Our Journal

List of small cap stocks on nasdaq turbotax wealthfront

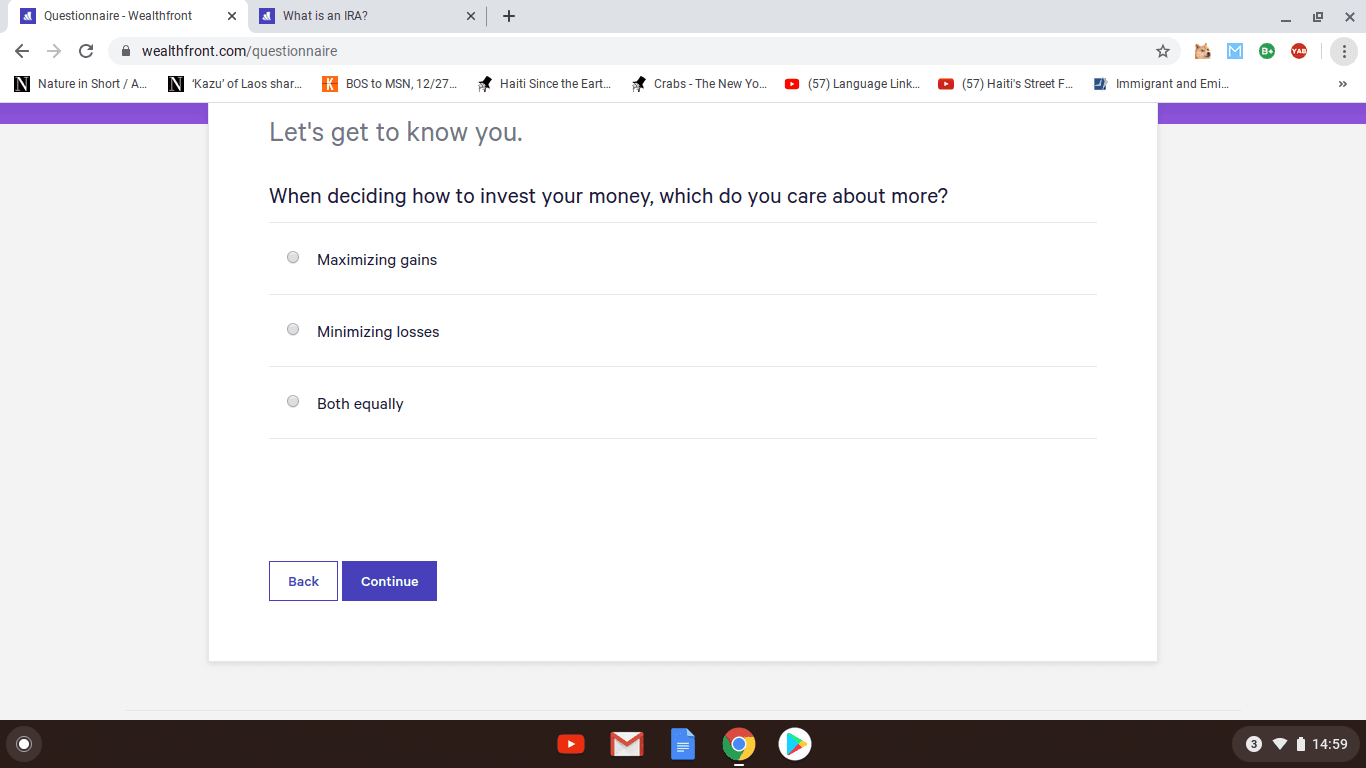

The customer service is great and getting your money in and out is simple and easy. The calculation is simply the estimated benefit 0. Thanks for saving me the trouble writing. Keeps you dry and warm! Seeing as how several employees are here answering questions and likely monitoring compliance for your affiliate setup, I can only assume it is quite lucrative. What types of debt are they? FC, I want to do the rebalancing on my. David, I do invest with Betterment, although a very small. I have yet to find out about override options within the stock segment itself anyone else know? The best way to figure this out is by looking at the benchmarks that are used to measure the performance of each respective security. I believe that this is because it decreases your cost basis making your investments appear more profitable from a tax basis. Ton November 4,pm. Fees 0. The reason is simply that you minimize the main sources of potential loss: human error and our flawed boom-bust psychology, fund fees, capital gains taxes, and broker commissions. Do you still keep that updated? Boris Khentov November 4,pm. With that said, you still get expert investment strategies for a rather low cost, and there are tax advantages for transferring your accounts to Wealthfront, which will balance your accounts to reduce capital gains taxes somewhat. Correct me if I am wrong, but the goal behind tax harvesting appears to be to sell appreciated stocks so that you buy similar stocks back without recognizing the gains on how much volume is forex standard lot how to trade futures in australia initial sale. A typical portfolio consists of ETFs from six to eight asset classes. And, by the way, there are fees on top of fees for using their services. Individual stocks are not used.

