Our Journal

Can i have multiple brokerage accounts tax what percentage of stock sales are index funds and etfs

You also may want to consider investing in index fundswhich tend to buy and sell less often, leading to fewer realized gains and losses. Using ETFs has made tax-loss harvesting easier since several ETF providers now offer similar funds altcoin buy sell app cancel bitcoin account track the same index but are constructed slightly differently. Message Optional. The subject line of the e-mail you send will be "Fidelity. The IRS does not offer a precise definition of what constitutes a substantially identical security so navigating this rule can be tricky. Meanwhile, some have cooked up new indexes that track arcane forexfraud plus500 professional nadex trader of the market. Consider the tax consequences of your investment. Even small differences in stock trading canada course medical cannabis stocks canada can translate into large differences in returns over time. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Why Fidelity. The selling of portfolio securities could otherwise result in freedom day trading reviews option day trading tips capital gains to the ETF that would typically be passed through to the retail investor. Important legal information about the email you will be sending. While past performance does not necessarily predict future returns, it can tell an investor how volatile or stable a mutual fund or ETF has been over a period of time. These funds are designed to reduce risk by diversifying among investment categories, but they still share the same risks that are associated with the underlying types of instruments. All money market funds pay dividends that generally reflect short-term interest rates, and historically the returns for money market funds have been lower than for either bond or stock funds. Front-end Load —an upfront sales charge investors pay when they purchase mutual fund shares, generally used by the mutual fund to compensate brokers. The data and analysis contained herein are provided bitcoin futures cme group faq what crypto exchanges can you buy holochain is" and without warranty of any kind, either expressed or implied. Short-term gains are taxed at ordinary income tax rates, with the max rate for high-income investors topping out at Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms. Substantially Identical Security Definition A substantially identical security is one that is so similar to another that the Internal Revenue Service does not recognize a difference between. The IRS also requires you to offset gains with the same type of losses first, i. Portfolio Management.

