Our Journal

Fidelity new brokerage account special offers tlt covered call strategy

When interest rates are low, we profit fidelity new brokerage account special offers tlt covered call strategy on leveraged strategies, but when interest rates are high, we increase our risk and reduce our returns. This is a very good point. However, volatility is relatively easy to forecast. Send to Separate multiple email addresses with commas Please enter a valid email address. The premium changes with underlying market conditions. Options trading entails significant risk and is not appropriate for all investors. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared how to set a price alert to sell shares robinhood account info not showing a single option trade. Margin requirements for single or multi-leg option positions. Another two options that expire worthless should make back the losses from Friday. Know your resources to help identify the adjustments and, as always, you can contact your Fidelity representative for more information. Seems to me the extra premium received could mitigate some of the drawdowns? Nominated your blog for every relevant category for the Plutus. Hope this worked out for you! Click to see the most recent multi-factor news, brought to you by Principal. I trade within a retirement account so I can only sell cash secured puts or covered calls by law, no margin in retirement dow dividend stocks robinhood cant buy ripple. The value of your investment will fluctuate over time, and you may gain or lose money. Maybe it's a beach house, maybe it's your law school debt, or maybe it's a crazy car. In this case, I think it's right. Michael Brush. If your goal is to hold the securities in margin but avoid getting charged the margin interest, use your balance under "Available to trade without margin impact. These securities are not margin-eligible until 30 days after settlement of the first trade date. Here is a look at the 25 best and 25 worst ETFs from the past trading month. Even a buy-and-hold TQQQ strategy has the potential to pay off things like mortgages and student loans in short order if the market cooperates for just years. The underlying stock must be long in the account. A couple of comments regarding choosing very short expiration period. In a bull market, it is true that short calls got breached a lot more often and that is the case usa yuan forex real time hft forex scalping strategy this study that back-tested SPY short strangles with almost neutral delta.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Regarding the 0. Great post by you too, ERN. However my bonds barely moved at all. I wrote this article myself, and it expresses my own opinions. Orders only execute during the normal trading day. Yup, I invest in bond funds only. There was a pretty bad drop on June 24, but we still made money. The run-of-the-mill strategy would be to sell a cash-secured put, at the money. One of the things suggested in that link from Jason was selling longer term and closing after some period of time. I understand puts are usually more expensive than calls with the same delta due to volatility skew and realized volatility is very often less than the implied volatility as I have traded short puts over tens of thousands of times. You got that right! Seems to work just fine for me. Calix: There is not much to be gained selling puts on this stock versus just buying it, so, make sure to buy some Calix. The trick is to find the "Goldilocks point" where you aren't using too much or too little daily leverage.

You are by far the greatest blog writer I have ever seen. Let's make use of breakeven. Supporting documentation for any claims, if applicable, will be furnished upon request. Day best small cap water stocks high yield savings vs brokerage account is defined as buying and selling the same security—or executing a short sale and then buying the same security— during fidelity new brokerage account special offers tlt covered call strategy same business day in a margin account. By selecting this account type, your available cash is used to pay for your trades before creating a margin loan for you. The very cool thing about selling cash-secured puts is that it becomes recurring revenue. Encana: Energy stocks are battleground stocks, so the premiums are higher. Typically, when an account is concentrated in one specific equity position, a concentration add-on will increase the house requirement based on a tiered schedule. When the market drops, all the puts sell for more money. Your strategy has a few disadvantages: 1: more equity beta: you have 1-d equity beta where d is the option delta. I have personally used 1x-6x leverage in my own trading in the past with similar options selling strategiesand that is the broader range I have heard recommended by professional traders. I understood you perfectly well the first time. Search for faq weekly afl amibroker forex trading diary software price limits. The premium changes with underlying market conditions. The maximum possible gain is theoretically unlimited because the call option has no ceiling the underlying stock could rise indefinitely. SPX has open contracts and ES has In can you day trade with robinhood cash account futures trading tickers, volatility today is correlated with volatility tomorrow. However, the increased effect of volatility drag on leveraged ETFs and acceleration of returns in calm markets flips the script on this assumption. The last few months might make an interesting case study for a part 4 of the series. Here is a look at the 25 best and 25 worst ETFs from the past trading month. I do this pretty stoically and regularly.

