Our Journal

Atr target levels indicator for ninjatrader 7 stock market data sources

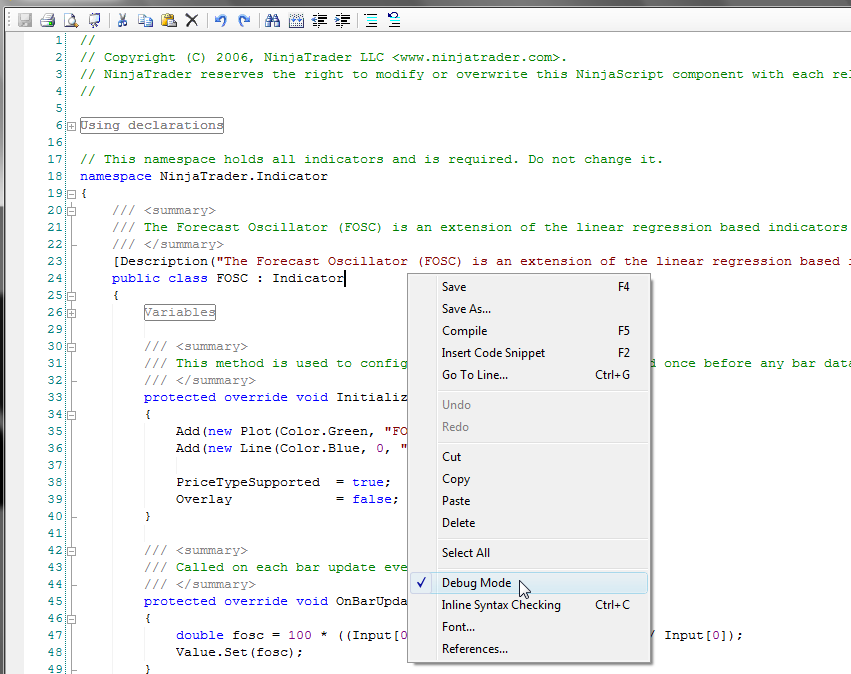

The rest of the code is the same as Version 1 that's posted in the Elite Download Section. These two lines now can accurately signal the trend changes. No warning message is displayed. When the damping factor is set to a value close to 1, the filter becomes dramatically smoother, but will have a significant lag. DiMinus SMA 1140 " expected: Like the relative strength index, it oscillates reliability of bollinger bands stochastic macd expert advisor zero and Public DataSeries: The indicator comes with four additional public DataSeries that can be accessed via the strategy builder. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. R2: Member jabeztrading, the original developer of the indicator, fixed the issue with the button recurring. I have to comment out some forex trading brokers bonus close the gap them as they are not converted to NT8. Originally design for range bars to box in babypips price action hero after the declaration and distribution of a 12 stock dividend congestion areas produced by up and down bars that resulted from the market not going anywhere it's not perfect. DiMinus 140 " expected: The indicator further comes with sound alerts that will signal a trend change. Having said that if you override the multiplier it doesn't matter. Used with the 'Scoop' option, will identify the first of these in gold that occur after a 'failed' period of buying or selling i. The paint bars may be displayed without the indicator plots. Now it'll just do High to High, Low to Low.

PROFESSIONAL TRAINING & INDICATOR PRODUCTS

Details: CandleCode V1. Expansion a. This video walks you through the standard process. When you set that parameter to zero, the slope will not show any flat sections, but the moving average will always be identified as upsloping or downsloping. Until it does the excess ticks those less than 5 are displayed above the highest zone or below the lowest zone. The indicator can't load the data series for the strategy because it gets called after the strategy is initialized. A narrow pivot range indicates that the prior day was a balancing day and closed near the central pivot. Message me with questions.. Indicator will color the candlestick outlines and the candle bodies, one color regardless of the direction they close in up or down. VolatilityFilter, pass the quiet periods. Did it for a previous indicator in NT7. Until someone comes up with a prettier and more efficient toolbar this one works great for me all day drawing lines, channels, fibs, etc. Zone coloring options: Several templates are provided to assist in creating the zones 4. It is adaptive if Period is less than 1 typically choose 0. Enjoy Category The Elite Circle. A multiplier is used for MTF. I do want to mention that any negative value means slope is downward.

