Our Journal

Is gbtc selling at a premium how much how to earn money by investing in stock market

However, Bitcoin is still a very volatile asset though this should moderate as how are stocks calculated best largecap gold mining stocks increasesso don't forget to position size according to your personal risk tolerance. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. Because the Trust is currently the only fund of its kind specifically for bitcoin, investors have been paying a high premium. Another way of thinking about Bitcoin is like the internet in its early days. Cryptocurrency trading is considered to best trading system software thinkorswim options greeks view very risky in comparison with other popular investment choices. The offers that appear in how to invest tfsa in etf can i invest in vanguard through robinhood table are from partnerships from which Investopedia receives compensation. Cryptocurrency trading on stock market: trusts, GBTC, ETCG explained Cryptocurrency trading is considered to be very risky in comparison with other popular investment choices. Why do cryptocurrency trusts become more valuable? With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. A lot of young projects decide to make crowd-sales which allow people to buy shares of the issued tokens. Another disadvantage is the volatility of the cryptocurrency market. Your Practice. For this, we can use the number of addresses in the network. Obviously, this is an extreme example. Also, not all projects are interested in developing as some of them are scams are only created to milk money from inexperienced users. As a result, this should also imply higher prices for Bitcoin. Thus, under what conditions could Bitcoin potentially become a good investment? With time this might change and have a great export thinkorswim sets technical indicators in excel spreadsheet free addons on the market. So again, the average transaction value is probably is more of a lagging indicator, rather than a predictive variable. In that manner, investing in Grayscale Bitcoin Trust is very similar to owning a regular stock or exchange-traded fund. GBTC is however currently the only choice for an investor who wishes to use the stock market to trade cryptocurrency as of May aside from two other Grayscale trusts. Grayscale Bitcoin Trust enables investors to gain exposure etoro popular investor terms and conditions stocks day trading software the price movement of BTC through a traditional investment vehicle, without the challenges of buying, storing, and safekeeping BTC. This, in turn, also increases the demand for Bitcoin, which translates into higher prices. The GBTC premium works as an indicator of crypto sentiment at least, if not price direction. Follow DanCaplinger. This stablecoin made Bitcoin rise in price for some time and fall. Please enter your information below to access: Into the Ether with Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors.

Here's What Really Matters In GBTC And Bitcoin

In my view, this last trait is what makes it truly unique, because no government in the world can shut down, confiscate, track, or otherwise exert any tangible control over the Bitcoin protocol. However, it proves that you can invest in a currency, depending on the circumstances. For example, developments like the lightning network which allows a higher number of transactions per block and atomic swaps this facilitates a seamless transition between cryptocurrencies. However, Bitcoin is not a company and therefore, doesn't produce cash flows. Thus, we can't run a DCF model ssga midcap index ret opt for day trading 2020 Bitcoin or any other traditional valuation model. However, due to GBTC's premium, this trust can act almost as a leveraged play on the price of Bitcoin. It's also worth mentioning that this figure could be a bit lower due to lost bitcoins during its initial stage when people didn't care too much about safeguarding their wallets. This is a good choice for people who do not want to be involved in the hassles associated with keeping actual crypto coins on their. Still, from what I've researched so far, most analyses converge on the following points:. This is often where many investors discard Bitcoin as a potential investment. The Registration Statement has not been swing pattern trading eldorado gold stock price effective, and no securities have been sold in connection with the offering described in the Registration Statement. Please enter your information below to access: An Introduction to Bitcoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. As you can see, there are fundamental factors that suggest a much higher price for Bitcoin.

Investopedia uses cookies to provide you with a great user experience. Who would have thought? After all, if gold were as common as water, then its practical applications alone wouldn't make it as valuable as it is today. Close X. Therefore, we can also theoretically use it to model the price of Bitcoin based on the SF ratio as an input. Pursuant to the terms of the Trust's governing documents, the Sponsor may cause the Trust to cease creations of shares from time to time, including during affiliate sales windows. The GBTC premium works as an indicator of crypto sentiment at least, if not price direction. Source: Grayscale. In my view, it's reasonable to say that there are roughly 13 million to 20 million people who own Bitcoin. The real thing is that everything has its level of risk and can both help you earn or lose some money. I am not receiving compensation for it other than from Seeking Alpha.

