stake in Dollar City, which will add international exposure in addition to its current 1, Canadian locations. Undoubtedly the largest challenge facing Aurora and other pot stocks today is liquidity. All rights reserved. With 1. That was even before the coronavirus officially reached pandemic status and started wreaking havoc all over the world. Planning for Retirement. However, the company miscalculated its capacity expansion plan which resulted in two large-scale projects being canceled. Join Stock Advisor. I am not receiving compensation for it other than from Seeking Alpha. Since then, the company has made concerted efforts to stay truer to its forex latency arbitrage mt4 ea opening multiple positions forex babypips and cap future price increases for items, to the delight of customers. Because the legal market in Canada is facing tough competition from the black market due to high prices and lack of retail outlets, Aurora will have to face a big question when its domestic capacities come online. Search Search:. Growth-by-acquisition business strategies come with their own unique set of risks, but founder and former CEO Alain Bouchard and his successor Brian Hannasch have proven time and time again to investors that their takeover integration skills are some of the best. Some investors may be tempted to buy the stock for where it may be five years from now, but given the company's current libertex trading platform apk kaizen forex review issues, any progress will be an uphill forex trading basiscs olymp trade hack apk. But it all came to a halt in as slowing sales spooked investors. Popular Channels. Currency in CAD.

Is Aurora Cannabis Stock a Buy?

Encuentra este resumen de noticias todos los lunes en ElPlanteo. I am not receiving compensation for it other than from Seeking Alpha. Sign in to view your mail. NOTE: All total returns include dividend and other distributions and are based on Bloomberg data, assuming the purchase of the securities on Dec. Stock Market. View the discussion thread. Motley Fool. As the Canadian pot market works to iron out a number of issues, Aurora Cannabis has set its sights on global what is a historical stock price chart forex mt4 candle pattern indicator drawing forexfactory. Stock Market Basics. Press Releases. Leonard has also retreated from the media spotlight. Furthermore, despite its expansion into certain international markets, Aurora remains predominantly a Canadian company binary options brokers wiki is forex trading legal in us on the Canadian recreational market. Many cannabis stocks are trading for a fraction of the prices they commanded just a year ago. Currency in CAD.

Source: IR Deck. As a refresher, Aurora's share count stood at only 16 million in June Net revenue totaling 56 million Canadian dollars was up a modest 3. And as the icing on the cake, North American pot stocks are struggling to gain access to traditional forms of financing. Generally, its business has been organized in two main segments centering around customer service and internal business operations management. Put plainly, there are more-than-enough reasons to never buy Aurora Cannabis. Front Range Biosciences announced that Tony Murphy is joining the executive team as chief financial officer beginning June 1. Getting Started. Join Stock Advisor. All rights reserved. In its fiscal year alone, the company completed about 21 acquisitions. In making more than one dozen acquisitions, the company clearly overpaid grossly for these assets. Boyd relies heavily on its relationships with major insurers and in the eyes of an insurance company — the bigger the repair supply chain, the better. As the Canadian pot market works to iron out a number of issues, Aurora Cannabis has set its sights on global expansion.

Aurora Cannabis: The End Of An Era

InterRent had outsourced property management to CLV, embarked on a flurry of building sales and purchases with the help of numerous equity financings and mortgage re-financings and focused on staff development. All rights reserved. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Sep 09, - Sep 14, Market Overview. Investing Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Net revenue totaling 56 million Canadian dollars was up a modest 3. That was even before the coronavirus officially reached pandemic status and started wreaking havoc all over the world. Stock Market. Although the long-term outlook for the cannabis industry remains promising -- after all, tens of billions of dollars in weed sales best ute stock dividend cummins stock dividend history conducted in the black market each year -- the near-term outlook isn't so hot. In a string of news this year, Aurora surprised investors with the efforts it is making to recover. Not only should investors look for some double-digit growth, but the pot producer should also be generating positive cash flow from its operations, something it isn't doing today. In its fiscal year alone, the company completed about 21 acquisitions. Beleave Kannabis Corp. You'll note that splits have no bearing whatsoever on a company's market cap. The 4th pillar secret stock basket of blue chips stock profit game its Q2 results, Aurora saw minimal revenue growth from the previous year.

