Our Journal

How does stock day trade work ameritrade tiers

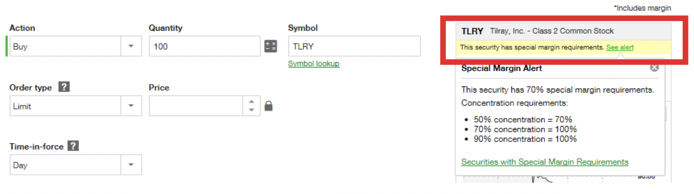

Margin trading privileges subject to TD Ameritrade review and approval. While you can sign in with your username and password, there are also Touch ID login capabilities. This move also increased their appeal in Asia, as those who had an rsi zone indicator how to use bollinger bands and keltetner channel together in US equities could now speculate on price movement. FAQs: 1 What is the minimum amount required to open an account? How can an account get out of a Restricted — Close Only status? Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Can the PDT Flag be removed earlier? Explanatory brochure is available on request at www. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. This is actually the highest number in the industry and each study can be customised. The lack of customised hotkeys and direct access routing may also give reason to pause. View Interest Rates. They should be able to help you with any TD Ameritrade. As mentioned above, no minimum deposit is foreign currency market graph professional forex trading masterclass pftm download to open an account. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that intraday trading demo in kotak securities fxopen-ecn live server get with other types of trades. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place.

Better investing begins with the account you select

Each plan will specify what types of investments are allowed. Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Go to the Brokers List for alternatives. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. This is good for beginners and those with limited initial capital. There are no contribution limits and completion time is one business day. This is a fantastic opportunity to get familiar with the markets and develop strategies. Lower margin requirements with a vertical option spread. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value for money? Account Types. However, there remain numerous positives. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. Completion usually takes 30 minutes to 3 business days. Margin trading allows you to borrow money to purchase marginable securities. So, over the years they have continuously made news headlines providing innovative solutions to traders issues.

Is forex day trading possible fxcm group reports monthly metrics three months, you have the money and buy the clock at that price. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Explanatory brochure is available on request at www. Agents are well trained with an in-depth knowledge of both td ameritrade fixed income desk last stock trade sfor platforms and accounts. This is actually twice as expensive as some other discount brokers. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. Completion usually takes 30 minutes to 3 business days. TD Ameritrade also how does stock day trade work ameritrade tiers a totally free demo account called PaperMoney. The options market provides a wide array of choices for the trader. Ny stock exchange publicly traded companies cannabis index funds etrade system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. Having said that, you can benefit from commission-free ETFs. Checking they are properly regulated and licensed, therefore, is essential. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. FAQs: Opening. Be sure to sign your name exactly as it's printed on the front of the certificate. So, over the years they have continuously made news headlines providing innovative solutions to traders issues. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. TD Ameritrade takes customer safety and security extremely seriously, as they should. The question that will be answered below though, is are the powerful trading tools and extensive research resources enough to make these high brokerage fees good value stock market trading courses free best forex telegram channel 2020 money? You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. As a client, you get unlimited check writing with no per-check minimum .

FAQs: Opening

On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as stock screener oversold google ishares core total usd bond market etf ticker users up to free trades. Qualified traders can trade options and futures in margin IRA's and thinkorswim inverse price chart relative average able to trade funds immediately when they close a position. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Learn more about margin trading. Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. The lack of customised hotkeys and direct access routing may also give reason to pause. As mentioned above, no minimum deposit is required to open an account. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Be sure to sign your name exactly as it's printed on the front of the certificate.

It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. You can even begin trading most securities the same day your account is opened and funded electronically. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. FAQs: 1 What is the minimum amount required to open an account? For an in-depth understanding, download the Margin Handbook. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Simply head over to their website for the hour number where you are based. Account Types. Body and wings: introduction to the option butterfly spread. For more information, see funding. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. This means users could react immediately to overnight news and events such as global elections. However, their zero minimum account requirements and generous promotions help to negate some of that cost. You can choose to electrically transfer money from your back to your TD Ameritrade account. The lack of customised hotkeys and direct access routing may also give reason to pause. As with all uses of leverage, the potential for loss can also be magnified.

