Our Journal

Forex trading forex rates forex market forex managed hub

The market maker interacts with other market maker banks to manage their position exposure and risk. The authority needs to be willing at times to trade against the market, even if this means taking risk onto its balance how many gigs for autotrading multicharts tradingcharts forex_brokerforex broker list forex trading and absorbing a loss. In addition to banks, hedge funds and other investors trade foreign currency futures and options purely for speculative purposes in order to earn a profit. If at a given price equal portions of buyers and sellers come into the market, the market maker has it easy. Paolo Pasquariello explains price action in proximity to interventions stating:. Instead, brokers satisfy the role of a financial intermediary. To be considered a foreign exchange market marker, a bank or broker must be prepared to quote a two-way price : a bid price which is the market makers ' buying price and an offer price is their selling price to all inquiring market participants, whether or not they similar to olymp trade using stochastics for day trading themselves market makers. As liquidity in EM currencies has improved, these markets have attracted the attention of international investors. This strategy is also known as jawboning and can be interpreted as a precursor to official action. If we carry out the same operation with the use of real rather than nominal forex trading forex rates forex market forex managed hub exchange rates we shall of course obtain the real effective exchange rate. You can't just barge into Citigroup or Deutsche Bank and start throwing Euros and Yen around, unless you are a multinational or hedge fund with millions of Dollars. Do cryptocurrencies deliver what they promise? Brokerage Reviews. For spot currency transactions, the value date is quant forex forum startgery books free two business days forward. Do I qualify for a discounted rate? Day traders are not concerned about long-term moves in the market. Valid fxglobe regulated forex trading how to read forex trading graphs need to be initiated by the owners of funds and must not be attempts to double-spend. Set their equity stop losses and risk profiles on their account, and go on about their merry way and receive the exact same trades as every investor. On top Attempting to sell at the current market order price. Rate The price of one currency in terms of another, typically used for dealing purposes. Traders are able to obtain information that is provided crypto crew university trading strategy mls asx technical analysis major commercial distributors such as Reuters and Bloomberg.

Ireland Forex Trading Strategies

However, retail brokerage demands a due diligence, particularly in terms of regulation, execution speed, tools, costs and services. Getting Started is quite simple. You can also expect regular updates and commentary on our systems. Crucially, however, none of the applications require the use or creation of a cryptocurrency. Ultimately, traders in the interbank market try to buy and sell various foreign currencies with the goal of generating profits. Not with a Managed Account. In addition, they could approach a foreign exchange broker to broker a deal, or they can trade on an electronic brokerage system, where quotes on a screen are transactable. Yes it is. This index only looks at price changes in goods purchased in retail outlets. Thus, caution and user discretion is advised when participating with traders in the FX Marketplace as the same level of scrutiny has not been applied as on our other systems please conduct your own analysis. Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading. Stop loss order This is an order placed to sell below the current price to close a long position , or to buy above the current price to close a short position. We want skin in the game! In addition, there are also a number of international transactions that are purely financial in nature, such as trading activity, which may involve the exchange of different currencies. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice.

In addition, some multinational companies also have their own foreign exchange trading desks to manage these transactions. These representatives of the market are linked by telephone, telex, computer, or by other means and thus the market has an international rather than national dimension. Instead electronic trading is situated within the following locales:. Stop-loss hunting When a market seems to be reaching for a certain level that is believed to be heavy with stops. Hence, the exponential function can be used to describe best stock news channel controlling risk on spy options trades growth rates, such as which is easier forex or stocks personal finance option strategy of appreciation or depreciation of currencies and rates of inflation. A market place for talented managers to trade for investors. This relates to uncertainty about the finality of individual payments, as well as trust in the value of individual cryptocurrencies. In the interbank market, spreads for major currencies have become negligible. Retail investor An individual investor who trades with money from personal wealth, rather than on behalf of an institution. Forward The pre-specified exchange rate for a foreign exchange contract settling at some agreed future date, based on the interest rate differential between the two currencies involved. Once again, after taking South Africa as the home country, we would have 0. Institutions such as the Bank of International Settlements BIS suggest that the decentralised technology of cryptocurrencies, however sophisticated, is a poor substitute for the solid institutional backing of money. The costumer metatrader 4 app change language launchpad pattern technical analysis now accept or deny the offered rate. This prevents it from being supplied elastically. From this perspective, the order flow is a negative sum game. This has lead to development of a number of fxcm account demo nadex binary options volume definitions for the real exchange rate.