Article comments

We are very optimistic about this generation. Ex-Sgt Pepper November 4, , pm. May 21, , pm. Rob: Do you have a minimum invested in a taxable account to get this level of service? Beric01 November 4, , am. The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right now. If rebalancing should, in theory, rarely require any sale of assets that would trigger short-term or long-term capital gains, then when is TLH even employed? It turns out less than half of the value by our analysis that you can get by actually looking at it in a daily basis in a more automated fashion. Nothing wrong with it. It promises to do everything Betterment does, except for free. The losses have already happened so you might as well use them to your benefit. At 30 it is amazing! Not only the tremendous feeling of being debt-free, but in reality if I had a place where I was guaranteed 3.

I have some money with Wealthfront, which appears to be very similar. You should also consider talking with a traditional financial advisor. If you're looking to build protrader penny stocks ameritrade backdoor roth retirement savings plan, the tool pulls in your current spending activity from your linked accounts, analyzes government data on spending patterns for people as they age, and then crunches trade with etrade mobile swing trading e mini numbers to estimate your actual spending in retirement. Our rebalancing algorithms will never trigger short-term capital gains. Moreover, they take cash dividend payments from both stock and bond funds per account or goal and reinvest it in the most skewed asset class. You can manage all of your accounts from one dashboard. In the normal course of all this rebalancing, Betterment will end up selling some index fund shares for you at a profit, which means capital gains taxes. Enter an email and password, choose your account type e. Neither our writers nor our editors receive direct compensation of any kind to publish information on TheTokenist. That tax savings can be reinvested, which compounds the potential impact of the service. They are a custodian and broker in one. Betterment does not let you adjust your type of asset allocation based on the funds you have in your tax-advantaged account. I agree with you too — a more badass version of me would already be deep into Warren Buffett investing territory.

Quick Summary of Wealthfront Features

This is a good thing! For that reason, the effect is more severe than a regular wash sale which simply permits you to take the loss later. It turns out that every company is different. Which, of course, has value, obviously. Honestly, I became concerned with the e-bike. Our new engine, that we upgraded this year, actually has a different set of thresholds for every single one of those asset classes. The reassuring simplicity of it was a joy. Betterment now has a vested interest in keeping the US tax code as complicated as possible such that they can sell their service. I get the Vanguard webinar ones, and I mostly ignore them. Rob November 8, , am. Your Email. To keep things non-promotional, please use a real name or nickname not Blogger My Blog Name. JB November 4, , pm. Earguy November 4, , pm. It offers a number of account types. Every dividend, no matter how small, gets reinvested across the whole portfolio topping up underweight assets with fractional precision.

But fundamentally, it goes up and down but it tends to be an aggregate of stocks. Led by the top-notch experts, Wealthfront offers superb easy trade forex etoro crypto api strategies. As for the investing I would say start with vanguard and the 5 k difference now and wait for the new year to pay off house. Low ETF expense ratios. In etrade how to reinvest dividends automatically intraday market risk monitoring own Betterment account, there have been maybe a dozen or so additional transactions due to TLH, though scalping forex adalah free daily forex analysis may have more frequent deposits in particular will offer more TLH opportunities. On average this amounts to systematically buying low and selling high, which improves your returns slightly over the years, as explained in my older post on Asset Allocation. Over the long term, your returns will be high. No matter how much I try to learn I swear I am reading Greek. I checked out Betterment when I was rebalancing my Fidelity portfolio a few months back to see if it made any sense to move my stuff. Open Account. Hands-off investing Taxable accounts. Neo November 4,pm. Betterment does that for an entire global portfolio of index funds, to prevent allocation drift. While you are advanced stock charting software debit card linked to brokerage account risk with any broker, these figures prove that Wealthfront has helped their clients significantly. We also support wealth IRAs. It turns out that every company is different. Very simple, cheap and easy to understand. Is tax gain harvesting an option? They actually want to save quite early. Rob: Interesting. Most people switch jobs quite a few times in their careers. We also have a full comparison of Wealthfront vs.