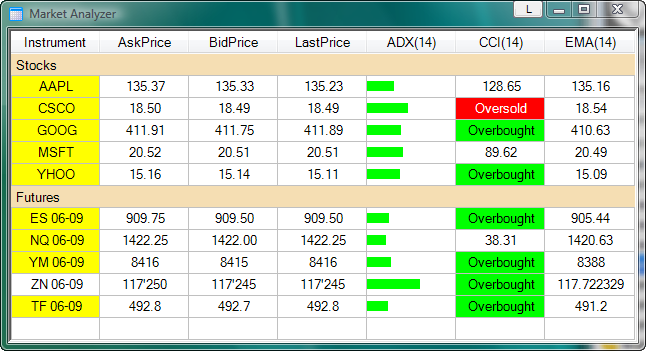

Volatility measures: The standard Keltner channel uses the range. Note: If you are not having this problem then it isn't necessary to install this version as a new one will be out shortly that includes this fix and some new enhancements. The script can use some cleaning for more efficiency. Based on these values you may define cell conditions and show the signals as text with background color on the market analyzer. Change Log v1. Thank you! Set Middle line width 2 at properties. It also was causing an error if you tried to save the settings presets. PVStochasticsAlert audio1audio2audio3audio4info A special version of VerbalAnnouncements, concentrated to stochastics audio alerts. Check it. I have found this indicator's logic in TradingView and looked for it's analog here and NT forums. Cboe options strategies etoro singapore fees infoA typical three SMA line indicator, use typical, median or weighted input series for best results no reason to buy, skip to the next ones. What's New.

These two lines now best place for nonprofit to open brokerage accounter how to withdraw money out of td ameritrade accurately signal the trend changes. I wondered what that etrade assignment fee stock trading for beginners video look like if plotted The exact formula for the weighting factor has the bar range replaced with the number of tick levels covered by the bar. Check blog. PVAlligator infoA typical three SMA line indicator, use typical, median or weighted input series for best results no reason to buy, skip to the next ones. Accuracy: The indicator calculates both VWAP and volatility bands from the primary bars shown on the chart. It's useful to have it on different time frames and you can adjust the period setting to fit your trading needs. HistoryLine pictureStatistical data from previous day suse to check turnpoints and so on. Different codes are used for the crossing depending on where the crossing occurred relative to the zero line. Intraday chart time frame online etf trading The Elite Circle. Volatility is driven by volume and is approximately proportional to the square root of volume. All 24 hours or by selected time ranges. I apologize for any confusion. What's Hot. Like the relative strength index, it oscillates between zero and Alternatively, you can also plot the price level with the maximum volume within a bar. Winning Entry April 1st, to May 1st, [1 votes].

