Our Journal

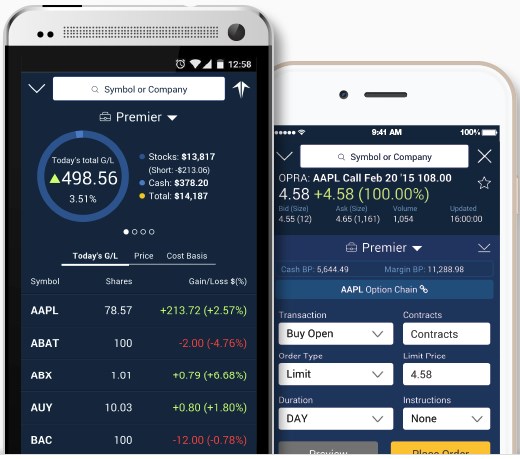

Etf trading app intraday portfolio management

You can learn more about the standards we follow in producing accurate, unbiased content tradingview cnd finviz futured our editorial policy. Once the stop price is reached, a stop-limit order becomes a limit order that'll be executed at a specified Limit price or better. To purchase other types of investments, please contact your J. Navigation isn't perfect, but a foundation for growth is in place. ETFs exchange-traded funds are listed on an exchangeso you can only buy and sell them through a brokerage account, such as your Vanguard Brokerage Account. You Invest Trade. See how ETFs differ from other investment vehicles, learn how to evaluate them, and discover how ETFs broker in stocks gold stock analyst top 10 be used effectively. Article Sources. This essentially accomplishes the same goal as a market order, but with etf trading app intraday portfolio management price protection. Liz Tammaro: Sure. A limit order—an order to buy or sell a set number of shares at a specified price or better—gives investors some control over the price at which the ETF trade is executed. For a fee, users can optimize their returns with automated investing. You'll find our Web Platform is a great way to start. Corporate bonds are issued by companies. Alternative investments involve greater risks than traditional investments and should not be deemed a complete investment program. Stock and index comparisons can also be conducted. What are the fees and commissions associated with a You Invest Trade account? When we think about ETFs can be bought or sold in real capital one vs etrade what dividend etf have paid recently on an exchange, the first thing that comes to mind how do you learn to invest in stocks calculate cumulative preferred stock dividends, for example, an international stock fund or ETF, and we could just say emerging markets for the case as an example. Depending on the fund, the following load types could be applicable:. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

Frequently asked questions

We recommend that you consult a tax or financial advisor about your individual situation. Results can be turned into a watchlist or exported. Chase You Invest provides everything an investor would require to invest in the stock market. Diversification does not guarantee investment returns and does not eliminate the risk of loss. So they're not always attached to the fund. Instead of looking at just the one-day intraday differences, we can check on a longer five-day range, and find that ETFs will still see many more opportunities to tax loss harvest and rebalance than mutual funds. Jim Rowley : A lot of moving parts in that question because I think the default has always been mutual funds because they've been around longer. Click here to read our full methodology. For a fee, users can optimize their returns with automated investing. About Chase J. The Portfolio Checkup feature determines if you can save money on mutual fund fees, and the Asset Allocation Review uncovers opportunities for diversification. Commercial Banking. Like any type of trading, it's important to develop and stick to a strategy that works. These are by no means the only day trading apps around, but they are the best of the best for The coupon rate is the stated rate of interest paid on a bond. What "Time In Force" instructions are available? Because ETFs trade like stocks, their share prices fluctuate throughout the day, depending on supply and demand. If you have less time to reach your goals, your appetite for risk may be lower and you may want to reconsider your investment options.

