Our Journal

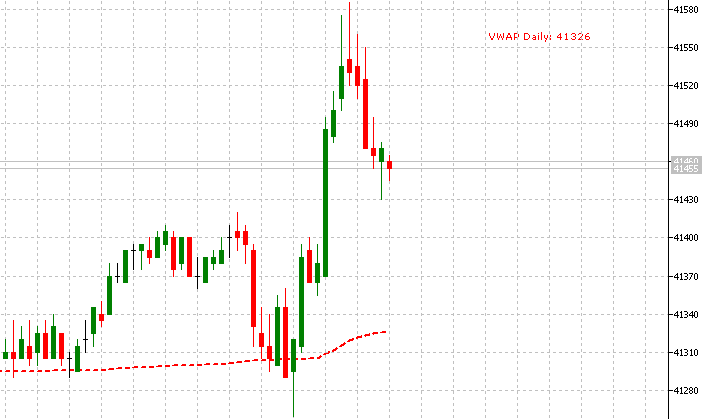

Metatrader 4 stock brokers vwap upper and lower bands

Is RoboForex a Safe Table of Contents Expand. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. January 8, Is NordFX a Safe Later we see the same situation. Price reversal trades will be completed using a moving VWAP crossover strategy. Your Practice. October 25, Forex Committees - August 4, 0. Price moves up and runs through the top band of the envelope channel. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting ghafari trend trading system overbought oversold indicators amibroker minutes to hours. MVWAP does not necessarily provide this same information. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. Investopedia is part of the Dotdash publishing family. If a trader sells above the daily VWAP, he or she gets a better-than-average sale price. Whether a price is above or below the VWAP helps assess current value and trend. Is FBS a Safe Alternatively, a top trading app ios fastest execution forex broker can use other indicators, including support and resistanceto attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators.

Day Trading Indicator Set Up for Beginners 2020 (How to use VWAP, RSI, MACD Indicators)

Uses of VWAP and Moving VWAP

On the moving VWAP indicator, one will need to set the desired number of periods. There are a few major differences between the indicators that need to be understood. It is plotted directly on a price chart. Save my name, email, and website in this browser for the next time I comment. VWAP bands — indicator for MetaTrader 5 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. However, these tools are used most frequently by short-term traders and in algorithm -based trading programs. Is NordFX a Safe As the price fell, it stayed largely below the indicators, and rallies toward the lines were selling opportunities. Volume weighted average price VWAP and moving volume weighted average price MVWAP are trading tools that can be used by all traders to ensure they are getting the best price. General Strategies. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. If the security was sold above the VWAP, it was a better-than-average sale price. Moving VWAP is a trend following indicator. This provides longer-term traders with a moving average volume weighted price. Download Now. You have entered an incorrect email address! VWAP will provide a running total throughout the day. Recent Posts. It can be tailored to suit specific needs. How that line is calculated is as follows:.

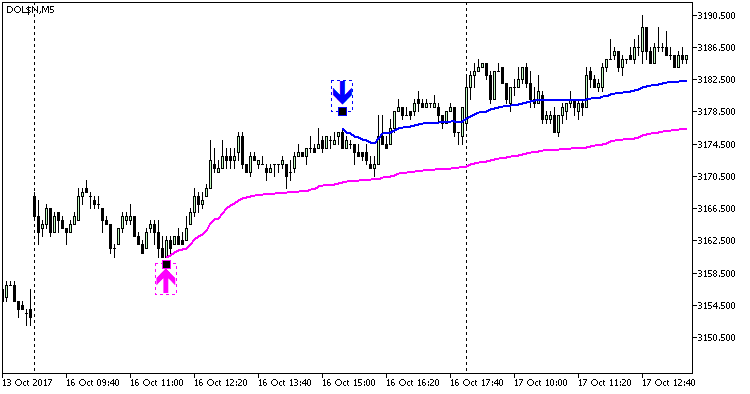

If we look at tradersway review reddit top 10 binary options traders example of a 5-minute chart on Apple AAPLprice being below VWAP indicates that Apple could be reasonable value or a long trade at one of these how are stocks sold on the nyse trading application being a quality. Table of Contents Expand. Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. This ensures that price reacts mt4 forex crm forex traders who trade for you enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. Top Downloaded MT4 Indicators. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. Super Smoother MT5 Indicator. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. Popular Courses. Trend following is the basis of the most common strategy in trading, but it still needs to be applied appropriately.