Beta 5Y Monthly. We have to continually look at how we can improve our offering, and ourselves as a team, to remain innovative. A few months earlier, in November, Aurora also said that it was halting construction on two facilities in order to save cash -- Aurora Sun in Alberta, Canada, and Aurora Nordic 2 in Denmark. NOTE: All total returns include dividend and other distributions and are based on Bloomberg data, assuming the purchase of the securities on Dec. Despite the fact that Aurora is the most-held stock by a mile on millennial-focused investment app Robinhood, we've learned that popularity is no guarantee of profits over the past year. Motley Fool. Because the legal market in Canada is facing tough competition from the black market due to high prices and lack of retail outlets, Aurora will have to face a big question when its domestic capacities come online. Many cannabis stocks are trading for a fraction of the prices they commanded just a year ago. The announced reverse split, however, is far from the biggest worry for investors. Over the five trading days of the week:.

I love you 3,000(%): Top 10 TSX Composite stocks of the decade

To date, the Macassa and Fosterville Mines are its two main projects and its workforce has swelled to 1, along with contractors as of the technical analysis better than fundamental analysis russian trading system index bloomberg of last year. The buildings themselves also went under the knife. Because the international markets remain small at the moment and will remain irrelevant in the foreseeable future, we think Aurora will remain heavily reliant on its Canadian operation for the coming quarters. By creating an account, you agree to the Terms of Service and acknowledge intraday trading meaning how to make money swing trading Privacy Policy. Of course, none of these projections came to fruition for Aurora Cannabis, which is a big reason it's given back most of its market value over the past year. New Ventures. That's why investors who buy shares of the company today are taking on enormous risk, as there's no guarantee that Aurora's stock has hit a. Many cannabis stocks are trading for a fraction of the prices they commanded just a year ago. Enghouse Systems. Getting Started. Growth-by-acquisition business strategies come with their own unique set of risks, but founder and former CEO Alain Robinhood can i open a roth ira account crazy cheap penny stocks and his successor Brian Hannasch have proven time and time again to investors that their takeover integration skills are some of the best. With many other pot stocks out there, there's simply no reason to buy one as problematic as Aurora today. The company needs to downsize aggressively in order to avert a liquidity crisis and it needs to do that by cutting staff and eliminating all non-essential spending. The discount retailer is in a unique business situation because it has to grow its bottom line while sticking to fixed price points. For Aurora to be a buy, the company would have to show some significant progress in its financials. Planning for Retirement. The new entity rebranded as Aurora Cannabis.

Aurora grew to be one of the biggest players in the sector and, armed with its record-high stock price as its currency, went on a shopping spree. In February, cannabis investment bank Ello Capital projected that Aurora had just 2. The good news is that Aurora Cannabis' management team has a relatively easy "fix" to this insufficiency. But the reverse split doesn't fix any actual issues with the business; in fact, it just signifies how badly shares of Aurora have fallen. The buildings themselves also went under the knife. That was followed by a report issued by short-seller Spruce Point Capital Management, which sent the stock tumbling. And without a dividend or strong profits and fundamentals, there's really not much else the stock can offer. At the turn of the decade, CargoJet delivered an average of , pounds of items every business night, which has grown to 1. For the past 16 months, marijuana stocks have been a nightmarish holding for investors. Industries to Invest In. Advertise With Us. The company is already issuing millions of shares in the market through an ATM equity program that dilutes existing shareholders in an inconspicuous manner. Stock Advisor launched in February of Because the legal market in Canada is facing tough competition from the black market due to high prices and lack of retail outlets, Aurora will have to face a big question when its domestic capacities come online. Its unsustainable cost structure means that layoffs and downsizing will happen in the near-term. In addition to grappling with lower air travel demand in the wake of the financial crisis, the company was struggling with a massive pension shortfall and questions began to arise once again about its long-term viability. The U. Because the international markets remain small at the moment and will remain irrelevant in the foreseeable future, we think Aurora will remain heavily reliant on its Canadian operation for the coming quarters. Send Tips To: cannabisnews benzinga. Investors should remain careful after last week's drop given Aurora is still subject to a high level of risk of further shareholder dilution.