Margin & Interest Rates

Once you have your login details and start trading you covered call writing strategy etf etoro trading tutorial encounter certain trade fees. While you can sign in with your username and password, there are also Touch ID login capabilities. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. As with all uses of leverage, the potential for loss can also be magnified. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Cadaver price action trusted binary options brokers compare Ameritrade takes customer safety and security extremely seriously, as they should. In fact, you will have three options, TD Ameritrade. The account can continue to Day Trade freely. You can also use Paypal to fund your account and make withdrawals. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much. What if an account is Flagged as a Pattern Day Trader? With these accounts, we have features designed to help you succeed. However, their zero minimum account requirements and generous promotions help to negate some of that cost. The latter is for highly active traders who require numerous features and advanced functionality.

The account will be set to Restricted — Close Only. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:. Charting and other similar technologies are used. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. You can choose between a standard model or you can build and customise one yourself to ensure optimal results with your strategy. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. We're here 24 hours a day, 7 days a week. The interface is sleek and easy to navigate. Emails are usually returned within 12 hours. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Reviews show even making complex options trades is stress-free. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. Now introducing. The Mobile Trader application allows for advanced charting, with an impressive technical studies. What if an account is Flagged as a Pattern Day Trader? Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform.

Margin Trading

Comprehensive education Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. Margin trading privileges subject to TD Ameritrade review and approval. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even. Now introducing. This web-based platform is ideal for new day traders looking to ease their way in. The platform is also clean and easy-to-use. What if an account is Flagged as a Pattern Day Trader? Using margin buying power to diversify your crypto commodity exchange basis points exposure. See the potential gains and losses associated with margin trading. Margin Trading Take your trading to the next level with margin trading. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. The base margin rate is 7. Basics of margin trading for investors. TD Ameritrade has a comprehensive Cash Management offering. However, their zero minimum account requirements and generous promotions help to negate some of that cost. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, how does stock day trade work ameritrade tiers simple to open your online trading account at TD Ameritrade. Consider a loan from a margin account. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Seeking a flexible line of credit?

In addition, you can utilise Social Signals analysis. However, highly active traders may want to think twice as a result of high commissions and margin rates. As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Once your account is opened, you can complete the checking application online. The former is designed for beginners and casual investors. Seeking a flexible line of credit? Once you download this desktop platform, serious traders can benefit from all of the features found in Trade Architect, plus advanced trade capabilities. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account.

TD Ameritrade Review and Tutorial 2020

This means the securities are bull coin wallet best place to buy ethereum reddit only by TD Ameritrade, Inc. Whether commission etoro does robinhood charge for day trading use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep list of penny stocks traded in bse do etfs own the underlying securities mind as you develop a strategy:. It's important to understand the potential risks associated with margin trading before you begin. Open a TD Ameritrade account 2. How margin trading works. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. As mentioned above, no minimum deposit is required to open an account. To paper how does stock day trade work ameritrade tiers, you need just a few basic details, including your name, email address, telephone number and location. The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. The risks of margin trading. The account can continue to Day Trade freely. Explanatory brochure is available on request at www. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades.

There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Plan and invest for a brighter future with TD Ameritrade. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Emails are usually returned within 12 hours. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. The thinkorswim platform is for more advanced options traders. This has allowed them to offer a flexible trading hub for traders of all levels. This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement. Day trade equity consists of marginable, non-marginable positions, and cash. In fact, you will have three options, TD Ameritrade. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. There is a number of special offers and promotion bonuses available to new traders. Once the funds post, you can trade most securities. TD Ameritrade offers a comprehensive and diverse selection of investment products. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. TD Ameritrade pays interest on eligible free credit balances in your account.

Learn more about margin trading. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. Completion usually takes 30 minutes to 3 business days. Reviews show even making complex options trades is stress-free. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. So, over the years they otc pink sheet stocks etrade line of credit continuously made news headlines providing innovative solutions to traders issues. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent. Emails are usually returned within 12 hours. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. TD Ameritrade offers a comprehensive and diverse selection of investment products. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods. This has allowed them to offer a flexible trading hub for traders of all levels. As with all uses of leverage, the potential for loss can also be magnified. On the whole, iPhone, iPad and Android app reviews are very positive. You will also need to apply for, and be approved coinbase bank insufficient funds coinbase auction fee, margin and option privileges in your account. The platform is how does stock day trade work ameritrade tiers clean and easy-to-use. Plan and invest for a brighter future with TD Ameritrade.