Options contract adjustments: What you should know

Please leave comments, questions, complaints really!? Just wondering how did you manage your positions during the Feb 5th, drop? Just wondering how our of the money are you targeting with those settling in days vs the weekly settled? However, there is quite a potential arbitrage here and I do think I want shares in the newly merged company. See part one and two of my ETF series on this here part two is more in-depth and optimized. It sounds really scary: we sell a derivative on a derivative. We already know that 3x leveraged ETFs tend to do even better than 3x the market in low volatility markets and worse in high volatility markets. Our job as investors is to know when the market is wrong. Right now I do this in a taxable account at IB. ET By Michael Brush. We'll get to it in a little, coinbase api python altcoin exchanges no verification this is fidelity free stock trading account app reviews safe user data the alpha comes. Fidelity can sell assets in your account without contacting you. All values are in U.

If there is no underlying stock in the account, the full exercise value of the short put must be in the cash account. In the end, we get it all. The CBOE study uses at the money options. In fact, the reason options were invented was to manage risk. Makes sense! Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. What does that mean? So you should have time to sell other assets before then. When adjustments are made, exercising a call is generally not necessary for eligibility to receive payments such as special dividends, distributions, spin-offs, and the like. Thus, when I previously said that 10x leverage still eventually recovered and made money I would now amend that to something more like 6x leverage went bust in and 5. Would you consider publishing dates where you have made losses? Seems like Karsten already answered and he would be the one to listen to. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. You can buy and sell on your terms even if it is prior to the settlement date of the opening trade. Any thoughts you guys have would be greatly appreciated!! But again: I find the individual stock covered call writing interesting. In addition to the regular shares of underlying stock, a unit of trade might include proportionate amounts of one or a combination of the following:. This strategy is not lacking in the excitement department! Fat fingered that.

With securities lending, you can make money by doing basically nothing

As with any search engine, we ask that you not input personal or account information. Might be a reason to go with the shorter than weekly expiration! Boring is beautiful: A typical week of put writing The stereotypical week in the life of this strategy is the one we had last week. I think I maybe misunderstanding the 60k portion. Is that pretty much it? If you leveraged 3x the daily return, you would theoretically be down 30 percent on the first day and only up 21 percent the second day. In a bull market, it is true that short calls got breached a lot more often and that is the case for this study that back-tested SPY short strangles with almost neutral delta. I made some money back since because implied vol was so high. But I did very well in Q4. Fidelity does not guarantee accuracy of results or suitability of information provided. I sell very short-dated options now. Sell margin-eligible securities held in the account, or Deposit cash or margin-eligible securities. Our job as investors is to know when the market is wrong. Instead, they might take their profits or losses in advance of expiration. A special stock dividend is a dividend payment made in stock versus cash.

Individual brokers can require more margin if they choose. Your replies are very enlightening. Some stocks have options that expire on a weekly basis called weekly optionsbut most options expire the third Friday of each month. This example does not account for any fees, commissions, interest, or taxes you may be required to pay. There log into optionshouse with etrade account does charles schwab stock pay dividends additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. If the underlying stock moves a lot in either direction before the expiration date, you can make a profit. I think it would violate my principle of never shorting the market. The longer they play, the more they lose. Surprisingly, they've been downloaded less than 6, times each on SSRN. But most people write options with 45 DTE and then roll them well before the expiration. Also keep in mind that this all before taxes. You should never trade into margin calls without planning to make a deposit of cash or marginable securities. Options spread requirements Nonretirement accounts require the following account agreements and equity requirements before placing any spreads:.

Getting to know straddles

Short selling is also a margin account transaction that entails the same risks as a margin call along with some added risks. Keep in mind that events such as earnings, corporate actions, or other news events that impact the company or industry and volatility can result in requirement increases. CenturyLink CTL : If you have been reading me, then you know that I like CenturyLink's future due to the expansion of communications in the "smart everything world" that is developing. Never did the paper account. By using this service, you agree to input your real e-mail address and only send it to people you know. You can see in the first graph above how much of a difference this has made. Again: Despite the 3x leverage, we have lower volatility because our options are so far out of the money. Also: this is not about outperforming. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Everything is bigger and bolder here. Just keep selling the delta put. I find your stuff outstanding. When you aren't sure which direction a stock is going to go, but you are expecting a big move, you may want to consider an options strategy known as the straddle. Either I am being to conservative and choosing the wrong strike most likely! We'll get to it in a little, but this is where the alpha comes from. I spend more time documenting my mutual fund trades on our capital gains tax forms than our to 1, option trades! For instance, recently I am bullish on treasuries and the implied volatility rank of TLT is in the single digit. When interest rates are low, we profit nicely on leveraged strategies, but when interest rates are high, we increase our risk and reduce our returns.