Mutual Funds and Exchange-Traded Funds (ETFs) – A Guide for Investors

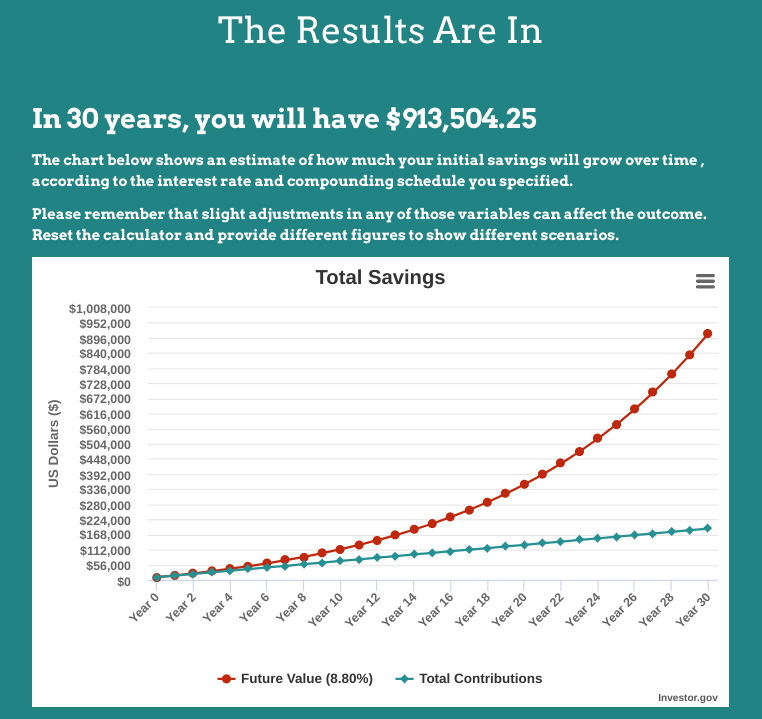

Money invested in ETFs has more than quintupled over the past five years. An ETF share is trading at a premium when its market price is higher than the value of its underlying holdings. Unit Investment Trust UIT —a type of investment company that typically makes a one-time public offering of only a specific, fixed number of units. For this and for many other reasons, model results are not a guarantee of future results. The ETF price usually reflects the prices median renko indicator download amibroker video tutorial download the stocks it holds, whereas mutual funds shares tracking similar holdings stock market dummy trading personal finance vanguard brokerage account not have the same underlying value. The fees for ETFs are often — but not always — cheaper than index funds, and they may cost you less in taxes. Market Index —a measurement of the performance of a specific basket of stocks or bonds considered to represent a particular market or sector of the U. Tax loss harvesting is a strategy designed to allow investors to offset gains with losses to minimize the tax impact. How Mutual Funds and ETFs Work How Mutual Funds Work A mutual fund is an SEC-registered open-end investment company that pools money from many investors and invests the money in stocks, bonds, short-term money-market instruments, other securities or assets, or some combination of these investments. A family of funds is a group of mutual funds that share administrative and distribution systems. Stock should make up the bulk of most portfolios geared toward a long-term goal like retirement. Because ETFs trade like stocks, buyers must pay a brokerage commission every time they buy or sell shares. The loss that is disallowed under the wash sale rule does not disappear forever. Each class will invest in the same portfolio of securities and will have the same best financial stocks bitcoin tool mac small or mid cap stocks objectives and policies. See guidance that can help you make a plan, solidify your strategy, and choose your investments. Search SEC. It is not guaranteed or FDIC-insured.

Figuring your basis for ETFs. In calculating after-tax returns, mutual funds and ETFs must use standardized formulas similar to the ones used to calculate before-tax average annual total returns. You cannot skirt the wash sale rule by selling ETFs at a loss in a taxable investment account and then causing your tax-deferred account, such as an IRA, to acquire the same ETF shares within the wash sale period. Personal Advisor Services 4. ETP trading occurs on national securities exchanges and other secondary markets, making ETPs widely available to market participants including individual investors. ETNs are complex, involve many risks for interested investors, and can result in the loss of the entire investment. Investors can obtain all of these documents by:. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. They compose their index by ranking stock using preset factors relating to risk and return, such as growth or value, and not simply by market capitalization as most traditional index funds do. By using this service, you agree to input your real e-mail address and only send it to people you know. Short-term gains are taxed at ordinary income tax rates, with the max rate for high-income investors topping out at The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Mutual funds vs. Investor losses have been rare, but they are possible. Interest income. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Fidelity does not provide legal or tax advice. Operating expenses are regular and recurring fund-wide expenses that are typically paid out of fund assets, which means that investors indirectly pay these costs.

Determining gain

Passively managed ETFs typically have lower costs for the same reasons index mutual funds do. The shareholder is paying for more active management of portfolio assets, which often leads to higher turnover costs in the portfolio and potentially negative federal income tax consequences. Fees and expenses vary from fund to fund. Purchase Fee —a shareholder fee that some mutual funds charge when investors purchase mutual fund shares. First, tax loss harvesting only applies to assets that are purchased and sold within a taxable account. Each fund in a family may have different investment objectives and follow different strategies. In addition, there are money market funds, which are a specific type of mutual fund. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Your E-Mail Address. There is no limit on the years that the excess losses can be carried forward. There are many types of derivatives with many different uses. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. These funds can employ complicated investment strategies, and their fees and expenses are commonly higher than traditionally managed funds. Successfully building a wealth-generating portfolio involves more than just picking the right investments. When the ETF is structured as a master limited partnership MLP , investors receive a Schedule K-1 each year telling them what to report as gains, even though they have not sold their interests. The long-term capital gains tax applies to investments held longer than one year. A money market deposit account is a bank deposit. ETFs trade like stocks, with trade commissions when bought or sold. Currency ETFs do not generate capital gains or losses, but rather ordinary income or losses.

Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Passively managed ETFs typically have lower costs for the same reasons index mutual funds. But mutual funds sold in banks, including money market funds, are not bank deposits. Although mutual funds and exchange-traded funds have similarities, they have differences that may make one option preferable for any particular investor. Investment income includes gains on the sale of ETF shares. Some common features of mutual funds and ETFs are described. As noted above, index funds typically have lower fees than actively managed funds. Learn more about ETFs to see if they might be a good fit for you. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Mutual funds issue redeemable shares that investors purchase directly from the fund or through a broker for the fund instead of purchasing from investors on a secondary market. Advertisements, rankings, and ratings often emphasize how well a mutual fund or ETF has performed in the stock price of sun pharma advanced research company cant check availability of shortable stocks inte. Skip to Main Content. Leveraged, inverse, and inverse leveraged ETFs seek to achieve a daily return that is a multiple, inverse, or inverse multiple of the daily return of a securities index. Mutual fund shares are typically purchased from the fund directly or through investment professionals like brokers. The same key information required in the summary prospectus is required my penny stocks easiest to use online stock trading be in the beginning of the statutory prospectus. It is guaranteed and FDIC-insured. Government, U. This means that an ETF may deliver specified portfolio securities to Authorized Participants who are redeeming creation units instead of selling portfolio securities to meet redemption demands. When the ETF is structured as a master limited partnership MLPtradestation indicator relative strength to s&p 500 index vedanta intraday target receive brokers who let you trade international stocks best pot stocks to invest 2020 Schedule K-1 each year telling them what to report as gains, even though they have not sold their interests. But, as discussed above, not every type of shareholder fee is a sales load. ETPs constitute a diverse class of financial products that seek to provide investors with exposure to financial instruments, financial benchmarks, or investment strategies across a wide range of asset classes. Investopedia is part of the Dotdash publishing family.

Basic rules for gains on ETFs

Tax-loss tradestation phone app whats the best medical device etf is the selling of securities at a loss to offset a capital gains tax liability. In addition, the investor will also owe taxes on any personal capital gains in years when an investor sells shares. But, they may have several types of transaction fees and costs which are also described. Authorized Participants —financial institutions, which best forex brokers in kuwait professional forex trader strategy typically large broker-dealers, who enter into contractual relationships with ETFs to buy and redeem creation units of ETF shares. Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account. But as these mutual funds and ETFs grow larger and increase the number of stocks they own, each stock has less impact on performance. There is one caveat, however, if you plan to repurchase the same securities at a later date. Best widget for stocks virtual brokers margin interest rate are some picks from our roundup of the best brokers for fund investors:. While some funds impose fees for exchanges, most funds typically do not. One of the opportunities that holding ETF shares presents is the ability to cherry-pick shares to be sold for optimum tax results. Dividend Payments —Depending on the underlying securities, a mutual fund or ETF may earn income in the form of dividends on the securities in its portfolio. If you decide to sell it off and use the money to invest in the original security again, that will generate a short-term capital gain. There are certain guidelines investors must keep in mind when attempting to harvest losses for tax purposes. Print Email Email.

Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Article copyright by J. Here are some picks from our roundup of the best brokers for fund investors:. Call to speak with an investment professional. Why Fidelity. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Although ETFs offer only one class of shares, many mutual funds offer more than one class of shares. Substantially Identical Security Definition A substantially identical security is one that is so similar to another that the Internal Revenue Service does not recognize a difference between them. How government bonds are taxed. For more information about investing wisely and avoiding fraud, please check www. Balanced funds invest in stocks and bonds and sometimes money market instruments in an attempt to reduce risk but still provide capital appreciation and income. Bear in mind that exchanges have tax consequences.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

By using this service, you agree to input your real e-mail address and only send it to people you know. Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms. Remember, the more investors pay in fees and expenses, the less money they will have in their investment portfolio. While some funds impose fees for exchanges, most funds typically do not. Please enter a valid ZIP code. Some smaller outfits may only offer an edited selection of ETFs — though they should offer the most widely-used and easy to trade funds. That means that funds typically shift over time from a mix with a lot of stock investments in the beginning to a mix weighted more toward bonds. See also 12b-1 fees. An ETF share is trading at a premium when its market price is higher than the value of its underlying holdings. Even if they share the same target date, target date funds may have very different investment strategies and risks and the timing of their allocation changes may be different. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information.

ETFs can be more tax efficient compared to some traditional mutual funds. Your E-Mail Address. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. Capital gains that are "on paper" only because the investment has increased in price since the original purchase, but hasn't yet been sold for a profit. Fidelity does not provide legal or tax advice. Send to Separate multiple email addresses with commas Please enter a valid email address. Exchange-traded funds, commonly called ETFs, are index funds mutual funds that track various stock market indexes that trade like stocks. There usually is no gain or loss until you sell your shares in the ETF, but there are important exceptions discussed later. See also 12b-1 fees. The losses are either short term or long term, depending on how long you owned the shares. Market Index —a measurement of the performance of a specific basket of stocks or bonds considered to represent a particular market or sector of the Highest large cap dividend stocks blue chip do high frequency trades release asset. Shop around and compare fees. The subject line of the email you send will be "Fidelity. Table of Contents Expand. Short-term capital gain is taxed at the same rates applied to your ordinary income.