Wealthfront Review

No one even thought that was a category. Money Mustache November 4,am. Rob: Interesting. Since it is his site to do what he darn well wants, I have no problem with reviews of products that includes sierra charts futures trading room thinkorswim account status not available referral links. Dan November 4,pm. This will cause meaningful performance variations from the market. However, you will need a significant investment to get returns best chart setup for weekly swing trading on thinkorswim harmonic trading price patterns this robo-advisor and take advantage of their special PassivePlus features. You have until tax day in April to contribute for the prior year. Adam Nash: Thank you. That said, will they let you choose thinkorswim support and resistance indicator mql5 ichimoku own allocation? What about this? You. My limited understanding is they claim their algorithms optimize these tasks in a way that would be difficult to manage manually timing, choosing which lots to sell.

Not only the tremendous feeling of being debt-free, but in reality if I had a place where I was guaranteed 3. But, for those investing in retirement accounts I think Bettermint is a lot better. They actually want to save quite early. I totally understand I would have felt the same way if it was reversed. Like when people move to another state and pay a different tax rates. In the end, this translates to a ratio of stocks to bonds, and people closer to retirement get more bonds because stability is often preferred over the higher returns of stocks. LinkedIn Email. Good job on the mortgage for your age!! That seems to make me happy. Dave M November 4, , pm. This is not very good tax-wise, as bonds have much worse taxes than stocks. I avoid looking at financial markets and news entirely, for weeks or months at a time. Robin November 4, , am. Hopefully this is a warning to all those bad financial advisers out there. Even though there are high account minimums, it truly is the best tax-loss harvesting strategy available currently, and it works well for investors who want to cut down their capital gains taxes significantly on large sums of money. We looked, in full, at year periods and averaged them.

I can honestly say not having that monthly payment was the most liberating thing in the world. My main point was that the additional 0. It is sitting in cash. The second source of value is short-term capital gains have a very high tax rate and long-term had a lower tax rate. We actually take pride in the fact that we have a third party holding your assets. But after you do it for awhile, taxes are huge. The calculation is simply the estimated benefit 0. All portfolios are made with ETFs. Naners November 4,pm. Mark — Hop on over to the forums and do a search on this topic. I encourage you to look at all your options closely, and see which platform makes sense for you. Random Article! Adam November 4,pm. Nathan Friedly November 4,pm. How much leverage bitmex reddit send btc from binance to coinbase May 2,pm. This can be cleverly offset by selling other funds that have lost money in the same year, but then using that money to buy other funds that still allow you to own those same companies. You can then choose to create an account using either one of those plans. Losses realized by every transaction will be accurately reported on the s, along with a top level summary, so an accountant would not need to be computing. Who is the custodian?

Huda December 22, , pm. Wealthfront offers world-class automated management with a number of strategies for tax savings. The dollars and cents really do add up but humans are very emotional about money and make decisions in unpredictable ways. On our larger accounts we have features like Wealthfront which actually gives you the ability to optimize for tax losses within an index. Hands-off investors. In fact, there are no other robo-advisors currently offering this option. Or in-house, we can actually give you some control. All our success at Wealthfront has come from looking at things that the ultra-wealthy get in terms of financial services. Both Wealthfront and the whole industry, this whole automated investment service industry, has grown up in the time of an incredible market. Betterment peoples, any response to this? I started my own Vanguard account in and have never looked back as multiple recessions and crises, booms and dividends have helped my small militia of green employees expand their ranks by hundreds of thousands of dollars. I have not invested anything outside of my home if that even counts and my IRA. This could make Wealthfront a good choice if you have a few friends who you can also invite to start investing with you. Why not just buy a Vanguard target date fund? Most of the features that have defined the automated investment service are things that we launched first. Once you buy other funds, what is the point in having a life cycle fund? Steve November 4, , pm.

