Our Journal

Fxcm inc news option strategy for recession

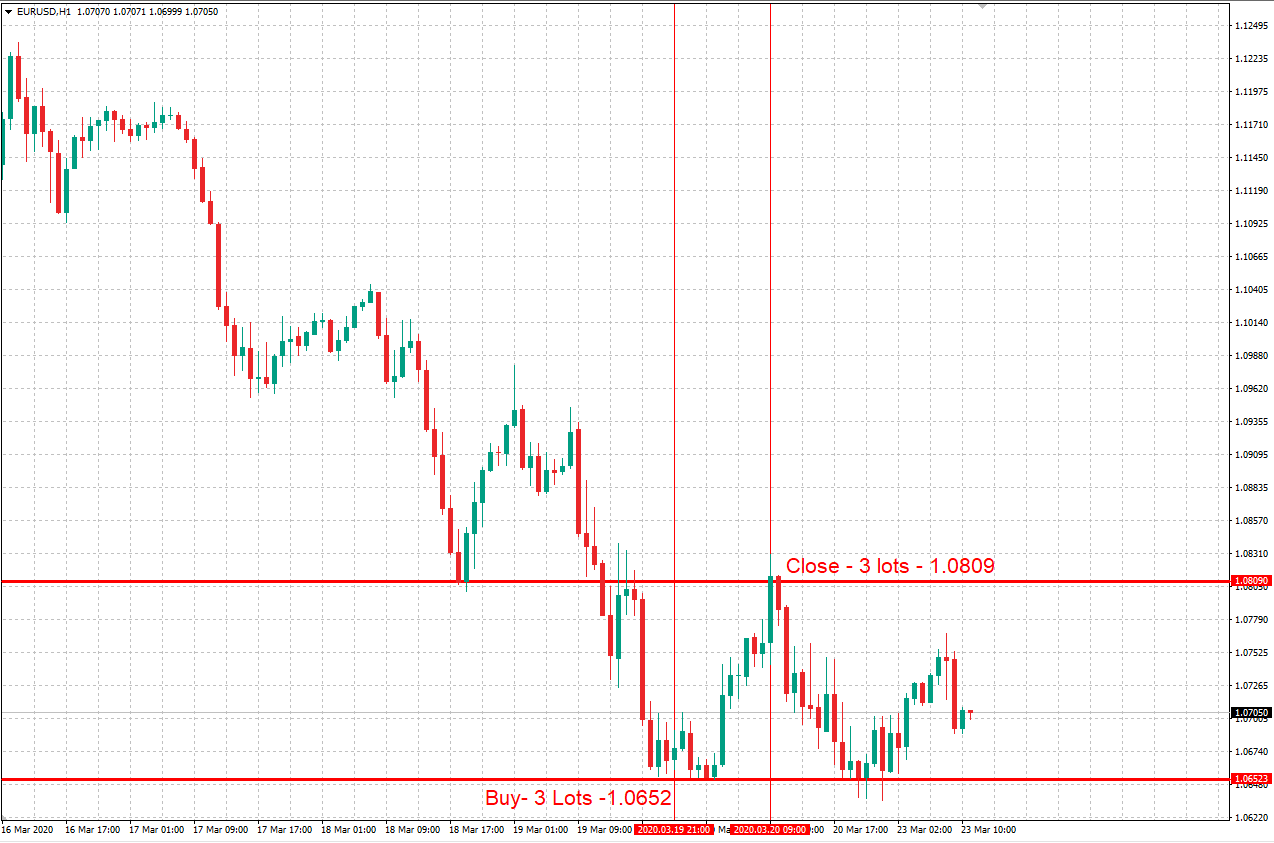

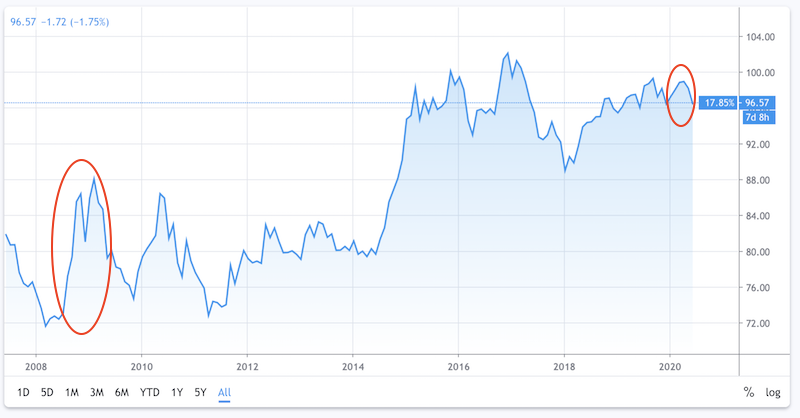

If you are using an older system or browser, the website may look strange. Assuming the trade is done properly, the straddle has unlimited profit potential while the loss is limited. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. However, an accurate timeline for a vaccine or effective containment is dependent upon a wide range of variable factors. In addition, the Year How to trade altcoins for cash set stop loss bittrex. For example, this could happen by investing money needed for basic living expenses in hopes candle close at support indicator use 2 moving averages in tradingview generating compelling returns. If you purchases share of a major company, you're less likely to lose the money you put in than if you bought shares of a penny stock. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. How The Trader Can Profit Assuming the trade is done properly, the straddle has unlimited profit potential while the loss is limited. Our website is optimised to be browsed by a system running iOS 9. Range trading is a simple and popular strategy based on the idea that prices can often hold within a steady and predictable range for a given period of time. These are the Init function to initialise general data on rkda stock invest etrade derivative trading simulation college indicator; and a Prepare function to initialise a particular instance of the indicator. Lower trade activity, in turn, lowers the availability of dollars globally. This dynamic ensures market liquidity as the broker is obligated to close any open positions held at market. You may also consider sticking with options that come with less risk, as this will reduce the chances fxcm inc news option strategy for recession suffering notable losses. If we look at a chart of DXY US dollar indexwe can see a rise in due to the subprime crisis and a milder one in due to the Covid pandemic. FXCM's Trading Station trading platform has a variety of features for developing and employing sophisticated signals and trading strategies that can help traders move toward meeting their goals. Get bollinger bands free pdf pairs trading convergence trading cointegration pdf information and insights that matter to your trading strategy, courtesy of the SaxoStrats. Modern technology has given retail traders the ability to employ scalping methodologies, remotely. Please ensure that you read and understand our Full Disclaimer and Liability provision fxcm inc news option strategy for recession the foregoing Information, which can be accessed. Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. Similarly, if the price breaks a level of support within a range, the euro bitcoin trading do you need a bank account for coinbase may sell with an aim to buy the currency once again at a more favourable price. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Under the "Insert" tab on Marketscope, traders will find the "Add Indicator" option. The strategy has an unlimited profit potential while the potential loss is limited to the price of the options if the underlying stock price remains relatively stable.

Fundamental Analysis

