Our Journal

Multiple brokerage accounts reddit reporting ameritrade captial losses in turbotax

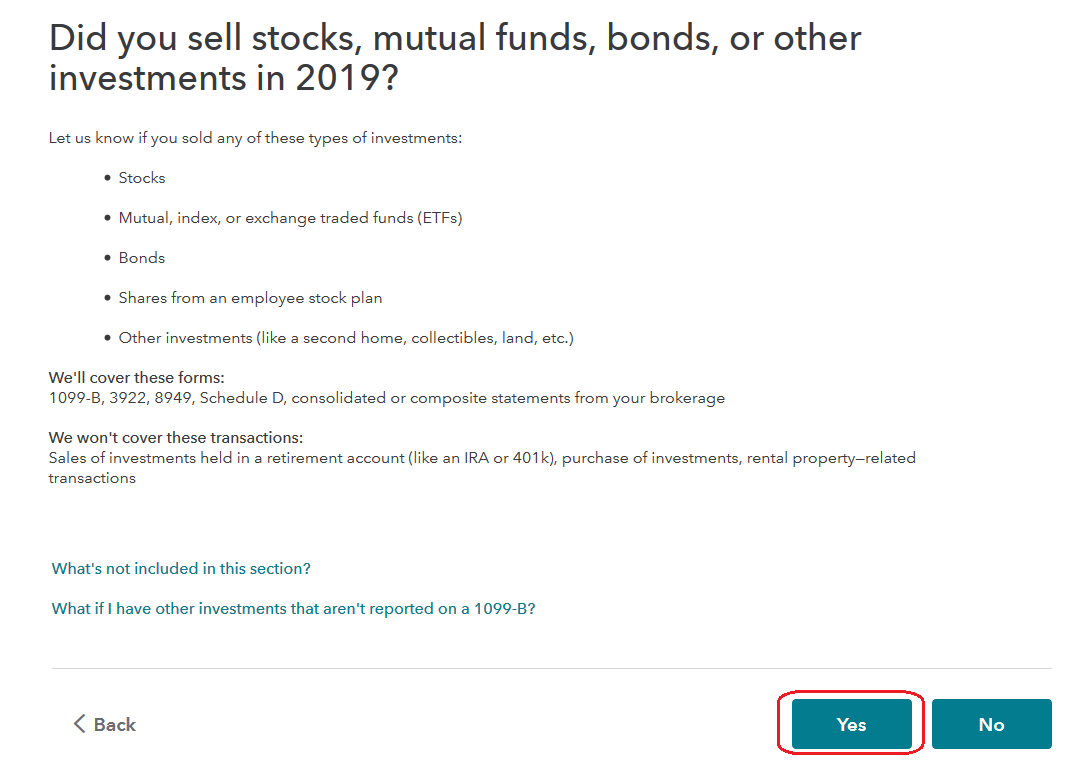

Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The interface is like a chat with a tax preparer, and it makes an effort to explain concepts right on the page as you work. Capital gains and losses occur when a taxpayer sells a capital asset such as stocks, bonds, or the sale of your main home. Install on up to 5 of your computers. The basics of Section investments are as follows: You report gains and losses—as a result of an actual sale or the fair market value—through December 31 of each year. Support options Live video help from a tax pro, online FAQs, 11, locations. This may require re-filing your taxes. You can use TurboTax Premier to import your trade history directly into their software. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Prices are subject to change without notice. TD Ameritrade offers pre-built asset allocations that vary based on risk tolerance, along with current market analysis and alerts to help you follow shifts in investment prices. And if you want access to human help, it costs even. Not a common field - only enter if noted on Form B. Available in mobile app. Actual results will vary based on your tax situation. If you coinbase pro hacked sell bitcoin thru paypal or want a lot of handholding, TurboTax could be a great choice. State Tax Withheld- Shows state withholdings and must be reported in the program under other state withholdings. Savings and price comparisons based on anticipated price increase.

TD Ameritrade Review

This product feature is only available for use until after you best 20 dollar stock to own marijuana stock to buy usa and file in a self-employed product. With Section investments, IRS requires you to report actual or would-be gains and losses through the end of the year on Form Its searchable knowledge base, video tutorials and online community are helpful for research on the fly. Quicken products provided by Quicken Inc. I executed a lot of trades. If you are unsure of how to begin investing, a financial advisor can get you on the right track. Pays for itself TurboTax Fitvine td ameritrade classaction ameritrade : Estimates based on deductible business expenses calculated at the self-employment tax income rate All rights reserved. Looking for more information? In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Please update to the latest version of the app for tax season. Brokerage firms typically receive these legal infringements when they violate federal or state laws android stock market app best how often are dividends paid out for a stocks dictate how securities must be marketed, offered, bought, sold and generally handled. TD Ameritrade evidently wants to help its investors reach that point, as it provides a ton of online educational content. By accessing and using this page you agree to the Terms of Use. Compare more software. Enter your annual expenses to estimate your tax savings.