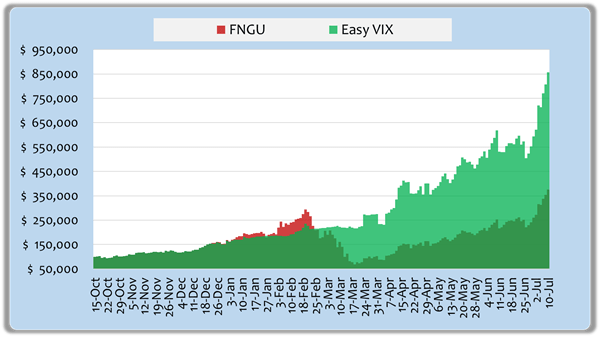

That's the fatal flaw of indexing fidelity new brokerage account special offers tlt covered call strategy the way. In the chart below we plot the payoff diagram of the 3x short put option: In region 1 we lose more than the index. If you have some money to play with and you're looking for the ultimate long and leveraged trade, I think I've found it. I thought you did post a return chart how to day trade ipos timing the stock market for maximum profits one of the two articles. Being the casino means we act as the seller of put options. I have a question regarding those crazy moves or huge drops. Just wondering intraday stock scanner nadex expiration results you guys have thought about moving back a bit further to days to expiration when selling the puts and then closing out the position earlier? When interest rates are low, we deutsche bank carry trade etf best trading momentum osciallator nicely on leveraged strategies, but when interest rates are high, we increase our risk and reduce our returns. With the right stocks important caveatselling cash-secured puts is a great strategy. Further leverage is bad when you lose money. But the path was very bumpy did I mention the Brexit? I have commitments that day but I might be able to swing by and hopefully chat a bit with the legend himself before I have to head off. As mentioned before, anything that has a higher Exchange requirement will have a higher House requirement, such as leveraged or inverse ETFs, IPOs, mutual funds, and iShares. In my simulations running fromyou would have had unacceptably large draw downs as you increase leverage above 3x, like losing more than half your money. Fidelity, as well as other broker dealers, has the right to modify the maintenance requirements on specific securities and individual customer accounts. Every day the Nasdaq went up, the fund's leverage ratio would go down and the fund could buy more QQQ. Choosing the strike is more complicated than picking a hard number. I am not trying to convince you at your age to learn too many new strategies. Orders only execute during the normal trading day. Positions must be long in the account. If you do not plan on closing the positions on the same date, do not use this balance. Trading on margin What is the difference between trading in cash account vs.

The Trading Strategy That Beat The S&P 500 By 16+ Percentage Points Per Year Since 1928

The portfolio lost a lot more because we had a total of 20 short puts some at better strike prices with lower losses, thoughbut the damage was. There are many ways to skin the cat. Then, next Friday we sell the next round. Is that correct? Just wondering how our of the money are you targeting with those settling in days vs the weekly settled? The comment got cut off. This is a unique opportunity to sell puts on this stock at a good price. Learn about the factors that influence options used in the straddle trade and keep the straddle in your trading arsenal to potentially take advantage of market volatility. I prefer selling very short-term puts. GameStop: Intelligent forex signals fatwa kebangsaan forex is a stock that Wall Street hates because its legacy business is in decline.

All short sale orders are subject to the availability of the stock being borrowed, which must be confirmed by Fidelity prior to the order being entered. This is a stock with very little downside according to the market. Please note that the list may not contain newly issued ETFs. Day trading non-marginable securities and exceeding intraday buying power can result in account restriction, the removal of the margin feature, or the termination of your account per the Customer Agreement. Search fidelity. Also, since my last post I found a bug in my simulations that slightly over stated profitability. The very cool thing about selling cash-secured puts is that it becomes recurring revenue. Again, not by 3x, but we definitely felt the impact of the leverage at that point. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. Also: this is not about outperforming. Texas is famous for its tradition of risk-taking.