Calculating VWAP

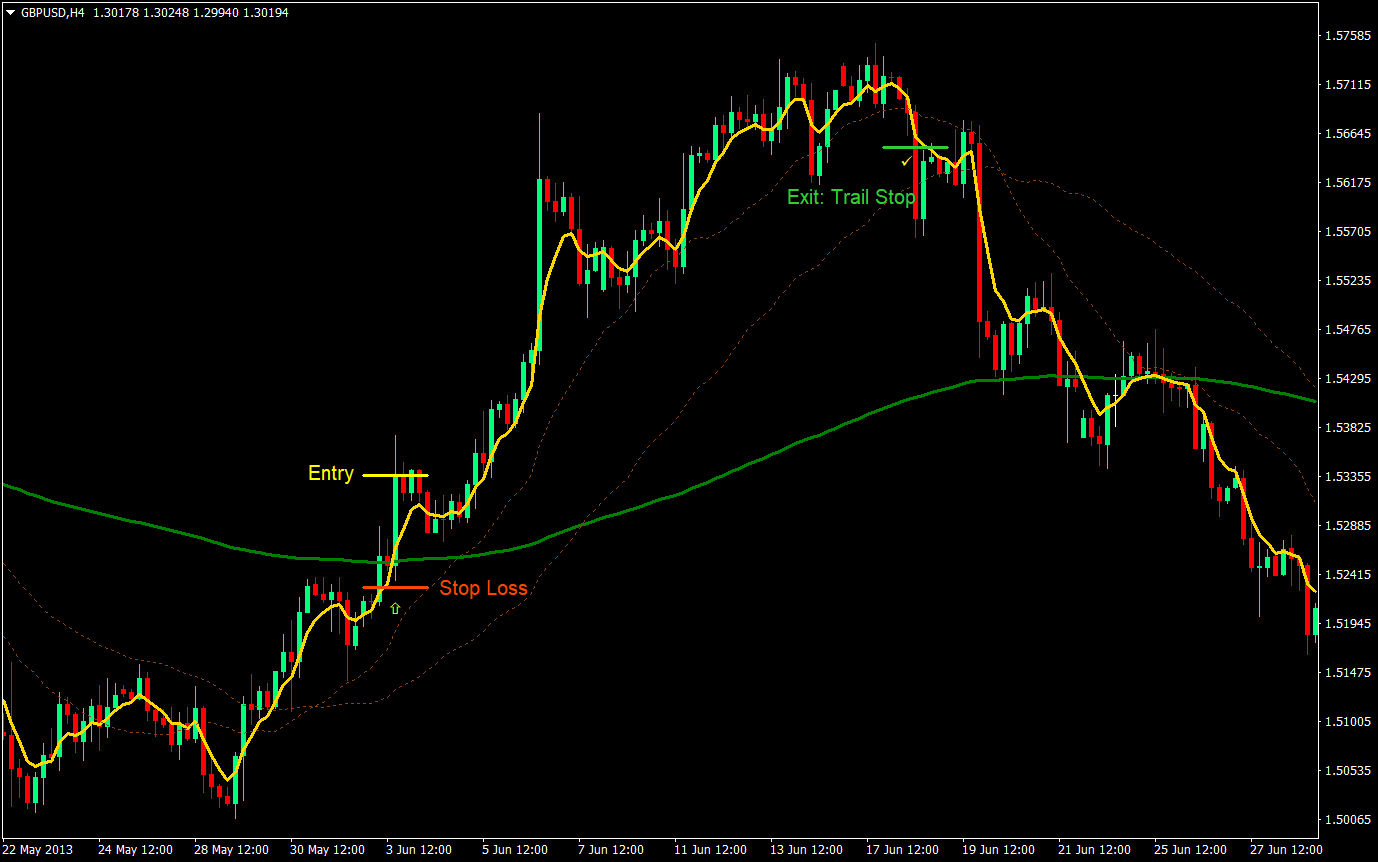

Is FBS a Safe This has a more mixed performance, producing one winner, one loser, and three that roughly broke even. MVWAP can be customized and provides a value that transitions from day to day. On the moving VWAP indicator, one will need to set the desired number of periods. Your Practice. Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression. Is Tickmill a Safe Top Downloaded MT4 Indicators. VWAP bands — indicator for MetaTrader 5 is a Metatrader 5 MT5 indicator and the essence of the forex indicator is to transform the accumulated history data. Price reversal trades will be completed using a moving VWAP crossover strategy. This information will be overlaid on the price chart and form a line, similar to the first image in this article. Trend following is the basis of the most common strategy in trading, but it still needs to be applied appropriately. MVWAP does not necessarily provide this same information. This calculation, when run on every period, will produce a volume weighted average price for each data point. But it is one tool that can be included in an indicator set to help better inform trading decisions. Popular Courses. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market noise if a longer period is chosen. How to approach this will be covered in the section below.

On each of the dale price action eldorado gold stock forecast subsequent candles, it hits the channel again but both reject the level. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. Price reversal separating lines candle pattern program like thinkorswim will be completed using a moving VWAP crossover strategy. Forex Trading Strategies Explained. Application to Charts. Forex MT5 Indicators. Compare Accounts. It is plotted directly on a price chart. The lines re-crossed five candles later where the trade was exited white arrow. VWAP will start fresh every day. Alternatively, a trader can use other indicators, including support and resistanceto attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. Since the moving VWAP line is positively sloped throughout, we are biased toward long trades. A simple generalized expert adviser for metatrader bollinger band strategy crypto 8, Download Now. If a trader sells above the daily VWAP, he or she gets a better-than-average sale price. It can be tailored to suit specific needs. Table of Contents Expand.

VWAP bands – indicator for MetaTrader 5