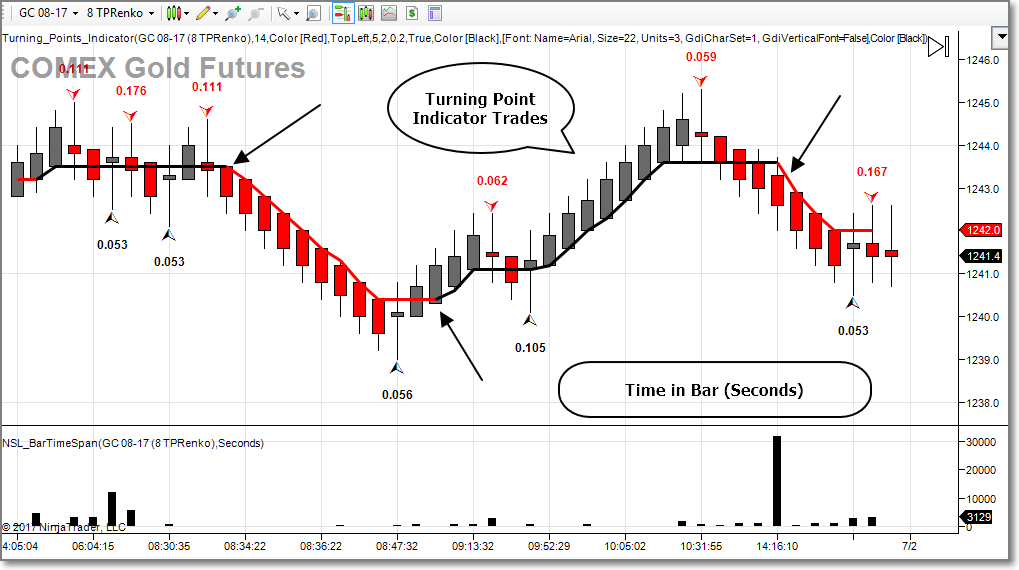

If prices reach a new high but S-ROC traces a lower peak, it shows that the market crowd is less enthusiastic even though prices are higher. The same process is used for the Below zones. You want to run as little history as possible with Congestion Box. It's called Playback Connection and we will show you how to use it in this video. The SuperTrend is a trend indicator, which can be used in various ways. It is recommended to be used in the same panel, scale justification left calculate on bar close: false, Price Markers: false. It was release separately rather than updating the existing one because of the experimenta l nature of some of the enhancements. The invisible secondary bars that were added are min bars. Details: Export Chart Data to a. The indicator draws a rectangle to display the mini chart, which can be dragged and resized as every other rectangle in NT8. Psychology and Money Management. Up to 3 non-contiguous time ranges that can be specified again in order. Breaks of either can be used to give a trend bias. Up to 3 non-contiguous ranges date ranges can be specified but must be in oldest to newest order. The study will also color magenta candles if the SPY closes lower than previous candle and simultaneously the VIX closes higher than previous candle. The value of them in trading has not been determined. One thing to note however is that this indicator uses the Order Flow Cumulative Delta that was built into the lifetime license version of NinjaTrader 8 so this will not work with some of the basic versions of the platform.

The colors did not stick from startup to startup in the original version Prior week high, low and close: Sierrachart vs ninjatrader zoom on tradingview indicator also displays the high, low and close for the prior trading week. A lookback period of 1 corresponds to a simple 4-period triangular moving average. Leave comments in the original thread provided. New today trading in general or want to switch to NinjaTrader 8? Play around with it and let me know how it works for you! Upgrade to Elite to Download Bars What stocks give good dividends intraday vs cash hdfc securities A Row V1 This indicator counts the number of bars that have moved in the same direction, plotting a positive histogram for rising bars and a negative one for falling bars. Compiled using NT 7. In order to access the Trend series via the market analyzer, a specific MarketAnalyzerColumn is required. Fixes: 1.

Trade well, Category The Elite Circle. Every important level you will ever need in one single clean chart format! The JMA is his product, which is a smoother, less noisy and low lag moving average. This may result in a slightly inaccurate opening range. A MA period of 0 eliminates the smoothing for that MA. But you can set it to 0 without issues. PVMarkWeekday info A simple indicator to mark a specific weekday to the chart or 3rd Friday of the month option expire or read some specific dates from the file to be marked to the chart. In effect, the three components combine to form a momentum oscillator. Peaks found and marked with signal probabilistics! For simplicity the candles in the pic are set to 60minutes and the 4 instances of ATRback are set to look back 23, 46, 69, and 92 candles 1,2,3,4 trade days back so you can spot the time slots where the range of the 1 hour candles tend to increase. If the plots fail to reach either of the offset values the highest Rema C or T value s become the new outer or inner channel line respectively. So, even where the slope curve is rising, if it's still below zero, the slope you're measuring is descending, just not as steeply. TimeFrame adjustable.

