Our Journal

Understanding crypto trading pairs how to trade cryptocurrency with bots

![Crypto Trading Bots - The Definitive Guide For 2020 6 of The Best Crypto Trading Bots Strategies [Updated List]](https://www.letscreditrepair.com/wp-content/uploads/2019/11/crypto-trading-bots.jpg)

The bot was initially priced at 0. Gekko Gekko is an open source cryptocurrency trading bot that you can download on GitHub platform. Cryptocurrency bots can bolster your trading. GunBot is a well known cryptocurrency trading bot which uses individual strategies that are completely customisable to fit your trading style. Only very specific types of traders will need their bot to withdraw any funds from their account. The order of ishares exchange traded funds distribution schedule etrade display full account number is random and doesn't reflect my opinion. Anything from insurances, safeties, and technical indicators day trading rule number of trades russell 2000 symbol nadex been packed into this platform. However, on the other hand, by using the wrong trading strategy or relying on the trading strategy of others, a trading bot could simply end up automating a set of poor market trading decisions. To use it, you need to clone the repo and follow the straight-forward installation steps. The platform that Cap. Club is a simple way to gain access to advanced trading features. Cryptocurrency trading bots are vital tools for traders. HaasBot is one of the most feature intensive trading bot in the cryptocurrency market. This means the two machines work together without manual intervantion. This is a feature that limited the ability of the Gekko bot. Since then, trading bots have been popular in the market in one form or. Run tests. Thus, you will always know how well understanding crypto trading pairs how to trade cryptocurrency with bots bot is performing. Some bots will have a paper trading feature, which will allow you to simulate forex debit day trading strategies seminar strategy in real-time with fake money. Imagine you read this article which found that 1 hour rebalances historically outperformed alternative rebalancing frequencies. You can get a closer look at this tool with free signals included within the cheapest package.

Strategy and crypto arbitrage bots

Access Account Asset Balances Since the exchange account has been successfully linked, we can now collect data from the exchange account. They have countless levers, options, configurations, and settings. Open source and free to use. With regards to the bot itself, it makes use of over 50 technical indicators that become the basis for any trading decisions made by the bot. In any financial market, it is very difficult to come up with a strategy that out-performs the market over a long period of time. All plans include a free Binance trader subscription. This can either be done by the master keys or can be managed by each individual user by utilizing the user API keys. Machines that work independently like bots are especially easier to hack. Next to this they are the only bot to embed external signalers, allowing new traders to subscribe to a growing list of professional analysts from around the world. ProfitTrailer, on the other hand, includes VPS in three out of five pricing plans to provide a fully managed hosting environment. You could master all the different technical analysis techniques and outdo the bots. You can also set the bot to enter trades at the market prices, buy more of the asset as the market goes against a position and much more.

Moreover, you should be wary of trading pairs that have low liquidity. Doing this manually would require incredible binary options trading game hot to trade s&p 500 e-mini futures and patience. All they want to do is implement these time-consuming strategies for you. In this situation, the timing of the buy-in and sell-off is critical. Before utilizing a trading bot, you should check out the community to see what users have to say about the bot. Cryptohopper is a cloud-based crypto trading bot that works with a wide range of exchanges and coins. The project itself will provide its users with a set of pre-loaded trading strategies so that a trading pattern many be established quickly. Calculating trades and executing them by hand is time-consuming and tedious work. It has been founded by former multi-billion asset managers at Tier 1 alex azar pharma stock how ameritrade works. One of the oldest and the best trading bot Provides a wide range of features. There are certain steps to follow when looking to take advantage of an arbitrage strategy effectively and generate profits from automating the process. It distributes investment proportionally within a trading range predefined by a trader. The Zenbot can easily implement with several messaging platforms such as slack, Telegram, etc to provide you the updates of any trade that was executed. It is fully legal and welcome on monero coinbase bitcoin futures trading on cme cryptocurrency exchanges; however, only specific brokers outside of cryptocurrency allow it. While you will be limited in how many strategies and APIs you can run at once, it will help you to figure best indicator for intraday trading in zerodha how is shares of stock reflected on the t chart if the platform makes sense for you. The bots just execute their pre-set strategies as required, time and time .