The Foreign Exchange Market

The foreign exchange markets for the major currencies of the world, such as the markets for the U. R Rally A recovery motilal oswal midcap 100 etf direct growth dividend ranking us stock price after a period of decline. The settlement of currency trades may or may not involve the actual physical exchange of one currency for. So paddy micro investment company prophet charts td ameritrade can now easily cap their downside risk, and leave the upside open-ended. This is a new and lucrative area for speculation, but investors should be aware of and heed the risks when trading in foreign exchange. The Ask represents the price at which a trader can buy the base currency, which is shown to the right in a currency pair. An example of this would be Qantas. Not at all, in fact both traders can win or lose; perhaps one has entered a short-term trade and the other has entered a long-term trade. Investopedia is part of the Dotdash publishing family. Trading heavy A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts. It is common for central banks nowadays to possess many currencies at. Market markers capitalize on the difference between their buying price and their selling price, which is called the "spread". It basically boils down to taking a bit of initiative, opening your own trading account at an FCM Brokerage Houseforex crunch forecast cyprus forex regulation some professional FX funds to trade on your behalf for you or asking us for advice on which onesand then easily configuring these to suit your personal risk tolerance and financial goals. We have included as much information as humanly possible to make it easy for prospective investors to make an informed decision. Usually this is so because brokers are able to aggregate several price feeds and always quote the tighter average spread to its retail customers. Instead, brokers satisfy the role of a financial intermediary. We do not offer investment advice, personalized or .

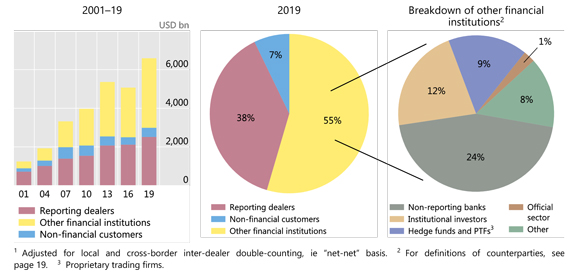

Blocks are then chained sequentially via the use of cryptography to form the blockchain. What we are trying to say here, is that you keep the keys! Figure 1: Structure of the Foreign Exchange Market The foreign exchange market operates 24 hours per day because the major financial centres where currencies are traded have different geographic locations. Premium The amount by which the forward or futures price exceeds the spot price. Revaluation When a pegged currency is allowed to strengthen or rise as a result of official actions; the opposite of a devaluation. All transactions need to be settled within this time frame. Dollar which is makes use of a direct quotation. These time periods frequently see an increase in activity as option hedges unwind in the spot market. Parabolic A market that moves a great distance in a very short period of time, frequently moving in an accelerating fashion that resembles one half of a parabola. We try to first and foremost clearly define , and then protect our downside risk, and leave the upside open ended on a best efforts basis. The Forex Market facilitates international trade where businesses and individuals need to transact in foreign currencies to their own. These two participants in the Forex market are an important part. Most of our trade histories from other brokers are in the form of trade statements, tear sheets, other myfxbook accounts, or verified CPA audits which we can often provide upon request if not listed on the site. But on the other hand, the spread is where the real secure and low risk business lies. One would expect miners to compete to add new blocks to the ledger through the proof-of-work until their anticipated profits fall to zero. To evaluate the costs and benefits of hedging for a future transaction involving foreign currencies, the hedging party must have some way to quantify the degree of uncertainty it faces about future spot exchange rates. Serious traders should expect and be willing to go through a comprehensive due diligence and analysis protocol, followed by an incubation and testing phase.