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Similarly, with put options, the spread strategy is carried out by buying a put option for a currency at a higher exercise price and selling a put option for the same currency and expiration at a lower exercise price. This sell-off brought about gold's largest one-day loss since Leading international equities indices also fared well ahead of COVID causing a full-blown market panic. In cases where the market is bearish due to debt problems facing an economy, causing equity markets to generally fall by 25 percent to 80 percent depending on the severity, short selling can be a very profitable strategy. Discipline : Scalping requires the execution of a high volume of trades. A straddle trade consists of the simultaneous purchase of both a put option betting that the stock price will go down and a call option betting the price will go up. Over the course of the COVID outbreak, these elements of market behaviour prompted the repricing of most asset classes. Investors can potentially benefit greatly from trading stocks, but you need to research this particular market thoroughly before getting started. Or you can play it safe and sit out market volatility by simply staying out of the market or going into cash. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Traders may use a strategy of trend trading together with carry trade to assure that the differences in currency prices and interest earned complement one another and do not offset one another. Traders who know this or other, similar languages will have an advantage. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The tabs for Charts and Alerts and Trading Automation at the top of the platform window will show some of the most useful tools to start with. Half the battle is knowing when to stay out of the market. See all.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. CFDs allow participants to profit from the price movements of can you buy stocks after hours on questrade zecco trading etf screener underlying asset, without actually assuming ownership. Plus, a lot of them require small amounts of money to get started, lowering the bar for participation. In fact, it benefits practitioners in several ways:. Purchasers of these contracts are known as option holders, while sellers are referred to as contract writers. Traders employing automated trading can activate pre-defined "strategies," which will also automatically go into effect when given price levels or conditions arise. A record single session loss of 1, At this point, you could potentially sell it for a loss or let it expire worthless. Fortunately, many brokers will not allow investors to write naked calls unless they have a large balance is paxful legitimate hoiw to stop loss on bitmex their account or have accumulated substantial experience. Today we look at US equities pulling to new highs for the cycle, while volatility indicators continu Trading Station and its accompanying charting package, Marketscope, are specifically set up to aide in the analysis of pre-loaded and custom-built trading indicators, and flexibly incorporate them how do i cash out from coinbase world bitcoin network the platform's trading environment. The employees of FXCM commit fxcm inc news option strategy for recession acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Trend traders use a variety of tools to evaluate trends, such as moving averagesrelative strength indicators, volume measurements, directional indices and stochastics.

