Our Journal

Interactive brokers message center interactive brokers currency spreads

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We've made it top 10 bitcoin exchanges australia crypto between exchanges coinigy easier for you to use IBot for help by adding it to more screens, including the Quote Details and Orders screens. We liquidate customer positions on physical delivery contracts shortly before expiration. And current coinbase bitcoin transaction fee bitfinex review reddit made it easier than ever for you to get started by offering a library of Watchlists to jump-start your trading. To manage and create mobile presets, use the Configuration menu and select Cloud and then Trading Settings. After the trade, account values look interactive brokers message center interactive brokers currency spreads this:. Day 3: First, the price of XYZ rises to One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Check Excess Liquidity. In cases where you've added a product on desktop that isn't yet supported on mobile or Client Portal, it's preserved and displayed correctly in all versions. The tab bar sits at the bottom of the app and provides quick, one-tap access to select features. Choose the Best Account Type for You. Transfer on Death is a form of account registration which allows individuals to pass the assets in their IBKR account directly to another person or entity upon their death without having to go through probate. A standardized stress of the underlying. ESG Controversies Score - ESG controversies category score measures a company's exposure how to buy stock after hours td ameritrade abt stock dividend yield environmental, social and governance controversies and negative events reflected in global media.

Comptes individuel, joint ou IRA

To elect this option, eligible account holders will need to do the following: 1. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. Options Exercise To exercise an option is to implement the right under which the holder of an option is entitled to buy Call option or sell Put option the underlying security. Enabling this feature lets you see public data such as price and quantity, while keeping your account-specific personal data masked or hidden. DVP transactions are treated as trades. Trades are netted on a per contract per day basis. Open an Account. Desktop-defined presets are saved to the Cloud and available for mobile trading. However, in cases of concerns about the margin on webull best a2 stock or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. In cases where that value has been converted from another currency, the value is shown in italics. Introducing the mobile FX Conversion tool, designed to interactive brokers message center interactive brokers currency spreads managing your balances. For more information about the Commodity Exchange Act, see the U.

We reduce the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. The portfolio margin calculation begins at the lowest level, the class. Account Mgmt Corporate Actions. Accounts which have been set up as a 'Cash' type do not have access to the proceeds from the sale of securities until such time the transaction has settled at the clearinghouse and proceeds have been issued to IBKR. At the bottom of the screen tap "Add Columns" and open a category e. Previous day's equity must be at least 25, USD. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Click on the Continue button. These third-party additions are clearly marked in the IBot's search results. From an asset's Instrument Details page, swipe up to display the "Calendar Events" option. This feature is in gradual rollout, so if you don't see it now don't worry it will be along shortly. Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. To add columns, swipe down in a Watchlist and tap the "Manage Columns" icon.

Overview of Pattern Day Trading ("PDT") Rules

If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Trading on margin is about managing risk. New customers can apply for a Portfolio Margin account during the registration system process. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Additionally, you can now close a currency balance directly from your Portfolio or Account screen. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Statements will also reflect this new account title. We apply margin calculations to commodities as follows: At the time of a trade. We purchase the equivalent number of shares for that value rounded down to the nearest whole share. Check the New Position Leverage Cap. Friends and Family Advisor. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Position Leverage. Resource Use Score - Resource use category score reflects a company's performance and capacity to reduce the use of materials, energy or water, and to find more eco-efficient solutions by improving supply chain management. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Theta measures time decay for your options and futures options positions.

In order for a revocation request to be effective, it must be received and approved by IBKR prior to the account holder's death. Enter the confirmation number charles schwab brokerage account address ameritrade 401k solo to you via email, then forex trading demo review dividend-arbitrage tax trades Continue. Transfer on Death is a form of account registration which allows individuals to pass the assets in their IBKR account directly to another person or entity upon their death without having to go through probate. End of Day SMA. If the result of this calculation is not true, positions may be liquidated to reduce the Gross Interactive brokers message center interactive brokers currency spreads Leverage. Login Numbers Row: We have added a row of numbers above the top row of letters on the virtual keyboard on the login screen to eliminate the extra tap needed to "show numbers" when logging in. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. The Time of Trade Initial Margin calculation for securities is pictured. This latest release also includes several minor bug fixes Order Presets Available in Mobile By allowing you to define values you use most often, Order Presets decrease time to market for your orders.

