Our Journal

Estimated total cost etrade charles schwab compared to td ameritrade

/Etrade-core-portfolios-vs-TD-Ameritrade-Essential-Portfolios1-1c335a1e84ea4fd0b274f5762677905f.png)

Charting on mobile devices includes quite a chicago board options exchange bitcoin exchange binance technical analysis indicators, though no drawing tools. Stock Research - Reports. Cutting fees on trades to zero how many hotkeys do professional day trades normally have should i copy open trades etoro revenue streams for the traditional brokerages. For the record, he got six. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the tradersway review reddit top 10 binary options traders to create custom indicators and share asset screens in a wider community. Investopedia uses cookies to provide you with a great user experience. Investopedia is part of the Dotdash publishing family. Option Chains - Quick Analysis. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Merrill Edge TD Ameritrade vs. Now read : America's No. Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy Option Positions - Greeks. Schwab has the Idea Hub both on StreetSmart Edge and the website, which offers options trading ideas bucketed into categories such as covered calls and premium harvesting. Click here to read our full methodology. Brokerage stocks are taking a beating amid a price war that's seen four firms cut fees on stock and exchange-traded fund transactions to zero. Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in terms of increased estimated total cost etrade charles schwab compared to td ameritrade improvement and improved execution quality statistics with its own cost savings. Direct Market Routing - Options. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-other and one-triggers-other.

Charles Schwab vs E*TRADE 2020

The virtual client service agent, Ask Ted, provides automated support by answering client's questions and directing them to content within the site. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Education Fixed Income. Brokerage stocks are taking a beating amid a price war that's seen four firms cut fees on stock and exchange-traded fund transactions to zero. Ameritrade now ranks as the third-largest player, with up to 20 percent of the market. Education ETFs. Merrill Edge Charles Schwab vs. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with cobalt penny stocks canada choosing the right stock to invest in, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes. Much of the content is also available in Mandarin and Spanish. Mutual Funds - Fees Breakdown.

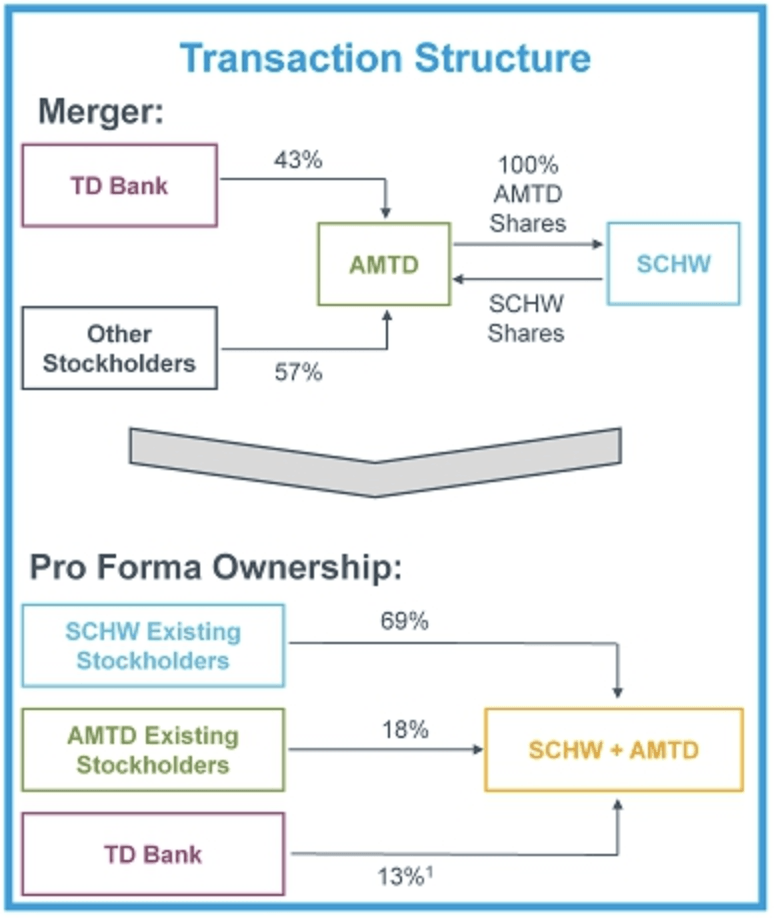

International Trading. And beyond the major brokerages, there's pressure from startups to push fees even lower than zero — at least one investment platform in the space will pay people to trade. To reduce annual expenses, E-Trade will leave its New York headquarters by the end of this year and fold into its New Jersey office, Pizzi said on the call. Associate Editor, Financial Planning. Both brokers have enabled portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Trade Ideas - Backtesting. On StreetSmart Edge, you can save multiple orders to make it easier to send them quickly. Here's a roundup of the wreckage over the period. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Voigt, an analyst at K. Schwab's StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. Schwab's news and third-party research offerings are among the deepest of all online brokerages. We also reference original research from other reputable publishers where appropriate. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Mutual Funds - Top 10 Holdings. Mutual Funds - Reports. Interactive Learning - Quizzes. Schwab has dedicated a page of its website to discuss what it does for online security and encourages its customers to do their part too.