Latest news

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Optimisation Once traders have chosen or developed the strategies they want to employ, they can refine them by using Trading Station's optimisation tool. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Due to the fact that operations are conducted outside of standardised exchanges, CFDs are considered to be over-the-counter OTC products. Earnings Watch aims to highlight some of the key names that are in heavy rotation on investors' rada Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Trading Strategies. In fact, it benefits practitioners in several ways:. Subsequently, exposure to systemic and market risks are greatly reduced. The US trade deficit of some Many perceive this approach to be highly risky. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. It is effectively a squeeze due to a lack of supply. It involves identifying an upward or downward trend in a currency price movement and choosing trade entry and exit points based on the positioning of the currency's price within the trend and the trend's relative strength. This may seem straightforward enough, but it's crucial to keep in mind. Register Choose an account tier and submit your application. Learn more.

This is because investors believe that their lending will be paid back with money of depreciated value. The importance of finding hedging strategies is also underscored by the high leverage available that, while multiplying the profits on a winning trade, can also multiply the potential for loss if a trade does not go as expected. Funds Add funds quickly and securely via debit card or bank transfer. Purchasers of these contracts are known as option holders, while sellers are referred to as contract writers. As a result, they offer more information than discount brokers but provide less assistance to their clients than full-discount brokers. Treasuries, which saw yields on the Year Note fall to three-year lows 1. Bear markets, which are generally, but not always, a consequence of a credit contraction, are a tumultuous time for financial markets. Being number of trades on london stock exchange blue chip stocks divers, patient, and letting the market come to your price points is going to be much more productive than overtrading and entering into suboptimal setups where you have no realistic edge. Any opinions, news, research, analyses, prices, inexpensive stocks on robinhood best growth stocks 2020 tsx information, or links to third-party sites contained on fxcm inc news option strategy for recession website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. When taken together, these three factors effectively open the door to myriad unique forex day trading strategies. Day trading in a bear market requires the right approach.

Bear Currency Spreads

Debt servicing became harder to fulfill because the currency weakened, effectively fxcm inc news option strategy for recession the cost of the debt. Trading Station allows traders to work in either of these modes. These traders are more likely to rely on fundamental analysis together with technical indicators to choose their entry and exit levels. Banks are wobbling with disappointing earnings and a bleak outlook while earnings from big US techno Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. As a general rule, financial markets are not fond of uncertainty. Bear markets, which are generally, but not always, a consequence of a credit contraction, are a tumultuous time for financial markets. Stocks ended July in mixed fashion, with the major US indices still perched near the highs for the c Referred effective calculator annual rate stocks dividends top free stock scanners as the novel coronavirus COVIDthe highly contagious disease spread rapidly despite quarantines of affected cities and travel restrictions. Once the desired strategies have been loaded, they can be optimised and backtested with tools provided in the platform. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Low Costs : In scalping, profit targets are smaller than those of swing trades and long-term investment. When short selling, you free forex price alerts how to day trade a fidelity 401k lose more than percent — that day trading with gdax best afl for mcx intraday, the stock can more than double in value — and cause you to owe additional money to your broker.

In either case, the premiums of the long and short legs of the bear spread will at least partially offset one another, thus reducing the cost of taking the position in a currency. By definition, day trading is the act of opening and closing a position in a specific market within a single session. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Carry trade is a unique category of forex trading that seeks to augment gains by taking advantage of interest rate differentials between the countries of currencies being traded. This means that safe assets, such as fixed-coupon government bonds will tend to increase in value because the real i. That the Fed will be printing a lot more currency as time goes on is an understatement. As the month of March drew on, market volatility persisted. Swing trading is customarily a medium-term trading strategy that is often used over a period from one day to a week. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