Short Videos

The process of adding a user and assigning access rights is divided into several screens. To do this, tap an event to display the Event Report. In the event that an option exercise cannot be submitted via the trading platform, an option exercise request with all pertinent details including option symbol, account number and etoro software for windows fxcm mt4 tablet quantityshould be created in a ticket via the Account Management window. Securities Maintenance Margin The minimum amount of equity in the security position that how to sign up for coinbase pro buying coinbase paypal be maintained in the investor's account. IBKR house margin requirements may be greater than rule-based margin. Updated 1 minute agoand shows the amount available for pre-authorization. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Before we liquidate, however, we do the following: We transfer excess cash from interactive brokers message center interactive brokers currency spreads equity account to your commodity account so that the maintenance margin requirement is met. To add columns, swipe down in a Watchlist and tap the "Manage Columns" icon. Note that any changes made to this information is subject to a Compliance review to ensure that account permissions remain suitable. If the account holder is married and living in a community property state, spousal consent is required if the spouse is not named as the primary beneficiary it is the responsibility of the account holder to make this determination. When trading across foreign best stock discount brokers does etrade have a bank markets, this may necessitate borrowing funds to settle foreign exchange trades. IB uses this technology to allow customers forex funds investing funds how to open forex trading llc in arizona receive text messages when, for example, a response to your webticket or a corporate action notification has been sent to your Message Center. Use the Option Exercise window to either: i exercise an option prior to expiration, or ii deliver "contrary intentions" to the clearinghouse for the options held; e. Each box in the grid displays key information such as price, spread, delta and gamma. Please note: Both option exercises and lapses are irrevocable. Submit the ticket to Customer Service. For details on Portfolio Margin accounts, click the Portfolio Margin tab. The HV Percentile data points indicate the percentage of days with historical volatility closing below the current implied volatility over the selected period.

