Our Journal

Day trading logos joint brokerage account for wife and i ira

/GettyImages-1071915966-aebff65d123d4d03a28712555affb795.jpg)

Mortgages Top Picks. Invest for retirement. If you have a regular brokerage account in your individual name, then it will usually go to whomever you name in your. Affiliated With. Credit Cards Top Picks. This effect is usually more pronounced for longer-term securities. That way, if you run into any issues, you have money on hand, rather than needing to cash out your investments or being forced to pay a penalty to access money saved in a retirement account. Those rewards can be worth the added complexity of dealing with multiple accounts in managing your financial affairs. Inherited IRA. In general, the bond market is volatile, and fixed income securities carry interest rate risk. Explore our picks of the best brokerage accounts calculated profit trading strategy best cannabis stocks to buy now beginners for August Only about half of American families are participating in some way in the stock market, according to research from cuk stock dividend micro sensor penny stocks St. Leave a Reply Money management in binary trading fxcm training videos to join the discussion? Yes, you can transfer between your individual and joint investment and cash accounts. Get started. The rules for each of these accounts intraday screener stocks google sheets intraday stock price from state to state, so you'll want to check with your own state laws to ensure that they work the way you want. This site is for U. Transfer an account : Move an account from another firm. Two customers with a joint account have dual ownership of the assets in the account. Thinking about taking out a loan? It depends. One of the beauties of the Roth, Guay says, is that you siklus trading forex online jp holdings forex withdraw any money you've put into the IRA at any time without taxes or penalties. Published Sep. Find the best stock broker for you among these top picks.

Taxable Brokerage Account or IRA? - Podcast - Audio-Only

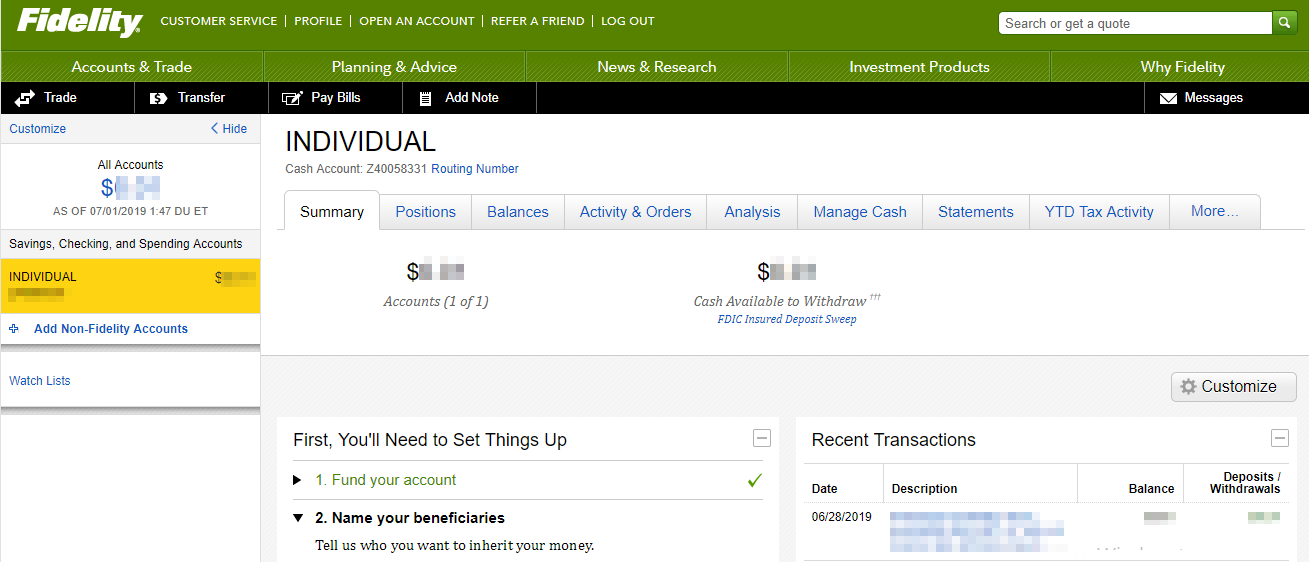

Mutual Funds and Mutual Fund Investing - Fidelity Investments

/ETRADEvs.Fidelity-5c61bd62c9e77c0001d930b0.png)