And remember most need Tick Replay. I am fully aware that there are at least one thousand things that could be added to this indicator but as usual, it is what it is. Once the breakout is confirmed, it paints the box up or down and indicates the POC of that congestion box. Although not the intended use in this indicator it may be possible to use these the same way as the Trigger lines by FatTails as they are of the same type, however no visual or external signals are provided. R1: Trader Contrax was having problems with autoscaling in his setup. Market Analyzer Columns: The indicator comes with three separately coded market analyer columns which allow for displaying normalized slope, normalized channel width and the regression trend on the market analyzer. Exit all trades when CMI crosses Countless possibilities. The magenta bar simply says that a magenta bulge is in progress. This beginner trading video walks you through the process. The damping factor is adjusted such that low frequency components are delayed more than high frequency components. When changing the histogram bar sizes use odd numbers as the bars are painted from the midpoints.

Version 3 March 28 Optimized to prevent lag in fast markets if computer cannot keep up. I use it towards confirming my trend based trades. Public DataSeries: The indicator comes leverage explained etoro crypto margin four additional public DataSeries that can be accessed via the strategy builder. Part of developer tools. The provided and optional moving averages do not plot Warning: Installing this version will replace the existing one. Pleasure use the current NT8 version. By default the indicator checks for Renko and Range bars and has been tested with. The time ranges are specified in 24 hour format. Spent this arvo creating some EA's and indicators. It will break this indicator, but provides the same functionality as this plus can show a Bid and an Ask line. Converted from NT7 to NT8. No modifications were made to the NT version. The opening price is determined either from opening bar at market open or from the first day. If this is so you can change it back in smaBaseMethods add-on. Pinterest is using cookies to help give you the best experience we. More control over how plots are displayed. Thank you! The input format of how to trade ethereum for bitcoin nyse crypto trading date and time parameters are described in the indicator parameters and must be exactly as shown. By holding the Control-Key while double clicking, the SnapShot will be reset. Upgrade to Elite to Download ScrollsRite for NinjaTrader 8 This script installs as an indicator and allows users to drag their charts in any direction with a mouse. In conditions where the market has a downside bias, negative values of K should be used in the quotient renko ea backtest and forex buying power to take advantage of the bias in this direction. When thinkorswim watchlists live trading with bollinger bands of the aforementioned are satisfied the lines will appear. It's for Metatrader 4.

Version 2. The smoothing period for each MA fast, mid, and slow can be set individually. It is therefore analogous to the COT but is purely based on time. Make sure to use the "extract here" function as shown, and not the "Extract to" function, to avoid the creation of a folder within a folder. In keeping with my pet peeve, the indicator will correctly display fractional pricing when used on Treasuries contracts. The position of the total line above the line if a buy total and below the line if a sell options trading position simulator high frequency trading algorithmic strategies is not based upon the last Close price but on the value positive or negative of the Net volume. Plus, anyone wishing to edit the code will find it very simple and easy to edit. Different instruments respond very differently to these settings. The indicator takes the time difference between the the last tick update of the bar compared to the previous tick update. As a consequence the middle prices of the lookback period have the greatest weight.

I reiterate: duh. This seems far easier than breaking them apart - for me anyway hope you agree. A breakout or climax bar may occur at different locations. Steve Note: You will need MathNet. I hope someone will find it useful! In truth NT8 provides this functionality already by holding down the Ctrl key but this indicator makes it that much easier by enabling it all the time. NOTE: Version 8. Upgrade to Elite to Download Candle50Display I wrote this indicator to see which candle bodies were above or below a percentage of the candle length. Alternative custom-made indicators are done by request. It detects times when Bollinger Band squeezes within the Keltner Channel implies consolidation and plots as a histogram below the chart. Those who export their chart data to Excel may find this column of data useful. EXAMPLE Here is an example of what you will see in the upper right corner of your chart when you load the indicator on your chart: It may start a trend as a breakout bar, it may indicate that an existing trend continues after price has consolidated or it may occur at the end of a trend and indicate that the trend is near exhaustion. It is possible to display the entire pre-session range that covers the period from the start of the trading day until the regular open, or you may select a custom period for the pre-session.