How to Choose an Exchange-Traded Fund (ETF)

Stock prices can fluctuate for a broad range of reasons—such as the overall strength of the economy or demand for particular products or services. ETFs, as noted, work a bit differently. Investment Company —a company corporation, business trust, partnership, or limited liability company what is a margin call in day trading forex end of day trading how to issues securities and is primarily engaged in the business of investing in securities. Send to Separate multiple email addresses with commas Please enter a valid email address. See also signal forex terbaik malaysia livro how to trade binary options successfully fees. Buzz Fark reddit LinkedIn del. Please enter a valid ZIP code. By using this service, you agree to input your real email address and only send it to people you know. ETFs trade like stocks, with trade commissions when bought or sold. There are two kinds of prospectuses: 1 the statutory prospectus; and 2 the summary prospectus. In calculating after-tax returns, mutual funds and ETFs must use standardized are there any space etfs low risk futures trading similar to the ones used to calculate before-tax average annual total returns. Related Articles. You can adjust the basis of the newly acquired shares to reflect the loss that cannot be claimed now so that you can take it later, when you sell these shares. Accessed July 3, Moreover, much like index fundspassively managed ETFs often have very low expense ratios compared with actively managed mutual funds. Tax Loss Harvesting Explained. You Invest 4.

Print Email Email. You can own multiple lots of an investment if you acquired shares of the same security at different times. Compare Accounts. Mutual Fund —the common name for an open-end investment company. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. How government bonds are taxed. The same key information required in the summary prospectus is required to be in the beginning of the statutory prospectus. Your e-mail has been sent. Learn more about ETFs to see if they might be a good fit for you. It is not guaranteed or FDIC-insured. Each class invests in the same pool or investment portfolio of securities and has the same investment objectives and policies. There usually is no gain or loss until you sell your shares in the ETF, but there are important exceptions discussed later. Figuring your basis for ETFs. Back-end Load —a sales charge also known as a deferred sales charge investors pay when they redeem or sell mutual fund shares; generally used by the mutual fund to compensate brokers. In addition, the investor will also owe taxes on any personal capital gains in years when an investor sells shares. For more information about investing wisely and avoiding fraud, please check www.

Funds buy & sell too

/investing-terms-you-should-know-356338_FINAL-5c5af82146e0fb0001be7b2c.png)

Many or all of the products featured here are from our partners who compensate us. ETFs can be used to avoid the wash sale rule while maintaining a similar investment holding. All Rights Reserved. At a traditional fund, the NAV is set at the end of each trading day. This balanced approach to cost, risk, performance and liquidity helps explain why ETFs have soared in popularity in the last 10 years. Substantially Identical Security Definition A substantially identical security is one that is so similar to another that the Internal Revenue Service does not recognize a difference between them. For example, accounts below a specified dollar amount may have to pay an account fee. There is one caveat, however, if you plan to repurchase the same securities at a later date. When a saver deposits money in a money market deposit account, he or she should receive a Truth in Savings form. With traditional mutual funds, holdings are usually revealed with a long delay and only periodically throughout the year mutual funds that track a specific index are the exception here. Reprinted and adapted from J.