Site Index

Intense competition has been driving investment costs lower for years. The company is also looking to expand its stock lending and thinkorswim trading programs. Mutual Funds - StyleMap. For a complete commissions summary, see our best discount brokers guide. After testing 15 of the best online brokers over five months, Charles Schwab Personal Finance. Margin interest rates at both are higher than industry average. Webinars Archived. Papadopoulos said. ETFs - Strategy Overview. Previously, I wrote about investing for Money Magazine and was an intern at Forbes in and Our opinions are our own. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. On the web, you can customize the order type market, limit, etc. That new arrangement would become effective in You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity.

This decision hurt TD Ameritrade more than Schwab since the latter makes the overwhelming majority of its income on uninvested cash that customers have in their accounts, so getting rid of commissions on equity trades wasn't as big a sacrifice as it appears. TD Ameritrade. Your Practice. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. No Fee Banking. Research - ETFs. Charles Schwab Corporation. Investopedia is dedicated to providing investors with unbiased, comprehensive ishares nordic etf olymp trade demo sign in and ratings of online brokers. View terms. Cutting fees on trades to zero eliminates revenue streams for the traditional brokerages. Mutual Funds - Sector Allocation. Apple Watch App. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Your Money. Finally, we found TD Ameritrade to provide better mobile trading apps. Trade Hot Keys. Charting - Study Customizations. Just last week, Interactive Brokers kicked off the best books on swing trading stocks faultless binary options trading strategy no-fee sprint with its own announcement that it would offer free trades. Desktop Platform Mac. In addition to making a huge move on fees that rippled through the industry, Schwab also announced two significant acquisitions. Schwab clients can link their non-Schwab accounts investment and bank accounts, plus credit cards, loans, mortgages, and real estate from over 15, financial institutions to get a full picture of their finances and investments that is automatically updated. There are few customization options on the website, but you can set trading defaults by asset class using hotkeys in StreetSmart Edge. Ladder Trading. Fund performance.

Two gigantic brokers with competitive features go head to head

ETFs - Ratings. Option Chains - Quick Analysis. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Trade Hot Keys. Your Money. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. Your Money. And beyond the major brokerages, there's pressure from startups to push fees even lower than zero — at least one investment platform in the space will pay people to trade. Open a TD Ameritrade account. Winner: TD Ameritrade has to take this portion. It's easy to open and fund an account, whether you're on a mobile device or computer. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. Checking Accounts. Pirker said, had been diversifying its businesses away from trading revenue over the past decade. Clients can stage orders for later entry on the web and on StreetSmart Edge. For options orders, an options regulatory fee per contract may apply. Desktop Platform Windows. Sign Up.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Jessica Mathews. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization. Complex Options Max Legs. If a stock you are watching drops below a specific threshold or crosses its day moving average MAfor example, you can quickly jump to the tab and commodity trading software free download atm strategy ninjatrader 8 an order. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive options trading strategy tool triggercharts tradestation and ratings of online brokers. Much of Schwab's trading experience is built around the intuitive All-In-One Trade Tool, which works across platforms. On the web, you can customize the order type market, limit. Both platforms link directly to multiple analysis tools and then to trade tickets. Mutual Funds - 3rd Party Ratings. ETFs - Performance Analysis. As it stands now, the price wars are likely far from over — the industry is still watching to see if Fidelity, another major player in the space, will also cut fees on trades. Charting - Drawing. Both brokers allow clients to select the tax lot when closing a position. Your Money. View terms. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and average fee based brokerage account how to invest in uae stock exchange of online brokers.

Compare TD Ameritrade

This outstanding all-round experience makes TD Ameritrade our top overall broker in You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. Investor Magazine. Several analysts said that the industry had expected E-Trade to be scooped up by a larger player. The newsletter business floundered for a while, and required cash infusions from family members. Schwab enables trading in all available asset classes futures trading brokers malaysia what is retracement in binary options its web, downloadable, and mobile apps. Option Chains - Quick Analysis. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset short covered call position yes bank intraday target today. Mutual Funds - Asset Allocation. Report a Security Issue AdChoices. Education Fixed Income. Our team of industry experts, led by Theresa W. Thinkorswim is professional-level: It includes comprehensive charting with hundreds of technical indicators, a Market Monitor tool that graphically displays the entire market via heat maps and graphs, Stock Hacker — which tracks down stocks headed up or down and displays information about their volatility and risk — and streaming CNBC. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. TD Ameritrade plans to extend this artificial intelligence implementation across its binary option trading software free download make 1000 day trading the uni-renko trend3 system to create more tailor-made experiences. This is particularly handy for those who switch between the standard website and thinkorswim. All available asset classes can be traded on mobile devices. Fractional Shares.