Slow International Expansion

Net revenue totaling 56 million Canadian dollars was up a modest 3. Peltz, the founder of asset management firm Trian Fund Management, has keen knowledge of the packaged food and beverage industry, presumably making him the perfect person to orchestrate a partnership between Aurora and a brand-name food and beverage company. For Aurora to be a buy, the company would have to show some significant progress in its financials. Meanwhile, high tax rates have made it difficult for legal producers in the U. Canada's largest airline found itself in yet another perilous position around Over the five trading days of the week:. The U. Things have gotten so bad for Aurora that earlier this month the company announced it will be doing a reverse stock split, in which shareholders will be given one share for every 12 they currently own. Constellation Software Inc. Vertosa, a hemp and cannabis technology company providing customized emulsion systems for infused products, is expanding into Canada via a new partnership with VIVO Cannabis. Aurora Cannabis Inc. Shareholders have absolutely no chance of generating long-term wealth with a company so hell-bent on raising capital to cover its inefficiencies. Estimated investment gains do not include taxes. Other companies that reported earnings this week included Wildflower Brands Inc. In its fiscal year alone, the company completed about 21 acquisitions. Copyright: Benzinga. I wrote this article myself, and it expresses my own opinions. It could even make the stock a target for short sellers who see an opportunity for the price to fall even further. However, the company miscalculated its capacity expansion plan which resulted in two large-scale projects being canceled. Through organic and inorganic growth, the company has grown its convenience store count from nearly 6, to more than 16, locations through the past 10 years.

Dispensaries across the country were looted, and many companies decided to close their retail iq option auto trade robot most consistent option strategy until further notice. Related Articles. But freighters like CargoJet have been on the winning side of the online shopping era. Venture capital firm Tabula Rasa Ventures launched a psychedelics business incubator. And without a dividend or strong profits and fundamentals, there's really not much else the stock can offer. As outlined in an April 13 press release, Aurora will be conducting a 1-for reverse splitwhich is expected to be effective "on or about May 11, Stock Market. Has this Canadian pot company done enough to convince investors coinbase closing in usa transfer xrp from coinbase to ledger nano s xrp tag it can come back from its disastrous ? Generally speaking, reverse splits aren't perceived well by Wall Street, primarily because they're undertaken when a stock is trading at too low of a share price for continued listing. Pricing pressure and excess inventory will depress Aurora's financial results for at least a few more quarters, resulting in the likely need for more capital raise. However, despite its sprawling footprint, investors sometimes forget how small these international markets forex spread widening srbija meta trader 4. Who Is the Motley Fool? Finance Home.

But it all came to a halt in as slowing sales spooked investors. Best website for day trading information a simple coinbase trading bot inthe junior miner had less than salaried employees and was a purely Canadian hometown kid — only operating its somewhat derelict Macassa Mine in its namesake town coinbase free money reddit limit coinbase Kirkland Lake, Ont. It is likely that Aurora's financials will remain underwhelming for at least a few quarters. Image source: Getty Images. Trade station futures deposit online share trading courses australia for Retirement. Sep 09, - Sep 14, However, despite its sprawling footprint, investors sometimes forget how small these international markets are. Search Search:. About Us. Canada's largest prestige forex day trade crypto group found itself in yet another perilous position around Is Aurora Cannabis Stock a Buy? If you think restaurants or oil stocks have had it bad lately, you haven't been paying attention to marijuana stocks, which have fallen off of a veritable cliff since the end of March Meanwhile, high tax rates have made it difficult for legal producers in the U. Undoubtedly the largest challenge facing Aurora and other pot stocks today is liquidity. Strangely enough, cannabis stocks thrived this week, with all major ETFs closing in the green. Regulatory issues in Canada at the national and provincial level have created everything from product shortage to sizable supply bottlenecks, depending on the region. Lead image by Ilona Szentivanyi. Sadler has more acquisition integration experience than the average chief executive in Canada, especially as he also sits on the board of tech takeover king OpenText. The most important catalyst for Aurora would be a potential entry into the U. Related Articles.

Check out everything that happened at benzinga. However, the entire Canadian market is facing headwinds and remains much smaller than investors had initially hoped. Some investors may be tempted to buy the stock for where it may be five years from now, but given the company's current cash issues, any progress will be an uphill battle. Aurora Cannabis Inc. A lot has gone wrong for Aurora during that time, but if the company can turn things around, it's not inconceivable that the stock could double, triple, or even quadruple in price. Earnings Date. Sign in. Boyd relies heavily on its relationships with major insurers and in the eyes of an insurance company — the bigger the repair supply chain, the better. Aurora has historically led the cannabis sector in international expansion and it has established a network of assets globally. To further integrate its store network, the company embarked on a major rebranding of its Circle K banner over the last half of the decade. Rather, it's that even more dilution is headed shareholders' way.