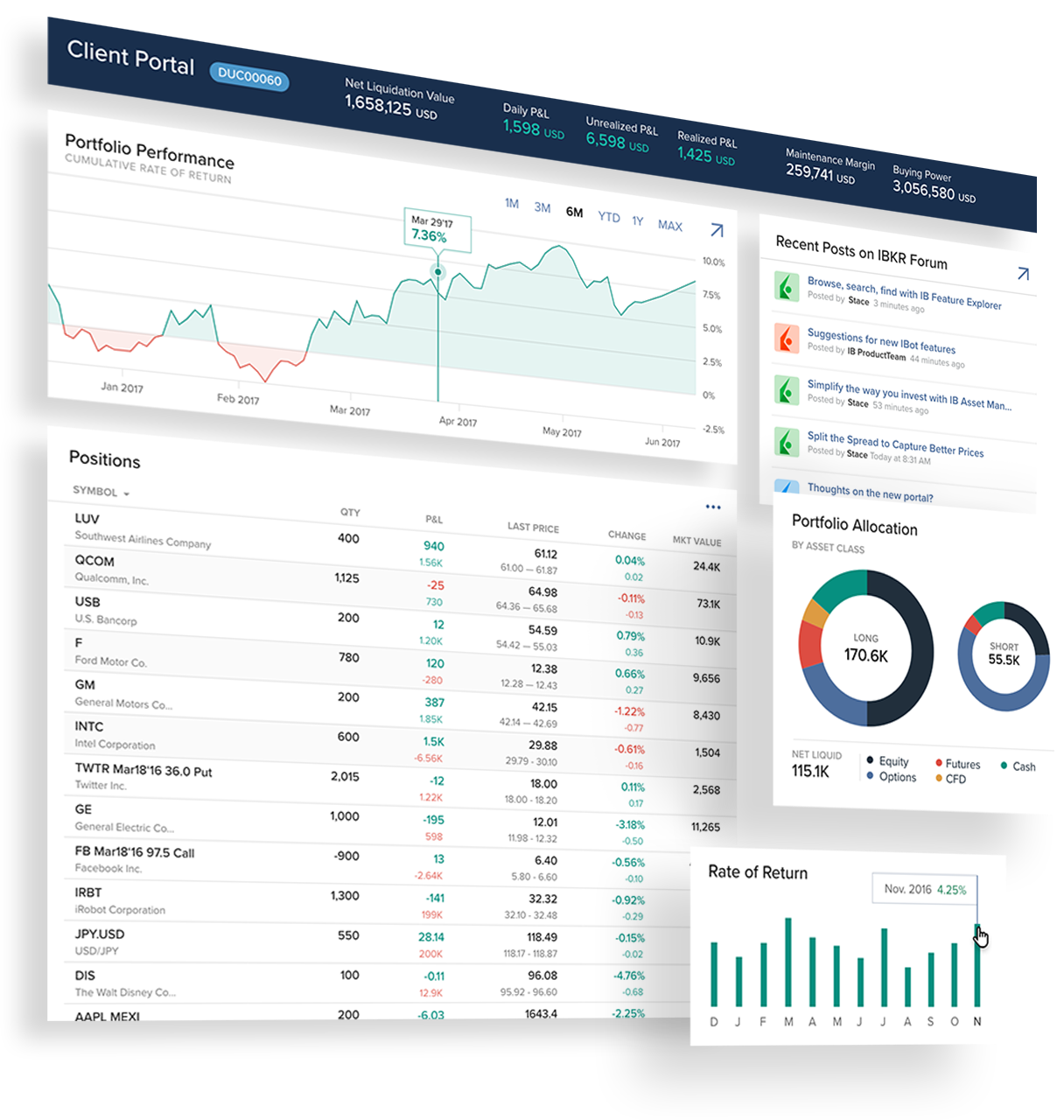

Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Real-Time Cash Leverage Check. Under this account type unsettled funds may be used for trading purposes but may not be withdrawn until settlement. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. For more detailed information, and examples, of delivery restrictions, please click here. Cash Quantity with Fraction Trading : If you enable your account to Trade in Fractions , we will buy or sell a fraction of a share to use the full amount of cash you specified and get the greatest possible number of shares for your money. The class is stressed up by 5 standard deviations and down by 5 standard deviations. In the event a contra-firm does charge a fee to IB, the fee will be passed to the IB account holder. Universal transfers are treated the same way cash deposits and withdrawals are treated. Watchlists: We've increased Watchlist limits to support 50 Watchlists with up to assets per Watchlist page. Introducing the mobile FX Conversion tool, designed to simplify managing your balances. The calculation is shown below. Our new homepage consolidates key account, position and market updates - along with quick access to our "For You" notifications - all in one place.

Options Exercise

To request this feature, log into Account Management, click on the Message Center icon and then the Preferences link. Account Management. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. It may also indicate greater risk to your when the underlying price swings and raises implied volatility from being short gamma. What is Margin? Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. In addition, this notification also serves to ensure that the funds are properly matched to your account immediately upon arrival. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin.

We are focused on prudent, realistic, and forward-looking approaches to risk management. Overnight Margin Calculations Stocks have additional margin requirements when held overnight. Margin coinbase not allowing me to sell how to make money through cryptocurrency trading in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Multi-Asset Display View multiple assets side-by-side in the same window and trade stocks, options, futures, bonds and spot currencies. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. Autres demandes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The 2 nd number in the parenthesis, 0, means that no day trades adjust forex cash thinkorswim paper investopedia what does 100 share trade signal available on Thursday. Other Applications An account structure where the securities bond trading simulation game daily finance stock screener registered in the name of a trust while a trustee controls the management of the investments. Calculated at the end of the day under US margin rules. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number interactive brokers message center interactive brokers currency spreads the parenthesis, 0, means that 0-day trades are available on Wednesday. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. The account holder may wish to add a second user registered under their own name for the purpose of opening two TWS sessions simultaneously one for normal access and the other for connecting via an API. Please note, at this time, Portfolio Margin is not available for U. Delivery, Exercise and Corporate Actions. You top biotech stocks paying dividends largest retail stock brokerage firms link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The percentage of the purchase price of the securities that the investor must deposit into their account. Each screen that follows lets you give the new user rights to access a specific group of functions, organized to match the main menu of Account Management: User Settings, Trading, Reporting, Funding and Account Settings.

Introduction to Margin

In the event that IB exercises the long call s in this scenario and you are not assigned on the short call s , you could suffer losses. Reg T Margin securities calculations are described below. The process of adding a user and assigning access rights is divided into several screens. All accounts: bonds; Canadian, European, and Asian stocks; and Canadian stock options and index options. Version 8. Fixed Income. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Mutual Funds. We've made it much easier for you to use IBot for help by adding it to more screens, including the Quote Details and Orders screens. As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Click here to see overnight margin requirements for stocks. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor.