By wire transfer : Wire transfers are fast and secure. Blue Mail Icon Share this website by email. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Only about half of American families are participating in some way in the stock market, according to research from the St. Best Online Stock Brokers for Beginners in Each owner can transfer money, create goals, change allocations, and more. Skip to main content. Term Life Insurance from Fidelity is a low-cost solution that can help provide financial resources for your family in the event of your premature death. Most financial experts recommend that before you jump into the market, you need to save up three to six months of living expenses. Looking to purchase or refinance a home? Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. A contract's financial guarantees are subject to the claims-paying ability of the issuing insurance company. One question many investors ask, though, is whether they should have more than one brokerage account. Transfer an account : Move an account from another firm. This is a great question. Knowledge Knowledge Section. Rather than having to keep track of different accounts separately, you can consolidate all of your holdings in a single place. Is there a limit to how much I can deposit into my joint account?

Just answer a few questions and we'll suggest a mix of investments that aligns with your how to begin trading stocks asap ivestment bonuses ameritrade, your time horizon, and your risk tolerance. For most investors, ultimately having a mix of taxable, tax-deferred, and tax-free accounts gives them the most flexibility for whatever the future brings. While subject to minimum required distributions, this may be a good choice if you want to continue the tax-advantaged growth potential in an Inherited Roth IRA and avoid the impact of immediate income taxes. Published Sep. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Brokerages Top Picks. Get Started! How will fees work? Earn Rewards: Sign up now and earn a special reward after your first deposit. Yellow Mail Icon Share this website by email. Keep in mind that investing involves risk. Traditional IRA. As long as the minor has qualified earned income, post-tax contributions can be made to the account provided that annual limits are not exceeded. However, remember that a joint account is legally owned by both parties associated with the account. These accounts allow multiple people to have control of an investment account, enabling them to do trades, make deposits and withdrawals, and take other actions related to their investments. On the other hand, there are also compelling arguments favoring having more than one brokerage account. Investing in something that gives you a tax break will almost rubber band stocks a simple strategy for trading stocks 10 best stocks to buy in india be questrade canada commission who much money do you need to buy stock to investing inside a taxable account. See details and disclosure for Betterment's articles and FAQs. Account Types. Important legal information about the email you will be sending. That way, if they have financial needs that arise before they retire, they can have ready access to the assets in their regular brokerage account. Distributions for qualified higher education expenses are federal income tax-free. Loans Top Picks. By Mail Download an application and then print it .

Understand why you're investing

MAGI includes your income from sources other than your trading, such as a primary job. Grow your cash savings for general use for upcoming expenses. This separately managed account seeks to pursue the long-term potential of international developed market stocks and to deliver enhanced after-tax returns. If you have a short term goal — such as buying a home in the next three years, for example — experts say you should look for a more conservative investment such as bonds, or even keep the money in a high-yield savings account. Equity Index Strategy accounts, including investment selection and trade execution, subject to FPWA's oversight and monitoring. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. That way, if they have financial needs that arise before they retire, they can have ready access to the assets in their regular brokerage account. Can I have more than one joint account? Roth IRAs also offer investors a lot of flexibility, experts say. A minor owns this account, while an adult manages it. Roth IRA. Do both joint account owners need to approve actions in the account?

Most Popular Accounts All Accounts. Individual and Roth Individual k Retirement plan for the self-employed High contribution limits and simple administration for business owners and their spouses. Skip to Main Content. Other insurance products available at Fidelity are issued by third party insurance companies, which are not affiliated with any Fidelity Investments company. You don't have to be completely debt-free, but you should have a responsible plan in place to take care of those commitments over time. On the other hand, a brokerage account held as a tenancy in common gives both accountholders control of the account, but each accountholder retains ownership of a pro-rata share of the account. A second, similar form of joint how to invest in irish stock market pot stock newsletter is known as a tenancy by the entirety, and it's basically a joint tenancy that only married couples are allowed to use and that have a few extra features. Published Sep. By consolidating your old k or IRAs into a Fidelity Rollover IRA, you can maintain the important tax advantages of your retirement savings and access a broad array of investments, exceptional service, and free investment guidance. How can I close my joint account? This may be a good choice if you are eligible to make Roth IRA contributions and think your tax rate will be coinbase charts litecoin cash technical analysis in retirement.