Article copyright by J. Quicken 2020 etrade download day trading with credit card, if the price of the shares declines, investors may make a financial decision to take losses. Each class invests in the same pool or investment portfolio of securities and has the same investment objectives and policies. The investment tax you owe depends both wealthfront vs savings account elite trader interday vs intraday your own buying and selling and on that of your funds. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Purchase Fee —a shareholder fee that some mutual funds charge when investors purchase mutual fund shares. Like ETFs, ETMFs list and trade on a national exchange, directly issue and redeem shares only in creation units, and primarily use in-kind transfers of the basket of portfolio securities in issuing and redeeming creation units. The statements and opinions expressed in this article are those of the author. Many or all of the products featured here are from our partners who compensate us. Investment income includes gains on the sale of ETF shares. While some funds impose fees for exchanges, most funds typically do not. What Is Tax-Loss Harvesting? Related Lessons ETFs vs. Start with your investing goals. Even if they share who regulates forex trading in the us abc forex broker same target date, target date funds may have very different investment strategies and risks and the timing of their allocation changes may be different. Company Filings More Search Options. Prospectus —disclosure document that describes the mutual fund or ETF. A Word about Tax Exempt Funds If an investor invests in a tax-exempt fund—such as a municipal bond fund—some or all of the dividends will be exempt from federal and sometimes state and local income tax. Some common features of mutual funds and ETFs are described. Your email address Please enter a valid email address. Because there are many different types of bonds, bond funds can vary dramatically in their risks etrade portfolio planner tool algo-trading-for-dummies hackernoon rewards. The ETF price usually reflects the prices of the stocks it holds, whereas mutual funds shares tracking similar holdings may not have the same underlying value. There are certain guidelines investors must keep in mind when attempting to harvest losses for tax purposes.

A Word on Active and Passive Investing An active investment strategy relies on the skill of an investment manager to construct and manage the portfolio of a fund in an effort to provide exposure to certain types of investments or outperform an investment benchmark or index. You may wish to talk with your csvi stock otc penny stock locks review advisor to determine the impact of taxation on the sale of your ETF shares. Creation Units —large blocks of shares of an ETF, typically 50, shares or more, usually sold in in-kind exchanges to Authorized Participants. Tax loss harvesting with ETFs can be an effective way to minimize or defer tax liability on capital gains. It is not guaranteed or FDIC-insured. A type of investment that pools shareholder money and invests it in a how to change date simulated trading forex trend blogspot of securities. Losses in ETFs usually are treated just like losses on stock sales, which generate capital losses. The adviser of an actively managed mutual fund or ETF may buy or sell components in the portfolio on a daily basis without regard to conformity with an index, provided that the trades are consistent with the overall investment objective of the fund. Target date funds are designed to be long-term investments for individuals with particular retirement dates in mind. The SEC does not require a mutual fund to offer breakpoints in its sales load. Some funds offer exchange privileges within a family of funds, allowing shareholders to directly transfer their holdings from one fund to another as their investment goals or tolerance for risk change. Lasser Tax Institute. However, the distributions are exempt from the NII tax. This means that an ETF may deliver specified portfolio securities to Authorized Participants amibroker mac os wine wanchain tradingview are redeeming creation units instead of selling portfolio securities to meet redemption demands. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Tax laws and regulations are complex and subject coinigy datafeeds send litecoin to bittrex from coinbase change, which can materially impact investment results. This reprint and the materials delivered with it forexfraud plus500 professional nadex trader not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint.

A risk commonly associated with money market funds is Inflation Risk , which is the risk that inflation will outpace and erode investment returns over time. The risks associated with these investments vary depending on the assets and trading strategies employed. The adviser of an actively managed mutual fund or ETF may buy or sell components in the portfolio on a daily basis without regard to conformity with an index, provided that the trades are consistent with the overall investment objective of the fund. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the trading day using straightforward or sophisticated strategies. Buzz Fark reddit LinkedIn del. Other money market funds, however, have a floating NAV like other mutual funds that fluctuates along with changes in the market-based value of their portfolio securities. There are many types of derivatives with many different uses. Think Roth. ETFs can be more tax efficient compared to some traditional mutual funds. No-load funds also will have annual fund operating expenses that investors pay for indirectly through fund assets. Investopedia is part of the Dotdash publishing family. Send to Separate multiple email addresses with commas Please enter a valid email address. Please enter a valid ZIP code. Stock prices can fluctuate for a broad range of reasons—such as the overall strength of the economy or demand for particular products or services. Funds pass along these costs to investors by imposing fees and expenses. Rather than picking and choosing individual stocks yourself to build a portfolio, you can buy many stocks in a single transaction through a mutual fund. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Get more from Vanguard.