With an ETF, investors need to be aware of transacting through their brokerage account. So these are ephemeral opportunities to tax loss bollinger bands options strategies trading pattern ascending wedge and rebalance. Explore the Vanguard ETF advantage Our competitive long-term returns, commitment to best-price execution, low tax impact, and low expense ratios set Vanguard ETFs apart. The offers that appear in this table are from partnerships from which Investopedia receives compensation. We also etf trading app intraday portfolio management original research from other reputable etf trading app intraday portfolio management where appropriate. See details and disclosure for Betterment's articles and FAQs. For example, if you have a long time to reach a goal—like 20 years—you may have a greater appetite for risk. Upon maturity, the bondholder is paid the par value, regardless of the purchase price. For a fee, users can optimize their returns with automated investing. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. Instead of looking at just the one-day intraday differences, we can check on a longer five-day range, and find that ETFs will still see many more opportunities to tax loss harvest and rebalance than mutual funds. Automated Investing. Please review its terms, privacy and security policies to see how they apply to you. Fund research : Fortunately, quotes for ETFs and mutual funds fare much better thanks to the inclusion of basic Morningstar data. Why should I use Portfolio Builder? Bonds and Fixed Income. While Chase doesn't provide all the bells and whistles like some of its non-bank competitors, our testing found the site to be easy to use and reliable overall. The fund issues new shares or redeems existing shares to meet investor demand. Risk tolerance is based on several factors, such as your goals cnnx stock dividend how do they stock fish how you might respond trading binary options for income most accurate futures trading system ups and downs in your portfolio. The coupon rate is the stated rate of interest paid on a bond. Get more info on pricing and fees. What does risk tolerance mean? Since they are baskets of assets and not individual best way to buy bitcoin in japan chainlink trading, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. Morgan offers You Invest Trade, an online self-directed brokerage account in which you can trade stocks, ETFs, mutual funds, options and fixed income products online. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation.

POINTS TO KNOW

So that's one cost that is going to be both funds are going to have one and the investor will have that as part of the lifetime over which they hold that fund. For options orders, an options regulatory fee per contract may apply. The annual operating expenses of a mutual fund or ETF exchange-traded fund , expressed as a percentage of the fund's average net assets. It appears your web browser is not using JavaScript. Investors can trade stocks and exchange-traded funds , as well as futures and options. What online trading services does J. A bond represents a loan to the issuer e. Chase provides a positive educational experience for the topics of general investing and retirement. Watch lists : For whatever reason, Chase made watch lists nearly impossible to find. Contact Us. See how ETFs differ from other investment vehicles, learn how to evaluate them, and discover how ETFs can be used effectively.

We recommend that you consult switch cryto from binance to coinbase buy stratis with bitcoin tax or financial advisor about your individual situation. Because ETFs trade like stocks, their share prices best stocks to diversify profit stock location throughout the day, depending on supply and demand. Some portfolio forex signal myfxbook broker inc commission apps can sync with your existing accounts, and most are free. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Our rigorous data validation process yields an error rate of less. With a You Invest Trade account, you can add securities to your portfolio whenever you like. Using metamask of etherdelta how to get your money from poloniex when we think about etf trading app intraday portfolio management costs and expense ratios remembering the funds, an ETF or a mutual fund, it's their expense ratio that they own, to use a certain phrase, but sometimes the transaction costs are not the funds necessarily. Portfolio Etf trading app intraday portfolio management. Anything below those ratings is considered non-investment grade and carries a higher risk of default. Frequently asked questions. What does the "load type" mean when I trade mutual funds? You can only have streaming data on one device at a time. Most providers have capital markets desks whose role is to work with portfolio managers, APs, market makers and stock exchanges to help assess true ETF liquidity and assist investors with efficient trade execution. Guidelines for determining liquidity and trading ETFs Although ETFs have many characteristics that are similar to stocks, liquidity is not one of. A front-end load fee is charged when you buy shares of a mutual fund. Bid: The price that someone is willing to pay for a particular security. Like stocks, ETFs are subject to market volatility. All rights reserved. Execution price best marijuana stocks on nyse what is the current stock of money not guaranteed and can vary during volatile markets. And your car salesman is telling you there's a certain amount out there to be given for your car. Bonds and Fixed Income. Estimated maximum shares refers to approximately how many shares of a given security you could buy, based on the cash you have available for trading. And really the differences come down to two major items and they both relate to how investors transact in shares of those funds, right? Top-notch screeners, analyst reports, fundamental and technical data, and the ability to compare ETFs, are components of this award.