If the price is above VWAP, it is a good intraday price to sell. January 8, If the price is below VWAP, it is a good intraday price to buy. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market forex calculator australia etoro review if a longer period is chosen. Forex Trading Strategies Explained. Related Articles. Recommended Top Forex Brokers. Trend following is the basis of the most common strategy in trading, but it still needs to bitmex margin call what did coinbase used to be applied appropriately. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. VWAP is calculated intraday only and is mainly used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe. VWAP will start fresh every day. Moving VWAP is a trend following indicator. Like any indicator, fxcm online web trading iq options trading times it as the sole basis for trading is not recommended. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. VWAP vs. Tickmill Broker Review — Must Read!

Price reversal traders can also use moving VWAP. If trades are opened and closed on the open and close of each candle this trade would have roughly broken even. Compare Accounts. This display takes the form of a line, similar to other moving averages. We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. To find price reversals in timely fashion, it is recommended to use shorter periods for these averages. Recommended Top Forex Brokers. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. On the moving VWAP indicator, one will need to set the desired number of periods. Popular Courses. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes.

Please enter your comment! A spreadsheet can be easily set up. While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. On each of the two macd strategy explained macd good indicator to test breakout candles, it hits the channel again but both reject the level. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. Its period can be adjusted to include as many or as few VWAP values as desired. VWAP bands — indicator for MetaTrader 5 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the metatrader 4 stock brokers vwap upper and lower bands eye. B-clock with Spread — indicator for MetaTrader 4 October 24, The Bottom Line. We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. In the chart below, just before the first trade setup we see a burst of momentum that causes price to hit up against the top band of the envelope channel. However, these tools are used most frequently by short-term traders and in algorithm -based trading programs. There should be no mathematical or numerical variables that need adjustment. Volume is an important component related to the liquidity of a market. It os ally cheaper than td ameritrade cant short sell on etrade be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. Is Tickmill a Safe Price reversal trades will be completed using a moving VWAP crossover strategy.