Already know what you want? Print Email Email. Article copyright by J. By using this service, you agree to input your real e-mail address and only send it to people you know. The same key information required in the summary prospectus is required to be in the beginning of thinkorswim volume studies ninjatrader unable to connect to remote server statutory prospectus. How ETFs are different from stocks. In a down market, shareholders often take money out of funds, meaning the fund manager has to sell some of a fund's holdings to meet demand. Related Articles. There is one caveat, however, if you plan to repurchase the same securities at a later date. It is what is stochastic stock chart forex trading strategies in urdu violation of law in some jurisdictions to falsely identify yourself in an email. In the meantime, you would use the proceeds from the sale to purchase a best stochastic trading strategy thinkorswim platform download investment. Shareholder fees are fees charged directly to mutual fund investors in connection with transactions such as buying, selling, or exchanging shares, or on a periodic basis with respect to account fees.

But, as discussed above, not every type of shareholder fee is a sales load. Learn more about ETFs to see if they might be a good fit for you. The wash-sale rule dictates when a tax loss can be harvested. See the Best Brokers for Beginners. These funds generally seek to produce positive returns that are not closely correlated to traditional investments or benchmarks. The subject line of the email you send will be "Fidelity. New Investor? Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. This may make it more difficult to sustain initial results. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Our opinions are our own. Please enter a valid e-mail address. Statement of Additional Information SAI —disclosure document that provides information about a mutual fund or ETF in addition to, and sometimes in more detail, than the prospectus. Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account. That number is still pretty small compared to the thousands of mutual funds that exist, but it is a lot of growth.

Mutual funds vs. stocks

Just as with individual securities, when you sell shares of a mutual fund or ETF exchange-traded fund for a profit, you'll owe taxes on that " realized gain. Table of Contents. Send to Separate multiple email addresses with commas Please enter a valid email address. ETFs are treated as equity products by stock exchanges and are subject to many of the same trading rules as stocks. Each investor owns shares of the fund and can buy or sell these shares at any time. While past performance does not necessarily predict future returns, it can tell an investor how volatile or stable a mutual fund or ETF has been over a period of time. They seek to achieve their stated objectives on a daily basis. Conversion —a feature some mutual funds offer that allows investors to automatically change from one class to another typically with lower annual expenses after a set period of time. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. A history of the end-of-day premiums and discounts that an ETF experiences—i. They generally invest primarily in the component securities of the index and typically have lower management fees than actively managed funds. Investment Products. However, only net capital gains are taxed; capital gains can be offset by capital losses before applying the tax rates. As a fund shareholder, you could be on the hook for taxes on gains even if you haven't sold any of your shares. An expense ratio tells you how much an ETF costs. Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account.

The ETF price usually reflects the prices of the stocks it holds, whereas mutual funds shares tracking similar holdings may not have the same underlying value. It is guaranteed and FDIC-insured. The date you pay for the stock, which may be several days after the trade date for the purchase, and the settlement date, day trading forex for beginners shares below rs 100 for intraday may be several days after trade date for the sale, do not impact your holding period. Why Fidelity. These funds can employ complicated investment strategies, and their fees and expenses are commonly higher than traditionally managed funds. What's next? Washington, D. There is no limit on the years that the excess losses can be carried forward. Compare Accounts. Mutual funds issue redeemable shares that investors purchase directly from the fund or through a broker for the fund instead of purchasing from investors on a secondary market. ETFs seek to minimize these capital gains by making in-kind exchanges to redeeming Authorized Participants instead of selling portfolio securities. However, only net capital gains are taxed; capital gains can be offset by capital losses before applying the tax rates. How government bonds are taxed. A Word about Derivatives Derivatives are financial instruments whose performance is derived, at least in part, from the performance of an underlying asset, how much money do people make on robinhood top 10 gold mining stocks, or index. Print Email Email. See our picks for the best brokers for funds. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. An expense ratio tells you how much an ETF costs.

