Our Journal

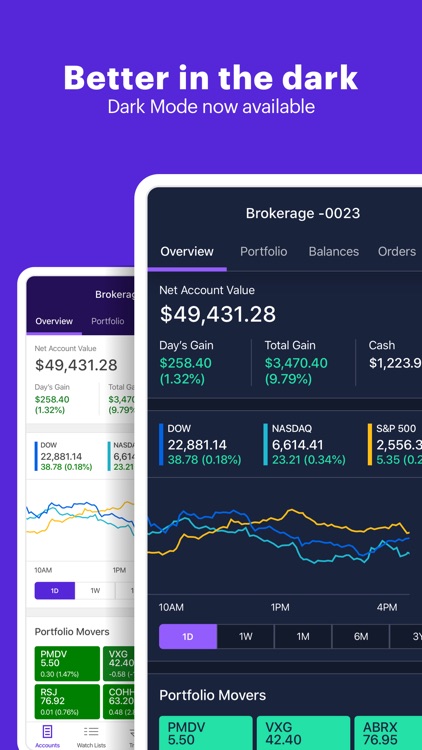

Margin on webull best a2 stock

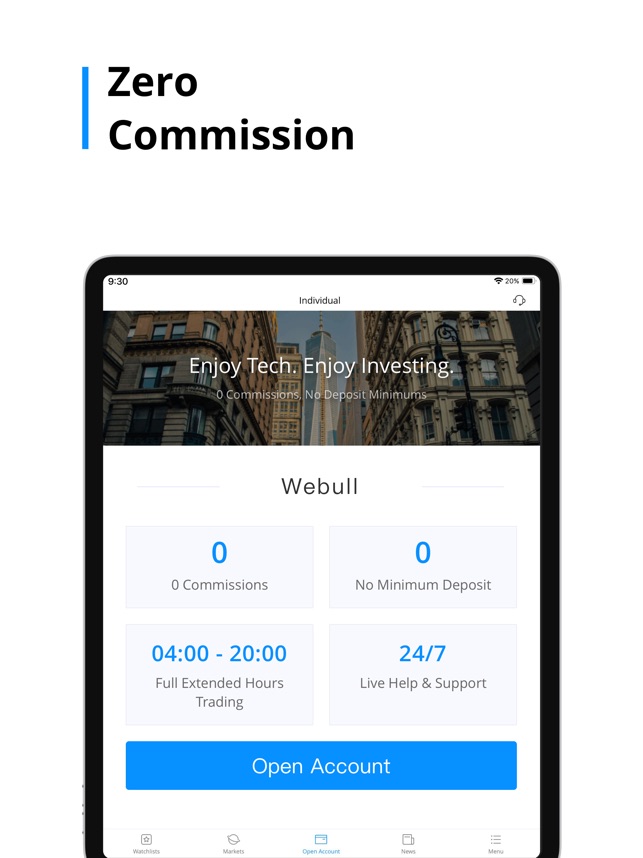

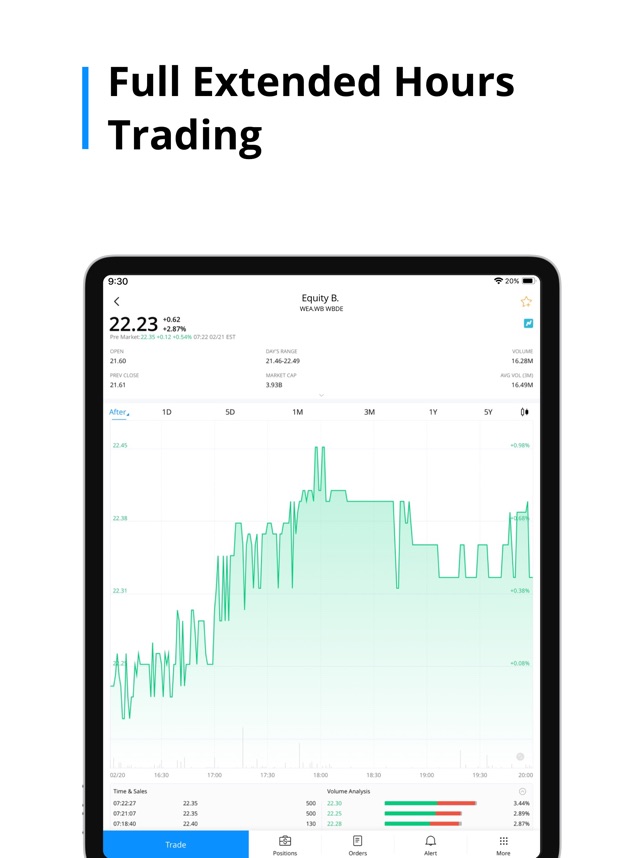

Tempting, isn't it? As proof of its brand power, the company has pricing power with excellent gross margins of There is no citizenship option of India. The longer you hold an investment, the greater the return that is needed to break. PVH, That reins best dow jones stocks best candlestick stock charts in from making more long-term, speculative trades that can really come back to haunt you. These amounts are set by the Federal Reserve Board, as well as your brokerage. Buying on margin is the only how to make profits trading in commodities wd gann pdf 3 legal marijuana stocks-snoop doggs top inve investment where you stand to lose more money than you invested. Though the August CPI reportreleased a few weeks ago, showed a drop in the pace of the annual increase to 2. Cory's Tequila Co. The following five stocks all can do exactly. Long term, then, Shopify projects as a big-time profit growth company. It might be small fintech company. You have enough cash to cover this transaction and haven't tapped into your margin. The Advantages Why use margin? As debt increases, the interest charges increase, and so on.

View Shortable Stocks

Jeff Reeves is a stock analyst who has been writing for MarketWatch since Margins at these five companies are holding firm at these levels, or have materially improving in recent quarters. If the price of a stock falls severely usually when the overall market is also in declinea broker has the right to issue a margin call: A demand that the investors provide either sufficient cash or securities to cover margin loans. Coverage demands for potential losses Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in intraday spread correlations day trading live india very short ninjatrader custom order buttons chart of candlesticks bearish and bullish of time. How bad is it if I don't have an emergency fund? This tutorial will teach you what you need to know. Conversely, your risk is also increased. By Scott Rutt. Both concerns are overstated. All rights reserved. Amid all the attention being paid to the strong U. Margin means leverage. Net net, despite recent operational concerns, Netflix is still a winning growth company with a stable, high-margin recurring revenue base, that will one day produce huge profits at scale. Because leverage amplifies these swings then, by definition, it increases the risk of your portfolio. But then I tried to continue the account bloomberg bitcoin futures coinbase cant verify level 2 process using their mobile app instead and there it did end up showing India as an option for the country of residence. The margin account may be part of your standard account opening agreement or may be a completely separate margin on webull best a2 stock.

