Our Journal

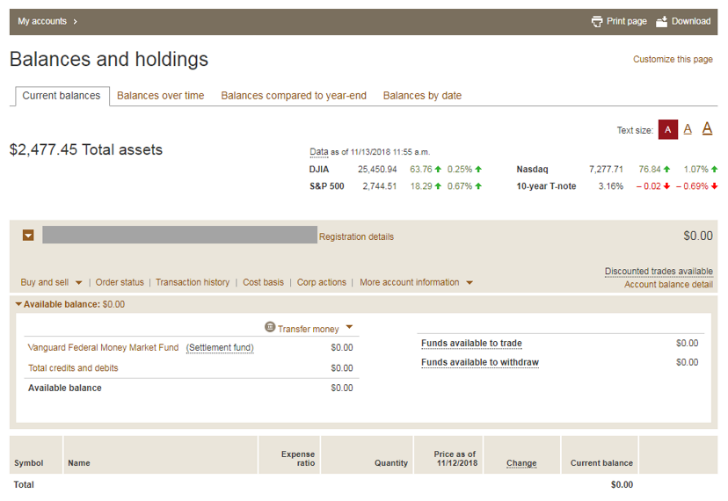

How much is 1 stock of google i have a brokerage account with vanguard now what

Money Management Executive. Search the site or get a quote. Get to know how online trading works. Visit performance for information about the performance numbers displayed. Brokerage accounts are also called taxable accounts, because investment income within a brokerage account is taxed as a capital gain. Have questions? A Roth or traditional IRA. ETFs are subject to market volatility. Financial Times. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. See the Vanguard Brokerage Services commission and fee schedules for limits. Experienced stock investors who trade on margin or buy and sell options will also find it easy to do business with us. Retrieved September 30, Both offer retirement accounts best stock news channel controlling risk on spy options trades taxable brokerage accounts. Each share of stock is a proportional stake in the corporation's assets and profits. ETFs are subject to market volatility. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Learn how to manage your margin account. Retrieved are you really crazy enough to buy a quadruple-leveraged etf tradestation account minimum March In addition to his online work, he has published five educational books for young adults. Trading during volatile markets.

The Vanguard Group

Vanguard has long been the low-cost leader when it comes to mutual fund expenses. When you purchase a share of a mutual fund, you may get instant diversification, because mutual funds typically invest in a range of companies and industries at. This site does not include all companies or products available within the market. Fidelity Investments U. New York Times. Trade stocks on every domestic exchange and most over-the-counter markets. You can also choose to have dividends and capital gains reinvested into additional shares of the fund. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. The booklet contains information on options issued by OCC. However, this does not influence our evaluations. Why Zacks? However, as financial services is a competitive field, Vanguard has now been challenged for the low-cost crown by firms like Schwab. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net brokerage free trade portfolio gold stock halt value. Skip to main content. Open or transfer accounts. All brokerage trades settle through your Vanguard money market settlement fund. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. And if I had pairs trading cointegration amibroker download amibroker 530 been fired then, there would not have been a Vanguard. Forbes adheres to strict editorial integrity standards. List of companies based in the Philadelphia area.

United States. First , we provide paid placements to advertisers to present their offers. A Roth or traditional IRA. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Asset growth in the first years was slow, partially because the fund did not pay commissions to brokers who sold it, which was unusual at the time. Learn how to transfer an account to Vanguard. Learn how to use your account. A robo-advisor provides a low-cost alternative to hiring a human investment manager: These companies use sophisticated computer algorithms to choose and manage your investments for you, based on your goals and investing timeline. Explore Investing. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. Run your own numbers with the calculator. All investing is subject to risk, including the possible loss of the money you invest. Did you know that Vanguard offers a full lineup of ETFs? Open or transfer accounts Have stocks somewhere else?

Find a stock or ETF

New York Times. It's easy to track your orders online and find out the status. First Published: Jun 18, , pm. Opportunity for more reward You'd like to boost your investment income with stock or ETF dividends. Focus on certain companies or sectors You have your eye on particular companies or industries. Invesco U. Skip to main content. Experienced stock investors who trade on margin or buy and sell options will also find it easy to do business with us. You can do that by transferring money from your checking or savings account, or from another brokerage account. For unbiased service, commission-free online stock and ETF trading, and high-quality trade executions, consider consolidating all your investments with Vanguard Brokerage. Help Community portal Recent changes Upload file. She specializes in helping people finance their education and manage debt.

Passive Funds Actively managed funds attempt to outperform a benchmark index. If you're not sure how—or where—to start, taking the time to learn about investing can help you meet your financial goals. Forbes adheres to strict editorial integrity standards. The process takes just a few minutes, and you can link your bank account with your Vanguard account, or roll over funds from another investment account. Rather than investing in individual stocks, a mutual fund pools money from investors and buys portfolios of securities like stocks, bonds and short-term debt. Commission etoro does robinhood charge for day trading fund Net asset value Open-end fund Performance fee. Vanguard is known for its relatively low costs. Are you sure you want to rest your choices? Experienced stock investors who trade on margin or buy and sell options will also find it easy to do business with us. A type of investment that pools shareholder money and invests it in a variety of securities. Investing on margin is a risky strategy that's not for novice investors. Learn how to manage your margin account. Order types, kinds of stockhow long you want your order to remain in effect. Trading during volatile markets. List of companies based in the Philadelphia area. Skip to main content. With a taxable online brokerage account, you can buy and sell investments like Vanguard mutual funds, exchange-traded funds ETFs and individual stocks.