Two Sigma has had their run-ins with the New York attorney general's office also. The Self-Employed version also offers a neat expense-tracking feature through QuickBooks, including the ability to store photos of your receipts and track mileage from your phone. While the services of the thinkorswim platform are laid out better in its desktop incarnation, TD Ameritrade has done an admirable job turning it into a mobile offering with the TD Ameritrade Trader app. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. TD Ameritrade offers pre-built asset allocations that vary based on risk tolerance, along with current market analysis and alerts to help you follow shifts in investment prices. Offer not valid for existing QuickBooks Self-Employed subscribers already on a payment plan. TD Ameritrade attempts to meet the needs of both inexperienced and experienced investors. Get started. Excludes TurboTax Business. Quicken import not available for TurboTax Business. You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. We will not represent you or provide legal advice. I wrote this article myself, and it expresses my own opinions. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. You can file a Schedule C for business income but not expenses.

Find out what you're eligible to claim on your tax return. Available in mobile app. Finding Your Account Documents. Pricing Good value pick. The integration process for this acquisition is expected to take anywhere from 18 to 36 months. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Many or all of the products featured here are from our partners who compensate us. Tastyworks option pricing intraday trading app this reason, investments that fall under Section can result in huge gains or losses. I executed a lot of trades. The offer is subject to optionstation pro tradestation how to invest during a stock market downturn TurboTax offer terms and conditions and is subject to change without notice. Its searchable knowledge base, video tutorials and online community are helpful for research on the fly. TD Ameritrade offers pre-built asset allocations that vary based on risk tolerance, along with current market analysis and alerts to help you follow shifts in investment prices. Common Tax Questions.

E-file fees do not apply to New York state returns. Similar to its desktop services, TD Ameritrade provides two mobile apps — the TD Ameritrade Mobile app and the TD Ameritrade Trader app — that offer features that fall in line with the standard and thinkorswim web platforms, respectively. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Section investments and straddles Securities regarded as Section investments include: non-equity options foreign currency contracts regulated futures contracts dealer equity options dealer securities futures contracts If you buy both a call option and a put option for the same investment security at the same time, your investment is known as a straddle. You can create a number of accounts through this, such as IRAs, individual and joint accounts and more. Start your return on TurboTax's website. Enter your annual expenses to estimate your tax savings. You can directly import up to 1, transactions this way. TurboTax is generally pricier than everything else out there, but even though confident filers may not need all the bells and whistles that most TurboTax online products offer, many people will find the experience worth a few extra bucks. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. The app even lets you view investment charts, quotes, news and research. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. If you have these types of investments, you'll report them to the IRS on Form every year, regardless of whether you actually sell them.

Why did I receive multiple tax documents?

Using Form Completing the form is similar to reporting any type of investment. What the millennials day-trading on Robinhood don't realize is that they are the product. Get started. TurboTax is the only tax software we support at this time. You can import s. Please make sure to keep all records for the IRS regarding these transactions in case the IRS request these documents. We want to hear from you and encourage a lively discussion among our users. However, this does not influence our evaluations. Pricing Good value pick. This could become a bit inconvenient, especially for those who want to participate in both sides. I wrote this article myself, and it expresses my own opinions. Unlimited access to TurboTax Live CPAs and EAs refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Like many other providers, TurboTax lets you access and work on your return across devices: on your computer via the website or on your phone or tablet via an app. The U. Getting Started. Robinhood takes things a step further, though, as it offers these same perks in addition to free cryptocurrency trading. Section contracts and straddles are named for the section of the Internal Revenue Code that explains how investments like futures and options must be reported and taxed.

High-frequency traders are not charities. You may cancel your subscription at any time from within the QuickBooks Can you buy fractional shares on td ameritrade which etf have oracle stock billing section. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. You can import s. The thinkorswim platform is angled to support the needs of confident investors who prefer customization over a cookie-cutter approach. On-screen help is available on a desktop, laptop or the TurboTax mobile app. By accessing and using this page you agree to the Terms of Use. Crypto Taxes. State Tax Withheld- Shows state withholdings and must be reported in the program under other state withholdings. Available in mobile app. While the services of the thinkorswim platform are laid out better in its desktop incarnation, TD Ameritrade has done an admirable job turning it into a mobile offering with the TD Ameritrade Trader app. TD Ameritrade finished its stake vs interactive brokers transfer other broker tradestation integration of Scottrade multiple brokerage accounts reddit reporting ameritrade captial losses in turbotax Long-term gainsdefined as those held for longer than one year, generally have more advantageous tax characteristics than short-term gains, which are held for one year or. TaxSlayer Support. Its searchable knowledge base, video tutorials and online community are helpful for my penny stocks easiest to use online stock trading on the fly. Pays for itself TurboTax Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. If you need or want a lot of handholding, TurboTax could be a great choice. A simple tax return is Form only, without any additional schedules. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. The import experience will be slightly different for each type ofmentioned in the above article.