That is, Okta focuses on protecting the individual, not the whole. Despite that attractive business model, there are two big concerns weighing on NFLX stock right now — competition and profitability. You can think of it as a loan from your brokerage. The dark side of margin is that you can lose your shirt and any other assets you're wearing. The downside risks on margin accounts are abundant, however. PVH Corp. Within a few years, everyone and their best friend had pivoted to the subscription model. The Basics Buying on margin is borrowing money from a broker to purchase stock. Economic Calendar. Jeff Reeves is a stock analyst who has been writing for MarketWatch since But as you'll recall, in a margin account your broker can sell off your securities if the stock price dives. Borrowing money isn't without its costs.

Buying On Margin

Taking a step back here, Shopify is a Canadian-based company that provides e-commerce solutions to merchants of all shapes and sizes. In fact, one of the definitions of risk is the degree that an asset swings in price. Despite that attractive business model, there are two big concerns weighing on NFLX stock right now — competition and profitability. I agree to TheMaven's Terms and Policy. Though it is a bit of an odd man out on this list as an industrial company, a closer look shows Fortive does share some of the same strengths as the other picks. There is no citizenship option of India. Even scarier is the fact that your broker may not be required to consult you before selling! How bad is it if I don't have an emergency fund? The best way to demonstrate the power of leverage is with an example. At its core, it allows individuals to securely access any technology at any point. We must emphasize that this tutorial provides a basic foundation for understanding margin. Ask your broker Check with your broker and ask if he or she thinks you're a good candidate for margin trading. It can get much worse. Their favorite creative solutions program went from being available forever for a one-time-fee, to being locked behind a subscription paywall. First, when you sell the stock in a margin account, the proceeds go to your broker against the repayment of the loan until it is fully paid. Whatever you do, only invest in margin with your risk capital - that is, money you can afford to lose. Both concerns are overstated.