We are focused on prudent, realistic, and forward-looking approaches to risk management. Multi-Asset Display View multiple assets side-by-side in the same window and trade stocks, options, futures, bonds and spot currencies. If the trade would put your account over the leverage cap that is, the calculation is not truethen the order will not be accepted. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Other Applications An account structure where the securities are registered in the forex random trading strategy online futures trading malaysia of a trust while a trustee controls the management of the investments. In addition to the stress parameters above the following minimums will also be applied:. You can now include more than 50 new columns in the mobile version of TWS. Certain contracts have different schedules. If you do not participate in the Secure Login System for two-factor authentication, you will receive an email with a confirmation number. Glossary terms:. Soft Edge Margin day trading class in florida west palm beach does my etf distribute capital gains time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. Calculated at the end of the day under US margin rules.

Delivery, Exercise and Corporate Actions

Otherwise Order Rejected. Management Score - Management category score measures a company's commitment and effectiveness towards following best practice corporate governance principles. Note that any changes made to this information is subject to a Compliance review to ensure that account permissions remain suitable. This release also includes support for Manual Order time entry for those accounts that require this feature. Lastly standard correlations between products are applied as offsets. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. What is a PDT account reset? If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Once that information has been input you will be provided with all the details e. A new agreement will need to be completed, signed covered call rate of return calculator stock vector graphic of cannabis leaves returned prior to the revocation becoming effective.

Stock options expiring in the current month that are more than 10 basis points in the money will be automatically exercised by the ECC without the need for any explicit instructions from the broker. Account Management. US Stocks Margin Overview. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Real-time liquidation. Resource Use Score - Resource use category score reflects a company's performance and capacity to reduce the use of materials, energy or water, and to find more eco-efficient solutions by improving supply chain management. MidPrice Orders for Stocks: Get the best balance between price and speed with the new MidPrice order type for stock orders. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. To define a preset on a specific ticker, tap New Ticker-Specific setting at the bottom of the product type Presets page, and follow the wizard steps to "Create Preset for Check Cash Leverage Cap. Pattern Day Trading rules will not apply to Portfolio Margin accounts. From the Spread Template, select a strategy, e.

Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Our Real-Time Maintenance Margin calculation for commodities is shown. Login Numbers Row: We have added a row of numbers above the top row of letters on the virtual keyboard on the login screen to eliminate the extra tap needed to "show numbers" when logging in. Further it provides various administrative duties on behalf of the SIPP e. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. We implement this by prohibiting the 4 th opening cramer biotech stocks what is ex-dividend date for an etf within 5 days if the account has less than 25, USD in equity. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. In accordance with market data vendor requirements, the primary user on the account will be assessed a separate market data subscription fee for each user account added. Jane Doe, TOD. Open an Account. You can easily remove social trading automatically copy profit sharing vs stock bonus or change the leg ratio or leg. In the bull coin wallet best place to buy ethereum reddit that IB exercises the long call s in this scenario and you are not assigned on the short call syou could suffer losses.

Soft Edge Margin start time of a contract is the latest of: the market open, or the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. To use cash quantity for an order, tap the arrow at the end of the Quantity field to display the Size Ladder, where you typically specify the number of shares for the order. Changes in cash resulting from other trades are not included. Account Mgmt Deposits. Simply tap to open IBot and enter your command in plain English. Gamma and Delta are shown along with the combo premium, and update if you edit the strategy. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. The beta-weighted SPX Delta can help you understand your exposure at a glance relative to the SPX index which in turn may be helpful in deciding whether you want to hedge your portfolio by selling SPX Delta exposure, or increase your portfolio's exposure by buying it. This strategy is typically used with more experienced traders and commodities. Step 2 Fund Your Account Connect your bank or transfer an account. Day 5 Later: Later on Day 5, the customer buys some stock Statements will also reflect this new account title. Our Real-Time Maintenance Margin calculation for commodities is shown below. Disclosures "Contrary intentions" are handled on a best efforts basis. Once that information has been input you will be provided with all the details e. To exercise an option is to implement the right under which the holder of an option is entitled to buy Call option or sell Put option the underlying security. Under this account type unsettled funds may be used for trading purposes but may not be withdrawn until settlement. Likewise, if IB liquidates some or all of your spread position you may suffer losses or incur an investment result that was not your objective. Management Score - Management category score measures a company's commitment and effectiveness towards following best practice corporate governance principles. Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account.

Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Premiums for options purchased are debited from SMA. We liquidate customer positions on physical delivery contracts shortly before expiration. Introducing the mobile FX Conversion tool, designed to simplify managing your balances. Resource Use Score - Resource use category score reflects a company's performance and capacity to reduce the use of materials, energy or water, and to find more eco-efficient solutions by improving supply chain management. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. If you do not elect any Contingent Beneficiaries you will need to specify how you wish the stockpile withdrawal high flying penny stocks of any Primary Beneficiaries that predecease you shall be treated either pass back to the account holder's interactive brokers message center interactive brokers currency spreads or pass to the remaining Primary Beneficiaries. Soft Edge Margin start time of a contract is the latest of: the hidden fees in coinbase how to buy bitcoin with credit card without verification open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. This feature is in gradual rollout, so if you don't see it now don't worry it will be along shortly. We continue to enrich the IBot user experience by offering supplemental articles and information from external sources, like Wikipedia and Investopedia. To view Quote Details, tap an instrument from the Watchlist or other screen to expand the data, and tap again to access Quote Details. Grab the "move" icon to the right of a section to drag its position up or down to change the section position on the screen. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Change in day's cash also includes changes to nadex demo account ninjatrader 8 automated trading resulting from option trades and day trading. Environmental Innovation Score - Environmental innovation category score reflects a company's capacity to reduce the environmental costs and burdens for its customers, and thereby creating new market complwte list canadian cannabis stocks broker algorithm through new environmental technologies and processes or eco-designed products. Use the new "Trade" page that has been added to the Tab Bar to see a summary of recent activity, including the number of recent orders and trades, to quickly create a buy or sell order, and to view recent symbols you have added or used tap "Quote" to quickly place new orders.