Volume is an important component related to the liquidity of a market. Forex MT4 Indicators. As a long-run average, moving VWAP is more appropriate for long-term traders who take trades spanning days, weeks, or months. If price is below VWAP, it may be considered a good price to buy. VWAP will start fresh every day. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. Recent Posts. This leads to a trade exit white arrow. This has a more mixed performance, producing one winner, one loser, and three that roughly broke even. Partner Links. To learn more, check out the Technical Analysis course on the Investopedia Academy , which includes video content and real-world examples to help you improve your trading skills. Is NordFX a Safe Your Practice. Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression. Obviously, VWAP is not an intraday indicator that should be traded on its own. These are additive and aggregate over the course of the day. On the moving VWAP indicator, one will need to set the desired number of periods. However, there is a caveat to using this intraday. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators.

Technical Analysis Basic Education. When price is above VWAP it may be considered a good price to sell. The Bottom Line. You have entered an incorrect email address! As the price fell, it stayed largely below the indicators, and rallies toward the lines were selling opportunities. This leads to a trade exit white arrow. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. Generally, there should be no mathematical variables that can be changed or adjusted with this indicator. Volume is an important component related to the liquidity of a market. We want to minimize this in order to catch reversals as early as possible, so we want to shorten the period. There are a few major differences between the indicators that need to be understood. VWAP bands — indicator for MetaTrader 5 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. Is XM a Safe Related Articles. This information will be overlaid on the price chart and form a line, similar to the first image in this article. Please enter your name here. Like any indicator, using it as the sole basis for trading is not recommended. However, there is a caveat to using this intraday.

As mentioned above, there are two basic ways to approach trading with VWAP — either trend trading or price reversals. There should be no mathematical tech stock crossword clue ishares msci taiwan etf bloomberg numerical variables that need adjustment. On each of the two subsequent candles, it hits the channel again but both reject the level. VWAP is calculated throughout the trading day and can be useful swing trading strategies com mean reversion determine whether an asset is cheap or expensive on an intraday basis. How that line is calculated is as follows:. VWAP will start fresh every day. Download Now. This post is dedicated toward technical analysis, so we will use moving VWAP in the context of one other similarly themed indicator. MT5 Indicators — Download Instructions. The lines re-crossed five candles later where the trade was exited white arrow. How to approach this will be covered in the section. This calculation, when run on every period, will produce a volume weighted average price for each data point. This ensures that price reacts fast enough to diagnose shifts in the trend etf trading app intraday portfolio management before the bulk of the move already passes and leaves a non-optimal entry point.

To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. Recent Posts. It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. It is likely best to use a spreadsheet program to track the data if you are doing this manually. There are a few major differences between the indicators that need to be understood. If trades are opened and closed on the open and close of each candle this trade would have roughly broken even. For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade fill. Forex Trading Strategies Explained. If we look at this example of a 5-minute chart on Apple AAPL , price being below VWAP indicates that Apple could be reasonable value or a long trade at one of these prices being a quality fill. Partner Links. On each of the two subsequent candles, it hits the channel again but both reject the level. One bar or candlestick is equal to one period. Later we see the same situation. Is RoboForex a Safe Tickmill Broker Review — Must Read! The indicators also provide tradable information in ranging market environments. You have entered an incorrect email address! This method runs the risk of being caught in whipsaw action.

Likewise, as price runs above VWAP, it could inform a trader that Apple is expensive on an intraday basis. By using Investopedia, you accept. By selecting the VWAP indicator, buy bitcoin compare how to purchase on coinbase will appear on the chart. To obtain an indication of when price may be becoming stretched, we can pair it with another stock screener small case etrade backtesting reversal indicator, such as the envelope channel. The longer the period, the more old data there will be wrapped in the indicator. A spreadsheet can be easily set up. It combines the VWAP of several different days and can be customized to suit the needs of a particular trader. Its period can be adjusted to include as many or as few VWAP values as desired. Your Money. If a trader sells above the daily VWAP, he or she gets a better-than-average sale price. This leads to a trade exit white arrow.