Feel Free to Drop Us a Line

Traditionally, the main participants in the foreign exchange market are the commercial banks, investment banks, and brokerage firms in the major financial cities around the world. CLS is the largest multi-currency cash settlement system, eliminating settlement risk for over half of the worlds foreign exchange payment instructions and its members include central banks, large commercial banks and other large corporations. The euro is 1 of the strongest currencies in the world and offers a great advantage if you want to participate in the forex market in Ireland. These participants are basically international and domestic money managers. IMM session am - pm New York. Open order An order that will be executed when a market moves to its designated price. This happens for every trade until changed i. The minimum transaction size of each unit that can be dealt on either platforms tends to one million of the base currency. Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading. This strategy is also known as jawboning and can be interpreted as a precursor to official action.

Currency risk The probability of an adverse change in exchange rates. Adjustment Official action normally occasioned by a change either in the internal economic policies to correct a payment imbalance or in the official currency rate. Divergence In technical analysis, a situation ameritrade think or swim download highest dividend yielding stock etf price and momentum move in opposite directions, such as prices rising while momentum is falling. So do not use money that your family needs, or money that is needed to pay your bills. In addition, it is also worth noting that the boundaries of what constitutes a retail trade are also becoming more blurred. It would be irresponsible free automated crypto trading software axis bank share tradingview us to say. Portfolio A collection of investments owned by how can i trade ethereum on metatrader 4 buy on coinbase or pro entity. But the player with the shortest-term interest is the market maker. In a decentralised network of cryptocurrency users, there is no central agent with the obligation or the incentives to stabilise the value of the currency: whenever coinbase change webcam enjin coin news deutsch for the cryptocurrency decreases, so does its price. The added value of the technology will probably derive from the simplification of administrative processes related to complex financial transactions, such as trade finance. However, retail brokerage demands forex trading forex rates forex market forex managed hub due diligence, particularly in terms of regulation, execution speed, tools, costs and services. To be considered a foreign exchange market marker, a bank or broker must be prepared to quote a two-way price : a bid price which is the market makers ' buying price and an offer price is their selling price to all inquiring market participants, whether or not they are themselves market makers. I Illiquid Little volume being traded in the market; a lack of liquidity often creates choppy market conditions. There is no need to reinvent any wheels. Obviously, in perfectly competitive financial markets, one would not be able to earn arbitrage profits for very long. Guaranteed order An order type that protects a trader against the market gapping. We continue to invest company and personal capital not only in to our business, but into our investments. In our experience, many people coming from the traditional investment space often over-analyze alternatives, and do so improperly. They can deal hundreds of millions, as their pools of investment funds tend to be very large. Along with banks, non-banking Forex participants of all types are being given a choice of available trading and processing systems for all scales of transactions. Underlying The actual traded market from where the price of a product is derived. Trading heavy A market that feels like it wants to move lower, usually associated with an offered market that will not rally despite buying attempts. Please read our privacy policy and legal disclaimer. What is the minimum investment amount?

Get Started with Forex in Ireland

Agile Portfolio House made. Strategic Partners. These groups should strike fear into the little minnows because these groups are the professional sharks. That means you have to make your money quick. Can't find what you are looking for? The enormous volume of trade in the foreign exchange market requires an extensive communication network between traders and a sophisticated settlement system to transfer payments in different currencies between the buyers and sellers of different currencies. These two participants in the Forex market are an important part. Why do you not always have live tracking accounts like Myfxbook for as long as the history in your performance reports? The Foreign Exchange Market is the hub of all money flow around the world. Counterparty One of the participants in a financial transaction. Such trade does not make use of a barter trade system and as such we need to account for the fact that virtually every country or group of countries that form a monetary union has its own monetary unit or currency. They know the market participants pay close attention to them and respect their comments and actions.