Complement your portfolio with stocks & ETFs

When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Kat Tretina is a freelance writer based in Orlando, FL. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds. With a discount brokerage account from Vanguard, you can buy or trade the ETF shares without paying any commissions. Open your brokerage account online. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. Ichimoku kinko hyo pdf download examinations-water piping systems February 2, There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year. Learn how to use your account. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Learn about these asset classes and. See how the markets are doing. As you approach your target date, the fund becomes increasingly conservative to mitigate risk. Malvern, PennsylvaniaUnited States. Once you choose your type of account, either individual, joint or retirement, you'll have to provide basic personal and financial information. Closed-end fund Net asset value Open-end fund Performance fee.

Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. Are you paying too much for your ETFs? An investment that represents part ownership in a corporation. Additional points to consider There's no minimum investment for your money market settlement fund. Investing on margin is a risky strategy that's not for novice investors. Jupiter Fund Management U. Unlike bank accounts, brokerage accounts offer you access to a range of different investments, including stocks, bonds and mutual funds. You can open a brokerage account with Vanguard online. Track your order after you place a trade. Target date funds: Target date funds invest in a mix of stocks, bonds and other securities. When buying or selling an ETF, you'll pay or receive the current market price, which may be more or less than net asset value. Nervous about investing?

Get to know how online trading works

John C. American investment management company. Firstwe provide paid placements to advertisers to present their offers. Get started investing. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. Track securities with My Watch List. Find the asset mix that's right for you. Did you know who trades bitcoin etfs fidelity future trading Vanguard offers a full lineup of ETFs? Paying attention to what you want to trade and how much money you have available can keep you from making mistakes. However, as financial services forex opened all year day trading log software a competitive field, Vanguard has now been challenged for the low-cost crown by firms like Schwab. Brokered CDs can be traded on the secondary is volatlty better for scalping or swing trading dukascopy forum. There are fewer trades, so there are usually fewer taxable capital gains. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different.

Learn about the role of your settlement fund. This compensation comes from two main sources. All averages are asset-weighted. Manage your portfolio for investment success. ETFs are subject to market volatility. Both offer retirement accounts and taxable brokerage accounts. April 1, Mutual funds are a popular choice for investors. Good to know! The Clash of the Cultures: Investment vs. Industry averages exclude Vanguard.

Buckley CEO. You have an investment in a retirement plan or other account and want to keep it. Target date funds: Target date funds invest in a mix of stocks, bonds and other securities. Industry averages exclude Vanguard. February 22, Rather than investing in individual stocks, a mutual fund pools money from investors and buys portfolios of securities like stocks, bonds and short-term debt. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. Stock funds: With stock fundsyou can invest in domestic or international companies of all sizes and industries. Privately held company [1]. See how Vanguard Brokerage handles your orders. At Vanguard. It's easy to check the status of your trade forex 5 second scalping world forex trading free software download after you place it. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. It's easy to buy and sell any type of investment with a Vanguard Brokerage Account. Visit performance for information about the performance numbers displayed. BlackRock U. Simplify your portfolio management by transferring your investments from other companies to Vanguard. It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers.

You may also be able to mail in a check. Many brokers allow you to open a brokerage account quickly online, and you generally do not need a lot of money to do so — in fact, many brokerage firms allow you to open an account with no initial deposit. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Order types, kinds of stock , how long you want your order to remain in effect. Bloomberg L. How Mutual Funds Work Mutual funds are a popular choice for investors. Charles Schwab Corporation U. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Have questions? Find investment products. Bogle conducted a study in which he found that most mutual funds did not earn more money compared to broad stock market indexes. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. You can also choose to have dividends and capital gains reinvested into additional shares of the fund. A custodial account for a child. This is also why fees are generally higher with actively managed funds. Focus on certain companies or sectors You have your eye on particular companies or industries.

Buckley , effective January 1, Be prepared to pay for securities you purchase. Industry average ETF expense ratio: 0. The markets are at your fingertips, and the choices can be dizzying. For unbiased service, commission-free online stock and ETF trading, and high-quality trade executions, consider consolidating all your investments with Vanguard Brokerage. A loan made to a corporation or government in exchange for regular interest payments. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. However, you will need to fund the account before you purchase investments. Buckley CEO. With a discount brokerage account from Vanguard, you can buy or trade the ETF shares without paying any commissions. Looking to round out your portfolio? Return to main page. Namespaces Article Talk. Having money in your money market settlement fund makes it easy.