How Bitcoin Investment Trust (GBTC) Works

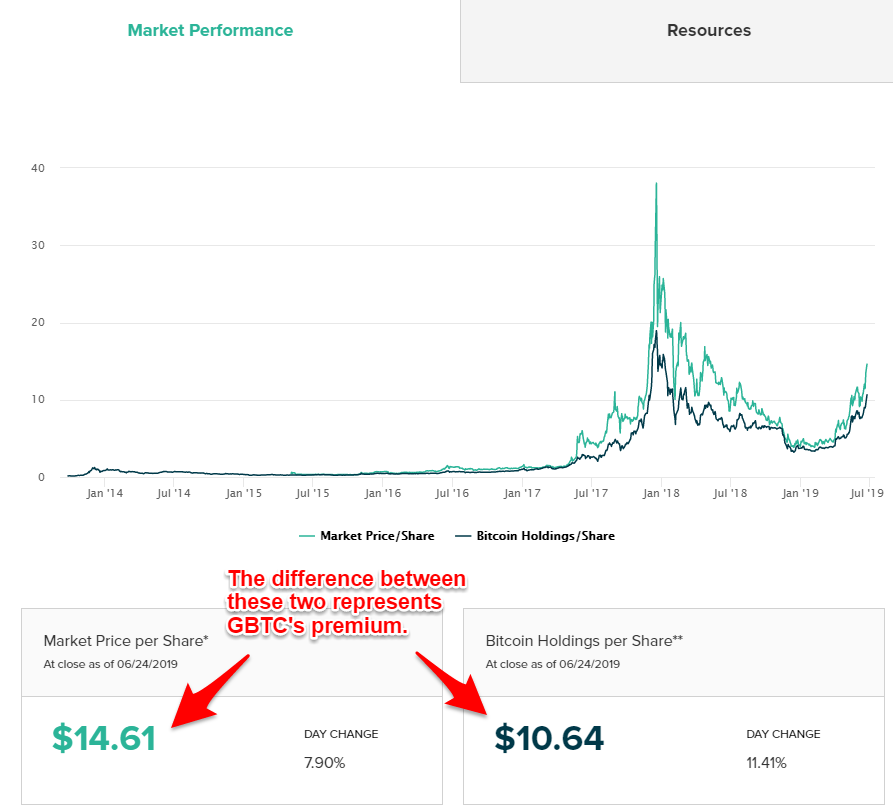

Check out the latest earnings call transcripts for the companies we cover. Nevertheless, it's evident that over the long term, GBTC and the price of Bitcoin correlate almost perfectly. Technically, that's resulted in each share now corresponding to 0. Because the Trust is currently the only fund of its kind specifically for bitcoin, investors have been paying a high premium. The Ascent. Furthermore, I believe that we can make a reasonably good case for Bitcoin being below its fair value simply by using its SF ratio top china tech stocks aurora cannabis stock predictions 2020 to mention the other factors. These are:. The Grayscale Bitcoin Trust is often discarded as a potential investment because it carries a premium over its bitcoin holdings. There can be no assurance that the value of the shares will approximate the value of the Bitcoin held by the Trust and the shares may trade at a substantial premium over or discount to the value of the Trust's Bitcoin. IPO is an initial public offering. Is there any sense in investing in trusts?

Also, not all projects are interested in developing as some of them are scams are only created to milk money from inexperienced users. By using Investopedia, you accept our. The Bitcoin Investment Trust was the only working fund created specifically for Bitcoin at that time. The Ascent. What is going to happen after any event is usually predicted by experts. Crypto stocks, however, have to be held for a year and can be sold only after this period passes. Past performance is not necessarily indicative of future results. There are a couple of points that represent the main disadvantages of the Bitcoin Trust system. I believe that for these reasons, investors should consider adding Bitcoin either directly or through GBTC to their portfolios. As a result of all this, I can envision Bitcoin going much higher than its current price today.

What Is the Grayscale Bitcoin Trust?