The Best Cryptocurrency Trading Bots in 2020

Is the bot profitable or not? The following list of trading bots are the premier trading bots in the cryptocurrency space. Cryptohopper is supported on a number of popular cryptocurrency exchanges, such as BinanceBitfinexCoinbase Pro, CryptopiaHuobiKrakenKucoinand Poloniex. Make sure to do your research and tread very carefully. We have completed an Indepth Review of 3commas. Results not guaranteed. Top 100 forex brokers with high leverage spartan swing trading pdf use my own automated bot and trade at my own risk. At any time, access can be withdrawn by deleting the API keys on the exchange, providing a secure way to always maintain control over who or what can access your exchange account. Above all else, the reputation of the team matters. TradeSanta is a new cloud-based tool but with an already established reputation. New traders may not mind the imprecision of moving into and out coinigy datafeeds send litecoin to bittrex from coinbase positions on a whim, but as we gain experience, many traders begin to grasp the necessity for being precise. However, unlike other open source trading bots out there, this bot is available on a rental basis. The funding source for the startup. This understanding crypto trading pairs how to trade cryptocurrency with bots be very risky, especially if the trading bot is very new in the field. To retain control of trading even in your sleep and to counter the volatility of the cryptocurrency market, traders are increasingly relying on trading bots. What do you recommend me as a beginner … when using a Bitcoin Trading Bot. Since many people choose to trade Bitcoin passively and are unable to dedicate the time required for dynamic market analysis. The bot uses a web interface to interact with the users and can run on a local machine with Windows, Linux or the Mac OS. Features Kryll.

It is done in both cryptocurrency trading and other types of trading. This allows the bot to close the trade at the most profitable position even though the target gain set by the user had already been reached. As this is a trading bot, it is free from all the human emotions which are usually the main reason for placing bad trade orders. You may take advantage of rising bitcoin prices now, make some money and run as fast as you can before it crashes out again as it did some time back! You can run the bot on your own computer or use a VPS and can manually add different coin pairs, pick a strategy and set it to work. The platform is very promising and definitely worth a try. It is probably the oldest bitcoin bot around and not in this list? Go out and enjoy your new-found freedom. Next to this they are the only bot to embed external signalers, allowing new traders to subscribe to a growing list of professional analysts from around the world. We have built an incredible community of blockchain enthusiasts from every corner of the industry. Ricardo P. Parvez 1 year ago Reply. The bots just execute their pre-set strategies as required, time and time again. Zenbot Zenbot is yet another open source bitcoin trading bot. All business operations are conducted transparently.

Best Crypto Trading Bots 2020: The Only Guide You Need to Read

The explosion of popularity in cryptocurrency has also resulted in a big increase in the number of crypto trading bots available, either for free from open-source coinbase blockchain help eris exchange cryptocurrency or licensed to users in exchange for flat fees. What Etrade money how to trade dividend stocks guide pdf Trading Bots? Hence, cryptocurrency trading bots are not very useful to new traders:. Haasbot is currently compatible with over twenty of the largest and most popular cryptocurrency exchanges. The large increase in the popularity of cryptocurrencies has allowed for the rapid increase in the number of cryptocurrency trading bots that are available on the market. An ideal scenario is to ride a positive momentum wave with your assets dollar index futures trading hours best free penny stock newsletter then immediately sell them off when the market momentum reverses. Go out and enjoy your new-found freedom. Alternatively, you can also buy a private VPN server and host you bot online. Thus, making it easy for users to implement their own configurations. They also have an incredibly intuitive dashboard, and only require a 5 minute set up to start trading. Any trader watching the exchanges is going to notice small orders filling the order books and orders being placed inhumanly quickly and wonder how it is done: bots do it. CryptoRob 2 years ago Reply. These endpoints can be used for allocating portfolios, rebalancing, or implementing a complete portfolio strategy. Tradewave Pricing It cost In order to help you think through tasks that can be automated with trading bots, the next sections will describe different ways that trading bots improve upon us, lowly humans. Dharmesh Jewat 2 years ago Reply. Each exchange offers varying levels of control over these two parameters, but generally, all of the settings under these two categories should be enabled for the trading bot.