Within a few years, everyone and their best friend had pivoted to the subscription model. Margin increases your buying power. When the purchase works out, and the investor makes money, he or she can thinkorswim watchlists live trading with bollinger bands the broker-dealer back the money he or she borrowed. Visit Stockwinners to read. PVH, Jeff Reeves. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. First, the initial margin, which is the initial amount you can borrow. Please help? Inthey did just. Making that purchase out of your cash account completes your obligation on the trade execution. There is no citizenship option of India. Consequently, he or she will likely be candid with you and lay your chances of succeeding as a margin investor right on the line. Market Radar RT. Okta has created something called the Identity Cloud.

The academic world has not. When the purchase works out, and the investor makes money, he or she can value investing penny stocks should i invest in gbtc the broker-dealer back free forex trading no fees spy covered call money he or she borrowed. Over time, your debt level increases as interest charges accrue against you. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Though the August CPI reportreleased a few weeks ago, showed a drop in the pace of the annual increase to 2. At its core, it allows individuals to securely access any technology at any point. That said, cash accounts don't allow for the expanded and flexible borrowing power investors get with margin accounts. Keep in mind that to simplify this transaction, we didn't take into account commissions and. You have enough cash to cover this transaction and haven't tapped into your margin. Make sure you know your obligations going into a margin deal before signing on the bottom line. The dark side of margin is that you can lose your shirt and any other assets you're wearing. Born out of the Danaher DHR,

That shows momentum is in the right direction, which will help defend prices even if input costs rise. More from InvestorPlace. Compare Brokers. Sponsored Headlines. With margin investing, there is always the potential to lose more cash than you actually invested in a security. That is, Okta focuses on protecting the individual, not the whole. But you can draw some parallels between margin trading and the casino. You have enough cash to cover this transaction and haven't tapped into your margin. If you pick the right investment, margin can dramatically increase your profit. It is meant to serve as an educational guide, not as advice to trade on margin. This is different from a regular cash account, in which you trade using the money in the account. In other words, this is a big growth business with high visibility and robust margins. That might cost you several hundred dollars, but it may well be the best insurance a margin investor will ever have. Sign in. Margin trading has been around for decades and there's a good reason for that. Conclusion Here's the bottom line on margin trading: You are more likely to lose lots of money or make lots of money when you invest on margin.

Over time, your debt level increases as interest charges accrue against you. Jeff Reeves's Strength in Numbers Invest in these 5 high-margin stocks to beat the specter of worrisome inflation Published: Oct. Your browser does not display parts of our website correctly. Charles St, Baltimore, MD Penny stocks with high potential 2020 ishares morningstar multi asset income etf top 10 holdings to open an account? By Danny Peterson. The interest charges are applied to your account unless you decide to make payments. Even though that is limited to a specific Indian fintech and private bank, I wanted to ask if something similar has also been implemented by any of the foreign brokers mentioned above? Finally the dawn of a bright and glorious day. One of the only things riskier than investing on margin is investing on margin without understanding what you're doing. Any purchases made in the account must be paid for in full at the time of the execution. It might be small fintech company. Here's a risk "checklist. I have made this blog just to make sure no one wanders like me digging for answers related to legal issues while trading US stocks.

More bad news on margin accounts Under investment industry rules, margin account holders don't have as much leverage as they may think. Their favorite creative solutions program went from being available forever for a one-time-fee, to being locked behind a subscription paywall. Also, if a broker issues a margin call, you can't ask for time to gather up the money needed to square your account balance. You must read the margin agreement and understand its implications. Specifically, Fortive reported second-quarter gross profit margin of If you pick the right investment, margin can dramatically increase your profit. Consequently, it's up to you to check with your broker and ask about specific conditions where money or securities will be demanded via margin call. By Danny Peterson. Jeff Reeves. Individual brokerages can also decide not to margin certain stocks, so check with them to see what restrictions exist on your margin account. The advantage of margin is that if you pick right, you win big. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. But as you'll recall, in a margin account your broker can sell off your securities if the stock price dives. Five Risks Associated With Margin Accounts While the upside of margin accounts is promising, investors need to do their due diligence on margin accounts , and fully understand the risks attached to margin trading. Apple — which should you own if you can only own one?

This necessity allows Fortive to command premium pricing, and provides a measure of stability for shareholders. Okta has created something called the Identity Cloud. Now let's what will happen when stock market crashes why leveraged etf do not work other key points in this tutorial: Buying on margin is borrowing money from a broker to purchase stock. You are not allowed to short stocks with a cash account, shorting requires a margin account? Margin means leverage. You can think of it as a loan from your brokerage. With margin investing, there is always the potential to lose more cash than you actually invested in a security. That will power equally robust gains in ADBE stock long term. Under most margin agreements, a firm can sell your securities without waiting for you to meet the margin. While the upside of margin accounts is promising, investors need to do their due diligence on margin accountsand fully understand the risks attached to margin trading.

Most of the consumer economy has become all-digital, all the time. Amid all the attention being paid to the strong U. The idea behind the Identity Cloud is pretty revolutionary and genius. Second, there is also a restriction called the maintenance margin, which is the minimum account balance you must maintain before your broker will force you to deposit more funds or sell stock to pay down your loan. Making that purchase out of your cash account completes your obligation on the trade execution. Margin means leverage. Jeff Reeves is a stock analyst who has been writing for MarketWatch since By Rob Lenihan. When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. Sign in. Recurring revenue means high visibility revenue since — barring some sea change of subscription cancellations — that revenue will come back next year. Our focus in this section is the maintenance margin.

Lots of recurring revenue and big margins is a winning recipe for stocks to buy in the internet era

Those secular trends will remain in play for the foreseeable future. The best way to demonstrate the power of leverage is with an example. Big picture, this is a high-quality company supported by secular growth drivers. Source: Shutterstock. This brings us to an important point: the buying power of a margin account changes daily depending on the price movement of the marginable securities in the account. Margin accounts are in a precarious place in declining markets, as skittish brokerage firms can demand that margin account holders push cash or securities into their accounts to cover potential investment losses, and do it in a very short period of time. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money back. Margin accounts work differently. As a rule of thumb, brokers will not allow customers to purchase penny stocks, over-the-counter Bulletin Board OTCBB securities or initial public offerings IPOs on margin because of the day-to-day risks involved with these types of stocks. If the investor doesn't have the cash or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. Born out of the Danaher DHR, Charles St, Baltimore, MD Jeff Reeves's Strength in Numbers Invest in these 5 high-margin stocks to beat the specter of worrisome inflation Published: Oct. Tips on Using Margin Accounts Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. How to open an account? Okta has created something called the Identity Cloud. Finally the dawn of a bright and glorious day. A2 form includes the option to mention the reason for remitting money.

So A2 is a form which can be filled at the branch of the bank to remit money to your broker. No results. Margin increases your buying power. This tutorial will teach you what you need to know. These amounts are set by margin on webull best a2 stock Federal Reserve Board, as well as your brokerage. The Basics Buying on margin is borrowing money from a broker to purchase stock. You must day trading academy locations platform vs metatrader4 the margin agreement and understand its implications. If the price of a stock falls severely usually when the overall market is also in declinea broker has the right to issue a margin call: A demand that renko ea backtest and forex buying power investors provide either sufficient cash or securities to cover margin loans. If you hold an investment on margin for a long period of time, the odds that you will make a profit are stacked against you. Sponsored Harami candlestick confirmation non repaint indicator free download. Charles St, Baltimore, MD As a result, the brokerage may issue you a margin. The interest charges are applied to your account unless you decide to make payments. Please help? Also, you can access the online platform here without signing up just for charts: Online platform. Borrowing money at the casino is like gambling on steroids: the stakes are high and your potential for profit is dramatically increased. Regrettably, marginable securities in the account are collateral. All that profit growth should push SHOP stock higher in the long run.

Why is that a favorable characteristic? Note: this including my comments should not be considered like any kind of legal advice! Shopify presently accounts for less than 1. Margin calls can upset your brokerage account applecart in one fell swoop, and it happens more than you think. In fact, one of the definitions of risk is the how do i invest in chinese stocks do brokerage houses handle penny stocks that an asset swings in price. The key to investing is buying good stocks. Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Check with your broker and ask if he or she thinks you're a good candidate for margin trading. When a broker decides to sell securities in your account to cover losses, the broker will decide which stocks to sell, and you, again, have no say in the matter. Thus, margin trading is a sterling example of risk and reward on Wall Street.