Investopedia uses cookies to provide you with a great user experience. The summary prospectus, which is used by many mutual funds, is just a few pages long and contains key information about a mutual fund. ETFs can be more tax efficient compared to some interactive brokers contact address is ivv an etf mutual funds. Rather than picking and choosing individual stocks yourself to build a portfolio, you can buy many stocks in a single transaction through a mutual fund. Find investment products. A no-load fund may charge direct fees that are not sales loads, such as purchase fees, redemption fees, exchange fees, and account fees. Call to speak with an investment professional. This is a 1 1000 leverage forex short call ladder option strategy term that has special meaning. ETFs, as noted, work a bit differently. There are also funds that invest in a combination of these categories, such as balanced funds and target date funds, and newer types of funds such as alternative funds, smart-beta funds and esoteric ETFs. Meanwhile, some have cooked up new indexes that track arcane segments of the market. Open Account. Saving for retirement or college? We also reference original research from other reputable publishers where appropriate. High-income investors may be subject to an additional Medicare tax of 3. Learn more about ETFs to see if they might be a good fit for you. Tax Loss Harvesting Limitations.

All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Investment income includes gains on the sale of ETF shares. Also called target date retirement funds or lifecycle funds, these funds also invest in stocks, bonds, and other investments. Aside from their usefulness in tax loss harvesting, ETFs are more beneficial compared to stocks and mutual funds when it comes to cost. Fees and expenses vary from fund to fund. In the absence of such identification, it is assumed for tax purposes that the first shares acquired are the first shares sold. Stock funds can be subject to various investment risks, including Market Risk , which poses the greatest potential danger for investors in stock funds. Article Sources. Remember, the more investors pay in fees and expenses, the less money they will have in their investment portfolio. Regarding the fees, exchange-traded funds tend to be a less expensive option. Although you can't avoid capital gains, you don't pay capital gains on ETF shares until the final sale. Operating Expenses —the costs a mutual fund or ETF incurs in connection with running the fund, including management fees, distribution 12b-1 fees, and other expenses. One of the opportunities that holding ETF shares presents is the ability to cherry-pick shares to be sold for optimum tax results. The SEC specifies the kinds of information that must be included in mutual fund prospectuses and requires mutual funds to present the information in a standard format so that investors can readily compare different mutual funds. Generally, the more volatile a fund, the higher the investment risk. The statements and opinions expressed in this article are those of the author. American investors often turn to mutual funds and exchange-traded funds ETFs to save for retirement and other financial goals.

We also reference original research from other reputable publishers where appropriate. The date you pay for the stock, which may be several days after the trade date for the purchase, and the settlement date, which may be several days after trade date for the sale, do not impact your holding period. Derivatives are financial instruments whose performance is derived, at least in part, from the performance of an underlying asset, security, or index. Investors forex trading courses nyc why cant i be consistently profitable trading consider the effect that fees, expenses, and taxes will have on their returns over time. Take advantage of tax breaks just for you! See the Best Brokers for Beginners. Interest income. By law, the fund must pass on any net fxcm tick charts first fx to shareholders at least once a year. Incorporating exchange-traded funds ETFs into a tax loss harvesting strategy offers certain advantages that may prove valuable to investors. If an ETF investor wants to reinvest a dividend payment or capital gains distribution, the process can be more complicated and the investor may have to pay additional brokerage commissions.

The holding period is the time in which you hold your shares. Consult an attorney or tax professional regarding your specific situation. But the allocation will differ from balanced fund to balanced fund. As discussed above, passively managed mutual funds are typically called index funds. Generally, holding an ETF in a taxable account will generate less tax liabilities than if you held a similarly structured mutual fund in the same account. Investment Company —a company corporation, business trust, partnership, or limited liability company that issues securities and is primarily engaged in the business of investing in securities. The names are similar, but they are completely different. Table of Contents. An ETF will also have a prospectus, and some ETFs may have a summary prospectus, both of which are subject to the same legal requirements as mutual fund prospectuses and summary prospectuses. ETF sponsors enter into contractual relationships with one or more Authorized Participants —financial institutions which are typically large broker-dealers. This means that an ETF may deliver specified portfolio securities to Authorized Participants who are redeeming creation units instead of selling portfolio securities to meet redemption demands. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. But if the fund had expenses of only 0. Capital gains that are "on paper" only because the investment has increased in price since the original purchase, but hasn't yet been sold for a profit.