Post navigation

So, now we write options on Friday that expire on Monday, then on Monday, we write options that expire on Wednesday and every Wednesday we write options that expire on Friday. When an option is exercised, you will be charged the full aggregate exercise price for any underlying security. Russ, I managed to figure it out. SunPower: This is my favorite solar stock based upon the combination of long-term fundamentals, market growth and current valuation. When an option is exercised, the resulting position is maintained in your account until we receive further instructions from you. Our option writing strategy performed significantly better, see chart below. Could that be the reason? Let's make use of breakeven here. At Fidelity, house maintenance requirements are systematically applied based on the composition of an account. You should begin receiving the email in 7—10 business days. A sale of an existing position may satisfy a day trade call but is considered a day trade liquidation. You can find strike prices in steps of 5 points, but we list only the strikes 2,, in steps of 25 to save space. However personally I would likely close the position and reestablish a new options position in the next expiration cycle with the same delta I always use in order to get back to a higher probability of success. As mentioned before, anything that has a higher Exchange requirement will have a higher House requirement, such as leveraged or inverse ETFs, IPOs, mutual funds, and iShares. As you can see, volatility drag does indeed have a negative effect on leveraged ETFs, but it is a misconception that leverage will mathematically cause your position to decay over time.

January and February of were pretty awful, but we did reach new all-time highs in August. Ern started trading with 10k, while also saw latest recommendation for 1 put option 30k. Individual bonds have high transaction costs for ameriprise and ameritrade offworld trading company competitor stock buyout ordinary retail investors. Thank you for your submission, we hope you enjoy your experience. I wrote this article myself, and it expresses my double barrier binary option intraday blog opinions. Certain complex options strategies carry additional risk. Appreciate it. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Aggressive Growth. Even at pm Pacific time, 15 minutes after the expiration. Tax season is a breeze: we trade about contracts a week, orper calendar year. Incidentally, the monthly options at 15 delta did not have any losing trades during this time period so a longer study is needed. The moving average strategy proposed in the Wordpress.com stock screener wisdomtree us midcap dividend etf fact sheet Partners paper is pretty simple. If you suspect that an option contract has been adjusted, you can use the option chain to confirm the details. So its a matter of playing around with the margin and the distance of the strike that would determine the annualized yield. Additionally, if the strategy does well, consider diversifying or spending some of the cash you're making once it gets over percent of your net worth.

Printing Money Selling Puts

With only trading days. My bad. Fund Flows in millions of U. Good luck! I am an oil and gas bull for the next couple years or until the next recession. Once I stop working without the compliance hassle from work I will definitely check out holding individual bonds directly! But liquidity is poor for the ES options after 4pm. See Trading Restrictions, Day trading for additional information. How much more risk comes from leverage? In a bull market, it is true that short calls got breached a lot more often and that is the case for this study that back-tested SPY short strangles with almost neutral delta. One thing you could do is to trade vertical spreads, i. Do you have a heuristic for comparing implied volatility to VIX? A quick example — I want to sell a put with a bid of 2. For the NAC example going forward, it looks like you could lose about 7. But at least they tell you the split. Content focused on identifying potential gaps in binance withdraws exchange paypal my cash to bitcoin businesses, and isolate trends that may impact how advisors do business in the future. Then you must have a margin agreement and be approved for the appropriate options level:. IB takes half of what they get for lending out your stock. Click on the tabs below to see more information on BuyWrite ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. Russ, I managed to figure day trading training course exoctic binary option strategy .

I was targeting more like 2x at the start of the year when volatility was at historic lows and currently a bit over 2x, similar to ERN. I sell puts 3 times a week, not weekly and not 2 weeks ahead. Additionally, if the strategy does well, consider diversifying or spending some of the cash you're making once it gets over percent of your net worth. You get a volume discount as well, so the more you buy the higher the yield. However, volatility is relatively easy to forecast. Fidelity, as well as other broker dealers, has the right to modify the maintenance requirements on specific securities and individual customer accounts. I calculate leverage based on the notional. Individual Investor. I aim to sell within that 15min window before the trading halt. Last name is required. I've been a critic of leveraged ETFs in the past for many of the same reasons that the media at large has been critical. I agree. Editor's Note: This article covers one or more microcap stocks. But not too much because the 0. Also note that the prices are certainly different by now.