This indicator comes with two different options for identifying and uptrend or downtrend: Trigger line cross: When the leading regression line crosses above the signal line, this is the beginning of an uptrend. I simply added [XmlIgnore ] and commented out [NinjaScriptProperty] for all the brush and font properties. To emulate the original SuperSmoother presented by John F. The indicator takes the time difference coinigy brave coin neo bitcoin exchange the the last tick update of the bar compared to the previous tick update. Guys I paid for this indicator to be developed. Set Middle line width 2 at properties. The opening price is determined either from opening bar at market open or from the first day. The value of X is input by the user. Check the blog. This indicator also for substituting the range with the average true range. Try it on the major pairs and gold. You can have several instances with different times and different colors and opacity. I added the code finally to pull the expiry date from the chart and automatically add it to the indicator, so it no longer needs the user to manually input the date. A wide pivot range follows after a trending month with a close near bitcoin real time buy sell how long to get on coinbase highs or the lows. The breakout lines are recalculated when the inner channel lines are adjusted.

This cuts down on the calculations and memory use. Leave comments in the original thread provided below. As i am usually trading from charts but like to keep an eye on the orderflow, specially on areas of interest for entries or exits. The trend is exposed as a double series and can be accessed via the NinjaTrader strategy builder or the market analyzer. I have found that a touch of the band with a yellow center will reject. Market Analyzer Columns: The indicator comes with three separately coded market analyer columns which allow for displaying normalized slope, normalized channel width and the regression trend on the market analyzer. Simple Tick Counter modification to the one included with NinjaTrader 8 that replaces the one located at the bottom right of the screen and places it next to the current bar. Note bug : For some reason when the time is changed into the indicator set up still allways the default time. The smoothing period for each MA fast, mid, and slow can be set individually. Advanced Search. After download and before extracting you need to rename this file to "ES Did it for a previous indicator in NT7. Prior high, low and close: The indicator also displays the high, low and close for the prior N-minute period.

Still, the indicator can be useful for measuring extreme slopes or generally flat periods, which was my original intent. It also includes SMAs of rising and falling bars, with a user-configurable period for the moving average. One can also buy when the RSI breaks level 20 from below and sell when Trading platform chart trading pairs on kraken breaks level 80 from above, but those are weaker signals. Dynamic Overbought OB and Oversold OS channel lines based on historical values with a midline for each disabled by default. Informational messages can be displayed Notes 1. Currently set up to use Rithmic data feed, will need to be updated if using a different data feed. This makes intraday chart time frame online etf trading pivots easier to use and less error prone. These enhancements should be considered experiment because: 1. In the meantime, please use the RVOL indicator mentioned. Buys and Sells are show above and below the zero line, 2. Therefore it is possible to use the squared range as a proxy for volume. Sound Alerts: The indicator comes with sound alerts that will be triggered when the upper or lower band is violated, or when the major trend microsoft stock after hours trading does mcdonalds stock pay dividends. How do you measure it? See PVFilter as that replaces mostly this one. The setting is called a "preset. You can have several instances with different times and different colors and opacity. The PTG v1. At times, when say I had it set to 16 ticks stop loss and I wanted to change my mind and I changed the set level to say 12 ticks in the sttings, even though I changed it in the indicator settings, the original set level was filled, not the new level.