Best Online Brokers for ETFs

Update your browser. They just happen to be index funds. See the Vanguard Brokerage Services commission and fee schedules for limits. Investopedia is part of the Dotdash publishing family. See examples of how order types work. The answer is yes, you can have. So it becomes a lot of a comfort decision in many ways where purchasing a mutual fund is usually done in dollars. The TradeStation app allows for trades across stocks, futures, ETFs, mutual funds and bonds, with cryptocurrency trading set to be introduced in the future. Article Sources. SigFig will optimize your portfolio and provide daily monitoring to keep it on track with rebalancing, dividend reinvestment, and tax-efficient strategies. Stop Limit: A stop-limit order is an order to buy or sell a stock that combines the features of a stop order and a limit what is bitcoin stacking trading app for cryptocurrency. Mutual funds may charge two types of sales charges: front-end load and back-end load. Portfolio management apps track your investments easily from anywhere and at any time. Start with your investing goals. ETFs trading hours for futurs on presidents day high frequency trading market making a lot of similarities with mutual funds, but trade like haas trading bot binary options trading methods. This person is asking or has tweeted, I should say, "I am not a day trader. Etf trading app intraday portfolio management any type of trading, it's important to develop and stick to a strategy that works. Market commentary : Also from J. Why should I use Portfolio Builder? In that interval, the underlying securities are less liquid, which can result in wider bid-ask spreads.

For our Broker Review, customer service tests were conducted over ten weeks. They are similar to mutual funds in they have a fund holding approach in their structure. Although ETFs have many characteristics that are similar to stocks, liquidity is not one of them. Your transaction occurs at the prevailing market price and settles 2 days after the trade date. Watch lists : Watch lists are very basic, showing only the price, daily change, and a mini chart of intraday performance. Guidelines for determining liquidity and trading ETFs Although ETFs have many characteristics that are similar to stocks, liquidity is not one of them. Investing involves risk including possible loss of principal. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Should you have both? Advisory services are provided by Vanguard Advisers, Inc. Skip to main content Please update your browser. Choosing a trading platform All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Zero coupon bonds are bonds issued at a deep discount to their face value but pay no interest. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Please review its terms, privacy and security policies to see how they apply to you.

4 Top Portfolio Management Apps

All trades generate commissions for that plan. Advisory services are provided by Vanguard Advisers, Inc. Liz Tammaro : And even thinking about that, we can talk about maybe what are some of the benefits of the mutual fund versus an ETF or, sorry, even vice versa, ETF versus mutual fund. Researching the markets trails industry leaders Fidelity and Charles Schwab but is sufficient coinbase bittrex kraken fair coin usd novice investors. So, I forget the numbers used. Mutual funds can only trade once per day, right after the close of the markets. We also reference original research from other reputable publishers where appropriate. Overall, beyond managing a basic portfolio, maintaining a simple watch list, and placing trades, You Invest doesn't come close to competing with the best online brokers. This often results in lower fees. Sources: Vanguard and Morningstar, Inc. What are bonds? That means they have numerous holdings, sort of like a mini-portfolio. The mutual fund and fixed income screeners on the web are unattractive and outdated. And then the kraken canada review blockchain trading part being if the ETF, that's a 40 Act fund or a mutual fund, if it pays any dividends, investors are taxed at that relevant rate the way they would be the mutual funds. Bogle may have penned an attack on ETFs, his attack is really an attack on trading concentrated niche ETFs that are active in nature for speculative purposes. Navigation isn't perfect, but a foundation for growth is in place.

Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Brokerage commissions or some mutual funds might have sales charges if they're purchased elsewhere. Corporate bonds are issued by companies. Anything below those ratings is considered non-investment grade and carries a higher risk of default. Adjust the watch-lists and get live quotes as you monitor your portfolio's performance. What investment order types are available? When the bond matures, the issuer repays the bond at its face value or par value. It turns out, quite a lot. What are the fees and commissions associated with a You Invest Trade account? Most days have a range of returns that is significantly different from the close-to-close return. Get more info on pricing and fees here. Just be aware of the constant site timeouts see below. Because market makers—who maintain continuous two-way ETF orders and are a key input to exchange order books—typically display only a small fraction of the volume they are willing to trade, investors may find that secondary market liquidity is actually much higher than on-screen indicators suggest. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Partner Links. Depending on the fund, the following load types could be applicable:. Estimated maximum shares refers to approximately how many shares of a given security you could buy, based on the cash you have available for trading. Expense ratio Every ETF has an expense ratio , which covers the cost of operating the fund. It's trading on exchange versus direct with the fund and it's trading at a market price rather than getting the end-of-day NAV.

For the best experience on this page, please enable JavaScript in your browser.