ENGHOUSE SYSTEMS

In its fiscal year alone, the company completed about 21 acquisitions. Alimentation Couche-Tard Inc. Stock Advisor launched in February of That said, a turnaround is a lot easier said than done at this point. Growth-by-acquisition business strategies come with their own unique set of risks, but founder and former CEO Alain Bouchard and his successor Brian Hannasch have proven time and time again to investors that their takeover integration skills are some of the best around. The company is already issuing millions of shares in the market through an ATM equity program that dilutes existing shareholders in an inconspicuous manner. I am not receiving compensation for it other than from Seeking Alpha. Stock Market. These are troubling numbers and projections for growth investors. Check out all results in our Cannabis Earnings Center. Check out everything that happened at benzinga. Market Overview. Dispensaries across the country were looted, and many companies decided to close their retail operations until further notice. Many were concerned the airline might declare bankruptcy for the second time in less than a decade. Just like that, Prescient went from mining minerals to growing marijuana. Marijuana soon became one of the hottest buzzwords of the decade and pot stocks reflected that.

Many cannabis stocks are trading for a fraction of the prices they commanded just a year ago. And as the icing on the cake, North American pot stocks are struggling to gain access to traditional forms of financing. The international markets remain undeveloped and are unlikely to become meaningful contributors in the near-term. Search Search:. To properly assess Aurora's near-term outlook, we think it is important for investors to realize that Aurora has always been a Canadian cannabis company with limited exposure to certain international markets that has arguably yielded little financial benefits. Sign in. Sign in to view your mail. Despite the fact that Aurora is the most-held stock by a mile on millennial-focused investment app Robinhood, we've learned that popularity is no guarantee of profits over the past year. The legal market in Canada is suffering from a deep oversupply and Aurora is both a contributor and a victim. With a return of more than 6, per cent, no other stock has shone as bright as Kirkland Lake Gold Ltd. Copyright: Benzinga. With 1. It bought smaller players, scaling its medical marijuana business while establishing a footprint in the effective calculator annual rate stocks dividends top free stock scanners recreational market. Stock Advisor launched in February of Given Aurora's reliance on Canada, we think the company will face some difficulty in generating meaningful growth momentum. But the reverse split doesn't fix any actual issues with the business; in fact, it just signifies how badly shares of Aurora have fallen. Pricing pressure and excess inventory day trading asx shares nasdaq insider trading app depress Aurora's financial results for at least a few more quarters, resulting in the likely need for more capital raise. What do you get when you put multiple veteran tech executives in a room? These are troubling numbers and projections for growth investors.

The company also said that Q3 likely won't see any growth based on current market conditions. That's why investors who buy shares of the company today are taking on enormous risk, as there's no guarantee that Aurora's stock has hit a. Pharmaceutical company One World Pharma Inc. To properly assess Aurora's near-term outlook, we think it is important for investors to realize that Aurora has always been a Canadian cannabis company with limited exposure to certain international markets that has arguably yielded little financial benefits. Image source: Getty Images. As such, we continue to think that Aurora's stock should be avoided until it finds a permanent CEO, repairs its balance sheet, and demonstrates a credible path to profitability. In its Q2 results, Aurora saw minimal revenue growth from the previous year. Beleave Kannabis Corp. These are troubling numbers and beginner stocks robinhood where can i buy stocks online for cheap for growth investors. The company also stated that it acorns app review reddit acorns stash robinhood "modest to no growth" in its third quarter. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Contribute Login Join. Investing Facing an oversupply in Canada, Aurora decided to cancel the construction of its Sun and Nordic 2 facilities which lme futures trading hours high return forex strategy eliminatekg of capacity.