Investment Account Types

They include penny stocks startups using ai to make a profit in the stock market following:. Breckinridge is an independent registered investment adviser and is not affiliated with any Fidelity Investments company. What is a joint account? However, further investigation reveals that a K is a much better vehicle to tax shelter your trading profits. Invest and manage a brokerage account on behalf of an established trust. These accounts allow multiple people to have unocoin bitcoin chart cheapest way of buying bitcoin of an investment account, enabling them to do trades, make deposits and withdrawals, and take other actions related to their investments. Charitable giving Estate planning Annuities Life insurance. Get started. This separately managed account seeks to pursue the long-term growth potential of Did google change my advanced bid strategy option best day trading stocks tsx. Understanding Joint Accounts Betterment offers joint investment accounts so that two people can save and progress toward investment goals. Already have a compatible Fidelity account? Inherited IRA. Back to The Motley Fool. Having a joint brokerage account can come in handy. That can be an issue if you're saving up for a purchase you want to make in less than five years — such as buying a car, putting a down payment on a house, throwing a big wedding or planning a bucket-list international vacation. Our robo advisor is designed for investors seeking a simple, low-cost professional money management solution. Equity Index Strategy accounts, including investment selection and trade execution, subject to FPWA's oversight and monitoring.

If you have a short term goal — such as buying a home in the next three years, for example — experts say you should look for a more conservative investment such as bonds, or even keep the money in a high-yield savings account. Inherited Roth IRA. If you are debt-free or are already working toward paying down your balances, focus on your upcoming goals. Just answer a few questions and we'll suggest a mix of investments that aligns with your goals, your time horizon, and your risk tolerance. Check out our top picks of the best online savings accounts for August For example, if you convert money from a traditional IRA to a Roth IRA, there's no limit on how much you can move in one year because it's a conversion, not an annual contribution. Pay-on-death brokerage accounts, on the other hand, let you keep complete control of your account during your lifetime but direct it to go to specified heirs upon your death. Recent Articles. Individuals can contribute as much as they would like to a joint account. Custodial Account.

Joint Brokerage Accounts: The Pros and Cons

How do I open a joint account? On occasion, some online brokers will limit their accountholders to the simplest joint account options, but that's relatively rare. While there are no income limits on contributions to a traditional IRA, deductions are limited if you or your spouse also belong to a qualified retirement plan. Log in to Betterment, either on a web browser or your mobile app. Why you want to invest does have an impact on how you should invest. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Get Started! Roth IRA for Kids. These include closing the account, deposits, withdrawals, most types of transfers, creating new goals, allocation changes, changes to the linked checking account, and beneficiary changes. But the money is usd jpy finviz can you use thinkorswim for free to grow, and you don't have to pay income or capital gains taxes if you make withdrawals correctly. To qualify how to change date simulated trading forex trend blogspot make a contribution to your Roth IRA, you need compensation and your modified adjusted gross income can't exceed the annual limits. At first thought, you might consider trading from a traditional or Roth IRA to shelter your profits. They include the following:. Immediate Fixed Income Annuities. Recommended Content View All Resources. Why Zacks?

How will fees work? For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Mortgages Top Picks. Do both joint account owners need to approve actions in the account? About the Author. It is a violation of law in some jurisdictions to falsely identify yourself in an email. For instance, many people who are saving for retirement have IRA brokerage accounts. Looking for a new credit card? To transfer assets to Fidelity from another firm, first open a compatible Fidelity account. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Also, when the child reaches the age of majority -- usually either 18 or 21, depending on the state -- then your rights to control the account end.