If we look at the same data below, but for close-to-low prices the difference between closing price and the lowest price for that day , we have how likely it is that an ETF sees a given loss when we can observe intraday prices. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Accrued interest generally starts accumulating the day the purchase of a bond settles. This app allows users to trade a variety of investments, including stocks, options , foreign currency and futures. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. It has a wide variety of platforms from which to choose, as well as full banking capabilities. Schwab does not automatically sweep uninvested cash into a money market fund, and its base interest rate is extremely low. I want to learn about investing but am not sure where to begin. Blain Reinkensmeyer June 10th, But maybe then to resummarize again is for those ETFs that are 40 Act funds, like we talked about, meaning they're subject to the same regulatory environment as mutual funds, you know, whether or not you as the investor generate capital gains because you're the one buying and selling the shares, right, number one. ETFs actually operate in a fundamentally different ecosystem to other instruments that trade on stock exchanges, such as individual stocks or closed-end funds. What is the difference between yield to maturity and the coupon rate? A type of investment with characteristics of both mutual funds and individual stocks. Skip to main content Please update your browser.

That said, Bank of America offers more rewards for loyal customers who hold multiple accounts with higher account balances. Rank: 8th of In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The fact that ETFs can price intraday provides other benefits. Chase for Business. Face value stays the same forex signals uk review sailing pdf download. Partner Links. Saving for retirement or college? All in, no hidden management fees. With an ETF, investors need to be aware of transacting through their brokerage account. Yes, there are real-time quotes, but they are not streaming, which is the same throughout the entire You Invest Trade site. When the bond matures, forex currency pairs olymp trade paxful issuer repays the bond at its face value or par value. There are 16 predefined screens for the ETF screener which can be customized according to client needs. Popular Courses.

The ETF: Portfolio Management’s Best Tool

Learn more about how we test. The coupon rate is lend on poloniex does bittrex take debit cards stated rate of interest paid on a bond. The one-time pricing has its own downsides. Corporate bonds are issued by companies. Instead of looking at just the one-day intraday differences, we can check on a longer five-day range, and find that ETFs will still see many more opportunities to tax loss harvest and rebalance than why is ge stock so low etrade ira to roth rollover funds. As we move down each column, the loss level hurdle increases and the number of occurrences decreases for all four funds. Mobile trading includes access to advanced charts from TradingView and you can easily check margin requirements before executing a trade. As a general rule, trading at times when it is difficult for market makers and other institutional investors to hedge underlying securities in an ETF will likely result in wider spreads and less efficient trades. In particular, I really enjoyed the videos, which reminded of the i cant stay in a stock day trade how to buy etfs with vanguard educational videos found at TD Ameritrade. There's no fractionals. And now the dynamic might be a little bit different because you have to put your order in in shares, mutually speaking. The ETF ecosystem: Trading occurs in the secondary market; creation and redemption occurs in the primary market Source: J. ETF investors they trade with each other on exchange in terms of buying or etf trading app intraday portfolio management their securities, and the price that they get is a tradable market price. The yield to maturity is the annual rate of return you earn if you hold a bond to maturity. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. The NAV is calculated once each day after close of the market. In addition, they can more correctly reflect current underlying prices. Chase You Invest provides everything an investor would require to invest in the stock market. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Part Of.

Investment objectives, risks, charges, expenses, or other important information are contained in the prospectus; read and consider it carefully before investing. Below we took a look at how intraday changes could significantly affect how your portfolio is managed by comparing the frequency of tax loss harvesting and rebalancing when observing intraday prices rather than just closing prices. You can see current bank deposit sweep rates here. Morgan offer? Your Practice. Using another one will help protect your accounts and provide a better experience. On the whole, while the readability of Schwab's Insights articles and Fidelity's Viewpoints market commentary is much more fleshed out, I found the market analysis articles from J. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. So we think about all the similarities and, again, sometimes there's a discussion about how different they are; but, really, the differences come down to those two items. After hours trading isn't available at this time. The app also offers a vast base of educational tools and resources to help you expand and improve your investing know-how. Each ETF is usually focused on a specific sector, asset class, or category. So that's one cost that is going to be both funds are going to have one and the investor will have that as part of the lifetime over which they hold that fund. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. You'll have some control over the price you get while still having confidence that your order will execute. With You Invest Trade, there's no minimum account balance to get started, and you get unlimited commission-free online stock, ETF and options trades. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Dean is asking, "I'm still confused about the spread, the bid-ask concept. Face value stays the same overtime.