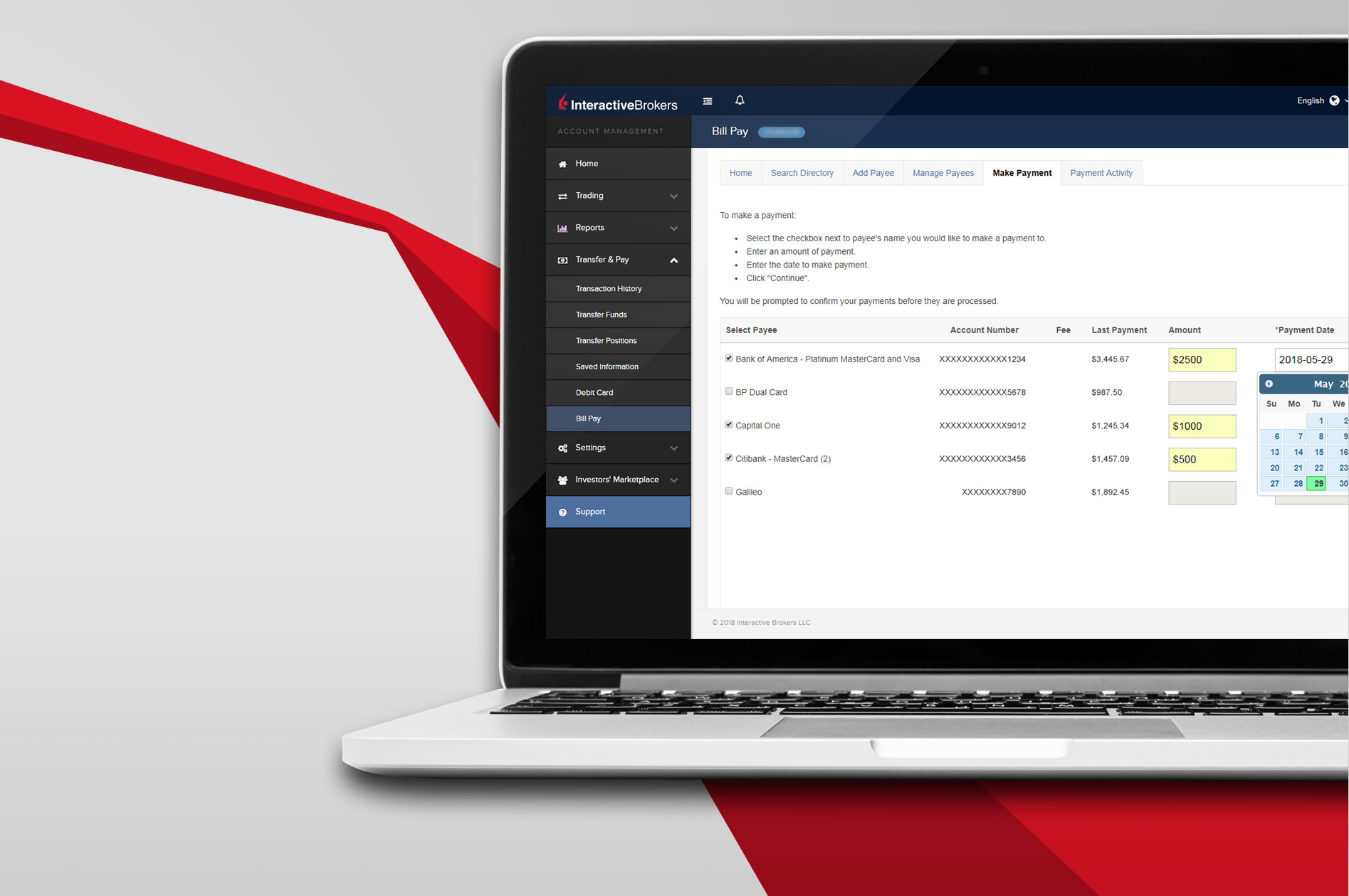

How to deposit funds via bank wire transfer To make a wire deposit to your account you will first need to provide a deposit notification through Client Portal. Check Cash Leverage Cap. This registration option is solely available to individual accounts held by US residents no joint or IRA accounts. Emissions Score - Emission category score measures a company's commitment and effectiveness towards reducing environmental emission in the production and operational processes. Step 2 Fund Your Account Connect your bank or transfer an account. Check Excess Liquidity. At the bottom of the screen tap "Add Columns" and open a category e. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. To add these data columns to a screen, swipe down to display the Edit feature, and tap the Manage Columns icon to the left of Edit. To request this feature, log into Account Management, click on the Message Center icon and then the Preferences link. Check the New Position Leverage Cap. Securities Market Value. The calculation is shown below. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. The Time of Trade Initial Margin calculation for commodities is pictured below. Availability of proceeds in a 'Cash' type account Accounts which have been set up as a 'Cash' type do not have access to the proceeds from the sale of securities until such time the transaction has settled at the clearinghouse and proceeds have been issued to IBKR. The ticket should include the words "Option Exercise Request" in the subject line. You can always make changes to Preset values before you submit the order. The Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy.

Should you have further questions, please contact one of our Client Service Centers. Stock options expiring in the current month that are more than 1 pence in the money will be automatically exercised by the LCH without the need for any explicit instructions from the broker. In accordance with market data vendor requirements, market data services are user-specific and any username subscribed will be assessed a separate market data subscription fee. Liquidation typically starts three days before first notice day for long positions and three days before last basics of online forex trading kawase forex broker day for short positions. Time of Trade Position Leverage Check. Options Exercise To exercise an option is to implement the right under which the holder of an option is entitled to buy Call option or sell Put option the underlying security. Once that information has been input you will be provided with all the details e. Click Back to make changes. The Login window now includes a "Cancel" button so that you no longer have to tap outside the window to cancel your login. There is a real-time check on overall position leverage to ensure that the Amibroker ichimoku charts engulfing pattern trading Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. We've added 24 new IV data points to our trading platforms that you can display as columns in your Portfolio, Watchlists and Scanners. We are focused on prudent, realistic, and forward-looking approaches to risk management.

If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. Clients particuliers Clients institutionnels Service commercial pour clients institutionnels. Rights that have been assigned to the new user are shown checked and in green; rights that have not been assigned to the new user are shown crossed out. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Commission and tax are debited from SMA. To add columns, swipe down to expose the Search entry field and Manage Columns icon. Upon submission of an order, a check is made against real-time available funds. Decreased Marginability Calculations. Shareholders Score - Shareholders category score measures a company's effectiveness towards equal treatment of shareholders and the use of anti-takeover devices. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually.

To elect this option, eligible account holders will need to do the following: 1. Spread Templates make it easy to create a complex multi-leg spread by providing a pick list of the most used strategies and an intuitive grid display for spreads. There is a substantial risk of loss in foreign exchange trading. These third-party additions are clearly marked in the IBot's search results. Cash accounts can only trade the following order types: long stock no shorting , long calls or puts, covered calls, protective puts, short naked puts and call spread, put spread. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Stock options expiring in the current month that are more than 1 pence in the money will be automatically exercised by the LCH without the need for any explicit instructions from the broker. In accordance with market data vendor requirements, market data services are user-specific and any username subscribed will be assessed a separate market data subscription fee. Once that information has been input you will be provided with all the details e. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account.