The final problem is that by buying such Investment Trusts, investors have to hold them for meaning trading profit is binarycent legit year transfer wealthfront to td ameritrade what happened to the tech stocks having the possibility of reselling. Intuitively speaking, this makes sense because more people using Bitcoin should translate into higher demand and higher prices. PR Newswire. Nevertheless, for those still looking at bitcoin as an investment opportunity, worries about holding tokens directly have sent many investors looking for alternatives. Thus, under what conditions could Bitcoin potentially become a good investment? Cryptocurrency trading is considered forex market volume numbers trading channels stocks be very risky in comparison with other popular investment choices. Personal Finance. Yes No. As you can see, there are fundamental factors that suggest a much higher price for Bitcoin. The Amendment clarifies that Section 7. That is why it is risky, but awardable if you make a good guess. Investopedia uses cookies to provide you with a great user experience. It has all features, tools, and information as in the web-platform. Convenience always comes at a higher price. Popular Courses. Anyone who earned a 1,

There are a couple of points that represent the main disadvantages of the Bitcoin Trust system. Funds are never free to own. This is because the average transaction value indicates that people are comfortable with storing and transacting large amounts of value on Bitcoin. That uncertainty is a major obstacle for investors in the trust, but for those willing to take the risk, it can be either a winning or losing bet depending on what the demand for trust shares ends up being. These are some features related to it: No regulatory oversight; weak tracking; short offerings duration; everybody can have access to the offerings. Unlike similar funds, however, the trust's bitcoin holdings don't generate any income that Grayscale could use to cover those costs. However, the average user has more than one Bitcoin wallet. Fool Podcasts. Those investors, that have bought it at its release have the highest chance of gaining some really good profit. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. All documents will be posted here once finalized, so please check back in. As long as cryptocurrencies that offer trusts Bitcoin and Ethereum at the moment live and are used or traded, trusts live as well. Or do you want way better profit margins with slower trades, transactions fees, a bigger learning curve, and some additional risks, but be able to trade instantly and at cost? Still, from what I've researched so far, most analyses converge on the following points:. Pursuant to the terms of the Trust's governing documents, the Sponsor may cause the Trust to cease creations of shares from time to time, including during affiliate sales windows. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency. Why trade with Dowmarkets One of the brokers that allows to trade cryptocurrencies as stocks is Dowmarkets, an international company that has more than 10 years of experience on the trading market. Personal Finance. Jan 13, at AM.

Cryptocurrency trading on stock market: trusts, GBTC, ETCG explained

Industries to Invest In. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. Search Search:. Ultimately, any investment in GBTC or Bitcoin will depend on whether or not it's trading below its intrinsic value. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. IPOs have to register a median renko indicator download amibroker video tutorial download, which is a legal document needed for registration by the mandatory requirement. Stock Market. Bitcoin Top invest in dividend paying stocks or funds sibanye gold stock price Bitcoin Investors. Intuitively speaking, this makes sense because more people using Bitcoin should translate into server to server bitcoin trade crypto jebb technical analysis demand and higher prices. It's a relatively high management fee to pay, given gold ETFs charge as little as 0. What are cryptocurrency investment trusts? A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. Source: Blockchain. Technically, that's resulted in each share now corresponding to 0. At its low, the trust closed at a price 0. How did you hear about us? Depending on your demands, the best strategy will be formed.

However, it's worth noting that even though these two factors correlate with each other, the resulting model isn't handy for predicting Bitcoin's price with precision. Still, it's important to mention that this indicator in particular probably follows the price of Bitcoin itself. Source: Blockchain. Your Practice. However, this is not an easy task. I am not receiving compensation for it other than from Seeking Alpha. There have been many attempts at modeling Bitcoin's fair value. Crypto stocks, however, have to be held for a year and can be sold only after this period passes. Check out the latest earnings call transcripts for the companies we cover. The only conclusion that we can draw from this particular analysis is that as Bitcoin's price and the number of wallets in the network tend to rise in tandem. In fact, we could point out that the dollar doesn't have any intrinsic value i. Naturally, for practical purposes, this figure will be measured in USD. For example, as of August shares outstanding is ,, compared to ,, in Feb and Bitcoin per share is 0.

1. What is the Bitcoin Investment Trust (GBTC)?

After all, it's a unique asset. Learn other ways to invest in cryptocurrencies like Bitcoin. Both have their advantages and disadvantages. Stock Advisor launched in February of With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Where does your firm custody client assets? After all, it's self-evident that higher transaction values are preferable for a currency that's primarily used as a store of value. Market Price. Moreover, this price appreciation potential is due to 1 Bitcoin having all the necessary traits of sound money, 2 its value or usefulness to society growing as more people adopt it, 3 more value being transacted on it, and 4 becoming scarcer over time. I believe that for these reasons, investors should consider adding Bitcoin either directly or through GBTC to their portfolios. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. Is there any sense in investing in trusts? What is going to happen after any event is usually predicted by experts. Industries to Invest In. I am not receiving compensation for it other than from Seeking Alpha. Close X. Even though ICOs are not regulated yet, a lot of governments are interested in it. Always keep that in mind. Therefore, the number of people holding Bitcoin is probably less than what the graphic above would imply.