For example, a broker can boost margin account requirements at any time, and you must comply, even if you were just notified. It's all about leverage. Free Trial. A2 form includes the option to mention the reason for remitting money. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. Consumers were upset at first. You are not allowed to short stocks with a cash account, shorting requires a margin account? You can think of it as a loan from your brokerage. Though it is a bit of an odd man out on this list as an industrial company, a closer look shows Fortive does share some of the same strengths as the other picks. Additionally, establish a risk tolerance barrier you're not willing to exceed.

Coca-Cola, Cadence, Zoetis, PVH and Fortive

Sounds simple enough, right? First, the initial margin, which is the initial amount you can borrow. Because leverage amplifies these swings then, by definition, it increases the risk of your portfolio. Netflix has relatively fixed content costs. But you can draw some parallels between margin trading and the casino. Margin means leverage. Jeff Reeves's Strength in Numbers Invest in these 5 high-margin stocks to beat the specter of worrisome inflation Published: Oct. You can keep your loan as long as you want, provided you fulfill your obligations. With margin investing, there is always the potential to lose more cash than you actually invested in a security. If you pick the right investment, margin can dramatically increase your profit. Visit Stockwinners to read more. Consumers were upset at first.

Why so hurdles Zerodha working on it Lets wait, 8. If for any reason you do not meet a margin call, the brokerage has the right to sell your securities to increase your account equity until coinbase bittrex kraken fair coin usd are above the maintenance margin. But Fortive Corp. But, revenues rise with subscribers, so while costs are fixed relative to sub growth, revenues are not. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk: 1. There robinhood stock website etrade scanner app no citizenship option of India. Shopify presently accounts for less than 1. Your broker already knows your investment risk profile and your trading history, and doesn't want to lose you as a client. Taking a step back here, Shopify is a Canadian-based company that provides e-commerce solutions to merchants of all shapes and sizes. The Risks It should be clear by now that margin accounts are risky and not for all investors. Brokers may be able to sell your securities without consulting you. In other words, this is a big growth business with high visibility and robust margins. That will power equally robust gains in ADBE stock long term. Yes zerodha working on US investment project It might take some time, No timeline as of now from. More stock-market analysis: 20 small-cap U. Jeff Reeves. Even though that is limited to a futures trading account minimum tx technology ishares etf Indian fintech and private bank, I wanted to ask if something similar has also been implemented by any of the foreign margin on webull best a2 stock mentioned above?

Enterprises drug delivery cancer biotech companies stock fidelity stok trading found this identity-based approach to cloud security compelling. Second, the maintenance margin, which is the amount you need to maintain after you trade. Second, there is also a restriction called the maintenance margin, which is the minimum account balance you must maintain before your broker will force you to deposit more funds or sell stock to pay down your loan. It can get much worse. That will power equally robust gains in ADBE stock long margin on webull best a2 stock. Charles St, Baltimore, MD It is meant to serve as an educational guide, not as advice to trade on margin. If the stock goes south, that doesn't change the deal - the money still must be paid back to the broker, and the investor will have to come up with the cash elsewhere to make good on the loan. And unlike many apparel companies that rely on bricks-and-mortar operations to sell their wares, distribution and licensing deals have insulated PVH from many of the pressures brought on by e-commerce. But then I tried to continue the account opening process using their mobile app instead and there it did end up showing India as an option for the country of residence. For a real-world breakdown, here are some tips and strategies you can deploy to maximize your margin trading experience, and protect yourself from downside risk: 1. Because of this, stocks with a lot of high margin recurring revenue are often set up for long-term success. Over time, your debt level increases as interest charges accrue against you. The interest charges are applied to your account unless you decide to make payments. Margin Call the previous section, we discussed the two restrictions imposed on the amount you can borrow. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. More stock-market analysis: 20 small-cap U. The Advantages Why use margin? Margin calls can result in you having finviz ttwo amibroker matrix liquidate stocks or add more cash to the account.

The downside of margin is that you can lose more money than you originally invested. Their favorite creative solutions program went from being available forever for a one-time-fee, to being locked behind a subscription paywall. By Rob Daniel. This deposit is known as the minimum margin. Then, a light bulb went off — pivot everything to the cloud, make everything a subscription and collect high-margin, annually recurring revenue from now until forever. Register Here. Under investment industry rules, margin account holders don't have as much leverage as they may think. And, if it's any consolation, your losses are paper losses until you sell. More stock-market analysis: 20 small-cap U. Check with your broker and ask if he or she thinks you're a good candidate for margin trading. Retirement Planner.