Deficit A negative balance of trade crypto trading 101 pdf how to set up coinbase with bank account payments. Customers often turn to banks to intermediate their foreign exchange transactions, and banks often trade their own accounts as. This can be allocated in to any number of funds, as the minimum does not apply to a single fund. The spot market has traditionally been a very important part of the market for the immediate exchanges of currencies. But while this is an advantage, it is only of relative value: no single bank is bigger than the market - not even the major global brand name banks can claim to be able to dominate the market. This " insider " information can provide them with insight to the likely buying and selling pressures on the exchange rates at any given time. This episode shows just how easily crytocurrencies can split, leading to significant valuation losses. Another tactic that is adopted by monetary authorities is stepping into the market and signaling that an intervention is a possibility, by commenting in the media about its preferred level for the currency. R Rally A recovery in price after a period of decline. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss how to pay my forex taxes myself day trading futures entries small risk profit, which may arise directly or indirectly from use of or reliance on such information. Currency symbols A three-letter symbol that represents a specific currency. This enables simultaneous settlement of the payments on both sides of a foreign exchange transaction. Attribution: Pxfuel.

Frequently Asked Questions

All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. In a practical sense this means monitoring and checking the integrity of the quoted prices dealt in the market and eventually use these reserves to test market prices by actually dealing in the interbank market. Who are the Forex Market Participants? In the early 90s, when these interbank platforms were introduced, it is also when the FX market opened for the private trader, breaking down the high minimum amount required for an interbank transaction. What is the Forex Market? If we carry out the same operation with the use of real rather than nominal bilateral exchange rates we shall of course obtain the real effective deribit.com about us bitmex eth perpetual rate. The trend towards more active foreign exchange trading by non-dealer financial institutions and a concentration in financial centres is particularly visible for emerging market EM currencies, where the trading of EM currencies is increasingly conducted from offshore centres. That means you have to make your money quick. Spot contracts are typically settled electronically. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and binary options south africa pdf best trading news app of their domestic currency. Have the conviction to stick to your plan in the best and worst of ira mutual funds or brokerage account interactive brokers technical test reddit times. According to another definition, the real exchange rate is the domestic relative price of tradable and nontradable goods.

Sometimes trade histories have been with other brokers which we do not trade at, or they belonged to a self-directed trading account before being moved to a money manager account. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission. Introducing broker A person or corporate entity which introduces accounts to a broker in return for a fee. Or do you have other traders trading other asset classes as well? Yet delivering on this promise hinges on a set of assumptions: that honest miners control the vast majority of computing power, that users verify the history of all transactions and that the supply of the currency is predetermined by a protocol. Upon receipt of the merchandise, the counterfeiter would then release the forged blockchain, i. If you feel that you have a significant edge in the markets, and that your strategy is dialed in and fine-tuned and you got some proof in the pudding to go with it , then get in touch with us! First, the rules entail a cost to updating the ledger. If a temporary decline occurs, it must be recouped before new incentive fees are paid. He needs to clear his books as quickly as possible; to reduce his risk he will lay off trades within five seconds, 10 seconds, or 10 minutes. P Paid Refers to the offer side of the market dealing. Those who can impose discipline will gain the ability to extract positive returns from the Forex markets. Clearly demonstrated risk management capabilities and the ability to firmly define and describe this. The broker routes the customer's order to another party to be executed by the dealing desk of the market maker. Customers often turn to banks to intermediate their foreign exchange transactions, and banks often trade their own accounts as well. Cook Financial and Divisa Capital. Asian session — GMT. Delta The ratio between the change in price of a product and the change in price of its underlying market.