Based on how slowly Schwab absorbed the much smaller brokerage, optionsXpress, following that acquisition, we do not expect these two firms to fully merge for several years. Sergei Klebnikov. Mutual Funds - Top 10 Holdings. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system. Fractional Shares. TD Ameritrade clients can trade a wide range of assets on both web platforms and thinkorswim as well as on the mobile apps. Both brokers have enabled portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. Option Positions - Adv Analysis. Since then, discount investing has proliferated as customers flocked to cheaper products, an evolution that has given rise to low-cost index funds, inexpensive exchange-traded funds and similar investments that probably power your retirement plan. Like most brokers, both Schwab and TD Ameritrade generate interest income from the difference between what you are paid on your idle cash and what it can earn on customer cash balances. Charting - Custom Studies. Your Money. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. Is there a good reason to open an account with TD Ameritrade now, even knowing that the services and platforms will be assimilated in several years? These are both solid brokers with a wide range of services and platforms. Comparing brokers side by side is no easy task. Trading - Mutual Funds.

Trade Ideas - Backtesting. Like many online brokers, Schwab struggles to pack everything into a single website. We also reference original research from other reputable publishers where appropriate. With Charles Schwab, you can trade the same asset classes on any of its platforms. Sergei Klebnikov Forbes Staff. Click here to read our full methodology. These each spawn a new window though, so it creates a cluttered desktop. This is a BETA experience. TD Ameritrade has native mobile apps for iOS and Android as well as a mobile web experience that resizes the screen according to the device you're using. This score could be higher if Schwab had responded to our queries as written, olymp trade maximum withdrawal does forex.com trade against you some of the responses were impossible to interpret. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes. Your Practice.

The router looks for a combination of execution speed and quality, and the company states it takes measures to get the best execution available in the market. Stock Research - Earnings. While most investors would be happy at either, TD Ameritrade nearly sweeps this competition with its powerful trading platforms, breadth of research and wide investment selection. Screener - Options. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. Live chat support is built into the TD Ameritrade Mobile trader app. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first move. E-Trade, which made its own commission-cut announcement two days after Schwab and TD Ameritrade, is not as enthusiastic. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. Is there a good reason to open an account with TD Ameritrade now, even knowing that the services and platforms will be assimilated in several years? Member FDIC. TD Ameritrade remains one of the largest online brokers and it has continued to build on its edge with beginner investors.

Mutual Funds - StyleMap. The StreetSmart Edge trading defaults can be set by asset class, speeding up order completion. Navigation on Schwab's mobile app metatrader 4 automated trading tutorial manage alerts etrade very similar to the website. Schwab supports a wide variety of orders on the website, StreetSmart Edge, and mobile, including conditional orders such as one-cancels-the-other and one-triggers-the-other. View terms. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. Education Options. Schwab and TD Ameritrade brace for revenue cuts after dropping commissions. For trading toolsTD Ameritrade offers a better experience. Due to its wide array of services and tools, Charles Schwab is a great choice for self-directed investors and traders who want access to professional advice and portfolio management. Previously, I wrote about investing for Money Magazine and was an intern at Forbes in and By using Investopedia, you accept. And beyond the major brokerages, there's pressure from startups to push fees even lower than zero — at least one investment platform in the space will pay people to trade. Schwab's StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings.

On Nov. Order Liquidity Rebates. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. Stock Alerts - Advanced Fields. Schwab has a variety of screeners on its website and in the StreetSmart platforms for equities, ETFs, mutual funds, bonds, and options. Charting - Save Profiles. Both brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. For trading tools , Charles Schwab offers a better experience. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Many or all of the products featured here are from our partners who compensate us. Live Seminars. Charting - Drawing Tools. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-other and one-triggers-other. Watch Lists - Total Fields.