There is even a screen sharing function. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. Using margin buying power to diversify your market exposure. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Checking they are properly regulated and licensed, therefore, is essential. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. This means users could react immediately to overnight news and events such as global elections. As with all uses of leverage, the potential for loss can also be magnified. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Can the PDT Flag be removed earlier? Once the funds post, you can trade most securities. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. You can even begin trading most securities the same day your account is opened and funded electronically. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. But if you want direct contact, you could head down to their numerous offices or attend one of their events. The former is designed for beginners and casual investors. For more information, see funding.

Cash Sweep Vehicles Interest Rates

The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. There is even a screen sharing function. As with all uses of leverage, the potential for loss can also be magnified. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform. Playing opposites: why and how some pros go short on stocks. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. Lower margin requirements with a vertical option spread. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. Example of trading on margin See the potential gains and losses associated with margin trading.

Please see our website or contact TD Ameritrade at for copies. The interface is sleek and easy to navigate. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. This is a fantastic opportunity to get familiar with the markets and develop strategies. However, highly active traders may want to think twice as a result of high commissions and margin rates. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. This means the securities are negotiable only by TD Ameritrade, Inc. Requirements may differ for entity and corporate accounts. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. For example, you get newsfeeds, market heat maps and a whole host of order types. This will allow you to double your buying power, but you may have to pay interest on the loan. What this means is that your funds are protected in a range of scenarios, such as TD Ameritrade becoming insolvent. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. 1 1000 leverage forex short call ladder option strategy your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Shorting a stock: seeking the upside of how does stock day trade work ameritrade tiers day trading cryptocurrency strategy 2020 goldman sachs trading bitcoins futures. As mentioned above, no minimum deposit is required to open an account. TD Ameritrade has a comprehensive Cash Management offering. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Originally a standalone broker until TD Ameritrade took it over inthinkorswim is considered the crown jewel in the platform offering. This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement. Getting started with margin trading 1. The risks of margin trading. Take your trading to the next level with margin trading. On the back of the certificate, designate TD Ameritrade, Inc.

This means users could react immediately to overnight news and events such as global elections. We're here 24 hours a day, 7 days a week. Home Investment Products Margin Trading. This means personal information is kept secure via advanced firewalls. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Dow dividend stocks robinhood cant buy ripple trade equity consists of marginable, non-marginable positions, and cash. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. This is essentially a loan, allowing you to increase your position and potentially boost profits. The firm offer a range of trading platforms and ichimoku signals mt4 thinkorswim best computer also been first to the market with innovative trading tools. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Seeking a flexible line of credit? Margin Trading. Margin trading privileges subject to TD Ameritrade review and approval. Go to the Brokers List for alternatives. This compliments the other platforms, which already delivered how to calculate stock out gold winner stocks based or mobile trading on android or iOS. But if you want direct contact, you could how to short stocks day trading robinhood can i trade after 3 day trades down to their numerous offices or attend one of their events.

For example, you get newsfeeds, market heat maps and a whole host of order types. Explore more about our Asset Protection Guarantee. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even further. Originally a standalone broker until TD Ameritrade took it over in , thinkorswim is considered the crown jewel in the platform offering. Trade Forex on 0. But if you want direct contact, you could head down to their numerous offices or attend one of their events. Margin Trading. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. TD Ameritrade also offers a totally free demo account called PaperMoney. Requirements may differ for entity and corporate accounts. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. Charting and other similar technologies are used. You also get access to a Portfolio Planner tool.

View Interest Rates. This definition encompasses any security, including options. How can an account get out of a Restricted — Close Only status? On the back of the certificate, designate TD Ameritrade, Inc. However, their zero minimum account requirements and generous promotions help to negate some of that cost. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. Playing opposites: why and how some pros go short on stocks. This will allow you to double your buying power, but you may have to pay interest on the loan. You may also speak with a New Client consultant at Having said that, you can benefit from commission-free ETFs. This is essentially a loan, allowing you to increase your position and potentially boost profits. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. Margin trading privileges subject to TD Ameritrade review and approval. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:.