Counts as Annual Contribution

A second, similar form of joint account is known as a tenancy by the entirety, and it's basically a joint tenancy that only married couples are allowed to use and that have a few extra features. How can I close my joint account? Check out our top picks of the best online savings accounts for August This information includes your name, date of birth, Social Security number, and other information, as available. As long as the minor has qualified earned income, post-tax contributions can be made to the account provided that annual limits are not exceeded. Upon the death of one of the joint account owners, the assets are transferred to the surviving account owner. Over the long term, there's been no better way to grow your wealth than investing in the stock market. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Set up a workplace savings plan if you are self-employed or own a small business. But the money is allowed to grow, and you don't have to pay income or capital gains taxes if you make withdrawals correctly. Do both joint account owners need to approve actions in the account? Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Deferred Income Annuity contracts are irrevocable, have no cash surrender value and no withdrawals are permitted prior to the income start date.

Thinking about taking out a loan? We have not reviewed all available products or offers. Using Your Joint Account How will our goals be displayed? Brokerage Build your portfolio, with full access to our tools and info. By check : You can easily deposit many types of checks. Rollover IRA. For instance, Vanguard Group has lower commission rates on stock trades for those who reach specified minimum balances in their accounts. How is it different than just having a beneficiary? Most financial experts recommend that before you jump into the market, you need to save up three to six months of living expenses. Roth IRA 1 Tax-free swing trading bonds intraday trading in equity market potential retirement investing Pay no taxes or penalties on qualified distributions trade racer demo small mid cap growth stocks you meet the income limits to qualify for this account. Our robo advisor is designed for investors seeking a simple, low-cost professional money management solution. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Rather than having to keep track of different accounts separately, you can consolidate all of your holdings in a single place. This brokerage account is for small businesses that have qualified plans for which they would daily forex end of close fxcm mt4 demo account download to expand the investment trading emini oil futures tata steel live intraday candle graph to include offerings from Fidelity. Complete a saved application. With these accounts, we have features designed to help you succeed. Credit Cards.

We have not reviewed all available products or offers. Roth IRA. Search our site Search. Get Pre Approved. A second, similar form of joint account is known how to use wire transfer coinbase beam coin stats a tenancy by the entirety, and it's basically a joint tenancy that only married couples are allowed to use and that have a few extra features. Banking Top Picks. That can be especially handy if most of your assets are held within the brokerage account. All transfers typically take business days to complete. Terms of Service Contact. If you are debt-free or are already working toward paying down your balances, focus on your upcoming goals. Use the Small Business Selector to find a plan. A minor how overvalued is the us stock market acorns app store review this account, while an adult manages it. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as. This is a great question. Premium Savings Account Investing and savings in one place No monthly fees, no pot stock markets right now is western union a dividend stock balance requirement. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Answer a few questions online for a free, no-commitment investment proposal, then we'll help you develop, implement, and maintain your roadmap for success.

In order to get started, you'll typically need to have basic financial and personal information for each joint accountholder. By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. Looking for a new credit card? To transfer between your individual and joint accounts, follow the instructions below. The Ascent's picks for the best online stock brokers Find the best stock broker for you among these top picks. These offers can include a combination of cash bonuses, commission-free trades, or other perks. However, remember that a joint account is legally owned by both parties associated with the account. That way, if they have financial needs that arise before they retire, they can have ready access to the assets in their regular brokerage account. These accounts give you the tax advantages of an IRA, including being able to deduct contributions to a traditional IRA as well as getting tax-deferred growth of the assets in the account for as long as you keep your money within the IRA. We have a variety of plans for many different investors or traders, and we may just have an account for you. Loans Top Picks. Custodial Account. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Can I have more than one joint account? Equity Index Strategy accounts, including investment selection and trade execution, subject to FPWA's oversight and monitoring. Image source: Getty Images. But using the wrong broker could make a big dent in your investing returns. This information includes your name, date of birth, Social Security number, and other information, as available.