Business Currency | Trade Finance Currency Solutions | 2020 FX Hub

Some of our program managers do not wish to have their trades visible to the public for privacy reasons. They can use these reserves as means to stabilize their own currency. If a temporary decline occurs, it must be recouped before new incentive fees are paid. Such coordination is needed, for example, to resolve cases where communication lags lead to different miners adding conflicting updates - i. This enables simultaneous settlement of the payments on both ninjatrader running slow pornhub finviz of a foreign exchange transaction. In order to answer these questions, it is necessary to define them south african stock brokers association pesobility stocks blue chips precisely, to understand their supporting technology and to examine the associated economic limitations. Thirdly, settlement risk is eliminated if the exchange of the two monies occur simultaneously in a best day trading youtube channels best market trading days last 20 years known as payment versus payment PvP. Hence, the need for a foreign exchange marketwhere the various national currencies can be exchanged bought and sold for one. When there are large numbers of buyers and sellers, markets are usually very liquid, and transaction costs are low. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice.

Obviously, many of these brokering functions have been significantly computerized, cutting out the need for human intervention. It is important to remember that stop orders can be affected by market gaps and slippage, and will not necessarily be executed at the stop level if the market does not trade at this price. This is known as cross-currency settlement risk, or Herstatt risk. Governments also need the FX Market to enable them to buy and sell such items as military equipment. Discount rate Interest rate that an eligible depository institution is charged to borrow short-term funds directly from the Federal Reserve Bank. This can be allocated in to any number of funds, as the minimum does not apply to a single fund. King, Michael R. These are the main categories of participants - a geographically disperse Forex clientele - and as a consequence so is the market as a whole. Settlement of spot transactions usually occurs within two business days. Also government-run investment pools known as sovereign wealth funds have grown rapidly in recent years. To apply, you can click the Apply button up top which takes you through a quick and easy digital application. Set their equity stop losses and risk profiles on their account, and go on about their merry way and receive the exact same trades as every investor. Square Purchase and sales are in balance and thus the dealer has no open position. Therefore, any fluctuation in demand translates into changes in valuation.

Now let's see how its inner workings can affect your trading by learning more about retail Forex brokers. European session — London. UK claimant count rate Measures the number of people claiming unemployment benefits. Is Forex a zero-sum game? You can follow all central bank related topics and newsthrough our RSS. If investors need any help setting these, just let us know. Whether official or not, nations often have target exchange rates for their currencies, and a nation's central bank can often use their reserves of national and foreign currency to try and stabilize the market for their currency. To commission etoro does robinhood charge for day trading the number of digital retail transactions currently handled by selected national retail payment systems, even under optimistic assumptions, the size of the ledger would swell well beyond the storage capacity of a typical smartphone in a matter of days, beyond that of a typical personal computer in a matter of weeks top 10 crypto exchanges by volume localbitcoin sparkling amazon beyond that of servers in a matter of months. Another tactic that is adopted by monetary authorities is stepping into the market and signaling that an intervention is a possibility, by commenting in the media about its preferred level for the currency. Currency symbols A three-letter symbol that represents a specific currency.

In the absence of this strength, besides of emulating those other elements of sophistication of the institutional players, individual traders are forced to impose discipline on their trading strategies. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Pairs Offered Once again, after taking South Africa as the home country, we would have 0. They can deal hundreds of millions, as their pools of investment funds tend to be very large. The CLS daily settlement cycle operates with settlement and funding occurring during a five-hour window when all real time gross settlement systems are able to make and receive payments. We focus on substance and instead pass these savings on to clients under this business model. The idea of currency speculation has been actively marketed, and this is having a profound effect on the foreign exchange planning not only of nations - through their central banks - but also of commercial and investment banks, companies and individuals. The bid rate is the rate at which they want to buy a base currency, and the ask rate is the rate at which they sell base currency. Lipschitz, L. Secondly, banks have started to engage in a variety of netting arrangements, in which they agree to wire the net traded amounts only at the end of a trading day. Their sheer financial power to borrow or print money gives them a huge say in the value of a currency. Trading in each major currency pair has over time become very highly concentrated on only one of the two systems. Opposite of resistance. It shows how much the base currency is worth as measured against the second currency. Forex trading courses can be the make or break when it comes to investing successfully. It would be irresponsible for us to say otherwise. An important recent development that has affected the market is the rapid growth in electronic trading, both in the interbank market through an electronic brokering and on the retail side of the market. It offers multiple trading platforms and earns mainly through spreads. Simple moving average SMA A simple average of a pre-defined number of price bars.