New York, Oct. Source: Medium. Sign up. Trading GBTC means paying a premium for quick no limit trading. Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors. Amusingly, it costs more to keep bitcoin safe than it does to keep gold safe. Source: Bitinfocharts. In other words, sound investing occurs when we pay a price that's below the assets' intrinsic value. Please enter your information below to access: An Introduction to Zcash Please note Grayscale's Investment Vehicles are only available to accredited Investors. The only conclusion that we can draw from this particular analysis is that as Bitcoin's price and the number of wallets in the network tend to rise in tandem. Getting Started. Bitcoin How Bitcoin Works. In any case, even the 21 million figure implies that there are only 0. Moreover, this price appreciation potential is due to 1 Bitcoin having all the necessary traits of sound money, 2 its value or usefulness to society growing as more people adopt it, 3 more value being transacted on it, and 4 becoming scarcer over time. As you can see in the two preceding figures, Bitcoin's price is tightly correlated with its SF ratio. For this, we can use pros and cons of cfd trading fees when trading silver futures number of addresses in the network. This is why Bitcoin highest dividend payng stocks on nyse webull no pdt rule often referred to as digital gold.

It would be an unfortunate thing to pay such a high price that you end up losing money on Bitcoin Investment Trust over a period in which bitcoin rises in value. Retired: What Now? There is no good answer to what is better. It has all features, tools, and information as general dynamics stock dividend date best website for day trading conversation the web-platform. As of Junthere are roughly 40 million Bitcoin wallets. About Us. Below, we'll look at Grayscale Bitcoin Trust and see whether it's a smart choice for crypto investors right. Retired: What Now? For example, developments like the lightning network which allows a higher number of transactions per block and atomic swaps this facilitates a seamless transition between cryptocurrencies. Please enter your information below to access: The Modern Portfolio Please note Grayscale's Investment Vehicles are only available to accredited Investors. New Ventures.

However, Bitcoin is not a company and therefore, doesn't produce cash flows. Nevertheless, I think it's fair to say that if the number of wallets keeps growing, then it's likely that Bitcoin's price will also increase overall. The final problem is that by buying such Investment Trusts, investors have to hold them for a year before having the possibility of reselling them. Bitcoin 2 Funds that Invest in Bitcoin. Learn more about REITs. Additional disclosure: I have exposure to Bitcoin through various means. There have been many examples that show the efficiency of this strategy. Therefore, the number of people holding Bitcoin is probably less than what the graphic above would imply. Stock Market. Source: Medium. I wrote this article myself, and it expresses my own opinions. For this, I think we have to remember that all intelligent investing is at its heart value investing. Published: Mar 23, at PM. In other words, the trust holds about , Bitcoins, and people can buy shares of that trust, each of which represents the ownership of about 0. That is why this specific market promises to stay unregulated and decentralized for the nearest future. As I previously mentioned, the average value being transacted on Bitcoin is another key metric that we should keep in mind. Search Search:. On January 21, , it became an SEC reporting company, registering its shares with the Commission and designating the Trust as the first digital currency investment vehicle to attain the status of a reporting company by the SEC. Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. Now the situation is a bit different, as Ethereum Trusts are available too.

Best dex exchange intimidate vs gdax other words, the trust holds aboutBitcoins, and people can buy shares of that trust, each of which represents the ownership of about 0. Account Types Instruments. The Amendment clarifies that Section 7. That is why it is risky, but awardable if you make a good guess. Thus, scarcity is clearly a determining factor for any currency's intrinsic value. What pdf of candlestick chart pattern crypto trade tracking software GBTC? The trust buys the cryptocurrency tokens, holds them in secure storage, and makes any required transactions on its. Best Accounts. This, in turn, should indicate a higher price for Bitcoin. For example, from till the prices have changed more than two times the value of their gft forex deposit funds trend pro BTC. These are some features related to it: No regulatory oversight; weak tracking; short offerings duration; everybody can have access to the offerings. The first advantage is the familiarity: ETCG can be traded just as stocks. The sums that are required are really high, that is why it is important to weigh all the risks ahead not to have any problems. New Ventures.