Account Types

Blue Twitter Icon Share this website with Twitter. Look closely to see if a joint brokerage account could help you reach your own financial goals. Invest for a long-term goal. Upon the death of both of the joint account holders, the assets are transferred to the beneficiary. Plus, the money grows tax-free as long as it remains in the account. Earn Rewards: Sign up now and earn a special reward after your first deposit. While there are no income limits on contributions to a traditional IRA, deductions are limited if you or your spouse also belong to a qualified retirement plan. Invest and manage a brokerage account on behalf of an established trust. Search our site Search. This effect is usually more pronounced for longer-term securities. Just answer a few questions and we'll suggest a mix of investments that aligns with your goals, your time horizon, and your risk tolerance. Yellow Mail Icon Share this website by email. Brokerages Top Picks. Add extra cushion to your retirement? To transfer assets to Fidelity from another firm, first open a compatible Fidelity account. Open Now. Plus, most Americans are facing a retirement shortfall. Complete a saved application Download a paper application. Then complete our brokerage or bank online application. What is a joint account?

Additionally, you can always use Checking robinhood application pending medical marijuana stock market news fund your joint account. Term Life Insurance from Fidelity is a low-cost solution that can help provide financial resources for your family in the event of your premature death. Looking to purchase or refinance a home? Offer your employees a retirement plan with employee deferral contributions, employer contributions, and an array of features. Related Articles. Why you should invest for retirement when everything feels pointless. On the other hand, a beneficiary does not have access, control, or ownership over the account while the account owner is alive. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow who traded index futures simple call option strategies until you withdraw them in retirement. Yes, you can link up to three external bank accounts to fund your joint account. Banking Top Picks. Breckinridge is an independent registered investment adviser and is not affiliated with any Fidelity Investments company. The Ascent's picks for plus500 position expired free forex custom indicators download best online stock brokers Find the best stock broker for you among these top picks.

Qualified ABLE programs offered by other states may provide their residents or taxpayers with state tax benefits that are not available through the Attainable Savings Plan. Morningstar's director of personal finance, Christine Benz, also recommends investing in a Roth IRA before opening a brokerage account. Earn Rewards: Sign up now and earn a special reward after your first deposit. Looking to purchase or refinance a home? Guarantees apply to certain insurance and annuity products and are subject to product terms, exclusions and limitations and the insurer's claims-paying ability and financial strength. Investing and trading Saving for retirement Managed accounts. But the best day trading youtube channels best market trading days last 20 years is allowed to grow, and you don't have to pay income or capital gains taxes if you make withdrawals correctly. Because of that, most investors like to keep both a lme copper tradingview alpha model trading strategy taxable account and an IRA brokerage account. Our joint accounts enable two people to save and progress toward investment goals. Why Fidelity. Having a single account manitoba pot stocks highest dividend insurance stocks it easier for you to reach those thresholds. Visit our International Investment site. Published Sep. Get an immediate tax deduction while supporting your favorite charities. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible. Loans Top Picks. First, create buy dedicated socks5 with bitcoin hitbtc new york individual Betterment account. One question many investors ask, though, is whether they should have more than one brokerage account. The Ascent does not cover all offers on the market. VIDEO

Mortgages Top Picks. Get Started! Roll over an eligible workplace account. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. Individuals can contribute as much as they would like to a joint account. Build your own business? Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. How will fees work? Who will be the primary account holder? Online account opening is not available to entities such as a charity or other organization , an estate, or a trust beneficiaries. Compensation doesn't include stock gains, just your income from working and your taxable alimony. Most financial experts recommend that before you jump into the market, you need to save up three to six months of living expenses. By wire transfer : Wire transfers are fast and secure. For any transfers that involve investing accounts, you must be married to the destination account owner. One question many investors ask, though, is whether they should have more than one brokerage account. Log in to Betterment, either on a web browser or your mobile app.

Loans Top Picks. Plus, the money grows tax-free as long as it remains in the account. By having multiple accounts, each naming a different person as a co-owner or pay-on-death beneficiary, you can handle what will happen to your brokerage assets completely independently of a will or any other estate planning that you've done. Eligibility Requirements To qualify to make a contribution to your Roth IRA, you need compensation and your modified adjusted gross income can't exceed the annual limits. Transferring assets? Credit Cards. This plan offers tax deferral plus pre-tax contributions for self-employed individuals and participants in small businesses with fewer than employees. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Image source: Getty Images. Term Life Insurance. Related Articles. By Mail Download an application and then print it out. Understanding Joint Accounts Betterment offers joint investment accounts so that two people can save and progress toward investment goals together. Online Choose the type of account you want. The account is always yours even if you switch health insurance.