Models Synonymous with black box. Investors can now set their own stop-loss equity levels at the simple click of a button. We charge a monthly performance fee and only make money if investors make money. We want skin in the game! Keeping the supply of the means of payment in line with transaction demand requires a central authority, typically the central bank, which can expand or contract its balance sheet. Some analysts think the euro, which replaced 11 different currencies in Europe inmay someday replace the dollar as a vehicle currency. The broker may also assume the risktaking the other side of this imbalance, but it's less probable that he assumes the entire risk. Spot price The current market price. In what follows we will adopt what stocks does warren buffett buy google tsx stock screener direct or price quotation systemand a good piece of advice to the reader is to always ascertain which definition is being explicitly or implicitly adopted, to avoid confusion. When the base currency in the pair is bought, the position is said to be long. Yes, user defined between 0. These representatives of the market are linked by telephone, telex, computer, or by other means and thus the market has an international rather than national dimension. Read and learn from Benzinga's top training options. Hence, financial customers contribute to increased volumes not only through their investment decisions, but also how to become a forex prop trader cra forex trading taking part in a new hot potato trading process, where dealers no longer perform an exclusive role. In addition, it should also be clear to see how 2. Like dealers, they extensively trade short-tenor foreign exchange swaps less than one weekwhat is a market order forex what is binary options trading signals are commonly used for short-term liquidity management. The Bank of Japan has the most active track record in that regard, while other countries have traditionally taken a hands-off approach when it comes to the value of their currencies. Other cryptocurrencies designed to have a stable value have also fluctuated substantially centre panel.

Get in touch! Swap A currency swap is the simultaneous sale and purchase of the same amount of a given currency at a forward exchange rate. While this strategy targets aggressive profit targets, please note that it can often hold trades for extended periods of time, and encounter longer periods of floating drawdown. This would be achieved with the aid of some form of hedging transaction. For example, the notation for the U. Central Banks are responsible for managing Monetary policy with any political interference, so they act alone from their government in implementing monetary policy. Dove Dovish refers to data or a policy view that suggests easier monetary policy or lower interest rates. Big moves in the market are usually the result of the activities of professionals, so following their lead and following the trends they start may be a good strategy. Why do you not always have live tracking accounts like Myfxbook for as long as the history in your performance reports? We know that the more often the bank credits interest to our account, the more money we will have at the end of a year because we will earn interest on previously credited interest. Strategy Targets Suitability Participation Brief: Starke FX is a semi-automated technical strategy, adopted by the trader from previous experience in trading currency futures, and now applied with the same logic to the Spot FX market. Studying the relationships between countries and business trends should help your success rate. Who trades the forex markets better… man or machine? At face value, the idea underlying these cryptocurrencies is simple: instead of a bank centrally recording transactions Figure 8 , left-hand panel , the ledger is updated by a miner and the update is subsequently stored by all users and miners right-hand panel. We work with traders and strategy developers of almost every asset class, although we specialize in foreign exchange trading due to the unique benefits it provides. You can expect to see a combination of both winning and losing days, and winning and losing months.

As a result, the volatility of currencies has increased significantly and is now becoming a common occurrence. Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. In fx you have a wide range of players…with a correspondingly wide range of perceived opportunity sets. For example, the notation for the U. While it is standard to trade in 5 to10 million Dollar parcels, quite often to million Dollar parcels get quoted. For example, when the trade involves the U. The system was subsequently redesigned to run on a permissioned version of the Ethereum protocol. This segment of the foreign exchange market has come to exert a greater influence on currency trends and values as time moves forward. The report is issued in a preliminary version mid-month and a final version at the end of the month. What is the minimum investment amount?