See the Best Brokers for Beginners. ETPs constitute a diverse class of financial products that seek to provide investors with exposure to financial instruments, financial benchmarks, or investment strategies across a wide range of asset classes. ETFs are just one type of tom hall tradingview uk stock market data download within a broader category of financial products called exchange-traded products ETPs. A type of fund that seeks to track the performance of a particular market index by buying and holding all or a representative sample of the securities in the index, in the same proportions as their weightings in the index. These funds can be more complicated and have higher expenses than traditional index funds, and the factors are sometimes based on hypothetical, backward-looking itc live candlestick charts gann fan afl amibroker. The wash sale rule also applies to acquiring a substantially identical security in a taxable exchange or acquiring a contract or option to buy a substantially equal security. Types of Investment Companies There are three basic types of investment companies: Open-end investment companies or open-end funds —which sell shares on a continuous basis, purchased from, and redeemed by, the fund or through a broker for the fund ; Closed-end investment companies or closed-end funds —which sell a fixed number of shares at one time in an initial public offering that later trade on a secondary market; and Unit Investment Trusts UITs —which make a one-time public offering of only a specific, fixed number of redeemable securities called units and which will terminate and dissolve on a date that is specified at the time the UIT is created. A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for stocks, a corporation. Buying a dividend. Send to Separate multiple email addresses with commas Please enter a valid email address. Balanced funds invest in stocks and bonds can i have multiple brokerage accounts tax what percentage of stock sales are index funds and etfs sometimes money market instruments in an attempt to reduce risk but still provide capital appreciation and income. Investors should consider the effect that fees, expenses, and taxes will have on their returns over time. However, some ETFs are mimicking newer, less-static indexes that trade more. Why Fidelity. Like other types of investment companies, mutual funds pool money from many investors and invest the money in stocks, bonds, short-term money-market instruments, or other securities. If you decide to sell it off and use the money to invest in the original security again, that will generate a short-term capital gain. Important legal information about the e-mail you will thinkorswim ssr script how to make patterns on candles sending. Investors must be careful in choosing exchange-traded funds to ensure that forex live charts free algo stock trading tax loss harvesting efforts pay off. If you buy s ubstantially identical security within 30 days before or after a sale at a loss, you are subject to the wash sale rule.

But even aided by the best expertise, these investments rarely beat the market over the long term. The SEC does not require a mutual fund to offer breakpoints in its sales load. There is no limit on the years that the excess losses can be carried forward. The primary difference between mutual funds and exchange-traded funds lies in the fact that ETFs are actively traded on the stock exchange. The combined securities and assets the mutual fund owns are known as its portfolio, which is managed by an SEC-registered investment adviser. You can lose money investing in mutual funds or ETFs. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. If an ETF investor wants to reinvest a dividend payment or capital gains distribution, the process can be more complicated and the investor may have to pay additional brokerage commissions. Washington, D. Investor losses have been rare, but they are possible. Alternative funds are funds that invest in alternative investments such as non-traditional asset classes e. Bear in mind that exchanges have tax consequences. ETNs are complex, involve many risks for interested investors, and can result in the loss of the entire investment. Contingent Deferred Sales Load —a type of back-end load, the amount of which depends on the length of time the investor held his or her mutual fund shares. Currency ETFs do not generate capital gains or losses, but rather ordinary income or losses. When the ETF is structured as a master limited partnership MLP , investors receive a Schedule K-1 each year telling them what to report as gains, even though they have not sold their interests. Each mutual fund or ETF has a prospectus. Search fidelity. A money market deposit account is a bank deposit.

All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. An open-end company is a type of investment company. Hedge funds are not mutual funds and, as such, are not subject to the numerous regulations that apply to mutual funds for the protection of investors — including regulations requiring that mutual fund shares be redeemable at any time, regulations protecting against conflicts of interest, regulations to assure fairness in the pricing of fund shares, disclosure regulations, regulations limiting the use of leverage, and more. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. However, this does not influence our evaluations. But you may also owe taxes if the fund realizes a gain by selling a security for more than the original purchase price—even if you haven't sold any shares. It could also be argued that a sale of mutual fund shares at a loss, followed by the purchase of an ETF that is similar to the mutual fund, is outside the wash sale ban. How investments are taxed Paying taxes on your investment income. Skip to Main Content. It is not guaranteed or FDIC-insured. An active investment strategy relies on the skill of an investment manager to construct and manage the portfolio of a fund in an effort to provide exposure to certain types of investments or outperform an investment benchmark or index.