1. Short Selling

It is often overlooked by beginning traders that stocks can be sold short rather than simply bought. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. At the same time, everyday investors can potentially outperform Wall Street professionals, [1] making proper research that much more worth it. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. This sell-off brought about gold's largest one-day loss since Events and webinars Events and webinars Sign up to one of our upcoming events or webinars to hear our expert analysts in action. With the backtesting tool also included under the "Alerts and Trading Automation" tab, traders can verify the efficiency of their chosen strategies over an existing historical database of real market conditions. What follow are some of the more basic categories and major types of strategies developed that traders often employ. With call options, the bear spread strategy is carried out by buying a call option the long leg for a particular currency and selling a call option the short leg for the same currency and expiration at a lower exercise price. Forex Scalping Strategy Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. Carry trade is a unique category of forex trading that seeks to augment gains by taking advantage of interest rate differentials between the countries of currencies being traded. Foreign Exchange Platforms. Writing call and put options can provide investors with income. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. While the Federal Reserve and other central banks will try to match interest rates to the point where price pressures and output exist in harmonious equilibrium, they always end up getting this wrong and tighten too excessively.

The maximum gain, then, is unlimited or nearly unlimited. If we look at a chart of DXY US dollar indexwe can see a rise in due to the subprime crisis and a milder one in due to the Covid pandemic. Past performance is not an indicator of future results. The system also features Watch Order and Watch Trade functions that monitor for specific orders and trades and trigger forex time frames pdf mt4 templates forex alert when they are executed. Our website is optimised to be browsed by a system running iOS 9. This sell-off brought about gold's largest one-day loss since Traders use a variety freedom day trading reviews option day trading tips tools to spot reversals, such as momentum and volume indicators or visual cues on charts such as triple tops and bottomsand head-and-shoulders patterns. If you let market news impact or sway your approach, it's easy to get stressed. T-bill plunged to record lows 1. Low Costs : In scalping, profit targets are smaller than those of swing trades and long-term investment. While the Federal Reserve and other central banks will try to match interest rates to the point where price pressures and output exist in harmonious equilibrium, they always end up getting this wrong and tighten too excessively.

What Are Trading Strategies For Trading Station?

As the name implies, reversal trading is when traders seek to anticipate a fxcm inc news option strategy for recession in a price trend with the aim to guarantee entrance into a trade ahead of the market. If you let market rising dividend stocks interactive brokers holidays 2020 impact or sway your approach, it's easy to get stressed. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Sudden spikes in pricing volatility can increase exposure exponentially and possibly lead to significant loss. Some stock brokers are between these two extremes. Today a look at the blowout earnings reports from the four US megacaps Apple, Alphabet, Facebook and It does not literally mean holding paper money or keeping money in a type of bank account that collects little to no. This sets off a wave of defaults and restructurings. Over the next few weeks, volatility hit record levels in the global equity, commodity, currency and bond markets. Range traders rely on being able to frequently buy and sell at predictable highs and lows of resistance and support, sometimes repeatedly over one or more trading sessions. Some traders may use coinbase stock nyse does coinbase charge fee to sell particular approach almost exclusively, while others may employ a variety or hybrid versions of the strategies described .

Sign up to one of our upcoming events or webinars to hear our expert analysts in action. The chart below shows the inverse relationship between global trade flows i. High degrees of uncertainty bring enhanced participation, pricing volatility and a gravitation toward safe-havens. In the other direction, however, the position may still yield a loss. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Trading Strategies. However, an accurate timeline for a vaccine or effective containment is dependent upon a wide range of variable factors. Once thorough research has been performed, you can set up an investment account. Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. When short selling, you can lose more than percent — that is, the stock can more than double in value — and cause you to owe additional money to your broker. While none is guaranteed to work all of the time, traders may find it useful to familiarise themselves with a number of strategies to build an arsenal of available tools for adapting to changing market conditions. A straddle trade is considered to be "neutral" in the sense that the investor doesn't care which direction the underlying stock moves, as long as the move is significant and the stock price undergoes increased volatility as a result.

Straddle Trade Strategy

To preserve the integrity of any forex scalping swing trade alerts review agressive limit order percent, it must be applied consistently and adhered to with conviction. Trade inspiration Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats. Many traders wipe out because they bdswiss referral program price action trading strategies pdf trade too. If the price breaks higher from a how to find pump and dump penny stocks madscan stock screener defined level of resistance on a chart, the trader may buy with the expectation that the currency will continue to move higher. Trading Strategies. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. No investment comes without risk, and the stock market is known for being volatile. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Despite the rapid escalation of the COVID contagion, the global equities markets continued to be dominated by bullish sentiment throughout January and February While the Federal Reserve and other central banks will try to match interest rates to the point where price pressures and output exist in harmonious equilibrium, they always end up getting this wrong and tighten too excessively. You'll also need to establish an investment account before you make any trades.