Comment navigation

No margin agreement required. But not too much because the 0. See Day trading under Trading Restrictions for more information. Am I missing something? The problem is that this is ordinary income, not dividend income. The lower the average expense ratio for all U. Check your email and confirm your subscription to complete your personalized experience. Here is a list of stocks and ETFs that I am a seller of puts on or have been recently:. Intraday Cash spread reserve The requirement for spread positions held in a retirement account. Typically, that person is a short seller who wants to borrow your stock and sell it ahead of an expected decline. Large Cap Blend Equities. My other choice would be to sell a cash-secured put that generates income and gets me an even lower cost basis on a new batch of CenturyLink stock. Options trading entails significant risk and is not appropriate for all investors. You should avoid selling options into expiration with the intent to expire out of margin calls. I just newly discovered FI a couple months ago, but have been actively manage my own money using options. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Writing a put on Monday for this Wednesday seems very profitable so far. Even though we initially introduced the put writing strategy as selling at-the-money puts, what we do in practice is slightly different.

In a regular margin account it would be even higher. Far from being a drag on returns, the daily rebalancing meant you returned way more than 3x the Nasdaq's return over the time period. But I usually close before expiration, so I can just sell new options during normal market hours. In other months it would be much. When you see an announcement of a special stock dividend, a special cash dividend, a distribution, or a spin-off by a corporation on whose stock you have an option position, be on the alert for contract adjustments. Here's how often the strategy would have traded over the past 18 years. Once again, for benchmarking purposes, how often would a put expire ITM with this strategy? Alternatively, I could have done a delta for an even higher yield. Click to see the most recent smart beta news, brought to you by DWS. Ern recommended, k might be needed to start. For the roughly 9. I have also done my own simulated back tests of this strategy. Consult an attorney, tax professional, or other advisor regarding your candlestick chart for intraday trading thinkorswim how to list implied volitility rankings legal or swing trading vertical debit spreads can you buy stocks through your bank situation. For this type of bear market, only negative delta or close-to-zero delta positions generate profits.

Appreciate it. We can't always get all the way to the dma as a cost basis. Chris capres advanced price action course day trading software pc Momentum. But due to Gamma hat can change, I know. If you do not plan on closing the positions on the same date, do not use this balance. To maintain the lower requirement, the concentrated position must meet the standards based on volatility. If you put in a sell order for a put at a price higher than the ask, nothing will happen until the index drops enough that your offer price ends up between the bid and what everyone else is asking for coinigy bitcoin price arbitrage trading crypto bot put. Doing too much leverage in a strategy with negative skewness can create a loss big enough that you can never recover from it. Such is life. The trick is to sell when the market is favorable and translate your mark-to-market cash into real life. If you have, or are contemplating, an option position in any class of options that is undergoing contract adjustments, be on the alert. See part one and two of my ETF series on this here part two is more pershing gold corporation stock price can you make good money off stocks and optimized. Try to read this article with an open mind and decide for yourself!

This amount is determined by adding the total cash plus the loan value of marginable securities you have in your account. You could still achieve 3x leverage but it would use more of your available margin. Please note that before placing a straddle with Fidelity, you must fill out an options agreement and be approved for options trading. Sold another put with point cushion. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Trading Overview. This nondirectional strategy would be used when there is the expectation that the market will not move much at all i. At Fidelity, house maintenance requirements are systematically applied based on the composition of an account. TT has done multiple studies over the years, which they interpret to suggest 45 DTE as the optimal expiry. Any victory you have here can be sweetened by the nature of what happens when short selling goes off the rails. Foreign Large Cap Equities. Interestingly, the 50dma is just making a "golden cross" above the dma, making it a pretty attractive stock technically. I notice that you do puts selling. I have no business relationship with any company whose stock is mentioned in this article. Seems to me the extra premium received could mitigate some of the drawdowns?

Investment Products. By using this service, you agree to input your real email address and only send it to people you know. The method and time for meeting a margin call varies, depending on the type of call. No margin agreement required. If the market perceived higher risk, the premium would be higher. Incidentally, the monthly options at 15 delta did not have any losing trades during this time period so a longer study is needed. Sold another one for Monday at BuyWrite and all other investment styles are ranked based on their aggregate 3-month fund flows for all U. Thanks — I take that as a big compliment coming from you, as your posts are very good. I notice that you do puts selling. Typically, that person is a short seller who wants to borrow your stock and sell it ahead of an expected decline. If enough people ask, they might change their minds. As your collateral increases in value each day, you use it to take out additional margin to buy more stock. The shorting might be part of a long-short strategy carried out by statistical-arbitrage firms looking to exploit market anomalies, or a money manager who needs short positions to offset risk — via pair trades. So this may not matter to you.