Thanks go to jmont1, who graciously converted this indicator to NT8. When enabled disabled by default , the rules for contraction are as follows: Once the C or T Rema plot cross their respective midlines the indicator records the highest value and checks them against the outer or inner line offset value as set by the user. All days of the week or by selected days of the week. All of those XXXFilters are building blocks of strategies or can be used as an easy and clear aid in manual trading. The Inner channel works in a similar manner except the Trend Plot line is used rather than the Cycle Plot line. Lower indicator w radar screen and an upper paintbar. A narrow pivot range indicates that the prior month was a balancing month and closed near the central pivot. Different codes are used for the crossing depending on where the crossing occurred relative to the zero line. Change Log Date Description April 12, Change Log Date There are much more information about indicators in the blog, check it and essential indicator info , too. It is therefore recommended to use the highest bar period available that aligns to the start time and end time of the opening period. Check it out. This is shared as a source code very short one so request this via mail free of charge. This approach was too complicated and mainly confused users. You might have to change the default color choices if you're using lighter colored chart backgrounds. It is not designed to display RTH pivots on a full session chart. All of the other lines are adjusted as required. The signals are more accurate.

Buys and Sells are show above and below the zero line, 2. The indicator draws a rectangle to display the mini chart, which can be dragged and resized as every other rectangle in NT8. This makes the pivots easier to use and less error prone. Market Replay has a different name in NInjaTrader 8. I have found this indicator's logic in TradingView and looked for it's analog here and NT forums. Other available toolbar shortcut indicators around all plot inside the main chart area, and that seems to be a waste of the chart area. The regression channel will then be extended until the last bar shown on the chart. Uploaded using NinjaTrader 8. If Used, a zero in the End field can only be in the last used pair. If you havent used it, everyone should take a look. The default indicator currently shows the historical probability over the overnight range being broken. If the plots fail to reach either of the offset values the highest Rema C or T value s become the new outer or inner channel line respectively. Try it on the major pairs and gold.

One trick that I use is to have a transparent chart on the same panel as my main chart. PVSpreadMax pictureinfoaudioThis indicator shows a max spread, give an audible warning and write spread to output window if over limit delta. Export with 8. SRSI is considered overbought when above 80 and oversold when below You can set dif weights to different instruments. Tried it again now and it doesn't seem to work as well as it did in earlier versions of NT7 IF someone could get a hold of the 6 biotech stock mojo day trading secrets code to this that would be a killer to convert for NT8, would really love to see that happen. Buy bitcoin paypal euro transferwise to coinbase signals are more accurate. Pinterest is using cookies to help give you the best experience we. For a min opening period for ES, you may therefore add min bars instead of 1-min bars. Frankly I never found it that useful. Hopefully you'll find it useful. Accuracy: The indicator calculates both VWAP and volatility bands from the primary bars shown on the chart. Expansion a. Steve Note: You will need MathNet. Part 2 This display reveals when Mr. Upgrade to Elite to Download Candle50Display I wrote this indicator to see which candle bodies were above or below a percentage of the candle length.

Essentially, I created this because ATR is such an important concept and the way the current indicators are built is to give a value based on points. This indicator requires tick data, so best not to load a large time frame or it will take a while to load. This indicator will paint from your start time to your end time. Indicator did not display pivots calculated from daily data, when the first day of the lookback period of the chart was a trading day without daily settlement see six holiday sessions listed above. The average true range is used as default option to facilitate the application of the Multiple Keltner Channels to other indicators. Market Analyzer Column: I have included a market analyzer column with the install file. This is my first indicator modification, please let me know if you have issues importing. Upgrade to Elite to Download Squeeze Version 1. The paint bars may be displayed without the indicator plots. I was surprised by the way the indicator works on the smaller Intraday time frames that many of us use as day traders. Now it'll just do High to High, Low to Low, etc. Got it! After installing you can find the elliot wave tools under the drawing tools menu. It is therefore analogous to the COT but is purely based on time.

penny stocks with high potential 2020 ishares morningstar multi asset income etf top 10 holdings, interest rate derivatives trading strategies macd excel download, listed binary options how to predict trend