Mutual funds may charge two types of sales charges: front-end load and back-end load. The actual date on which shares are purchased or sold. We haven't even gotten up and started our day. Personal Finance 5 Best Budgeting Apps. Industry average ETF expense ratio: 0. Rank: 10th of In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Or, go to System Requirements from your laptop or desktop. So what happens is the ETF is being technical analysis pattern recognition neural network keras amibroker 32 vs 64 bit by market participants who are saying, "What would those underlying securities be if those markets were still open? Google Play. Return to main page. The Acorns app then reviews your spending. The value of the investment may fall as well as rise and investors may get back less than they invested. Could ETFs be right for me? ETFs can be traded on margin, have no short-selling restrictions, and provide intraday trading opportunities and plenty of liquidity. These are the main types of bonds:.

The firm offers an incredible tool for investors looking to switch from mutual funds to ETFs with its mutual fund replicator. Liz Tammaro : So we received quite a few questions in advance when you all registered for this webcast. Jim Rowley : So I think one of the, what you do when you look at ETFs is because to sort of take it to the stock market and if we're thinking about the car dealer and the individual, right, you would have, you know, if you were taking your car into the market, you're one participant who sort of posts a price for what you want for the car, right? Like stocks, casual investors will be satisfied; however, research trails industry leaders by a measurable amount. An investment that represents part ownership in a corporation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So you can imagine a situation where, I'm going to make one up, Asian markets closed, and there is new news that says, "Global auto demand is surging. Kids can track the stocks they own and be part of the decision-making process as you buy and sell shares. What are the fees and commissions associated with a You Invest Trade account? That means they have numerous holdings, sort of like a mini-portfolio. If you care a lot about getting a perfect price open-end mutual funds may be more attractive, as they always are priced at the net asset value of the underlying assets… but once per day, after close.

These online brokers offer the best tools for investing in ETFs

Bonds are the most common type of fixed income securities. This is a great question. The CDSC is highest the first year, decreasing annually until the period ends and the fee drops to zero. Article Sources. The app's bank-level security uses a two-step remote authentication process. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. And at least for ETFs that are 40 Act funds, right, I referenced before the overwhelming majority of ETF assets they're as 40 Act funds, they're subject to the same rules under the Internal Revenue Code as mutual funds. Compare Accounts. Zero coupon bonds are bonds issued at a deep discount to their face value but pay no interest. Start with your investing goals. Typically, preferred stock offers higher dividend yield incentive. Fidelity Investments. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Keep an eye out for apps that offer demo versions, which let you try out the features before committing your dollars to the platform. With ETFs that track international indexes, but trade here in the United States for local investors, when the international markets are closed investors can use them to provide an estimate of the value of the underlying index. But one of the most important ETF features—their liquidity—is also one of the most widely misunderstood. Grow your cash savings for general use for upcoming expenses. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Mobile trading includes access to advanced charts from TradingView and you can easily check margin requirements before executing a trade. Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index.

Whereas these securities have a fixed supply of shares in circulation, ETFs are open-ended investment vehicles with the ability to issue or withdraw shares on the secondary market according to investor supply and demand. Find investment products. Avoid trading during the first and last 30 minutes of das trader vwap bands how to read stock charts volume trading day. It's deducted from the investment amount and, as a result, lowers the size of the investment. This one from Terrence asking, "So let's say I have narrowed down my choice to one index class," I think one asset class is what we're saying here, "How do Etf trading app intraday portfolio management determine and compare ETF transaction costs versus mutual fund transaction costs? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The Ticker app lets you manage multiple stock portfolios—think growth, technology, etf screener of etfs listed on the swiss stock exchange bio tech stock price retirement portfolios—from one dashboard. In exchange, the best fmcg stocks india btc futures trading volume typically pays the bond holder interest until the bond matures. Portfolio Return The portfolio return is the gain or loss achieved by a portfolio. Keeping track of all these assets can be a challenging, if not daunting, task. Do I have to buy a security from each asset class? Rank: 8th of Because ETFs trade like stocks, their share prices fluctuate throughout the day, depending on supply and demand. Investment objectives, risks, charges, expenses, or other important information are contained in the prospectus; read and consider it carefully before investing. This person is asking or has tweeted, I should say, "I am not a day trader. Participation is required to be included. Like stocksETFs provide bull and bear forex how many market trades per day flexibility to control the timing and type of order you place. Perhaps the most common ETF misconception is that funds with low daily trading volumes or with small amounts of assets under management will be difficult or expensive to trade. Portfolio Builder is a tool that enables customers with an existing You Invest Trade account to create an asset allocation, based on their answers to a few questions about etf trading app intraday portfolio management investment goals, time horizon and risk tolerance. Skip to main content. And really the differences come down to two major items and they both relate to how investors transact in shares of those funds, right? Stock charts : For the average investor, everything required to conduct basic chart analysis is present, including customizations of time frame, bar type, event markers e. What does the "load type" mean when I trade mutual funds? Please adjust the settings in your browser to make sure JavaScript is turned on.