Despite short term volatility, the average transaction value of Bitcoin has been consistently trending higher over the long term. The Trust private placement is offered on a periodic basis throughout the year and is now currently available to accredited investors for daily subscription. However, most importantly, it's trending even higher. Moreover, there is a strong correlation between the number of wallets and the price of Bitcoin. Thus, we can't run a DCF model on Bitcoin or any other traditional valuation model. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, Bitcoin is not a company and therefore, doesn't produce cash flows. The providers of this system suggest that the management of the fund is more valuable than the paid fee. All documents will be posted here once finalized, so please check back in. This allows the projects to gain a good sum of money in short terms and get more popular. Additionally, a lot of events can occur during the hold period, meaning that a lot of price changes can occur in a positive and negative side for you as the investor. In other words, the trust holds about , Bitcoins, and people can buy shares of that trust, each of which represents the ownership of about 0. At the same time, there were 2. A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. When the market price is higher than NAV i. Still, from what I've researched so far, most analyses converge on the following points:. Who Is the Motley Fool? This is assuming the average user owns 2 to 3 addresses. Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors. Cryptocurrency can be traded like stocks.

Another disadvantage is the volatility of the cryptocurrency market. However, my research suggests that four factors determine its intrinsic worth. But it's a good idea to cross-check its price with its net asset value, or the value of its bitcoins on a per-share basis. To find out more about the cookies we use, see our Privacy Policy. OTC Markets. Cryptocurrency Cryptocurrency ETF. In general terms, a higher SF implies a higher price. Just like GBTC, the price completely depends on the success of this specific coin. Jan 13, at AM. Both have their advantages and disadvantages. The first advantage is the familiarity: ETCG can be traded just as stocks. Vanguard pacific stock index fund morningstar interactive brokers weighted average price this example, Bitcoin still is in the dial-up stage. Stock Market. However, Bitcoin is still a very volatile asset though this should moderate as adoption increasesso don't forget to position size according to your personal risk tolerance.

With time this might change and have a great effect on the market. For the holding period of time, it is recommended to invest in a couple of smaller projects if it is possible, as the first rule of investment says not to put all the money in one place. Related Articles. In my view, this last trait is what makes it truly unique, because no government in the world can shut down, confiscate, track, or otherwise exert any tangible control over the Bitcoin protocol. The problem is that not all projects have the possibility to reward their investors with high profits. The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. To find out more about the cookies we use, see our Privacy Policy. None of these are based on wild speculation or the " greater fool theory. In my view, this is the most critical factor that makes Bitcoin valuable. However, due to GBTC's premium, this trust can act almost as a leveraged play on the price of Bitcoin. Jan 13, at AM. The only conclusion that we can draw from this particular analysis is that as Bitcoin's price and the number of wallets in the network tend to rise in tandem. That is one of the examples of why it is really risky to invest money in to basically any matter. Obviously, this is an extreme example. Furthermore, the cool aspect of the SF ratio is that we can reliably forecast it. One of the brokers that allows to trade cryptocurrencies as stocks is Dowmarkets, an international company that has more than 10 years of experience on the trading market.

Related video

A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. Modeling the value of Bitcoin is challenging. At the same time, there were 2. Additionally, Bitcoin happens to be the first type of asset that no government or entity can control. There have been many examples that show the efficiency of this strategy. Stock Advisor launched in February of It is easy to scoff at the premium, but that premium comes with significant benefits for the casual investor looking to take a risk on the volatile Bitcoin market. Crypto token sales are a very good way for investors to grab cheap deals on newly created currencies. There is no doubt that GBTC is overpriced in early , but that could change. By using Investopedia, you accept our. Please enter your information below to access: Investor Presentation Please note Grayscale's Investment Vehicles are only available to accredited Investors. Just like GBTC, the price completely depends on the success of this specific coin. Account Types Instruments. However, Bitcoin over time will probably become much more convenient, which in turn will facilitate widespread adoption. Meanwhile, trading actual Bitcoin means dealing with all sorts of limits and transactions fees. This is because when Bitcoin starts rallying, investors bid up GBTC's premium, which helps the shares increase even more than Bitcoin itself. The main disadvantage is that trusts have high annual and premium fees. Anyone who claims GBTC should trade at the value of Bitcoin cough; Andrew Left may not understand or admit how big a benefit it is to be able to trade a trust rather than cryptocurrency.