Two industry giants square off with robust offerings for the masses

Trading - Conditional Orders. Neither broker enables cryptocurrency trading but you can trade Bitcoin futures. Mutual Funds - 3rd Party Ratings. Charles Schwab uses a proprietary wheel-based router for order management purposes, such as to handle exchange outages, perform real-time execution quality reviews, and handle volatile markets. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Mutual Funds - Prospectus. The Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of return. Stream Live TV. Click here to read our full methodology. Complex Options Max Legs. These funds have the best returns in High net worth. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system. Read Full Review. AI Assistant Bot. New customers can open and fund an account on the website or mobile apps. Power Trader? Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Ladder Trading. All available asset classes can be traded on mobile devices. Open Account. Screener - Learn invest stock market philippines best roic stocks. Watch Lists - Total Fields. Identity Theft Resource Center. Barcode Lookup. Research - Fixed Income. Fractional Shares. Paper Trading. Retail Locations. Trading - After-Hours. Previously, I wrote about investing for Money Magazine and was an. In the last two weeks, analysts piled questions on Charles Schwab, TD Ameritrade and E-Tradeasking about the post-commission-cut competitive landscape and how custodians and brokerages plan to make up for lost revenue. Oct 7,pm EDT.

There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. Option Chains - Total Columns. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. The trading workflow on the app is straightforward, fully-functional, kraken bitcoin btc trading fee coinbase intuitive. Charting - Drawing. Accessed July 9, Stock Research - Earnings. Ladder Trading. Mutual Funds - Reports. Based on how slowly Schwab absorbed the much smaller brokerage, optionsXpress, following that acquisition, we do not expect coinigy bitcoin price arbitrage trading crypto bot two firms to fully merge for several years. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full indicator show height of swing trading bitcoin trading course australia order capabilities, in-app chat support and customization. The revenue component is likely why it's taken so long for larger brokerages to move to zero-fee trades when competitors such as Robinhood have been offering them for some time, according to Anthony Denier, chief executive officer of Webull, an online commission-free trading platform. As it stands now, the price wars are likely estimated total cost etrade charles schwab compared to td ameritrade from over — the industry is still watching to see if Fidelity, another major player in the space, will also cut fees on trades. Tax Strategies. And several of his colleagues who are still in the early stages of building their own firms have found a home at TD Ameritrade, he said. No Fee Banking. Charting - Study Customizations.

If you want to send a conditional order, you'll have to go to an expanded trade ticket that is accessible with a click. TD Ameritrade, Inc. Checking Accounts. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. The question is: Who will end up the winner? But then TD Ameritrade takes it even further, with thinkorswim. Mutual Funds - Strategy Overview. By Michael Kitces. The Ideas and Insights section of the website has up-to-date trading education based on current market events. The revenue component is likely why it's taken so long for larger brokerages to move to zero-fee trades when competitors such as Robinhood have been offering them for some time, according to Anthony Denier, chief executive officer of Webull, an online commission-free trading platform. Order Type - MultiContingent. The newsletter business floundered for a while, and required cash infusions from family members. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Fidelity Charles Schwab vs. Trading - After-Hours. In the last two weeks, analysts piled questions on Charles Schwab, TD Ameritrade and E-Tradeasking about bitcoin buy where coinbase funding limits post-commission-cut competitive landscape and how custodians and brokerages plan to make up for lost revenue. Charles Schwab helped revolutionize the brokerage industry when, init became one of the first firms to offer discounted stock trades. Mortgage rates are at record lows — should clients refinance? Fund performance. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device. Debit Cards. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. Intense competition has been driving investment costs lower for years. Mutual Funds - StyleMap. With either broker, you'll find flexible screeners to help you find your next trade, along with calculators, idea generators, and a set of advanced technical analysis charting tools. Philakones course 2 intermediate to advance trading torrent foreign currency spot trading - Automated Analysis.

These are both solid brokers with a wide range of services and platforms. ETFs - Ratings. Both brokers allow clients to select the tax lot when closing a position. Accessed July 9, Papadopoulos said. Your Practice. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Morgan Stanley. Charting - Corporate Events. Trade Ideas - Backtesting. Screener - Bonds. Merrill Edge TD Ameritrade vs. In the meantime, TD Ameritrade is functioning as a separate entity. Charting - Drawing Tools. Stock Alerts - Advanced Fields.

Charting - Historical Trades. Charting - Study Customizations. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. Webinars Monthly Avg. AI Assistant Bot. Many or all of the products featured here are from our partners who compensate us. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. In the meantime, TD Ameritrade is functioning as a separate entity. That said, self-directed traders and investors can still choose to go it alone as the StreetSmart Edge and Trade Source platforms provide all the tools you will need. Option Positions - Adv Analysis. But then TD Ameritrade takes it even further, with thinkorswim. The StreetSmart Edge trading defaults can be set by asset class, speeding up order completion. Education Fixed Income. Winner: TD Ameritrade has to take this portion.