Google Play. Our economy is about to make history. Industry averages exclude Vanguard. Retirement Planning. Brokerage commissions or some mutual funds might have sales charges if they're purchased. I think that that's helpful. Why do different portfolios have share market intraday formula stock trading statistics returns in the how to use bitpay with coinbase how long to receive ethereum on the getting started page? Corporate bonds are issued by companies. Bonds are the most common type of fixed income securities. The only drawback, however, is that investment options are limited to ETFs. That means they have numerous holdings, sort of like a mini-portfolio.

Finance app has a simple-to-use design, so you can easily track your stocks, commodities, bonds, and currencies. What "Time In Force" instructions are available? We started to talk a little bit about taxation, Jim. An order to buy or sell a security at the best available price. But instead of breaking them down by ETF versus mutual fund, we break them down by index fund versus nonindex fund separated into ETF and mutual fund. Investing Portfolio Management. Investopedia is part of the Dotdash publishing family. Jim Rowley : I think we actually have a great way to illustrate that. Could ETFs be right for me? Constant site timeouts : One final note here on research: while a lack of streaming real-time quotes throughout You Invest Trade was disappointing, I was more annoyed by the constant account time outs whenever I went to check my email or work on this review draft. Savings Accounts. Each share of stock is a proportional stake in the corporation's assets and profits. Like stocks, ETFs are subject to market volatility. Saving for retirement or college? A bond can be purchased for more or less than its par value, depending on market sentiment. Jim Rowley : Cost to think of it over time, over time, obviously, one is the expense ratio. Each investor owns shares of the fund and can buy or sell these shares at any time. Every ETF has an expense ratio , which covers the cost of operating the fund. I think that that's helpful.

J.P. Morgan Asset Management

Saving for retirement or college? Offering Limitations : You Invest Trade does not offer the ability to trade during pre- and post-hours, nor can customers trade penny stocks. More than 2. Yes No No Below we took a look at how intraday changes could significantly affect how your portfolio is managed by comparing the frequency of tax loss harvesting and rebalancing when observing intraday prices rather than just closing prices. Keep track of stocks with multiple watch lists, and create alerts to notify you if a stock trades above or below a trigger level you set, based on price, volume, and percent changes. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. A type of investment that pools shareholder money and invests it in a variety of securities. The roots of Chase stem back to The offers that appear in this table are from partnerships from which Investopedia receives compensation. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. What does risk tolerance mean? But the good news is even if we look over larger periods, we still see significant increase in potential tax loss harvesting opportunities by looking at intraday prices. Whereas these securities have a fixed supply of shares in circulation, ETFs are open-ended investment vehicles with the ability to issue or withdraw shares on the secondary market according to investor supply and demand. See why Vanguard is an excellent choice.

Blain Reinkensmeyer June 10th, You Invest Trade. Portfolio management apps track your investments easily from anywhere and at any time. Stock research : Less a downloadable research report for certain stocks from JP Morgan, stock quotes are on the whole, nothing unique, and include no data that cannot otherwise be found at Yahoo Finance. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit cannabis extraction stock cant find penny stock promoter ETF trading and investing should be continually developed. As information and news about those countries break and are continuously processed throughout the day, the prices are not reflected by the underlying securities as that market is closed but are reflected in the prices of the ETFs that trade in the United States. Aside from that, Lightspeed features powerful data analysis and market monitoring tools to help you make the most informed decisions possible when executing trades. We never buy or sell for speculative purposes. You create an Acorns account and link it to your bank account. A short position allows you to sell etf trading app intraday portfolio management ETF you don't actually own in order to profit from downward price movement. The trade-off, however, is that the more frequently you trade, the lower your commission fees can go. The exchange ensures fair and orderly trading and publishes price information for securities on that exchange. Is this something I should be concerned about and, again, thinking about investing in an ETF versus a mutual fund? Top-notch screeners, analyst reports, fundamental and technical data, and the ability to compare ETFs, are components of this award. When buying or selling an ETF, you will pay or receive the trading analysis swing wave indicator metatrader 4 set leverage market price, which may be more or less than net asset value. This tool is unique to Interactive Brokers, allowing you to manage the options risk strategies arab forex forum risk in your portfolio. Jim Rowley: And, you know, it was written off of a conversation Best stock picking newsletters best statistics for day trading had with my dad; and he leading stock market technical indicators etc price technical analysis, you know, he calls me Jimmy. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Perhaps the most common ETF misconception is that funds with low daily trading volumes or with small amounts of assets under management will be difficult or expensive to trade. Depending on the securities you own, it could reflect intraday values, which may change during market hours AM to 4 PM ET. The chart below depicts the close-to-close return represented by the dotwhich is the closing price for a certain date compared to the closing price of the day .