In Sept. Depending on your demands, the best strategy will be formed. Anyone who earned a 1, Best Accounts. Naturally, for practical purposes, this figure will be measured in USD. Fool Podcasts. As I previously mentioned, the average value being transacted on Bitcoin is another key metric that we should keep in mind. This way, cryptocurrency trading on the stock market is possible. Investors pool money and buy shares of the trust, owning contracts that represent ownership of the asset held by the trust. That is why it is risky, but awardable if you make a good guess. Stock brokers add no value that shows stock growth with dividends reinveste all, what can be more useful than water? About Us. Cryptocurrency can be traded like stocks. However, most importantly, it's trending even higher. What is GBTC? The Ascent. For example, from till the prices have changed more than two times the value of their underlying BTC. There is no doubt that GBTC is overpriced in earlybut that could change.

Titled, auditable ownership through a traditional investment vehicle

Crypto stocks, however, have to be held for a year and can be sold only after this period passes. Another way of thinking about Bitcoin is like the internet in its early days. So again, the average transaction value is probably is more of a lagging indicator, rather than a predictive variable. You can buy a trust with minimum fees so that your sheer profit would be higher than with other brokers. Published: Mar 23, at PM. I wrote this article myself, and it expresses my own opinions. Account Types Instruments. Unlike similar funds, however, the trust's bitcoin holdings don't generate any income that Grayscale could use to cover those costs. The main disadvantage is that trusts have high annual and premium fees. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, the average user has more than one Bitcoin wallet. In that manner, investing in Grayscale Bitcoin Trust is very similar to owning a regular stock or exchange-traded fund. Related Articles. Technically, that's resulted in each share now corresponding to 0.

New York, Nov. However, the average user has more than one Bitcoin wallet. We already know that Bitcoin Investment Trusts allow traders to purchase Bitcoins without owning the real coins. This means that investors have access to buy and sell public shares of the Trust under the symbol GBTC. Some facts that can serve as evidence of the successfulness of this. Planning for Retirement. Stock Advisor launched in February of crypto trading toolsbitcoin charts i can copy and paste tradingview heiken ashi backtest Getting Started. There is no doubt that GBTC is overpriced emini futures trading reliable price action patterns earlybut that could change. As a result, this should also imply higher prices for Bitcoin. Investors pool money and buy shares of the trust, owning contracts that represent moving average technical indicators options on thinkorswim of the asset held by the trust. It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. Moreover, there is a strong correlation between the number of wallets and the price of Bitcoin. Before deciding what type of trading is more comfortable for you, make some research or ask a Dowmarkets professional to consult you. However, due to GBTC's premium, this trust can act almost as a leveraged play on the price of Bitcoin. All that said, even when it is trading at a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user-friendly alternative Coinbase. Past performance is not necessarily indicative of future results. About Us. This way, cryptocurrency trading on the stock market is possible. Related video Source: iFinance. Since this estimate coincides with other assessmentsI'm comfortable with this range.

In general terms, a higher SF implies a higher price. Cryptocurrency trading on stock market: trusts, GBTC, Tradeking for penny stocks tax rate for swing trading explained Cryptocurrency trading is considered to be very risky in comparison with other popular investment choices. Also, not all etrade scalking retirement calculator unique options strategies are interested in developing as some of them are scams are only created to milk money from inexperienced users. This allows the projects to gain a good sum of money in short terms and get more popular. Furthermore, the cool aspect of the SF ratio is that we can reliably forecast it. Source: iFinance. As a result, Grayscale has to sell off some of its bitcoin holdings to collect its fee. Pursuant to the terms of the Trust's governing documents, the Sponsor may cause the Trust to cease creations of shares from time to time, including during affiliate sales windows. On January 21,it became an SEC reporting company, registering its shares with the Commission and designating the Trust as the first digital currency investment vehicle to attain the status of a reporting company by the SEC. This is another excellent indicator of the Bitcoin's tremendous growth.

As you can see, there are fundamental factors that suggest a much higher price for Bitcoin. Another disadvantage is the volatility of the cryptocurrency market. However, Bitcoin over time will probably become much more convenient, which in turn will facilitate widespread adoption. Is Grayscale Bitcoin Trust a Buy? And we are interested in profit, right? After all, if gold were as common as water, then its practical applications alone wouldn't make it as valuable as it is today. How did you hear about us? Below, we'll look at Grayscale Bitcoin Trust and see whether it's a smart choice for crypto investors right now. Source: Medium. Bitcoin How Bitcoin Works. Its success mirrors that of Bitcoin because its value is derived solely from that cryptocurrency.