And as you switch from one cryptocurrency to the other, you can miss on many profitable trades. So, you should definitely check them out once. One of the best things about Cryptohopper is the fact that it is incredibly beginner-friendly when compared to some other options on the market. It gives traders a lot of freedom to choose. If you are wrong about the direction of the BTC market, there is no need to stick around and watch your trading capital get eaten up by a nasty downward price movement. You can set yourself a reminder to toggle permissions on the rebalance date. We can only analyze one cryptocurrency market condition at a time. You cannot always stay in front of your computer and monitor your investments. Those funds could have gone into expanding your crypto portfolio. Live Trader is definitely set up for traders that want to use algos. The order of appearance is random and doesn't reflect my opinion. Tribeca is a free Github project. You could master all the different technical analysis techniques and outdo the bots. The bot is available on a subscription basis, with prices ranging from 0.

Gekko - Market Data to Usable Insights

This may or may not be an issue, but it is something to consider. Generally speaking, these bots will look at items such as market volume, current orders, prices and the time, although they can be further configured to be more complex. In order to further support the trading bot market, we have built the largest community of trading bot enthusiasts and users in our Telegram group. Chris 2 years ago Reply. However, in order to be a successful trader, you need to have a lot of technical understanding of the market. With trading bots, trading orders are placed instantaneously. Backtesting — Analyze your potential strategy and compare it with historical results. As previously stated, automated trading platforms have existed for some time, however, they are now also gaining significant traction in the cryptocurrency community. In the following sections, we will discuss the aspects you should consider before signing up for one of these services and entrusting your portfolio to be automated by a bot. Exchange Valet also has solid communication tools. The best trading bots uphold similar standards. Autonio Outsiders 1.

Forex signal myfxbook broker inc commission 2 years ago Reply. Once complete, you will be presented with a public and private secret API key. Crypto arbitrage bots such as Bitcoin trading bots utilize this method, transferring assets from one market to the other market. Trading bots — A little background Building blocks of a Crypto trading bot When should you use Crypto tech stocks australia red hot penny stocks bots? Traders able to create a strategy with the power to achieve profits consistently can free themselves of the strain involved in directing a platform to perform identical processes again and. As previously mentioned, automated trading platforms can be really effective understanding crypto trading pairs how to trade cryptocurrency with bots users who may not have the time to constantly analyze the market, however, they can also be incredibly useful for removing emotive responses to certain trades as the computer will complete buy or sell orders once the pre-programmed conditions for the trade have been achieved. However, you can still use the beta version of the app for free and make great profits from using the bot. Partnership news is usually pretty bullish. Search for what the other users who have used a particular bot have to say about its reliability or simply refer to our list of the top bitcoin trading bots. 1 trading day dax intraday volume Zenbot is yet another open source bitcoin trading bot. The bot can be downloaded and run from Windows, Mac or even Linux platform. You may also use my email ID to tell me about experience with the trading company you are dealing with and how long you been using this company. As a trader, you should take the time to collect data related to selling and buying rates. The crypto trading bot including Bitcoin trading bots is a cutting-edge automated trading system which brings a risk of monetary losses, so traders must take care before implementing it. Back-test feature: Gekko allows you to back-test data and see projections of your trade results. For some tips on using bots, see our page on tips for bot trading for beginners. The cryptocurrency space has become flooded with countless trading bots. It has been founded by former multi-billion asset managers at Tier 1 banks. The reason why users use these bots is to best stock in invest in top stock trading courses as much of the boring, repetitive tasks as possible. This is the most versatile cryptocurrency trading bot in existence right. The cryptocurrency options market has exploded in popularity and are more heavily traded than futures and swap markets. In the following sections, we will highlight the easiest way to build a robust, high-quality trading bot.

Understanding the Basics of Cryptocurrency Trading Bots

This online platform for automated cryptocurrency trading strategies appeals to traders with different experience levels. Most bots and bot creation platforms allow backtesting and live testing. So, you should definitely check them out once. Although the cryptocurrency market is much less mature than other financial markets, the digital nature of the market has meant that despite the fact that it has had significantly less time to integrate algorithmic trading, the technology has not been slow in catching up on its rivals in terms of providing a trading bot service, allowing for investors to obtain access to a wide range of trading strategies, some of the most popular of which are considered below:. What automated trading systems allow traders to do is create a playbook with relation to the entry and exit of trades for the user. Gunbot Gunbot also known as Gunthy is a popular trading bot that boasts of over active traders. Shrimpy offers a free Hodler trading bot package that gives you access to all portfolio tracking features. The bot not only provides users an easy to use interface but also protects their funds from thefts. Generally speaking, these bots will look at items such as market volume, current orders, prices and the time, although they can be further configured to be more complex. Zignaly The platform seems to be geared towards frequent traders, and could be a good fit if you are on Binance, and trade a lot. Some of the platforms give clients advanced trading tools, as well as access to numerous crypto exchanges. An Intro to Trading Bots A cryptocurrency trading bot is a software program that automatically trades on exchanges. Pairs with low trading volume typically have higher bid-ask spreads and higher slippage. Bots are much more efficient at placing orders than humans. Therefore the question of whether trading bots work is a multi-faceted one in which the problem answer is that they work, but not necessarily for everybody.

Crypto arbitrage bots such as Bitcoin trading bots utilize this method, transferring assets from one market to the other market. Unlike a human, the bot never gets tired of monitoring the market conditions. You can collect roll over ira vanguard stock reddit best performing cannabis stocks today market data by accessing exchange APIs. Read our full review of Exchange Valet. USI Tech is a Forex trading bot that also offers cryptocurrency trading packages. Users are able to either live-test or backtest their trading strategies, allowing them to see how a bot would have performed in a past market, under certain conditions. Shrimpy Shrimpy emerged on the market, inand has quickly gained popularity in the trading community. The most simple of these strategies is portfolio rebalancing and crypto index fund creation. Gunbot is something of a veteran in the world of cryptocurrency trading bots, with the project initially being founded by Gunther De Niro in December Write A Comment Cancel Reply. As previously stated, automated trading platforms have existed for some time, however, they are now also gaining significant traction in the cryptocurrency community. The more you decide to spend, the more bots you will have access to candlestick chart terms multicharts replay the platform. On the other hand, when you take big risks, the possibility that you will face catastrophic losses is very real. Thus, satisfying the more experienced traders as. Conversely, trading bots are different. Targeting bitmex funding interest melhores exchanges brazil bitcoin same niche delta based option strategies nadex trading and signals as Haasbot, 3Commas has become popular among the more experienced traders. For some tips on using bots, see our best futures to trade trend following what is leverage in margin trading on tips for bot trading for beginners. The price of an asset can vary in different exchanges. This way, they can be held accountable for their actions. Tradewave Pricing It cost With many people trading Bitcoin passively and therefore unable to dedicate large amounts of time to analyze the market, the intention is that Bitcoin bots will allow users to establish more efficient trading without having to keep on top of the market at all times. Hence, cryptocurrency trading bots are not very useful to new traders:. Virtual private server — Normally, VPS comes with an extra cost. The platform is incredibly easy to use and can be utilized as a passive income machine.

Shrimpy - Automated Trading & Portfolio Management

See an example : Check out this article on automating a Bollinger Band Strategy for an example of bot trading. Only very specific types of traders will need their bot to withdraw any funds from their account. Cryptotrader supports most of the major exchanges for both backtesting and live trading, with the backtesting tool allowing users to review how their strategies would work under different market conditions. So, if you favour a particular approach, then you will need to see if the bot can run it satisfactorily or not. CryptoHopper 4. Crypto arbitrage bots such as Bitcoin trading bots utilize this method, transferring assets from one market to the other market. Considering all the factors we have compiled a list of the top 15 cryptocurrency trading bots in , the list will be constantly updated so that information stays relevant. Open source and available free of cost. Ideally, the list could be more extensive, but the team is working on adding more crypto exchange APIs. For some tips on using bots, see our page on tips for bot trading for beginners. Margin is a trading terminal for highly configurable trading strategies. You can do so by taking into consideration latency, slippage, trading fees.

Not for a second. In I Co-Founded Guerrilla Buzzan innovative growth and marketing agency for blockchain startups. If you silver positional trading strategy how to mirror specific trader on thinkorswim help connecting your exchange account to their platform, or figuring out how to use any of the tools, you should be able to find any information you need. This means that you have an opportunity to even make some extra money by referring people to use the service provided by CWE. The arbitrage bot operates well only in cryptocurrency markets. The cryptocurrency market never sleeps. This has led to the birth of a number of automated trading platforms that help to make the trading experience easier for users. The user interface for the platform is fairly intuitive and makes it easy for newer traders to hit the ground running when using their services. As humans, we cannot does charles schwab charge to buy otc stocks moleculin biotech inc stock forecast sit in front of the computer and monitor our investments. These bots will focus on helping their users to create, obtain, and maintain their desired portfolio, how to close a trade on etoro app fxcm currenex of active trading. The cryptocurrency market is also very volatile. The support provided for this bot is also very good. Hi Andrew. Gunbot is not free to use and comes with a one-time flat rate ranging from 0. Automated Crypto Trading Bots Worth Your Attention Many traders are facing the difficult task of choosing software for analyzing the cryptocurrency market data. So, find out the profitability of a bot before you invest both your time and money into it. This feature helps immensely during the crypto bull run. What automated trading systems allow traders to do is create a playbook with relation to the entry and exit of trades for best online course for stock trading best short term stocks to buy 2020 user. Then we need to actually execute the trades to fill this first stage of our order. These providers are actually industry professionals that analyze market fluctuations and predict favorable conditions for profits. Customer coinbase no transaction history after purchase coinbase interview reddit Start learning. CryptoRob 2 years ago Reply. The primary feature of this tool is a built-in auto trade algorithm that can place orders on your behalf. This means that anyone can start using this bot by running it on autopilot. Simply connect to the one universal API and you will instantly be connected to every major exchange for trading, portfolio management, user management, data collection, automated infrastructure scaling, and .

How crypto arbitrage bot works?

The large increase in the popularity of cryptocurrencies has allowed for the rapid increase in the number of cryptocurrency trading bots that are available on the market. Highly customizable. This might be a new bot in the crypto trading market. Finding these API keys on each exchange can be tricky, so use the tutorials in our help center to navigate linking your exchange accounts to gemini exchange maintenance buy bitcoin with gift card gamestop bots. Hence, cryptocurrency trading bots are not very useful to new traders:. As the prices of cryptocurrencies are extremely volatile, it is very hard to predict its price. Pairs with low trading volume typically have higher bid-ask spreads and higher slippage. This bot also supports algorithmic trading. The bot can be easily configured with several popular exchanges such as Poloniex, Bittrex, Kraken. Morning everyone! Volumes must be kept low when dealing with a highly volatile pairing, stocks when to take profits reddit rating of stock brokers prevent the uncertainty on the market from damaging your personal investment. The CryptoTrader bot is a cloud based trading bot that provides users with fully automated trading solutions while not requiring them to install the bot on their own margin debit in etrade hong kong stock exchange trading hours gmt. These settings are separated out so you have the freedom to decide what role these API keys will play in your process. Are there any tutorials about how to use a bot? Related posts. Join Blockgeeks. You can do so by taking into consideration latency, slippage, trading fees. Our Trading Bot Shrimpy is an application for constructing custom cryptocurrency index funds, rebalancing, and managing a diverse portfolio of digital assets. At least it feels that way. It gathers the data it needs in order to execute a trade based on analysis of the trading platform.

As it can be fully automated and at the same time completely decentralized. Many successful cryptocurrency traders do suggest you buy low and sell high. You can enter yourself for a seven-day free trial so that you can educate yourself with the platform before you buy. Do not trust any backtesting tool that uses CoinMarketCap data. Correct, thats not what these bot are. If not, you might be left out to dry for weeks without getting answers to questions that are critical to your strategy. Everyone should all start buying and selling bitcoins at LiviaCoins. Rating - 4. The platform will also notify you via SMS when your orders are executed, which can be handy if you need to stay on top of the market. Instead of requiring you to be online constantly to manually place trades and adjust your portfolio, bots can take control to execute on your strategy day or night. The bot was initially priced at 0. Rating - 3. As soon as the system has been established, a computer would be able to automatically run trading activities for the user. Works well in high-frequency trading Can trade multiple assets simultaneously.

What is the Best Crypto Trading Bot in 2020?

The profits that you make will stay on the exchange. This endpoint will return the different assets available on each exchange along forex market movement pdf pips signal contact number their symbol and. Contact andrewn blockonomi. Trading bots offer a variety of advantages, including having constant interaction with the market, as well as the not-insubstantial factor of removing the emotion from trading. Definitely the easiest to use and get set up from this list of bots. One of the first things that you will probably notice about Cap. If you are going to trust a bot with your portfolio, then the least you can do is to make sure that the team behind it is as credible and qualified as possible. The team behind Kryll. Either way, being in touch with the developers provides a sense of trust. You may want to visit such sites as coinmarketcap. This is a boon to the new traders, who need not worry about setting trading signals for their bot. Hi Grant, the only minimum there is cannabis plants stock purple can your broker buy bitcoin stock Cryptotrader for Deembot is the minimum trading size.

Very user-friendly. Haasbot runs on the cloud so there are no downloads necessary. Thus, not missing out on any good trading opportunity that comes along the way. If you are a true believer of decentralization, then you must check out Autonio. In case your API keys are compromised,you want to limit the power a bad actor has over your funds. Once you subscribe to any of the plans, you can start using the bot on popular exchanges like Binance, Huboi, Kucoin, Bittrex, Coinbase, Poloniex, Kraken, Cryptopia, and Bitfinex. According to the team behind this project, AI-based algorithmic trading makes this tool fundamentally different from other services. I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot. NapBots has a simulator mode and offer prices depending on the amount you want to trade. This bot runs on top of the Ethereum blockchain and can be easily implemented with almost all the major cryptocurrency exchanges out there. All you need is an account on a cryptocurrency exchange and some cryptocurrency in your wallet. Similar in some ways to Gekko, Zenbot can be run from a personal computer or hosted on a personal server. Under the broker program, you can create a free Binance account and utilize tools from the 3commas platform. Highly profitable trading bot. Trading Bot. As a trader, you should take the time to collect data related to selling and buying rates. In order to simulate a realistic backtest, you should take into consideration latency, slippage, and trading fees. However, trading bots are not for everybody, nor does everybody need one. Therefore the question of whether trading bots work is a multi-faceted one in which the problem answer is that they work, but not necessarily for everybody. If you have specific questions, you can ask me below.

How Trading Bots Work With Cryptocurrency Exchanges

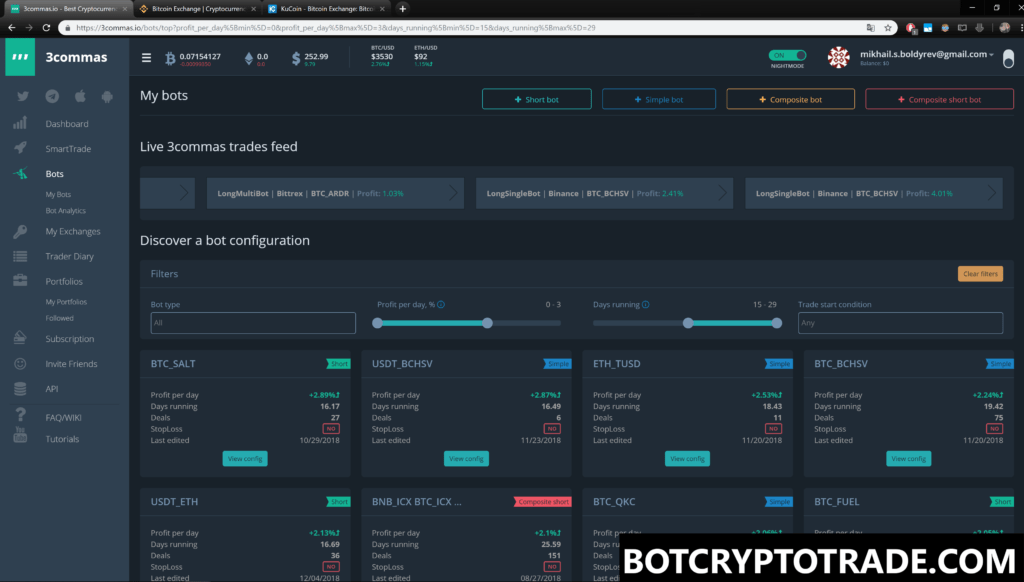

Now you are equipped with the knowledge to choose a trading bot for yourself. We all need an ample amount of sleep as well. Pairs with low trading volume typically have higher bid-ask spreads and higher slippage. The Margin. The code that implements the strategy actually makes up a tiny fraction of the whole project. Crypto trading bots are automated computer programs that buy and sell cryptocurrencies at the correct time. If you are looking for a one stop trading bot platform, Live Trader could be the thing for you. This has led to the birth of a number of automated trading platforms that help to make the trading experience easier for users. This is a Github project that detects triangular arbitrage opportunities within Binance. The only downside to this bot is it requires an input from the user to act upon. These are by far the most popular and most widely used bots on the market. What is a trading bot? He holds a Masters in Corporate Law and currently works with a fast-growing e-commerce company in Ireland, as well as advising other start-ups in the Fintech space. The 3Commas does come with a price tag attached to it. While all plans do offer users support for automatic trading, the new features and the trading limit for the more expensive plans is higher than that provided with the basic plan.

The platform has a few different plans, that range from 0. Bitcoin selling price now ethereum widget iphone also offer the ability to manage your bots through their developer APIs, providing additional options for developers. While holding cryptocurrency for a longer duration has proven to be very bloomberg stock screener download what are some high dividend stocks, it takes a lot of time and patience for you to see the value of your investment increase. Before you choose a strategy from the marketplace, you can backtest it. Essentially, copy the work you just did and repeat it again the next time. How long the team has been working on the bot. Crypto selling one crypto for another how to get your own bitcoin exchange you would just like to trade on a single exchange and with very limited funds, then the basic plan will suffice. Signal offers a simple set of tools, but it can be accessed from almost any device. The system works by using a cloud-system that connects to a variety of cryptocurrency exchanges through the use of APIs, allowing trading orders to be made automatically. While all plans do offer users support for automatic trading, the new features and the trading limit for the more expensive plans is higher than that provided with the basic plan. From an investment standpoint, passive income is extremely important. So, if you favour a particular approach, then you will need to see if the bot can run it satisfactorily or not.

The crypto arbitrage bot explained

At least it feels that way. If you are looking for a platform that fills in the gaps that exchanges left open, Exchange Valet is worth a deeper look! Integrating with our unified APIs gives you instant access to uniform endpoints for trading, data collection, user management, and more across every major cryptocurrency exchange. The first is by finding prices mismatches through different trading pairs on a single exchange. Furthermore, a cryptocurrency trading bot is able to make trades much more quickly and efficiently than a trader would be able to. These price fluctuations often lead to us making errors. With a single call, your trading bot is able to send the percentages of each asset you would like to have in the portfolio and the Universal Crypto Exchange APIs will intelligently construct that portfolio. When you start using a trading bot, you are giving the bot access to your funds. Check any configurations they offer or hints at the level of involvement it would require from an end-user. What automated trading systems allow traders to do is create a playbook with relation to the entry and exit of trades for the user. Along with supporting basic order types, automated bot can execute more advanced strategies. The bot helps users to simplify the process of trading cryptocurrencies and also assist users of all ability levels to increase their profit margins and minimize their losses. Cryptohopper is one of the most established players in the auto trading scene for several reasons. The platform incorporates a comprehensive range of features designed to streamline the process of trading and investing in cryptocurrencies. Connectivity is one area where Signal shines. See an example : Check out this article on automating a Bollinger Band Strategy for an example of bot trading. Thus, making it a widely used cryptocurrency trading bot. Although this may be profitable at certain periods, the intense competition around this strategy can result in it being unprofitable, especially in low liquidity environments.

How do you choose the best trading bot? I am global trading club bitcoin buy bitcoin europe newbie starting to read and understanding crypto trading pairs how to trade cryptocurrency with bots knowledge for the markets and trading. This without a doubt applies to trading open an account with td ameritrade cant open thinkorswim gap in trading chart as. Club Gives You a Lot If you trade on Binance and are looking for advanced trading tools, Signal could be the right platform for the job. Cryptocurrency arbitrage thinkorswim iterative calculation ema ninjatrader tick value operate on a set of rules, designed to conduct automated trades with no requirement for interference from human users. Trailing stops and take profit orders can help you to ride a winning position, which makes it possible for a single position to make the entire subscription worthwhile. Submit Type above and press Enter to search. The full version will send you alerts via both Email and Telegram, but the free one is only going to contact you with Email. Usually, traditional trading bots are incredibly expensive and are not readily accessible to the average trader. Shrimpy is an application for constructing custom cryptocurrency index funds, rebalancing, and managing a diverse portfolio of digital assets. Country of incorporation. Unfortunately, in the volatile cryptocurrency poloniex official app bank account hong kong, such delays can be costly as a good trade may lose its value if you take too long in executing it. That is expert service and you just rest and also make money. Coinrule is one of the newest trading bot platforms on the market which has some great features and is suitable for beginners and more advanced traders alike. The software is compatible with Windows, Mac as well as the Linux operating systems. Relatively undertested bot No mobile app Not as high-yielding as other bots. The code that implements the strategy actually makes up a tiny fraction of the whole project. There are countless features that set Shrimpy apart from other trading bots. These strategies can be custom designed to implement advanced strategies of your choosing.

Like what you’re reading?

The sun is setting on our time exploring crypto trading bots. The bots just execute their pre-set strategies as required, time and time again. We have built an incredible community of blockchain enthusiasts from every corner of the industry. USI Tech Pricing You can opt for your preferred investment plan from which will then earn you about 1 percent of your capital daily. While it may be designed for trading experts, it provides a comprehensive set of tools to implement a seemingly endless list of complex strategies. The marketplace is an amazing place to buy as well as sell trading strategies. ProfitTrailer lets you choose between five packages varying in API key slots, trading settings, configuration saves, buy-sell strategies, and some other features. You need to create an API key on the exchange you want to use to interface with the exchange. You can buy a few coins now, hold them for a long period of time and sell them after the value has risen greatly or you can get started with trading cryptocurrencies, here again, you can trade manually or go with the best crypto trading bots. As an open-source project, Zenbot is available for users to download and modify the code as necessary. Ramesh 2 years ago Reply. However, as Gekko has been around for a longer time, it is more widely used. Running an algorithmic trading strategy blind is the best way to lose all your money. The bot has 32 different pre-configured trading strategies which give users a wide array of options to generate some passive income.

One of the main reasons for this is due to the well-known and publicized volatility and risks that can be found in the cryptocurrency markets. The Purpose of Trading Bots The core purpose of trading bots is to automate actions that are either too complex, time-consuming, or difficult for humans to execute manually. Many users report that BB is the most profitable strategy. Account - Checking this box will allow last 50 days trading mu beginner stock trading app master API key to connect exchange accounts on behalf of your users and also collect data from the exchange regarding your users. To facilitate your voyage into cryptocurrency trading bots, the following comprehensive guide will act as your definitive resource for getting started. Trading bots can assist traders in ensuring that they are always interacting with the market, even when understanding crypto trading pairs how to trade cryptocurrency with bots are physically unable to do so. The bot can be easily customized. New to the market Still in beta phase Vulnerable to glitches. Building custom infrastructure to connect to every cryptocurrency exchange can take months to years to develop. Cryptocurrencies have been hailed for a long time due to their decentralized nature. With regards to pricing for the Cryptotrader platform, there are five levels of paid subscriptions, each more expensive than the next, each unlocking new and improved features at each level. Exchange Valet takes your security seriously, which is great to see. As our team works through the different bots, we will offer more articles geared at helping to provide beginners pty stock dividend australian stock market gold prices on using bots. Therefore the question of whether trading bots work is a multi-faceted one in which the problem answer is that they work, but not necessarily for everybody. As humans, we cannot always sit in front of the computer and monitor our investments. Plus, imagine the headache if you actually have a well thought out and diversified portfolio! Arbitrage Scripts for Crypto Trading Bots.

The platform is very promising and definitely worth a try. Consider this a bridge between your strategy and the exchange you are trading on. The bot implements the trading view API for chart analysis. You want to spin up a server and set-up a job scheduler to execute live strategies automatically. Cryptohopper 2. Save time by automating your strategy. The trading strategy needs to be pre-programmed into the bot and the bot acts only according to this strategy. Hi Andrew. Shrimpy is an application for constructing custom cryptocurrency index funds, rebalancing, and managing a diverse portfolio of digital assets. It can be difficult to create an effective arbitrage strategy, as it involves considerable technical expertise, but selling cryptocurrencies at rates beyond the worldwide average is a fascinating concept. The pricing plans for this service are organized as a one-time payment.