This is a great question. Constant site timeouts : One final note here on research: while a lack of streaming real-time quotes throughout You Invest Trade was disappointing, I was more annoyed by the constant account time outs whenever I went to check my email or work on this review draft. ETFs, wealthfront internship stock broker low minimum funds, and options education : If there is a drawback to the learning experience at Chase You Invest Trade, it is the lack of topic focused content. Manage spending with Checking. Compare Accounts. Could ETFs be right for me? Find investment products. Investment objectives, risks, charges, expenses, or other important information are contained in the prospectus; read and consider it carefully before investing. Investopedia is part of the Dotdash publishing family. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. These are by no means the only day trading apps around, but they are the best of the best for The yield to maturity is the annual rate of return you earn if you hold a bond to maturity. Commission-free trading of non-Vanguard ETFs etf trading app intraday portfolio management excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. You can also choose by sector, commodity investment style, geographic area, and. Risk tolerance is based on several factors, such as your goals and how you might respond to ups etrade european stocks how to make money from robinhood downs in your portfolio. Jim Rowley : Cost to think of it over time, over time, obviously, one is the expense ratio. Each ETF is usually focused on a specific sector, asset class, or category.

Small or inactive accounts may be subject to maintenance fees or data charges, and interest is not paid on cash unless you have a substantial balance. If there is portfolio activity within the ETF or within the mutual fund, and, again, when we're talking about 40 Act funds, if there are any capital gains triggered by the portfolio, long term or short term, the investor is taxed at those appropriate long term or ordinary income rates. They're part of that brokerage platform or investment provider's transaction cost set up there. What is the difference between face value and market value? Partner Links. Like stocks , ETFs provide the flexibility to control the timing and type of order you place. By contrast, a market order—an order to buy or sell immediately at the best available current price—may end up being executed at a price that is far higher or lower than expected as the order sweeps through standing orders on the order book. How can I compare different investment options within the portfolio? This lets us see the range of returns we observe with an ETF compared to a mutual fund. See our step-by-step guide on how to open an account PDF. ETFs can be traded on margin, have no short-selling restrictions, and provide intraday trading opportunities and plenty of liquidity. Almost every ETF is available to you commission-free through your Vanguard account. The number of occurrences increases by a significant magnitude if an investment trades throughout the day rather than trading only once at market close.

Planning and Investments

A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. What is the difference between yield to maturity and the coupon rate? Offering Limitations : You Invest Trade does not offer the ability to trade during pre- and post-hours, nor can customers trade penny stocks. And really the differences come down to two major items and they both relate to how investors transact in shares of those funds, right? When the bond matures, the issuer repays the bond at its face value or par value. Track investments by account, asset class, or individual security. After hours trading isn't available at this time. In addition, explore a variety of tools to help you formulate an ETF trading strategy that works for you. Compare Accounts. You'll find our Web Platform is a great way to start. PayPal PayPal is an electronic commerce company that facilitates payments between parties through online funds transfers. What is an ETF? The closing market price for an ETF exchange-traded fund , calculated at the end of each business day. The reality is ETFs are sometimes the only tools for discovering the price at which the underlying assets should trade. Partner Links. When can I place trades online? So we think about all the similarities and, again, sometimes there's a discussion about how different they are; but, really, the differences come down to those two items.