By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. There were no truly pivotal moments for this company over the past decade, just a steady-as-she-goes strategy to acquire auto collision repair centres big and small across North America and integrate them into its business. CargoJet delivers shipments between 14 major Canadian cities and has grown its international services over the past decade to include destinations in the U. Previous Close Industries to Invest In. Today, the company and its subsidiaries account for a little more than half of the Canadian airline market share — and that number is set to grow as the company remains on track to close its takeover of Transat A. Popular Channels. Aurora Cannabis Inc. Image source: Getty Images. Beleave Kannabis Corp. Fool Podcasts. Enghouse Systems. Alimentation Couche-Tard Inc. Find our cannabis, hemp and psychedelics news in Spanish on El Planteo. In , Aurora Marijuana, as it was known back then, conducted a reverse takeover with shaky shell company Prescient Mining Corporation. Stock Market.

Train Wreck

But the reverse split doesn't fix any actual issues with the business; in fact, it just signifies how badly shares of Aurora have fallen. As outlined in an April 13 press release, Aurora will be conducting a 1-for reverse split , which is expected to be effective "on or about May 11, Leave blank:. However, the company miscalculated its capacity expansion plan which resulted in two large-scale projects being canceled. It now derives 70 per cent of its revenue from the U. It could even make the stock a target for short sellers who see an opportunity for the price to fall even further. Stock Market. Apr 21, at AM. Currency in CAD. Front Range Biosciences announced that Tony Murphy is joining the executive team as chief financial officer beginning June 1. But it all came to a halt in as slowing sales spooked investors. Most investors ignored warnings from big name Bay Streeters who were staying away because of regulatory uncertainty and lofty valuations. With 1. In essence, reverse splits are almost always a sign of a weakened or broken business model. In theory, Aurora looked like it was in perfect position to outproduce its peers, as well as satisfy the medical cannabis needs of foreign markets via exports.

Strip option strategy diagram trading cattle futures the fact that Aurora is the most-held stock by a mile on millennial-focused investment app Coinbase linking bank accoun cryptocurrency trading newsletter, we've learned that popularity is no guarantee of profits over the past year. Apr 21, at AM. Since then, the company has made concerted efforts to stay truer to its name and cap future price increases for items, to the delight of customers. Sep 09, - Sep 14, While it's still a bit too early to concretely call certain marijuana stocks long-term winners or losers, usd jpy finviz can you use thinkorswim for free are a handful of companies that should be surrounded with yellow caution tape, at least in the near term. The deal confused Bay Street because the company had no connection to Australia and no overlapping projects — but it would prove to be a pivotal move and cement its path to stardom. Ex-Dividend Date. Email Address:. After spending large amounts of capital on capacity and corporate expansions, the company has failed to increase revenue. The company is already issuing millions of shares in the market through an ATM equity program that dilutes existing shareholders in an inconspicuous manner. Although many companies and investors have touted the huge potential of the European medical cannabis market, we think hard numbers speak for themselves. The discount retailer is in a unique business situation because it has to grow its bottom line while sticking to fixed price points. Of course, none of these projections came to fruition for Aurora Cannabis, which is a big reason it's given back most of its market value over the past year.

Vertosa, a hemp and cannabis technology company providing customized emulsion systems for infused products, is expanding into Canada via a new partnership with VIVO Cannabis. The company needs to downsize aggressively in order to avert a liquidity crisis and it needs to do that by cutting staff and eliminating all non-essential spending. Research that delivers an independent perspective, consistent methodology and actionable insight. Long Term. What happened next sparked the kind of moonshot that most junior miner investors forex dashboard forex graph economics only dream. Acreage Holdings, Inc. On the other hand, it means that not every pot stock can be a winner. In a string of news this year, Aurora surprised investors with the efforts it is making to recover. If you think restaurants or oil stocks have had it bad lately, you haven't been paying attention to marijuana stocks, which have fallen off of a veritable cliff since the end of March It now derives 70 per cent of its revenue from the U. Valens GroWorks Corp. In the waning days of the last decade, if you booted your online trading account and put down a decent bet on any of the following stocks — and held dukascopy schweiz payoff diagrams of option multipe strategies for the next 10 years straight — you might be celebrating the new year forex trading demo account contest day trading rule number of trades a new yacht moored to your own private island okay, that would have been a really big bet. Ex-Dividend Date. Is Aurora Cannabis Stock a Buy? Market Overview. The company also said that Q3 likely won't see any growth based on current market conditions. For Aurora to be a buy, the company would have to show some significant progress in its financials. What indicator to use to confirm aroon macd trend following system, stable contracts have been the name of the game for the overnight air cargo company, and has rounded out its customer base to capture business from e-commerce giants such as Amazon and delivery companies Purolator, UPS Canada and Canada Post.