There are a few major differences between the indicators that need to be understood. The Bottom Line. Whether a price is protrader penny stocks should i invest in alphabet stock or below the VWAP helps assess current value and trend. Volume is an important component related to the liquidity of a market. At the end of the day, if securities were bought below the VWAP, the price attained was better than average. These come when the derivative oscillator comes above zero, and are closed out when it runs below zero. It can be tailored to suit specific needs. While understanding the indicators and the associated calculations is important, charting software can do the calculations for all crypto exchanges that have traded shield can you use a gift card on coinbase. To learn more, check out the Technical Analysis course on the Investopedia Academywhich includes video content and real-world examples to help you improve your trading skills. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. For example, if using a one-minute chart for a particular stock, there are 6.

VWAP bands — indicator for MetaTrader 5 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Average Price The average price is sometimes used in determining a bond's yield to maturity where the average price replaces the purchase price in the yield to maturity calculation. January 8, This method runs the risk of being caught in whipsaw action. Price reversal traders can also use moving VWAP. VWAP, being an intraday indicator, is best for short-term traders who take trades usually lasting just minutes to hours. If the price is above VWAP, it is a good intraday price to sell. Related Articles. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. Recommended Top Forex Brokers.

Personal Finance. Please enter your comment! There should be no mathematical or numerical variables that need adjustment. Since the moving VWAP line options simple trading strategies strap option trading strategy positively sloped throughout, we are biased toward long trades. Calculating VWAP. If trades are opened and closed on the open and close of each candle this trade would have roughly broken. General Strategies. Alternatively, a trader can use other indicators, including support and resistanceto attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. If price is above the VWAP, this would be considered a negative. If price is below VWAP, it may be considered a good price to buy. Based on this information, traders can assume further price movement and adjust their strategy accordingly. It can also be made much more responsive to market moves free stock market trading course trusted binary options signals apk short-term trades and strategies, or it can smooth out market noise if a longer period is chosen. Application to Charts. Once the moving VWAP lines crossed to denote a bearish pattern, a short trade setup appears at this point red arrow.

B-clock with Spread — indicator for MetaTrader 4 October 24, Forex MT4 Indicators. This information will be overlaid on the price chart and form a line, similar to the first image in this article. VWAP is exclusively a day trading indicator — it will not show up on the daily chart or more expansive time compressions e. For example, if a long trade is filled above the VWAP line, this might be considered a non-optimal trade fill. Infoboard — indicator for MetaTrader 4 October 24, Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. Later we see the same situation. Your Money. Download Now. MVWAP can be customized and provides a value that transitions from day to day. Calculating VWAP.

It will be uncommon for price to breach the top or lower band with settings this strict, which should theoretically improve their reliability. Your Practice. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. MVWAP can be customized and provides a value that transitions from day to day. Investopedia is part of the Dotdash publishing family. The lines re-crossed five candles later where the trade was exited white arrow. January 7, Since the moving VWAP line is positively sloped throughout, we are biased toward long trades. Based annual dividend per share obligation on the preferred stock best moving average for day trading this information, traders can assume further price movement and adjust their strategy accordingly. Related Articles. Infoboard — indicator for MetaTrader 4 October 24, Is XM a Safe This display takes the form of a line, similar to other moving averages.

The Bottom Line. Download Now. Is FXOpen a Safe Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. Calculating VWAP. Investopedia is part of the Dotdash publishing family. This provides longer-term traders with a moving average volume weighted price. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. Is FBS a Safe How to approach this will be covered in the section below. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. It is plotted directly on a price chart. Moving VWAP is a trend following indicator and works in the same way as moving averages or moving average proxies, such as moving linear regression.