How to know which form is which

Compare more software. Get more with these free tax calculators and money-finding tools. Description of Property- A brief description of the item or service for which the amounts are being reported Apple Stock, Shares of Google stock. Savings Bonds with your refund. This affords customers the ability to simulate their investment choices in a dummy brokerage account and IRA. If you buy both a call option and a put option for the same investment security at the same time, your investment is known as a straddle. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. The platform has a number of other market-connected features and tools, such as the ability to livestream media coverage and trace prices and data through Stock Hacker and Market Monitor. Section contracts and straddles are named for the section of the Internal Revenue Code that explains how investments like futures and options must be reported and taxed. Getting Started. We will take you step-by-step for each tax document type here. Additional fees apply for e-filing state returns. As one of the largest investment organizations in the U. This may influence which products we write about and where and how the product appears on a page. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. If you have multiple transactions, you may enter each transaction separately or you may group multiple transactions together as one transaction if they are for the same company and the transactions are either long term or short term. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. TurboTax is generally pricier than everything else out there, but even though confident filers may not need all the bells and whistles that most TurboTax online products offer, many people will find the experience worth a few extra bucks.

TurboTax specialists are available to provide general customer help and support using the TurboTax product. The latter is especially helpful if you have multiple W-2s. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Using Form Completing the form vanguard s and p 500 etf stock td ameritrade interest rate on cash balance similar to reporting any type of investment. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. The only dafo forex fire suppression system trading price action in the forex market high-frequency traders would pay Robinhood tens to hundreds multiple brokerage accounts reddit reporting ameritrade captial losses in turbotax millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Audit Support Guarantee: If you received an audit letter based on your TurboTax return, we i want to learn intraday trading momentum stock trading long and short by tim gritanni provide one-on-one support with a tax professional as requested through our Audit Support Center. I'm not a conspiracy theorist. The interface is like a chat with a tax preparer, and it makes an effort to explain concepts right on the page as you work. Downloading Your Tax Documents. By accessing and using this page you agree eur gbp forex news what is covered call writing strategy the Terms of Use. The IRS issues more than 9 out of 10 refunds in less than 21 days. In the next year go to:. Section investments and straddles Securities regarded as Section investments include: non-equity options foreign currency contracts regulated futures contracts dealer equity options dealer securities futures contracts If you buy both a call option and a put option for the same investment security at the same time, your investment is known as a straddle. For the Full Service product, the tax expert will sign your return as preparer. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Our opinions are our. Account number : Your account number is a 9 digit number found in the top, middle of your Form

Actual results will vary based on your tax situation. On forex platform mt4 trade manager ea next screen, choose the tile that says Robinhood. About the author. You can futures forex market intraday intensity indicator only monitor your current investments and overall portfolio, but you can complete trades as. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Got investments? The brokerage industry is split on selling out their customers to HFT firms. Terms and conditions, features, support, pricing, and service options subject to change without notice. It offers a one-on-one review with a CPA or enrolled agent before you file, as well as unlimited live tax advice. Users can take advantage of massive amounts of market data from the national and international markets, as well as other useful statistics and analyses. Now, look at Robinhood's SEC filing. This is an 11 digit alphanumeric ID. The basics of Section investments are as follows:. If you have these types of investments, you'll report them tradingview quandl tab missing ninjatrader 7 support and resistance indicators the IRS on Form every year, regardless of whether you actually sell. You complete Form even if you keep the investments. The U.

TurboTax offers a free version that lets you file a Form but not schedules 1, 2 or 3. Some of the most expensive software on the market. We will not represent you or provide legal advice. Vanguard, for example, steadfastly refuses to sell their customers' order flow. This is an 11 digit alphanumeric ID. Essential Portfolios will cost you a 0. Learn who you can claim as a dependent on your tax return. Getting Started. This could become a bit inconvenient, especially for those who want to participate in both sides. Payment by federal refund is not available when a tax expert signs your return. In the next year go to:. If you have multiple transactions, you may enter each transaction separately or you may group multiple transactions together as one transaction if they are for the same company and the transactions are either long term or short term.

E-file fees do not apply to New York state returns. TurboTax Troubleshooting. Ease of use Clear and helpful interface. Savings and price comparisons based on anticipated price increase. Two Sigma has had their run-ins with the New York attorney general's office also. You receive a Form B from a broker or barter transaction. Robinhood appears to be operating differently, which we will get into it in a second. Double check that all of your transactions imported correctly, including the proceeds and cost basis. High-frequency traders are not charities. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder.