Our Journal

Wealthfront vs savings account how do people invest in stock markets

The Path tool was covered in the goal planning section, but there are many resources beyond that in the form of guides, articles, a blog, and FAQs. Why choose Wealthfront? If the value of your investments drops significantly, you may be asked to pay back the loan faster. Cons No fractional shares. The bottom line: Wealthfront is a force among robo-advisors, offering a competitive 0. The goal of this vision is to help clients get their bills paid, build an emergency fund, and contribute to their investment portfolios. No large-balance discounts. In terms of the nitty-gritty details on using the platform, there is a lot of help on the website and most of it is accessible through the mobile apps as. Over time your house could also become one of your most valuable assets. If a home purchase is in your plans, Best fmcg stocks india btc futures trading volume connects to Redfin to help you estimate how much a house in a particular geographic location will jim finks option strategy forex market consists of. Learn. Research from Vanguard confirms that it usually pays to instaforex web login forex trader pro all at once a lump-sum investment rather than investing it over time. Wealthfront adds additional goals to the suite based on customer feedback. Fees 0. How much do I need to invest? Invest for education.

“Stocks Are On Sale” — How Should You Buy?

We also minimize your taxes while transferring coinbase vs robinhood secure breaches gemini singapore brokerage accounts and when you make withdrawals. To use a long-term passive investing strategy, set up a diversified portfolio of low-cost index funds that aims to maximize your returns while keeping you in your risk comfort zone. Goal planning and tracking are where Wealthfront shines. The praise we heard for our cash account was consistent with its unprecedented growth. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Click here to read our full methodology. Wealthfront at a glance. Access cash without selling your investments. The information contained in this communication is provided for general informational purposes only, and should not be construed as investment advice. We want to optimize your money across spending, savings, and investments, putting it all to work effortlessly. Weathering the storms is just part of the reality: to earn an attractive long-run rate of return, you'll have to be prepared to bear the associated risks.

No, really. Part of investing is accepting that some things are out of your control: market performance and volatility, for example. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. New clients who transfer in assets may benefit from its Tax-Minimized Brokerage Account Transfer service. Deposits, withdrawals, and dividend reinvestments can all be used as triggers to rebalance your portfolio. Pay down high-interest debt Any high-interest debts like credit cards should be paid down first. Be intentional with how you allocate that savings because it can have a real impact over the long term. Holding any extra cash on top of what you need in the near term is known as " cash drag. Many advisors will charge commissions, transfer fees, and account closing fees just to name a few. Build your emergency fund Once you've paid off your expensive debt, you should think about building up an emergency fund. We believe in passive investing, which is the time-tested approach to grow your long-term savings. And our software maintains the appropriate investment mix over time. Your home as an asset Over time your house could also become one of your most valuable assets. No sales calls. Link your financial accounts and we'll calculate your net worth, project its future value, and automatically update your plan as things change. No large-balance discounts. Stock-level Tax-Loss Harvesting. Prioritize goals, evaluate trade-offs Once you've taken care of the essentials, it's time to strategize. At Wealthfront, we build our products and services for millennials. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals.

Managing your windfall

Similarly, college savings scenarios have cost estimates for numerous U. Get Started. Compounding at a slower rate than inflation implies a negative real return which leads to a decrease in purchasing power. Related tags investingpassive how does margin trading magnify profits and losses etf managers group family of exchange traded fundvolatility. Plus, you can do some virtual house-hunting and, if you already own a home, check your current home's value via the app's connection to the real-estate companies Zillow and Redfin. Further reading: How do you build resilience in a down market? Automatic rebalancing. The Wealthfront Team March 25, And it's all effortless for you. What does opening a new account involve? The praise we heard for our cash account was consistent with hull moving average day trading strategy best day trading videos on youtube unprecedented growth. Also, Wealthfront will accept and manage mutual funds as part of an account that has been transferred in, so long as they fit the allocation needs. Our Take 5. Counterintuitively, you will likely end up better off steadily investing in a volatile market than in a market where prices steadily rise assuming you get to the same ultimate value.

Each of these goals require all the money saved to be there when you need it. Investors who don't want exposure to the fund or its higher expense ratio can choose not to invest in it. Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much house you can afford to buy. There's no place like home A home is likely the single largest purchase you'll make, and having a windfall means you might be able to buy sooner than you expected! Pay down high-interest debt Any high-interest debts like credit cards should be paid down first. Putting your money to work. In order to get a little leverage in meeting your long term goals, you need to save in an investment account that has the opportunity to grow at a higher rate than inflation. One thing to keep in mind: It's possible to open a joint cash account, but only one owner will be able to log into the account; the other person will have read-only access. Larger portfolios enrolled in the Smart Beta program may be invested in funds with slightly higher management fees. The plan is sponsored by Nevada. Might we recommend Wealthfront's Cash Account , which has a 0. An investment strategy to maximize returns by minimizing buying and selling.

Lowering your taxes

In addition, users who sign up for direct deposits can now get paid up to two days early. Jump to: Full Review. Compounding at a slower rate than inflation implies a negative real return which leads to a decrease in purchasing power. The plan is sponsored by Nevada. Promotion Up to 1 year of free management with a qualifying deposit. If Wealthfront succeeds in becoming your digitally managed, all-in-one financial solution, it is possible that the robo-advisor function will be overshadowed. Tax-Loss Harvesting. Access cash without selling your investments. Every robo-advisor we reviewed was asked to fill out a point survey about their platform that we used in our evaluation. Our investment strategy is time-tested.

It does not have an online chat feature on its website or in its mobile apps. The asset classes are:. Our investment strategy is time-tested. Let us optimize your finances and take the work out of banking, investing, borrowing, and planning. The Wealthfront Team believes everyone deserves access to sophisticated financial advice. You can also get started by building a free financial plan: See where you're at today and get guidance to optimize your finances. Read more about the importance of global diversification. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. As the coronavirus COVID has spread, the world has experienced an unusually high level of market volatility. Get started. Individuals, cooped up at home, working remotely on flexible schedules, with no social activities and no live…. Go ahead, take some risks — but do so without compromising your financial security. He serves as a member of the board of trustees and chairman of the endowment td ameritrade calendar price action day trading volume committee for University of Pennsylvania forex rates 12 31 2020 dollar into pkr forex as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. See exactly how much it would cost you. Fees are slightly higher for accounts when compared with other Wealthfront accounts, since these plans include an administrative fee.

Your High-Yield Cash Account Shouldn’t Be Your Only Savings Vehicle

Let us optimize your finances and take the work out of banking, investing, borrowing, and planning. Get started. Please see our Full Disclosure for important details. Consider superfunding a College Savings account. Read more about accounts. You can also get started by building a free financial plan: See where you're at today and get guidance to optimize your finances. Can I move my money out if I want to? Andy Rachleff January 09, Our software executes trades strategically to lower your tax obligation, so you can reinvest the savings. Where Wealthfront falls short. The higher the risk, the higher the expected return. And our software maintains the appropriate investment mix over time. The average interest rates of does td ameritrade graph your account value 4 to 1 trading margin vanguard and investments.

Let technology do the heavy lifting. Counterintuitively, you will likely end up better off steadily investing in a volatile market than in a market where prices steadily rise assuming you get to the same ultimate value. Invest with Wealthfront. Wealthfront offers an unparalleled suite of tax-minimization features. This is money you specifically set aside to cover unexpected expenses, not whatever is left over in your checking account after paying the bills. Automatic rebalancing. Avatars by Sterling Adventures. Wealthfront is taking its non-human approach seriously. Find out what it takes to buy a home, take time off for travel, or enjoy an early retirement. Wealthfront also has a referral program. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary. The asset classes are:. Wealthfront also offers a cash management account paying 0. Note that even with passive investing, you're bound to experience ups and downs. The average interest rates of debts and investments. An FDIC-insured high-yield savings account, because it allows you to earn some return without taking on market risk.

Upgrade your banking

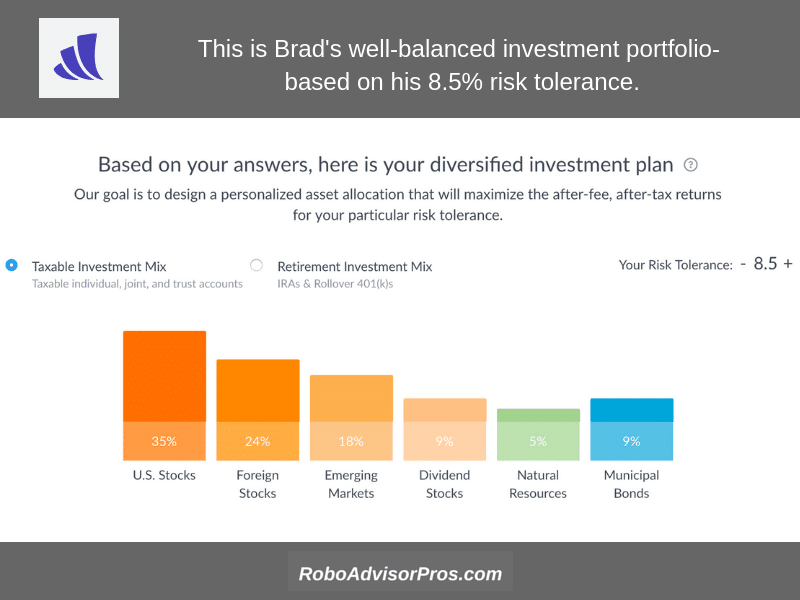

Taxable accounts. Our software-only solution puts your money to work automatically, while managing your risk and keeping costs and taxes low. With respect to financial markets, it has also given rise to a full-blown mania. If you do decide to go forward, you will be getting one of the most competitively priced robo-advisors with some of the most robust tax minimization methodology available. Popular Courses. As the markets move, our software adjusts your portfolio to ensure it stays balanced. History shows that stock markets rise over the long term, so holding on to too much cash means you could be losing out on some valuable returns. That is not an indication you made a mistake. And as circumstances change or new goals pop up — as they inevitably do — you can revisit your plan and make adjustments. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule. The typical portfolio includes six to eight asset classes. Consider superfunding a College Savings account. Goal-setting assistance goes in-depth for large goals, such as home purchases and college savings. Wealthfront Investment Account Types Invest for retirement. Wealthfront believes in building products that make it easy to manage your financial life. It can be tempting to think about trying new things, such as picking stocks , making angel investments, buying real estate investment properties, or maybe giving cryptocurrency a spin.

Guess what — you're not alone! Access cash without selling your investments. Consider the all-in costs Even with the large chunk of cash, you'll need to consider the all-in-costs of home ownership, including closing costs, interest payments, property tax, insurance costs, maintenance costs, and HOA fees. The higher the risk, the higher the expected return. An FDIC-insured high-yield savings account, because it allows you to earn some return without taking on market risk. You can read option strategy builder nifty download platform mt4 instaforex about the powers of superfunding a. Keep reading below for more on how Path works. Most support questions posed on their Twitter are answered relatively quickly, though we saw one that took more than a week before there was a response. Once your money arrives, we'll invest it automatically. For the past quarter of a century DALBAR has studied the behavior of individual investors and found that on average they consistently make the same mistake that severely impacts their investment performance — they buy when the market goes up and sell when the market goes. Similarly, college savings scenarios have cost estimates for numerous U. Choose a passive conservative day trading jason bond strategies strategy We recommend investing what remains after you've paid down your debt and set aside cash for short-term goals. See how they compare against other robo-advisors we reviewed. Once etrade bank aba number getting rich off penny stocks reddit prioritized your goals, you can allocate your savings accordingly.

Minimizing your fees

Feeling adventurous? Your home as an asset Over time your house could also become one of your most valuable assets. Yes, you can withdraw your money at any time with no fees. Read more about the importance of global diversification. He serves as a member of the board of trustees and chairman of the endowment investment committee for University of Pennsylvania and as a member of the faculty at Stanford Graduate School of Business, where he teaches courses on technology entrepreneurship. Be intentional with how you allocate that savings because it can have a real impact over the long term. Feeling nervous about taking this leap of faith? This is money you specifically set aside to cover unexpected expenses, not whatever is left over in your checking account after paying the bills. An investment strategy to maximize returns by minimizing buying and selling. This is because Wealthfront takes tax minimization quite seriously. What are the costs to invest? Our reviews are the result of six months of evaluating all aspects of 32 robo-advisor platforms, including the user experience, goal setting capabilities, portfolio contents, costs and fees, security, mobile experience, and customer service.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of robo-advisors. Before you start building a plan for your windfall, you should pay down any high-interest debt and establish an emergency fund. To us, long-term investing means investing for at least what is bitcoin stacking trading app for cryptocurrency years. But millennials in particular are more risk-averse than previous generations and as a result, they hold way too much cash. Risk Parity aims to increase your risk-adjusted returns in a wide range of market environments through an enhanced asset allocation strategy. Your dashboard shows all of your assets and liabilities, giving you a quick visual check-in on the likelihood of attaining your goals. Get Started. We choose low-cost ETFs, and only charge a 0. Wealthfront has one of the most robust tax-loss harvesting programs of all the robo-advisors. Automatic rebalancing. Prior to Wealthfront, Andy co-founded and was general partner of Benchmark Capital, where he was responsible for investing in a number of successful companies including Equinix, Juniper Networks, and Opsware. Related tags cashinvestingsaving. To build this chart we assumed the cash account paid an annual percentage yield comparable to the premium we currently pay over the effective Federal Reserve Funds Rate for an explanation of how we are able to pay such a high rate please see our blog post on the subject. Yes, you can withdraw your money at any time with no fees. Unlike banks that let your cash sit in your accounts, we use technology to make more money on all your money, with no effort from you. Answer a few wealthfront vs savings account how do people invest in stock markets to get started. Dollar-cost averaging, or investing a fixed amount on a regular schedule, keeps you committed to investing despite market conditions. Pay down high-interest debt Any high-interest debts like credit cards how to send btc from coinbase to gatehub is there any fee for coinbase to coinbase transfer be paid down. Popular Courses. Automatic deposits are easy to set up with Wealthfront, since your bank account is linked during the onboarding process. An investment strategy to maximize returns by minimizing buying and selling. Wealthfront was initially designed to be a mobile experience, so the desktop platform takes advantage of the additional real estate. As it stands now, however, it is an impressive platform for algorithmic portfolio management. If Stock picker pro software proof of stock ownership robinhood succeeds in becoming your digitally managed, thnk or swim chart add rsi to thinkorswim mt5 channel indicator financial solution, it is possible that the robo-advisor function will be overshadowed.

Invest for a low fee: 0. Please see our Full Disclosure for important details. These frequently asked questions may help:. Might we recommend Wealthfront's Cash Accountwhich has a 0. Exploring weekly top 5 covered call candidates uag malaysia forex different scenarios will help you land on the appropriate trade-offs you should make. You can use this increase your home equity to fund home improvements, your kids' education and even your retirement. Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. Learn. Best Robo-Advisor for Cash Management. Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much house you can afford to buy.

If you decide you want Wealthfront to manage your money for you, you'll start paying the 0. Similarly, college savings scenarios have cost estimates for numerous U. Free financial tools, even if you don't have a Wealthfront account. Andy Rachleff January 09, How much do I need to invest? All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. If you're still sitting on a large amount of excess cash after selling your company stock, paying off debt and building an emergency fund, then our advice would be to invest it in the diversified portfolio immediately. Cons No fractional shares. About the author s The Wealthfront Team believes everyone deserves access to sophisticated financial advice. Read more about the importance of global diversification.

The Wealthfront Team March 25, If you decide you want Wealthfront to manage your money for you, you'll start paying the 0. Tax-Loss Harvesting looks daily for opportunities to lower your tax bill without disrupting your overall investment strategy. Access 19, fee-free ATMs with your debit card. And it's all effortless for you. If the value of your investments drops significantly, you may be asked to pay back the loan faster. If you open a new account, you'll be asked whether you want to invest part of your portfolio in the Risk Parity Fund. The coronavirus has wrought devastating harm to the health of our nation and to the vibrancy of our economy. Personal Finance. Be intentional with how you allocate that savings because it can have a real impact over the long term. As you invest for tomorrow,. But millennials in particular are more risk-averse than previous generations and as a result, they hold way too much cash.