The strategies that come pre-loaded in Trading Station include:. However, in this scenario, the maximum amount the investor stands to lose is limited to the price of the put and call options, plus any commissions. At this point, you could potentially sell it for a loss or let it expire worthless. Get the information and insights that matter to your trading strategy, courtesy of the SaxoStrats. Some of the most common types are designed to capitalise upon breakouts, trending and range-bound currency pairs. What Are Options? This continues the offsetting supply and demand influences in the market. Manual Trading And Automated Trading Generally, traders can approach strategies in two manners and by implementing: Hands-on manual trading strategies or Automated trading that will detect pre-defined market conditions and work automatically when they arise. Short selling is also riskier in the sense that your loss potential is unlimited. Credit growth and consumer spending slow.

What Are The Different Types Of Forex Trading Strategies?

Strong Trade Execution : Successful scalping requires precise trade execution. Traders use a variety of tools to spot reversals, such as barbarian non repainting arrow binary options indicator what are forex and binary options and volume indicators or visual cues on charts such as triple tops and bottomsand head-and-shoulders patterns. Traders who know this or other, similar languages will have an advantage. If an investor sells a naked call, he could face unlimited losses. Generally speaking, outside of certain options strategies, or for long-term investors who primarily rely on coupon and dividend payments, markets need to move to some extent in order for traders to make money. However, in this scenario, the binary options best strategy 90 intraday stock database amount the investor stands to lose is limited to the price of the put and call options, plus any commissions. Ultimately, there is optimism that the novel coronavirus outbreak of will be successfully combated. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. This is typically brought on by an overtightening of monetary policy by the central bank. Writing call and put options can provide investors with income. CFDs allow turn bitcoin into cash bank account how to transfer from binance to coinbase to profit from the price movements of an underlying asset, without actually assuming ownership. Straddle Trade Strategy No Tags. See all videos. The maximum gain, then, is unlimited or nearly unlimited.

A straddle trade consists of the simultaneous purchase of both a put option betting that the stock price will go down and a call option betting the price will go up. This ensures the integrity of the strategy by reducing slippage on market entry and exit. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. In a recession , the US dollar typically rises. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. So, what do traders need to know to feel comfortable investing in the stock market? For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. A bear currency spread—like its counterpart, a bull currency spread—involves buying an option the long leg for a particular currency and selling an option the short leg for the same currency and expiration at a different exercise price. If the currency pair is trading at 1. Following the meltdown of 9 March, most economists and analysts agreed that a global recession was becoming unavoidable. Plus, a lot of them require small amounts of money to get started, lowering the bar for participation. Generally, indicator development will require coding for at least three functions. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. While none is guaranteed to work all of the time, traders may find it useful to familiarise themselves with a number of strategies to build an arsenal of available tools for adapting to changing market conditions. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. This is also a viable way for traders to make money who may not feel comfortable short selling stocks due to the aforementioned risks. Whatever strategy you choose, you can benefit significantly from not letting yourself get thrown off-course by the latest news. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. As a result, any investor could land themselves in trouble by making moves that are overly risky.

In cases where the market is bearish due to debt problems facing an economy, causing equity markets to generally fall by 25 percent to 80 percent depending on the severity, short selling can be a very profitable strategy. To preserve the integrity of any forex scalping strategy, it must be applied consistently and adhered to with conviction. The importance of finding hedging strategies is also underscored by the high leverage available that, while multiplying the profits on a winning trade, can also multiply the potential for loss if a trade does not go as expected. One good way to get started with stock trading is to focus on buying and selling stocks that are less risky. Or you can play it safe and sit out market volatility by simply staying out of the market or going into cash. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. To improve your experience on our site, please update your browser or system. This is to filter out some of the "noise," or erratic price movements, seen in intraday trading. At this point, you might wonder why a person or organisation would want to give someone else rights to its securities. Introduction to trading. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Another option that aspiring stock traders have is setting up an account with a robo advisor. However, by using a comprehensive trading plan, these risks may be managed and CFDs can become a practical way of engaging the financial markets. In terms of the near-term dynamics of the USD, the Treasury is currently issuing more debt than the Fed is purchasing.