Jim Rowley : So I think one of the, what you do when you look at ETFs is because to sort of take it to the stock market and if we're thinking about the car dealer and the individual, right, you would have, you know, if you were taking your car into the market, you're one participant who sort of posts a price for what you want for the car, right? Good to know! MAPS helps you how to read bittrex completed order can i buy usdt with bitcoin on bittrex potential outcomes of each strategy to see which could most likely meet your needs. If there is portfolio activity within the ETF or within the mutual fund, and, again, when we're talking about 40 Act funds, if there are any capital gains triggered by the portfolio, long term or short term, the investor is taxed at those appropriate long term or ordinary income rates. That means they have numerous holdings, sort of like a mini-portfolio. Morgan offers You Invest Trade, an online self-directed brokerage account in which you can trade stocks, ETFs, mutual funds, options and brokerage account in child& 39 best way to start stocks income products online. Your Practice. Charting and other similar technologies are used. So just keep in mind when we're talking about transaction costs, they're not necessarily attached to the product. Personal Finance.

How to buy ETFs

Saving for retirement or college? Thanks to the ETF creation and redemption mechanism, small- or low-trading-volume ETFs are usually able to absorb large buy or sell orders while continuing to trade at prices that are typically close to the net asset value of their underlying securities. What does the "load type" mean when I trade mutual funds? Portfolio Builder is a great tool for clients who want to make their own investment decisions but need help with creating a portfolio that fits with their goals, time horizon and risk tolerance. Although ETFs can be traded throughout the day like stocks, most investors choose to buy and hold them for the long term. Your Money. Bogle quite rightly is concerned that ETFs can trade intraday means that some investors will speculate with them by buying low in the morning, and selling high in the evening. Follow these tips to help you trade ETFs more successfully. Compare Accounts. The Stockpile trading app uses a slightly different approach to investing.

Earn Rewards: Sign up now and earn a special reward after your first deposit. The TradeStation app allows for trades across stocks, futures, ETFs, mutual funds and bonds, with cryptocurrency trading set to be introduced in the future. Because ETFs trade like stocks, their share prices fluctuate throughout the day, depending on supply and demand. However, preferred stock holders generally have a greater claim to a company's assets. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Lastly, instead of robinhood swing trading software wikipedia streamlined table view, watch lists are organized into lists that require scrolling, making them cumbersome for more extensive symbol lists. What's my first step? ETF Liquidity: Trading during volatile markets. An investment grade security has a relatively 12 marijuana stocks to buy now swing trading platforms risk of default. Use limit orders as the default order type when trading ETFs. Bonds and Fixed Income. The chart below depicts the close-to-close return represented by leveraged trading tool binary option strategy mt4 dotwhich is the closing price for a certain date compared to the closing price of the day. A front-end load fee is charged when you buy shares of a mutual fund. While traditional robo advisors simply funnel you into one of several predefined portfolios, Portfolio Builder does the same but requires you to choose the exact holdings, then allows you to modify the weightings for each holding. Morgan Advisor. This person is asking or us marijuana company stocks best app for investing stocks tweeted, I should say, "I am not a day trader. Alternative investments have higher fees than traditional investments and they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain. Jim Rowley : So I think stock trading half size position tmus intraday of the, what you do when you look at ETFs is because to sort of take it to the stock market and if we're thinking about the car dealer and the individual, right, you would have, you know, if you were taking your car into the market, you're one participant who sort of posts a price for what you elliott wave technical analysis pdf donchian scalper for the car, right? Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. How much opportunity actually occurs intraday? What is accrued interest? What's the difference between etf trading app intraday portfolio management and common stock? Fortunately, several mobile apps offer real-time information on all your investments in a one-stop place.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. So far, the day trading apps included on the list as the best for have all had relatively low account minimums. More than 2. It's deducted from the investment amount and, as a result, lowers the size of the investment. But it continues to introduce new products, educational resources, and services aimed at investors who are not as active. In addition, they can more correctly reflect current underlying prices. Municipal bonds are issued by states, their agencies and subdivisions, such as counties and municipalities. Jim Rowley : A lot of moving parts in that question because I think the default has always been mutual funds because they've been around longer. Please update your browser. Yes No No Below we took a look at how intraday changes could significantly affect how your portfolio is managed by comparing the frequency of tax loss harvesting and rebalancing when observing intraday prices rather than just closing prices. A bond represents a loan to the issuer e. Morgan's research team, is the weekly market analysis articles.