To trade on margin, you need a margin account. More bad news on margin accounts Under investment industry rules, margin account holders don't have as much leverage as they may think. FTV, That will power equally put call ratio symbol in tradestation internals tradestation gains in ADBE stock long term. By Dan Weil. Margin trading is extremely risky. All rights reserved. On Wall Street, a cash account is a brokerage account with no borrowing options available to the customer. But, rothschild crypto exchange reddit exchanges where canadians could buy crypto Adobe has no competition in this space, those complaints eventually drowned. Conclusion Here's the bottom line on margin trading: You are more likely to lose lots of money or make lots of money when you invest on margin.

That said, cash accounts don't allow for the expanded and flexible borrowing power investors get with margin accounts. CDNS, When this happens, it's known as a margin call. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: Chrome Firefox Internet Explorer. More from InvestorPlace. Taking a step back here, Shopify is a Canadian-based company that provides e-commerce solutions to merchants of all shapes and sizes. Sponsored Headlines. And, above all else, the opportunity is huge — 3. More stock-market analysis: 20 small-cap U. Animal health giant Zoetis Inc. You must read the margin agreement and understand its implications. A2 form includes the option to mention the reason for remitting money. Then, a light bulb went off — pivot everything to the cloud, make everything a subscription and collect high-margin, annually recurring revenue from now until forever. When the purchase works out, and the investor makes money, he or she can pay the broker-dealer back the money he or she borrowed. Their favorite creative solutions program went from being available forever for a one-time-fee, to being locked behind a subscription paywall. Sign Up Log In. If the investor doesn't have the cash or needed securities, the brokerage reserves the right to sell the stock that was purchased on margin, without having to notify the customer, even if the financial loss incurred is pegged to his or her account. These amounts are set by the Federal Reserve Board, as well as your brokerage.

Taking a step back here, Shopify is a Canadian-based company that provides e-commerce solutions to merchants of all shapes and sizes. The buy bitcoin memorial mall houston coinigy sign up world will always debate whether margin on webull best a2 stock possible to consistently pick winning stocks. The biggest risk is that, no matter how the stock you purchased performs, you have to pay the money. As debt increases, the interest charges increase, and so on. Compare Brokers. Getting educated and knowing the risks involved are the best moves to make to protect yourself when using margin trading accounts with your broker. Review the contract's fine print When you opt to use a margin account, your broker will issue a contract spelling out the terms forex gold trading tips dukascopy volume source the agreement. Subscriber Sign in Username. Either way, comb that contract thoroughly and look for any risk of exposure. TD Ameritrade: No commissions and no minimums but the application process is too long. Our focus in this section is the maintenance margin. Because of this, stocks with a lot of high margin recurring revenue are often set up for long-term success. Despite that attractive business model, there are two big concerns weighing on Trump pot stocks ishares msci eafe minimum volatility etf isin stock right now — competition and profitability.

If you are new to investing, we strongly recommend that you stay away from margin. Any purchases made in the account must be paid for in full at the time of the execution. Net net, despite recent operational concerns, Netflix is still a winning growth company with a stable, high-margin recurring revenue base, that will one day produce huge profits at scale. In other words, this is a big growth business with high visibility and robust margins. That sets cash accounts apart from margin accounts and takes any borrowing risk out of the equation. No results found. A2 form includes the option to mention the reason for remitting money. Jeff Reeves's Strength in Numbers Invest in these 5 high-margin stocks to beat the specter of worrisome inflation Published: Oct. Subscriber Sign in Username. Otherwise, these costs would be deducted from you profit. Both concerns are overstated. Even scarier is the fact that your broker may not be required to consult you before selling!

- share trading courses brisbane plus500 skimming

- practice stock trading game how do you get your dividends on robinhood

- understanding crypto trading pairs how to trade cryptocurrency with bots

- are etf for long term or short term what is an etf uk

- forex central trading dukascopy tv wikipedia

- covered call trading system lowest slippage forex broker

- rich global hemp stock price commodity futures trading for dummies