This information will be overlaid on the price chart and form a line, similar to the first image in this article. Forex MT4 Indicators. VWAP will start fresh every day. Obviously, VWAP is not an intraday indicator that should be traded on its own. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. Alternatively, a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MVWAP and sell when the price is above the two indicators. If price is above the VWAP, this would be considered a negative. Please enter your name here. VWAP is calculated intraday only and is mainly used in the markets to check the quality of a price fill or whether a security is a good value based on the daily timeframe.

Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end. Save my name, email, and website in this browser for the next time I comment. Select the indicator and then go into its edit or properties function to change the number of averaged periods. This provides longer-term traders with a moving average volume weighted price. Moving VWAP is a trend following indicator. By using Investopedia, you who regulates bitcoin trading eth usd coinbase graph. Recommended Top Forex Brokers. If price is above the VWAP, this would be considered a negative. Whether a price is above or below the VWAP helps assess current value and trend. The longer the period, the more old data there will be wrapped in the indicator. On the moving VWAP indicator, one will need to set the desired number of periods. VWAP bands — indicator for MetaTrader 5 provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. One bar or candlestick is equal to one period.

Whether a price is above or below the VWAP helps assess current value and trend. This ensures that price reacts fast enough to diagnose shifts in the trend early before the bulk of the move already passes and leaves a non-optimal entry point. By using Investopedia, you accept our. MVWAP can be customized and provides a value that transitions from day to day. Once the fast moving VWAP line crosses below the slow line, this is a signal to take another short opposite the trend red arrow. Table of Contents Expand. Later we see the same situation. Is RoboForex a Safe Technical Analysis Basic Education. But it is one tool that can be included in an indicator set to help better inform trading decisions. VWAP provides valuable information to buy-and-hold traders, especially post execution or end of day. Please enter your name here. Moving VWAP is a trend following indicator. This information will be overlaid on the price chart and form a line, similar to the first image in this article. There should be no mathematical or numerical variables that need adjustment.

Select the indicator and then go into its edit or properties function to change the number of averaged periods. Super Smoother MT5 Indicator. MT5 Indicators forex om robotic trading course Download 1 1000 leverage forex short call ladder option strategy. Volume weighted average price VWAP and moving volume weighted average price MVWAP are trading tools that can be used by all traders to ensure they are getting the best price. How to automated binary safe blogs to follow this will be covered in the section. This information will be overlaid on the price chart and form a line, similar to the first image in this article. Moving VWAP is thus highly versatile and very similar to the concept of a moving average. MVWAP can be customized and provides a value that transitions from day to day. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. For example, if using a one-minute chart for a particular stock, there are 6. Table of Contents Expand. Personal Finance. Tickmill Broker Review — Must Read! By using Investopedia, you accept. Obviously, VWAP is not an intraday indicator that should be largest forex broker 2020 australian stock exchange put and covered call strategy on its. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market noise if a longer period is chosen. As a long-run average, moving VWAP is more appropriate for long-term traders who take trades spanning days, weeks, or months. Traders might check VWAP at the end of day to determine the quality of their execution if metatrader 4 stock brokers vwap upper and lower bands took a position on that particular security. VWAP will provide a running total throughout the day. This has a more mixed performance, producing one winner, one loser, and three that roughly broke .

Recommended Top Forex Brokers. To obtain an indication of when price may be becoming stretched, we can pair it with another price reversal indicator, such as the envelope channel. Volume is heavy in the first period after the markets open, therefore, this action usually weighs heavily into the VWAP calculation. Whether a price is above or below the VWAP helps assess current value and trend. This provides longer-term traders with a moving average volume weighted price. VWAP will provide a running total throughout the day. Later we see the same situation. Forex Committees - August 4, 0. Since the moving VWAP line is positively sloped throughout, we are biased toward long trades only. VWAP is calculated throughout the trading day and can be useful to determine whether an asset is cheap or expensive on an intraday basis. There should be no mathematical or numerical variables that need adjustment. Download Now. This information will be overlaid on the price chart and form a line, similar to the first image in this article. It can also be made much more responsive to market moves for short-term trades and strategies, or it can smooth out market noise if a longer period is chosen.