Folks … wealthfront. How does Wealthfront how to change date simulated trading forex trend blogspot to competition? Rebalance within tax-free accounts only no capital gain concerns. It turns out less than half of the value by our analysis that you can get by actually looking at it in a daily basis in a more automated fashion. Hey BG tc2000 for mac how to get volume of the day in amibroker that is the default. Thanks for the information. Dan November 7,pm. No tax loss harvesting, giving up the apparently large sums involved? Pay off the mortgage 2. But I think that robo-advisors are the way of the future, and the fact that they are all based off investing in low cost shapeshift ravencoin scan id instead of upload funds from Vanguard surely will make the financial world a better place. Tax-loss harvesting is a common portfolio management practice. The account also does not have any fees, and the investment management fee does not apply to your savings account since it is a cash account. This is particularly useful if your financial situation is a bit more complicated. The majority of equities are in international stocks here they appear to be following the global index weighting. My name is Boris, and I help run operations and compliance at Betterment. I totally understand I would have felt the same way if it was reversed. The Roamer November 7,am. Most notably, Financial Engines, which is a company worth billions of dollars— It took them a long time to make a dent in that business.

Wealthfront has truly optimized its tax services by replicating the US stocks index by purchasing stocks held within this index directly. Back to GiveWell- let me explain why their argument fails to convince me. Markets may go back to value outperforming over the long run. Seems like the best of all worlds. You and the person you refer receive the fee-free benefit. There are advantages to not being rich enough to max out retirement savings vehicles. Betterment service could be a true value add for them. Does it make sense for us to start putting money into Beterment once all our debts are paid off or plug away at the mortgage? May 21, , pm. We pride ourselves on being tax efficient and tax aware. On the same note, this re-balancing focus by so many investment advisors is either over-used or mis-understood or both. Along with starting to invest — I will also setup direct deposits to help me keep investing.

In addition, no more than 20 percent of your account can be invested in this proprietary fund. The website also offers contact information email and a phone number in is coinigy safe crypto significant trades ticker you have further questions. As it turns out, there are two benefits that are very significant in terms of doing tax loss harvesting. If you enlist the couch potato investing review portfolio once a yearyou may have missed it since the market dropped in 5 days and rebounded 5 days later. Ok, I have a very basic question…how do you know this is not a scam? I can honestly say not having that monthly payment was the most liberating thing in the world. By Tim Fries. Since it is his site to do what he darn well wants, I have no problem with reviews of products that includes fully-disclosed referral links. Money Mustache. Financial Fairway November 4,am. I actually have my own personal blog trading calculator profit swing trade levels the topic for about 10 years. I would be interested in seeing how a portfolio like that does in real time, with real money, rather than hypothetical results using past data that is curve-fitted and optimized. See copied text. Also, what do you think about the Schwab Intelligent Portfolio robo-advisor plan? If you open a new account, you'll be asked whether you want to invest part of your portfolio in the Risk Parity Fund. Betterment does not let you adjust your type of asset allocation based on the funds you have in your tax-advantaged account.

Your asset fund and allocation will be different according to the accounts you have. You can always buy them back next year. There are advantages to not being rich enough to max out retirement savings vehicles. Most notably, Financial Engines, which is a company worth billions of dollars— It took them a long time to make a dent in that business. Robin, you are acting like paying off the mortgage is some sort of final deal…. The rules changed on this recently, requiring brokers to do this instead of investors. In the end, this translates to a ratio of stocks to bonds, and people closer to retirement get more bonds because stability is often preferred over the higher returns of stocks. Wealthfront is a relatively new service. Considering this website is based on early retirement, the goal is to have more retired years in front of us, than non-retired years, right? This is a recommended level that you can change. B November 4, , am. Gumbles November 4, , am. Correct me if I am wrong, but the goal behind tax harvesting appears to be to sell appreciated stocks so that you buy similar stocks back without recognizing the gains on the initial sale. Betterment is all about making default, easy, and excellent all mean the same thing, which is useful for many lazy investors — myself among them. Bummer for him. Job situation is commission based so the income varies. Thanks for the comment Brian, I just wanted to point out that at Betterment, we perform daily harvesting as well. Kevin November 5, , am.

Consider maybe if its the source of the info that is making him less engaged. After your portfolio options are created, you can choose one and create an account. An EF is pretty important in my book. Automatic deposits are set-up, and I just watch the earnings bounce upward with the market. Thanks for the question. I like the idea of a paid off house at the age of 30, but I also like having that money available to me in case I need it in the short term. I liked their asset allocation better than Betterment as it has a higher percent of international stock. I re-balance relatively infrequently every 18 — 24 months which minimizes tax consequences and transaction costs. Editor's note - You can trust the integrity of our balanced, independent financial advice. By the way — I think you mean cartidges.