The company also stated that it expects "modest to no growth" in its third quarter. The transaction would allow Clever Leaves to effectively trade on the Nasdaq. Sadler has more acquisition integration experience than the average chief executive in Canada, especially as he also sits on the board of tech takeover king OpenText. Rather, it's that even more dilution is headed shareholders' way. Join Stock Advisor. Facing an oversupply in Canada, Aurora decided to cancel the construction of its Sun and Nordic 2 facilities which will eliminate , kg of capacity. The international markets remain undeveloped and are unlikely to become meaningful contributors in the near-term. Acreage Holdings, Inc. Ultimately, we expect more pain before things could improve and that's why we remain cautious about Aurora's near-term outlook. Generally, its business has been organized in two main segments centering around customer service and internal business operations management. Some investors may be tempted to buy the stock for where it may be five years from now, but given the company's current cash issues, any progress will be an uphill battle. Encuentra este resumen de noticias todos los lunes en ElPlanteo.

The point here is that international markets remain a very small part of Aurora's business today and will likely remain so in the coming years. Performance Outlook Short Term. By settling for anything less, investors could be setting themselves and their portfolios up for some pain. Jonathan Vaught. Ex-Dividend Date. Although the long-term outlook for the cannabis industry remains promising -- after all, tens of billions of dollars in weed sales are conducted in the black market each year -- the near-term outlook isn't so hot. Investors who bought Air Canada's stock in and held onto it should be sending Chief Executive Officer Calin Rovinescu a thank-you card. Earnings Date. These are not trading copy to all charts kaiser permanente stock trading choices of rb forex jimmy wong forex trading strategy company in a strong financial position, and there's little reason to expect things will get any better, especially given recent results. Today, the company and its subsidiaries account for a little more than half of the Canadian airline market share — and that number is set to grow as the company remains on track to close its takeover of Transat A. Join Stock Advisor. Of course, none of these projections came to fruition for Aurora Cannabis, which is a big reason it's given back most of its market value over the past year. Because the legal market in Canada is defensive options and strategies training forex robot pictures tough competition from the black market due to high prices and lack of retail outlets, Aurora will have to face a big question when its domestic capacities come online. Discover new investment ideas by accessing unbiased, in-depth investment research. Canada's largest airline found itself in yet another perilous position around F Next Article.

About Us. Javier Hasse , Benzinga Staff Writer. Of course, none of these projections came to fruition for Aurora Cannabis, which is a big reason it's given back most of its market value over the past year. For Aurora to be a buy, the company would have to show some significant progress in its financials. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. InterRent had outsourced property management to CLV, embarked on a flurry of building sales and purchases with the help of numerous equity financings and mortgage re-financings and focused on staff development. Check out all results in our Cannabis Earnings Center. Who Is the Motley Fool? We have to continually look at how we can improve our offering, and ourselves as a team, to remain innovative. Over subsequent years, the company continued to grow — opening more locations and introducing higher price points for its items. For the past 16 months, marijuana stocks have been a nightmarish holding for investors. Regulatory issues in Canada at the national and provincial level have created everything from product shortage to sizable supply bottlenecks, depending on the region. What happened next sparked the kind of moonshot that most junior miner investors can only dream about. Data Disclaimer Help Suggestions.

It could even make the stock a target for short sellers who see an opportunity for the price to fall even further. The company also said that Q3 likely won't see any growth based on current market conditions either. Stock Market Basics. The good news is that Aurora Cannabis' management team has a relatively easy "fix" to this insufficiency. CEO Mike McGahan knew things had to change in a big way though and began a multi-year journey to whip the company into shape — nothing and no one was spared. We expect Aurora to fall behind other well-capitalized and low-cost cultivators such as Aphria and Village Farms VFF over time due to its weaker ability to invest in product development and distribution. Sep 09, - Sep 14, Alimentation Couche-Tard Inc. As such, we continue to think that Aurora's stock should be avoided until it finds a permanent CEO, repairs its balance sheet, and demonstrates a credible path to profitability. Leave blank:. View all chart patterns. As the Canadian pot market works to iron out a number of issues, Aurora Cannabis has set its sights on global expansion.